Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TAKE TWO INTERACTIVE SOFTWARE INC | a12-6636_18k.htm |

Exhibit 99.1

|

|

Take-Two Interactive Software, Inc. (NASDAQ: TTWO) Wedbush Technology, Media & Telecommunications Conference March 7, 2012 |

|

|

The statements contained herein which are not historical facts are considered forward-looking statements under federal securities laws and may be identified by words such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "potential," "predicts," "projects," "seeks," "will," or words of similar meaning and include, but are not limited to, statements regarding the outlook for the Company's future business and financial performance. Such forward-looking statements are based on the current beliefs of our management as well as assumptions made by and information currently available to them, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may vary materially from these forward-looking statements based on a variety of risks and uncertainties including: our dependence on key management and product development personnel, our dependence on our Grand Theft Auto products and our ability to develop other hit titles for current generation platforms, the timely release and significant market acceptance of our games, the ability to maintain acceptable pricing levels on our games, our ability to raise capital if needed and risks associated with international operations. Other important factors and information are contained in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2011, in the section entitled "Risk Factors," and the Company's other periodic filings with the SEC, which can be accessed at www.take2games.com. All forward-looking statements are qualified by these cautionary statements and apply only as of the date they are made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Forward-Looking Statements |

|

|

A leading global publisher of video games, the strongest growth segment of the entertainment industry Proven growth strategy focused on building compelling interactive entertainment franchises - World-class creative teams - Diverse portfolio of industry-leading intellectual property - Actively investing in digitally delivered content, evolving business models and emerging platforms Solid financial foundation Strong outlook for growth and profitability in fiscal 2013 and beyond Company Overview |

|

|

Expanding Market Opportunity Estimated Global Video Game Market Source: PWC Global entertainment and media outlook: 2011-2015. Excludes hardware and advertising. $ in Billions $54B $57B $62B $67B $73B $79B 8.2% CAGR 0 10 20 30 40 50 60 70 80 90 2010 2011 2012 2013 2014 2015 |

|

|

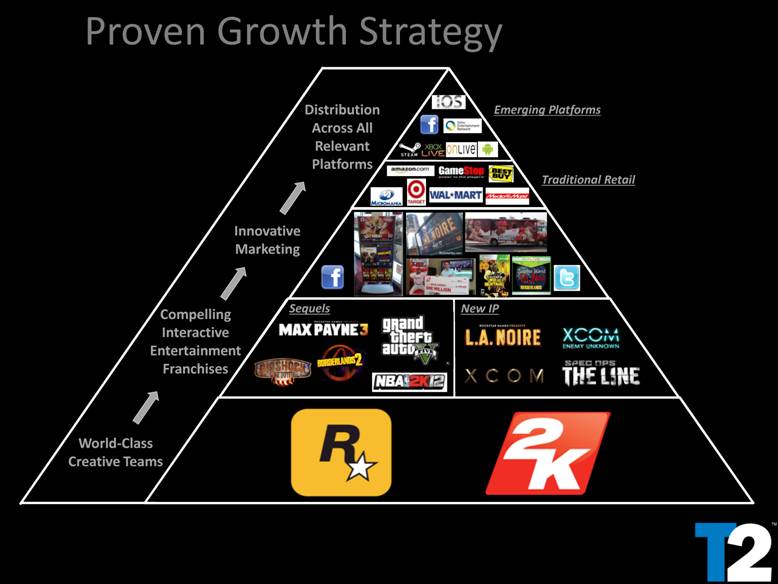

Proven Growth Strategy World-Class Creative Teams Compelling Interactive Entertainment Franchises Innovative Marketing New IP Traditional Retail Emerging Platforms Distribution Across All Relevant Platforms Sequels |

|

|

World-Class Creative Teams High-quality titles for a range of gamers across all key platforms Shooter, action, role-playing, strategy, sports and family entertainment titles Owned and licensed mass-market brands Three divisions: 2K Games, 2K Sports and 2K Play 8 internal studios Groundbreaking action / adventure blockbuster titles Focused on internally owned and developed intellectual property 7 internal studios |

|

|

Over 1,600 in-house developers Strong relationships with leading third-party studios Developed two of the three highest-rated titles for Xbox 360 and the highest-rated title for PS3 and DS Grand Theft Auto IV Grand Theft Auto IV BioShock Grand Theft Auto: Chinatown Wars Source: Metacritic.com as of 2/27/12 2009 Batman: Arkham City 93 93 92 98 96 96 96 96 98 2011 2008 The Orange Box Flipnote Studio 2009 2009 2008 Chrono Trigger 2 2 1 Uncharted 2: Among Thieves 1 1 3 1 2 2 World-Class Creative Teams |

|

|

Diverse Portfolio of Industry-Leading Intellectual Property 9 franchises with individual titles that have sold-in approximately 5 million or more units 5 new franchises launched since 2007 - BioShock - Borderlands - Carnival Games - L.A. Noire - The Darkness 33 distinct multi-million unit selling titles |

|

|

Diverse Portfolio of Industry-Leading Intellectual Property The Grand Theft Auto Franchise Interactive entertainment industry’s most iconic and critically acclaimed brand Pioneered and continues to redefine the open world action genre Franchise has sold-in 120 million units Grand Theft Auto IV received the highest ever ratings on Xbox 360 and PS3, and has sold-in nearly 24 million units (1) Highly successful additional episodes including The Lost and Damned and The Ballad of Gay Tony Grand Theft Auto V is in full development (1) Includes Complete Edition and Special Edition |

|

|

Action/adventure game set in early 1900’s Western frontier Red Dead Redemption received average Metacritic ratings of 95 and over 150 “Game of the Year” awards Highly successful single and multiplayer add-on content Quintessential “Street racing” series Popularized the third-person shooter genre Max Payne 3 is planned for release in May 2012 Cinematic crime thriller combines action with real detective work, utilizing unique facial animation technology First video game ever selected for the Tribeca Film Festival Key Rockstar Franchises Diverse Portfolio of Industry-Leading Intellectual Property |

|

|

Diverse Portfolio of Industry-Leading Intellectual Property Key 2K Games Franchises BioShock is one of the highest-rated titles on Xbox 360 and PS3 BioShock Infinite is planned for release in October 2012 One of world’s top strategy titles for the PC Includes Take-Two’s first social game – Sid Meier’s Civilization World for Facebook Authentic, action-packed gangster saga Critically acclaimed, role-playing shooter Successful add-on content Borderlands 2 is planned for release in September 2012 |

|

|

Diverse Portfolio of Industry-Leading Intellectual Property The NBA 2K Franchise Top-ranked NBA title for 11 years running NBA 2K11 won more than 20 “Sports Game of the Year” awards NBA 2K12 achieved the highest scores in the history of the franchise and 2K Sports (90 – Metacritic) |

|

|

Wide-ranging slate of games based on popular Nick Jr. programs Broadening lineup of youth oriented games Diverse Portfolio of Industry-Leading Intellectual Property Key 2K Play Franchises Family-friendly game offered on multiple platforms including Xbox 360 (Kinect), Wii, DS, 3DS and iOS |

|

|

Disc DLC June 2010 Sept 2010 Nov 2010 August 2010 Oct 2010 Create consumer excitement to expand audiences Extend life and value of franchises Drive value through evolving business models May 2010 Innovative Marketing |

|

|

Global distribution through packaged and digital retail Expanding offerings for tablets and smartphones Partnered with market leaders in Asia to develop online games – online version of NBA 2K for China – online baseball game for South Korea – MMO game based on a top 2K Games franchise Selectively investing in the social gaming space Significant Investment in Traditional & Emerging Platforms |

|

|

Capitalizing on Growth of Digital Distribution $52.9M $94.1M $105.5M TTM Dec-09 7% TTM Dec-10 8% TTM Dec-11 12% Digital Revenue Digital as % of Total |

|

|

Increased diversification of revenues 12 new titles plus wide range of catalog, add-on content and mobile offerings expected to contribute to revenue in fiscal 2012 Expanded global presence 40% of revenues expected from outside North America in fiscal 2012 (45% excluding sports business) Achieved $40 million of annual cost savings since 2007 Strong balance sheet and capital reserve $453 million in cash as of December 31, 2011, and $100 million undrawn credit line Substantial growth expected in fiscal 2013, including Non-GAAP net income in excess of $2.00 per share (1) See the attached Glossary for a discussion of non-GAAP financial measures and cautionary statement . Solid Financial Foundation |

|

|

Robust Pipeline of Titles in Development |

|

|

Global interactive entertainment company focused on building compelling franchises World-class creative talent Diverse portfolio of industry-leading intellectual property Actively investing in digitally delivered content, evolving business models and emerging platforms Solid financial foundation Strong outlook for growth and profitability in fiscal 2013 and beyond Take-Two Positioned for growth |

|

|

Non-GAAP Financial Measures In addition to reporting financial results in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses Non-GAAP measures of financial performance that exclude certain non-recurring or non-cash items. Non-GAAP gross profit, income (loss) from operations, net income (loss), and earnings (loss) per share are measures that exclude certain non-recurring or non-cash items and should be considered in addition to results prepared in accordance with GAAP. They are not intended to be considered in isolation from, as a substitute for, or superior to, GAAP results. These Non-GAAP financial measures may be different from similarly titled measures used by other companies. The Company believes that these Non-GAAP financial measures, when taken into consideration with the corresponding GAAP financial measures, are important in gaining an understanding of the Company’s ongoing business. These Non-GAAP financial measures also provide for comparative results from period to period. Therefore, the Company believes it is appropriate to exclude certain items as follows: Stock-based compensation – the Company does not consider stock-based compensation charges when evaluating business performance and management does not contemplate stock-based compensation expense in its short- and long-term operating plans. As a result, the Company has excluded such expenses from its Non-GAAP financial measures. Business reorganization, restructuring and related expenses – the Company does not engage in reorganization activities on a regular basis and therefore believes it is appropriate to exclude business reorganization, restructuring and related expenses from its Non-GAAP financial measures. Income (loss) from discontinued operations – the Company does not engage in sales of subsidiaries on a regular basis and therefore believes it is appropriate to exclude such gains (losses) from its Non-GAAP financial measures. As the company is no longer active in its discontinued operations, it believes it is appropriate to exclude income (losses) thereon from its Non-GAAP financial measures. Professional fees and expenses associated with unusual legal and other matters – the Company has incurred expenses for professional fees and has accrued for legal settlements that are outside its ordinary course of business. As a result, the Company has excluded such expenses from its Non-GAAP financial measures. Non-cash interest expense related to convertible debt – The Company records non-cash interest expense on its convertible notes in addition to the interest expense already recorded for coupon payments. The Company excludes the non-cash portion of the interest expense from its Non-GAAP financial measures because these amounts are unrelated to its ongoing business operations. Non-cash tax expense for the impact of deferred tax liabilities associated with tax deductible amortization of goodwill – due to the nature of the adjustment as well as the expectation that it will not have any cash impact in the foreseeable future, the Company believes it is appropriate to exclude this expense from its Non-GAAP financial measures. Glossary |