Attached files

| file | filename |

|---|---|

| 8-K - THIS FILING DISCLOSES MATERIAL TO BE USED IN MEETINGS WITH INVESTORS AND ANALYSTS - PROASSURANCE CORP | bodyoffiling.htm |

March 5, 2012

W. Stancil Starnes

Chairman and Chief Executive Officer

Chairman and Chief Executive Officer

Investor Presentation

Investor Presentation

Raymond James & Associates

Raymond James & Associates

33nd Annual Institutional Investors Conference

33nd Annual Institutional Investors Conference

This presentation contains Forward Looking Statements and other information designed to convey

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

our projections and expectations regarding future results. There are a number of factors which

could cause our actual results to vary materially from those projected in this presentation. The

principal risk factors that may cause these differences are described in various documents we file

with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our

regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review

this presentation in conjunction with a thorough reading and understanding of these risk factors.

This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in

our remarks and discussions. A reconciliation of these measures to GAAP measures is available in

our latest quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Reports on Form 8K disclosing that release.

our remarks and discussions. A reconciliation of these measures to GAAP measures is available in

our latest quarterly news release, which is available in the Investor Relations section of our website,

www.ProAssurance.com, and in the related Current Reports on Form 8K disclosing that release.

FORWARD LOOKING STATEMENTS

2

NON-GAAP MEASURES

The only pure-play, publicly-traded insurer

in the healthcare professional liability line

in the healthcare professional liability line

Handout Slides 2-6

Unmatched financial performance

Handout slides 7-13

Unequaled Value for Our Insureds

Handout slides 14-21

A Clear Strategy for an Uncertain Future

Handout slides 22-29

Handout slides 30-31

March 5, 2012

W. Stancil Starnes

Chairman and Chief Executive Officer

Chairman and Chief Executive Officer

Investor Presentation

Investor Presentation

Raymond James & Associates

Raymond James & Associates

33nd Annual Institutional Investors Conference

33nd Annual Institutional Investors Conference

March 5-6, 2012

Investor Handouts

Investor Handouts

Raymond James & Associates

Raymond James & Associates

33nd Annual Institutional Investors Conference

33nd Annual Institutional Investors Conference

ProAssurance

We are the only pure-play, publicly-traded

healthcare professional liability (HCPL)

insurance company in America

healthcare professional liability (HCPL)

insurance company in America

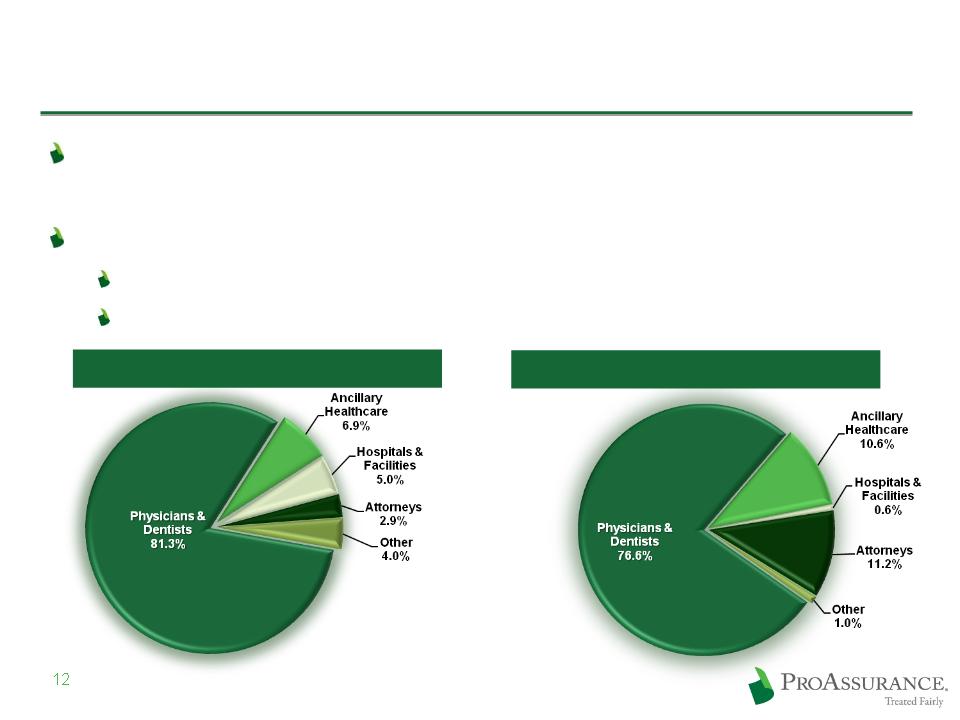

ProAssurance Corporate Profile

Specialty writer of professional liability insurance

Primarily Healthcare Professional Liability (HCPL)

Only pure play public company writing predominately HCPL

Market Cap: ~2.7 billion

Shareholders’ Equity: $2.0 billion

Total Assets: $5 billion

Annualized dividend yield is 1.1% / $0.25/share

Rated “A” by Fitch and A. M. Best

11

This is ProAssurance

Evolving strategy is successfully adding business across the

risk spectrum as the delivery of healthcare changes

risk spectrum as the delivery of healthcare changes

Distribution is Independent Agent (64%) and Direct (34%)

Direct in Alabama, Florida and in all states for Podiatric business

Dual distribution in DC, Texas and parts of Missouri

2011 Policyholders: ~71,500

2011 Gross Written Premium: $566 million

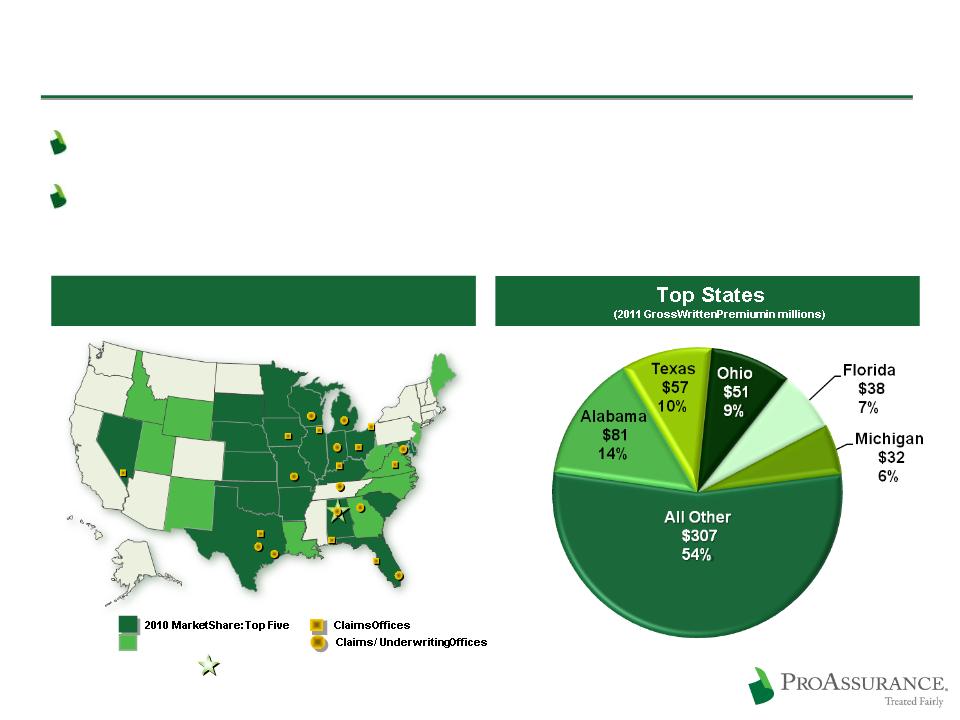

ProAssurance Geographic Profile

Broad geographic diversification

Locally-based decision differentiates ProAssurance by

addressing each state’s unique medical/legal challenges

addressing each state’s unique medical/legal challenges

13

Corporate Headquarters

Corporate Headquarters

(Birmingham)

2010 Market Share: Six-Ten

2010 Market Share: Six-Ten

ProAssurance Footprint

December 31, 2011

HCPL Stands Apart in Insurance

14

Long-tail vs. short tail

Prolonged period of “benign profitability”

Premiums levels remain well above levels of 2000

Significant policyholder retention

No large commercial carriers have entered the

market in a meaningful manned

market in a meaningful manned

Significant barriers to entry in underwriting and

claims handling

claims handling

No Catastrophe exposure

The Performance of ProAssurance

We ensure that we deliver an unparalleled level of

service and financial stability that truly

differentiates our coverage and our Company

service and financial stability that truly

differentiates our coverage and our Company

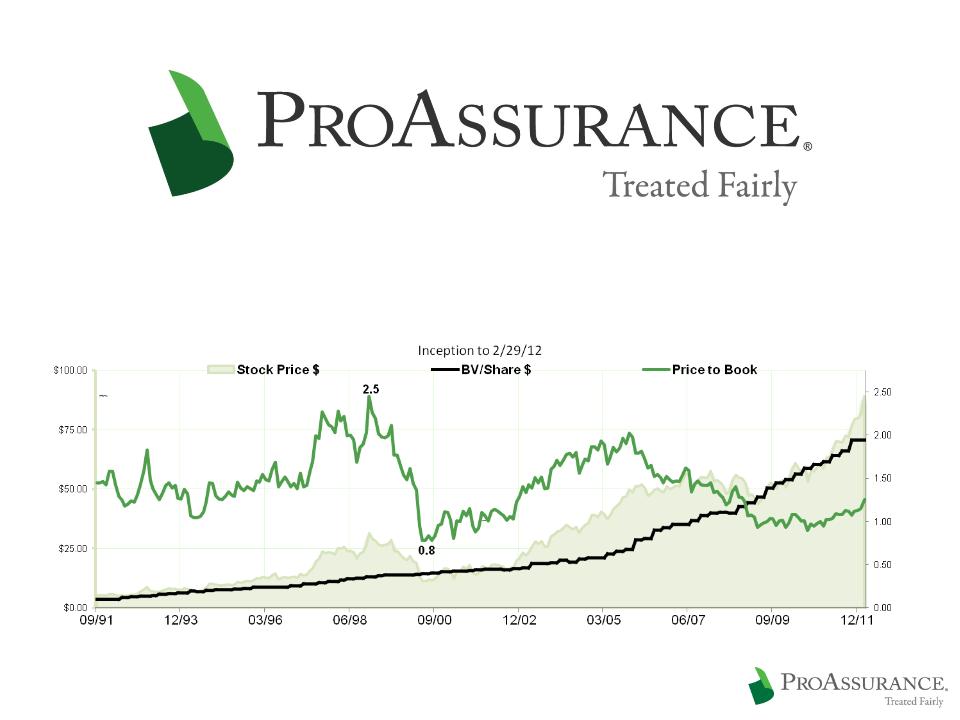

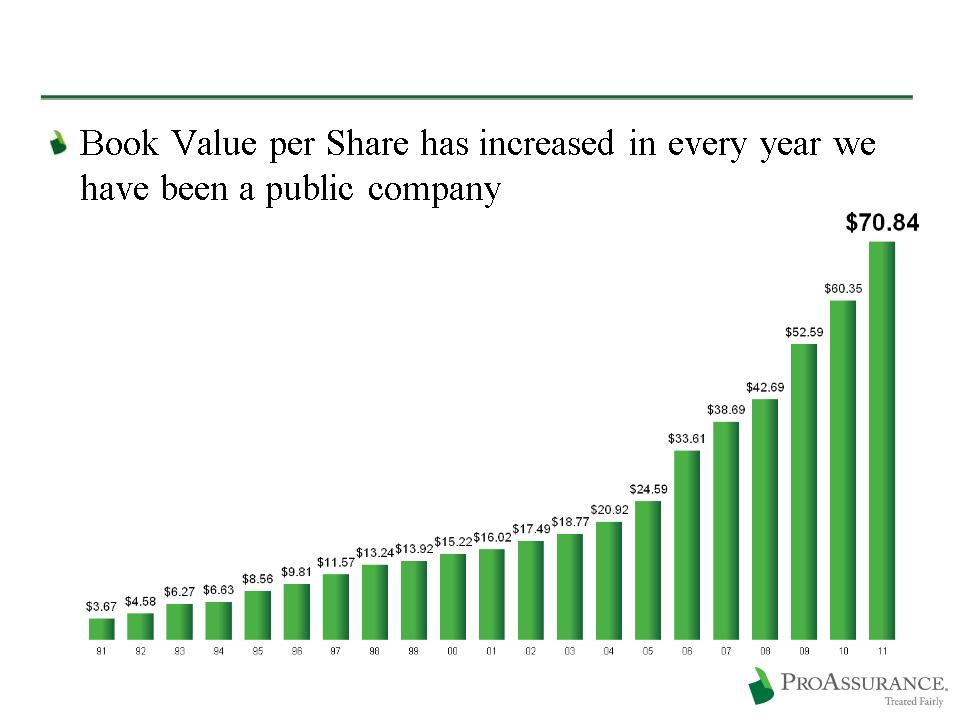

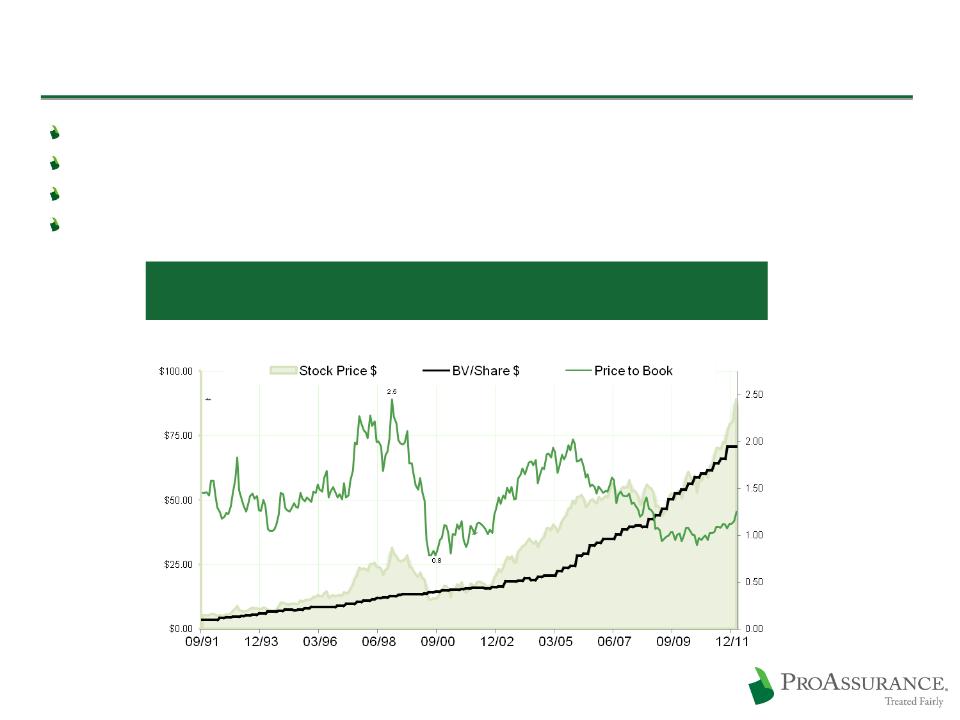

Consistent Success in All Financial Climates

16

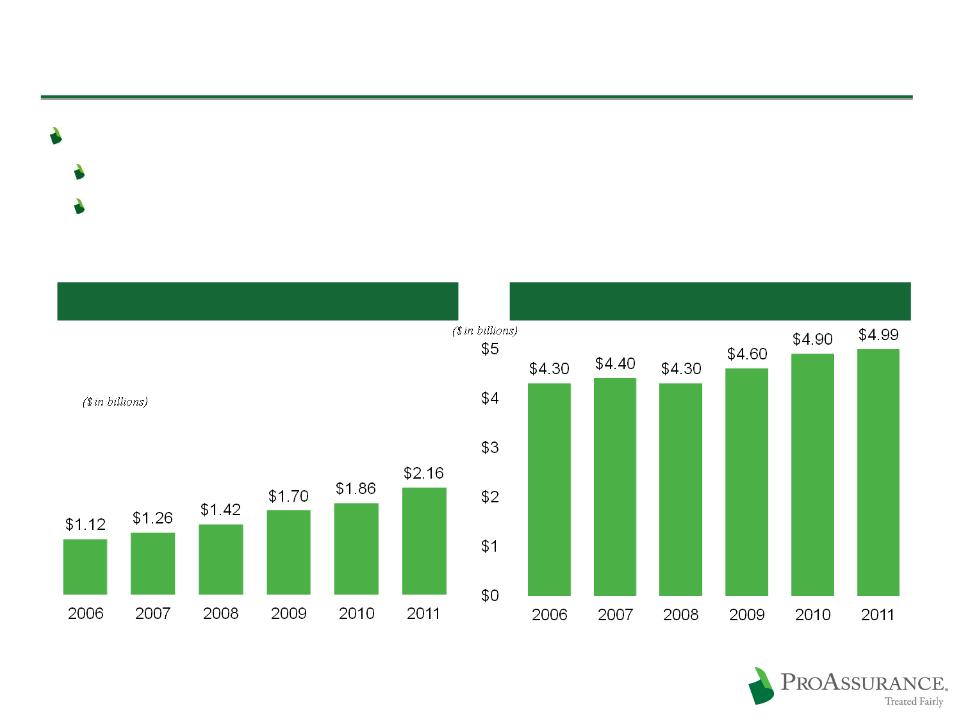

Historical Book Value Per Share

Inception to 12/30/11

CAGR: 16%

CAGR: 16%

Cumulative:1832%

10 Year Summary (2001 -2010)

CAGR: 16%

CAGR: 16%

Cumulative: 342%

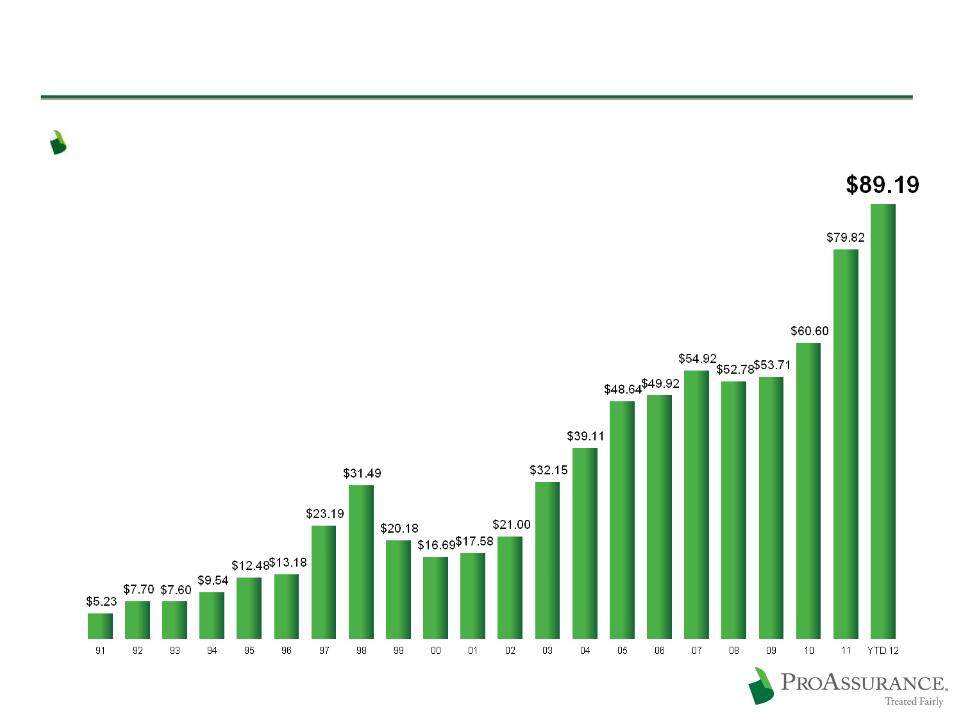

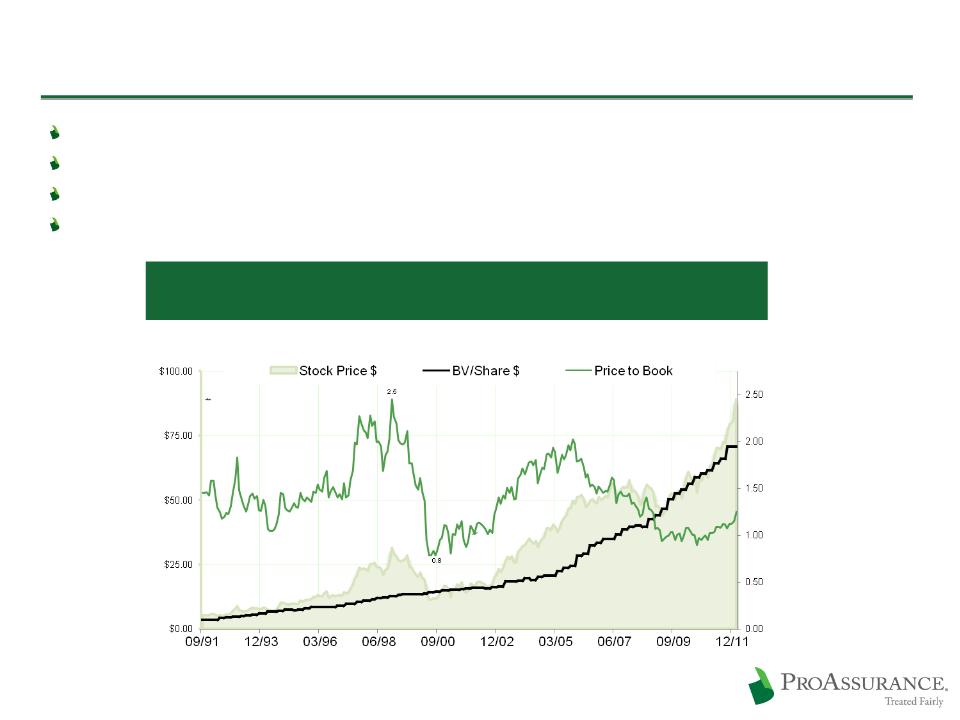

Consistent Success in All Financial Climates

Share price rewards long term holders with a

variety of investing styles

variety of investing styles

17

Historical Book Value Per Share

Inception to 2/24/12

CAGR: 15%

CAGR: 15%

Cumulative:1605%

10 Year Summary (2002 -2011)

CAGR: 16%

CAGR: 16%

Cumulative: 354%

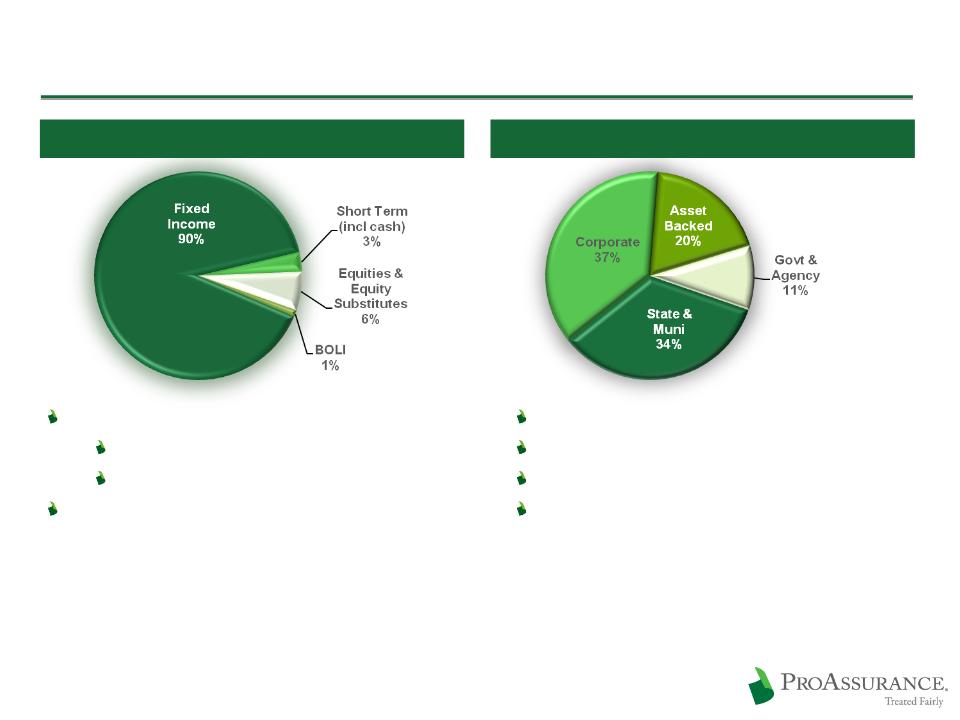

ProAssurance: Investment Profile

18

$4.1 Billion Overall Portfolio

$3.7 Billion Fixed Income Portfolio

Average duration: 3.9 years

Average tax-equivalent Income yield: 4.5%

Investment grade: 96%

Weighted average: AA-

12/31/11

Key portfolio actions in Q4

Added dividend-paying equities

Added to high yield investments

CUSIP-level portfolio disclosure on our website:

www.proassurance.com/investorrelations/supplemental.aspx

www.proassurance.com/investorrelations/supplemental.aspx

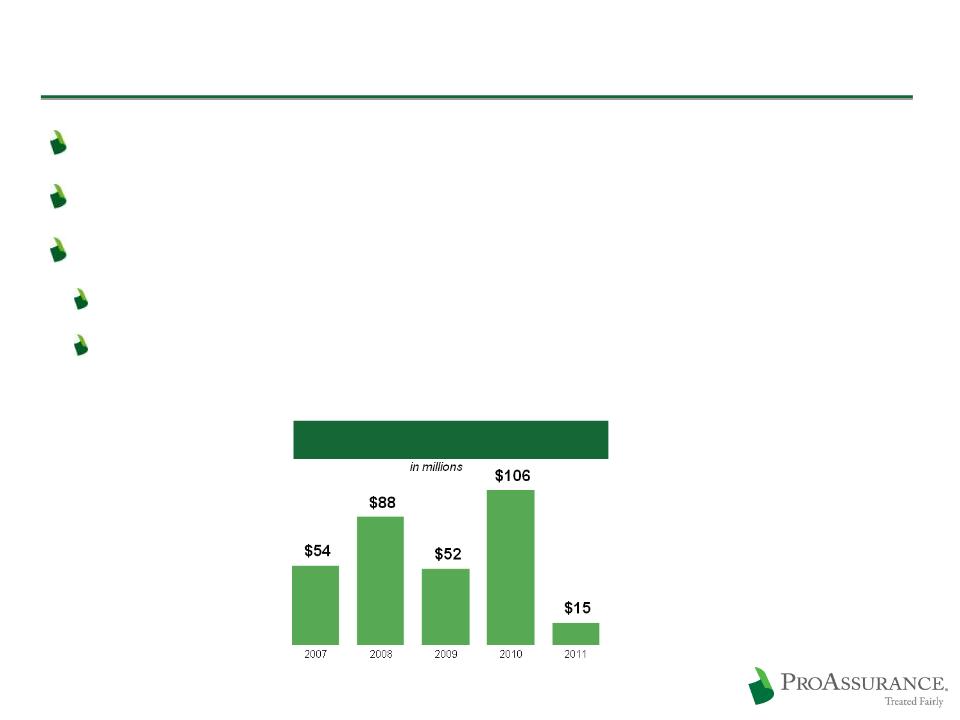

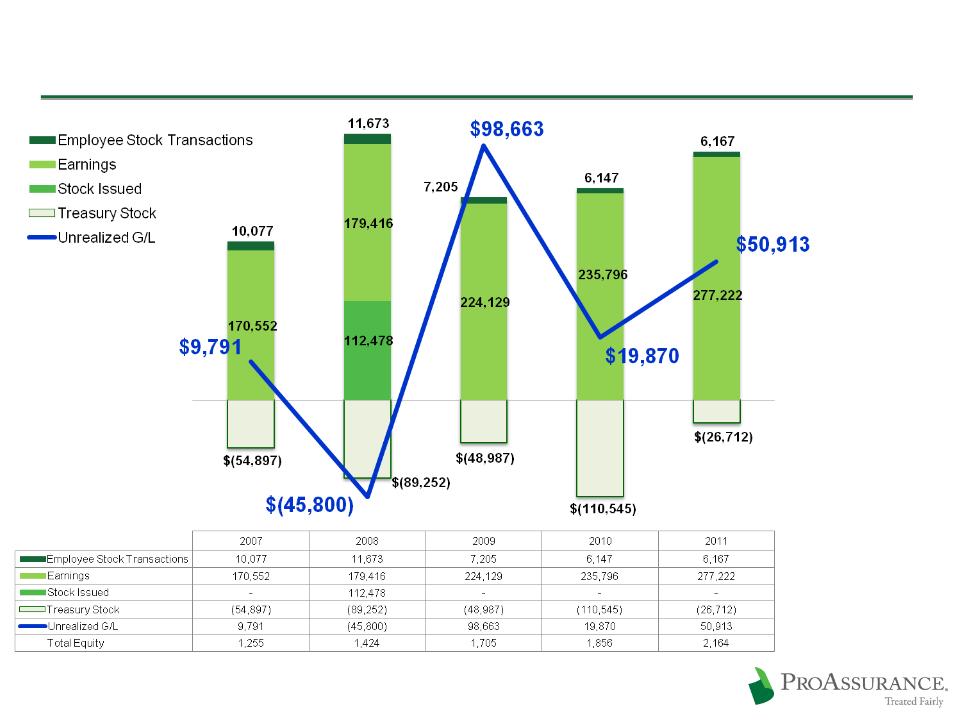

Committed to Effective Capital Management

Balancing future needs with current market reality

Dividend is current $1.00/share/year

Complements our prudent share repurchase program

$315 million spent to repurchase 6.0 million shares since 2005

Enhancing shareholder value by repurchasing

shares at prices that build Book Value

shares at prices that build Book Value

19

Share Repurchase History

Steady Return in an Unfavorable Environment

Meeting our long-term ROE target of 12% -14%

Components of Return on Equity (in millions)

Driven to Excel / Focused on Shareholder Value

Maintaining profitability

Sustaining book value growth

Producing sustainable shareholder value

Focusing on long-term—ready for the market turn

21

Current Prices Continue to Offer a Compelling Buying Opportunity

Current Price to YE 2011 Book: ~1.3x Average Since Inception: 1.4x

The Passion of ProAssurance

We ensure that we deliver an unparalleled level of

service and financial stability that truly

differentiates our coverage and our Company

service and financial stability that truly

differentiates our coverage and our Company

The Promise of Treated Fairly

23

The touchstone for every decision and

interaction at ProAssurance

interaction at ProAssurance

Affirms our existing, enduring commitment to

every stakeholder

every stakeholder

Insureds

Agents

Investors

The public

Employees

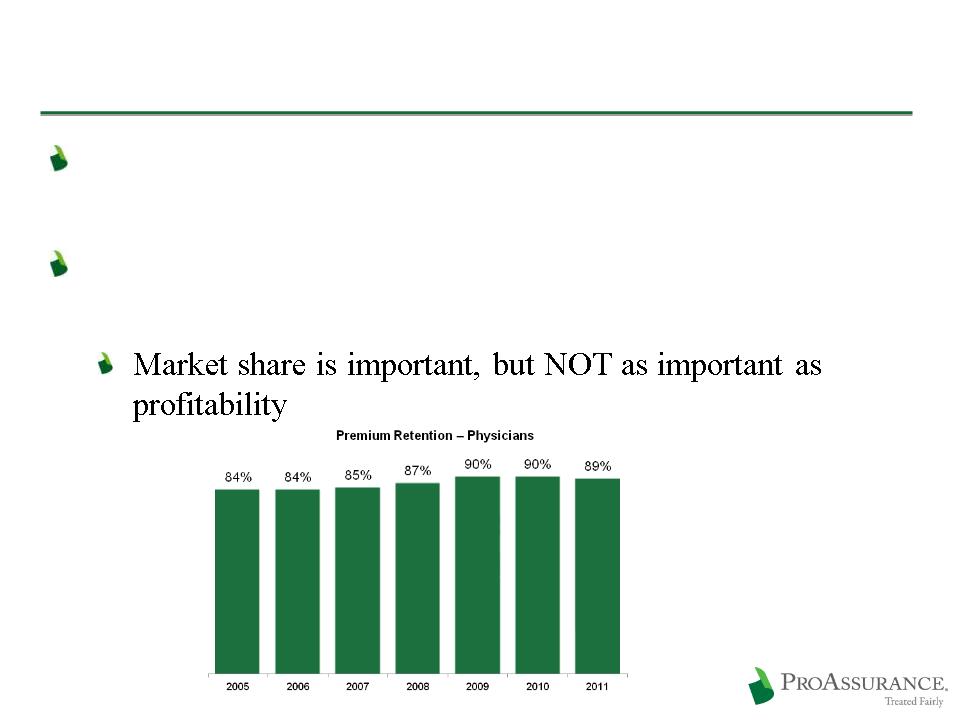

Underwriting for Profitability Not Market Share

Underwriting process driven by individual risk

selection and assessment of loss history, areas of

practice, and location

selection and assessment of loss history, areas of

practice, and location

Rates contemplate specific ROE expectations

Frequent rate/loss reviews ensure adequate prices

Rate filings consider the results of the past five to

seven years to ensure a single year does not unduly

influence results

seven years to ensure a single year does not unduly

influence results

Stringent underwriting standards maintain rate

structure and enhance profitability

structure and enhance profitability

24

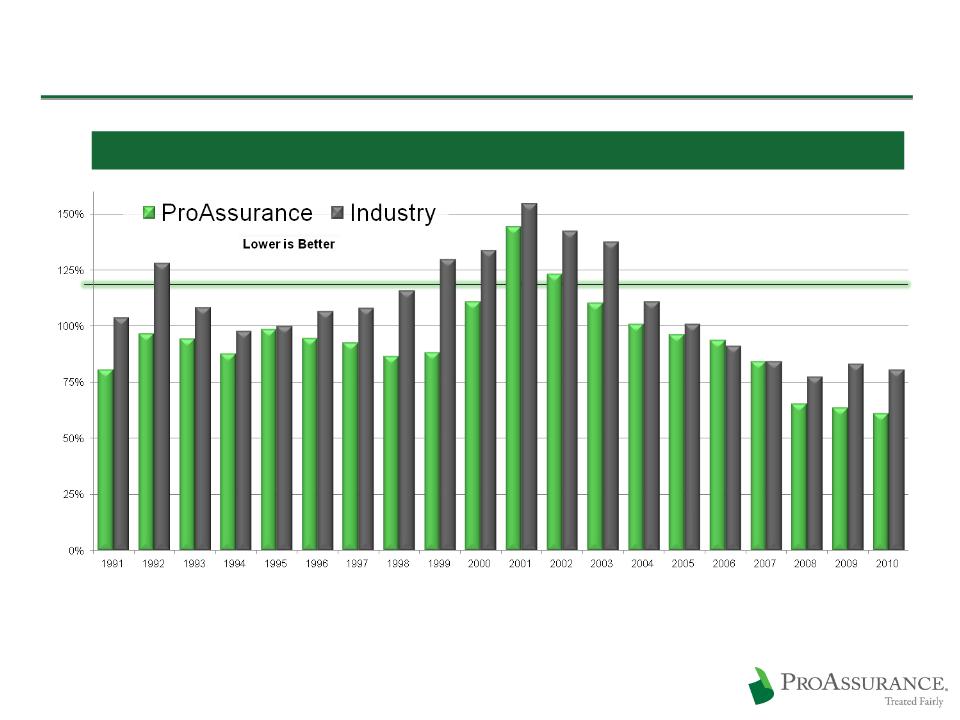

Calendar Year Combined Ratio: ProAssurance Consistently Outperforms

ProAssurance Outperforms the Industry

Five Years: ProAssurance Average: 73.5% / Industry Average: 83.3%

Ten Years: ProAssurance Average: 94.2% / Industry Average: 106.3%

All Years: ProAssurance Average: 93.6% / Industry Average: 109.7%

Source: A.M. Best Aggregates and Averages, Medical Malpractice Lines of Business

25

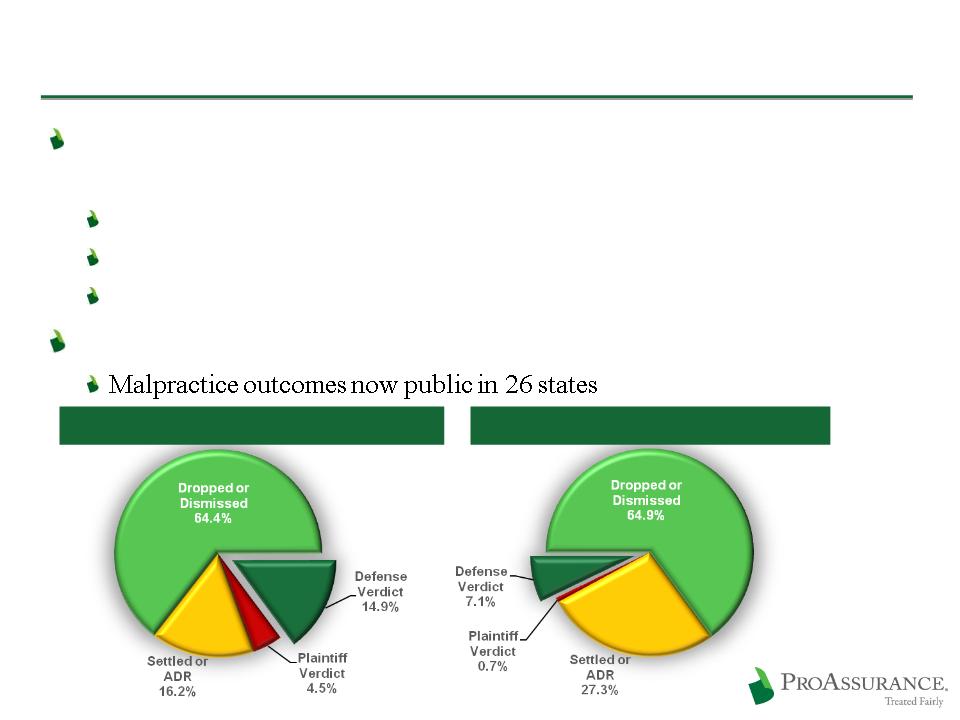

Differentiate Through Claims Defense

We leverage our financial strength to gives our insureds the

opportunity for an uncompromising defense of their claim

opportunity for an uncompromising defense of their claim

Differentiates our product

Provides long-term financial and marketing advantages

Retains business and deters future lawsuits

Increasingly important as claims data becomes public

ProAssurance: 79% Favorable Outcomes

Industry: 72% Favorable Outcomes

Source: PIAA 2010 Claim Trend Analysis

ProAssurance Excluded

ProAssurance Excluded

Five Year Average

2006-2010

2006-2010

26

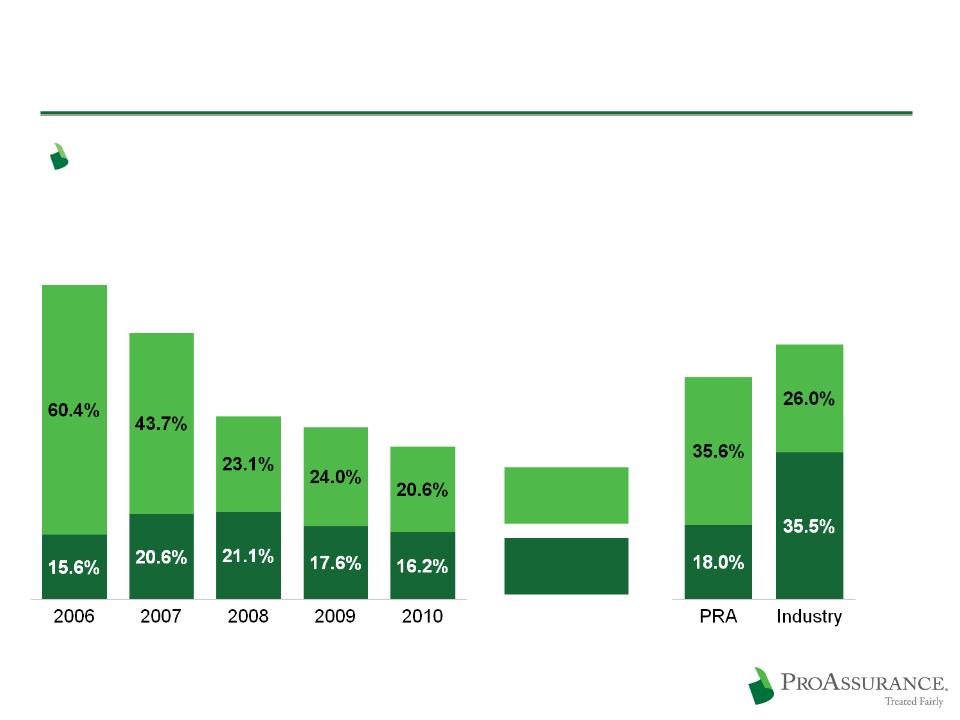

The Bottom Line Benefits of Strong Defense

Our ability and willingness to defend claims

allows us to achieve better results

allows us to achieve better results

Source: Statutory Basis, A.M. Best Aggregates & Averages

Some totals may not agree due to rounding

Some totals may not agree due to rounding

ProAssurance vs. Industry

Average Loss Ratio (2006-2010)

Legal

Payments

Payments

Loss

Payments

Payments

64.3%

44.2%

61.5%

53.6%

41.6%

76.0%

36.8%

ProAssurance Stand Alone

Loss Ratio (2006-2010)

27

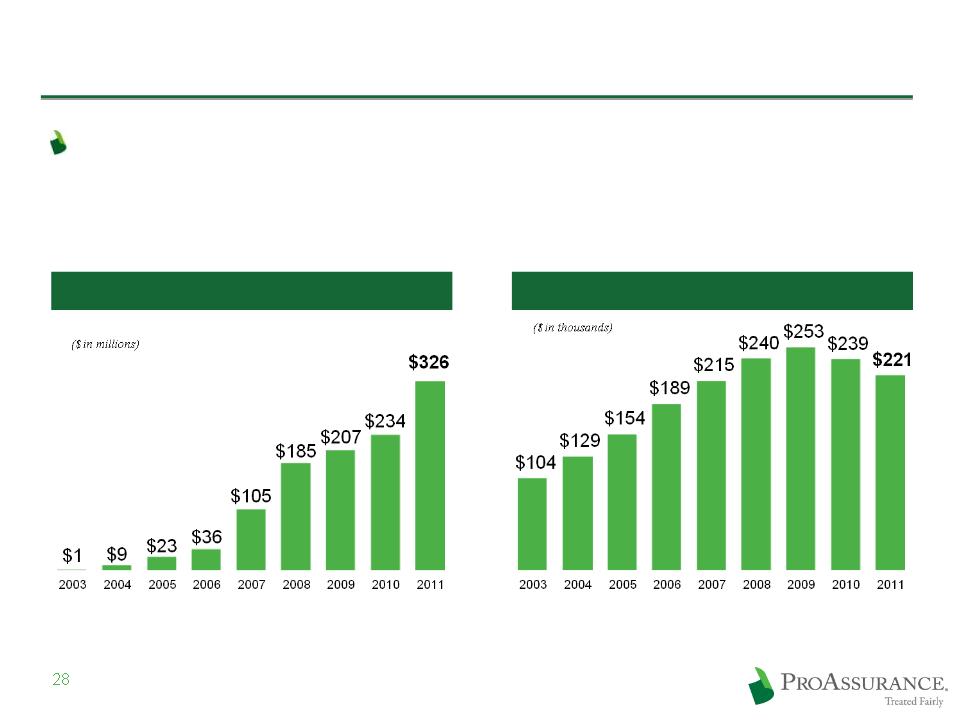

Conservative Approach to Reserves

Consistent reserving practices provide protection

against a loss trend reversal and capital erosion

against a loss trend reversal and capital erosion

Net Favorable Reserve Development

Net Reserve per Open MPL Claim1

1 Statutory basis; Loss & LAE

Acquired company data included at end of acquiring year

Acquired company data included at end of acquiring year

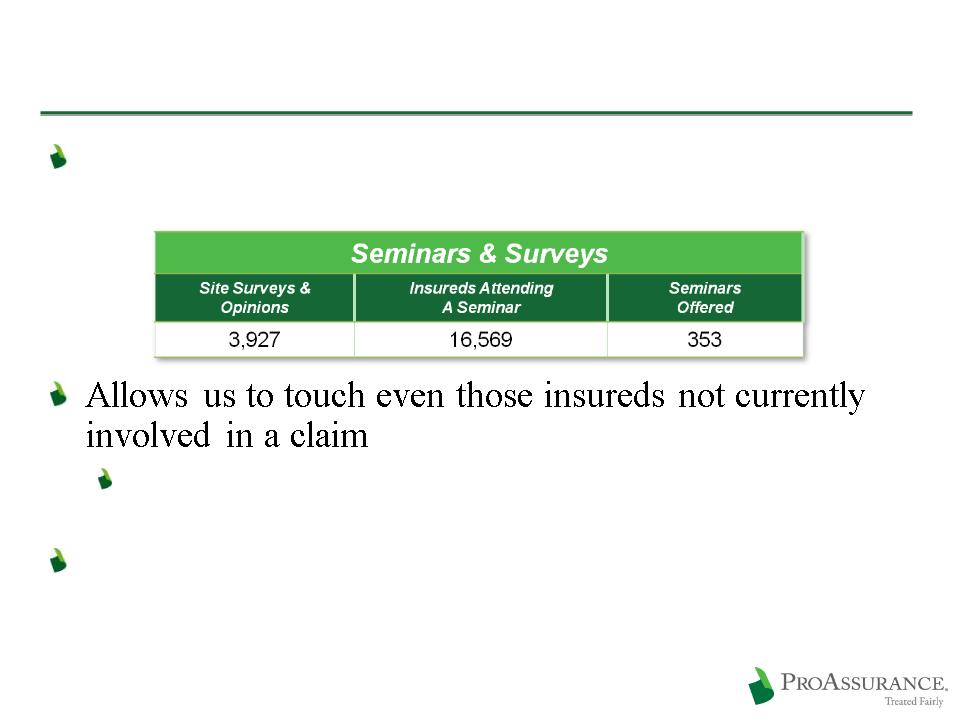

Effective Risk Management

Online and in-person risk management showcase our

expertise and differentiates our Company

expertise and differentiates our Company

Over 70% of insured physicians were touched by risk

management in 2011

management in 2011

Over 84,000 speciality-specific risk management

publications delivered each year

publications delivered each year

29

Prospects for ProAssurance

We are confident that our deep expertise and solid

financial strength have prepared us for the

challenges of the evolving healthcare market

financial strength have prepared us for the

challenges of the evolving healthcare market

ProAssurance’s Growth Outlook

Growth opportunities will be shaped by a healthcare

landscape that will see enormous changes—with or

without federal healthcare reform

landscape that will see enormous changes—with or

without federal healthcare reform

We are expanding our hospital capabilities and commitment

Building on two decades of hospital experience

We continue to enhance our commitment to individual

providers and small groups

providers and small groups

There will be M&A in our future but our growth

may be less dependent on M&A than in the past

may be less dependent on M&A than in the past

31

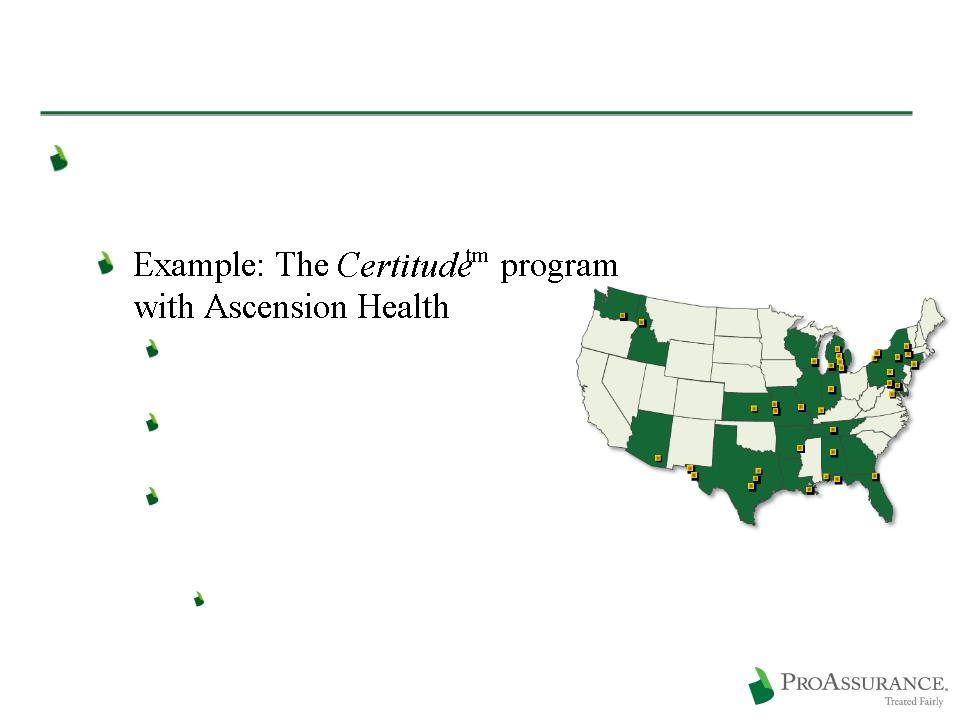

ProAssurance’s Growth Strategy

Leverage our reach, expertise and financial strength

with larger accounts

with larger accounts

Largest non-profit healthcare

system in the US

system in the US

Now in Michigan, expanding

into other states throughout 2012

into other states throughout 2012

Insuring Ascension-affiliated

physicians through coordinated,

jointly insured programs

physicians through coordinated,

jointly insured programs

Financial involvement of both entities creates incentive to reduce risk

32

*www.ascensionhealth.org/annualreport/health.php

Ascension Health’s Ministry Locations*

ProAssurance’s Growth Strategy

Joint physician/hospital insurance products to

addresses the unique risk tolerance and claims-

handling expectation of each insured

addresses the unique risk tolerance and claims-

handling expectation of each insured

Already creating broad interest in the market with

several policies in force

several policies in force

Providing sophisticated alternative risk

programs for organizations as they increase in

size and sophistication

programs for organizations as they increase in

size and sophistication

We have proven experience in facilitating self-

insurance and captive insurance programs

insurance and captive insurance programs

33

ProAssurance’s M&A Strategy

Consolidation will continue and will remain episodic

Fewer significant targets

Remaining companies of size are in important strategic

areas

areas

We prefer “health care centric” but will consider

closely related liability lines

closely related liability lines

Legal/regulatory environment must be favorable

Not all M&A opportunities should be pursued

We have not “bet the company” on any transaction

34

ProAssurance Operational Strategy

Maintain our profitability and book value growth

Ensure outstanding performance in a challenging

financial market and a demanding line of insurance

financial market and a demanding line of insurance

Focus on long-term

Maintaining balance sheet strength and institutional

expertise to prepare for a changing market

expertise to prepare for a changing market

Leverage financial strength

Protects the balance sheet

Maintains our leading market position

Builds strength for the next cycle turn

35

Healthcare Reform

Known: More customers for us

May accelerate the growth of hospital-owned practices and

consolidation into larger groups

consolidation into larger groups

Provides an opportunity for us due to our geographic reach,

long-term experience in hospitals and our financial strength

long-term experience in hospitals and our financial strength

We have enhanced our ability to write new classes of

business through acquisitions

business through acquisitions

May hasten the need for consolidation of smaller insurers

Unknown: Effect on the medical/legal environment

Increased patient frustration with the system

Possibility of more unexpected outcomes

36

Tort Reform

No meaningful Tort Reform in healthcare reform laws

No prospect for Federal Tort Reform

State Tort Reform battles now being fought in the

courts with mixed results

courts with mixed results

We do not depend on Tort Reform for success

Our results are solid in states with and without Tort Reforms

Prices are set, and reserves established, as if there is no tort

reform, until results reflect otherwise

reform, until results reflect otherwise

37

The Performance of ProAssurance

We ensure that we deliver an unparalleled level of

service and financial stability that truly

differentiates our coverage and our Company

service and financial stability that truly

differentiates our coverage and our Company

Driven to Excel / Focused on Shareholder Value

Maintaining profitability

Sustaining book value growth

Producing sustainable shareholder value

Focusing on long-term—ready for the market turn

39

Current Prices Continue to Offer a Compelling Buying Opportunity

Current Price to YE 2011 Book: ~1.3x Average Since Inception: 1.4x

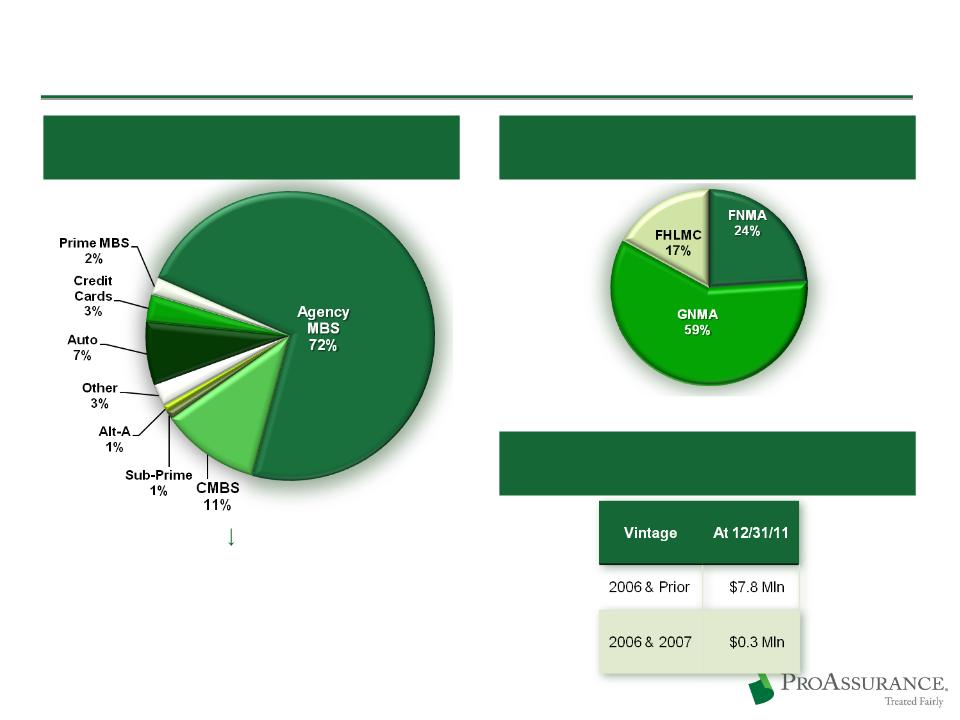

Investment Portfolio Detail

ProAssurance remains conservatively

invested, to ensure our ability to keep our

long-term promise of insurance protection

invested, to ensure our ability to keep our

long-term promise of insurance protection

ProAssurance Portfolio Detail: Asset Backed

41

12/31/11

Subject to Rounding

Asset Backed: $717 Million

Weighted Average Rating: “AA+”

Breakdown of Agency MBS Holdings

Key CMBS Details Provided on Following Page

Sub-Prime: $8.1 mil Market Value (AFS)

$1.2 mil net unrealized loss

$1.2 mil net unrealized loss

$81.2 million Fair Value in non-agency CMBS

Book Value: $76 million (2% of fixed income portfolio)

We have experienced no losses on our CMBS positions

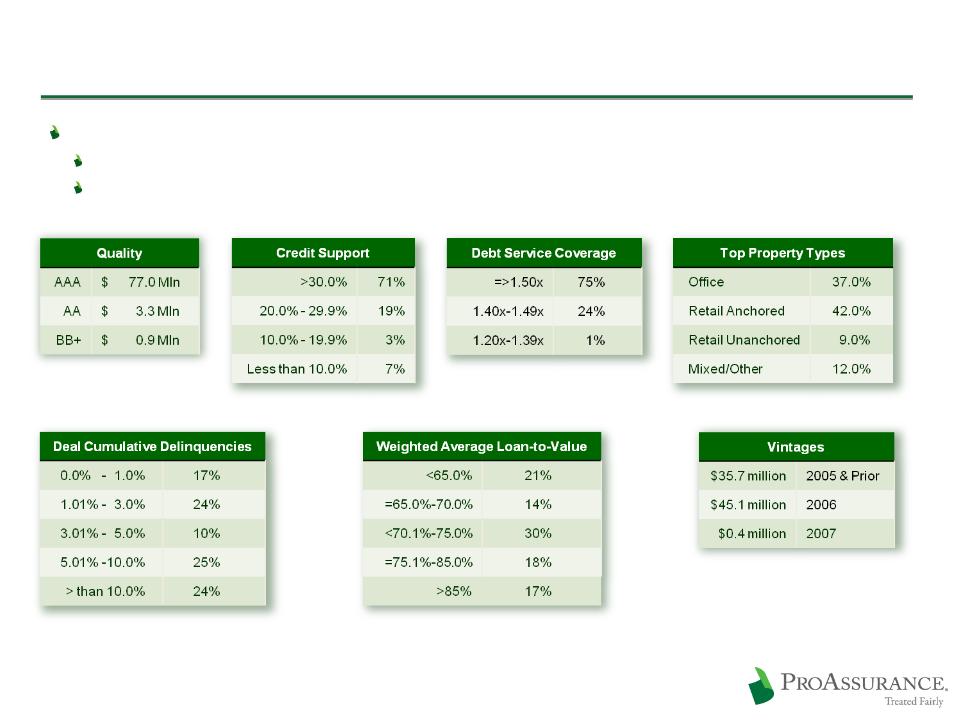

ProAssurance Portfolio Detail: CMBS

42

12/31/11

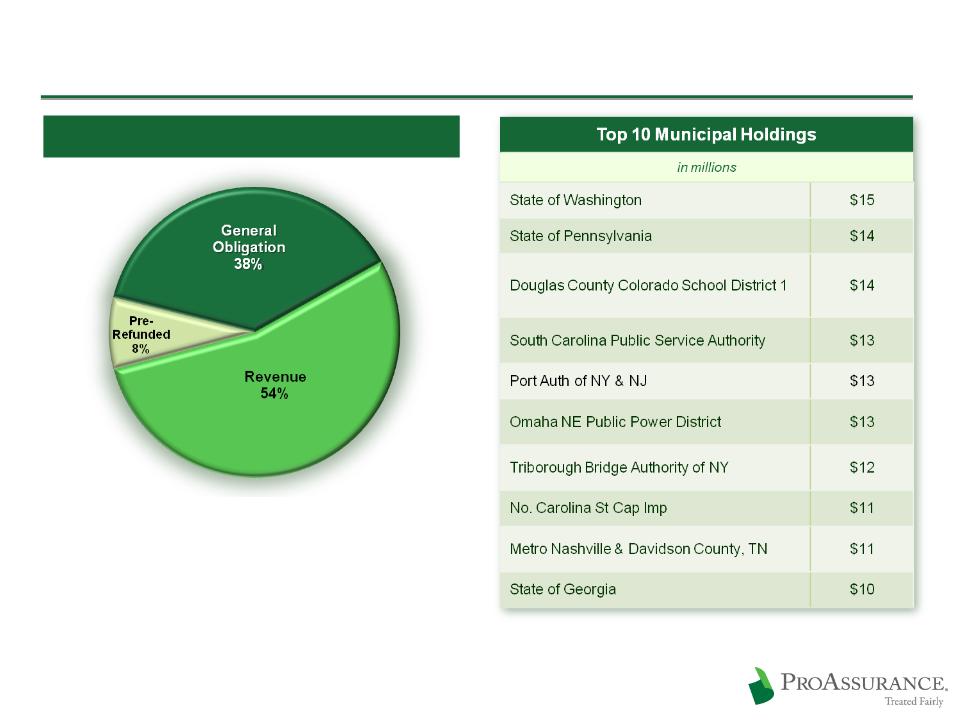

ProAssurance Portfolio Detail: Municipals

43

Municipals: $1.2 Billion / Average Rating is AA

Investment policy has always required

investment grade rating prior to applying the

effect of insurance

investment grade rating prior to applying the

effect of insurance

Weighted Average Rating: AA

12/31/11

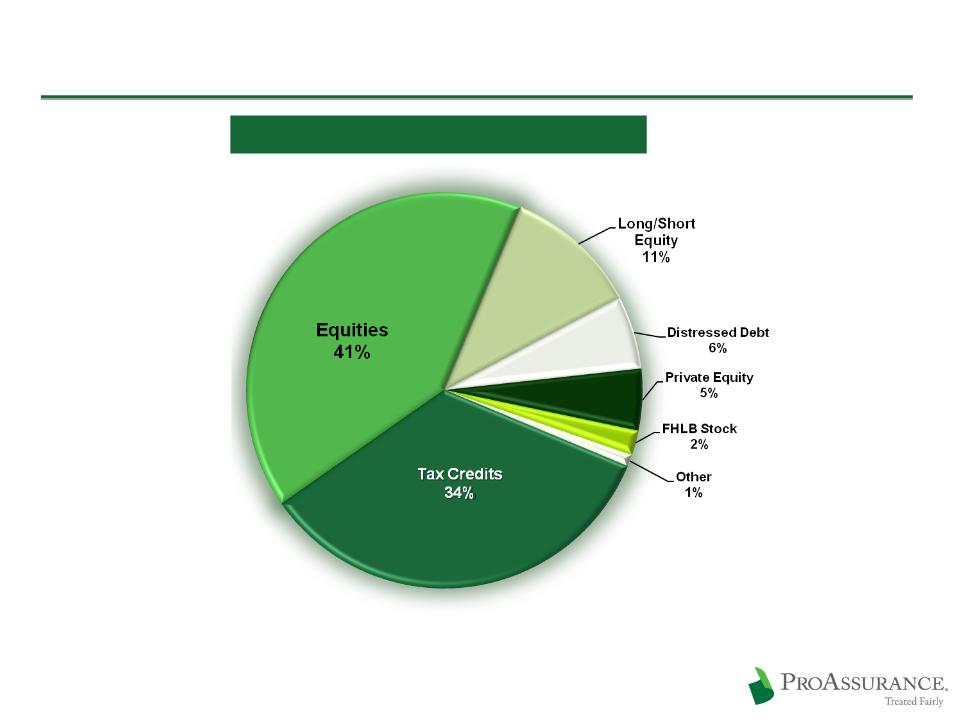

ProAssurance Portfolio Detail: Equities & Other

44

Equities & Other: $253 Million

12/31/11

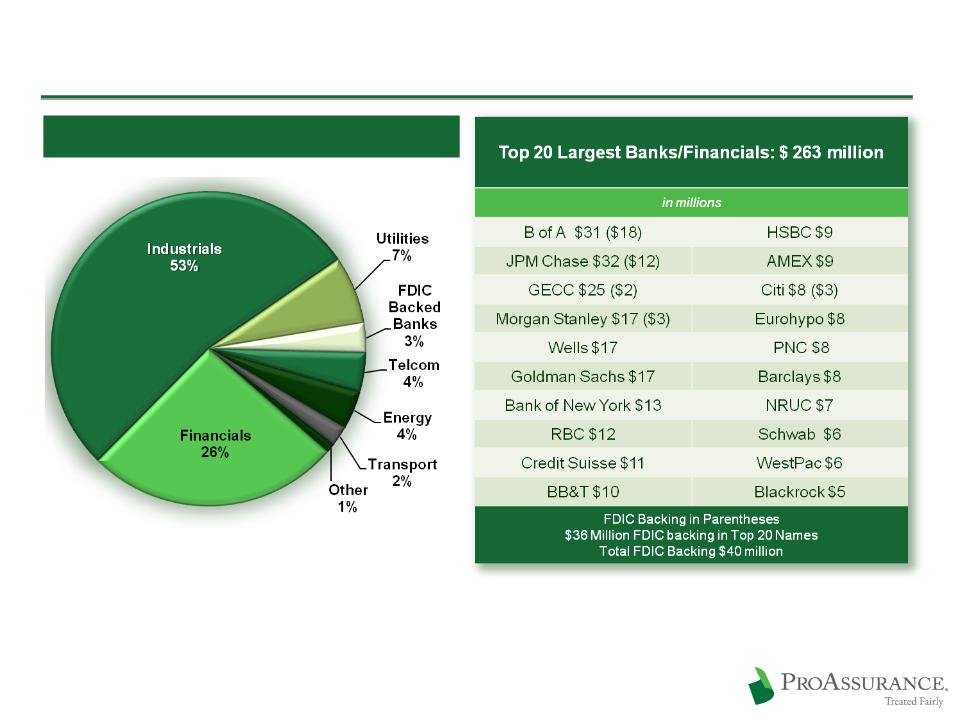

ProAssurance Portfolio Detail: Corporate

45

Corporates: $1.4 Billion

Weighted Average Rating: A

12/31/11

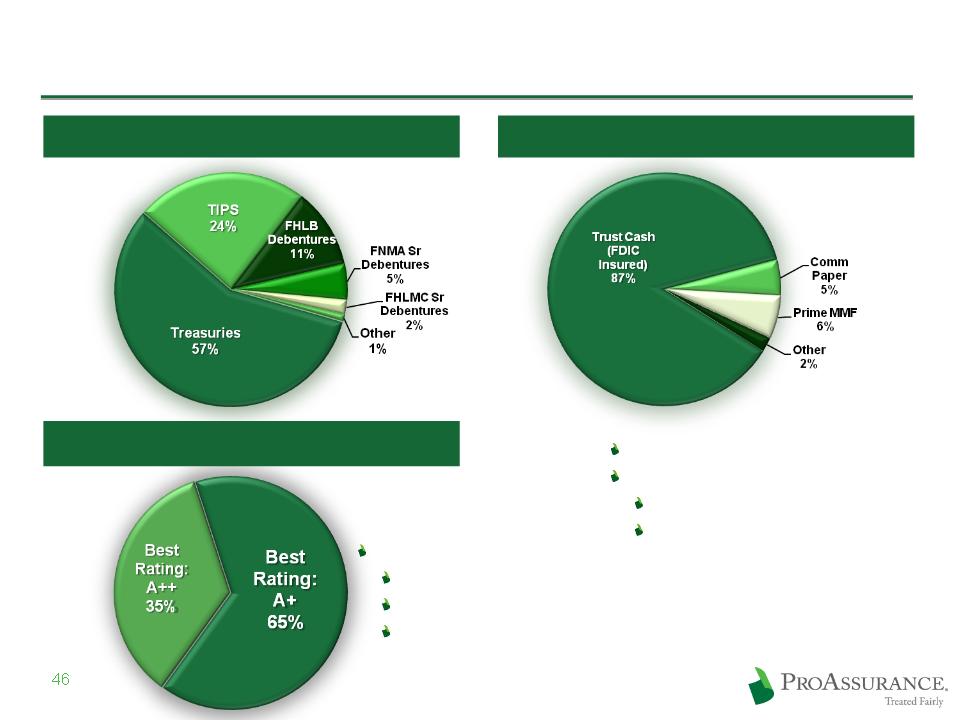

ProAssurance Portfolio Detail: Various

Rated A1/P1 or better

Money Markets:

Moody’s: Aaa

S&P: AAA

Weighted average rating

Moody’s: AA3

S&P: AA-

A. M. Best: A+

Treasury / GSE: $352 Million

Short Term: $119 Million

BOLI: $53 Million

12/31/11

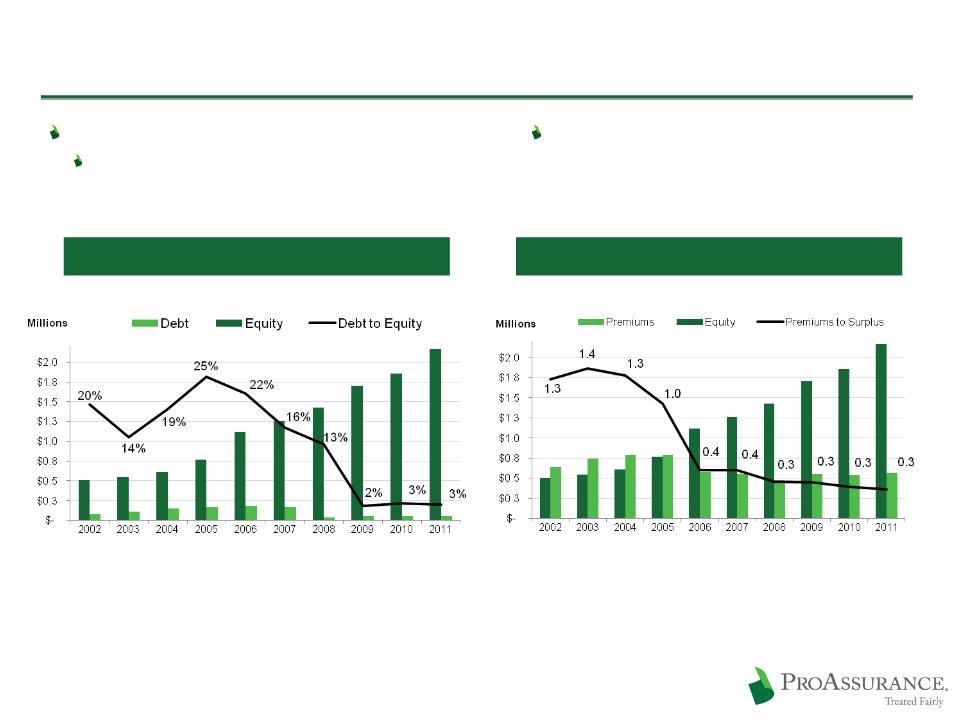

Conservative Use of Debt and Low Leverage

Low Debt to Cap Ratio

No strain on cash flow

47

Debt to Equity

No Debt Prior to 2001

Strong Capital Position

Prepared for an improving market

Long-Term Financial Strength Sets Us Apart

Ensuring the strength of our balance sheet is our top financial priority

Financial strength differentiates us in the market

The claims defense philosophy that differentiates us in the market leverages our

financial strength

financial strength

48

Shareholders’ Equity

94% Increase Since 12/31/06

Total Assets

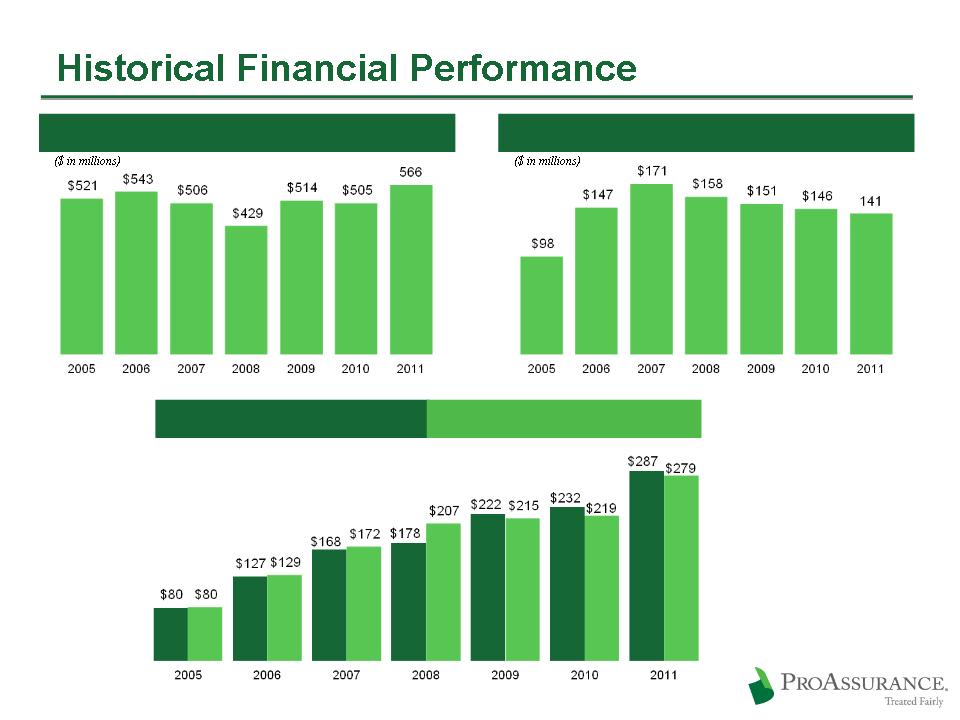

Net Investment Income

Net Premiums Written

($ in millions. Excludes discontinued operations)

Net Income

Operating Income1

49

1 Excludes the after-tax effects of net realized gains or losses, non-policyholder litigation

results and

guaranty fund assessments or recoupments

results and

guaranty fund assessments or recoupments

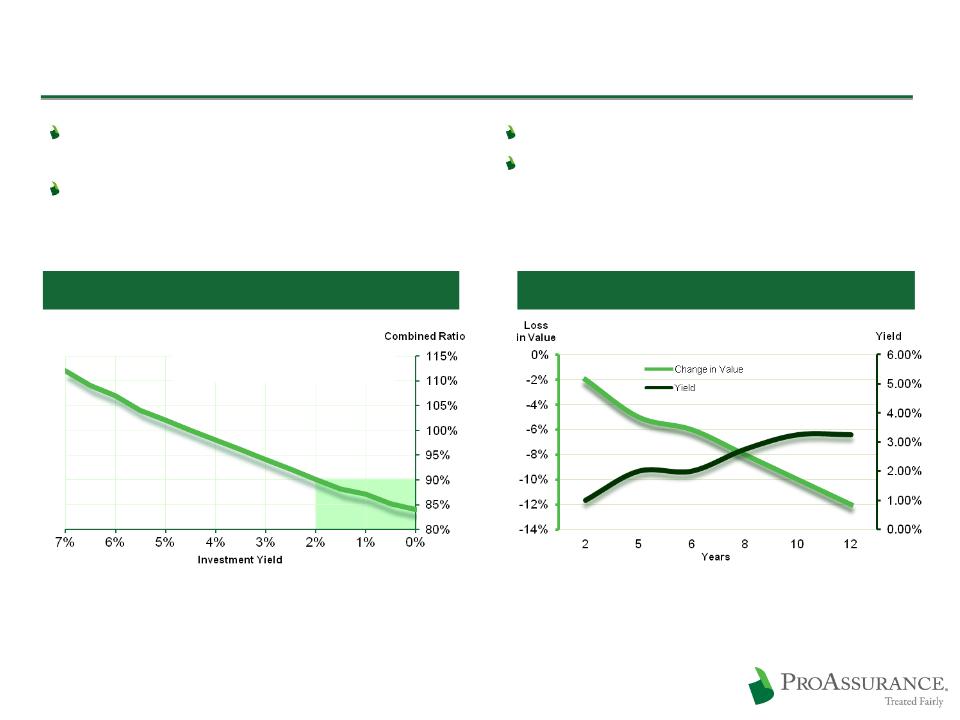

Pricing discipline becomes even more

critical in a low interest rate environment

critical in a low interest rate environment

Lack of investment yield may be a hard

market catalyst

market catalyst

Return on Equity and Investment Returns

50

Assumes a 1:1 premium to surplus ratio for physicians

professional liability claims-made coverages

professional liability claims-made coverages

Combined Ratio Required to

Generate a 13% Return on Equity

Generate a 13% Return on Equity

Long-Term ROE Target is 13%

The choice: chase yield or extend duration

We are maintaining duration, looking for

opportunities

opportunities

The Yield Trap

Revised to reflect yields at 12/31/11

Capital Growth: 2006-2010

in $000’s except total equity (000,000’s)

51

2011 Financial Highlights

|

|

Year Ended December 30,

|

|

|

|

2011

|

2010

|

|

Gross Premiums Written

|

$ 565,895

|

$ 533,205

|

|

Net Premiums Earned

|

$ 558,507

|

$ 505,407

|

|

Net Investment Income

|

$ 140,956

|

$ 146,380

|

|

Net Income (Includes Investment Losses)

|

$ 287,096

|

$ 231,598

|

|

Operating Income

|

$ 278,514

|

$ 219,457

|

|

|

|

|

|

|

December 30, 2011

|

December 31, 2010

|

|

Total Assets

|

$ 4,998,878

|

$ 4,875,056

|

|

Shareholders’ Equity

|

2,164,453

|

1,855,863

|

Investment Effect on P&C Industry ROE

Combined Ratio / ROE - a 100% Combined Ratio Isn’t What It Used to Be

* 2009 and 2010 figures are return on average statutory surplus.

2008 -2011 figures exclude mortgage and financial guaranty insurers

2008 -2011 figures exclude mortgage and financial guaranty insurers

Source: Insurance Information Institute from A.M. Best and ISO data.

Combined Ratios Must Be Lower in Today’s Depressed

Investment Environment to Generate Risk Appropriate ROEs

Investment Environment to Generate Risk Appropriate ROEs

53

Additional Discussion Materials

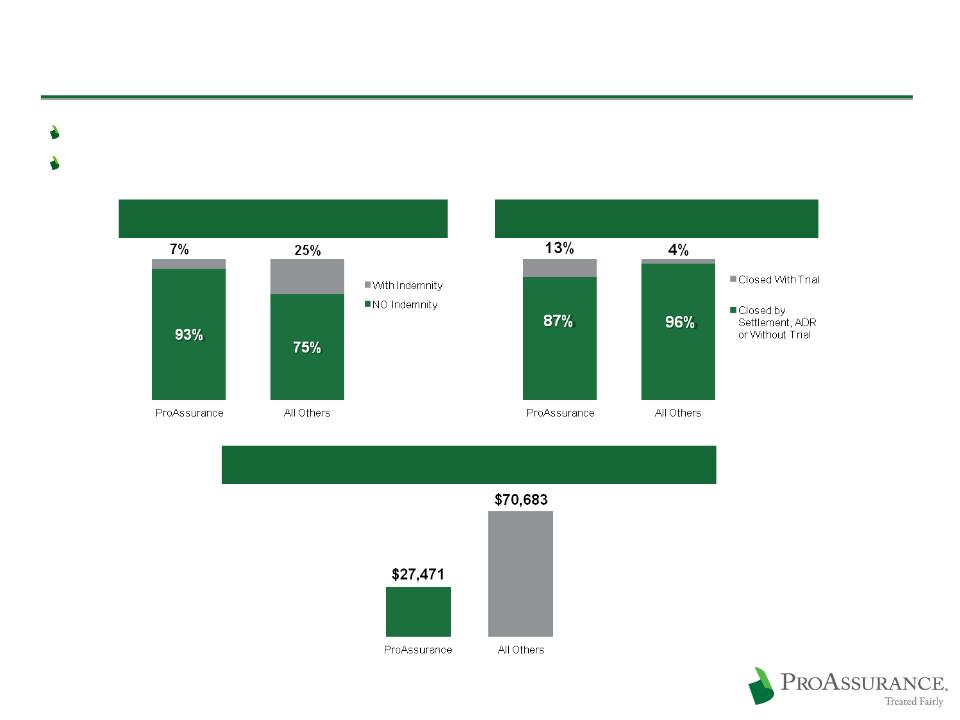

The Ohio Example: 2005 - 2009 Data

Comprehensive, reliable data provided by the Ohio Department of Insurance

Broad range of competitors and business approaches

55

www.insurance.ohio.gov/Legal/Reports/Documents/2009ClosedClaimReport.pdf

Fewer Claims Closed With Indemnity

More Claims Defended in Court

2.5x Lower Average Indemnity Payment per Closed Claim

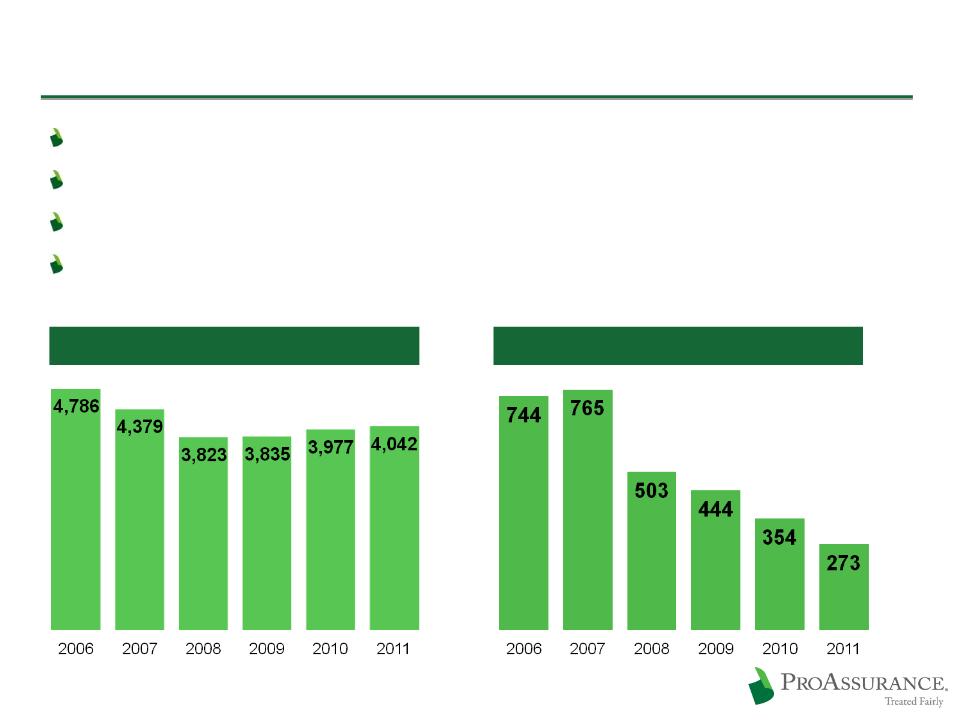

New Claims Opened Each Year

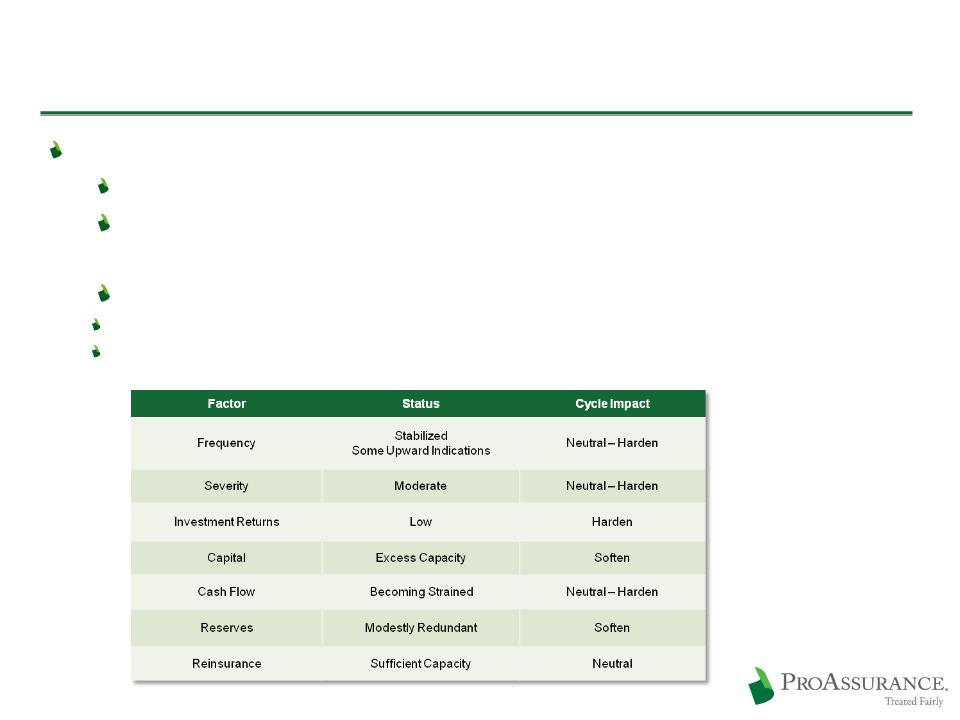

Claims Trends Remain Favorable

Fewer cases to try following significant decline in frequency

Severity trends steady and manageable

No observed effect from the economic downturn

Trends are much the same in states with or without Tort Reform

56

ProAssurance Claims Tried to a Verdict

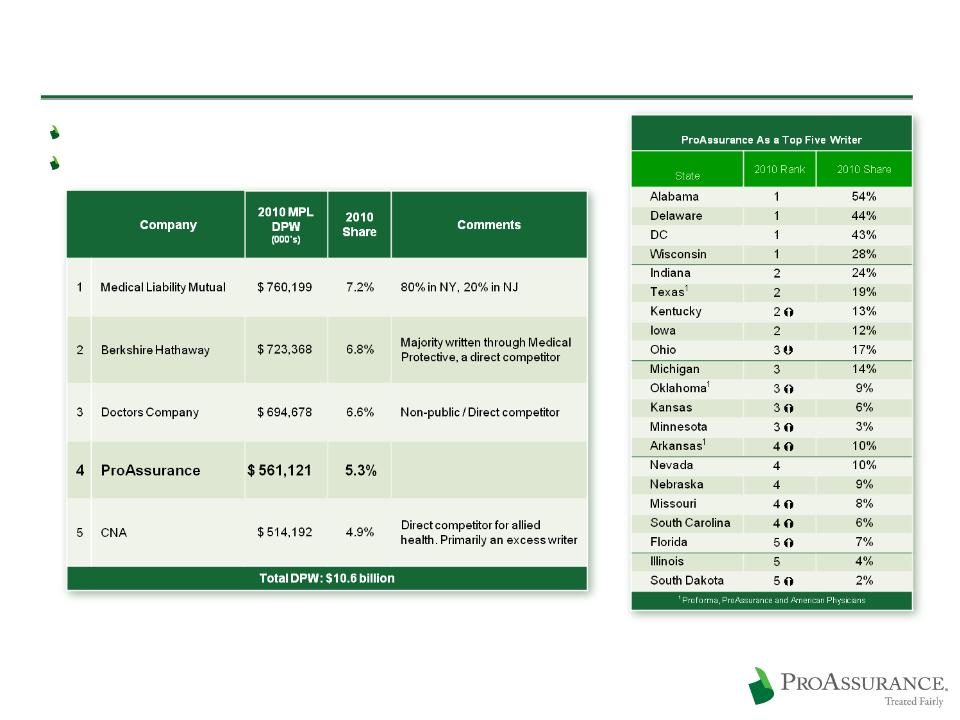

ProAssurance: Business Profile

Largest independent publicly traded writer of MPL insurance

Fourth largest overall writer

57

DPW: SNL & Highline Data 2010

Local Knowledge and National Reach

Medical/Legal environment varies by state

Often varies within states

Regulatory environment differs greatly

May limit the ability to ensure that rates accurately

reflect loss trends

reflect loss trends

Can affect the ability to introduce policy or

procedural changes

procedural changes

Overall business climate differs and can change

Demographics of the medical population and

consumers

consumers

58

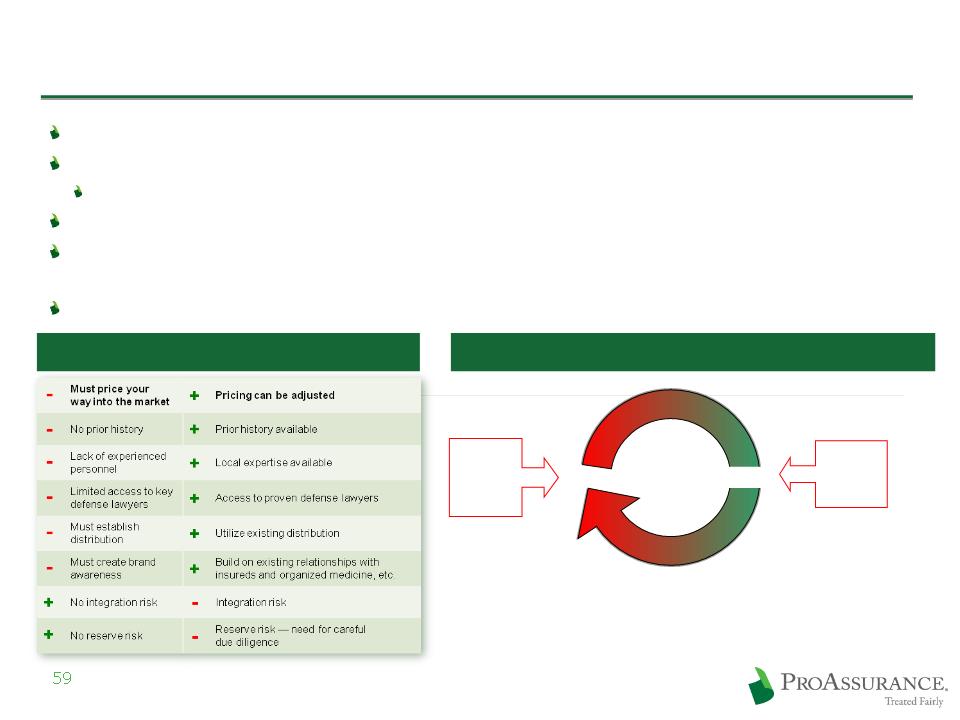

The Case for Growing Through M & A

Legal and regulatory environment must be favorable

Not all M & A opportunities should be pursued

The key is understanding why companies are available

We don’t “bet the farm” and can acquire without “breaking the bank”

We prefer “healthcare centric” but look for closely related liability lines to leverage expertise

(attorneys E & O for example)

(attorneys E & O for example)

Our strategy adapts to the available opportunities for profitable growth

De Novo vs. Acquisition

Soft Market

Hard Market

M & A

de novo

Expansion

Expansion

Internal

Growth

Growth

All avenues

open

because of

pricing

power

open

because of

pricing

power

M & A is

preferable

because of

pricing

pressure

preferable

because of

pricing

pressure

M & A and the Insurance Cycle

ProAssurance and Today’s Market

We are in a period of “benign profitability”

Prices have been falling yet profitability remains at attractive levels

We have seen no new large scale market entry from larger commercial

competitors

competitors

No expansion by mid-decade start-ups

Consolidation beginning in that segment

Start-up pricing advantage has vanished in current market conditions

60

ProAssurance and Today’s Market

ProAssurance’s retention remains at historically

high levels

high levels

Continued underwriting vigilance is being used

today to ensure future success

today to ensure future success

61

ProAssurance Business Outlook

We ARE writing new business that we believe will meet

our profitability goals

our profitability goals

$68 million in new physician business in 2011

Approximately $48 million due to AMPH

Includes approximately $6.5 million in first year claims-made

premium in the Certitudetm program

premium in the Certitudetm program

Major competitors continue to be largely disciplined in

pricing

pricing

No new market entrants

62

Understanding Recent Loss Trends

Frequency stable after

historic declines

historic declines

Lawyers are the gatekeepers

Must weigh the cost of a trial vs.

chances of success

chances of success

Likelihood of success is affected by

many factors

many factors

Societal perceptions of lawsuits against

physicians

physicians

Effects of the overall tort reform debate

and headlines across the country

and headlines across the country

Reforms enacted in some states

Medical utilization is down

Fewer chances for medical incidents

Better quality of care reduces the

number of medical misadventures

number of medical misadventures

Severity uptrend remains

steady at 3%-4%

steady at 3%-4%

Closely tied to inflation

Primarily medical cost inflation

Jury sentiment in reaction to

headlines has moderated, but

not eliminated, runaway

verdicts in recent years

headlines has moderated, but

not eliminated, runaway

verdicts in recent years

Tort Reforms have limited

non-economic damages in a

number of states

non-economic damages in a

number of states

63

The Residual Cost of a Plaintiff Verdict

Financial Effects

Higher MPL premiums

May affect quality scoring under new payment regimes

Credentialing Implications

Disclosure required when applying for licensing, privileges

and treatment panels throughout their medical career

and treatment panels throughout their medical career

Reputational Damage

May affect referrals

Online disclosure can affect acquisition of new patients

Emotional Stress before, during and after

Influences future treatment behavior and patient relationships

64

Effective, Experienced & Invested Management