Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Ignite Restaurant Group, Inc. | a2204919zex-23_1.htm |

As filed with the Securities and Exchange Commission on March 2, 2012

No. 333-175878

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IGNITE RESTAURANT GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5812 (Primary Standard Industrial Classification Code Number) |

94-3421359 (I.R.S. Employer Identification No.) |

9900 Westpark Drive, Suite 300

Houston, Texas 77063

(713) 366-7500

(Address, including zip code, and telephone number, including area code, of registrant's principal executive

offices)

Raymond A. Blanchette, III

President and Chief Executive Officer

Ignite Restaurant Group, Inc.

9900 Westpark Drive, Suite 300

Houston, Texas 77063

(713) 366-7500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| With copies to: | ||

Christian O. Nagler Jason K. Zachary Kirkland & Ellis LLP 601 Lexington Avenue New York, New York 10022 (212) 446-4800 |

Keith M. Townsend King & Spalding LLP 1180 Peachtree Street, N.E. Atlanta, Georgia 30309 (404) 572-4600 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(2)(3) |

||

|---|---|---|---|---|

Common Stock, $1.00 par value per share |

$100,000,000 | $11,610 | ||

|

||||

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

- (2)

- Includes the offering price of any additional shares of common stock that the underwriters have the option to purchase.

- (3)

- Previously paid.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 2, 2012

PROSPECTUS

Shares

Ignite Restaurant Group, Inc.

Common Stock

This is an initial public offering of shares of common stock of Ignite Restaurant Group, Inc. We are offering shares of our common stock, and the selling stockholders identified in this prospectus are offering an additional shares of common stock. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders in this offering.

Prior to this offering, there has been no public market for our common stock. The initial public offering price per share of the common stock is expected to be between $ and $ . We intend to apply to list our common stock on The NASDAQ Global Select Market under the symbol "IRG."

The underwriters have an option to purchase a maximum of additional shares from us, and up to additional shares from the selling stockholders. The underwriters can exercise this option at any time within 30 days from the date of this prospectus.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 15.

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds, before expenses to us |

Proceeds, before expenses to the selling stockholders |

||||

|---|---|---|---|---|---|---|---|---|

Per share |

$ | $ | $ | $ | ||||

Total |

$ | $ | $ | $ |

Delivery of the shares of common stock will be made on or about , 2012.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Credit Suisse | Baird | Piper Jaffray |

The date of this prospectus is , 2012.

You should rely only on the information contained in this prospectus or in any free-writing prospectus we may specifically authorize to be delivered or made available to you. We have not, the selling stockholders have not and the underwriters have not authorized anyone to provide you with additional or different information. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free-writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Until , 2012 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealers' obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

i

MARKET DATA AND FORECASTS

Unless otherwise indicated, information in this prospectus concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, including information from independent industry analysts and publications such as KNAPP-TRACK™ and Technomic, Inc., as well as our own estimates and research. KNAPP-TRACK™ is a monthly sales and guest count tracking service for the chain dinner house/theme restaurant market in the United States. Each monthly KNAPP-TRACK™ report aggregates the change in comparable restaurant sales and guest counts compared to the same month in the preceding year from the competitive set of participants in the chain dinner house/theme restaurant market and provides an average to which we can compare our results. The competitive set of participants for each KNAPP-TRACK™ report is comprised of approximately 50 casual dining restaurant brands and typically includes restaurants such as Applebee's, T.G.I. Friday's, Outback Steakhouse and Red Lobster. We and other restaurants benchmark our performance against the data included in the monthly KNAPP-TRACK™ report. Technomic, Inc. is a leading restaurant industry consulting and researching firm.

Our estimates are derived from publicly available information released by third-party sources, as well as data from our internal research, and are based on such data and our knowledge of our industry, which we believe to be reasonable. None of the independent industry publications used in this prospectus were prepared on our behalf, and none of the sources cited in this prospectus have consented to the inclusion of any data from its reports, nor have we sought consent from any of them.

TRADEMARKS AND TRADENAMES

This prospectus includes our trademarks, such as Joe's Crab Shack® and the design, our stylized logos set forth on the cover and back pages of this prospectus and Brick House Tavern + Tap® and the design, which are protected under applicable intellectual property laws and are the property of Ignite Restaurant Group, Inc. or its subsidiaries. Solely for convenience, trademarks, service marks and tradenames referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and tradenames. This prospectus may also contain trademarks, service marks, tradenames and copyrights of other companies, which are the property of their respective owners.

ABOUT THIS PROSPECTUS

Except where the context otherwise requires or where otherwise indicated, the terms "Ignite," "we," "us," "our," "our company" and "our business" refer to Ignite Restaurant Group, Inc. and its consolidated subsidiaries. The term "Joe's" refers to Joe's Crab Shack and "Brick House" refers to Brick House Tavern + Tap.

The term "selling stockholders" refers to JCS Holdings, LLC, our parent company, with respect to the sale of shares of common stock in this public offering and refers to the holders of our common stock that receive such common stock in the liquidation and distribution of JCS Holdings, LLC immediately following this public offering with respect to the sale of additional shares of the selling stockholders upon any exercise of the over-allotment option described herein. See "Prospectus Summary—Company History and Information" for more information on the liquidation and distribution of JCS Holdings, LLC and "Principal and Selling Stockholders" for more information on our beneficial ownership following the liquidation and distribution.

Throughout this prospectus, we provide a number of key performance indicators used by management and typically used by our competitors in the restaurant industry. These key performance indicators are discussed in more detail in the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Indicators." In this prospectus we

ii

also reference Adjusted EBITDA and restaurant-level profit margin, which are both non-GAAP financial measures. See "Prospectus Summary—Summary Historical Consolidated Financial and Operating Data" for a discussion of Adjusted EBITDA and restaurant-level profit margin, as well as a reconciliation of those measures to the most directly comparable financial measure required by, or presented in accordance with, generally accepted accounting principles in the United States, or U.S. GAAP.

Our fiscal year ends on the Monday closest to December 31 of each year. Our most recent fiscal year ended on January 2, 2012. Fiscal years 2011 and 2009 were 52-week years, while fiscal year 2010 was a 53-week year. The first three quarters of our fiscal year consist of 12 weeks and our fourth quarter consists of 16 weeks for 52-week fiscal years and 17 weeks for 53-week fiscal years.

iii

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. You should read the following summary together with the entire prospectus, including the more detailed information regarding our company, the common stock being sold in this offering and our consolidated financial statements and the related notes appearing elsewhere in this prospectus. You should also carefully consider, among other things, the matters discussed in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this prospectus before deciding to invest in our common stock. Some of the statements in this prospectus constitute forward-looking statements. For more information, see "Forward-Looking Statements."

Our Company

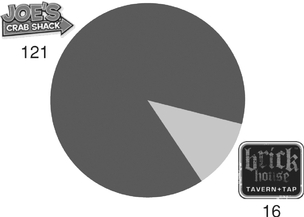

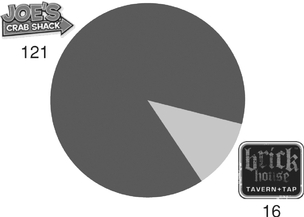

Ignite Restaurant Group, Inc. operates two restaurant businesses, Joe's Crab Shack and Brick House Tavern + Tap. Each of our restaurant businesses offers a variety of high-quality food in a distinctive, casual, high-energy atmosphere. Joe's Crab Shack and Brick House Tavern + Tap operate in a diverse set of markets across the United States.

Our comparable restaurant sales have increased for 14 consecutive fiscal quarters and outperformed the KNAPP-TRACK™ report of casual dining restaurants, which is an average of approximately 50 casual dining restaurant brands, over the same period of time. We have grown our comparable restaurant sales by 25% on a cumulative basis over the last four fiscal years. During our last fiscal year ended January 2, 2012, our comparable restaurant sales increased by 6.9% over the comparable period in our prior fiscal year.

Our current management team was put in place in fiscal year 2007. This team developed and implemented many of the initiatives and strategies which serve as the foundation for what our company is today. The impact of these strategies began to be take effect in fiscal year 2008. From the fiscal year ended December 29, 2008 through the fiscal year ended January 2, 2012, total revenues and Adjusted EBITDA (a non-GAAP financial measure) have improved at compounded annual growth rates of 14.0% and 29.5%, respectively. Over the same period, our total revenues increased from $273.4 million to $405.2 million, net income increased from a net loss of $3.2 million to net income of $11.3 million and Adjusted EBITDA increased from $20.3 million to $44.1 million. We opened 24 new restaurants, rebuilt one restaurant, closed eight restaurants and converted four Joe's Crab Shack restaurants to Brick House restaurants, which resulted in a net total of 16 new restaurants over the same period of time. For the fiscal year ended January 2, 2012, we opened 11 restaurants (including one conversion) and opened two additional restaurants for the period from January 3, 2012 to January 31, 2012.

As of January 31, 2012, we owned and operated 137 restaurants in 31 states.

1

Joe's Crab Shack

Joe's Crab Shack, founded in 1991, is an established, national chain of casual seafood restaurants. Joe's serves a variety of high-quality seafood items, with an emphasis on crab. Joe's is a high-energy, family-friendly restaurant that encourages guests to "roll up your sleeves and crack into some crab."

Crab is deliberately placed center stage as a defining item to the Joe's experience. Joe's Steampot and Crab in a Bucket offerings allow guests to choose between three varieties of crabs (Snow, Dungeness and King). Our Steampots are overflowing with generous portions of crab, other seafood, red potatoes, a fresh ear of corn and sausage, combined with a complementary set of savory seasonings. Our Crab in a Bucket entrées allow guests to pair their favorite crab selection with several distinctive preparations ranging from BBQ to Chesapeake Style or Garlic Herb. Joe's also leverages its crab-forward menu with other craveable crab items, including Made-From-Scratch Crab Cakes, Crab Nachos and Crazy-Good Crab Dip. In addition to our core crab-focused menu, Joe's also offers a broad range of entrées featuring a variety of seafood, including the Get Stuffed Snapper, Surf 'N Turf Burger and Shrimp Trio, as well as a wide range of traditional seafood entrées like the Fisherman's Platter. Joe's also offers several "out of water" options such as Pan Fried Cheesy Chicken and Ribeye Steak.

Many Joe's Crab Shack restaurants are located on waterfront property, and most locations offer outdoor patio seating and a children's playground. Joe's Crab Shack restaurants perform well in targeted markets with high population density and a propensity for seafood, as well as "destination" markets with national and regional tourist attractions, both of which are key characteristics of our new site selection strategy. Joe's Crab Shack restaurants are largely free-standing and average 8,000 square feet with over 200 seats.

We continuously seek to innovate our menu offerings. For example, we have dramatically shifted the menu mix at Joe's to focus on entrées featuring crab over the last four fiscal years. As a result of this strategy, the percentage of entrées at Joe's featuring crab increased from approximately 20% to 45% of total food revenues over the last four fiscal years. We believe this mix shift has contributed to increases in guest satisfaction, comparable restaurant sales and restaurant-level profit. For the fiscal year ended January 2, 2012, our average check was $23.07, lunch and dinner represented 27% and 73% of revenue, respectively, and our revenues were comprised of 84% food, 13% alcohol and 3% retail merchandise.

Brick House Tavern + Tap

Brick House Tavern + Tap, founded in 2008, is a casual restaurant business that provides guests a differentiated "gastro pub" experience by offering a distinctive blend of menu items in a polished setting. Brick House seeks to strike a balance between providing guests with an elevated experience while also appealing to "every-man, every-day." In 2011, Brick House was listed as the #1 "up and comer" full-service, varied-menu restaurant business by Technomic, a leading restaurant industry consulting and research firm.

Brick House offers guests a broad selection of high-quality, chef-inspired, contemporary tavern food and other American fare. Menu items include handcrafted appetizers such as Deviled Eggs, Meat and Cheese Board, Meatloaf Sliders and Fried Stuffed Olives. In addition, Brick House's Brick Burgers, including the Gun Show Burger and the Red Chili Burger, offer guests a distinct take on the traditional burger. Brick House further enhances its burger offerings through its most popular burger, The Kobe, which is hand-formed from high-quality American Wagyu beef. Guests can also choose from a broad selection of homemade entrées such as Drunken Chops, BBQ Baby Backs and Chicken & Waffles, which are among our most popular items. A Daily Special menu features classic tavern food with a twist including Prosciutto Wrapped Meatloaf, Steak Frites and Chicken Pot Pie. A New Brick Pizza section offers a Kobe Brick Pizza and Philly Cheese Steak Pizza. In addition, Brick House features a

2

diverse beverage selection highlighted by over 70 varieties of beer, including local microbrews and distinctive imports, a tap-at-your-table Beer Bong and a hand-pulled Cask Beer Engine. All Brick House restaurants have a full bar that supports a variety of liquor drinks, wine and beer cocktails like the Shandy and Bee Sting, as well as specialty cocktails like the Dark & Stormy, Moscow Mule and the Zombie.

The interior design of Brick House Tavern + Tap consists of diverse seating and gathering areas where guests can select multiple ways to enjoy their experience. In addition to a traditional dining room and bar area, Brick House also offers large communal tables and a section of leather recliners positioned in front of large HD TVs, where guests receive their own TV tray for dining. Each restaurant has a state-of-the-art entertainment package and provides guests with a clear line of sight to at least two HD TVs from every seat, making Brick House restaurants an ideal gathering place for sports enthusiasts. Outdoor seating is also available on the patio or around an open fire pit at nearly all locations. Both food and beverages are served by personable and engaging service staff.

For fiscal year ended January 2, 2012, the daypart mix at Brick House Tavern + Tap was 20% lunch, 25% afternoon, 38% dinner and 17% late night and our revenues were comprised of 53% food and 47% alcohol. Our entrées ranged in price from $8.00 to $20.00.

Our Business Strengths

We are focused on developing brands that have category leading and defendable positions within the casual dining segment. As a result, our core business strengths include the following:

Highly Differentiated Restaurant Brands. Our restaurants strive to provide a unique guest experience in a "come-as-you-are," upbeat and inviting restaurant environment. Both Joe's Crab Shack and Brick House Tavern + Tap are distinctively positioned restaurant brands, designed to have unique guest appeal. Joe's Crab Shack is a leading casual seafood brand that offers more than just a meal—a visit to Joe's is an event for the whole family, a night out. We provide a memorable, shareable "crab-cracking experience" where guests can roll up their sleeves and "break out of their shell" in a vacation-themed environment that offers an escape from the everyday. Brick House Tavern + Tap offers a comfortable, trend-forward yet timeless setting where guests can gather and share their passion for elevated, chef-inspired comfort food, while enjoying their favorite local, national or imported brand of beer and cheering for their favorite team. Each brand features food offerings and an atmosphere that attracts a diverse group of guests.

Authentic and Unique Menu Offerings. We offer high-quality, authentic seafood at Joe's Crab Shack and trend-forward, chef-inspired, contemporary tavern food and other American fare at Brick House Tavern + Tap. Signature dishes at both brands feature craveable flavor profiles. Food menus are complemented by an assortment of beverages and distinctive cocktails, including Joe's Shark Bite and Brick House's tap-at-your-table Beer Bongs. Our culinary and beverage teams develop recipes and menu offerings for both Joe's and Brick House to ensure that all items feature distinctive twists on classic items, as well as items exclusive to each brand.

Memorable Guest Service. Our servers are friendly, attentive and responsive to the needs of our guests. In addition, our servers strive to provide guests an unforgettable dining experience. Joe's staff creates a fun-loving atmosphere through high-energy special occasion celebrations, while the staff at Brick House is focused on providing hospitable and personal service to guests. We achieve this through experienced restaurant management teams that implement training programs specific to the menu and culture of each brand. We believe our distinctive guest service models provide an additional layer of brand differentiation.

Attractive Unit Economics. We have successfully increased our restaurant average unit volumes at a compounded annual growth rate of 8.1%, from $2.4 million in fiscal year 2008 to $3.0 million in fiscal

3

year 2011. Over the same period of time, we have increased our restaurant-level profit margin (a non-GAAP financial measure) by 330 basis points from 12.6% to 15.9%. We are targeting average unit volumes and restaurant-level profit margins for new locations to exceed system-wide fiscal year 2011 levels.

Experienced Management Team. Our experienced team of industry veterans has an average of 20 years of experience with restaurant companies such as T.G.I. Friday's, Darden, Applebee's, Yum! Brands, Landry's and Sbarro. Our management team is led by Raymond A. Blanchette, III, our President and Chief Executive Officer, who joined us in 2007. Mr. Blanchette was a former President for Pick Up Stix and Executive Director of International Business at T.G.I. Friday's, both are brands operated by Carlson Restaurants Worldwide. Within twelve months of his arrival, Mr. Blanchette transformed our leadership team by recruiting five highly experienced restaurant executives. Despite a difficult economic environment, we have achieved 14 consecutive fiscal quarters of comparable restaurant sales growth, expanded our geographic footprint and improved our financial performance. From fiscal year 2008 to fiscal year 2011, we increased net income from a net loss of $3.2 million to net income of $11.3 million and increased Adjusted EBITDA from $20.3 million to $44.1 million. The experience of our management team has allowed us to transform Joe's Crab Shack into a market leader while simultaneously developing and launching Brick House Tavern + Tap.

Our Strategy

Our strategies include the following:

Disciplined New Restaurant Growth. We believe there are meaningful opportunities to grow the number of restaurants of both Joe's Crab Shack and Brick House Tavern + Tap. We seek to maximize free cash flow for reinvestment into new restaurants at attractive returns. For both brands, we target new restaurant cash-on-cash returns, which we define as restaurant-level profit per store divided by total build-out cost (excluding capitalized interest) and pre-opening costs, to exceed 25%.

- •

- Joe's Crab Shack. We target steady state new restaurant

average unit volumes of approximately $3.9 million for Joe's Crab Shack. Joe's has a narrowly defined new restaurant development strategy that predominantly targets (i) specific

geographies with high population density and a propensity for seafood and (ii) locations in close proximity to regional and national tourist attractions. Twenty one of our twenty five top

performing Joe's Crab Shack restaurants meet one or both of these criteria and generated average unit volumes of $4.7 million in fiscal year 2011. In fiscal year 2010, we developed a new

restaurant prototype for Joe's Crab Shack, which has given Joe's a polished look and feel while maintaining the authentic crab shack ambiance. As of January 31, 2012, we have successfully

opened 11 new restaurants using this new prototype and development strategy.

- •

- Brick House Tavern + Tap. We target steady state new restaurant average unit volumes of approximately $3.2 million for Brick House Tavern + Tap. We believe Brick House has significant growth potential and intend to focus future development in the top 50 designated market areas across the country. We initially opened a limited number of Brick House restaurants across a broad range of geographies with the intent of optimizing the brand prior to a continued build out. We are currently in the process of integrating key insights into our future new restaurant rollout plans.

For fiscal year 2012, we target opening 11 to 13 new restaurants, the vast majority of which will be new Joe's Crab Shack restaurants. We expect that our new restaurant growth will continue to be substantially weighted towards new Joe's Crab Shack restaurants for the foreseeable future.

4

Comparable Restaurant Sales Growth. We believe the following strategies have contributed to our successful growth and will allow us to generate comparable restaurant sales growth in the future:

- •

- Continuous Menu Innovation. We believe menu innovation is

a critical factor in building guest loyalty and frequency. Both Joe's Crab Shack and Brick House Tavern + Tap have signature food and beverage offerings and a tradition of

consistent menu innovation. New menu items are typically introduced at both brands twice a year and we test new menu items in restaurants across several diverse geographies before they are introduced

into the broader base of restaurants. We have successfully introduced new and innovative items at both brands with such additions as Queen Crab, Skillet Paella and Mason Jars at Joe's Crab Shack and

Brick Pizza, Meat and Cheese Board, Fried Stuffed Olives and Chicken & Waffles at Brick House Tavern + Tap. We plan to continue our tradition of menu innovation in the

future.

- •

- Marketing our Restaurant Brands. We believe that our

marketing strategies will continue to increase brand awareness while driving new guest trial and repeat guest visits. In June 2007, we changed our marketing strategy for Joe's Crab Shack by developing

a long-term marketing plan supported by quantitative analysis that is designed to increase comparable restaurant sales and guest count, as well as build the brand for the future. We also

moved to a national cable platform, which provides television advertising reach to the Joe's Crab Shack restaurants that were previously outside of the spot/local television markets and previews the

Joe's Crab Shack brand in new development markets. These national marketing efforts are complemented by a combination of local marketing programs and social media. Brick House

Tavern + Tap is primarily marketed through local marketing, digital media and social media outlets. We also promote both brands using other in-restaurant sales

initiatives, which are typically focused on products and are not price point promotions.

- •

- Driving Guest Satisfaction. We believe our focus on menu innovation and guest service has contributed to Joe's Crab Shack's overall guest satisfaction score improving by over 1,300 basis points since we began measuring guest satisfaction through a third party vendor in August 2008. At Joe's Crab Shack, we use this third party research consisting of feedback from more than 40,000 guests, to develop operational initiatives, which we expect will continue to deliver high levels of guest satisfaction. We implemented a similar program at Brick House Tavern + Tap during the fourth quarter of fiscal year 2011. We believe improving guest satisfaction will continue to build loyalty and lead to increased sales from our guests.

Leverage our Scale to Enhance our Profitability. We believe we have a scalable infrastructure and can continue to expand our margins as we execute our strategy. While both brands have independent field operations, we use our shared services platform to handle many of the administrative functions for both brands. This leverageable structure should further our ability to enhance our profitability as we grow.

Our Principal Stockholders

Following completion of this offering, J.H. Whitney VI, L.P., or "J.H. Whitney VI," an affiliate of J.H. Whitney Capital Partners, LLC, or "J.H. Whitney," will own approximately % of our outstanding common stock, or % if the underwriters' option to purchase additional shares is fully exercised. As a result, J.H. Whitney VI will be able to have a significant effect relating to votes over fundamental and significant corporate matters and transactions. See "Risk Factors—Risks Related to This Offering and Ownership of Our Common Stock."

J.H. Whitney is a Connecticut-based private equity firm whose affiliated investment funds have current investments and remaining committed capital totaling $1.4 billion. J.H. Whitney focuses on investing in small and middle market companies with strong growth prospects in a number of industries.

5

Company History and Information

The first Joe's Crab Shack was opened in Houston, Texas in 1991. Landry's Restaurants, Inc., or "Landry's," acquired Joe's Crab Shack in 1994. On October 13, 2006, in connection with the purchase by JCS Holdings, LLC, an entity controlled by J.H. Whitney VI, of 120 Joe's Crab Shack restaurants from Landry's, which we refer to as the "Landry Acquisition," we changed our name to Joe's Crab Shack Holdings, Inc. In 2008, we developed our second brand, Brick House Tavern + Tap. With the addition of the Brick House brand, on July 7, 2009, we changed our name to Ignite Restaurant Group, Inc.

In connection with, and immediately prior to the completion of this public offering, Ignite Restaurant Group, Inc. will effect a -for-1 stock split of our common stock. The stock split will result in shares of common stock outstanding immediately after the stock split, all of which will be held by JCS Holdings, LLC, our parent company. Immediately after completion of this public offering, JCS Holdings, LLC will liquidate and distribute the shares of our common stock then held by it and/or the cash proceeds received in this public offering to the holders of its Series A preferred units and its common units in accordance with the provisions then in effect of the Third Amended and Restated Limited Liability Company Agreement of JCS Holdings, LLC, which we refer to as the Parent LLC Agreement. In addition, following this public offering, we will issue restricted shares of our common stock to members of our management and independent directors who held unvested common units in JCS Holdings, LLC as a replacement for such unvested common units, which will be subject to substantially identical vesting conditions as the unvested common units. The number of restricted shares of our common stock issued will be based on the ratio of unvested common units to vested common units multiplied by the number of our shares of our common stock received in the liquidation of our parent company. See footnote 5 to our unaudited pro forma condensed consolidated statement of operations for additional details relating to the number of restricted shares to be issued as a replacement for unvested common units on page 49.

Immediately following completion of this public offering, the distribution described above and the issuance of restricted shares of our common stock, shares of our common stock will be owned by (i) the entities and persons who purchase our common stock pursuant to this initial public offering and (ii) the entities and persons that owned or who were eligible to receive Series A preferred units and/or vested and unvested common units of JCS Holdings, LLC, which include J.H. Whitney VI and certain of our current and former officers, directors and employees.

Our principal executive office is located at 9900 Westpark Drive, Suite 300, Houston, Texas 77063. Our telephone number is (713) 366-7500, and our website addresses are www.igniterestaurants.com, www.joescrabshack.com and www.brickhousetavernandtap.com. The information contained on our websites are not deemed to be, and you should not consider such information to be, part of this prospectus.

Risk Factors

Investing in shares of our common stock involves a high degree of risk. You should consider the information under the caption "Risk Factors" beginning on page 15 of this prospectus in deciding whether to purchase the common stock in this offering. Risks relating to our business include, among others:

- •

- our ability to successfully maintain increases in our comparable restaurant sales, average weekly sales and average unit

volumes;

- •

- our ability to successfully execute our growth strategy and open new restaurants that are profitable;

- •

- macroeconomic conditions;

- •

- our ability to compete with many other restaurants;

- •

- changes in food and supply costs, including the cost of crab;

- •

- our ability to expand Brick House;

- •

- concerns regarding food safety and food-borne illness;

- •

- changes in consumer preferences; and

- •

- our ability to develop and maintain our restaurant brands.

6

The Offering

| Common stock offered by us | shares | |

Common stock offered by the selling stockholders |

shares |

|

Common stock outstanding immediately after this offering |

shares or shares, if the underwriters exercise their option to purchase additional shares from us and the selling stockholders. |

|

Use of proceeds |

We estimate that the proceeds to us from this offering, after deducting estimated underwriting discounts and commissions and offering expenses payable by us, will be approximately $ million, assuming the shares offered by us are sold for $ per share, the midpoint of the price range set forth on the cover page of this prospectus. |

|

We intend to use the net proceeds from the sale of common stock by us in this offering, together with cash on hand, (i) to prepay a portion of our senior secured credit facility, (ii) to pay J.H. Whitney a fee in connection with the termination of the management agreement, and (iii) for other general corporate purposes. For additional information, see "Use of Proceeds" and "Certain Relationships and Related Party Transactions." |

||

We will not receive any of the proceeds from the sale of shares of common stock by the selling stockholders. |

||

Principal stockholders |

Upon completion of this offering, J.H. Whitney VI will own a controlling interest in us. We currently intend to avail ourselves of the "controlled company" exemption under the corporate governance rules of The NASDAQ Stock Market. |

|

Dividend policy |

We currently expect to retain all available funds and any future earnings to fund the development and growth of our business and to repay indebtedness; therefore, we do not anticipate paying any cash dividends in the foreseeable future. Our ability to pay dividends on our common stock is limited by our existing credit agreements and may be further restricted by the terms of any of our future debt or preferred securities. For additional information, see "Dividend Policy." |

|

Proposed symbol for trading on The NASDAQ Global Select Market |

"IRG." |

7

Unless otherwise indicated, all information in this prospectus relating to the number of shares of common stock to be outstanding immediately after this offering:

- •

- assumes the effectiveness of our amended and restated certificate of incorporation and amended and restated

by-laws, which we will adopt prior to the completion of this offering;

- •

- gives effect to the stock split;

- •

- excludes shares of our common stock reserved for future grants under our new equity compensation

plan we intend to adopt in connection with this offering; and

- •

- assumes (i) no exercise by the underwriters of their option to purchase up to additional shares from us and the selling stockholders and (ii) an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus.

Immediately following this public offering, we will issue approximately restricted shares of common stock to members of our management and independent directors who held unvested common units in JCS Holdings, LLC as a replacement for such unvested common units, which will be subject to substantially identical vesting conditions as the unvested common units. The exact number of restricted shares of our common stock to be issued will be calculated based upon the initial public offering price net of underwriting discounts and commissions. See footnote 5 to our unaudited pro forma condensed consolidated statement of operations for additional details relating to the number of restricted shares to be issued as a replacement for unvested common units on page 49.

8

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA

The following table provides a summary of our historical and unaudited pro forma consolidated financial and operating data for the periods and as of the dates indicated. The summary historical consolidated financial and operating data presented below for the fiscal years ended December 28, 2009, January 3, 2011, and January 2, 2012 and selected balance sheet data presented below as of January 2, 2012 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The unaudited pro forma consolidated financial data as of and for the year ended January 2, 2012 have been derived from our historical financial statements for such year, which are included elsewhere in this prospectus, after giving effect to the transactions specified under "Unaudited Pro Forma Condensed Consolidated Financial Statements."

Our fiscal year ends on the Monday nearest to December 31 of each year. Fiscal years 2009 and 2011 were 52-week years ended on December 28, 2009 and January 2, 2012, respectively, while fiscal year 2010 was a 53-week year ended on January 3, 2011.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. This information should be read in conjunction with "Risk Factors," "Selected Historical Consolidated Financial and Operating Data," "Unaudited Pro Forma Condensed Consolidated Financial Statements," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and our audited consolidated financial statements and each of their related notes included elsewhere in this prospectus.

| |

Fiscal Year | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2010 | 2011 | |||||||||

Revenues |

$ | 307,801 | $ | 351,327 | $ | 405,243 | ||||||

Costs and expenses |

||||||||||||

Restaurant operating costs |

||||||||||||

Cost of sales |

89,845 | 103,981 | 127,607 | |||||||||

Labor and benefits |

87,920 | 98,162 | 111,721 | |||||||||

Occupancy expenses |

25,243 | 27,440 | 30,244 | |||||||||

Other operating expenses |

58,140 | 63,963 | 71,696 | |||||||||

General and administrative |

18,765 | 20,634 | 23,340 | |||||||||

Depreciation and amortization |

12,733 | 13,445 | 16,063 | |||||||||

Pre-opening costs |

1,323 | 3,844 | 3,989 | |||||||||

Restaurant impairments and closures |

15 | 909 | 333 | |||||||||

Loss on disposal of property and equipment |

1,017 | 2,797 | 821 | |||||||||

Total costs and expenses |

295,001 | 335,175 | 385,814 | |||||||||

Income from operations |

12,800 | 16,152 | 19,429 | |||||||||

Interest expense, net |

(3,867 |

) |

(3,831 |

) |

(9,215 |

) |

||||||

Gain on insurance settlements |

1,192 | 944 | 1,126 | |||||||||

Income before income taxes |

10,125 | 13,265 | 11,340 | |||||||||

Income tax expense |

255 | 1,417 | 87 | |||||||||

Net income |

$ | 9,870 | $ | 11,848 | $ | 11,253 | ||||||

9

| |

Fiscal Year Ended | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| |

December 28, 2009 |

January 3, 2011 |

January 2, 2012 |

||||||||

| |

(dollars in thousands, except per share data) |

||||||||||

Per Share Data: |

|||||||||||

Net (loss) income per share: |

|||||||||||

Basic |

$ | $ | $ | ||||||||

Diluted |

|||||||||||

Weighted average shares outstanding: |

|||||||||||

Basic |

|||||||||||

Diluted |

|||||||||||

Pro Forma Statement of Operations Data(1): |

|||||||||||

Pro forma net income |

$ | $ | |||||||||

Pro forma net income per share: |

|||||||||||

Basic |

$ | $ | |||||||||

Diluted |

$ | $ | |||||||||

Pro forma weighted average shares outstanding: |

|||||||||||

Basic |

|||||||||||

Diluted |

|||||||||||

Selected Other Data: |

|||||||||||

Restaurants open at end of period |

119 | 126 | 135 | ||||||||

Change in comparable restaurant sales(2) |

9.5 | % | 4.9 | % | 6.9 | % | |||||

Average weekly sales |

$ | 51 | $ | 54 | $ | 59 | |||||

Average unit volumes |

$ | 2,599 | $ | 2,810 | $ | 2,970 | |||||

Restaurant-level profit margin(3) |

15.5 | % | 16.7 | % | 15.9 | % | |||||

EBITDA(4) |

$ | 26,725 | $ | 30,541 | $ | 36,618 | |||||

Adjusted EBITDA(4) |

$ | 30,276 | $ | 39,910 | $ | 44,105 | |||||

Adjusted EBITDA margin(5) |

9.8 | % | 11.4 | % | 10.9 | % | |||||

Capital expenditures |

$ | 18,348 | $ | 33,333 | $ | 40,102 | |||||

| |

January 2, 2012 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma (6)(7) |

|||||

| |

(in thousands) |

||||||

Selected Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 3,725 | $ | ||||

Working capital (deficit) |

(16,135 | ) | |||||

Total assets |

180,207 | ||||||

Total debt |

117,757 | ||||||

Total stockholder's equity |

$ | 21,593 | |||||

- (1)

- Derived

from our unaudited pro forma condensed consolidated statements of operations for the fiscal year ended January 2, 2012, which are included

elsewhere in this prospectus. See "Unaudited Pro Forma Condensed Consolidated Financial Statements."

- (2)

- Our

comparable restaurant base includes restaurants open for at least 104 weeks, or approximately 24 months. Change in comparable restaurant

sales represents the change in period-over-period sales for the comparable restaurant base.

- (3)

- Restaurant-level profit margin represents revenues (x) less (i) licensing revenue not attributable to core restaurant operations, (ii) cost of sales, (iii) labor and benefits, (iv) occupancy expenses, and (v) other operating expenses (y) plus deferred rent (as described in footnote 4(a) below). Restaurant-level profit is a

10

supplemental measure of operating performance of our restaurants that does not represent and should not be considered as an alternative to net income or revenues as determined by U.S. generally accepted accounting principles, or U.S. GAAP, and our calculation thereof may not be comparable to that reported by other companies. Restaurant-level profit has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under U.S. GAAP. Management believes restaurant-level profit is an important component of financial results because it is a widely used metric within the restaurant industry to evaluate restaurant-level productivity, efficiency and performance. Management uses restaurant-level profit as a key metric to evaluate our financial performance compared with our competitors, to evaluate the profitability of incremental sales and to evaluate our performance across periods.

| |

Fiscal Year Ended | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

December 28, 2009 |

January 3, 2011 |

January 2, 2012 |

|||||||||

| |

(dollars in thousands) |

|||||||||||

Revenues |

$ | 307,801 | $ | 351,327 | $ | 405,243 | ||||||

Less: Licensing and other revenues |

(89 | ) | (373 | ) | (867 | ) | ||||||

Restaurant sales(A) |

$ | 307,712 | $ | 350,954 | $ | 404,376 | ||||||

Restaurant operating costs |

||||||||||||

Cost of sales |

89,845 | 103,981 | 127,607 | |||||||||

Labor and benefits |

87,920 | 98,162 | 111,721 | |||||||||

Occupancy expenses |

25,243 | 27,440 | 30,244 | |||||||||

Other operating expenses |

58,140 | 63,963 | 71,696 | |||||||||

Deferred rent |

(1,162 | ) | (1,322 | ) | (1,342 | ) | ||||||

Restaurant-level profit(B) |

$ | 47,726 | $ | 58,730 | $ | 64,450 | ||||||

Restaurant-level profit margin(B÷A) |

15.5 | % | 16.7 | % | 15.9 | % | ||||||

- (4)

- EBITDA

represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA further adjusts EBITDA to reflect the additions and

eliminations described in the table below. EBITDA and Adjusted EBITDA are supplemental measures of operating performance that do not represent and should not be considered as alternatives to net

income or cash flow from operations, as determined by U.S. GAAP, and our calculation thereof may not be comparable to that reported by other companies. EBITDA and Adjusted EBITDA have

limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under U.S. GAAP. Some of the limitations

are:

- •

- EBITDA and Adjusted EBITDA do not reflect our cash expenditures, or future

requirements for capital expenditures or contractual commitments;

- •

- EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our

working capital needs;

- •

- EBITDA and Adjusted EBITDA do not reflect the significant interest expense, or the

cash requirements necessary to service interest or principal payments on our debt;

- •

- EBITDA and Adjusted EBITDA do not reflect our tax expense or the cash requirements

to pay our taxes;

- •

- although depreciation and amortization are non-cash charges, the assets

being depreciated and amortized will often have to be replaced in the future, EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements; and

- •

- other companies in the restaurant industry may calculate EBITDA and Adjusted EBITDA

differently than we do, limiting their usefulness as comparative measures.

- Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our U.S. GAAP results and using EBITDA and Adjusted EBITDA only supplementally. We further believe that our presentation of these U.S. GAAP and non-GAAP financial

11

measurements provide information that is useful to analysts and investors because they are important indicators of the strength of our operations and the performance of our core business.

- As

noted in the table below, Adjusted EBITDA includes adjustments for restaurant impairments and closures, gains and losses on disposal of

property and equipment, gains on insurance settlements and pre-opening costs, among other items. It is reasonable to expect that these items will occur in future periods. However, we believe these

adjustments are appropriate because the amounts recognized can vary significantly from period to period, do not directly relate to the ongoing operations of our restaurants and complicate comparisons

of our internal operating results and operating results of other restaurant companies over time. In addition, Adjusted EBITDA includes adjustments for other items that we do not expect to regularly

record following this offering, such as sponsor management fees. Each of the normal recurring adjustments and other adjustments described in this paragraph and in the reconciliation table below help

management with a measure of our core operating performance over time by removing items that are not related to day-to-day restaurant-level operations.

- Management

and our principal stockholder use EBITDA and Adjusted EBITDA:

- •

- as a measurement of operating performance because they assist us in comparing the

operating performance of our restaurants on a consistent basis, as both remove the impact of items not directly resulting from our core operations;

- •

- for planning purposes, including the preparation of our internal annual operating

budget and financial projections;

- •

- to evaluate the performance and effectiveness of our operational strategies;

- •

- to evaluate our capacity to fund capital expenditures and expand our business; and

- •

- to calculate incentive compensation payments for our employees, including assessing

performance under our annual incentive compensation plan.

- In

addition, this measurement is used by investors as a supplemental measure to evaluate the overall operating performance of companies in our

industry. Management believes that investors' understanding of our performance is enhanced by including this non-GAAP financial measure as a reasonable basis for comparing our ongoing

results of operations. Many investors are interested in understanding the performance of our business by comparing our results from ongoing operations from one period to the next and would ordinarily

add back events that are not part of normal day-to-day operations of our business. By providing this non-GAAP financial measure, together with reconciliations, we

believe we are enhancing investors' understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing strategic initiatives.

- We also present Adjusted EBITDA because it is a measure which is used in calculating financial ratios in material debt covenants in our senior secured credit facility. As of January 2, 2012, we had $117.8 million of outstanding borrowings under the term loan and the ability to borrow up to an additional $23.6 million under the revolving credit facility. Failure to comply with our material debt covenants could cause an acceleration of outstanding amounts under the term loan and restrict us from borrowing amounts under the revolving credit facility to fund our future liquidity requirements. For the fiscal quarter ended January 2, 2012, we are required to maintain a fixed charge coverage ratio (ratio of free cash flow to fixed charges) of 1.40:1 and an effective leverage ratio (ratio of adjusted debt to Adjusted EBITDA plus cash rent expense) of less than 5.40:1. We believe that inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about how the covenants in those agreements operate. The material covenants in our senior secured credit facility are discussed further in "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources."

12

- Adjusted EBITDA is calculated as follows:

| |

Fiscal Year Ended | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| |

December 28, 2009 |

January 3, 2011 |

January 2, 2012 |

||||||||

| |

(in thousands) |

||||||||||

Net income |

$ | 9,870 | $ | 11,848 | $ | 11,253 | |||||

Income tax expense |

255 | 1,417 | 87 | ||||||||

Interest expense, net |

3,867 | 3,831 | 9,215 | ||||||||

Depreciation and amortization |

12,733 | 13,445 | 16,063 | ||||||||

EBITDA |

$ | 26,725 | $ | 30,541 | $ | 36,618 | |||||

Adjustments: |

|||||||||||

Deferred rent(a) |

1,162 | 1,322 | 1,342 | ||||||||

Restaurant impairments and closures(b) |

15 | 909 | 333 | ||||||||

Loss on disposal of property and equipment(c) |

1,017 | 2,797 | 821 | ||||||||

Sponsor management fees(d) |

1,120 | 1,139 | 1,188 | ||||||||

Gain on insurance settlements(e) |

(1,192 | ) | (944 | ) | (1,126 | ) | |||||

Pre-opening costs(f) |

1,323 | 3,844 | 3,989 | ||||||||

Other expenses(g) |

106 | 302 | 940 | ||||||||

Adjusted EBITDA |

$ | 30,276 | $ | 39,910 | $ | 44,105 | |||||

- (a)

- Deferred

rent represents the non-cash rent expense calculated as the difference in U.S. GAAP rent expense in any year and amounts payable

in cash under the leases during the year. In measuring our operational performance, we focus on our cash rent payments. See Note 2 to our audited consolidated financial statements for

additional details.

- (b)

- Impairment

charges were recorded in connection with the determination that the carrying value of certain of our restaurants exceeded their estimated fair

value. Also consists of expenses incurred following the closure of restaurants. See Notes 2 and 3 to our audited consolidated financial statements for additional details.

- (c)

- Loss

(gain) on disposal of property and equipment represents the net book value of property and equipment less proceeds received, if applicable, on assets

abandoned or sold.

- (d)

- Sponsor

management fees consist of fees and expenses paid to J.H. Whitney under the management services agreement, and compensation and expenses paid

to certain members of the management committee of our parent company, JCS Holdings, LLC. We will terminate this agreement in connection with the completion of this offering. See "Certain

Relationships and Related Party Transactions."

- (e)

- Gain

on insurance settlements consists of proceeds in excess of the net book value of assets lost and related costs from property insurance claims at

restaurants temporarily closed due to hurricane damage, flooding and/or foundational issues.

- (f)

- Pre-opening

costs include expenses directly associated with the opening of new restaurants and are incurred prior to the opening of a new

restaurant. See Note 2 to our audited consolidated financial statements for additional details.

- (g)

- Other

expenses consists of costs related to abandoned new restaurant developments, fees payable to the agent under historic credit facilities, certain

transitional general and administrative expenses, and expenses related to the modification of a sale-leaseback transaction.

- (5)

- Adjusted EBITDA margin is defined as the ratio of Adjusted EBITDA to total revenues. We present Adjusted EBITDA margin because it is used by management as a performance measurement of Adjusted EBITDA generated from total revenues. See footnote 4 above for a discussion of Adjusted EBITDA as a non-GAAP measure and a reconciliation of net income to EBITDA and Adjusted EBITDA.

13

- (6)

- The

data included in the pro forma column in the selected balance sheet data table above has been derived from our unaudited pro forma condensed

consolidated balance sheet, which is included elsewhere in this prospectus. See "Unaudited Pro Forma Condensed Consolidated Financial Statements."

- (7)

- A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) each of cash and cash equivalents, total assets and total stockholders' equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, if we change the number of shares offered by us, the net proceeds we receive will increase or decrease by the increase or decrease in the number of shares sold, multiplied by the offering price per share, less the incremental estimated underwriting discounts and commissions and estimated offering expenses payable by us.

14

Investing in our common stock involves a high degree of risk. Before you purchase our common stock, you should carefully consider the risks described below and the other information contained in this prospectus, including our consolidated financial statements and accompanying notes. If any of the following risks actually occurs, our business, financial condition, results of operation or cash flows could be materially adversely affected. In any such case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business

You should not rely on past increases in our comparable restaurant sales or our average unit volumes as an indication of our future results of operations because they may fluctuate significantly.

A number of factors have historically affected, and will continue to affect, our comparable restaurant sales and average unit volumes, including, among other factors:

- •

- our ability to execute our business strategy effectively;

- •

- unusually strong initial sales performance by new restaurants;

- •

- competition;

- •

- consumer trends and confidence;

- •

- introduction of new menu items; and

- •

- regional and national macroeconomic conditions.

Our comparable restaurant sales and average unit volumes may not increase at rates achieved over the past several fiscal years. Changes in our comparable restaurant sales and average unit volumes could cause the price of our common stock to fluctuate substantially.

If we fail to execute our growth strategy, which largely depends on our ability to open new restaurants that are profitable, our business could suffer.

One of the key means of achieving our growth strategies will be through opening new restaurants and operating those restaurants on a profitable basis. We expect this to be the case for the foreseeable future. For fiscal year 2012, we target opening 11 to 13 new restaurants, the vast majority of which will be new Joe's Crab Shack restaurants, and expect that our new restaurant growth will continue to be substantially weighted towards new Joe's Crab Shack restaurants for the foreseeable future. Because of the economic downturn, there are fewer new developments, such as shopping centers, being constructed, which reduces the supply of new restaurant locations. As a result, competition for prime locations is intense and the prices commanded for such locations have remained high. There is no guarantee that a sufficient number of locations will be available in desirable areas or on terms that are acceptable to us in order to achieve our growth plan. Delays or failures in opening new restaurants, or achieving lower than expected sales in new restaurants, could materially adversely affect our growth strategy. Once we have identified suitable restaurant sites, our ability to open new restaurants successfully and on the development schedule we anticipate will also depend on numerous other factors, some of which are beyond our control, including, among other items, the following:

- •

- our ability to secure suitable new restaurant sites;

- •

- consumer acceptance of our new restaurants;

- •

- our ability to control construction and development costs of new restaurants;

- •

- our ability to negotiate suitable lease terms;

15

- •

- our ability to secure required governmental approvals and permits in a timely manner and any changes in local, state or

federal laws and regulations that adversely affect our costs or ability to open new restaurants;

- •

- the cost and availability of capital to fund construction costs and pre-opening expenses; and

- •

- limitations under our current and future credit facilities.

Although we target specified new restaurant average unit volumes, cash on cash returns and capital investment for both Joe's and Brick House, new restaurants may not meet these targets. Any restaurant we open may not be profitable or achieve operating results similar to those of our existing restaurants. We may not be able to respond on a timely basis to all of the changing demands that our planned expansion will impose on management and on our existing infrastructure, or be able to hire or retain the necessary management and operating personnel. Our existing restaurant management systems, financial and management controls and information systems may not be adequate to support our planned expansion. Our ability to manage our growth effectively will require us to continue to enhance these systems, procedures and controls and to locate, hire, train and retain management and operating personnel.

There is also the potential that some of our new restaurants will be located near areas where we have existing restaurants, thereby reducing the revenues of such existing restaurants.

Macroeconomic conditions could adversely affect our ability to increase the sales and profits of existing restaurants or to open new restaurants.

The United States may continue to suffer from depressed economic activity. Recessionary economic cycles, higher fuel and other energy costs, lower housing values, low consumer confidence, inflation, increases in commodity prices, higher interest rates, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect discretionary consumer spending could adversely affect our revenues and profit margins and make opening new restaurants more difficult. Our guests may have lower disposable income and reduce the frequency with which they dine out. This could result in reduced guest traffic, reduced average checks or limitations on the prices we can charge for our menu items, any of which could reduce our sales and profit margins. In addition, many of our Joe's Crab Shack restaurants are located in areas that we consider tourist or vacation destinations. Therefore, in those locations, we depend in large part on vacation travelers to frequent our Joe's Crab Shack restaurants, and such destinations typically experience a reduction in visitors during economic downturns, thereby reducing the potential guests that could visit our restaurants. Also, businesses in the shopping vicinity in which some of our restaurants are located may experience difficulty as a result of macroeconomic trends or cease to operate, which could, in turn, further negatively affect guest traffic at our restaurants. All of these factors could have a material adverse impact on our results of operations and growth strategy.

Our success depends on our ability to compete with many other restaurants.

The restaurant industry is intensely competitive, and we compete with many well-established restaurant companies on the basis of taste of our menu items, price of products offered, guest service, atmosphere, location and overall guest experience. Our competitors include a large and diverse group of restaurant chains and individual restaurants that range from independent local operators that have opened restaurants in various markets to well-capitalized national restaurant companies. Our Joe's Crab Shack restaurants compete against other casual seafood restaurants, including both national and regional chains and local seafood restaurants, as well as against casual dining restaurants that provide a different type of food. Our Brick House Tavern + Tap restaurants compete against casual restaurants in the bar and grill segment and restaurants in the casual dining segment.

16

Some of our competitors have substantially greater financial and other resources than we do, which may allow them to react to changes in the restaurant industry better than we can. Other competitors are local restaurants that in some cases have a loyal guest base and strong brand recognition within a particular market. As our competitors expand their operations or as new competitors enter the industry, we expect competition to intensify. Should our competitors increase their spending on advertising and promotions, we could experience a loss of guest traffic to our competitors. Also, if our advertising and promotions become less effective than those of our competitors, we could experience a material adverse effect on our results of operations. We also compete with other restaurant chains and other retail businesses for quality site locations, management and hourly employees.

Changes in food and supply costs, including the cost of crab, could adversely affect our results of operations.

Our profitability depends in part on our ability to anticipate and react to changes in food and supply costs. Operating margins for our restaurants are subject to changes in the price and availability of food commodities, including crab, shrimp, lobster and other seafood. In fiscal year 2011, Snow Crab, Dungeness Crab, King Crab and shrimp accounted for approximately 43% of our total food purchases. Any increase in food prices, particularly for these food items, could adversely affect our operating results. We have experienced increases in crab pricing. We believe that the cost of crab will remain high through 2012 before moderating towards mean historical prices. In addition, we are susceptible to increases in food costs as a result of factors beyond our control, such as weather conditions (including hurricanes), oil spills, fisherman strikes, food safety concerns, costs of distribution, product recalls and government regulations. Furthermore, the introduction of or changes to tariffs on seafood, such as imported crab and shrimp or other food products, could increase our costs and possibly impact the supply of those products. We cannot predict whether we will be able to anticipate and react to changing food costs by adjusting our purchasing practices and menu items and prices, and a failure to do so could adversely affect our operating results. In addition, because our menu items are moderately priced, we may not seek to or be able to pass along price increases to our guests. If we adjust pricing there is no assurance that we will realize the full benefit of any adjustment due to changes in our guests' menu item selections and guest traffic.

Brick House is a newer and still evolving brand and our plans to expand Brick House may not be successful.

While Joe's and Brick House are subject to the risks and uncertainties described herein, there is an enhanced level of risk and uncertainty related to the expansion of Brick House, our newer brand. While Brick House has grown to 16 locations since its founding in 2008, it is still evolving and has not yet proven its long-term growth potential. For example, only five Brick House restaurants have been open for more than eight full fiscal quarters, qualifying them for inclusion in our comparable restaurant base.

Initially, we opened Brick House restaurants across a broad range of geographies with the intent of optimizing the brand prior to a continued build out. During the past three fiscal years, we have converted two Joe's Crab Shack restaurants to Brick House restaurants, and we are currently in the process of converting one Brick House restaurant to a Joe's Crab Shack restaurant. We are currently in the process of integrating key insights into our new restaurant rollout plans. There can be no assurance that the enhancements we intend to implement as part of the brand optimization process will be successful or that additional new restaurant growth will occur. Brick House will be subject to the risks and uncertainties that accompany any emerging restaurant brand. If Brick House fails to expand and/or continue generating profits, our operating results could suffer.

Guests at all of our existing Brick House restaurants were initially served by an all-female service staff. As part of our brand optimization process, during the fourth quarter of 2011, we converted to a more traditional service model utilizing both male and female servers at all of our existing Brick House restaurant locations and intend to use a more traditional service model at any new Brick House

17

restaurant locations. The conversion to a more traditional service model was made in combination with other modifications to the style and experience of our Brick House restaurants, including menu modifications and changes to appeal to a broader guest base. It is too soon to predict whether these changes will have a positive or negative impact on guest traffic. If guests and potential guests react unfavorably to our conversion to a more traditional service model and other modifications, our results of operations could be adversely affected.

Food safety and food-borne illness concerns may have an adverse effect on our business.

Food safety is a top priority, and we dedicate substantial resources to ensure that our guests enjoy safe, quality food products. However, food-borne illnesses, such as salmonella, E. coli, hepatitis A, trichinosis or "mad cow disease," and food safety issues have occurred in the food industry in the past, and could occur in the future. In addition, publicity regarding certain illnesses and contaminations related to seafood, including high levels of mercury or other carcinogens, oil contaminations, vibrio vulnificus and the Norwalk virus could affect consumer preferences and the consumption of seafood. Any report or publicity linking us to instances of food-borne illness or other food safety issues, including food tampering or contamination, could adversely affect our brands and reputation as well as our revenues and profits. Even instances of food-borne illness, food tampering or food contamination occurring solely at restaurants of our competitors could result in negative publicity about the food service industry or seafood restaurants generally and adversely impact our sales.

Furthermore, our reliance on third-party food suppliers and distributors increases the risk that food-borne illness incidents could be caused by factors outside of our control and that multiple locations would be affected rather than a single restaurant. Although we inspect food products when they are delivered to us, we cannot assure that all food items are properly maintained during transport throughout the supply chain and that our employees will identify all products that may be spoiled and should not be used in our restaurants. New illnesses resistant to any precautions may develop in the future, or diseases with long incubation periods could arise, such as "mad cow disease," which could give rise to claims or allegations on a retroactive basis. In addition, our industry has long been subject to the threat of food tampering by suppliers, employees or guests, such as the addition of foreign objects in the food that we sell. Reports, whether or not true, of injuries caused by food tampering have in the past severely injured the reputations and brands of restaurant chains in the quick service restaurant segment and could affect us in the future as well. If our guests become ill from food-borne illnesses, we could also be forced to temporarily close some restaurants. Furthermore, any instances of food contamination, whether or not at our restaurants, could subject us or our suppliers to a food recall pursuant to the recently enacted the Food and Drug Administration Food Safety Modernization Act.

Changes in consumer preferences could harm our performance.

Consumer preferences often change rapidly and without warning, moving from one trend to another among many product or retail concepts. We also depend on trends regarding away-from-home dining. Consumer preferences towards away-from-home dining or certain food products might shift as a result of, among other things, health concerns or dietary trends related to cholesterol, carbohydrate, fat and salt content of certain food items, including crab or other seafood items, in favor of foods that are perceived as more healthy. Our menu is currently comprised of crab and other menu items and a change in consumer preferences away from these offerings would have a material adverse effect on our business. Negative publicity over the health aspects of such food items may adversely affect demand for our menu items and could result in lower guest traffic, sales and results of operations.

18

If we fail to continue to develop and maintain our restaurant brands, our business could suffer.

We believe that maintaining and developing our restaurant brands are critical to our success and our growth strategy, and that the importance of brand recognition is significant as a result of competitors offering products similar to our products. We have made significant marketing expenditures to create and maintain brand loyalty as well as to increase awareness of our brands. If our brand-building strategy is unsuccessful, these expenses may never be recovered, and we may be unable to increase our future sales or implement our business strategy.

Any incident that erodes consumer affinity for our brands could significantly reduce their respective values and damage our business. If guests perceive or experience a reduction in food quality, service or ambiance, or in any way believe we failed to deliver a consistently positive experience, our brand value could suffer and our business may be adversely affected.

In addition, in connection with our acquisition by JCS Holdings, LLC, we granted a license to Landry's that allows Landry's to use certain of our intellectual property, including the Joe's Crab Shack name, to operate two Joe's Crab Shack restaurants. Although Landry's is required to adhere to certain minimum quality standards under the license, including with respect to menu, promotional materials and the specification and preparation of food and beverage items, we do not have operational control over the two restaurants. As a result, such Joe's Crab Shack restaurants owned and operated by Landry's may not be operated in a manner consistent with the standards we uphold at our restaurants. If such restaurants do not maintain operational standards consistent with the standards we demand of our restaurants, the image and brand reputation of Joe's Crab Shack may suffer and our business may be materially affected.

The impact of new restaurant openings could result in fluctuations in our financial performance.