Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SENOMYX INC | Financial_Report.xls |

| EX-23.1 - EX-23.1 - SENOMYX INC | a11-31388_1ex23d1.htm |

| EX-31.2 - EX-31.2 - SENOMYX INC | a11-31388_1ex31d2.htm |

| EX-32.1 - EX-32.1 - SENOMYX INC | a11-31388_1ex32d1.htm |

| EX-31.1 - EX-31.1 - SENOMYX INC | a11-31388_1ex31d1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 000-50791

SENOMYX, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

33-0843840 |

|

(State or other jurisdiction of incorporation |

|

(I.R.S. Employer Identification No.) |

|

4767 Nexus Centre Drive |

|

92121 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(858) 646-8300

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Exchange on Which Registered |

|

Common Stock, par value $0.001 per share |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer x |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2011, the aggregate market value of the voting stock held by non—affiliates of the registrant, computed by reference to the last sale price of such stock as of such date on the NASDAQ Stock Market LLC, was approximately $144,791,000. Excludes an aggregate of 11,453,702 shares of common stock held by officers and directors and by each person known by the registrant to own 5% or more of the outstanding common stock as of June 30, 2011. Exclusion of shares held by any of these persons should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant.

As of February 21, 2012, there were 39,765,823 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2011 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference in Part III, Items 10-14 of this Form 10-K.

SENOMYX, INC.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2011

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements included or incorporated by reference in this annual report on Form 10-K other than statements of historical fact, are forward-looking statements. You can identify these and other forward-looking statements by the use of words such as “may,” “will,” “could,” “anticipate,” “expect,” “intend,” “believe,” “continue” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to such statements.

Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth below under the caption “Risk Factors” in Part I Item 1A and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II Item 7 of this annual report on Form 10-K and elsewhere in this annual report on Form 10-K. Readers are cautioned not to place undue reliance on forward-looking statements. The forward-looking statements speak only as of the date on which they are made and we undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made except as required by law.

Overview

We are a leading company using proprietary taste receptor technologies to discover and develop innovative flavor ingredients for the packaged food, beverage and ingredient supply industries. We consider flavor ingredients to include flavors, such as savory flavors and cooling flavors, and flavor modulators, such as sweet and salt enhancers and bitter blockers. We also have an ongoing effort to discover and develop natural high intensity sweeteners. We believe our flavor ingredients will enable packaged food, beverage and ingredient supply companies to improve the nutritional profile of their products while maintaining or enhancing taste and, in certain cases, generating cost of goods savings. We license our flavor ingredients to our collaborators on an exclusive or co-exclusive basis, which we believe will provide these companies with a competitive advantage. We currently have collaborative agreements with several of the world’s leading packaged food, beverage and ingredient companies, including Ajinomoto Co., Inc., or Ajinomoto, Firmenich SA, or Firmenich, Nestlé SA, or Nestlé, and PepsiCo, Inc., or PepsiCo. We currently anticipate that we will derive all of our revenues from existing and future collaborative agreements. Depending upon the collaboration, our collaboration agreements generally provide for upfront fees, research and development funding, reimbursement of certain costs, milestone payments based upon our achievement of research or development goals and, in the event of commercialization, commercial milestones, minimum periodic royalties and royalties on sales of products incorporating our flavor ingredients.

Individuals experience the sensation of taste when flavor ingredients in food and beverage products interact with taste receptors in the mouth. A taste receptor functions either by physically binding to a flavor ingredient in a process analogous to the way a key fits into a lock or by acting as a channel to allow ions to flow directly into a taste cell. As a result of these interactions, signals are sent to the brain where a specific taste sensation is registered. There are currently five recognized primary senses of taste: umami, which is the savory taste of glutamate, sweet, salt, bitter and sour. In addition, there are secondary taste sensations, such as cool, hot and fat.

We are currently pursuing the discovery and/or development of flavor ingredients through five programs focused on savory, sweet, salt, bitter and cooling taste areas. The primary goals of our Savory Flavor Program are to add to the Company’s portfolio of new flavor ingredients that enhance or mimic the taste of naturally occurring glutamate and enable the reduction or replacement of added monosodium glutamate, or MSG, and to provide new savory tastes to foods by combining Senomyx’s savory flavors with other ingredients to create unique new flavors. The primary goal of our Sweet Taste Program is to add

to the Company’s portfolio of new flavor ingredients that allow a significant reduction of sweeteners in food and beverage products while maintaining the desired sweet taste. The goal of our Salt Taste Program is to identify flavor ingredients that allow a significant reduction of sodium in foods and beverages yet maintain the salty taste desirable to consumers. The goals of our Bitter Blocker Program are to reduce or block bitter taste and to improve the overall taste characteristics of packaged foods, beverages, over the counter, or OTC, health care products and pharmaceutical products. The goal of our Cooling Taste Program is to discover novel cooling compounds that have advantages over currently available agents for a variety of applications.

Our internet address is www.senomyx.com. We post links on our website to the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission, or SEC: annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendment to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. All such filings are available through our website free of charge. Our filings may also be read and copied at the SEC’s Public Reference Room at 100 F Street, NE Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Industry Background

Flavor Industry Overview

Flavor ingredients are used in a variety of packaged food, beverage and ingredient products throughout the world. Flavor ingredients are either naturally occurring or artificial compounds. Flavors include compounds that impart a taste such as strawberry or vanilla, or a taste sensation such as cooling. Flavor ingredients are generally sold as part of a flavor mixture or system to packaged food and beverage companies, or to companies that make pharmaceutical or OTC healthcare products. A flavor system is a combination or variety of flavor ingredients, such as a mixture of citrus, menthol and other cooling flavors. Flavor systems are also delivered in several forms such as powder or liquid, and may be specially processed to increase the functionality of the flavor.

While some packaged food, beverage and ingredient companies have their own internal research and development programs, most have traditionally relied on purchases of flavor ingredients from third parties. Historically, flavor ingredients have been sold on a commodity basis by independent manufacturers who make their products broadly available to packaged food, beverage and ingredient companies on a non-exclusive basis. This has limited the ability of packaged food, beverage and ingredient companies to use flavor ingredients to differentiate their brands from competitors.

Traditionally, companies have discovered new flavor ingredients primarily using inefficient, non-automated and labor-intensive trial and error processes involving a limited number of trained taste testers. Using this approach, taste testers must physically taste each potential flavor ingredient to assess the taste characteristics of the compound. Taste testers can assess only a limited number of potential flavor ingredients at one time due to the sensory fatigue that results from repeated tasting. As a result, only a small fraction of the available universe of ingredients can be tested economically.

Flavor ingredients are regulated in the United States under provisions of the Food, Drug and Cosmetic Act, or FD&C Act, administered by the Food and Drug Administration, or FDA. Flavor ingredients sold in countries and regions outside the United States are also subject to regulations imposed by national governments or regional regulatory authorities, as is the case in the European Union. For further discussion of the regulatory regime for flavor ingredients, please see the “Regulatory” section below.

Packaged Food and Beverage Industry

Packaged food and beverage products include carbonated and non-carbonated beverages, frozen foods, snack foods, ice cream, pasta, canned soup, pet food and numerous other products. According to recent data from Euromonitor International, an independent research organization, worldwide sales of packaged food and beverage products in 2010 were approximately $1.9 trillion, of which approximately $305 billion was generated in the United States. These figures represent annual growth rates of approximately 5% and 3%, respectively, over 2005 amounts. Based on these estimates, of the worldwide total, sales of packaged foods were approximately $1.5 trillion and sales of non-alcoholic beverages were approximately $466 billion.

Flavor Ingredients as a Source of Competitive Advantage

The packaged food, beverage and ingredient industries are comprised of a number of large and highly competitive market segments. Small market share gains in specific large market segments can translate into significant additional revenue for packaged food, beverage and ingredient companies. For example, according to recent Euromonitor data, estimated 2010 worldwide sales of non-alcoholic beverages were approximately $466 billion. Thus, an increase of a tenth of a percentage point in overall worldwide market share would result in additional revenue of approximately $466 million.

As a result of these market opportunities, packaged food, beverage and ingredient companies are constantly seeking ways to differentiate their products, demand for which can be greatly affected by very small actual or perceived improvements in flavor or health profiles. Flavor ingredients can potentially provide an important way to differentiate a particular product through enhanced taste, improvements in nutritional profile or labeling, flavor ingredient exclusivity and cost of goods savings.

· Taste. Product taste is a critical competitive factor for packaged food, beverage and ingredient companies. These companies seek to use flavor ingredients to improve or maintain taste while improving the nutritional profile of packaged food, beverage and ingredient products or reducing ingredient costs.

· Health Benefits. Packaged food, beverage and ingredient companies are exploring ways to improve overall nutritional quality of their products. It is widely accepted that poor diet contributes to adverse health conditions such as cardiovascular disease, diabetes and obesity. To address these concerns, many companies have introduced reduced calorie, reduced sodium and reduced fat content products to the market. Flavor ingredients with specific characteristics provide an innovative way to reduce the levels of ingredients that may contribute to these concerns without compromising desirable taste attributes.

· Flavor Ingredient Exclusivity. Failure of packaged food, beverage and ingredient companies to differentiate their brands from their competition, including private label products, may result in significant loss of market share, price pressure and erosion of profit margins. Packaged food, beverage and ingredient companies spend millions of dollars creating brands and brand images to compete with other products. Many of these competitive products contain the same or similar flavor ingredients. The limited availability of proprietary flavor ingredients makes it difficult for manufacturers to differentiate their products based on flavor ingredients.

· Cost of Goods Savings. The packaged food, beverage and ingredient industries purchase enormous quantities of raw materials to produce their products. According to the Food and Agriculture Division of the United Nations and LMC International, an economic and business consultancy providing economic research and consultancy services, estimated worldwide sugar consumption was approximately 152 million metric tons during 2010. Using calendar year 2011 refined sugar prices, the market value of processed sugar produced worldwide is therefore in excess of $111.1 billion on an annual basis. Similarly, according to Ajinomoto’s FY2010 Market and Other Information report and a Leatherhead Research report, worldwide demand for MSG was approximately 2.4 million metric tons in 2010, which would have had a cost of $3.4 billion. According to LMC International, worldwide demand for high-fructose corn syrup for 2010 was approximately 13.2 million metric tons, which would have had a cost of approximately $7.6 billion using January 2012 spot prices. Flavor ingredients can potentially facilitate a reduction in the quantity of these ingredients used in packaged food, beverage and ingredient products, which could result in significant decreases in costs and associated increases in profit margins.

Our Solution

We use our proprietary taste receptor-based assays and screening technologies to discover and develop novel flavor ingredients. We have developed proprietary taste receptor-based assays for use in our high-throughput screening systems to rapidly and efficiently screen our compound libraries and identify large numbers of novel potential flavor ingredients. We believe our approach improves the likelihood that ingredients with the desired characteristics can be discovered and then optimized into novel flavor ingredients.

We believe our approach will result in the discovery and development of flavor ingredients that will address the following key challenges faced by the packaged food, beverage and ingredient industries:

· Maintaining and Improving Taste. Our goal is to discover and develop flavor ingredients that will enable our current and future collaborators to improve or maintain taste while improving the nutritional profile of packaged food, beverage and ingredient products or reducing ingredient costs.

· Reducing Sugar, Artificial Sweeteners, Salt and MSG in Packaged Food and Beverage Products. Our resources are focused on discovering and developing flavor ingredients to enable our current and future collaborators to significantly reduce the levels of sugar, artificial sweeteners, salt and MSG in packaged food and beverage products while maintaining or improving taste. We believe reducing the levels of such ingredients will improve the nutritional profile and/or taste of packaged food and beverage products.

· Blocking Undesirable Tastes. We are developing flavor ingredients that we believe will be useful in blocking bitter and other unwanted tastes associated with certain packaged food and beverage products. Our technology may also be useful to improve the taste of products outside of food and beverages, such as OTC health care products and pharmaceutical products.

· Overcoming Deficiencies in Certain Flavor Ingredients. We seek flavor ingredients with lower costs and improved properties over existing ingredients, including flavor and physical properties.

· Identifying Natural Ingredients. We have the technology to screen libraries of natural samples isolated from plants and other natural sources to discover new natural ingredients.

· Obtaining Exclusive or Co-Exclusive Use of Proprietary Flavor Ingredients. We are able to offer our current and future collaborators exclusive or co-exclusive use of our proprietary flavor ingredients in defined packaged food, beverage and ingredient product categories. We believe this approach will assist our collaborators in differentiating their products from those of their competitors.

· Reducing Cost of Goods. We believe our proprietary flavor ingredients will enable our current and future collaborators to reduce overall raw material ingredient costs in certain cases, particularly for those products containing high levels of natural and artificial sweeteners and MSG.

Our Strategy

Our goal is to use our flavor programs to become the leader in the discovery and development of new and improved flavor ingredients. Key elements of our strategy include:

· Collaborating With Leading Packaged Food, Beverage and Ingredient Companies. We are collaborating with leading packaged food, beverage and ingredient companies to develop and commercialize our product candidates. Our collaborators are responsible for manufacturing, marketing, selling and distributing their products incorporating flavor ingredients discovered and developed by Senomyx. In addition, our collaborators are responsible for all manufacturing costs of our flavor ingredients. As a result, we expect our flavor ingredients will be commercialized without Senomyx incurring significant sales, marketing, manufacturing and distribution costs.

· Developing Flavor Ingredients that are Eligible for Flavor and Extract Manufacturers Association, or FEMA, Generally Recognized as Safe, or GRAS, Determination. Our primary focus is on the development of flavor ingredients that will qualify for a FEMA GRAS determination. Ten flavor ingredients developed as part of our savory, sweet and bitter programs have received FEMA GRAS determination. Upon the GRAS determination, our collaborators can begin to test market and commercialize products incorporating our flavor ingredients in many key markets. In the event that a particular product candidate is not eligible for FEMA GRAS determination, we may dedicate our development efforts to alternative flavor ingredients.

· Pursuing Additional Collaborations and Market Opportunities. As appropriate, we seek to establish additional collaborations with leading packaged food, beverage and ingredient companies to use flavor ingredients developed through our existing programs for exclusive or co-exclusive use within new packaged food, beverage and ingredient product fields. We intend to receive from future collaborators up-front fees, research and development funding, cost reimbursements, milestone payments, minimum periodic royalties and royalties on future sales of products incorporating these flavor ingredients.

· Maintaining and Expanding Our Technology Position. We believe our proprietary taste receptor-based technologies, including our receptor discovery, assay development and high-throughput screening technologies and natural and artificial compound libraries provide us and our collaborators with significant competitive advantages. We intend to continue to develop and acquire proprietary technologies and related intellectual property rights to expand and enhance our ability to discover and develop new proprietary flavor ingredients.

Our Discovery and Development Process

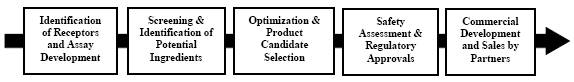

The following diagram summarizes our discovery and development process.

The key elements of our Discovery and Development process are:

· Identification of Relevant Taste Receptors and Proprietary Taste Receptor-Based Assay Development. The first steps in our discovery and development process are to identify the relevant taste receptors and to develop proprietary assays based on the identified receptors. Our assays are tests that measure interactions between the taste receptors and potential flavor ingredients. To date, we have developed assays to test for compounds that interact with receptors associated with savory, sweet, bitter and cooling tastes.

· High-Throughput Screening and Identification of Potential Ingredients. The next step in our discovery and development process is to use our proprietary taste receptor-based assays to identify compounds that bind to taste receptors, known as hits. We use automated high-throughput screening to evaluate rapidly our libraries of diverse artificial and natural compounds. A panel of taste testers then evaluates the taste effect of the most potent hits. Based on this evaluation, we designate hits that exhibit a positive taste effect as proof-of-concept compounds. We then select the most promising of those proof-of-concept compounds, which we call lead compounds, for optimization.

· Optimization of Lead Compounds and Selection of Product Candidates. The next step in our discovery and development process is to chemically enhance, or optimize, our lead compounds to allow lower amounts of the compound to be used in the finished product or improve the activity to meet the taste attribute goals of our collaborators. Optimization may also be required to enhance the safety profile or to improve the physical properties of a compound so that it is stable under manufacturing, storage and food preparation conditions. We refer to optimized compounds that provide desirable taste attributes in packaged food, beverage and ingredient product prototypes as product candidates. When screening natural libraries, optimization involves selecting the appropriate source and developing the most efficient process to obtain the active compound.

· Safety Studies and Regulatory Approval of Product Candidates. The next step in our discovery and development process is to select one or more product candidates for development and potential commercialization. We then evaluate the selected product candidate for safety, including preliminary in-vitro evaluation and additional in-vivo studies to confirm an acceptable safety profile. Following this evaluation, we submit the safety data along with the physical and chemical properties of the product candidate and a description of manufacturing and conditions of intended use to FEMA for review. The FEMA review is conducted by an Expert Panel identified and convened by FEMA. If the Expert Panel determines the product candidate to be GRAS, the conclusions of the Expert Panel are provided directly to the FDA and published in the journal Food Technology. The FEMA GRAS status allows the flavor ingredients to be commercialized in the United States and several other countries and regions. FEMA GRAS status also facilitates regulatory determinations in a number of additional countries.

Ten flavor ingredients developed as part of our savory, sweet and bitter programs have received FEMA GRAS determination. The process from selection for development until receipt of that determination has ranged from 12 to 18 months. Costs associated with the FEMA GRAS process, including external third-party safety studies and preparation of the application, ranged up to approximately $1 million per flavor ingredient. We expect that most of the flavor ingredients we develop in the future will require a similar amount of time and cost. However, the length of time and cost may vary depending on the properties of the flavor or flavor ingredient. In addition, regulatory approval of the flavor ingredients in other jurisdictions may require that we conduct additional studies or incur additional expenses. Furthermore, the regulatory approval of natural high intensity sweeteners will likely require submission through the Food Additive Petition process. For further discussion of the Food Additive Petition process, please see the “Regulatory” section below.

· Commercial Development and Sales by Partners. Following regulatory approval in a given country, foods and beverages containing our proprietary flavor ingredients can be commercialized immediately. Our collaborators have ultimate responsibility for commercialization of Senomyx flavor ingredients in their end product offerings. Prior to commercialization collaborators complete extensive product formulation work on targeted products. Our collaborators may validate final formulations for these products through in-house sensory evaluation as well as external in-market taste tests by consumers. Upon confirming consumer acceptance of these products, the collaborators complete activities such as production of the Senomyx flavor ingredients and the development of packaging and sales samples and materials, enabling the actual market launches of the products.

Our Discovery and Development Programs

We are currently pursuing the discovery and development of flavor ingredients through five programs focused on savory, sweet, salt, bitter and cooling taste areas.

Each of our programs focuses on developing flavor ingredients that address large, potentially overlapping markets. Our Savory Flavor Program is aimed at developing flavor ingredients that could be used in product categories such as ready meals, sauces, spreads, frozen foods, beverages, meal replacements, soups, pastas, dried foods, snack foods, processed meats, processed cheeses and cracker products. Our Sweet Taste Program is aimed at developing flavor ingredients or discovering natural high intensity sweeteners that could be used in product categories such as confectionaries, cereal, ice cream,

beverages, yogurt, dessert, spreads and bakery products. Our Salt Taste Program is aimed at developing flavor ingredients that could be used in product categories such as ready meals, sauces, spreads, frozen foods, beverages, meal replacements, soups, pastas, dried foods, snack foods, processed meats, processed cheeses, cracker products, canned foods and bakery products. Our Bitter Blocker Program is focused on developing flavor ingredients that could be used in product categories such as products that contain bitter tastants, including confectionaries, beverages, ice cream, ready meals, canned foods and soups, and products which utilize certain artificial sweeteners. Our Cooling Taste Program is aimed at developing flavor ingredients that could be used in products that incorporate cooling agents, such as cough medicines, confectionaries and OTC oral hygiene products.

The following table sets forth our key programs for which we have at least one collaboration agreement in place where any potential royalty payable to us is calculated as a percentage of the net sales price of a manufacturer’s finished products or is based on the volume of a manufacturer’s finished product that it sells. We refer to these types of collaborative agreements as retail-based agreements. The table provides the product categories licensed as part of the agreement and provides our estimates of the worldwide sales for food and beverage products of our existing collaborators in their exclusive or co-exclusive product fields.

|

Program |

|

Partner |

|

Product |

|

2010 Estimated Revenues of |

| |

|

Sweet Taste Program |

|

|

|

|

|

|

| |

|

- New enhancers |

|

PepsiCo |

|

Non-alcoholic beverages |

|

$ |

29.5 billion |

|

|

|

|

|

|

|

|

|

| |

|

Bitter Blocker Program |

|

|

|

|

|

|

| |

|

- Modulators including S6821 |

|

Undisclosed company |

|

Not disclosed |

|

$ |

10.3 billion |

|

(1) Based on recent data from Euromonitor and reports from our collaborators. Includes all revenues for licensed product categories, some of which may not be appropriate for Senomyx flavor ingredients within the category.

The following table sets forth our key programs for which we have at least one collaboration agreement in place where any potential royalty payable to us is calculated as a percentage of the sales price of either the Senomyx flavor ingredient itself or the flavor system in which the Senomyx flavor ingredient is contained or is based on the volume of the flavor ingredient itself used by a manufacturer in a finished product. We refer to these types of agreement as ingredient supply-based agreements. The table provides the product categories licensed as part of the applicable collaboration agreement and provides our estimates of the market potential for the relevant flavor ingredient licensed to our existing collaborators in their exclusive or co-exclusive product fields.

|

|

|

|

|

Product |

|

Competitive Market Overview (1) |

| |||

|

Program |

|

Partner |

|

Category |

|

Description |

|

Size |

| |

|

Sweet Taste Program |

|

|

|

|

|

|

|

|

| |

|

- Sucrose enhancer (S6973) and new enhancers |

|

Firmenich |

|

All food and certain selected beverages (2) |

|

Worldwide sucrose and fructose market |

|

$ |

118.7 billion |

|

|

- Sucralose enhancer (S2383) |

|

Firmenich |

|

All food and beverages |

|

Worldwide sucralose market |

|

$ |

320 million |

|

|

- New natural sweeteners |

|

PepsiCo |

|

Non-alcoholic beverages |

|

Worldwide high intensity sweetener market |

|

$ |

1.1 billion |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Savory Flavor Program |

|

|

|

|

|

|

|

|

| |

|

- Existing flavors |

|

Nestlé and undisclosed company |

|

Virtually all product categories, depending on geography |

|

Worldwide monosodium glutamate (MSG) market |

|

$ |

3.4 billion |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cooling Taste Program |

|

|

|

|

|

|

|

|

| |

|

- New cooling agents |

|

Firmenich |

|

All food, beverage and OTC categories |

|

Worldwide cooling agent systems |

|

$ |

1.2 billion |

(3) |

(1) Includes all ingredient costs for licensed product categories including ingredients which may not be appropriate for certain products within the category or licensed in the retail model. Based on 2010 data from Euromonitor, Leatherhead Research and Hill Consulting Group.

(2) Euromonitor worldwide sales in categories licensed to Firmenich were estimated to be approximately $70.5 billion in 2010.

(3) According to Hill Consulting Group’s 2006 “Cooling Agents” report, annual sales of current cooling compounds are in the range of $400 million, and we estimate the opportunity for flavor systems incorporating improved cooling agents may be three to four times that size.

The following table sets forth our key programs in which significant product categories remain available for future license.

|

Program |

|

Retail Model Unlicensed Product |

|

Ingredient Supply Model |

|

Bitter Blocker Program |

|

|

|

|

|

- Modulators including S6821 |

|

Products that contain bitter tastants (including caffeine or artificial sweeteners) such as tea, nutritional beverages, ice cream, yogurt and desserts |

|

Potential bitter tastants include whey and other dairy protein, cocoa, menthol and certain high intensity sweeteners |

|

|

|

|

|

|

|

Savory Taste Program |

|

|

|

|

|

- New flavor S9229 |

|

All product categories including ready meals, sauces, soups, snack foods, frozen foods, canned foods, dried foods and processed meats |

|

Worldwide MSG market |

|

|

|

|

|

|

|

Salt Taste Program |

|

|

|

|

|

- Salt enhancers |

|

All product categories including ready meals, sauces, soups, snack foods, frozen foods, canned foods, dried foods, processed meats and certain baked goods |

|

Not applicable |

|

|

|

|

|

|

|

Sweet Taste Program |

|

|

|

|

|

- New natural sweeteners |

|

All food product categories |

|

Worldwide high intensity sweetener market for all food product categories |

Savory Flavor Program

The goals of our Savory Flavor Program are to enhance the taste of naturally occurring glutamate and enable the reduction or elimination of added MSG and a related food additive, inosine monophosphate, or IMP, and to provide new savory tastes to foods by combining Senomyx’s savory flavors with other ingredients to create unique new flavors. We identified two product candidates, S336 and S807, that enhance the savory taste of glutamate. In March 2005, the FEMA Expert Panel determined that S336 and S807 were GRAS. In addition, two other savory flavors, S263 and S976, which are related to S336, were also determined by FEMA to be GRAS. During 2007, the Chinese Ministry of Health granted official regulatory approval in China for S336 and S807. Also in 2007, S336 and S807 received a positive review by the Joint FAO/WHO Expert Committee on Food Additives, or JECFA. The JECFA determination facilitates the acceptance or approval of flavors for use in food in many countries throughout the world. In 2010, the European Food Safety Authority, or EFSA, provided a “favorable opinion” for S336 and S807, which means that no further evaluation is needed. Final regulatory approval and commercialization in the European Union is contingent upon the ingredients being included in the EFSA Union List of Flavouring Substances. EFSA had previously targeted publication of the Union List by the end of 2010; however, the list is not yet published and there has been no official update. In 2011, two more savory flavors, S9229 and S5456, were also determined by FEMA to be GRAS. A more detailed description of the FEMA GRAS process is provided in Item 1, Business — Regulatory Process. We continue to develop potential new savory flavors.

Sweet Taste Program

Our Sweet Taste Program has two main components. We are looking to develop natural and artificial sweet taste modifiers, which we refer to as sweet enhancers, and we are also seeking to discover natural high intensity sweeteners.

Sweet Enhancers

The goals of the Sweet Enhancer component of our Sweet Taste Program are to enhance the taste of natural and artificial sweeteners and enable a significant reduction in added sweeteners. Senomyx has identified S2383, a novel enhancer of the high-intensity sweetener sucralose, as well as S6973 and S9632, two enhancers of sucrose, or plain sugar. Taste tests demonstrated that S2383 enabled up to a 75% reduction of sucralose in product prototypes such as beverages, yogurt and baked goods, yet maintained the same sweet intensity without any off-tastes. In November 2008 we announced receipt of FEMA GRAS status for S2383.

The new sucrose enhancer S6973 allows an approximately 50% reduction of sucrose in taste tests with product categories such as baked goods, cereals, gum, condiments and relishes, confectioneries and frostings, frozen dairy offerings, fruit ices, gelatins and puddings, hard and soft candy, jams and jellies, milk products, and sauces. In October 2009 we announced receipt of FEMA GRAS status for S6973.

S9632, a new sucrose enhancer with very favorable taste and physical characteristics, has advanced into final safety studies for anticipated year-end GRAS regulatory approval in the U.S. Taste tests and other evaluations indicate that S9632 may be beneficial for a broad range of beverages and other product applications.

We are also continuing to optimize and evaluate promising enhancers of high fructose corn syrup (HFCS) that enable up to a 33% HFCS reduction while retaining the preferred sweetness profile in taste tests. HFCS is widely used as a sweetener for beverages and other products.

Natural High Intensity Sweeteners

The goal of the Natural High Intensity Sweetener component of our Sweet Taste Program is to discover and develop novel no- or low-calorie natural high intensity sweeteners. Our activities to discover and develop natural high-potency sweeteners continue to progress. These activities include further expansion of our natural products library and high-throughput screening of these plant-derived samples.

Significant progress is being made with our activities to discover and develop natural high-potency sweeteners and sweet taste enhancers. We have achieved our first taste-proof-of-concept for this effort with a recently identified natural ingredient that provided a sweet taste. This accomplishment validates our approach of building a targeted natural-source library and using our proprietary technologies to identify potential new natural sweet flavor ingredients.

Salt Taste Program

The goal of the Salt Taste Program is to identify flavor ingredients that allow a significant reduction of sodium in foods and beverages yet maintain the salty taste desirable to consumers. This program is an important research focus for our longer-term pipeline. Current activities include targeted analytical approaches to discover specific proteins that could be viable candidates for the receptors or co-factors responsible for salt taste. We have assembled a proprietary database of proteins found in taste buds and progress is being made exploring the role of a number of these proteins that may be involved in salt taste perception. We recently identified a blocker of salt taste that could potentially be used as a tool to help discover the proteins involved with salt taste perception.

Bitter Blocker Program

The primary goals of this program are to reduce or block bitter taste and to improve the overall taste characteristics of foods, beverages, and ingredients. Two of our bitter blockers, S6821 and S7958, have received GRAS regulatory status. S6821 has demonstrated activity against bitter tasting foods and beverages that include soy and whey proteins, menthol, caffeine, cocoa, and Rebaudioside A (stevia). S7958, a related bitter blocker with similar functionality, has alternative desirable physical properties that may be useful for these or other product applications. In addition, we continue to evaluate and develop potential new bitter blockers. A Senomyx partner has successfully completed initial consumer studies with S6821. This partner is conducting additional product application work and scaling-up the manufacturing process for S6821.

Cooling Taste Program

The goal of the Cooling Taste Program is to identify novel cooling agents that have advantages over currently available agents (i.e. menthol and WS-3). Senomyx has identified several sample classes of new cooling agents that demonstrate a taste proof-of-concept and display preferred cooling properties.

Firmenich has exclusive commercialization rights for new flavors developed under the Cooling Taste Program. In the first quarter of 2012, Firmenich selected S5031 for initiation of development activities in support of future regulatory filings. S5031 is new cooling agent that has a ten-times greater potency in taste tests and other advantageous cooling properties compared to commonly used agents.

Commercialization

A key part of Senomyx’s strategy is commercialization of our ingredients by our collaborators. As of December 31, 2011, three of Senomyx’s collaborators have commercialized products containing Senomyx flavor ingredients. Below is a description of the status of each of these collaborators’ commercial efforts.

Initial market launch by Nestlé of products including our savory flavors occurred in June 2007. Nestlé’s marketing strategy is focused on countries where regulatory approval is in place, and targets products that contain high levels of MSG. In 2010, Nestlé expanded their commercialization efforts to include reformulated established products that contain these ingredients. Ongoing activities include launches of new and reformulated products that incorporate Senomyx’s savory flavors in countries in Asia, Latin America, Africa, and the Middle East. Nestlé has expanded its marketing efforts into additional countries in these regions during 2011.

Ajinomoto has been introducing products that contain a Senomyx flavor in several large geographies, including China and North America. Ajinomoto has continued to explore additional opportunities to expand their customer base and the number of product offerings in these markets.

Firmenich has exclusive worldwide rights to market S2383, Senomyx’s enhancer of sucralose, as either a stand-alone ingredient or as part of a flavor system in all food and beverage product categories. Retail products incorporating S2383 are currently being marketed in North America and Latin America. Firmenich continues to work with many other clients evaluating S2383 in a variety of products.

Firmenich also has exclusive worldwide rights to commercialize Senomyx’s S6973 sucrose enhancer for virtually all food and specified beverage categories. In addition to the first commercial launches of products that incorporate S6973, Firmenich has reported strong interest from numerous clients due to the ability of S6973 to enable a significant reduction of sucrose while maintaining the sugar taste, combined with the potential cost of goods savings.

Collaborative Agreements

We pursue collaborations with leaders in the packaged food, beverage and ingredient supply markets. Under each of our current collaborative agreements, we have agreed to conduct research and develop flavor ingredients in one or more specified taste areas, such as savory, sweet, salt, bitter or cool. These collaborations are generally focused on one or more specific product fields, such as non-alcoholic beverages, confectionary products or frozen foods. We currently have collaborative agreements with Ajinomoto, Firmenich, Nestlé and PepsiCo.

All of our current collaboration agreements provide for royalty payments in the event the collaborator commercializes a product incorporating our flavor ingredients. The specific type of royalty and method for calculating royalty payments varies by agreement and many factors may affect the potential royalty payments under our agreements. In addition, royalty rates under some of our agreements may vary from period to period. Accordingly, any estimates of future royalties are uncertain and difficult to predict. As described above, we generally describe our collaborative agreements as retail-based agreements or ingredient supply-based agreements. Under our retail-based royalty agreements, any potential royalty payable to us is calculated as a percentage of the net sales price of a manufacturer’s finished products or is based on the volume of a manufacturer’s finished product that it sells. Our retail-based royalty agreements provide for an effective royalty of up to 4%. Our agreements with Ajinomoto, our coffee and coffee whitener agreement with Nestlé and our agreement with PepsiCo are either exclusively or partially retail-based royalty agreements. Under our ingredient supply-based agreements, any potential royalty payable to us is calculated as a percentage of the sales price of either the Senomyx flavor ingredient itself or the flavor system in which the Senomyx flavor ingredient is contained or is based on the volume of the flavor ingredient itself used by a manufacturer in a finished product. Our ingredient supply royalty agreements specify royalty rates that are typically greater than the rates specified by our retail-based agreements. Our agreement with Ajinomoto, our agreements with Firmenich, our 2002 agreement with Nestlé and our agreement with PepsiCo are either exclusively or partially ingredient supply-based royalty agreements.

Most of our current collaboration agreements provide for research and development funding, milestone payments upon achievement of pre-defined research or development targets and cost reimbursement. Certain of our current collaboration agreements also provide for upfront fees and minimum periodic royalties. The research and development funding under each of these agreements is typically paid according to a fixed payment schedule, but may vary from period to period upon mutual agreement of the parties. Each of these collaborations provides us with a portion of the funding we require to pursue the discovery and development of flavor ingredients for the applicable program. Under each of these agreements, we are primarily responsible for the discovery and development phases and any associated expenses, while our collaborator is primarily responsible for selecting the products that may incorporate our flavor ingredients. Our collaborator is also responsible for manufacturing, marketing, selling and distributing any of these products, and any associated expenses. Under most of our agreements, we are primarily responsible for the regulatory approval phase and a portion of the associated expenses.

We believe our collaborations will allow us to benefit from our collaborators’ well-established brand recognition, global market presence, established sales and distribution channels and other industry-specific expertise. Each of our collaborations is governed by a joint steering committee, consisting of an equal number of representatives of the collaborator and us. The steering committees provide strategic direction and establish performance criteria for the research, development and commercialization of our flavor ingredients. In most instances, decisions of the steering committees must be unanimous.

Our collaborative agreements provide that we will conduct research and development on flavor ingredients for use within clearly defined packaged food, beverage and ingredient product fields on an exclusive or co-exclusive basis for the collaborator during the collaborative period specified in each of the agreements. Our current product discovery and development collaborators are not prohibited from entering into research and development collaboration agreements with third parties in any product field. Under the terms of each agreement, we will retain rights to flavor ingredients that we discover during the collaboration for use with the collaborator, or for our use or with other collaborators outside of the defined product field. We will also generally retain rights to any flavor ingredients that we discover after the

respective collaborative period, although in some instances we have agreed to arrangements where we would not launch competing products or collaborate with a collaborator’s competitor. In addition to the collaborative agreements, we have a commercialization and license agreement with Firmenich regarding our S2383 sucralose enhancer, which has already received GRAS status. In the case of certain of our agreements, if the collaborator terminates the agreement or fails after a reasonable time following regulatory approval or GRAS determination to incorporate one or more of our flavor ingredients into a product, it will no longer be entitled to use, and we will have the right to license the flavor ingredients to other packaged food, beverage and ingredient companies for use in any product field covered in the agreement.

Each of our agreements terminates when we are no longer entitled to royalty payments under the agreement. In addition, each agreement may be terminated earlier by mutual agreement or by either party in the event of a breach by the other party of its obligations under the agreement. Furthermore, following the collaborative research period under a given agreement, our collaborators may elect to discontinue the commercialization of one of our flavor ingredients and unilaterally terminate the agreement.

Key Collaborative Agreements

Firmenich

In July 2009, we entered into a collaboration agreement with Firmenich to work for a minimum two-year collaborative period to discover novel flavor ingredients intended to provide a sweet enhancement taste effect for sucrose, fructose, or various forms of rebaudioside. The agreement includes three consecutive options of one year each that could further extend the collaborative research funding period. Under the agreement, Firmenich agreed to pay a license fee in three installments, research and development fees, cost reimbursements and specified payments upon the achievement of milestones. In January 2010, Firmenich elected to proceed with commercial development of S6973. In conjunction with the decision, we received the final license fee installment payment in the amount of $8.0 million from Firmenich during the first quarter of 2010. In October 2010, we amended the agreement with Firmenich to include commercial development of S6973, Senomyx’s novel enhancer of sucrose, for specific beverage applications, in exchange for an incremental license fee, additional milestones and minimum annual royalties, in addition to royalties on sales of products containing S6973. In February 2011, Firmenich elected to exercise their first one-year option to extend the collaborative research funding period through July 2012. Under this agreement, in the fourth quarter of 2011, we earned a development milestone of $250,000, for which we will receive payment in 2012. Through December 31, 2011, we have received $28.0 million in license fees, research and development funding and cost reimbursements, one milestone of $250,000 and one milestone of $1.0 million. If all milestones are achieved and all extension options are exercised, and including the $29.2 million in license fees, research and development funding, milestones and cost reimbursements paid through December 31, 2011, we may be entitled to up to $47.7 million. There is no guarantee that we will receive any further milestone payments under this collaboration. We are entitled to receive royalties on future net sales of products containing a discovered flavor ingredient from the date of introduction of each product in each country until the expiration of relevant patents. Any future royalties under this collaboration are uncertain and difficult to predict.

Nestlé SA

In October 2004, we entered into a collaborative agreement with Nestlé focused on the discovery and commercialization of specified novel flavor ingredients in the coffee and coffee whiteners field. Under the terms of the agreement, Nestlé paid certain research and development funding through July 2010. Under this agreement, through December 31, 2011, we have received $10.7 million in research and development funding, one milestone of $225,000, one milestone of $350,000 and two milestones of $500,000 each. In the event of commercialization, we are entitled to receive royalties on future net sales of products containing a discovered flavor ingredient from the date of introduction of each product in each country until the expiration of relevant patents. We cannot assure you that we will receive any royalties under this collaboration.

PepsiCo

In August 2010, we entered into a collaboration agreement with PepsiCo. The agreement relates to a four-year research program to discover and develop (1) novel natural and artificial flavor ingredients intended to provide a sweet enhancement taste effect for sucrose and fructose, including high fructose corn syrup, and (2) natural high intensity sweeteners, in each case for use in non-alcoholic beverage product categories on a worldwide basis. Under the agreement, we received an upfront payment of $30.0 million from PepsiCo, $7.5 million of which was paid in the second quarter of 2010 in connection with the signing of a letter agreement between the parties and $22.5 million of which was paid in the third quarter of 2010. We are entitled to $32.0 million in committed research and development payments, payable in equal quarterly installments over the four-year research period. We are also entitled to milestone payments and reimbursement of certain out-of-pocket expenses. Upon commercialization, we are entitled to minimum annual royalties and royalty payments on products that incorporate selected flavor ingredients and/or natural high intensity sweeteners. Royalties on products sold by PepsiCo or its affiliates that incorporate a selected sweetness enhancer will be equal to a base amount plus a portion of the cost savings, if any, derived from the use of the flavor ingredient in the applicable product. Royalties on products sold by PepsiCo or its affiliates that incorporate a selected natural high intensity sweetener will be equal to a portion of the cost of the sweetener. PepsiCo has the option to extend one or more of the research programs for two additional years, which would result in additional research funding commitments and payments during the extension of the research program. PepsiCo has the unilateral right to terminate the agreement in the event that a direct competitor of PepsiCo acquires more than 30% of our outstanding voting securities.

With respect to the sweetness enhancers and natural high intensity sweeteners that PepsiCo selects for commercial development, generally PepsiCo will have (i) exclusive rights to use the selected enhancer or natural high intensity sweetener, as the case may be, for all forms of non-alcoholic beverages other than powdered beverages for so long as PepsiCo continues to pay the applicable minimum annual royalty, and (ii) co-exclusive rights to use the selected enhancer or natural high intensity sweetener, as the case may be, for all powdered non-alcoholic beverages. However, PepsiCo has agreed to sublicense its rights to any sweetness enhancers that they select for development to one or more third party ingredient suppliers that will be authorized to supply the sweetness enhancer, either alone or in combination with other flavors, to any third party manufacturer of non-alcoholic beverages for use in the categories of: functional beverages, including meal replacement drinks and energy drinks, coffee based drinks, milk and soy based beverages and sour-milk beverages. We will receive royalties based on a percentage of the net sales price of products that are sold by a sublicensee ingredient supplier and that incorporate a selected sweetness enhancer. PepsiCo was not granted a right to sublicense its rights to selected sweetness enhancers for use in the categories of non-alcoholic carbonated beverages, fruit drinks, teas, waters and sports drinks. Also, PepsiCo was not granted a right to sublicense its rights to natural high intensity sweeteners for use in any non-alcoholic beverages. Accordingly, we anticipate that PepsiCo will use sweetness enhancers and natural sweetness enhancers in those categories on an exclusive basis unless PepsiCo and Senomyx mutually agree to other arrangements at some time in the future.

Under this agreement, in the fourth quarter of 2011, we earned a development milestone of $750,000, for which we will receive payment in 2012.

Under this agreement, through December 31, 2011, we have received $43.5 million in upfront fees, research and development funding and cost reimbursements. If all milestones are achieved and all extension options are exercised, and including the $43.5 million in upfront fees, research and development funding and cost reimbursements, we may be entitled to up to $95.4 million. There is no guarantee that we will receive any additional milestone payments or royalties under this collaboration. In the event of commercialization, we are entitled to receive royalties on future net sales of products containing a discovered flavor ingredient from the date of introduction of each product in each country until the expiration of relevant patents. We cannot assure you that we will receive any royalties under this collaboration.

Other Collaborative Agreements

Ajinomoto

In March 2006, we entered into a collaborative research, development, commercialization and license agreement with Ajinomoto for the discovery and commercialization of novel flavor ingredients on an exclusive basis in the soup, sauce and culinary aids, and noodle product categories, and on a co-exclusive basis in the bouillon product category within Japan and other Asian markets. Under the terms of the initial collaboration, Ajinomoto agreed to pay us an upfront license fee and research and development funding for up to three years. In addition, we are eligible to receive milestone payments upon achievement of specific product discovery and development goals and reimbursement for certain patent costs. In April 2007, we amended the agreement to expand Ajinomoto’s rights into North America. Under the terms of the April amendment, Ajinomoto agreed to pay us an upfront license fee and we are eligible to receive an additional milestone payment upon achievement of a specific goal. In August 2007, we further amended the agreement to expand Ajinomoto’s rights into additional product categories and geographies that were not previously licensed by us. Under the terms of the August amendment, Ajinomoto agreed to pay us an upfront license fee. We received research and development funding through March 2010. In addition, we have received milestone payments, cost reimbursements and minimum periodic royalty payments from Ajinomoto.

Firmenich (Cool)

In December 2007, we entered into a collaboration agreement with Firmenich to work for a three-year collaborative period to discover and develop novel flavors that may be used by Firmenich on an exclusive basis worldwide as ingredients that impart a cool taste in flavor systems. In November 2010, we amended the agreement to extend the collaborative period until December 2012. Under the agreement, Firmenich has agreed to pay research fees and specified payments upon the achievement of milestones. Upon commercialization, we will be entitled to royalties. In addition, in the event of regulatory approval of a discovered compound, we are entitled to minimum periodic royalties and in the event of commercialization, we are entitled to receive royalties on future sales of products containing a discovered flavor or flavor enhancer until the expiration of relevant patents. We cannot assure you that we will agree with Firmenich to extend the collaborative period under this agreement beyond December 2012 or that we will receive any future milestone payments or royalties under this collaboration.

Firmenich (Sucralose)

In November 2008, we entered into a second collaboration agreement with Firmenich for S2383, our novel enhancer of the high-intensity sweetener sucralose. Under the agreement, Firmenich has agreed to pay to us royalty payments based on sales of S2383 when it is sold on either a stand-alone basis or within a flavor system. We have received royalty payments under this collaboration.

Nestlé SA

In April 2002, we entered into an initial collaboration agreement with Nestlé to discover specified flavor ingredients in the food and beverage product fields of dehydrated and culinary food, frozen food and wet soup. In April 2005, we amended the agreement to provide for an extension of the collaborative research phase. In March 2006, we further amended the agreement to include commercialization of novel flavor ingredients in the pet food category on a worldwide, co-exclusive basis. In addition to the expansion, under the amendment we reacquired rights to certain of our flavor ingredients in certain geographic regions. As a result of this amendment, Nestlé now has rights to flavor ingredients in Europe, Asia, Israel, Oceania, Africa, the Middle East and Latin America in specified product categories within the dehydrated and culinary food, frozen food, and/or wet soup product categories, as well as worldwide rights for the pet food category. In April 2008, we further amended the agreement to extend the collaborative period through April 2010. In September 2008, we further amended the agreement to provide for a specified escalating payment arrangement in lieu of a sales-based royalty for a limited period of time. In July 2010, we again amended the agreement to provide for an alternative methodology for calculating payments to us in lieu of a sales-based royalty.

Under this alternative methodology, Nestlé has agreed to pay us a pre-determined dollar amount, referred to as the Base Payment Amount, for Nestlé’s use of up to a specified volume (represented in kilograms) of S336, our savory flavor ingredient, over a calendar year, referred to as the Base Use Level. The Base Payment Amount will escalate over time beginning in 2013 and each year thereafter, but the Base Use Level will remain fixed for the duration of the Collaboration Agreement. If during any calendar year Nestlé uses quantities of S336 in excess of the specified Base Use Level, Senomyx will receive incremental payments based on the volume (in kilograms) of S336 that are used in excess of the Base Use Level. The amount that Senomyx will receive per kilogram of incremental usage of S336 above the Base Use Level has been fixed through the end of 2013, but will increase automatically on an annual basis beginning in 2014 and each year thereafter based on an agreed formula. This amendment, among other things, also grants Nestlé with additional non-exclusive rights to commercialize certain retail products containing S336 in additional countries in Asia.

We received research and development funding through April 2010. In addition, we have received milestone payments, cost reimbursements, royalty payments and minimum periodic royalty payments from Nestlé.

Our Technology

We have discovered or in-licensed many of the key receptors that mediate taste in mammals. Having isolated taste receptors, we have created proprietary taste receptor-based assay systems that provide a biochemical or electronic readout when a test compound affects the receptor. To enable faster compound discovery, we integrated our proprietary taste receptor-based screening assays into a robot-controlled automated system that uses plates containing an array of individual wells, each of which can screen a different compound. Our receptor-based discovery and development process has enabled us to improve our ability to find novel flavor ingredients over the traditional use of simple taste tests.

Receptor Discovery and Assay Development Technology

There are currently five recognized primary senses of taste: umami (which is the savory taste of glutamate), sweet, salt, bitter and sour. In addition, there are secondary taste sensations such as cool, hot and fat. Scientists generally believe that each of these taste sensations is recognized by a distinct taste receptor or family of taste receptors in the mouth or on the tongue. A taste receptor functions either by physically binding to a tastant in a process analogous to the way a key fits into a lock or by acting as a channel to allow ions to flow directly into a taste cell. The brain recognizes tastes by determining which of the numerous receptors in the mouth have been contacted by a given tastant. Savory, sweet and bitter flavor ingredients bind to taste receptors specific to each taste on the surface of taste bud cells. In contrast, the taste of salt and the sour taste are thought to be recognized by taste channels that allow the passage of particular ions into the taste bud cells. The tastes of cooling and heating are mediated by receptors found in certain nerves.

The current status in the development of proprietary taste receptor-based assay systems for taste receptors is as follows:

· Savory Receptor. Glutamate is a natural component of foods, including tomatoes, mushrooms, parmesan cheese, and meats. It is often added to foods in the form of MSG to provide a savory flavor. The savory receptor is composed of two proteins called hT1R1 and hT1R3. The T1R proteins are members of the G protein-coupled receptor, or GPCR, family and are expressed on the surface of certain taste bud cells. We created a proprietary high-throughput savory taste receptor-based assay system and demonstrated that it responded to MSG and inosine monophosphate, or IMP. Using this technology, we identified a number of savory flavor ingredients, including S807, S336, S263, S976, S9229 and S5456, which were determined to be GRAS.

· Sweet Receptor. The sweet receptor is composed of two proteins called hT1R2 and hT1R3. The hT1R3 protein is shared in common with the savory receptor. Like the savory receptor, the sweet receptor is also a member of the GPCR family and is expressed on the surface of certain taste bud cells. We created a proprietary high-throughput sweet taste receptor-based assay system and demonstrated that it responded to many different sweet-tasting compounds including carbohydrate sweeteners and artificial sweeteners. Our sucralose enhancer, S2383, was determined to be GRAS in November 2008. Our sucrose enhancer, S6973, was determined to be GRAS in October 2009. We have an ongoing research program to identify additional enhancers of sucrose, fructose and other sweeteners. In addition, we also have efforts in progress to discover natural high intensity sweeteners.

· Bitter Receptors. There are 25 bitter receptors in humans. These are also members of the GPCR protein family. Work from model systems showed that the 25 bitter receptors are likely present together in the same taste cell. The bitter receptors are believed to have evolved as a defense mechanism to warn of and prevent the ingestion of poisonous substances. It is thought that each bitter receptor recognizes a different set of bitter-tasting compounds. During 2008 we identified S6821 and other bitter blockers that met the criteria for reducing the bitterness of several variations of one collaborator’s product, as well as additional product prototypes. During 2010, we received GRAS regulatory determination for S6821 and S7958.

· Cool Receptor. The protein TRPM8 is an ion channel that is activated by both cool temperature and cooling agents such as menthol and WS-3. We developed a high-throughput screening assay using the TRPM8 protein, and we validated the assay using a set of known cooling agents. We have identified cooling agents from more than ten different chemical classes that have demonstrated a taste proof-of-concept. Senomyx has identified several sample classes of new cooling agents that demonstrate a taste proof-of-concept and display preferred cooling properties. S5031, a compound discovered by Senomyx, is new cooling agent that has a ten-times greater potency in taste tests and other advantageous cooling properties compared to commonly used agents.

· Salt Receptor. The primary receptor or receptors responsible for salt taste perception in humans have not been definitively identified in the scientific literature. Current activities include targeted analytical approaches to discover specific proteins that could be viable candidates for the receptors or co-factors responsible for salt taste. The Company has assembled a proprietary database of proteins found in taste buds and progress is being made exploring the role of a number of these proteins that may be involved in salt taste perception. Senomyx recently identified a blocker of salt taste that could potentially be used as a tool to help discover the proteins involved with salt taste perception.

Screening Technologies and Compound Libraries

We have developed or acquired access to expansive libraries of potential flavor ingredients currently comprised of over one million natural and artificial compounds. We intend to continue to acquire or develop additional compounds and natural samples to add to our libraries. We have designed and selected our libraries to comprise compounds that we believe are likely to lead to safe and economical for use in packaged food and beverage products. We are using our assay systems to screen the compounds in our libraries for their effects on specific taste receptors. These systems use many of the same technologies that pharmaceutical companies use to discover medicines. Our assay systems are much more sensitive than the human tongue, and can therefore be used to discover novel flavor ingredients that could not be identified using taste tests. We also use these systems to assist us in optimizing our lead compounds by rapidly and iteratively testing the potency of the potential flavor ingredients generated in the optimization process as the lead compound progresses to become a product candidate.

Regulatory Process

Flavoring substances, including flavor ingredients intended for use in foods and beverages in the United States, are regulated under provisions of the FD&C Act administered by the FDA. Flavor ingredients sold in countries and regions outside of the United States are also subject to regulations imposed by national governments or regional regulatory authorities, as is the case in the European Union. These regulations are subject to frequent revisions and interpretation.

Regulation of Flavor Ingredients in the United States

In the United States, flavor ingredients are regulated by the FDA as approved food additives, or as GRAS ingredients under the FD&C Act. The Food Additive Amendments of 1958 prompted the flavor industry to establish in 1960 the FEMA Expert Panel. FEMA has administered the GRAS program for flavors on behalf of the industry for over 50 years. Several countries outside of the United States, including Canada, Brazil, Argentina and the Philippines, allow flavor use in food based on FEMA GRAS recognition. Several other countries either add new FEMA GRAS compounds to their positive lists of approved flavoring agents or add the new FEMA GRAS lists to their flavor regulations by specific reference. Other possible routes to approval of a flavor-modifying compound are a GRAS self-determination (independent of FEMA) with or without FDA notification, or a food additive petition to the FDA. Our goal is that the flavor ingredients we may discover will be subject to one of the regulatory review processes described below.

GRAS Review Process. Flavor ingredients that qualify for the GRAS review process are generally intended to be consumed in small quantities and have data supporting their safety under conditions of intended use. An Expert Panel, convened to undertake a GRAS review, determines whether an ingredient is generally recognized as safe under the conditions of its intended use. These experts are qualified by scientific training and experience to evaluate the safety of certain new ingredients used in food and may declare them as having been adequately shown through scientific procedures to be generally recognized as safe under the conditions of their intended use. Under the GRAS process, manufacturers are required to obtain safety data from the scientific literature or through the conduct of safety studies, determine the estimated daily intake of the flavor ingredient per person and submit a report to the GRAS review panel describing the physical, chemical, safety, and metabolic properties of the flavor ingredient. The entire GRAS determination process, including the safety and metabolic studies, application preparation and GRAS panel review, can take up to two years or longer. However, if there are prior safety data on the ingredient or an ingredient with a related structure, then fewer safety studies may be required for the GRAS review and the GRAS review process can be considerably shorter than two years.

The most common types of GRAS review are:

· FEMA Expert Panel. The FEMA Expert Panel is an independent panel of experts for which FEMA provides administrative assistance. The FEMA Expert Panel, which may be used by FEMA members and certain other parties, meets up to three times per year. The conclusions of the Expert Panel regarding a flavor ingredient are provided directly to the FDA and published in the journal Food Technology. To our knowledge, the FDA has not challenged the FEMA Expert Panel’s conclusion that the use of a flavoring substance is GRAS. Ten of our flavor ingredients have been determined to be GRAS by the FEMA Expert Panel.

· Specifically Convened Independent Panel. An independent, qualified panel of experts in pertinent scientific disciplines may be formed by the manufacturer to evaluate the safety of a specific compound for GRAS status. This process is known as a “self determination of GRAS status.” The basis for the GRAS self determination is not required to be submitted to the FDA. However, the FDA may request information on ingredients that have been self determined to be GRAS, or the information may be provided voluntarily.

Regulation of Flavor Ingredients outside of the United States. Outside of the United States, flavor approvals vary by country. There is, however, some commonality in approach in many countries. As explained above, several countries either accept FEMA GRAS recognition as the basis for approval or

GRAS recognition facilitates country approval. Many countries, particularly developing countries in Latin America and Africa, accept favorable review by the WHO/FAO Joint Expert Committee on Food Additives, or JECFA, as the basis for approval or to facilitate approval. FEMA automatically submits new GRAS ingredients to the Codex Alimentarius through the FDA for JECFA review. Most other countries have their own unique approval processes. The European Union, or EU, has established EU-wide regulations for flavor ingredient use based on safety evaluations by the European Food Safety Authority, or EFSA, and risk management (i.e. regulation development) by the Directorate General for Health. A number of countries in eastern Europe or in Africa accept EU approval as the basis for approved use. China, Japan and Russia also have independent regulatory review processes for flavors.