Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST COMMUNITY BANKSHARES INC /VA/ | v304472_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - FIRST COMMUNITY BANKSHARES INC /VA/ | v304472_ex2-1.htm |

| EX-99.2 - EXHIBIT 99.2 - FIRST COMMUNITY BANKSHARES INC /VA/ | v304472_ex99-2.htm |

Merger of First Community Bancshares, Inc. and Peoples Bank of Virginia March 1, 2012 www.fcbinc.com

Forward - Looking Disclosures This presentation may include forward - looking statements. These forward - looking statements include, but are not limited to, statement s about (i) the benefits of a merger (the “Merger”) among First Community Bancshares, Inc. (“First Community”), First Community Bank and Peoples Bank of Virginia (“Peoples”), including future financial and operating results, cost savings enhancements to re venue and accretion to reported earnings that may be realized from the Merger; (ii) First Community’s and Peoples’ plans, objective s, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) othe r s tatements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “proje cts ,” or words of similar meaning generally intended to identify forward - looking statements. These forward - looking statements are based upon th e current beliefs and expectations of the respective managements of First Community and Peoples and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of First Community and Peoples. In addition, these forward - looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discu sse d in these forward - looking statements because of possible uncertainties. These forward - looking statements are based on current expectations that involve risks, uncertainties and assumptions. Should on e or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results may differ mat erially. These risks include: changes in business or other market conditions; the timely development, production and acceptance of ne w products and services; the challenge of managing asset/liability levels; the management of credit risk and interest rate risk ; t he difficulty of keeping expense growth at modest levels while increasing revenues; and other risks detailed from time to time in the Compa ny’ s Securities and Exchange Commission reports, including but not limited to the Annual Report on Form 10 - K for the most recent year ended and the Company’s filing on Form 8 - K relating to the Merger. Pursuant to the Private Securities Litigation Reform Act of 1995, the Company does not undertake to update forward - looking statements contained within this presentation. 2

Transaction Rationale □ In market acquisition consistent with FCBC’s Merger & Acquisition strategy □ Creates 10 th largest Virginia based bank by deposits in the Richmond market □ Strong cultural fit 3 Strategic Rationale Financially Attractive Low Risk Profile □ Exceeds Merger & Acquisition performance targets □ Immediately accretive to EPS □ Minimal tangible book value dilution with earnback period of 3 – 4 years □ Significant expense synergies □ Post - closing consolidated capital and liquidity ratios remain strong □ Comprehensive due diligence completed including rigorous review of loan and OREO portfolios □ Conservative credit mark

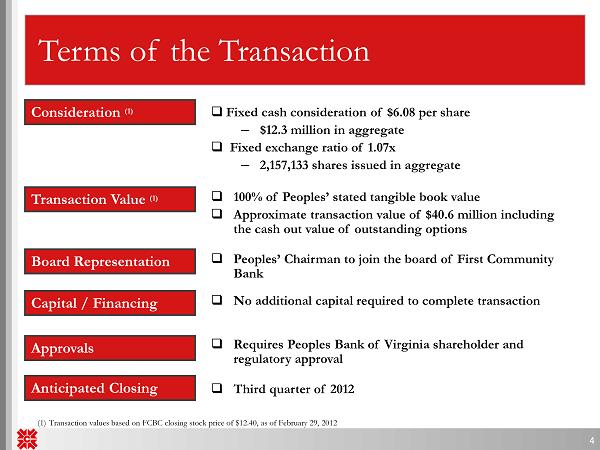

Terms of the Transaction 4 Transaction Value (1) Consideration (1) Board Representation □ 100% of Peoples’ stated tangible book value □ Approximate transaction value of $ 40.6 million including the cash out value of outstanding options □ Fixed cash consideration of $6.08 per share ─ $12.3 million in aggregate □ Fixed exchange ratio of 1.07x ─ 2,157,133 shares issued in aggregate (1) Transaction values based on FCBC closing stock price of $ 12.40, as of February 29, 2012 Approvals Anticipated Closing □ Requires Peoples Bank of Virginia shareholder and regulatory approval □ Third quarter of 2012 □ Peoples’ Chairman to join the board of First Community Bank Capital / Financing □ No additional capital required to complete transaction

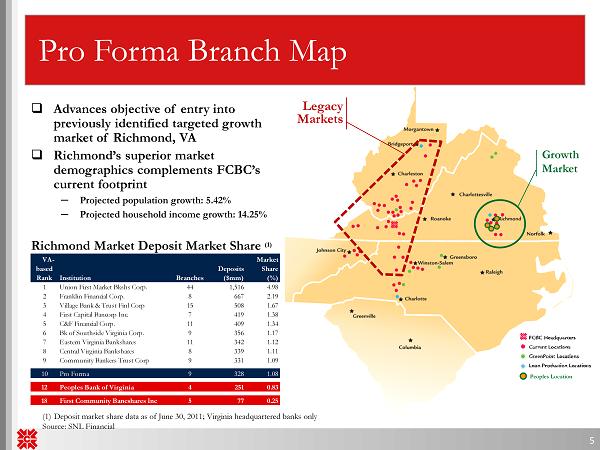

Pro Forma Branch Map Legacy Markets 5 Growth Market Peoples Location VA- based Rank Institution Branches Deposits ($mm) Market Share (%) 1 Union First Market Bkshs Corp. 44 1,516 4.98 2 Franklin Financial Corp. 8 667 2.19 3 Village Bank & Trust Finl Corp 15 508 1.67 4 First Capital Bancorp Inc. 7 419 1.38 5 C&F Financial Corp. 11 409 1.34 6 Bk of Southside Virginia Corp. 9 356 1.17 7 Eastern Virginia Bankshares 11 342 1.12 8 Central Virginia Bankshares 8 339 1.11 9 Community Bankers Trust Corp 9 331 1.09 10 Pro Forma 9 328 1.08 12 Peoples Bank of Virginia 4 251 0.83 18 First Community Bancshares Inc 5 77 0.25 Richmond Market Deposit Market Share (1) (1) Deposit market share data as of June 30, 2011; Virginia headquartered banks only Source: SNL Financial □ Advances objective of entry into previously identified targeted growth market of Richmond, VA □ Richmond’s superior market demographics complements FCBC’s current footprint ─ Projected population growth: 5.42% ─ Projected household income growth: 14.25%

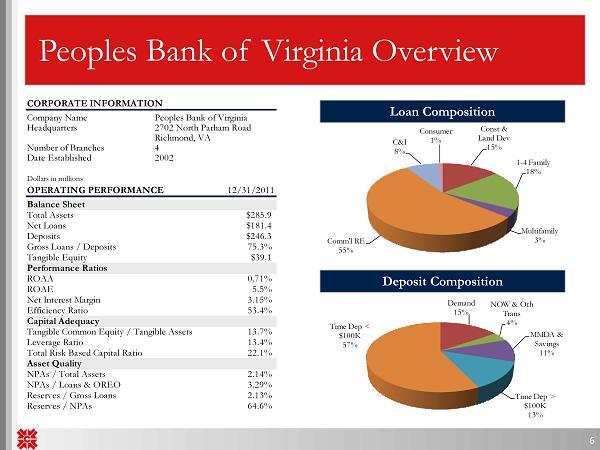

Peoples Bank of Virginia Overview 6 CORPORATE INFORMATION Company Name Peoples Bank of Virginia Headquarters 2702 North Parham Road Richmond, VA Number of Branches 4 Date Established 2002 Dollars in millions OPERATING PERFORMANCE 12/31/2011 Balance Sheet Total Assets $285.9 Net Loans $181.4 Deposits $246.3 Gross Loans / Deposits 75.3% Tangible Equity $39.1 Performance Ratios ROAA 0.71% ROAE 5.5% Net Interest Margin 3.15% Efficiency Ratio 53.4% Capital Adequacy Tangible Common Equity / Tangible Assets 13.7% Leverage Ratio 13.4% Total Risk Based Capital Ratio 22.1% Asset Quality NPAs / Total Assets 2.14% NPAs / Loans & OREO 3.29% Reserves / Gross Loans 2.13% Reserves / NPAs 64.6% Demand 15% NOW & Oth Trans 4% MMDA & Savings 11% Time Dep > $100K 13% Time Dep < $100K 57% Const & Land Dev 15% 1 - 4 Family 18% Multifamily 3% Comm'l RE 55% C&I 8% Consumer 1% Loan Composition Deposit Composition

Benefits to Peoples Bank of Virginia Shareholders 7 Shareholders Customers Employees □ Investment in FCBC stock provides opportunity for long term shareholder return □ Annual dividend of approximately $862,853 (1) ─ FCBC recently announced the 26th consecutive year of cash dividends to stockholders □ Liquidity in FCBC stock (1) Based on issuance of 2,157,133 shares of common stock □ Enhanced products and services □ Convenience of expanded branch network across West Virginia, Virginia, North Carolina, and Tennessee □ Stability in retention of senior management □ Cultural similarities with commitment to superior client service □ Geographic reach offers employees greater opportunity for growth and enrichment

Financial Impact of the Transaction 8 Transaction Assumptions Financial Impact Pro forma Capital Ratios □ Tier 1 Leverage Ratio of approximately 11.2% □ Total Risk - based Capital Ratio of approximately 17.3% □ Tangible Common Equity / Tangible Assets of approximately 9.4% □ EPS accretive in the first full year of combined operations □ Limited tangible book value dilution at closing □ Ability to leverage insurance business line and other product offerings increasing non - interest income □ Gross credit mark on total loans and OREO of $17.5 million or 9.4% ─ Reviewed 59% of total loans, 64% of non - performing loans, and 70% of land and ADC loans □ One - time merger expenses of approximately $5.2 million (before tax ) □ CDI of approximately 1%, amortized sum of the years digits over 7 years □ Cost savings of approximately 40% □ Anticipated closing third quarter 2012

Summary 9 □ Transaction drives EPS growth and shareholder value for both FCBC and Peoples shareholders □ Manageable transaction size and strong pro forma capital ratios allow for future opportunities □ M&A pipeline and organic growth opportunities in targeted growth markets remain attractive □ Low risk structure □ Comprehensive due diligence □ Strong cultural fit □ Additional product capabilities

Contact Information First Community Bancshares, Inc. NASDAQ: FCBC One Community Place Bluefield, VA 24605 For More Information Contact: David D. Brown Chief Financial Officer First Community Bancshares, Inc. (276) 326 - 9000 10