Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Arlington Asset Investment Corp. | v304481_8k.htm |

Investor Presentation March 1, 2012

1 Information Related to Forward - Looking Statements This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 19 95. These include statements regarding future results or expectations. Forward - looking statements can be identified by forward - look ing language, including words such as “believes,” “anticipates,” “views”, “expects,” “estimates,” “intends,” “may,” “plans,” “pro jec ts,” “potential,” “prospective,” “will” and similar expressions, or the negative of these words. Such forward - looking statements are based on facts and conditions as they exist at the time such statements are made. Forward - looking statements are also based on predictio ns as to future facts and conditions, the accurate prediction of which may be difficult and involve the assessment of events beyond ou r c ontrol. Forward - looking statements are further based on various operating and return assumptions. Caution must be exercised in relying o n forward - looking statements. Due to known and unknown risks, actual results may differ materially from expectations or projectio ns. You should carefully consider these risks when you make a decision concerning an investment in our common stock, along with the following factors, among others, that may cause our actual results to differ materially from those described in any forward - look ing statements: availability of, and our ability to deploy, capital; our ability to grow our business through a strategy focused on acquiring primarily private - label MBS and agency - backed MBS; yields on MBS; our ability to successfully implement our hedging strategy ; our ability to realize reflation on our assets; our ability to effectively migrate private - label MBS to agency - backed MBS; the credit performance of our private - label MBS; our ability to realize a higher return on capital reallocated to agency - backed MBS; current conditions and further adverse developments in the residential mortgage market and the overall economy; growth in the U.S. GDP; job growth; home price stabilization; private securitization activity; potential risk attributable to our mortgage - related portfolios; impacts of regulatory changes, including actions taken by the SEC, the U.S. Federal Reserve and the U.S. Treasury and changes affecting Fannie Mae and Freddie Mac; failure of sovereign or municipal entities to meet their debt obligations or a downgrade in the credit rating of such obligations; availability of opportunities that meet or exceed our risk - adjusted return expectations; overall interest rate environment and changes in interest rates, interest rate spreads, the yield curve and prepayment rates; changes in anticipated earnings and returns; the amount and growth in our cash earnings and distributable income; growth in our book value per share; our ability to maintain adequate liquidity; our use of leverage and dependence on repurchase agreements and other short - term borrowings to finance our mortgage - r elated holdings; the loss of our exclusion from the definition of “investment company” under the Investment Company Act of 1940; our ab ility to forecast our tax attributes and protect and use our net operating loss carry - forwards and net capital loss carry - forwards to offset future taxable income and gains; changes in our strategies, asset allocation and operational policies; our ability and willingness t o m ake future dividends; available technologies; failure in our operations or structure; competition for investment opportunities and quali fie d personnel; our ability to retain key personnel; effects of regulatory proceedings, litigation and contractual claims against us and our officers and directors; changes in, and our ability to remain in compliance with, law, regulations or governmental policies affecting our bus iness; risk from strategic ventures or entry into new business areas; failure to maintain effective internal controls; and the factors de scr ibed in the sections entitled “Risk Factors” in our annual report on Form 10 - K for the year ended December 31, 2011 and our other public filings with the SEC. You should not place undue reliance on these forward - looking statements, which apply only as of the date of this presentation. We undertake no obligation to update or revise any forward - looking statement, whether written or oral, relating t o matters discussed in this presentation, except as may be required by applicable securities laws.

2 Hybrid character provides attractive profitability and balanced exposure to different economic environments - Agency MBS portfolio (1) – $637 million market value, $ 82 million (2) allocated capital, 30 - year fixed rate portfolio High percentage prepayment protected, 6% CPR, 4.25% yield at cost (3) , 3.65% yield (3) at market value and 1.38% market hedge cost - Private - label MBS portfolio (1) – $180 million market value; $145 million (3) allocated capital 14.6% unlevered yield based on market value, 18.8% on cost Stable credit performance consistent with current US GDP and job growth Returns enhanced by $670 million of potential tax benefits; Arlington pays 2% cash tax rate - 4Q 2011 Core Operating EPS of $1.11; $5.99 for FY 2011 - 4Q 2011 ROE from Core Operating Income of 18.7%; 22.7% for FY 2011 Tax - advantaged dividends and attractive investment opportunity - 15% annualized dividend yield based on $3.50 per share annualized 4Q 2011 dividend rate (4),(5) - 20% adjusted annualized yield assuming a 15% individual Federal income tax rate on C - Corp dividends (6) - 98% price to tangible book value per share (4),(7) Potential for growth in cash earnings and distributable income from migration of appreciated capital to agency MBS from private - label MBS portfolio - Agency MBS opportunity: approximately 20% current cash return - Private - label MBS: approximately 8 - 13% current cash yield with potential appreciation ( 1 ) As of 12 / 31 / 11 . (2) Agency MBS allocated capital is composed of MBS and its related interest receivable, repo, its related interest and derivativ e instruments, and its related deposits and cash. Private - label MBS allocated capital is composed of MBS and repo and its related interest. ( 3 ) Economic yield assumes premium amortization . ( 4 ) Based on closing class A common stock price of $ 23 . 12 on 2 / 29 / 12 . (5) The annual dividend rate presented is calculated by annualizing the 4th quarter of 2011 dividend payment of $0.875. The Com pany maintains a variable dividend policy and the Board of Directors, in its sole discretion, approves the payment of dividends. Actual dividends in t he future may differ materially from historical practice and from the annualized dividend rate presented. (6) The Company's dividends are eligible for the 15% federal income rate on qualified dividend income, whereas dividends paid by a REIT are generally subject to tax at ordinary income rates (currently at a maximum federal rate of 35%). To provide the same after - tax return to a shareholder eligible for the 15% rate on qualified dividend income and otherwise subject to the maximum rate on ordinary income, a REIT would be required to pay dividends providing a 20% yield. (7) Based on book value per share of $23.67 at 12/31/11. Attractive Tax Advantaged Returns Plus Potential Growth AI: Focus on residential mortgage - backed securities, $1 billion in assets, internally managed C - Corp structure, NYSE listed

3 Consistent Spread Income Drives Core Operating EPS and Dividends (1) Graph dividend yields are based on closing class A common stock prices at the end of each quarter.

4 Portfolio Composition – Capital Allocation (1) (1) As of 12/31/11. (2) Agency MBS allocated capital is composed of MBS and its related interest receivable, repo, its related interest and derivative instruments, and its related deposits and cash. Private - label MBS allocated capital is composed of MBS and repo and its related interest. Agency MBS Private-label MBS Cash $20 - MBS, at amortized cost $609 $141 MBS, at fair value $637 $180 Allocated capital (2) $82 $145 Capital Allocation ($ in millions)

5 Hybrid Character – Attractive Opportunity Wide agency MBS portfolio spreads in current environment - Fed Funds expected to remain low through late 2014 - 6 - month portfolio CPR of 5.5% with 102.9 cost and 107.8 fair market value Compared to the FN 4.50% universe with a 6 - month CPR of 24.4% with a 106.5 market price (2) - High concentration in loans with prepayment protection Eurodollar futures provide hedge against increasing interest rates as economic environment shifts - 4 - year serial contracts starting at year - end 2012; $707 million average balance through year - end 2016 - Hedge period extends out five years – current market rate of 1.21% (2),(3) Private - label MBS portfolio benefits from strong credit cushion, positive supply technicals - Potential appreciation with job growth, home price stability and GDP growth (3.0% revised 4Q 2011 GDP growth) - Limited new private - label securitization - Positive technicals, Maiden Lane portfolio sale completed (1) Balances do not include 2011 year - end adjustments. (2) Source : Bloomberg. (3) As of 2/29/12. Yield Yield MBS Portfolio (Cost) (Cost) Agency-backed MBS $ 630,834 4.49% $ 640,932 4.49% Private-label MBS Senior securities 8,565 13.20% 8,604 14.44% Re-REMIC securities 133,944 17.27% 132,829 16.61% Other investments - IOs 1,121 12.84% 1,155 12.31% $ 774,464 6.81% $ 783,520 6.69% Repurchase agreements $ 646,914 (0.43)% $ 649,755 (0.33)% Net interest income/spread 6.38% 6.36% Average Balance Three Months Ended, December 31, 2011 (1) September 30, 2011 Average Balance

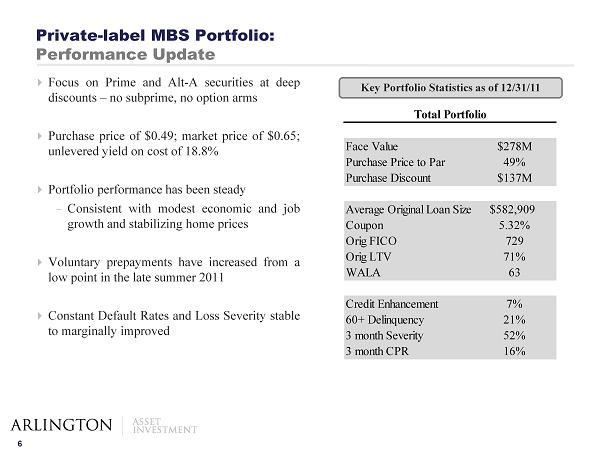

6 Focus on Prime and Alt - A securities at deep discounts – no subprime, no option arms Purchase price of $ 0 . 49 ; market price of $ 0 . 65 ; unlevered yield on cost of 18 . 8 % Portfolio performance has been steady - C onsistent with modest economic and job growth and stabilizing home prices Voluntary prepayments have increased from a low point in the late summer 2011 Constant Default Rates and Loss Severity stable to marginally improved Key Portfolio Statistics as of 12/31/11 Private - label MBS Portfolio: Performance Update Face Value $278M Purchase Price to Par 49% Purchase Discount $137M Average Original Loan Size $582,909 Coupon 5.32% Orig FICO 729 Orig LTV 71% WALA 63 Credit Enhancement 7% 60+ Delinquency 21% 3 month Severity 52% 3 month CPR 16% Total Portfolio

7 Private - label MBS Portfolio: Key Characteristics Jumbo Prime and Alt - A Loans - Higher home values and larger loan sizes (~ $590K) - More prime borrowers with greater financial flexibility - Stronger demographics, higher incomes - More desirable / stable housing markets Top 5 Largest MSA’s (1) : - Los Angeles - Long Beach - Santa Ana, CA (18.1%) - San Francisco - Oakland - Fremont, CA (9.6%) - New York - Northern New Jersey - Long Island, NY - NJ - PA (9.4%) - Washington - Arlington - Alexandria, DC - VA - MD - WV (7.2%) - San Diego - Carlsbad - San Marcos, CA (5.7%) Los Angeles MSA (1) (1) Source: Bloomberg.

8 Consistent spread income drives distributable income Returns enhanced by $670 million of tax benefits; Arlington pays 2% cash tax rate - 4Q 2011 ROE from Core Operating Income of 18.7%; 22.7% for FY 2011 Tax - advantaged dividends and attractive investment opportunity - 15% annualized dividend yield based on $3.50 per share annualized 4Q 2011 dividend rate (1),(2) - 20% adjusted yield assuming a 15% individual Federal income tax rate on C - Corp dividends (3) - 98% price to tangible book value per share (1),(4) Potential for growth in cash earnings and distributable income from migration of appreciated capital to agency MBS from private - label MBS portfolio - Agency MBS opportunity: approximately 20% current cash return - Private - label MBS: approximately 8 - 13% current cash yield with potential appreciation Potential upside to book value per share - Private - label MBS appreciation At $0.75 price = $3.81 per AI share At $0.85 price = $7.40 per AI share - $14.6 million tax reserve = $1.88 per share - $279 million of net operating loss carry - forwards = $12.60 per share after - tax ( 1 ) Based on closing class A common stock price of $ 23 . 12 on 2 / 29 / 12 . ( 2 ) The annual dividend rate presented is calculated by annualizing the 4th quarter of 2011 dividend payment of $0.875. The Co mpa ny maintains a variable dividend policy and the Board of Directors, in its sole discretion, approves the payment of dividends. Actual dividends in t he future may differ materially from historical practice and from the annualized dividend rate presented. (3) The Company's dividends are eligible for the 15% federal income rate on qualified dividend income, whereas dividends paid by a REIT are generally subject to tax at ordinary income rates (currently at a maximum federal rate of 35%). To provide the same after - tax return to a shareholder eligible for the 15% rate on qualified dividend income and otherwise subject to the maximum rate on ordinary income, a REIT would be required to pay dividends providing a 20% yield. (4) Based on book value per share of $23.67 at 12/31/11. Attractive Tax Advantaged Returns Plus Potential Growth AI: Focus on residential mortgage - backed securities, $1 billion in assets, internally managed C - Corp structure, NYSE listed

9 Exhibit A The following table presents a reconciliation of the GAAP financial results to non - GAAP measurements for the quarter and year ended December 31 , 2011 (dollars in thousands, except per share data) . ( 1) Adjusted expenses represents certain professional fees and income taxes that are not considered representative of routine activities of the Company. Quarter Ended Year Ended GAAP net income $6,941 $15,173 Adjustments Adjusted expenses (1) 752 1,825 Stock compensation 176 1,014 Net unrealized mark-to-market loss on trading MBS and interest rate hedge instruments 1,165 31,353 Other-than-temporary impairments 1,223 1,223 Adjusted interest related to purchase discount accretion (1,630) (4,218) Non-GAAP core operating income $8,627 $46,370 Non-GAAP core operating income per share (diluted) $1.11 $5.99 December 31, 2011