Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Altisource Portfolio Solutions S.A. | d308331d8k.htm |

Exhibit 99.1

| Altisource Today February 2012 |

| This presentation contains forward-looking statements. These statements may be identified by words such as "expect," "should," "could," "shall," and similar expressions. We caution that forward-looking statements are qualified to certain risks and uncertainties, that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ materially from these forward-looking statements may include, without limitation, general economic conditions, conditions in the markets in which Altisource(tm) is engaged, behavior of customers, suppliers and/or competitors, technological developments and regulatory rules. In addition, financial risks such as currency movements, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Altisource(tm) disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Forward-looking Statements |

| Altisource - Overview Altisource(tm) (NASDAQ:ASPS) is a global provider of solutions principally related to real estate and mortgage portfolio management, asset recovery and customer relationship management. William C. Erbey, Chairman William C. Erbey, Chairman William B. Shepro, Chief Executive Officer William B. Shepro, Chief Executive Officer Separated from Ocwen(r) on August 10, 2009 Separated from Ocwen(r) on August 10, 2009 Current Market Capitalization ~$1.4 billion Current Market Capitalization ~$1.4 billion ~6,400 Employees ~6,400 Employees Performance Since Separation CAGR Market Capitalization 104% CAGR Diluted Earnings Per Share 57% CAGR Service Revenue 41% |

| Key Takeaways Strong revenue growth visibility Operating margin expansion Attractive growth opportunities Strong cash generation |

| Strong Revenue Growth Visibility Long-term (8 year) service agreements with Ocwen(r) Long runway for elevated default and REO oriented service referrals Ocwen's track record of growing servicing business over an extended period of time Litton portfolio acquisition completed in September 2011 Signed definitive agreement in October 2011 to acquire Saxon/Morgan Stanley portfolio Signed definitive agreement in November 2011 to acquire a portion of Chase portfolio (CHART) 17% CAGR |

| Operating Margin Expansion Enabling operating margin improvement over full year 2011: Accelerated Service Revenue growth of Mortgage Services, relative to the other segments Reduced employee and vendor costs through deployment of next generation vendor management and business process management technologies Improved Financial Services performance Constraints to margin improvement: Development of new services (e.g., Insurance Services, Origination Services) which tend to have lower margins particularly as they scale-up Hiring employees and building infrastructure in advance of customer portfolio acquisitions (CHART) |

| Attractive Growth Opportunities Build Foundation Consistent, high-quality delivery leading to enhanced customer satisfaction Sustainable long-term growth leading to shareholder value creation People Technology Infrastructure- Support Functions Finance / Human Resources / Law / Quality Assurance / Vendor Management Metrics ? Basic Operating Principles ? Training Improve Operating Efficiency Diversify Revenue and Customer Base Service Development |

| Attractive Growth Opportunities The market verticals we operate in present significant opportunity for long-term growth. We believe success is a function of selective deployment of resources in a focused manner and execution. |

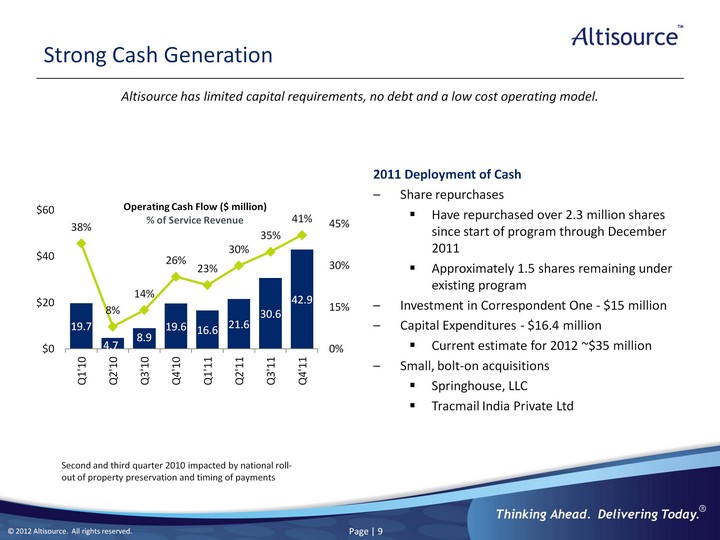

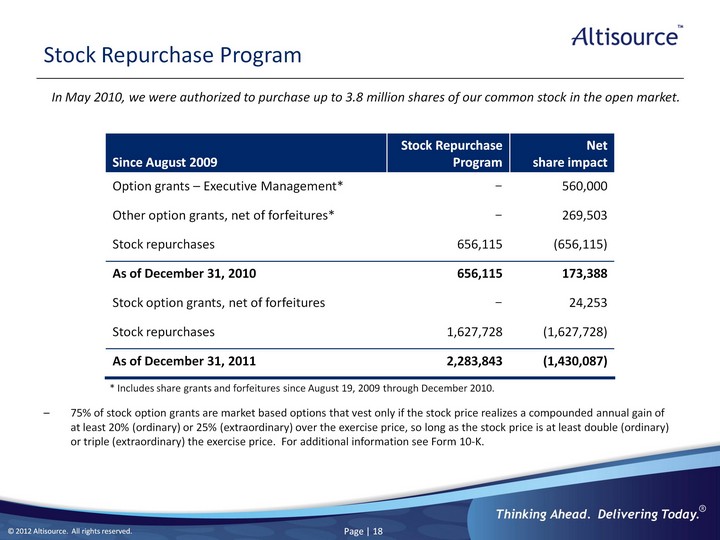

| Strong Cash Generation 2011 Deployment of Cash Share repurchases Have repurchased over 2.3 million shares since start of program through December 2011 Approximately 1.5 shares remaining under existing program Investment in Correspondent One - $15 million Capital Expenditures - $16.4 million Current estimate for 2012 ~$35 million Small, bolt-on acquisitions Springhouse, LLC Tracmail India Private Ltd Altisource has limited capital requirements, no debt and a low cost operating model. Second and third quarter 2010 impacted by national roll- out of property preservation and timing of payments (CHART) |

| Key Takeaways Strong revenue growth visibility Operating margin expansion Attractive growth opportunities Strong cash generation |

| Investor Relations Information Exchange NASDAQ Global Select Ticker ASPS Headquarters Luxembourg Employees More than 6,400 |

| Appendices What We Do (slides 13 - 15) Service Revenue per Loan (slides 16 - 17) Stock Repurchase Program (slide 18) |

| What We Do - Mortgage and Real Estate Management ORIGINATION ^Valuation ^Property Preservation and Inspection ^ Mortgage Component Services DEFAULT MANAGEMENT ^Valuation ^Property Preservation and Inspection ^Real Estate Brokerage ^Title Insurance ^Settlement Services ASSET MANAGEMENT ^Valuation ^Property Preservation and Inspection ^Title Search Services ^ Trustee Management ^ Non-legal Processing Services LOSS MITIGATION ^Valuation ^Loan Processing and Fulfillment ^Settlement Services ^Due Diligence and Forensics ^ Lenders One Services Across the Mortgage and Real Estate Life Cycle |

| What We Do - Customer Relationship & Receivable Management Altisource's subsidiary, Nationwide Credit(r), leverages a combination of behavioral sciences and a proprietary dialogue engine to help clients streamline processes, grow their customer base and improve their margins Customer Relationship Management Services Pre-Charge Off Collections Services Post-Charge Off Collections Services Transaction Delinquency Charge Off Customer Interface Account Resolution Recovery Management Capabilities: Inbound & Outbound Customer Service Calls Account Setup & Processing Billing Inquiry, Dispute Resolution & Escalation Back Office Services - Data Entry Document Verification Validation Exception Processing Quality Assurance Capabilities: First Party Solutions Third Party Solutions Automated Contact Solutions Multi-Lingual Capabilities: Third Party Solutions Primary Secondary Tertiary Optimal Resolution Modeling Pre-legal and Legal Services Bankruptcy Multi-Lingual Mortgages (deficiencies and charge-offs) Account Life Cycle |

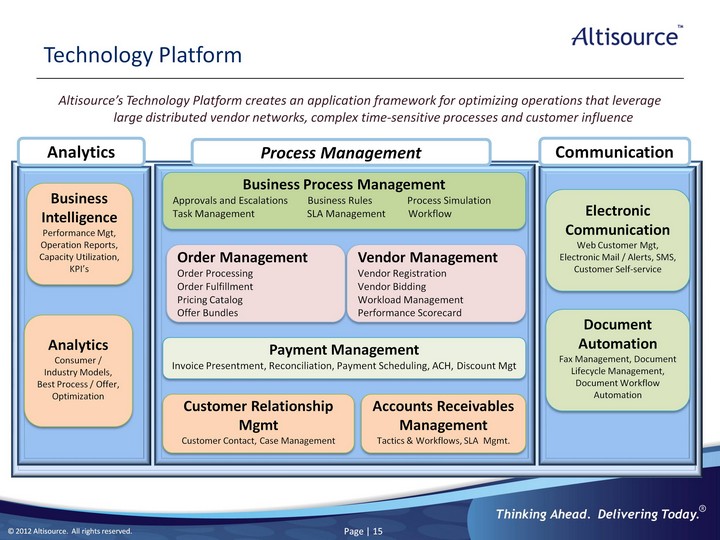

| Technology Platform Vendor Management Vendor Registration Vendor Bidding Workload Management Performance Scorecard Business Process Management Approvals and Escalations Business Rules Process Simulation Task Management SLA Management Workflow Payment Management Invoice Presentment, Reconciliation, Payment Scheduling, ACH, Discount Mgt Customer Relationship Mgmt Customer Contact, Case Management Accounts Receivables Management Tactics & Workflows, SLA Mgmt. Business Intelligence Performance Mgt, Operation Reports, Capacity Utilization, KPI's Analytics Consumer / Industry Models, Best Process / Offer, Optimization Order Management Order Processing Order Fulfillment Pricing Catalog Offer Bundles Process Management Analytics Electronic Communication Web Customer Mgt, Electronic Mail / Alerts, SMS, Customer Self-service Communication Document Automation Fax Management, Document Lifecycle Management, Document Workflow Automation Altisource's Technology Platform creates an application framework for optimizing operations that leverage large distributed vendor networks, complex time-sensitive processes and customer influence |

| Service Revenue per Loan per Quarter Notes: Service Revenue per loan is measured for the quarter Average loans serviced for Q4'11 is provisional and subject to change Revenue from Ocwen is derived through a variety of services with different revenue recognition practices. Factors that impact revenue generation include loan status (e.g., delinquency rates), mix of services delivered, type of loan (e.g., agency, non- agency), geographical coverage and timing of when loans are boarded. (CHART) |

| Service Revenue per Loan per Quarter Q1'10 Q2'10 Q3'10 Q4'10 Q1'11 Q2'11 Q3'11 Q4'11 Mortgage Services Revenue from Related Parties ($ 000s) 24,762 31,222 34,765 44,906 45,286 49,411 58,370 70,117 Less: Reimbursable Revenue Included Above 7,897 10,371 12,565 13,733 15,068 18,689 21,464 24,786 Service Revenue from Related Parties 16,865 20,851 22,200 31,173 30,217 30,723 36,906 45,331 Average Number of Loans Serviced by Ocwen 349,901 368,390 401,454 487,079 470,362 462,343 516,214 649,751 Service Revenue Per Loan Per Quarter ($) 48 57 55 64 64 66 72 70 |

| Stock Repurchase Program * Includes share grants and forfeitures since August 19, 2009 through December 2010. 75% of stock option grants are market based options that vest only if the stock price realizes a compounded annual gain of at least 20% (ordinary) or 25% (extraordinary) over the exercise price, so long as the stock price is at least double (ordinary) or triple (extraordinary) the exercise price. For additional information see Form 10-K. In May 2010, we were authorized to purchase up to 3.8 million shares of our common stock in the open market. Since August 2009 Stock Repurchase Program Net share impact Option grants - Executive Management* - 560,000 Other option grants, net of forfeitures* - 269,503 Stock repurchases 656,115 (656,115) As of December 31, 2010 656,115 173,388 Stock option grants, net of forfeitures - 24,253 Stock repurchases 1,627,728 (1,627,728) As of December 31, 2011 2,283,843 (1,430,087) |