Attached files

| file | filename |

|---|---|

| 8-K - SELECT COMFORT 8-K 2-27-2012 - Sleep Number Corp | form8k.htm |

EXHIBIT 99.1

Unleashing Profitable

Growth Formula

Growth Formula

February 2012

Statements used in this news release relating to future plans, events, financial results or

performance are forward-looking statements subject to certain risks and uncertainties

including, among others, such factors as current general and industry economic trends;

consumer confidence; the effectiveness of our marketing and sales programs, including

advertising and promotional efforts; consumer acceptance of our products, product quality and

brand image; our ability to continue to improve our product line and product quality; warranty

obligations; availability of attractive and cost-effective consumer credit options; execution of

our retail store distribution strategy; rising commodity costs and other inflationary pressures;

our dependence on significant suppliers, including several sole-source suppliers and the

vulnerability of suppliers to recessionary pressures; industry competition; risks of pending and

potentially unforeseen litigation; increasing government regulations; the adequacy of our

management information systems to meet the evolving needs of our business and evolving

regulatory standards; our ability to attract and retain key employees; and uncertainties arising

from global events, such as terrorist attacks or a pandemic outbreak, or the threat of such

events. Additional information concerning these and other risks and uncertainties is contained

in our filings with the SEC, including our Annual Report on Form 10-K, and other periodic

reports filed with the SEC. The company has no obligation to publicly update or revise any of

the forward-looking statements in this presentation.

performance are forward-looking statements subject to certain risks and uncertainties

including, among others, such factors as current general and industry economic trends;

consumer confidence; the effectiveness of our marketing and sales programs, including

advertising and promotional efforts; consumer acceptance of our products, product quality and

brand image; our ability to continue to improve our product line and product quality; warranty

obligations; availability of attractive and cost-effective consumer credit options; execution of

our retail store distribution strategy; rising commodity costs and other inflationary pressures;

our dependence on significant suppliers, including several sole-source suppliers and the

vulnerability of suppliers to recessionary pressures; industry competition; risks of pending and

potentially unforeseen litigation; increasing government regulations; the adequacy of our

management information systems to meet the evolving needs of our business and evolving

regulatory standards; our ability to attract and retain key employees; and uncertainties arising

from global events, such as terrorist attacks or a pandemic outbreak, or the threat of such

events. Additional information concerning these and other risks and uncertainties is contained

in our filings with the SEC, including our Annual Report on Form 10-K, and other periodic

reports filed with the SEC. The company has no obligation to publicly update or revise any of

the forward-looking statements in this presentation.

FORWARD LOOKING STATEMENTS

2

Self-funding, strong balance sheet and no debt

Self-funding, strong balance sheet and no debt

Accelerating margins

Accelerating margins

Compelling sales growth

Compelling sales growth

3

KEY INVESTMENT PROPOSITION

• Differentiated product -

DualAir™ adjustable mattress and

proprietary bedding collection

• Exclusive distribution

• Advantaged business model -

vertically integrated

vertically integrated

• 12 consecutive quarters of profit

improvement 26% comp in 2011

improvement 26% comp in 2011

4

SLEEP NUMBER OVERVIEW

5

Top-Line

Growth

Growth

Top-Line

Growth

Growth

Sustainable

Profitable

Growth

Profitable

Growth

Sustainable

Profitable

Growth

Profitable

Growth

• Older customer with back pain

• Narrow Direct Response media

• National store growth

• Younger, more affluent customer

• Broad-reach media

• Market development

COMPANY TRANSFORMATION

Sleep Number transformed into a strong company with sustainable, profitable growth

2011

(11%)

11%

23%

2011

2010

2009

Growth formula has led to record levels of sales and margin

1-Yr Comp

(4%)

19%

26%

Operating Margin

Operating Margin

8.6%

12.2%

2011

2010

2009

GM%

SM Exp%

61.6%

62.5%

63.3%

47.6%

44.6%

42.7%

4.4%*

EPS

EPS

$0.57

$1.07

2010

2009

$0.24*

*Pro Forma EPS

*Pro Forma Operating Margin

PROVEN GROWTH FORMULA

6

Net Sales Growth

Net Sales Growth

• Asset turnover rate 3x competitors

• Fast growing Return on Invested Capital

Additional financial buffer

Additional financial buffer

+

+

Gap to break-even sales $250M (33%)

Gap to break-even sales $250M (33%)

Break-even sales (ttm)

Actual sales (ttm)

$250M

(33%)

(33%)

$250M

(33%)

(33%)

>$125M in cash &

No debt

No debt

>$125M in cash &

No debt

No debt

Net sales distribution of

stores open > 1 year

stores open > 1 year

Main Driver

Quantum increase in store productivity

FY09

FY11

7

Sleep Number can manage economic headwinds and continue to invest in opportunities

POSITIONED WITH ECONOMIC FLEXIBILITY

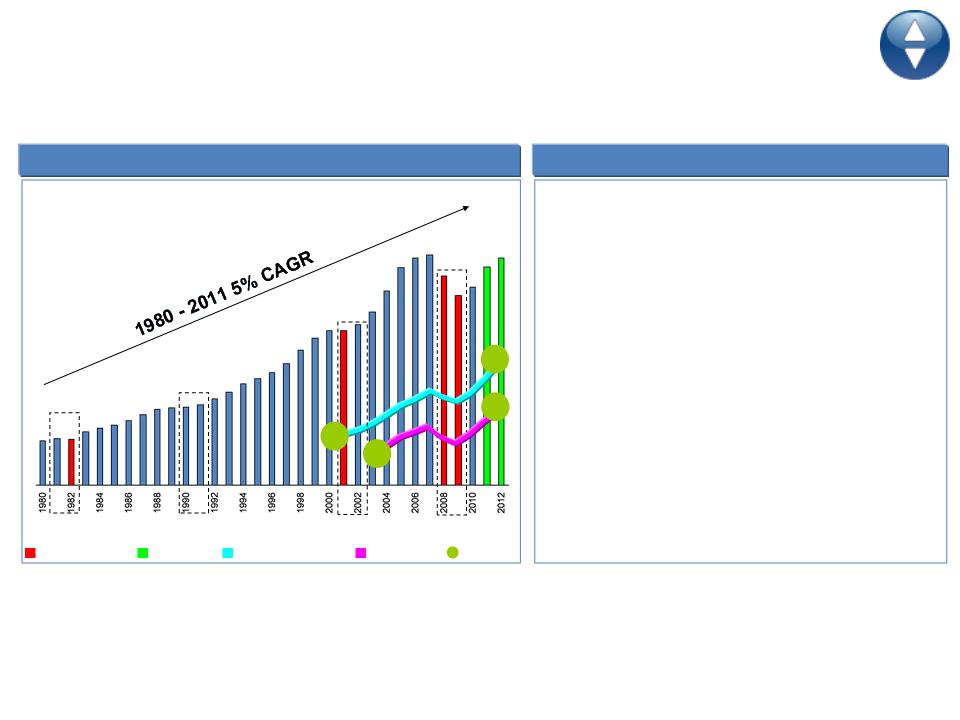

• Consistent growth over past three decades,

reset in 08/09 (resilient following recessions)

reset in 08/09 (resilient following recessions)

• Premium ($>1,000) outpacing total industry

• Current recovery driven by non-innerspring

• Industry sales at retail $12B

• Sleep Number has less than 5% share

US wholesale mattress sales steadily growing

US wholesale mattress sales steadily growing

Industry moving to non-innerspring

Industry moving to non-innerspring

Large industry with Sleep Number in the sweet-spot of premium & non-innerspring growth

INDUSTRY DYNAMICS

8

Premium segment (>$1,000)

Projected growth

Recession

Recession

Recession

Recession

Year of negative growth

1.3

6.9

6.5

6.8

5.6

Source: Industry report (ISPA) & KeyBanc estimates

($ in billions)

54%

Non-Innerspring

5.9

19%

33%

33%

Share of total

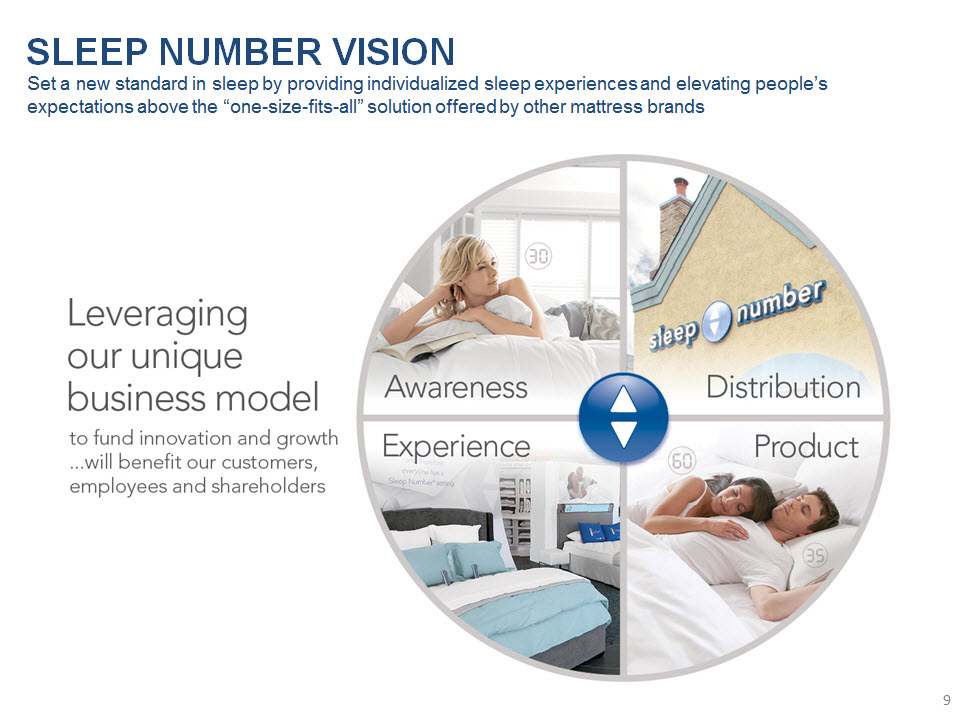

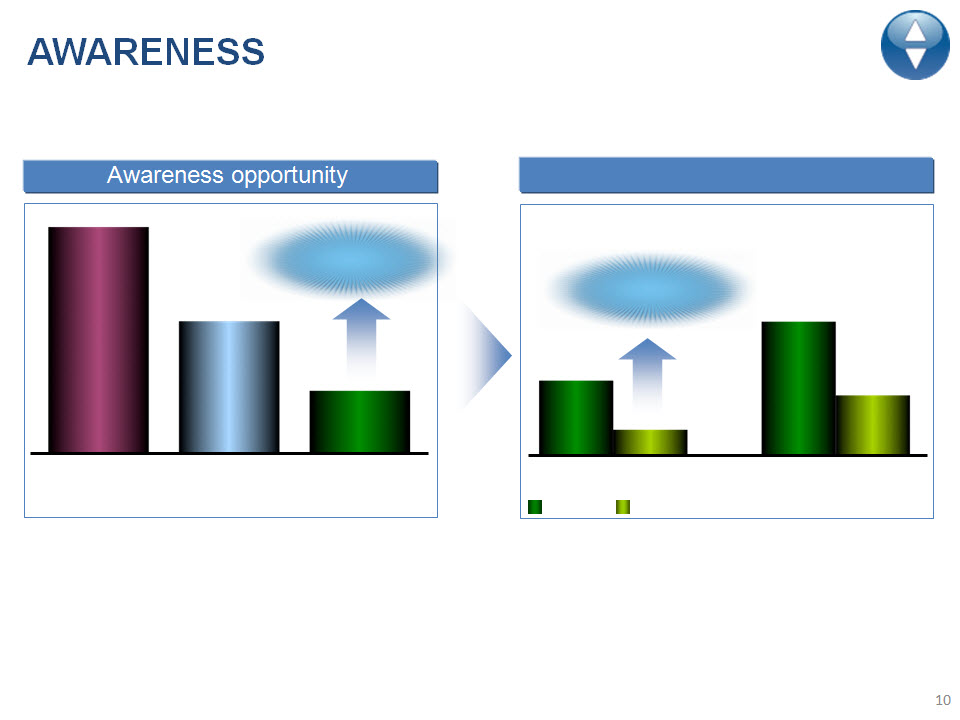

Broadening awareness is #1 growth opportunity

Awareness drives market share

Awareness drives market share

National average

• Leading markets 10-12% share

• Sleep Number awareness lags industry leaders

55%

55%

Leading

Innerspring

Leading

Non-Innerspring

32%

32%

15%

15%

Sleep Number*

Leading markets

10-12%

10-12%

Awareness

Market share

#1 growth

#1 growth

opportunity

opportunity

5%

5%

15%

15%

25%-

40%

10-15% share

10-15% share

$1.5B+ net sales

$1.5B+ net sales

* Awareness as of August 2011

AWARENESS

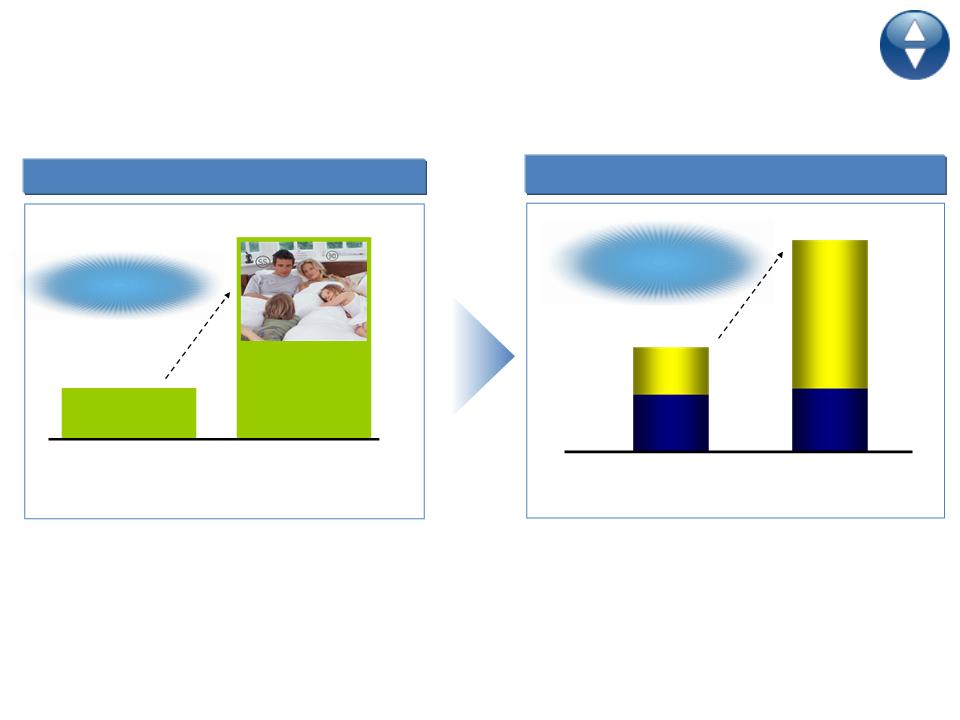

Increasing media investment & effectiveness

Increasing media investment & effectiveness

Broader target Customer

• Broader media strategy increases reach

• Increased investment focused on national

advertising leverage and local development

advertising leverage and local development

• Redefined target customer

• Includes prime mattress buying years

• Moving from need state to aspirational

11

Before

After

• 45-65+ yrs. old

• $50K+ income

• Need state-driven

• 30-54 yrs. old

• $75K+ income

• Values health

• Will pay premium

Targeting a broader customer base and investing for greater reach

2009

2012

Increases target

market 4x

market 4x

Increases target

market 4x

market 4x

Direct

Direct

Media

Media

Broad

Reach

Achieving ~3x reach

Achieving ~3x reach

with 2x investment

with 2x investment

$61M

$120M+

AWARENESS

National retailer

National retailer

National scale in place; now focused on local market development

• 380+ stores in 45 states

• Exclusive distribution

• 5-8% annual store growth with >90% market fill-in

12

Sleep Number store presence

• Differentiated store design

• Company-controlled retail experience

• Reposition or remodel 15-20% of stores annually

Flexible real estate - mall and non mall

Flexible real estate - mall and non mall

> $2.0M average sales per store planned in 2012

DISTRIBUTION

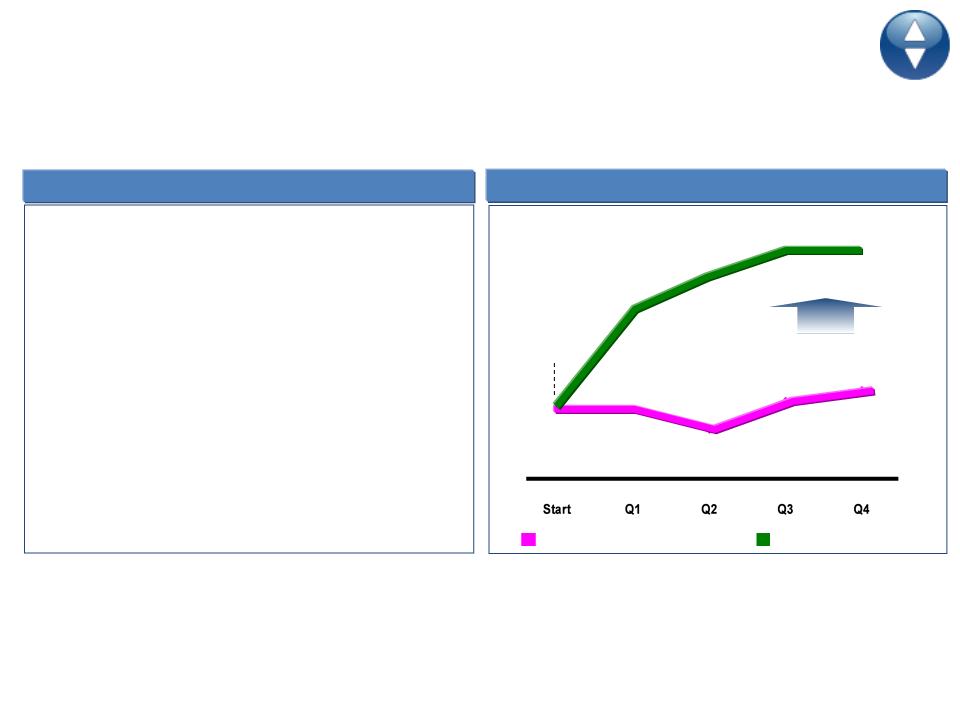

Aggressive growth strategy for large, underdeveloped markets

13

Aggressive growth strategy

Aggressive growth strategy

• Heavy-up local media for break-through share of

media voice

media voice

• Rapidly optimize store location, format and design

• Pilot market success - on track to double market

share in 3 years in these markets

share in 3 years in these markets

• Apply strategy to 13 total markets - represents 1/3

of bedding sales ($4B)

of bedding sales ($4B)

…4 in 2011, 3 in 2012 and 6 in 2013-2014

Aggressive growth pilot

Aggressive growth pilot

Growing 2-3x faster

Year 1

Year 1

22%

16%

25%

28%

49%

59%

66%

66%

2011 YOY% net sales-total company

4 aggressive growth pilots

Integrated

strategy

launch

DISTRIBUTION

INNOVATIVE PRODUCTS

The most differentiated products in the industry

c2

$999

c3

$1,399

c4

$1,699

p5

p6

$2,599

i8

$3,199

i10

$4,699

$2,099

Sleep Number Bed Series Pricing (Queen Sets):

m7

$3,199

Performance

Performance

Innovation

Innovation

Memory Foam

Memory Foam

Sleep Number Beds:

• DualAir™ Technology- adjusts on each side for

personalized comfort

• Clinically proven to improve quality of sleep

• Premium good/better/best range of beds

• Opening price point of $699 for queen mattress

Bedding Collection: Solutions designed to improve sleep

FlexFit™ Series: For a fully adjustable experience

Classic

14

15

Consumer insight-driven product launches

• Introduction to the Sleep Number experience

• Adjusts to individual’s size, shape, sleeping position

• CoolFit™ Foam, Memory Fiber or European White

Goose Down

Goose Down

• Price $189 - $229

AirFit™ Adjustable Pillow

INNOVATIVE PRODUCTS

• Proprietary CoolFit™ foam with gel technology

• CoolFit™ foam cools, contours and is more breathable

• Exclusive Sleep Number DualAir™ technology

• Price $3,199 queen set

m7 Memory Foam Bed

Differentiated store experience

Differentiated store experience

• Highly trained & tenured full time Sleep

Professionals

Professionals

• Technology shows science behind the bed

• Relationship-based selling process

• 95% of customers report store experience

exceeded expectations

exceeded expectations

End-to-end customer experience

End-to-end customer experience

Customers love their Sleep Number experience

16

Controlled brand experience to build value

EXPERIENCE

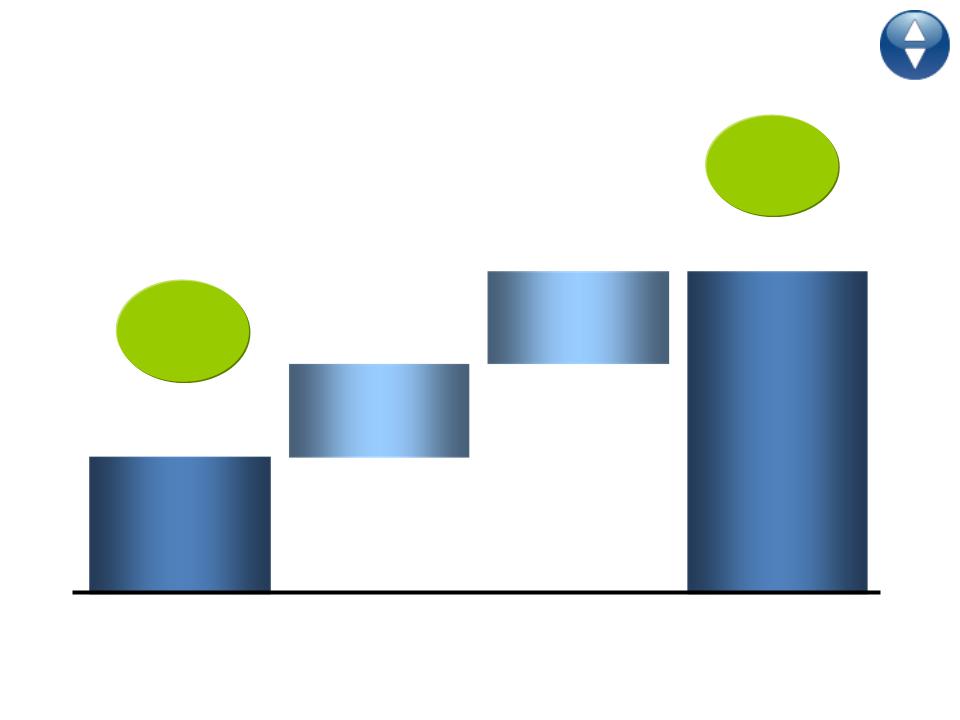

Growing share through existing and new stores while improving operating margins

2011

2015

$743M*

Open new

stores

stores

$1.5B+

•Build awareness

•Build awareness

•Remodels/Repositions

•Remodels/Repositions

•Product Innovation

•Product Innovation

12%

Operating

Margin

15%+

Operating

Margin

• 5-8% annual store

growth

growth

• 5-8% annual store

growth

growth

• Year 1 new stores >

company average

company average

• Year 1 new stores >

company average

company average

Leverage

existing stores

$400M+

$400M+

17

* (Net Sales)

LEVERAGING OUR UNIQUE BUSINESS MODEL

18

Gross Margin

Sales & Marketing

G&A/Other

Operating Margin

Profit Margins

Profit Margins

2011

2011

2015

2015

Drivers

Drivers

63%

43%

8%

12%

>15%

• Supply chain leverage & efficiencies

• Product innovation & pricing

• Store base leverage

• Media mix & efficiency

• Focus on core business

Compelling margin expansion delivers strong bottom-line and EPS growth

EPS growth 20%+

MARGIN OUTLOOK

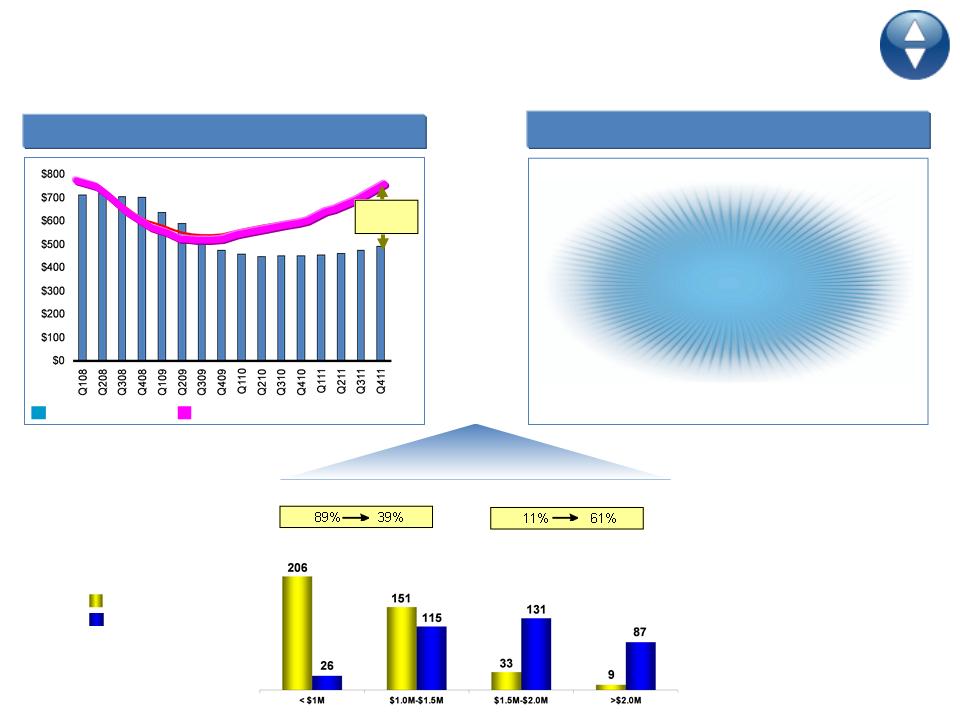

Sleep Number self-funds growth with advantaged profit and cash model

Robust cash flow

Robust cash flow

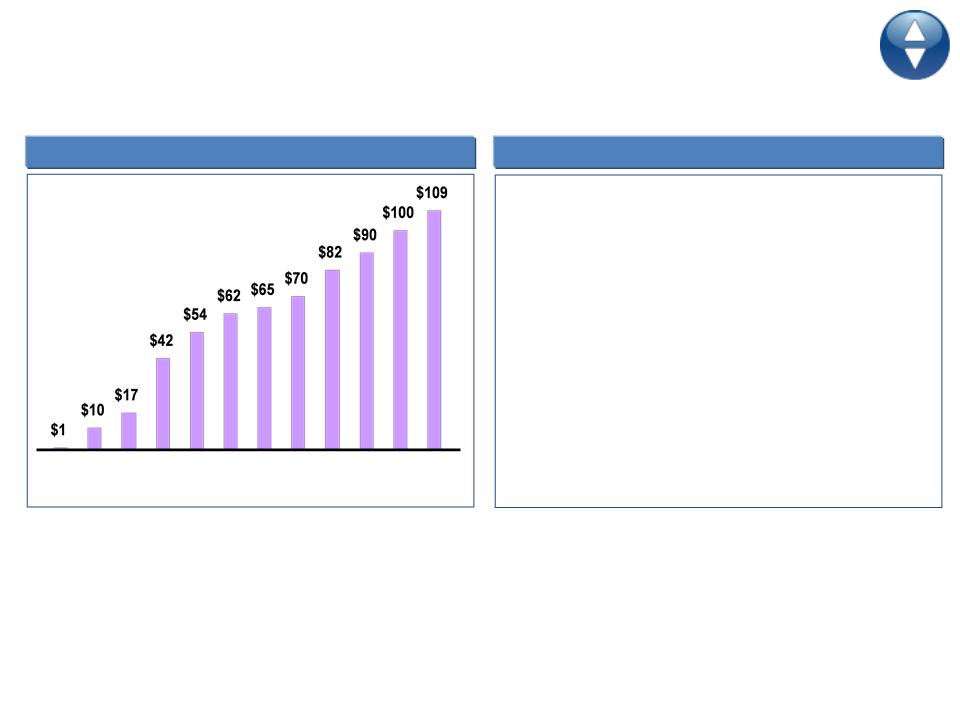

Q109

Q209

Q309

Q409

Q110

Q210

Q310

Q410

Q111

Q211

Q311

Q411

EBITDA ttm ($ in millions)

Use of Cash

Use of Cash

• Maintain $125M minimum balance

• Priority #1: Self-fund high growth

…stores, systems, product innovation

• Reinstate modest share buyback in 2012

19

STRONG CASH FLOW GENERATION

20

Self-funding, strong balance sheet and no debt

Self-funding, strong balance sheet and no debt

Accelerating margins

Accelerating margins

Compelling sales growth

Compelling sales growth

KEY INVESTMENT PROPOSITION

APPENDIX

21

Bill McLaughlin

President & CEO Age 55

Sleep Number since 2000

President & CEO Age 55

Sleep Number since 2000

Other experience: PepsiCo

Frito-Lay

Frito-Lay

Shelly Ibach

EVP & COO Age 52

Sleep Number since 2007

EVP & COO Age 52

Sleep Number since 2007

Shelly Ibach

EVP & COO Age 52

Sleep Number since 2007

EVP & COO Age 52

Sleep Number since 2007

Other experience: Macy’s

Target Corporation

Kathy Roedel

EVP & Chief Technology & Services

EVP & Chief Technology & Services

Kathy Roedel

EVP & Chief Technology & Services

EVP & Chief Technology & Services

Sleep Number since 2005 • Age 51

Sleep Number since 2005 • Age 51

Other experience: GE Healthcare

Wendy Schoppert

EVP & CFO Age 45

Sleep Number since 2005

EVP & CFO Age 45

Sleep Number since 2005

Other experience: US Bank

America West

Northwest

America West

Northwest

Mark Kimball

SVP & General Counsel Age 53

Sleep Number since 1999

SVP & General Counsel Age 53

Sleep Number since 1999

Other experience: Oppenheimer, Wolff & Donnelly

Karen Richard

SVP & Human Capital Age 41

Sleep Number since 1996

SVP & Human Capital Age 41

Sleep Number since 1996

Other experience: TCF Financial Corp

Strong, experienced management team with long tenure and diverse industry backgrounds

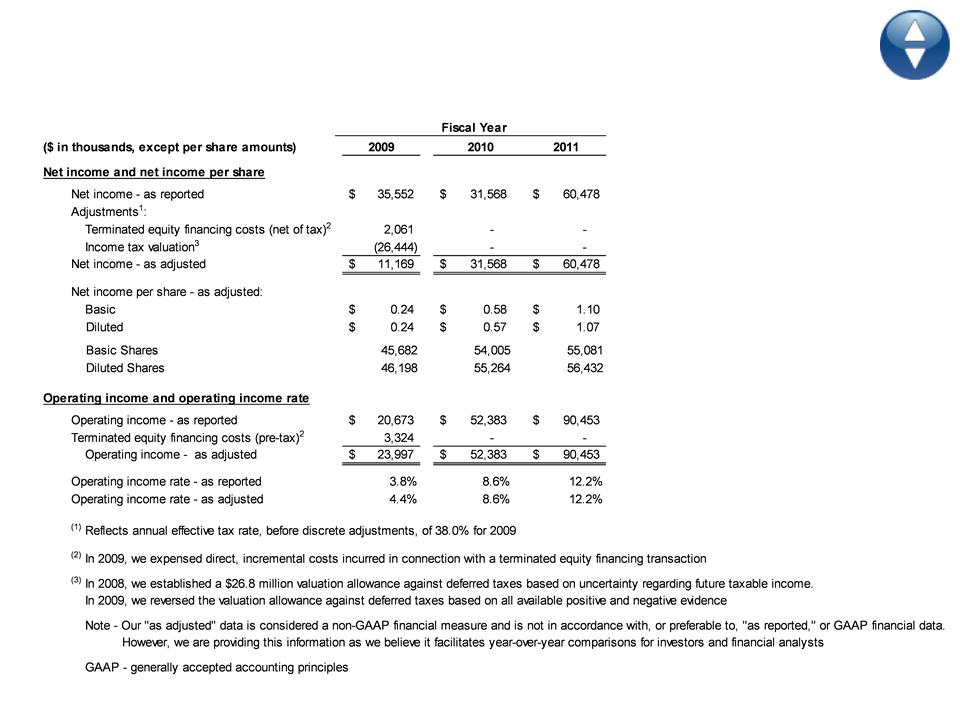

Non-GAAP Financial Measures Reconciliation

Fiscal Years 2009, 2010 and 2011

Fiscal Years 2009, 2010 and 2011

23

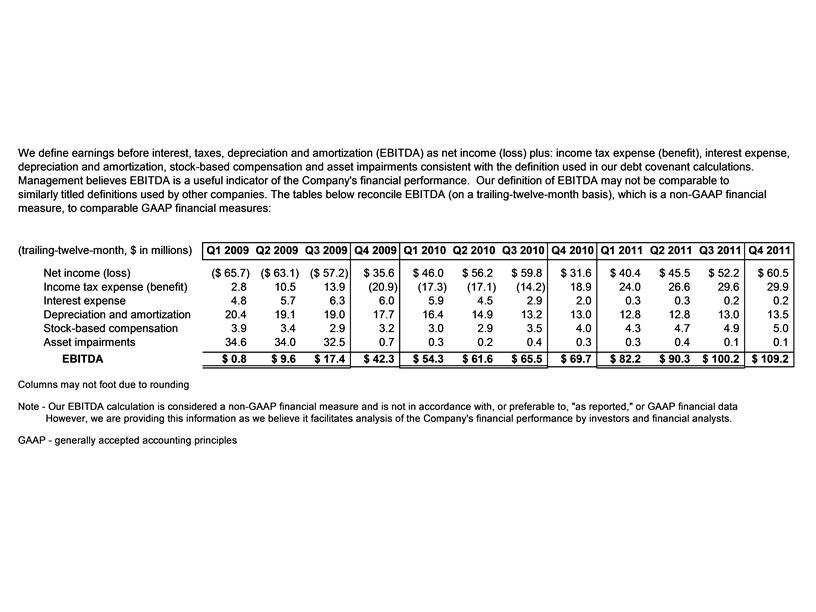

Non-GAAP Financial Measures Reconciliation

EBITDA for 2009, 2010 and 2011 (trailing-twelve-

month basis)

EBITDA for 2009, 2010 and 2011 (trailing-twelve-

month basis)

24

Thank You