Attached files

| file | filename |

|---|---|

| EX-31.2 - 302 CERTIFICATION OF CFO - EL CAPITAN PRECIOUS METALS INC | p1211a1_ex31-2.htm |

| EX-31.1 - 302 CERTIFICATION OF CEO - EL CAPITAN PRECIOUS METALS INC | p1211a1_ex31-1.htm |

| EX-23.1 - CONSENT OF CLYDE L. SMITH, PH.D. - EL CAPITAN PRECIOUS METALS INC | p1211a1_ex23-1.htm |

| EX-32.1 - 906 CERTIFICATION - EL CAPITAN PRECIOUS METALS INC | p1211a1_ex32-1.htm |

| EX-99.1 - EXHIBIT 99.1 - EL CAPITAN PRECIOUS METALS INC | p1211a1_ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 30, 2011

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to ____________

Commission File Number: 333-56262

(Exact name of registrant as specified in its charter)

|

Nevada

|

88-0482413

|

|

(State or Other Jurisdiction

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

Identification No.) |

|

15225 N. 49th Street

|

|

|

Scottsdale, AZ

|

85254

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (602) 595-4997

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the issuer’s voting stock held as of March 31, 2011 by non-affiliates of the registrant was approximately $277,493,018, based on the last trading price of the registrant’s common stock of $1.35 as reported on the OTC Bulletin Board on such date.

As of February 23, 2012, issuer had 247,187,945 shares of its $.001 par value common stock issued and outstanding.

Documents incorporated by reference: None

TABLE OF CONTENTS

|

Page

|

||||||

| 4 | ||||||

| 10 | ||||||

| 11 | ||||||

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) amends the Annual Report on Form 10-K of El Capitan Precious Metals, Inc. (“we,” “us,” “ECPN” or the “Company”) for the fiscal year ended September 30, 2011, filed with the SEC on December 29, 2011 (the “Original 10-K”). This Amendment No. 1 is being filed solely for the purpose of amending the description of our properties set forth in Part I, Item 2 of the Original 10-K and to reflect exhibits filed with this Amendment No. 1.

Except as described above, this Amendment No. 1 does not amend any other information set forth in the Original 10-K and the Company has not updated disclosures included therein to reflect any events that occurred subsequent to the filing of the Original 10-K. Accordingly, this Amendment No. 1 should be read in conjunction with the Original 10-K and the Company’s filings made with the SEC subsequent to the filing of the Original 10-K. The filing of this Amendment No. 1 is not an admission that the Original 10-K, when filed, included any untrue statement of a material fact or omitted to state a material fact necessary to make a statement not misleading.

|

PROPERTIES

|

El Capitan Property

Our primary asset is the 100% equity interest in El Capitan, Ltd., an Arizona corporation (“ECL”), which holds property interests in certain real property located near Capitan, New Mexico, as further described below (the “El Capitan Property”).

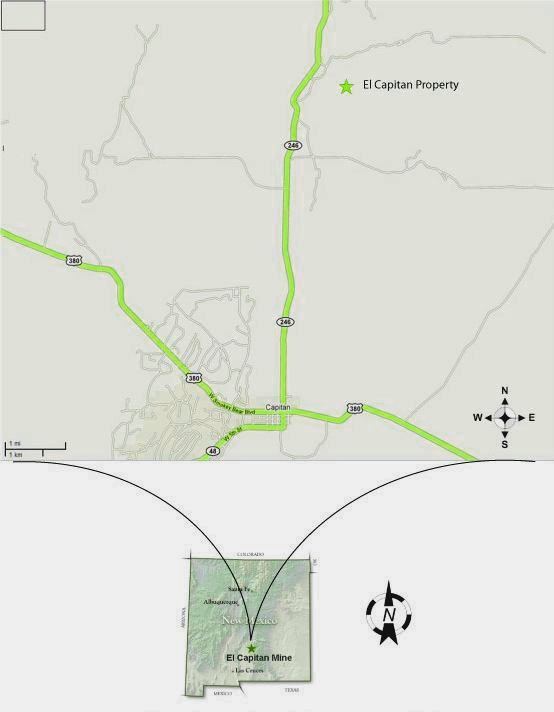

Below is a map setting forth the location of the El Capitan Property.

4

Location and Access to Deposits

The El Capitan Property is situated in the Capitan Mountains, near the city of Capitan, in southwest New Mexico. The main site can be reached by going north from Capitan on State Road 246 for 5.5 miles, turning right onto an improved private road and proceeding for about 0.7 miles.

Description of Interests

The El Capitan Property is owned by El Capitan, Ltd., an Arizona corporation (“ECL”) and subsidiary of the Company. The property originally consisted of four (4) patented and nine (9) Bureau of Land Management (“BLM”) lode claims; a mineral deposit is covered by these claims. The lode claims, known as Mineral Survey Numbers 1440, 1441, 1442 and 1443, were each located in 1902 and patented in 1911. On January 1, 2006, ECL finalized the purchase of the four patented mining claims on the property, which constitute approximately 77.5 acres in the aggregate.

The El Capitan Property originally consisted of approximately 200 acres of mineral lands bounded by the Lincoln National Forest in Lincoln County, New Mexico. During October and November 2005, based upon recommendations from our consulting geologist, we staked and claimed property surrounding the El Capitan site located in Lincoln County, New Mexico, increasing the total claimed area to approximately 10,000 acres. In August 2006, we reduced the number of claims to cover approximately 7,400 acres, and in August 2009, we reduced the number of claims to approximately 2,800 acres based upon continuing geological work and recommendations by our consulting geologist. In October and November 2011, at the recommendation of the Company’s geological consultant, the Company filed an additional 36 claims of 20 acres each on property adjacent to the Company’s existing claims, aggregating an additional 720 acres.

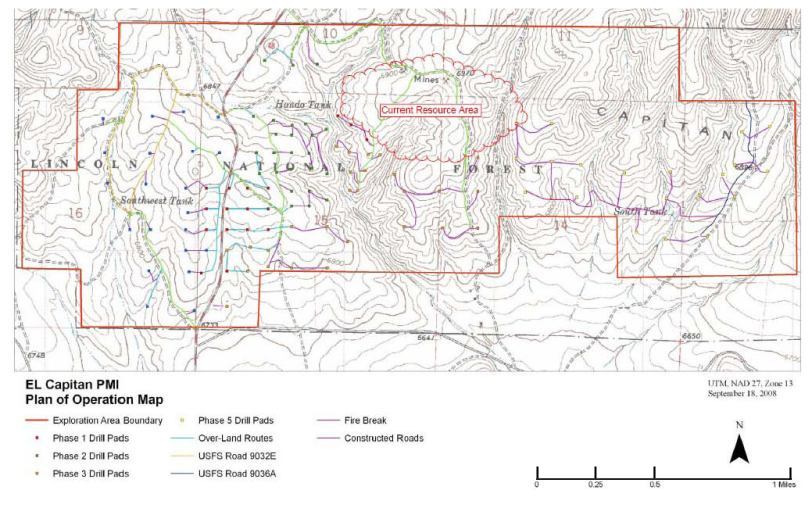

As of September 30, 2011, we own four patented claims, covering approximately 77.5 acres, and 140 lode claims with the BLM covering approximately 2800 acres at the El Capitan Property. The map sets forth on Exhibit 99.1 to this Amendment No. 1 shows the location of our claims on the El Capitan Property as of September 30, 2011.

Previous Operations

To our knowledge, prior to its acquisition by ECL, the property was last active in 1988. The property was previously drilled as an iron (Fe) resource by the U.S. Bureau of Mines in 1944 and 1948. From 1961 to 1988, to our knowledge, an estimated 250,000 tons of iron ore were produced on the property. Prior to December 2004, there had not been any significant exploration completed on the property. There had only been shallow drilling of the upper magnetite horizon, which was completed by the U.S. Bureau of Mines in 1944 and 1948, and additionally performed by ECL in 2002. Additionally, there was geologic mapping of the property at a scale of 1:3,600 by Kelley in 1952. ECPN has made its annual maintenance filings and payment of an annual maintenance fee to the BLM for the claims ($140 per year) and of bulk fuel and water well permits on the El Capitan site.

Geology

The main El Capitan deposit is exposed in an open-pit and outcrops within a nearly circular 1,300 foot diameter area, with smaller bodies stretching eastward for a distance of up to 7,000 feet. The El Capitan Property includes two magnetite-dominant bodies. The upper magnetite zone lies below a limestone cap that is a few tens of feet thick, and that is bleached and fractured with hematite-calcite fracture filling. Hematite is an iron oxide mineral, and calcite is a calcium carbonate mineral. Below the limestone cap, there is a mineral deposit which consists mainly of calc-silicate minerals, or minerals which have various ratios of calcium, silicon and oxygen. Beneath the calc-silicate deposit is granite rock. The El Capitan Property has an abundance of hematite, which occurs with calcite in later stage fracture fillings, breccias (rock composed of sharp-angled fragments), and stockworks (multi-directional fractured rock containing veinlets of hydrothermally introduced materials).

Potential mineralization has been defined as two separate types: (i) magnetite iron, and (ii) hematite-calcite mineralized skarn and limestone, which may contain precious metals. By using core holes located at strategic points throughout the property, we have been able to develop subsurface information and define the mineralization. To date, there have been no proven commercial precious metals reserves on the El Capitan Property site. To establish “reserves” (as defined under Industry Guide 7 issued by the SEC), we will be required to establish that the property is commercially viable. As of September 30, 2011, we have not completed a feasibility study on the property, and thus cannot identify the economic significance of the property, if any, at this time.

Exploration and Development

We currently do not have any detailed plans to conduct further exploration on the El Capitan Property. The Company is working with third parties to analyze samples from the El Capitan Property to create an economically feasible recovery model for the precious metals for the El Capitan Property ore, and is updating its geological report based upon the standards used in connection with Canadian National Instrument 43-101 with respect to the El Capitan Property, each a part of its strategic plan to engage an investment banking firm to sell the El Capitan Property to a major mining company or enter into a profitable joint venture agreement. Given the Company’s current plans to market the property for sale, the Company does not currently have any timetable, budget or plan to conduct further exploration on the El Capitan Property. The Company has not, and does not intend to, file any geological reports on SEDAR for review by Canadian authorities.

The Company and Gold and Minerals Company, Inc. (“G&M”), a wholly owned subsidiary of the Company, have incurred at total of $8,473,319 in exploration costs associated with the El Capitan Property. G&M has incurred $5,275,916 in exploration costs, commencing January 1, 1994 through December 31, 2011, and the Company has incurred $3,197,403 in exploration costs, from its inception on July 26, 2002 through December 31, 2011. The foregoing exploration costs include those costs associated with drilling, assaying, filing fees, extraction process development, consultant, geological, metallurgical, chemist, environmental and legal fees, and other miscellaneous property development costs.

The following describes the Company’s historical extraction and analysis of samples from the El Capitan Property.

Over the years, samples taken on the El Capitan Property, including samples taken by ECL, have given low-grade precious metal results when using standard fire assay methods. Through August 2006, due to the unique nature of the mineralization of the El Capitan Property, we have at times utilized testing and assaying methods that may be uncommon, including the use of alkali fusion assays, a more aggressive form of assay which completely converts the sample into a water soluble salt.

In January 2005, ECL completed a preliminary 32-sample surface sampling and assay program on the El Capitan Property to determine the property’s gold and platinum potential. This preliminary sampling was completed by Dr. Clyde L. Smith, Ph.D. This preliminary sampling and assay program was followed by three stages of diamond drilling and rotary drilling, totaling 45 holes between April 2005 and September 2006.

In 2007, ECPN engaged Dr. Smith to prepare a report to “provide an explanation of the work conducted on the El Capitan Gold-Platinum Project ... and to summarize the results of the geologic investigations ...” In this report, dated April 16, 2007, Dr. Smith states, “This resource [the El Capitan Property] qualifies as a ‘measured resource’ based upon the Canadian National Instrument 43-101 guidelines. Preliminary hydrometallurgical extraction results indicate potentially acceptable levels of recovery of both gold and platinum.”

We have retained the services of Dr. Smith to manage the investigation of the El Capitan Property. Dr. Smith is a Consulting Geologist with over 33 years of experience in the mining industry. Dr. Smith holds a B.A. from Carleton College, a M.Sc. from the University of British Columbia, and a Ph.D. from the University of Idaho. Dr. Smith also served as a member of the Industrial Associates of the School of Earth Sciences at Stanford University for several years. ECL has also retained the services of a Ph.D. chemist to compile the prior and ongoing metallurgical and geological information for incorporation into a formal presentation for the purpose of the future marketing of the property.

We retained a small metallurgical R&D lab in August 2006 to assess the potential for a modified fire assay technique that we believe is more appropriate for the material from the El Capitan deposit. Throughout 2007 investigations into the potential use of various industry-standard fire assay techniques to estimate the metal content of the El Capitan mineral samples were conducted. Such standard fire assay techniques produced limited improved results, and beginning in early 2008 and through early 2009, we conducted research into other assay techniques, including leaching, acid dissolution, and the addition of various precious metal collecting agents during the assay process. In early 2009, we completed these research analytical projects at the commercial laboratory and small, R&D-oriented facility we had contracted with. The results obtained were encouraging but resulted in inconsistent tests results.

In May 2009, we received results from a commercial lab for additional assay tests. These assay tests conducted were comparable to the test procedures used in December 2008. The gold values indicated average gold grades of .032 ounces per ton, which were similar to the December 2008 values, representing recoverable values using standard extraction techniques. The assay tests also indicated average silver grades of 1.25 ounces per ton, equating to an average gold equivalent of .05 ounces per ton. The December 2008 tests did not test for silver values. Our consultants determined that the low assay results reported in February 2009 came from an entirely different assay procedure and therefore were not comparable to the results obtained in the December 2008 and May 2009 tests.

In June 2009, we contacted Planet Resource Recovery, Inc. (“PRR”), for PRR to evaluate the use of its recovery technology in recovering precious metals from concentrates produced from El Capitan Property head ore. Effective May 4, 2010, we entered into a Joint Venture Agreement with PRR to process approximately 200 tons of concentrate from the El Capitan Property. As part of the Agreement, PRR was to build a production facility for this El Capitan recovery process at their Texas site. The production facility has not been completed and we are currently storing our concentrates in a secure site on property occupied by PRR.

In March 2010, we started a separate project using a team of experienced mining chemists and metallurgists to develop an assay process and a commercial precious metals recovery process for the ore from the El Capitan Property. This team initially focused on three (3) different recovery processes. By September 2010, this team had developed processes which yielded “metal in hand” assays, which indicates the El Capitan ore could be of commercial grade, if the recovery cost is not prohibitive.

In September 2010, we announced that our team of chemists and metallurgists had developed a gold recovery process which uses “lead collection with silver inquarting.” An independent certified analytical laboratory utilized this recovery process to recover metal from 3,000 tons of El Capitan head ore and produced a certified report of such results, indicating a value of 0.421 ounces of gold per ton of ore.

On November 3, 2010, we engaged another qualified consulting company to initially analyze ten core samples from the El Capitan Property, utilizing three different recovery processes. In 2011, the consultant company conducted tests to confirm the recovery of precious metals from the El Capitan ore under various methods of recovery. In April 2011, we received results that indicated potential economic values of gold, as well as the presence of platinum group metals (“PGM”). The results differed by analytical method, and the consulting company has proposed to undertake additional testing to achieve comparable results before proceeding with analysis and process testing of additional samples. In August 2011, we received the analytical data from work performed by the consulting company. This third party source has taken considerable time to perform the needed research to confirm the values of the PGM and gold samples taken from “Chain-of-Custody” head ore removed from the El Capitan Property. Preliminary review of the data supports El Capitan’s expectations of commercially recoverable precious metals, and the most recent samples of ore have assayed at 1.2 ounces of gold equivalent per ton.

The consultant company’s data has been submitted to a qualified metallurgical engineer and a qualified chemist, recommended by our consultant geologist Clyde Smith, Ph. D. Additional work by the consultant company is on hold as we are currently concentrating on the recovery process involving silver–lead inquarting and a carbon pre-roast process of the El Capitan ore.

Upon determination of the final recovery process best suited for the El Capitan ore, the cost of precious metal recovery will be determined to ensure the recovery process is not prohibitive in comparison to the price of the precious metals recoverable at the El Capitan Property.

Based upon recovery results attained in 2011, the Company deemed it necessary to update its geological report, based upon the standards used in connection with Canadian National Instrument 43-101, the standard for presentation of a mining property. The geological report will describe the geology, drilling locations, drilling samples, measured resource and the metallurgical value and make-up of the ore located at the El Capitan Property, and will be the central document for the Company’s presentation of the property to the market for sale. The Company’s previous geological report was completed in April 2007 and requires significant updating to bring it current. The update will include a site visit by a qualified metallurgical engineer, a review of the permits of the El Capitan Property, a complete metallurgical initiative to assess the ore content at the El Capitan Property, and multiple independent verifications of all the metallurgical work conducted for the site for accuracy and repeatability. The Company’s prior results are being replicated with “Chain-of-Custody” ore under the direction of qualified metallurgical engineer and chemist. The Company has not, and does not intend to, file any geological reports on SEDAR for review by Canadian authorities. The geological report will be used solely for purposes of presenting the El Capitan Property to the market for sale.

The Company engages third party consultants to provide extraction and analysis of samples. As part of its selection process, the Company takes into account the quality assurance practices of such consultants prior to engagement. Consequently, the Company has not created an independent quality assurance program.

From time to time, we have entered into agreements with various contractors to conduct exploration projects on the El Capitan Property. Each of the respective contractors utilizes its own equipment to conduct such exploration and testing or other contracted services, and must provide their own source of power and water to be utilized at the El Capitan Property.

COD Property

The COD Property is an underground property located in the Cerbat mountains in Mohave County, Arizona, approximately 11 miles north, northwest of Kingman, Arizona. The Cerbat mountains consist mainly of pre-Cambrian metamorphic rock which is intruded by granite, overlain by younger Tertiary-era volcanic rock. The property can be reached by taking Interstate 40 north out of Kingman to the Stockton Hill Road exit. After going approximately five (5) miles north on Stockton Hill Road, there is a subdivision road extending west. Following the subdivision road to the second southern extension road, the visitor will see road signs showing the directions to the property from that point.

The COD Property contains 13 claims granted by the BLM. This property has previously been mined through two underground shafts leading to seven levels, most recently in the mid 1980’s. The COD Property was originally mined in 1878.

Pursuant to a joint venture agreement with U.S. Canadian Minerals, Inc. (“U.S. Canadian”) entered into in May 2004, we transferred an 80% interest in the COD Property to U.S. Canadian. Pursuant to the agreement, we planned to explore the property to determine the feasibility of recovering gold and silver from the tailings of the COD Property. We were to receive 50% of the profits from the gold and silver tailings, if any. We were required to contribute the equipment necessary for such exploratory operations. U.S. Canadian agreed to contribute 90 days operating capital to provide for at least three workers, fuel, necessary equipment, and equipment repair and maintenance. After the 90-day period, the parties were to split the costs and expenses related to the operation of the mine in accordance with their profit participation in the COD Property. To date, we have spent approximately $2,500 on this project. On August 29, 2005, we executed a Quit Claim Deed in favor of U.S. Canadian covering all of the mining claims identified in the joint venture for purposes of facilitating the management of the claims by U.S. Canadian pursuant to the joint venture. There has been no activity by us at this property in the years ended September 30, 2011, 2010 and 2009. We were advised by U.S. Canadian on October 21, 2009, that they had transferred all of their interest in the COD Property to an unrelated party. On January 11, 2010, U.S. Canadian and the unrelated party rescinded the October 21, 2009 transaction and a Quit Claim Deed on the COD Property was returned to U.S. Canadian. U.S. Canadian, now known as Noble Consolidated Industries Corp. (“Noble”), is listed on the Gray Market Sheets with no value or trading activity. Based upon the events and financial condition of Noble, we have determined that this joint venture is not viable and, as a result, the Company does not consider the COD Property to be a material property of the Company at this time.

Executive Offices

Our executive offices are located at 15225 N. 49th Street, Scottsdale, Arizona 85254. The premises are contributed free of charge by Mr. Stephen J. Antol, a former officer of the Company. We believe that the office is adequate to meet our current operational requirements.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

|

Exhibit

Number

|

Description

|

|

|

2.1

|

Agreement and Plan of Merger between the Company, Gold and Minerals Company, Inc. and MergerCo, dated June 28, 2010 (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed July 7, 2010).

|

|

|

3.1

|

Articles of Incorporation, as amended (incorporated by reference to Exhibit 3.1 to the Company’s Form S-4 Registration Statement #333-170281 filed on November 2, 2010).

|

|

|

3.2

|

Restated Bylaws (incorporated by reference to Exhibit 3.2 to the Company’s Form S-4 Registration Statement #333-170281 filed on November 2, 2010).

|

|

| 4.1 | Rights Agreement between the Company and OTR, Inc. (incorporated by reference to Exhibit 4.1 to the Company’s Form 8-K filed on January 4, 2006). | |

| 10.1 |

Equity Purchase Agreement dated July 11, 2011 between El Capitan Precious Metals, Inc. and Southridge Partners II, LP.(incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed July 12, 2011).

|

|

| 10.2 | 2005 Stock Incentive Plan, as amended (incorporated by reference to Exhibit 10.1 to the Company’s Form S-8 Registration Statement #333-177417 filed on October 20, 2011). | |

| 23.1* |

Consent of Clyde L. Smith, Ph.D.

|

|

| 23.2 | Consent of MaloneBailey, LLP (incorporated by reference to Exhibit 23.2 to the Company’s Annual Report on Form 10-K filed on December 29, 2011). | |

|

31.1*

|

Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

31.2*

|

Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

32.1*

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

| 99.1* |

Map of Company’s Claims on El Capitan Property as of September 30, 2011.

|

|

| 101.INS* | XBRL Instance Document (incorporated by reference to Exhibit 101.INS to the Company’s Annual Report on Form 10-K filed on December 29, 2011).** | |

| 101.SCH* | XBRL Extension Schema Document (incorporated by reference to Exhibit 101.SCH to the Company’s Annual Report on Form 10-K filed on December 29, 2011).** | |

| 101.CAL* | XBRL Extension Calculation Linkbase Document (incorporated by reference to Exhibit 101.CAL to the Company’s Annual Report on Form 10-K filed on December 29, 2011).** | |

| 101.DEF* | XBRL Extension Definition Linkbase Document (incorporated by reference to Exhibit 101.DEF to the Company’s Annual Report on Form 10-K filed on December 29, 2011).** | |

| 101.LAB* | XBRL Extension Labels Linkbase Document (incorporated by reference to Exhibit 101.LAB to the Company’s Annual Report on Form 10-K filed on December 29, 2011).** | |

| 101.PRE* | XBRL Extension Presentation Linkbase Document (incorporated by reference to Exhibit 101.PRE to the Company’s Annual Report on Form 10-K filed on December 29, 2011).** |

__________________

|

*

|

Filed herewith.

|

|

**

|

In accordance with Rule 406T of Regulation S-T, this information is deemed not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

|

Financial Statement Schedules

None.

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

EL CAPITAN PRECIOUS METALS, INC.

|

||

|

Date: February 24, 2012

|

By:

|

/s/ Charles C. Mottley

|

|

Charles C. Mottley

|

||

|

Chief Executive Officer

|

||

11