Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ONCOR ELECTRIC DELIVERY CO LLC | d305352d8k.htm |

Exhibit 99.1

ONCOR 2011 Fourth Quarter And Year End Investor Call February 21, 2012 Oncor Electric Delivery

Forward Looking Statements This presentation contains forward-looking statements, which are subject to various risks and uncertainties. Discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in filings made by Oncor Electric Delivery Company LLC (Oncor) with the Securities and Exchange Commission (SEC). Specifically, Oncor makes reference to the section entitled “Risk Factors” in its annual and quarterly reports. In addition to the risks and uncertainties set forth in Oncor’s SEC filings, the forward-looking statements in this presentation could be affected by, among other things: prevailing governmental policies and regulatory actions; legal and administrative proceedings and settlements, including the exercise of equitable powers by courts; weather conditions and other natural phenomena; acts of sabotage, wars or terrorist or cyber security threats or activities; economic conditions, including the impact of a recessionary environment; unanticipated population growth or decline, or changes in market demand and demographic patterns; changes in business strategy, development plans or vendor relationships; unanticipated changes in interest rates or rates of inflation; unanticipated changes in operating expenses, liquidity needs and capital expenditures; inability of various counterparties to meet their financial obligations to Oncor, including failure of counterparties to perform under agreements; general industry trends; hazards customary to the industry and the possibility that Oncor may not have adequate insurance to cover losses resulting from such hazards; changes in technology used by and services offered by Oncor; significant changes in Oncor’s relationship with its employees; changes in assumptions used to estimate costs of providing employee benefits, including pension and other post-retirement employee benefits, and future funding requirements related thereto; significant changes in critical accounting policies material to Oncor; commercial bank and financial market conditions, access to capital, the cost of such capital, and the results of financing and refinancing efforts, including availability of funds in the capital markets and the potential impact of disruptions in US credit markets; circumstances which may contribute to future impairment of goodwill, intangible or other long-lived assets; financial restrictions under Oncor’s revolving credit facility and indentures governing its debt instruments; Oncor’s ability to generate sufficient cash flow to make interest payments on its debt instruments; actions by credit rating agencies; and Oncor’s ability to effectively execute its operational strategy. Any forward-looking statement speaks only as of the date on which it is made, and Oncor undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events. Regulation G This presentation includes certain non-GAAP financial measures. A reconciliation of these measures to the most directly comparable GAAP measures is included in this presentation, which is available on Oncor’s website, www.oncor.com, under the ‘News’ tab in the Investor Information section, and also filed with the SEC. Oncor Electric Delivery 1

4th Quarter and Year End 2011 Investor Call Agenda ?Financial Overview David Davis Chief Financial Officer ?Operational Review Bob Shapard Chairman and CEO ?Q&A Oncor Electric Delivery 2

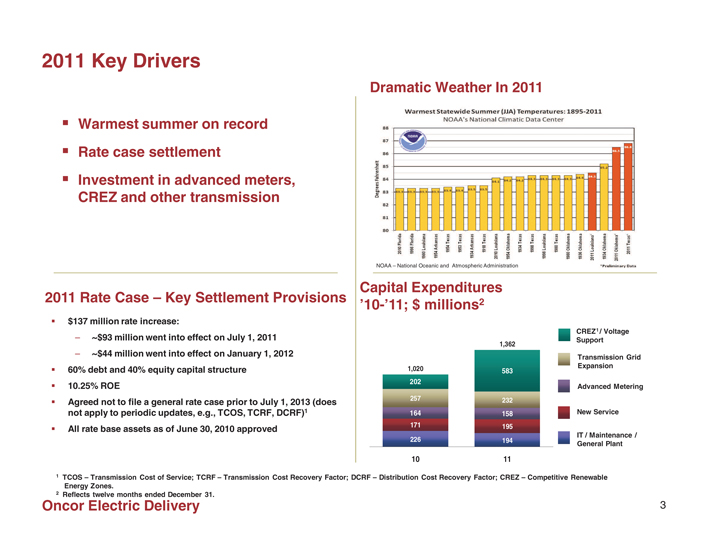

2011 Key Drivers ??Warmest summer on record ??Rate case settlement ??Investment in advanced meters, CREZ and other transmission 2011 Rate Case – Key Settlement Provisions $137 million rate increase: ~$93 million went into effect on July 1, 2011 ~$44 million went into effect on January 1, 2012 60% debt and 40% equity capital structure 10.25% ROE Agreed not to file a general rate case prior to July 1, 2013 (does not apply to periodic updates, e.g., TCOS, TCRF, DCRF)1 All rate base assets as of June 30, 2010 approved TCOS – Transmission Cost of Service; TCRF – Transmission Cost Recovery Factor; DCRF – Distribution Cost Recovery Factor; CREZ – Competitive Renewable Energy Zones. Reflects twelve months ended December 31. Oncor Electric Delivery Dramatic Weather In 2011 3

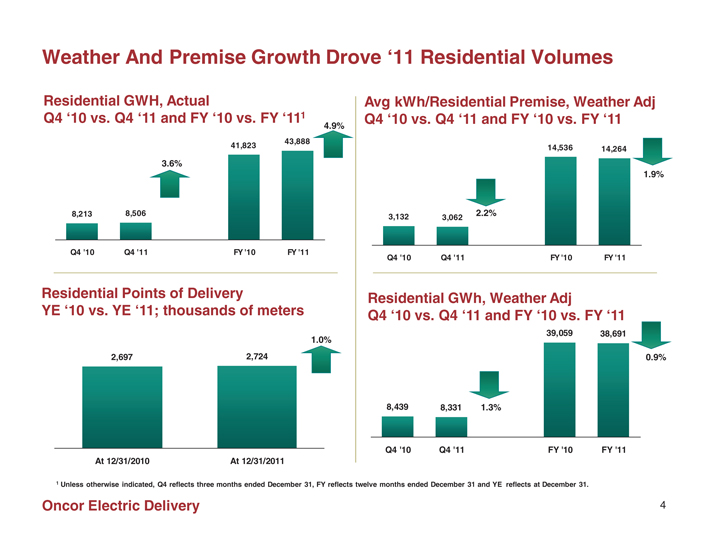

Weather And Premise Growth Drove ‘11 Residential Volumes Residential GWH, Actual Avg kWh/Residential Premise, Weather Adj Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘111 Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘11 4.9% 43,888 41,823 14,536 14,264 3.6% 1.9% 8,213 8,506 2.2% 3,132 3,062 Q4 '10 Q4 '11 FY '10 FY '11 Q4 '10 Q4 '11 FY '10 FY '11 Residential Points of Delivery Residential GWh, Weather Adj YE ‘10 vs. YE ‘11; thousands of meters Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘11 39,059 38,691 1.0% 2,697 2,724 0.9% 8,439 8,331 1.3% Q4 '10 Q4 '11 FY '10 FY '11 At 12/31/2010 At 12/31/2011 1 Unless otherwise indicated, Q4 reflects three months ended December 31, FY reflects twelve months ended December 31 and YE reflects at December 31. Oncor Electric Delivery 4

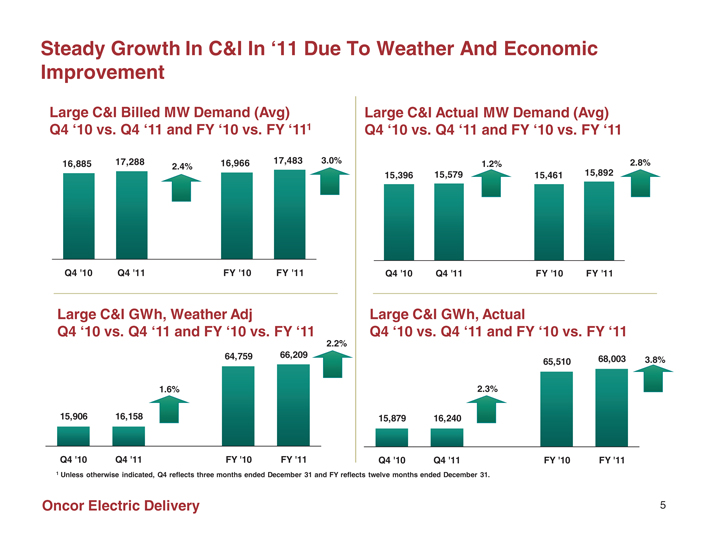

Steady Growth In C&I In ‘11 Due To Weather And Economic Improvement Large C&I Billed MW Demand (Avg) Large C&I Actual MW Demand (Avg) Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘111 Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘11 16,885 17,288 2.4% 16,966 17,483 3.0% 1.2% 2.8% 15,396 15,579 15,461 15,892 Q4 '10 Q4 '11 FY '10 FY '11 Q4 '10 Q4 '11 FY '10 FY '11 Large C&I GWh, Weather Adj Large C&I GWh, Actual Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘11 Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘11 2.2% 64,759 66,209 68,003 65,510 3.8% 1.6% 2.3% 15,906 16,158 15,879 16,240 Q4 '10 Q4 '11 FY '10 FY '11 Q4 '10 Q4 '11 FY '10 FY '11 1 Unless otherwise indicated, Q4 reflects three months ended December 31 and FY reflects twelve months ended December 31. Oncor Electric Delivery 5

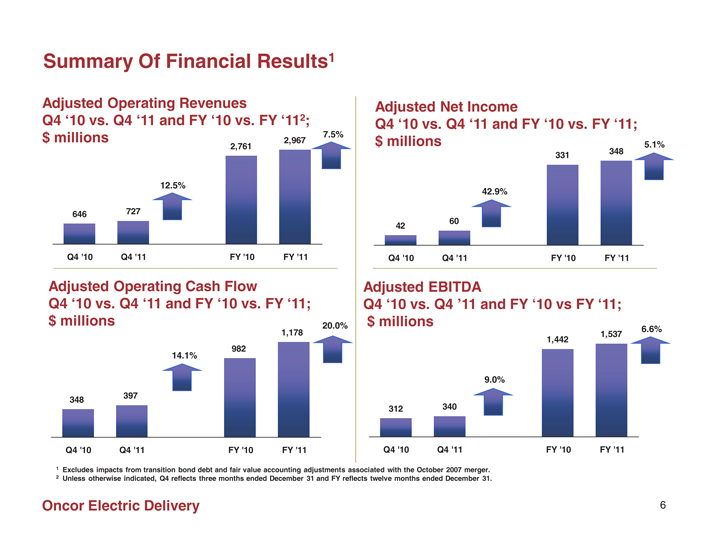

Summary Of Financial Results1 Adjusted Operating Revenues Adjusted Net Income Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘112; Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘11; $ millions 2,967 7.5% $ millions 5.1% 2,761 331 348 12.5% 42.9% 646 727 60 42 Q4 '10 Q4 '11 FY '10 FY '11 Q4 '10 Q4 '11 FY '10 FY '11 Adjusted Operating Cash Flow Adjusted EBITDA Q4 ‘10 vs. Q4 ‘11 and FY ‘10 vs. FY ‘11; Q4 ‘10 vs. Q4 ’11 and FY ‘10 vs FY ‘11; $ millions 20.0% $ millions 1,178 1,537 6.6% 1,442 982 14.1% 9.0% 348 397 312 340 Q4 '10 Q4 '11 FY '10 FY '11 Q4 '10 Q4 '11 FY '10 FY '11 Excludes impacts from transition bond debt and fair value accounting adjustments associated with the October 2007 merger. Unless otherwise indicated, Q4 reflects three months ended December 31 and FY reflects twelve months ended December 31. Oncor Electric Delivery

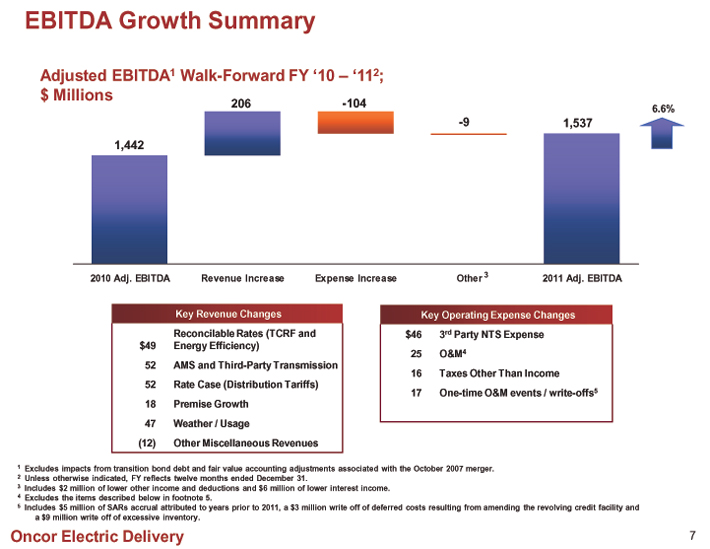

EBITDA Growth Summary

Adjusted EBITDA1 Walk-Forward FY ‘10 – ‘112;

$ Millions

1,442

206

-104

-9

1,537

6.6%

2010 Adj. EBITDA

Revenue Increase

Expense Increase

Other 3

2011 Adj. EBITDA

Key Revenue Changes

Reconcilable Rates (TCRF and

$49 Energy Efficiency)

52 AMS and Third-Party Transmission

52 Rate Case (Distribution Tariffs)

18 Premise Growth

47 Weather / Usage

(12) Other Miscellaneous Revenues

Key Operating Expense Changes

$46

3rd Party NTS Expense

25

O&M4

16

Taxes Other Than Income

17

One-time O&M events / write-offs5

1 Excludes impacts from transition bond debt and fair value accounting adjustments associated with the October 2007 merger.

2 Unless otherwise indicated, FY reflects twelve months ended December 31.

3 Includes $2 million of lower other income and deductions and $6 million of lower interest income.

4 Excludes the items described below in footnote 5.

5 Includes $5 million of SARs accrual attributed to years prior to 2011, a $3 million write off of deferred costs resulting from amending the revolving credit facility and a $9 million write off of excessive inventory.

Oncor Electric Delivery

7

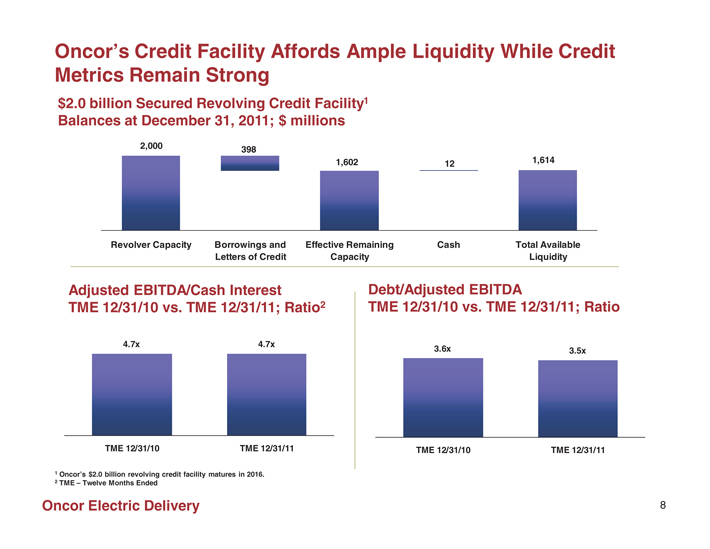

Oncor’s Credit Facility Affords Ample Liquidity While Credit Metrics Remain Strong $2.0 billion Secured Revolving Credit Facility1 Balances at December 31, 2011; $ millions 2,000 398 1,602 1,614 12 Revolver Capacity Borrowings and Effective Remaining Cash Total Available Letters of Credit Capacity Liquidity Adjusted EBITDA/Cash Interest Debt/Adjusted EBITDA TME 12/31/10 vs. TME 12/31/11; Ratio2 TME 12/31/10 vs. TME 12/31/11; Ratio 4.7x 4.7x 3.6x 3.5x TME 12/31/10 TME 12/31/11 TME 12/31/10 TME 12/31/11 1 Oncor’s $2.0 billion revolving credit facility matures in 2016. 2 TME – Twelve Months Ended Oncor Electric Delivery 8

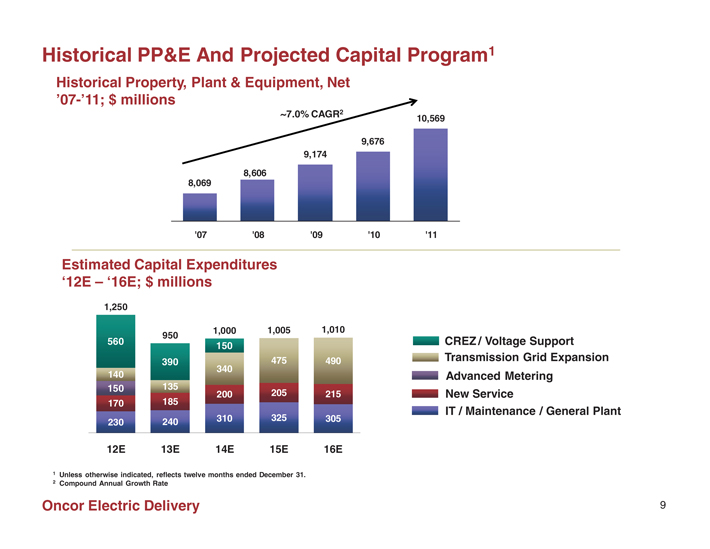

Historical PP&E And Projected Capital Program Historical Property, Plant & Equipment, Net ’07-’11; $ millions1 ~7.0% CAGR2 10,569 9,676 9,174 8,606 8,069 '07 '08 '09 '10 '11 Estimated Capital Expenditures ‘12E – ‘16E; $ millions 1,250 1,000 1,005 1,010 950 560 CREZ1 / Voltage Support 150 475 490 Transmission Grid Expansion 390 340 140 Advanced Metering 150 135 200 205 215 New Service 170 185 IT / Maintenance / General Plant 310 325 305 230 240 12E 13E 14E 15E 16E 1 Unless otherwise indicated, reflects twelve months ended December 31. 2 Compound Annual Growth Rate Oncor Electric Delivery 9

4th Quarter and Year End 2011 Investor Call Agenda ?Financial Overview David Davis Chief Financial Officer ?Operational Review Bob Shapard Chairman and CEO ?Q&A Oncor Electric Delivery

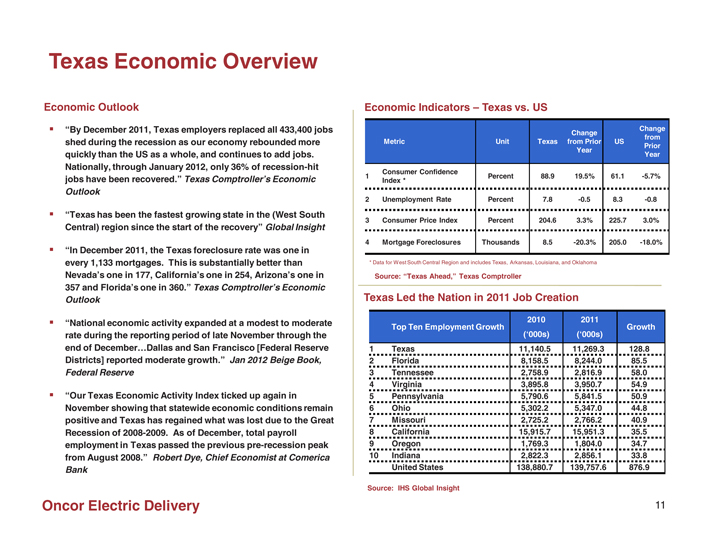

Texas Economic Overview Economic Outlook “By December 2011, Texas employers replaced all 433,400 jobs shed during the recession as our economy rebounded more quickly than the US as a whole, and continues to add jobs. Nationally, through January 2012, only 36% of recession-hit jobs have been recovered.” Texas Comptroller’s Economic Outlook “Texas has been the fastest growing state in the (West South Central) region since the start of the recovery” Global Insight “In December 2011, the Texas foreclosure rate was one in every 1,133 mortgages. This is substantially better than Nevada’s one in 177, California’s one in 254, Arizona’s one in 357 and Florida’s one in 360.” Texas Comptroller’s Economic Outlook “National economic activity expanded at a modest to moderate rate during the reporting period of late November through the end of December…Dallas and San Francisco [Federal Reserve Districts] reported moderate growth.” Jan 2012 Beige Book, Federal Reserve “Our Texas Economic Activity Index ticked up again in November showing that statewide economic conditions remain positive and Texas has regained what was lost due to the Great Recession of 2008-2009. As of December, total payroll employment in Texas passed the previous pre-recession peak from August 2008.” Robert Dye, Chief Economist at Comerica Bank Economic Indicators – Texas vs. US Change Change from Metric Unit Texas from Prior US Prior Year Year Consumer Confidence 1 Percent 88.9 19.5% 61.1 -5.7% Index * 2 Unemployment Rate Percent 7.8 -0.5 8.3 -0.8 3 Consumer Price Index Percent 204.6 3.3% 225.7 3.0% 4 Mortgage Foreclosures Thousands 8.5 -20.3% 205.0 -18.0% * Data for West South Central Region and includes Texas, Arkansas, Louisiana, and Oklahoma Source: “Texas Ahead,” Texas Comptroller Texas Led the Nation in 2011 Job Creation 2010 2011 Top Ten Employment Growth Growth (‘000s) (‘000s) 1 Texas 11,140.5 11,269.3 128.8 2 Florida 8,158.5 8,244.0 85.5 3 Tennessee 2,758.9 2,816.9 58.0 4 Virginia 3,895.8 3,950.7 54.9 5 Pennsylvania 5,790.6 5,841.5 50.9 6 Ohio 5,302.2 5,347.0 44.8 7 Missouri 2,725.2 2,766.2 40.9 8 California 15,915.7 15,951.3 35.5 9 Oregon 1,769.3 1,804.0 34.7 10 Indiana 2,822.3 2,856.1 33.8 United States 138,880.7 139,757.6 876.9 Source: IHS Global Insight Oncor Electric Delivery 11

AMS Initiative On Target For 2012 Completion Advanced Metering Initiative ??More than 2.3M meters installed through December 31, 2011; ~788,000 meters installed in ’11 ??$518M invested in AMS through December 31, 2011; $158M invested in 2011 ??$150M expected investment with ~960,000 meters to be installed in 2012 Oncor Electric Delivery 12

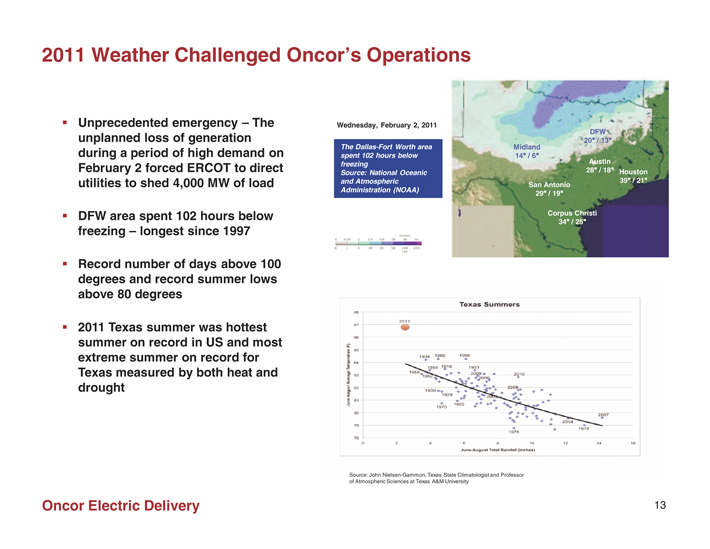

2011 Weather Challenged Oncor’s Operations Unprecedented emergency – The unplanned loss of generation during a period of high demand on February 2 forced ERCOT to direct utilities to shed 4,000 MW of load DFW area spent 102 hours below freezing – longest since 1997 Record number of days above 100 degrees and record summer lows above 80 degrees 2011 Texas summer was hottest summer on record in US and most extreme summer on record for Texas measured by both heat and drought Wednesday, February 2, 2011 DFW / 13 The Dallas-Fort Worth area Midland spent 102 hours below 14 / 6 freezing Austin Source: National Oceanic 28 / 18 Houston and Atmospheric 39 / 21 San Antonio Administration (NOAA) 29 / 19 Corpus Christi 34 / 25 Source: John Nielsen-Gammon, Texas State Climatologist and Professor of Atmospheric Sciences at Texas A&M University Oncor Electric Delivery 13

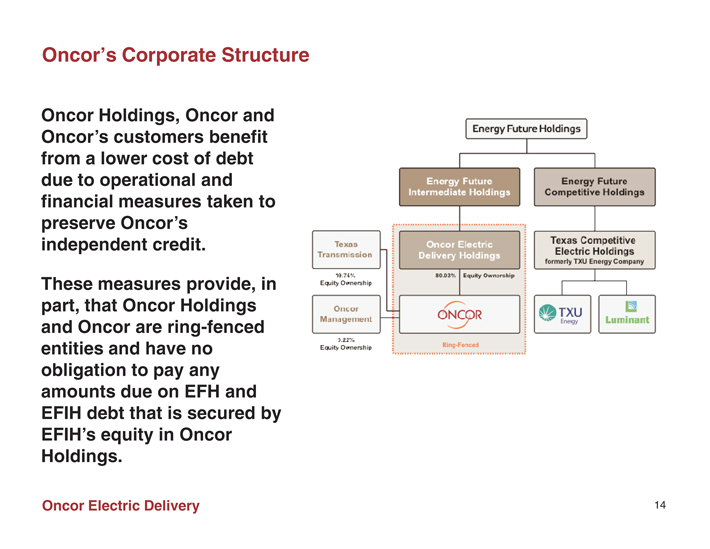

Oncor’s Corporate Structure Oncor Holdings, Oncor and Oncor’s customers benefit from a lower cost of debt due to operational and financial measures taken to preserve Oncor’s independent credit. These measures provide, in part, that Oncor Holdings and Oncor are ring-fenced entities and have no obligation to pay any amounts due on EFH and EFIH debt that is secured by EFIH’s equity in Oncor Holdings. Oncor Electric Delivery 14

Appendix—Regulation G Reconciliations and Supplemental Data Oncor Electric Delivery 15

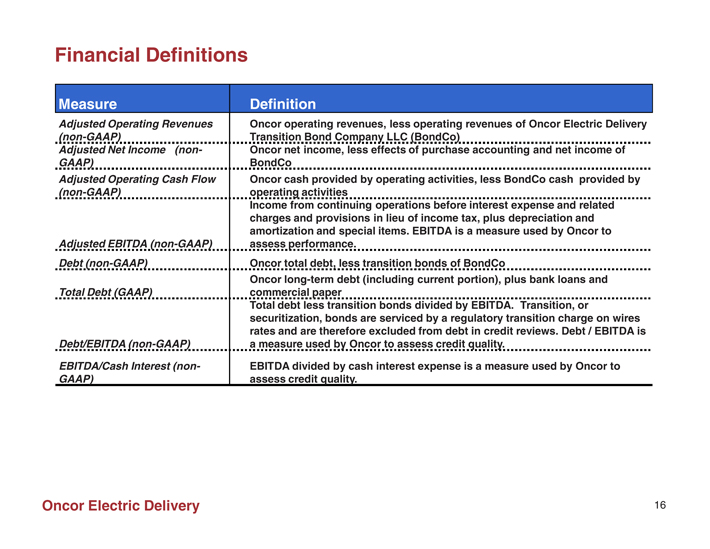

Financial Definitions Measure Definition Adjusted Operating Revenues Oncor operating revenues, less operating revenues of Oncor Electric Delivery (non-GAAP) Transition Bond Company LLC (BondCo) Adjusted Net Income (non- Oncor net income, less effects of purchase accounting and net income of GAAP) BondCo Adjusted Operating Cash Flow Oncor cash provided by operating activities, less BondCo cash provided by (non-GAAP) operating activities Income from continuing operations before interest expense and related charges and provisions in lieu of income tax, plus depreciation and amortization and special items. EBITDA is a measure used by Oncor to Adjusted EBITDA (non-GAAP) assess performance. Debt (non-GAAP) Oncor total debt, less transition bonds of BondCo Oncor long-term debt (including current portion), plus bank loans and Total Debt (GAAP) commercial paper Total debt less transition bonds divided by EBITDA. Transition, or securitization, bonds are serviced by a regulatory transition charge on wires rates and are therefore excluded from debt in credit reviews. Debt / EBITDA is Debt/EBITDA (non-GAAP) a measure used by Oncor to assess credit quality. EBITDA/Cash Interest (non- EBITDA divided by cash interest expense is a measure used by Oncor to GAAP) assess credit quality. Oncor Electric Delivery 16

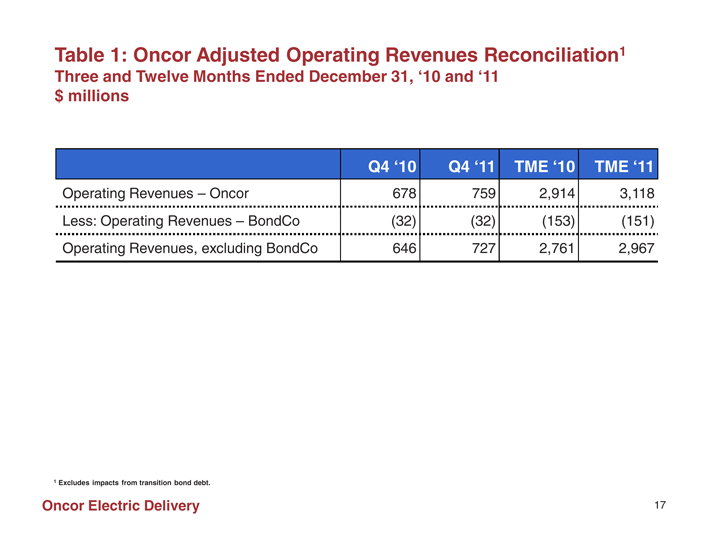

Table 1: Oncor Adjusted Operating Revenues Reconciliation1 Three and Twelve Months Ended December 31, ‘10 and ‘11 $ millions Q4 ‘10 Q4 ‘11 TME ‘10 TME ‘11 Operating Revenues – Oncor 678 759 2,914 3,118 Less: Operating Revenues – BondCo (32) (32) (153) (151) Operating Revenues, excluding BondCo 646 727 2,761 2,967 1 Excludes impacts from transition bond debt. Oncor Electric Delivery 17

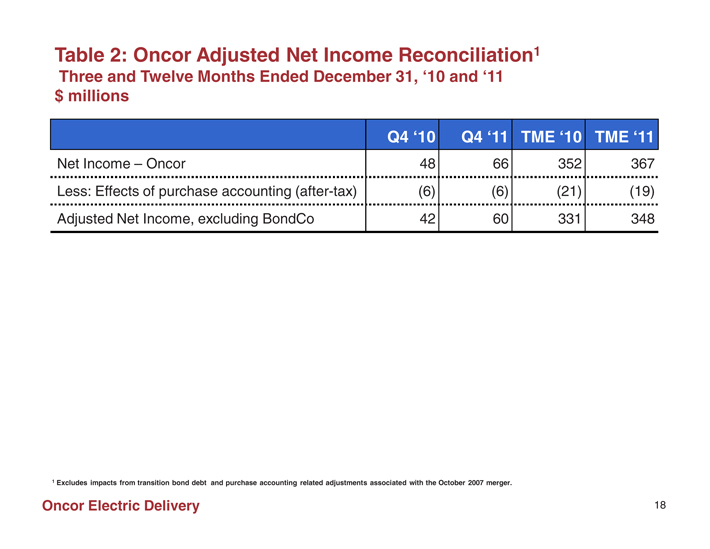

Table 2: Oncor Adjusted Net Income Reconciliation1 Three and Twelve Months Ended December 31, ‘10 and ‘11 $ millions Q4 ‘10 Q4 ‘11 TME ‘10 TME ‘11 Net Income – Oncor 48 66 352 367 Less: Effects of purchase accounting (after-tax) (6) (6) (21) (19) Adjusted Net Income, excluding BondCo 42 60 331 348 1 Excludes impacts from transition bond debt and purchase accounting related adjustments associated with the October 2007 merger. Oncor Electric Delivery 18

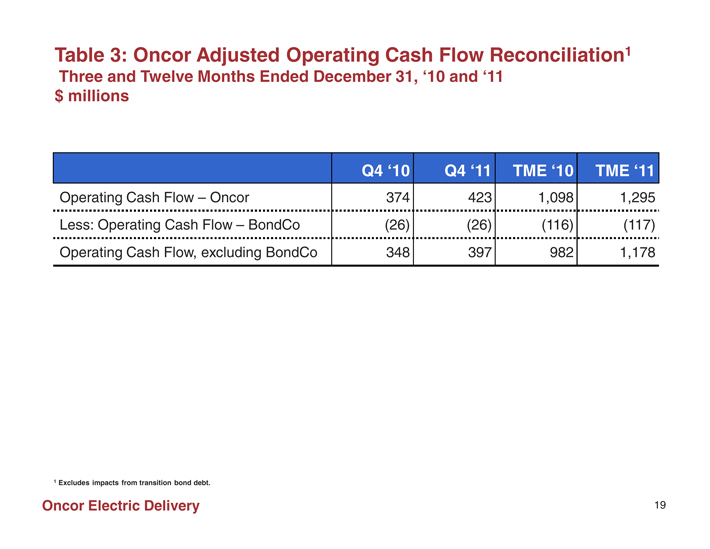

Table 3: Oncor Adjusted Operating Cash Flow Reconciliation1 Three and Twelve Months Ended December 31, ‘10 and ‘11 $ millions Q4 ‘10 Q4 ‘11 TME ‘10 TME ‘11 Operating Cash Flow – Oncor 374 423 1,098 1,295 Less: Operating Cash Flow – BondCo (26) (26) (116) (117) Operating Cash Flow, excluding BondCo 348 397 982 1,178 1 Excludes impacts from transition bond debt. Oncor Electric Delivery 19

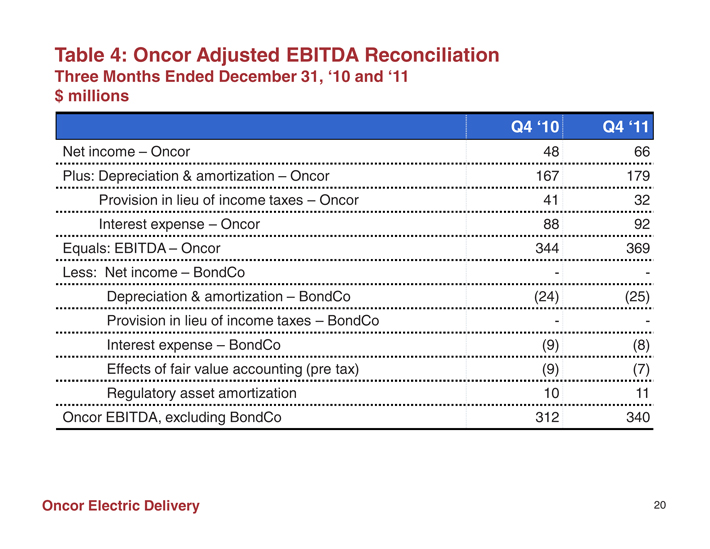

Table 4: Oncor Adjusted EBITDA Reconciliation Three Months Ended December 31, ‘10 and ‘11 $ millions Net income – Oncor 48 66 Plus: Depreciation & amortization – Oncor 167 179 Provision in lieu of income taxes – Oncor 41 32 Interest expense – Oncor 88 92 Equals: EBITDA – Oncor 344 369 Less: Net income – BondCo—-Depreciation & amortization – BondCo (24) (25) Provision in lieu of income taxes – BondCo—-Interest expense – BondCo (9) (8) Effects of fair value accounting (pre tax) (9) (7) Regulatory asset amortization 10 11 Oncor EBITDA, excluding BondCo 312 340 Oncor Electric Delivery 20

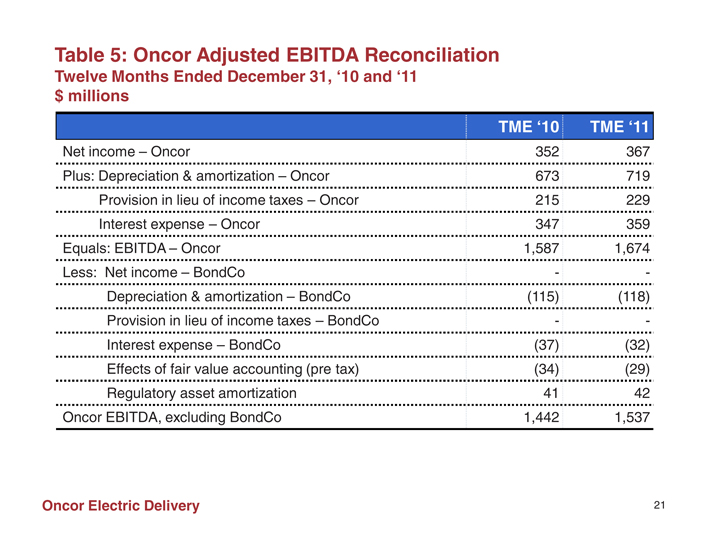

Table 5: Oncor Adjusted EBITDA Reconciliation Twelve Months Ended December 31, ‘10 and ‘11 $ millions TME ‘10 TME ‘11 Net income – Oncor 352 367 Plus: Depreciation & amortization – Oncor 673 719 Provision in lieu of income taxes – Oncor 215 229 Interest expense – Oncor 347 359 Equals: EBITDA – Oncor 1,587 1,674 Less: Net income – BondCo—- Depreciation & amortization – BondCo (115) (118) Provision in lieu of income taxes – BondCo—- Interest expense – BondCo (37) (32) Effects of fair value accounting (pre tax) (34) (29) Regulatory asset amortization 41 42 Oncor EBITDA, excluding BondCo 1,442 1,537 Oncor Electric Delivery 21

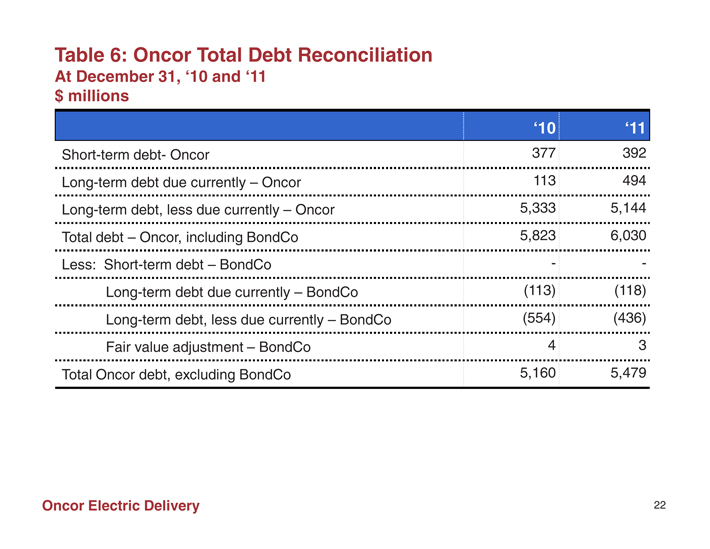

Table 6: Oncor Total Debt Reconciliation At December 31, ‘10 and ‘11 $ millions ‘10 ‘11 Short-term debt- Oncor 377 392 Long-term debt due currently – Oncor 113 494 Long-term debt, less due currently – Oncor 5,333 5,144 Total debt – Oncor, including BondCo 5,823 6,030 Less: Short-term debt – BondCo—- Long-term debt due currently – BondCo (113) (118) Long-term debt, less due currently – BondCo (554) (436) Fair value adjustment – BondCo 4 3 Total Oncor debt, excluding BondCo 5,160 5,479 Oncor Electric Delivery 22

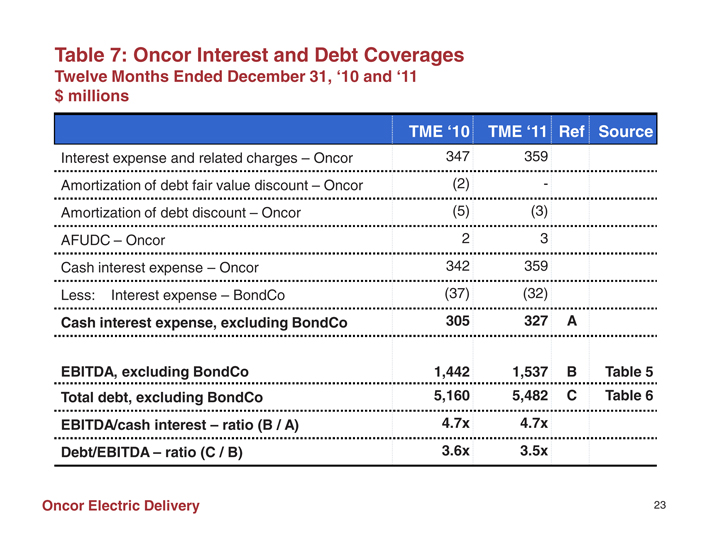

Table 7: Oncor Interest and Debt Coverages Twelve Months Ended December 31, ‘10 and ‘11 $ millions TME ‘10 TME ‘11 Ref Source Interest expense and related charges – Oncor 347 359 Amortization of debt fair value discount – Oncor (2) -Amortization of debt discount – Oncor (5) (3) AFUDC – Oncor 2 3 Cash interest expense – Oncor 342 359 Less: Interest expense – BondCo (37) (32) Cash interest expense, excluding BondCo 305 327 A EBITDA, excluding BondCo 1,442 1,537 B Table 5 Total debt, excluding BondCo 5,160 5,482 C Table 6 EBITDA/cash interest – ratio (B / A) 4.7x 4.7x Debt/EBITDA – ratio (C / B) 3.6x 3.5x Oncor Electric Delivery 23