Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Mondelez International, Inc. | d304731dex991.htm |

| 8-K - FORM 8-K - Mondelez International, Inc. | d304731d8k.htm |

Kraft

Foods February 21, 2012

CAGNY Conference

1

Exhibit 99.2 |

Forward-looking statements

2

This

slide

presentation

contains

a

number

of

forward-looking

statements.

The

words

“believe,”

“expect,”

“anticipate,”

“optimistic,”

“intend,”

“plan,”

“goals,”

“may,”

“aim,”

“will”

and

similar

expressions

are

intended

to

identify

our

forward-looking

statements.

Examples

of

forward-looking

statements

include,

but

are

not

limited

to,

statements

we

make

regarding

our

virtuous

cycle

of

growth;

our

5-10-10

strategy;

Kraft

Foods

Developing

Markets

and

Kraft

Foods

Europe

growth

in

2012;

the

2012

environment;

the

three

priorities

for

the

grocery

and

snacks

businesses’

success;

Power

Brands

and

2012

organic

growth;

product

line

pruning;

factors

that

will

drive

2012

results;

2012

top-line

momentum;

Cadbury

revenue

synergies;

cost

management;

2012

top-tier

growth;

one-time

and

refinancing

costs;

launching

two

investment

grade

companies;

sustainable,

top-tier

performance;

expectations

for

the

North

American

grocery

and

Global

snacks

companies;

next

steps

related

to

the

spin-off;

and

what

shareholders

can

expect

from

2012.

These

forward-looking

statements

involve

risks

and

uncertainties,

many

of

which

are

beyond

our

control,

and

important

factors

that

could

cause

actual

results

to

differ

materially

from

those

in

the

forward-looking

statements

include,

but

are

not

limited

to,

increased

competition,

pricing

actions,

continued

volatility

in

commodity

costs,

increased

costs

of

sales,

our

indebtedness

and

our

ability

to

pay

our

indebtedness,

risks

from

operating

globally,

our

failure

to

successfully

execute

in

developing

markets,

our

failure

to

recognize

the

synergies

from

our

combination

with

Cadbury;

our

failure

to

launch

two

successful

independent

companies;

and

tax

law

changes.

For

additional

information

on

these

and

other

factors

that

could

affect

our

forward-looking

statements,

see

our

risk

factors,

as

they

may

be

amended

from

time

to

time,

set

forth

in

our

filings

with

the

SEC,

including

our

most

recently

filed

Annual

Report

on

Form

10-K

and

subsequent

reports

on

Forms

10-Q

and

8-K.

We

disclaim

and

do

not

undertake

any

obligation

to

update

or

revise

any

forward-looking

statement

in

this

slide

presentation,

except

as required

by applicable law or regulation. |

Agenda

•

Driving sustainable, top-tier growth

•

Building on success in North America

•

2012 guidance

•

The path to separation

3 |

4

Irene Rosenfeld

Chairman and CEO |

Virtuous cycle

of growth is paying off 5

Focus on Power

Brands

+8% in 2011

Drive Top-Tier Growth

Organic Net Revenue

+6.6%

(1)

(1)

Reported Net Revenue growth was 10.5%. See GAAP to Non-GAAP reconciliation at the

end of this presentation. |

Strong growth

in global snacks portfolio •

Global Biscuits +9%

–

Developing Markets up double-digits

–

Developed Markets up mid-single digits

•

Global Chocolate +6%

–

Developing Markets up double digits

–

Developed Markets up slightly

•

Global Gum & Candy +1%

–

Developing Markets up high-single digits

–

Developed Markets down mid-single digits

6

(1) Reflects FY 2011 Organic Net Revenue Growth. Reported FY 2011 Net Revenue

growth was 11.5% for Biscuits, 16.1% for Chocolate and 11.8% for Gum & Candy.

Global Biscuits includes snack nuts. See GAAP to Non-GAAP reconciliation at

the end of this presentation. (1)

(1)

(1) |

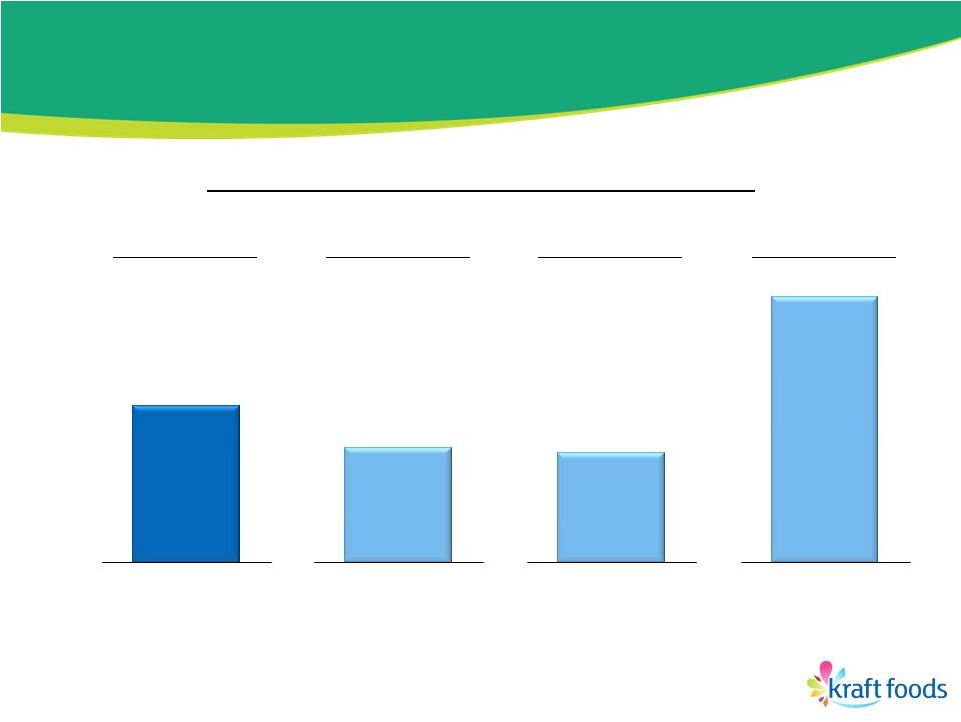

Delivering

top-tier organic growth 7

Organic

Revenue

Growth

(Fiscal

Year)

*

2009

2010

2011

(1)

(2)

(2)

(2)

(2)

(4)

(2)

(2)

(2)

(2)

(2)

(3)

(2)

1

General Mills

8.5%

1

Danone

6.9%

1

Danone

7.8%

2

ConAgra

7.7%

2

Hershey

6.1%

2

Nestlé

7.5%

3

Heinz

5.5%

3

Coca-Cola

6.0%

3

Hershey

6.9%

4

Nestlé

4.1%

4

Nestlé

6.0%

4

Kraft Foods

6.6%

5

Coca-Cola

4.0%

5

General Mills

4.0%

5

PepsiCo

5.0%

6

Hershey

4.0%

6

PepsiCo

3.5%

6

Sara Lee

4.9%

7

PepsiCo

4.0%

7

Kraft Foods

3.1/3.2%

7

Kellogg

4.5%

8

Danone

3.2%

8

Heinz

2.1%

8

Coca-Cola

4.0%

9

Campbell

3.0%

9

ConAgra

(0.8)%

9

General Mills

2.0%

10

Kellogg

3.0%

10

Kellogg

(1.3)%

10

Heinz

1.9%

11

Sara Lee

2.7%

11

Campbell

(2.0)%

11

ConAgra

1.1%

12

Kraft Foods

1.5%

12

Sara Lee

(2.8)%

12

Campbell

(1.0)%

* Source: Thomson First Call.

(1)

Reported Net Revenue growth was 27.0%; Combined Organic Net Revenue Growth was 3.1%; Kraft

Foods Base Organic Net Revenue growth was 3.2%. See GAAP to Non-GAAP

reconciliation at the end of this presentation.

(2)

Per company reports.

(3)

Reported net revenue growth was 10.5%. See GAAP to Non-GAAP reconciliation at the end

of this presentation.

(4)

Reflects Wall Street estimate. |

Virtuous cycle

of growth is paying off 8

Focus on Power

Brands

+8% in 2011

Reduce Costs

Productivity

>4%% COGS

Drive Top-Tier Growth

Organic Net Revenue

+6.6%

(1)

(1)

Reported Net Revenue growth was 10.5%. See GAAP to Non-GAAP reconciliation at the

end of this presentation. |

Virtuous cycle

of growth is paying off 9

Focus on Power

Brands

+8% in 2011

Reduce Costs

Productivity

>4%% COGS

Leverage Overheads

% of NR down (60)bps

(2)

Drive Top-Tier Growth

Organic Net Revenue

+6.6%

(1)

(1)

Reported Net Revenue growth was 10.5%. See GAAP to Non-GAAP reconciliation at

the end of this presentation.

(2)

Underlying overheads as a % of net revenue excludes Integration Program costs,

acquisition-related costs and costs associated with the proposed spin-off of the North American

grocery business. Reported overheads as a % of net revenue was down (130) bps versus

2010. See GAAP to Non-GAAP reconciliation at the end of this presentation. |

Virtuous cycle

of growth is paying off 10

Focus on Power

Brands

+8% in 2011

Reinvest in Growth

A&C 8% of NR

NPD 10%+ of NR

Reduce Costs

Productivity

>4%% COGS

Leverage Overheads

% of NR down (60)bps

(2)

Drive Top-Tier Growth

Organic Net Revenue

+6.6%

(1)

(1)

Reported Net Revenue growth was 10.5%. See GAAP to Non-GAAP reconciliation at the end

of this presentation.

(2)

Underlying overheads as a % of net revenue excludes Integration Program costs,

acquisition-related costs and costs associated with the proposed spin-off of the North American

grocery business. Reported overheads as a % of net revenue was down (130) bps versus

2010. See GAAP to Non-GAAP reconciliation at the end of this presentation. |

Operating

gains fueling EPS growth 11

2010

Diluted

EPS

2010

Adjustments

(1)

Operating

Gains

(2)

Other,

net

(3)

2011

Operating

EPS

(5)

$2.39

$(0.37)

$0.25

$0.02

$2.29

2010

Operating

EPS

(5)

$2.02

Non-

Operating

Items

(4)

$(0.30)

2011

Diluted

EPS

$1.99

+13%

+10% constant FX

(1)

2010 Adjustments include earnings and gain from discontinued operations,

acquisition-related costs, Integration Program costs and the U.S. Healthcare legislation

impact on deferred taxes.

(3)

“Other, net” includes the impact of: decreases in operating income from divestitures,

primarily the loss of the Starbucks CPG business; the increase in operations from one

month of Cadbury; the change in restructuring accrual reversals and asset impairments; the change in unrealized gains/losses

from hedging activities; favorable foreign currency; higher interest expense; changes in taxes;

and changes in shares outstanding.

(4)

Non-operating items include Integration Program costs and costs related to the proposed

spin-off of the North American Grocery business.

(5)

See GAAP to Non-GAAP reconciliation at the end of this presentation.

(2)

Includes

the

benefit

of

accounting

calendar

changes

(including

the

impact

of

the

53

rd

week

of

shipments). |

Delivering

top-tier earnings growth 12

2009

2010

2011

(2)

(4)

(4)

(4)

(4)

(3)

(4)

(4)

(4)

(4)

(4)

(4)

(4)

Operating EPS Growth

(1)

1

Hershey

15.4%

1

Hershey

17.5%

1

Kraft Foods

13.4%

2

General Mills

13.1%

2

General Mills

15.6%

2

Hershey

10.6%

3

Heinz

10.3%

3

ConAgra

14.5%

3

Coca-Cola

10.0%

4

Kraft Foods

8.0%

4

Coca-Cola

14.1%

4

General Mills

7.8%

5

Campbell

6.2%

5

PepsiCo

11.3%

5

Heinz

7.3%

6

Kellogg

5.7%

6

Campbell

11.3%

6

Danone

6.6%

7

PepsiCo

0.8%

7

Nestlé

7.4%

7

PepsiCo

6.5%

8

Nestlé

0.7%

8

Danone

5.4%

8

Campbell

2.8%

9

Danone

(0.8)%

9

Kraft Foods

4.7%

9

Sara Lee

2.6%

10

Coca-Cola

(2.9)%

10

Kellogg

4.4%

10

Kellogg

2.4%

11

Sara Lee

(15.2)%

11

Heinz

(1.0)%

11

ConAgra

0.6%

12

ConAgra

(20.0)%

12

Sara Lee

(9.5)%

12

Nestlé

(7.2)%

(1)

Source: Thomson First Call.

(2)

Represents

Operating

EPS.

Diluted

EPS

declined

17.7%.

See

GAAP

to

Non-GAAP

reconciliation

at

the

end

of

this

presentation.

(3)

Diluted EPS declined 16.7%. See GAAP to Non-GAAP reconciliation at the

end of this presentation. (4)

Per company reports. |

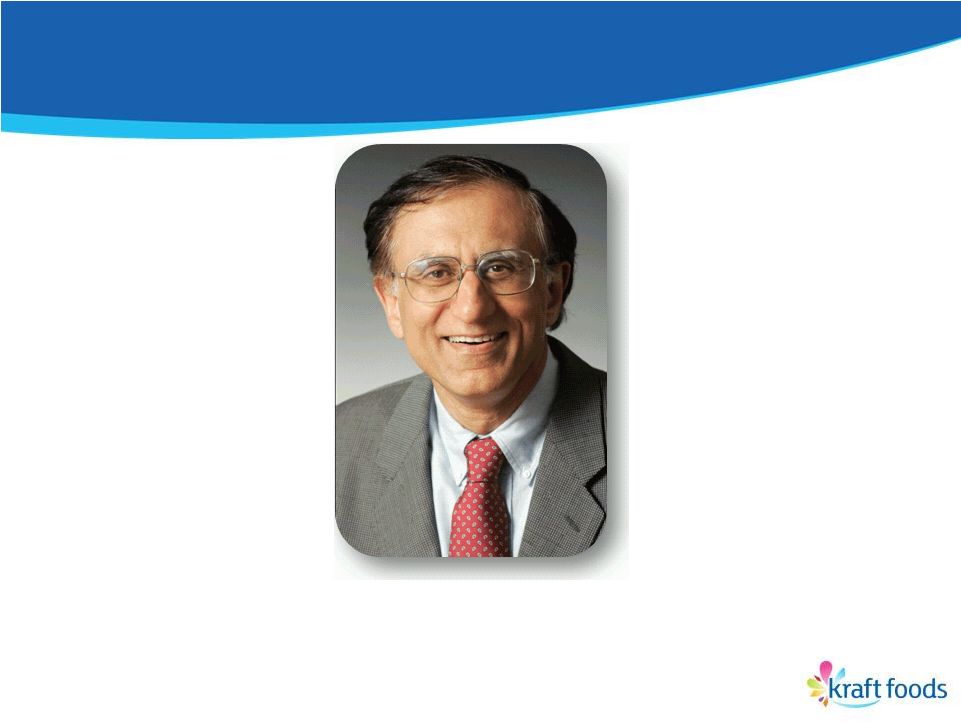

Kraft Foods

Developing Markets 13

Sanjay Khosla

President

Kraft Foods Developing Markets |

Kraft Foods

Developing Markets is driving a virtuous cycle

14

Focus on Power

Brands

+17% in 2011

(1)

Reported

Net

Revenue

growth

was

16.2%.

See

GAAP

to

Non-GAAP

reconciliation

at

the

end

of

this

presentation.

Drive Top-Tier Growth

Organic Net Revenue

+11.2%

(1) |

5-10-10 strategy drives revenue growth

15

5

Categories

10

Power Brands

10

Priority Markets

+12%

India

Chocolate

+30%

+17%

+50%

+35%

+12%

Brazil

+15%

To $2B+

+30%

to $800M+

China |

Kraft Foods

Developing Markets is driving a virtuous cycle

16

Focus on Power

Brands

+17% in 2011

Drive Top-Tier Growth

Organic Net Revenue

+11.2%

(1)

Reduce Costs

Productivity

4% COGS

Leverage Overheads

% of NR down (20) bps

(2)

(1)

Reported Net Revenue growth was 16.2%. See GAAP to Non-GAAP reconciliation at the end of this

presentation.

(2)

Underlying overheads as a % of net revenue excludes Integration Program costs, acquisition-related

costs and costs associated with the proposed spin-off of the North American grocery

business. Reported overheads as a % of net revenue was down (40) bps versus 2010. See GAAP

to Non-GAAP reconciliation at the end of this presentation. |

Kraft Foods

Developing Markets is driving a virtuous cycle

17

Focus on Power

Brands

+17% in 2011

Reinvest in Growth

A&C 10% of NR

NPD 12% of NR

Drive Top-Tier Growth

Organic Net Revenue

+11.2%

(1)

Reduce Costs

Productivity

4% COGS

Leverage Overheads

% of NR down (20) bps

(2)

(1)

Reported Net Revenue growth was 16.2%. See GAAP to Non-GAAP reconciliation at the end

of this presentation.

(2)

Underlying overheads as a % of net revenue excludes Integration Program costs,

acquisition-related costs and costs associated with the proposed spin-off of the North American

grocery business. Reported overheads as a % of net revenue was down (40) bps versus

2010. See GAAP to Non-GAAP reconciliation at the end of this presentation. |

Kraft Foods

Developing Markets will continue to drive strong growth in 2012

•

Relentless focus behind 5-10-10 strategy

•

Capture Cadbury synergies

•

Expand margins through productivity and

overhead leverage

18 |

Kraft Foods

Europe 19

Tim Cofer

President

Kraft Foods Europe |

Kraft Foods

Europe is driving a virtuous cycle 20

Focus on Power

Brands

+7% in 2011

Drive Top-Tier Growth

Organic Net Revenue

+4.6%

(1)

(1)

Reported Net Revenue growth was 14.9%. See GAAP to Non-GAAP reconciliation at the

end of this presentation. |

Power Brands,

innovation and geographic expansion driving growth

21

Choco-Bakery

+29%

+25%

+25%

+18% |

Kraft Foods

Europe is driving a virtuous cycle 22

Focus on Power

Brands

+7% in 2011

Reduce Costs

Productivity

>4% COGS

Drive Top-Tier Growth

Organic Net Revenue

+4.6%

(1)

(1)

Reported Net Revenue growth was 14.9%. See GAAP to Non-GAAP reconciliation at the

end of this presentation. |

Kraft Foods

Europe is driving a virtuous cycle 23

Focus on Power

Brands

+7% in 2011

Reduce Costs

Productivity

>4% COGS

Drive Top-Tier Growth

Organic Net Revenue

+4.6%

(1)

Leverage Overheads

% of NR down (150)bps

(2)

(1)

Reported Net Revenue growth was 14.9%. See GAAP to Non-GAAP reconciliation at the end

of this presentation.

(2)

Underlying overheads as a % of net revenue excludes Integration Program costs,

acquisition-related costs and costs associated with the proposed spin-off of the North American

grocery business. Reported overheads as a % of net revenue was down (200) bps versus

2010. See GAAP to Non-GAAP reconciliation at the end of this presentation. |

Kraft Foods

Europe is driving a virtuous cycle 24

Focus on Power

Brands

+7% in 2011

Reinvest in Growth

A&C 8% of NR

NPD 12% of NR

(1)

Reported Net Revenue growth was 14.9%. See GAAP to Non-GAAP reconciliation at the end

of this presentation. (2)

Underlying overheads as a % of net revenue excludes Integration Program costs,

acquisition-related costs and costs associated with the proposed spin-off of the North American

grocery business. Reported overheads as a % of net revenue was down (200) bps versus

2010. See GAAP to Non-GAAP reconciliation at the end of this presentation.

Reduce Costs

Productivity

>4% COGS

Drive Top-Tier Growth

Organic Net Revenue

+4.6%

(1)

Leverage Overheads

% of NR down (150)bps

(2) |

Kraft Foods

Europe will continue to drive a growth agenda in 2012

•

Top-line momentum

–

Distort investments towards Power Brands

–

Step up innovation

–

Excellent sales execution

–

Enter “white space”

markets

•

Expand margins and fund investments through

relentless cost management

–

Lower overheads

–

Increase productivity

25 |

Building on

Success in North America

26

Tony Vernon

President

Kraft Foods North America |

2011

Priorities •

Revitalize our brands

•

Increase marketing and sales excellence

•

Deliver record cost savings

27 |

Kraft Foods

North America is driving a virtuous cycle

28

Focus on Power

Brands

+4.5% in 2011

Drive Top-Tier Growth

Organic Net Revenue

+4.8%

(1)

(1)

Reported Net Revenue growth was 5.1%. See GAAP to Non-GAAP reconciliation at the end of

this presentation. |

Solid market

share performance in an unprecedented environment

29

Source: 52-weeks ending Dec. 24, 2011. 4-outlet data, Nielsen.

Percent of 2011 U.S. Retail Revenue

36%

Gaining/holding

share

31%

Pricing to

protect profit

13%

Outsized category

growth through

Innovation |

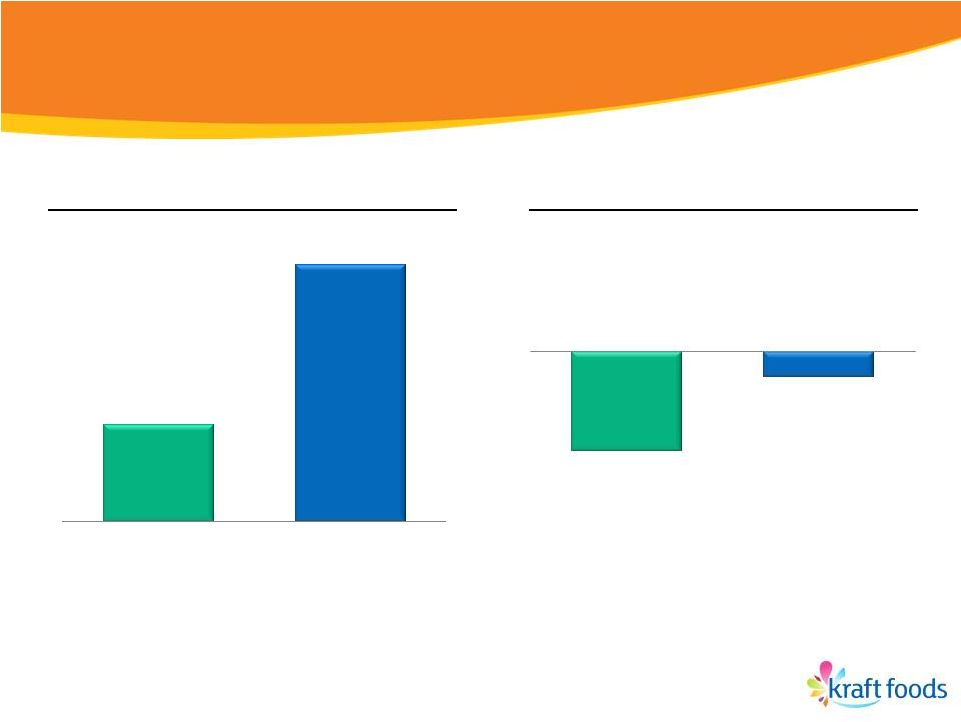

Drove our U.S.

retail categories faster than the industry

30

Total U.S.

Food &

Beverage

Kraft Foods

U.S.

Categories

(2.4)%

(0.6)%

2011 Equivalent

Units Growth

Total U.S.

Food &

Beverage

Kraft Foods

U.S.

Categories

2.7%

7.1%

2011 $ Growth

Source: 52-weeks ending Dec. 24, 2011. 4-outlet data, Nielsen.

|

Kraft Foods

North America is driving a virtuous cycle

31

Focus on Power

Brands

+4.5% in 2011

Leverage Overheads

% of NR down (60)bps

(2)

Drive Top-Tier Growth

Organic Net Revenue

+4.8%

(1)

Reduce Costs

Productivity

>4% COGS

(1)

Reported Net Revenue growth was 5.1%. See GAAP to Non-GAAP reconciliation at the end of

this presentation.

(2)

Reflects underlying overheads as a % of net revenue, which excludes Integration Program costs,

acquisition-related costs and costs associated with the proposed spin-off of the North

American grocery business. Reported overheads as a % of net revenue was down (60) bps

versus 2010. See GAAP to Non-GAAP reconciliation at the end of this presentation. |

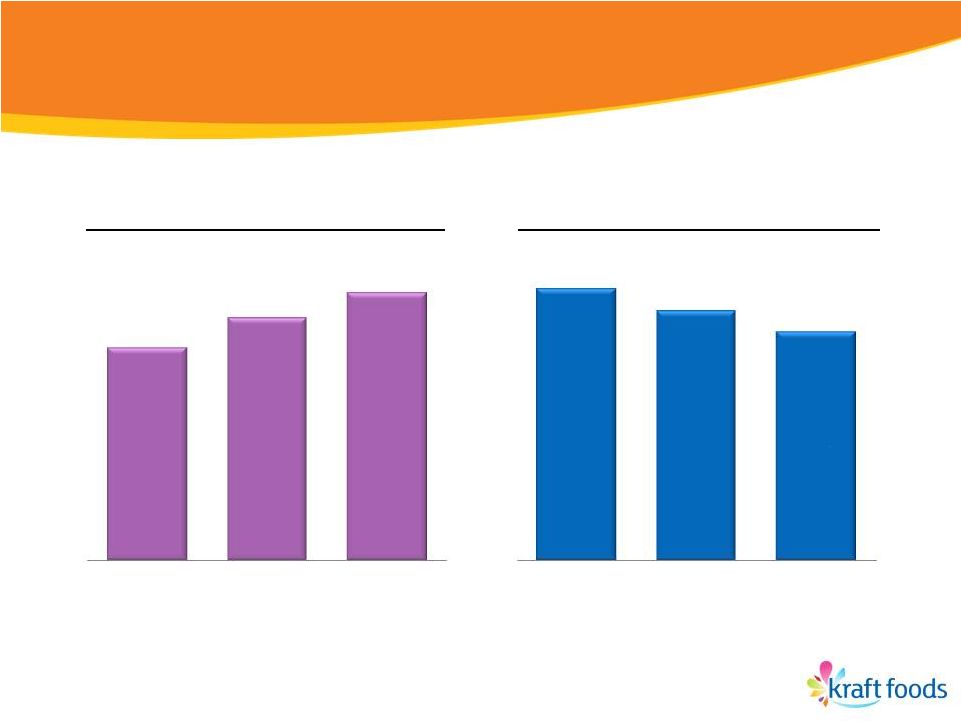

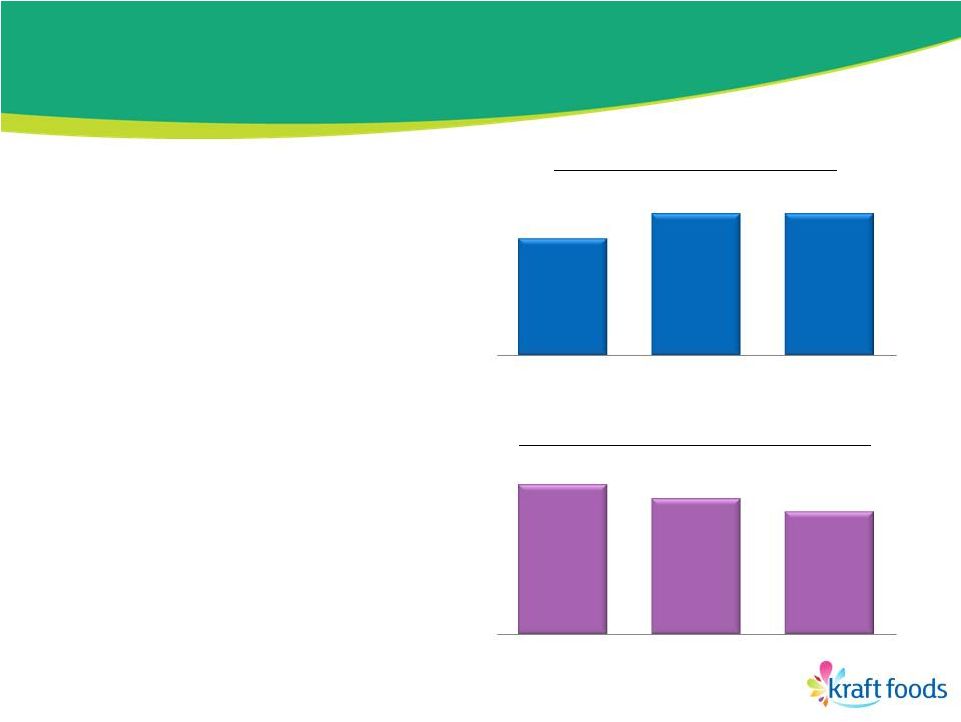

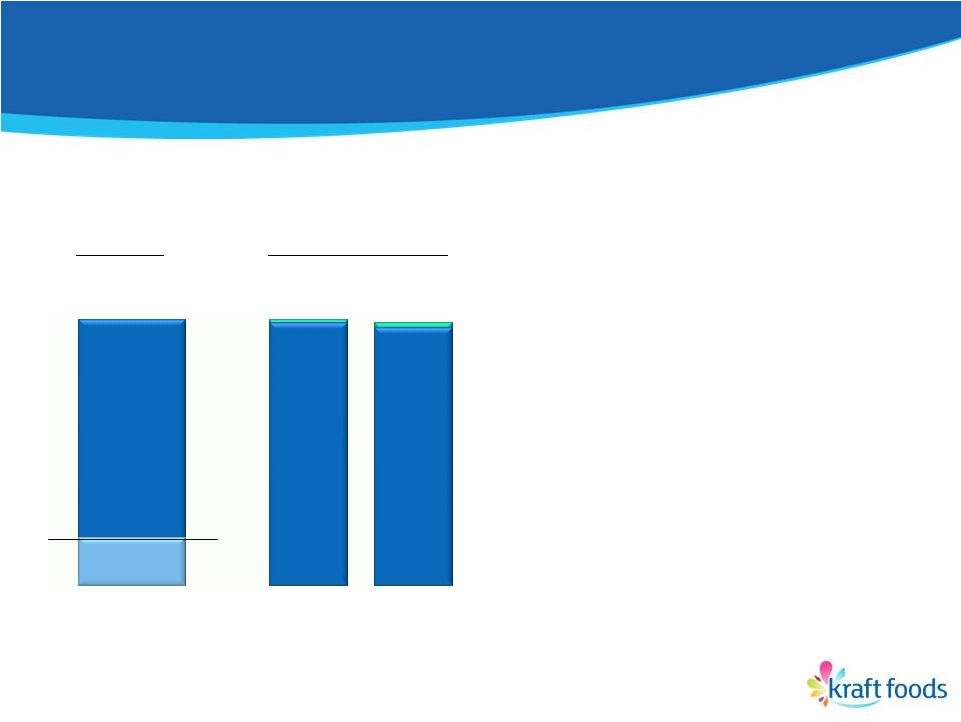

Focus on cost

reduction is paying off 32

Productivity as % of

Cost of Goods Sold

4.0%

4.4%

Overheads as % of

Net Revenue

(1)

12.0%

11.4%

(1)

Reflects underlying overheads as a % of net revenue, which excludes Integration Program costs,

acquisition-related costs and costs associated with the proposed spin-off of

the North American grocery business. Reported overheads as a % of net revenue

were 12.2% and 11.6% in 2010 and 2011, respectively. See GAAP to Non-GAAP

reconciliation at the end of this presentation. (2)

Reflects Kraft Foods base business only.

(3)

Pro forma combined Kraft Foods base business and Cadbury.

3.5%

(2)

12.6%

(3)

2009

2010

2011

2009

2010

2011 |

Kraft Foods

North America is driving a virtuous cycle

33

Focus on Power

Brands

+4.5% in 2011

Leverage Overheads

% of NR down (60)bps

(2)

Reinvest in Growth

A&C 6% of NR

NPD 9% of NR

Drive Top-Tier Growth

Organic Net Revenue

+4.8%

(1)

Reduce Costs

Productivity

4.4% COGS

(1)

Reported Net Revenue growth was 5.1%. See GAAP to Non-GAAP reconciliation at the end of

this presentation.

(2)

Reflects underlying overheads as a % of net revenue, which excludes Integration Program costs,

acquisition-related costs and costs associated with the proposed spin-off of the North

American grocery business. Reported overheads as a % of net revenue was down (60) bps

versus 2010. See GAAP to Non-GAAP reconciliation at the end of this presentation. |

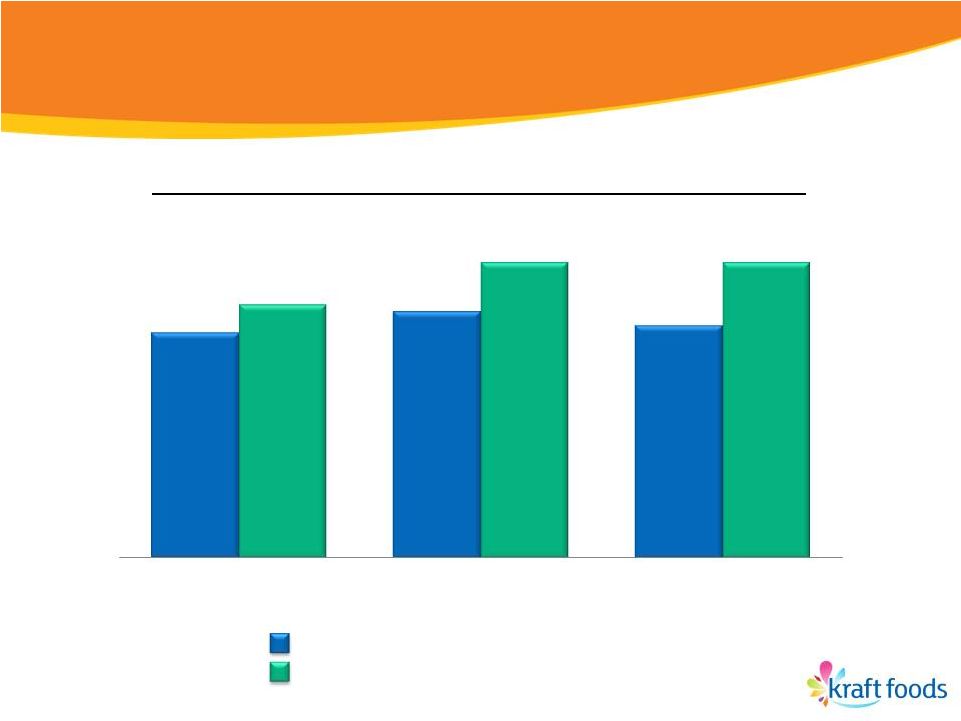

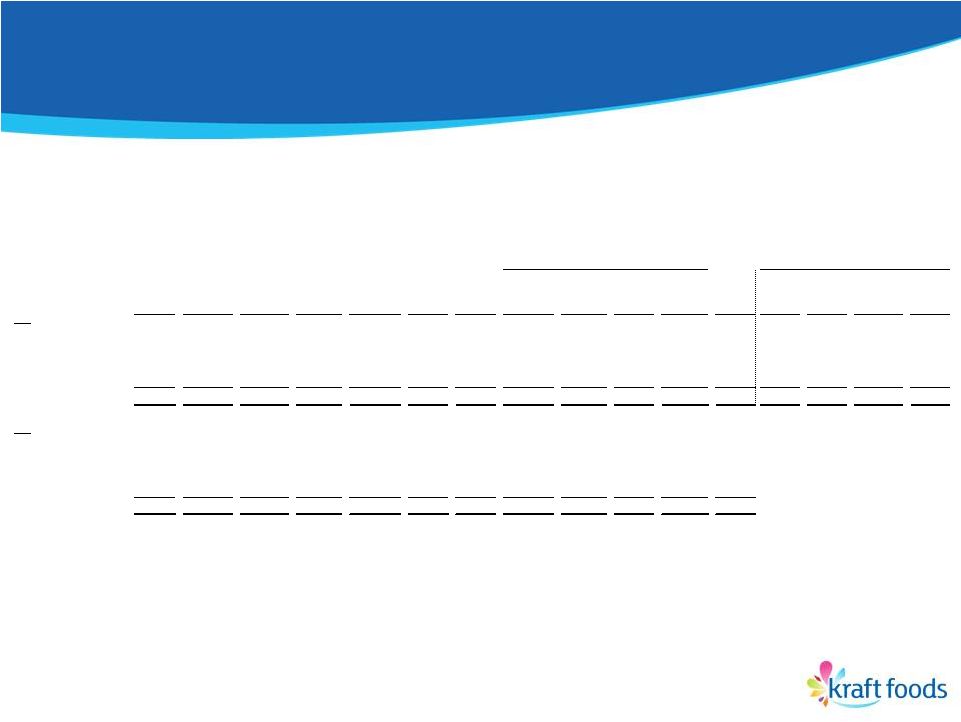

Distorting

brand building investments to Power Brands

34

KFNA A&C as a Percentage of Net Revenues

(1)

(1) Pro forma for Cadbury acquisition.

A&C % of net revenues for total KFNA

A&C % of net revenues for KFNA Power Brands

6.2%

6.5%

6.3%

6.6%

7.2%

7.2%

2009

2010

2011 |

Driving growth

in our iconic brands 35

+12%

+5%

+8%

+9%

+6%

+11%

+7%

+20%

+44%

+5% |

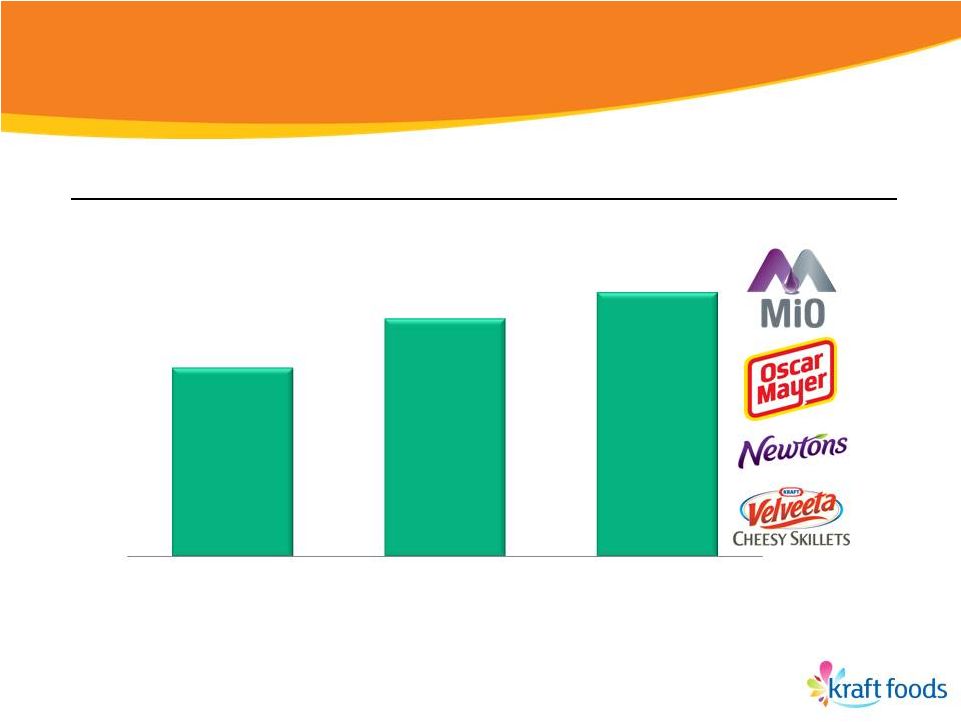

Stepping up

growth from new products 36

(1)

Reflects percentage of net revenue derived from products introduced within the prior 3

years. (2)

Reflects Kraft Foods base business only.

New Product Development as % of Net Revenue

8%

9%

6.5%

(1)

(2)

2009

2010

2011 |

•

Weak GDP rebound

•

High unemployment

•

Commodity costs

expected to remain

high / volatile

•

Low consumer

confidence, but

improving

•

F&B demand

recovering, but

remains weak

•

Value focus will

remain; more than

just low price

•

Rising prices driving

dollar growth but

volume softness

•

Dynamic retail

environment

•

Customers looking

for Kraft to bring

category leadership,

innovation, value

and H&W

37

37

Economy

Consumer

Customer

2012 environment will remain difficult |

Three

priorities will position both grocery and snacks businesses for success

1.

Strategically distort portfolio

–

Drive break-through innovation

–

Skew A&C investments to Power Brands

–

Discontinue products with low profitability

38 |

2012

Innovation 39 |

•

Higher-than-average gross margins

•

Vibrant categories

•

Outsized investments behind product news

40

A&C investments skewed to 21 Power Brands

will drive 2012 organic growth |

Selective

product line pruning will improve mix

•

Eliminating product lines with low profitability

–

40% from North America Foodservice

–

60% from other business units

•

Impacts organic net revenue growth

–

Up to 2 percentage points in North America

–

Up to 1 percentage point for total Kraft

•

Manageable impact to operating income

41 |

Three

priorities will position both grocery and snacks businesses for success

1.

Strategically distort portfolio

2.

Drive towards best-in-class costs

–

Deliver productivity of 4%+

–

Streamline manufacturing and distribution networks

–

Reduce overhead

42 |

Realigning

U.S. Sales organization 43

Grocery

Business

Snacks

Business

Retail Execution

HQ Sales |

Three

priorities will position both grocery and snacks businesses for success

1.

Strategically distort portfolio

2.

Drive towards best-in-class costs

3.

Reignite a winning culture

–

Spirit of a start up, soul of a powerhouse

–

Recruit the best talent

–

Reinvest in our employees

44 |

Summary

•

Kraft Foods North America is driving a

virtuous cycle

•

We will continue to deliver industry-leading

results

•

We will launch two businesses positioned

for success

45 |

Executive

Vice President and CFO

2012 Guidance

Dave Brearton |

2012 results

will be driven by multiple factors •

Strong organic growth from Power Brands

•

Full Cadbury synergies

•

Further gains from End-to-End Cost

Management

•

One-time costs to achieve peak performance

•

Financing costs to execute the separation

47 |

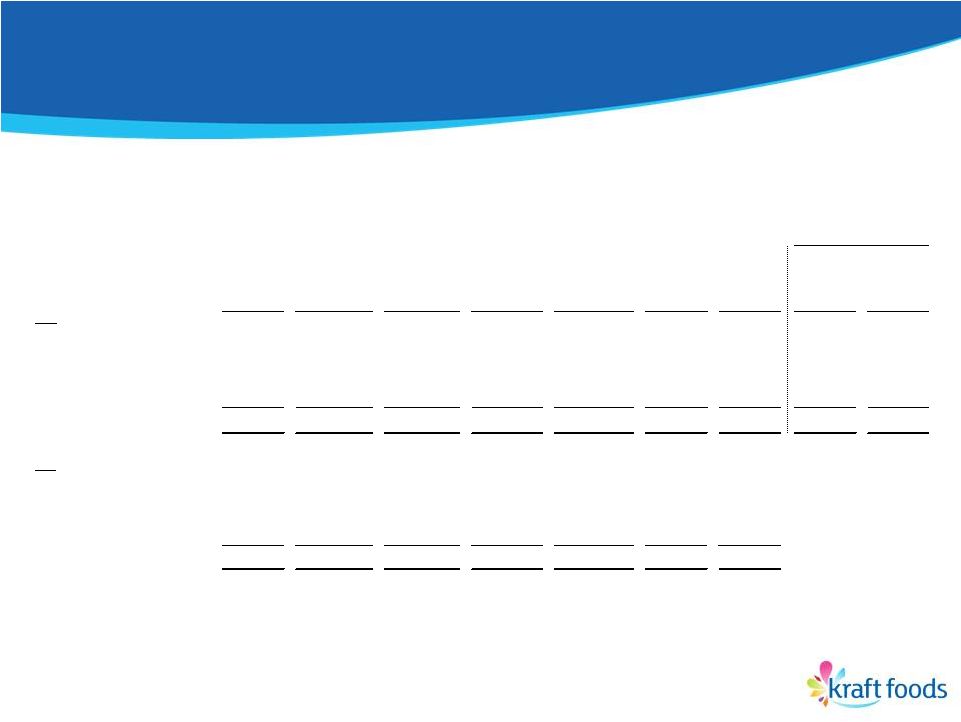

2012 will

benefit from the tailwind of top-line momentum in each region

48

Kraft

Foods

(1)

+6.6%

+4.8%

North

America

(1)

+4.6%

Europe

(1)

+11.2%

Developing

Markets

(1)

Pricing

Vol/Mix

6.0

pp

0.6

pp

6.1

pp

(1.3)

pp

4.4

pp

0.2

pp

7.3

pp

3.9

pp

2011 Organic Net Revenue Growth

(1)

Reported Net Revenues in FY 2011 increased 10.5%, 5.1%, 14.9% and 16.2% for Kraft Foods, North

America, Europe and Developing Markets, respectively. See GAAP to Non-GAAP

reconciliation at the end of this presentation. |

Cadbury

revenue synergies will escalate •

Achieved $400 million revenue run-rate

–

Drove 2011 revenue synergies of $300+ million

–

~60 bps of growth

•

On-track to reach $1 billion target

–

Roughly two-thirds from Developing Markets

–

50-100 bps of growth in 2012

49 |

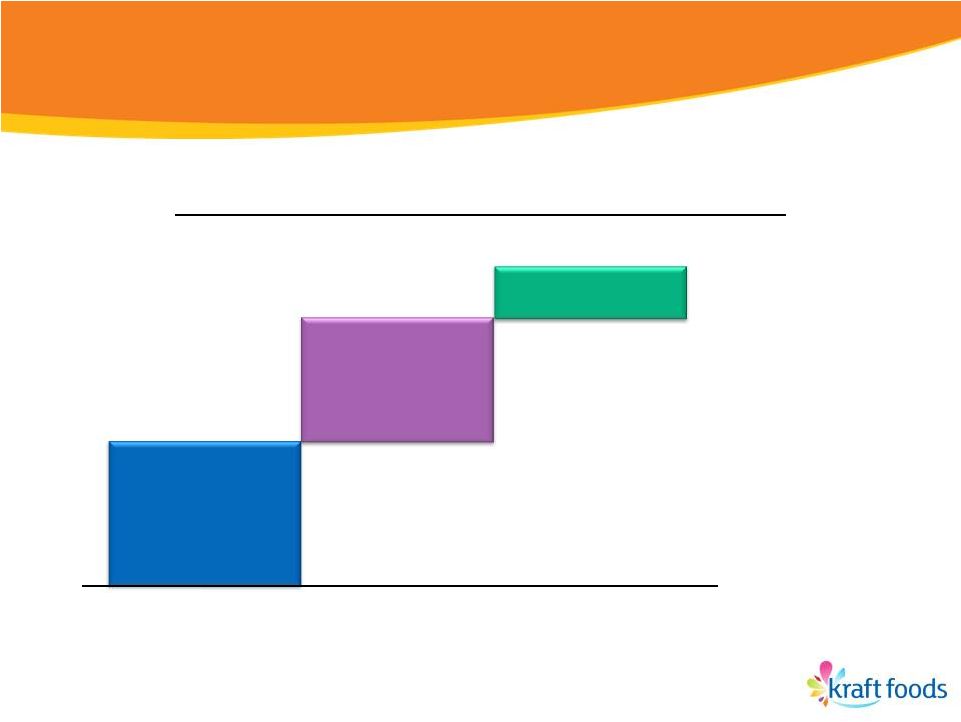

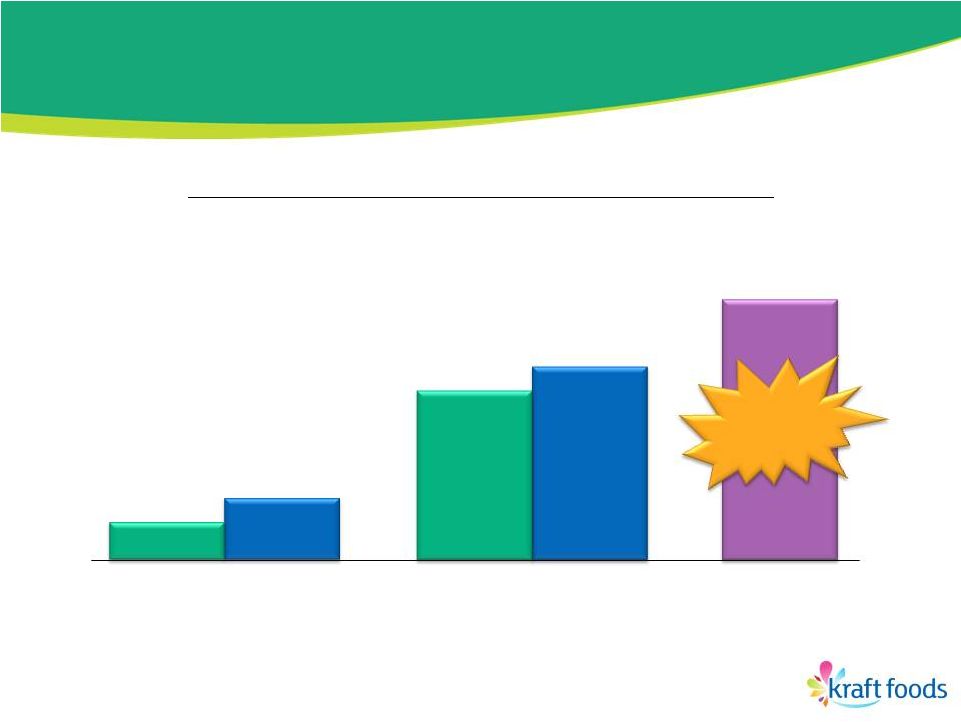

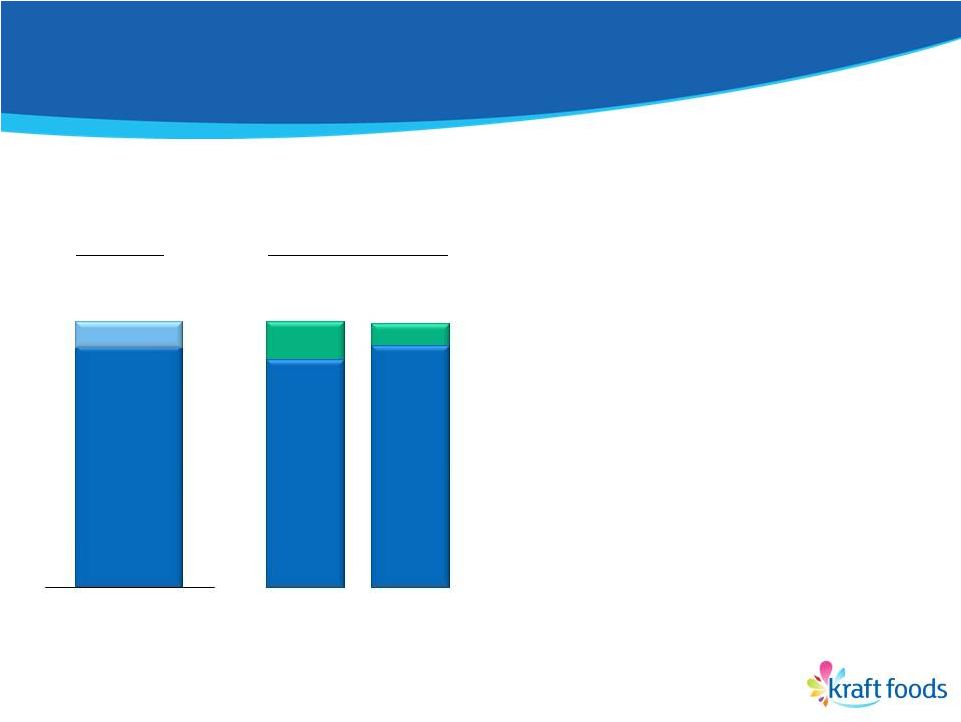

Exceeding

Cadbury cost synergy targets 50

(Cumulative P&L Impact, % of Original $750 Million Target)

Cost Synergies

~25%

~80%

105%+

~15%

Actual

2011

2012

Original

Estimate

2010

Actual

Original

Estimate

~70%

~$800

Million |

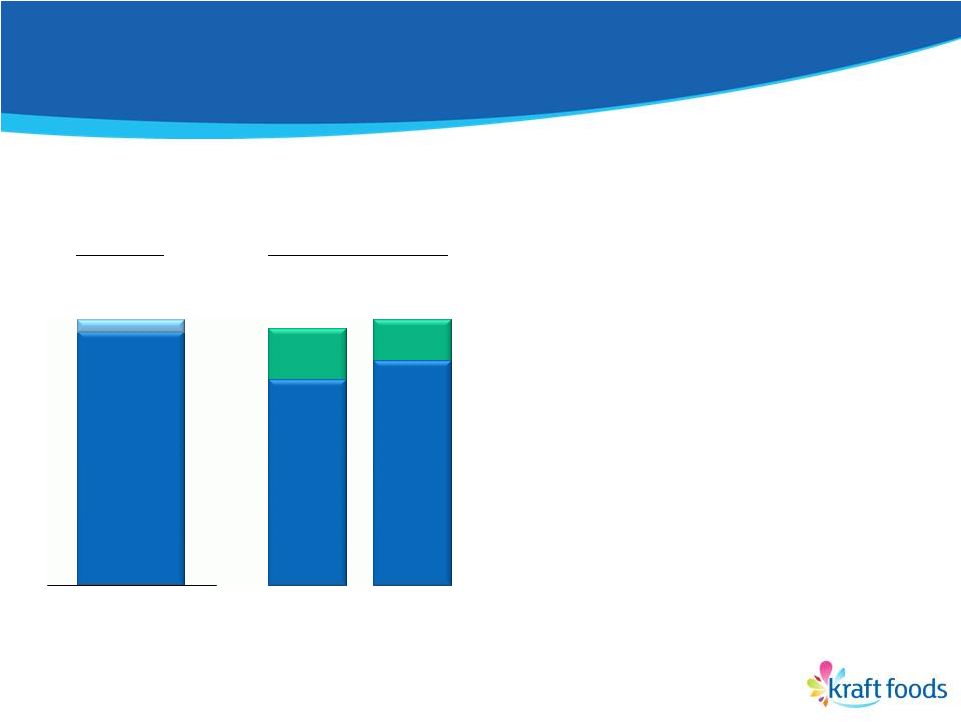

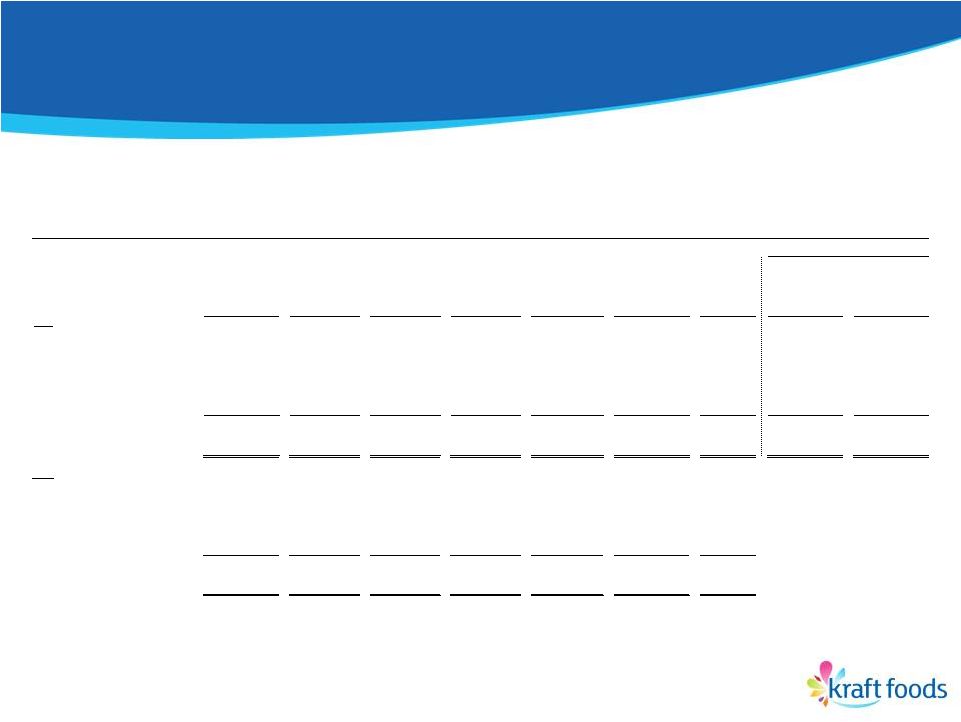

End-to-End Cost Management will drive

further gains

•

Productivity

–

Procurement

–

Manufacturing

–

Customer Service & Logistics

•

Overhead Cost Reset

–

North America: NOG

–

Europe: NOG

–

Developing Markets: HOG

51

Productivity % of COGS

Overheads % of Net Revenue

~4%

4%+

4%+

2010

2012E

2011

13.8%

14.4%

13%-13.5%

2010

2012E

2011

(2)

(3)

(4)

(1)

(1)

Kraft Foods Base Business only

(2)

Excludes integration and acquisition-related costs associated with the Cadbury acquisition,

and costs associated with the proposed spin-off of the North American grocery

business.

(3)

Reported Overheads as a % of Net revenues for FY 2010 was 16.0%. See GAAP to Non-GAAP

reconciliation at the end of this presentation.

(4)

Reported Overheads as a % of Net revenues for FY 2011 was 14.7%. See GAAP to Non-GAAP

reconciliation at the end of this presentation. |

Targeting

top-tier growth in 2012 52

•

Organic revenue growth consistent with

5%+ long-term guidance

+

Strong momentum, Power Brands in each region

+

Revenue synergies from Cadbury

+

Low/mid-single-digit benefit from pricing

–

Macroeconomic environment

–

Product pruning in North America of up to 1 pp

Organic Net Revenue growth

of approximately 5% |

Targeting

top-tier growth in 2012 •

Organic revenue growth consistent with

5%+ long-term guidance

•

Operating EPS growth consistent with

9%-11% constant-currency, long-term guidance

+

Strong operating momentum

+

Further gains from End-to-End Cost Management, synergies

–

Pension cost headwind ~4 pp

–

Higher effective tax rate (~28%)

53

Constant Currency Operating EPS growth

at low end of 9%-11% range |

Setting up

each company for future success •

“Clean sheet”

approach

–

Lean corporate structures

–

Tailoring support functions to needs of each company

–

Streamlining manufacturing and distribution infrastructures

•

Transition and transaction costs to execute

separation

•

$1.6-$1.8 billion of one-time costs

–

Approximately two-thirds in cash

–

Most expected to be booked in 2012

•

Key enabler to achieving peak performance for

each company

54 |

Refinancing

costs to be incurred to set up capital structures

•

Debt breakage and financing fees from

migrating debt to North American grocery

•

$400 million to $800 million cost

55 |

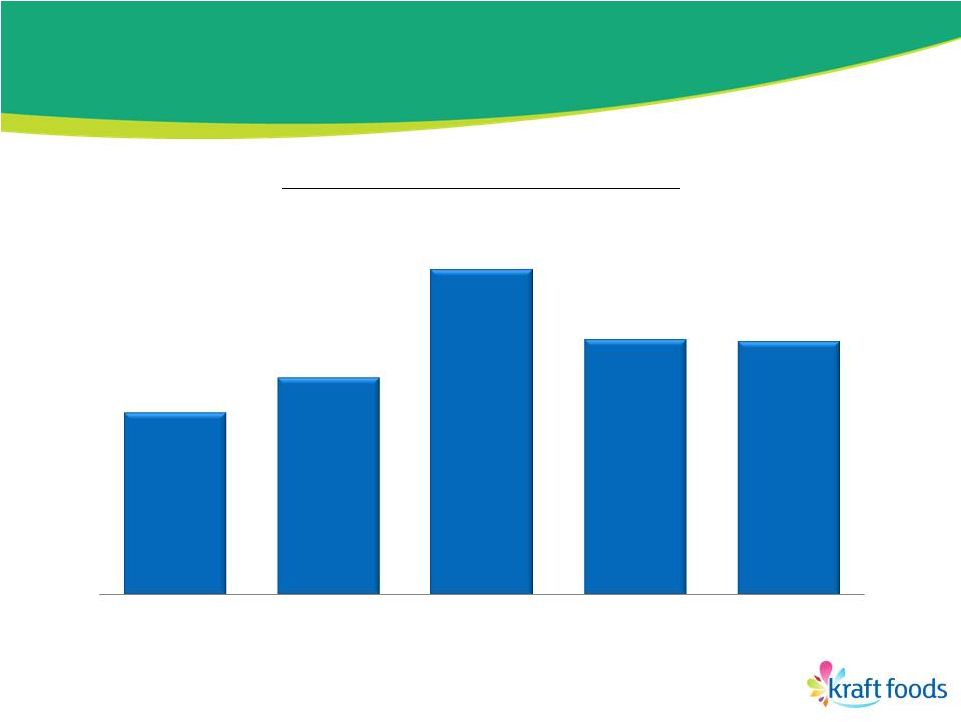

Generating

strong free cash flow 56

(1)

Adjusted free cash flow is defined as net cash from operating activities less capital

expenditures plus voluntary pension contributions and taxes paid on the gain on the

2010 sale of North America pizza business. See GAAP to Non-GAAP

reconciliation at the end of this presentation.

Adjusted

Free

Cash

Flow

(1)

($ billions)

$2.3

$2.8

$4.2

$3.3

$3.2

2007

2008

2009

2010

2011 |

Well-positioned to launch two investment

grade companies with access to CP

•

Successfully delevered from Cadbury acquisition

–

Gross debt-to-underlying EBITDA of 3.1x

–

Total debt down $4+ billion since March 2010

•

Taking actions to create space, flexibility

–

Issued $800 million floating rate notes in Jan. 2012

–

More to come

•

Several options to migrate debt to North

American grocery company

57 |

Driving

sustainable, top-tier performance for the long term

•

Top-tier operating performance on both

top and

bottom lines

•

Setting stage for strong, future gains through a

clean-sheet approach

•

On track to launch two investment-grade

entities with low-cost debt

58 |

The Path to

Separation Irene Rosenfeld

Chairman and CEO |

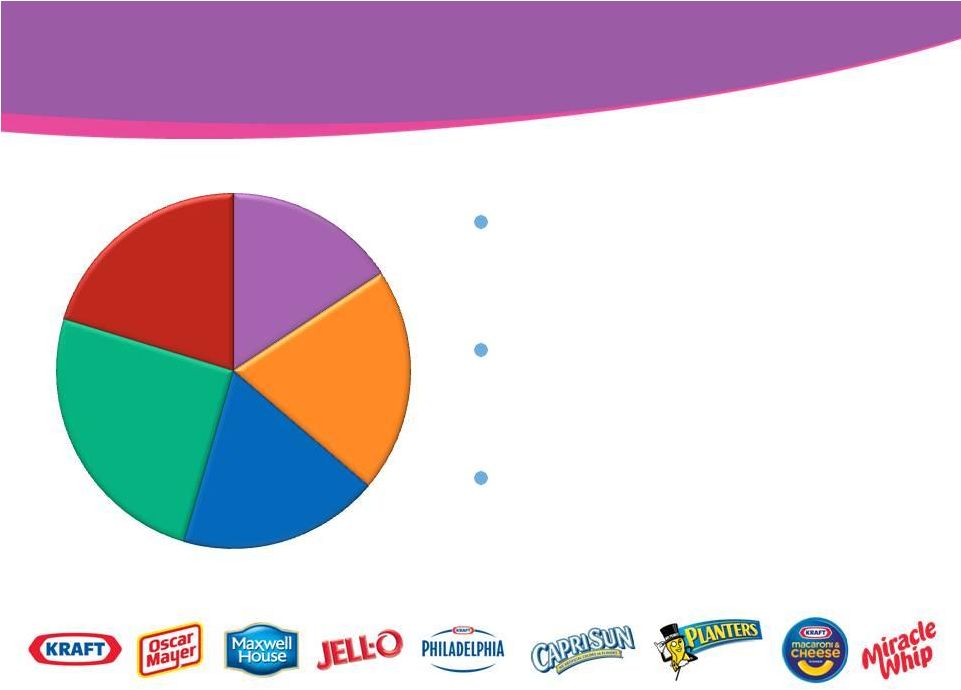

North American

grocery will be a major force in the industry

U.S. Beverages

16%

$18 Billion in Revenues*

U.S. Cheese

21%

U.S. Convenient

Meals

18%

U.S. Grocery

25%

Canada &

NA Foodservice

20%

Growth in line with

categories

Strong margins with

upside opportunity

Highly competitive

dividend payout

60

* Based

on

2011

reported

net

revenues

adjusted

for the

53

week

of

shipments

and

divestitures,

including

the

Starbucks

CPG

business.

rd

Includes Planters. All figures are

unaudited. |

Latin

America

CEEMA

Asia

Pacific

Europe

37%

North

America

19%

Developing

Markets

44%

$35 Billion in Revenues*

Industry-leading growth

Drive margin gains

through revenue growth

and cost containment

Invest to support future

growth

Top-tier EPS growth plus

a modest dividend

* Based

on

2011

reported

net

revenues

adjusted

for

accounting

calendar

changes,

the

53rd

week

of

shipments

and

divestitures.

Excludes Planters. All figures are unaudited.

61

Global snacks’

geographic profile is unique

within consumer products |

What’s

next •

Continue to report as one company

•

Initial Form 10 filing, carve-out financials in Q2

•

Tax Rulings around mid-year

•

Management structures and personnel decisions

finalized by mid-year

•

Complete separation no later than

Dec. 31, 2012

•

Investor events close to separation date

62 |

2012 will be

an exciting year for Kraft Foods and our shareholders

•

Strong operating momentum

•

Executing separation from position of strength

•

The best is yet to come!

63 |

|

Kraft

Foods 65

Organic Net

Revenue

Growth

(1)

•

Revenue growth in top-tier of

peer group

–

Positive vol/mix despite significant

pricing

•

Power Brands +8%

•

Underlying OI +10%

(3)

–

Pricing fully covered $2.6 billion

increase in raw material costs

•

Underlying OI Margin

essentially flat due to

denominator effect of pricing

FY 2011

+6.6%

Pricing

+6.0 pp

Vol/Mix

+0.6 pp

Operating

Income Margin

FY 2010

FY 2011

11.5%

(reported)

13.3%

13.4%

12.2%

(reported)

(2)

(2)

(1)

Reported Net Revenues increased 10.5% in FY 2011. See GAAP to Non-GAAP

reconciliation at the end of this presentation.

(2)

Underlying Operating Income margin excludes Integration Program costs, acquisition-related

costs and costs associated with the proposed spin-off of the North American grocery

business. See GAAP to Non-GAAP reconciliation at the end of this presentation.

(3)

Reported Operating Income increased 17.5%. See GAAP to Non-GAAP reconciliation at

the end of this presentation.

|

Kraft Foods

North America 66

Organic Net

Revenue

Growth

(1)

•

Pricing and new products drove

revenue growth

–

Vol/mix in line with expectations

–

Power Brands +6%

–

New products contributed 9%+

of revenue

•

Underlying SOI +4%

(3)

–

(3)pp impact from divestitures,

primarily Starbucks CPG business

–

Pricing fully covered increase in

raw material costs

•

Underlying SOI Margin

essentially flat due to

denominator effect of pricing

FY 2011

+4.8%

Pricing

+6.1 pp

Vol/Mix

(1.3)pp

Segment Operating

Income Margin

FY 2010

FY 2011

16.8%

(reported)

16.8%

17.0%

16.5%

(reported)

(2)

(2)

(1)

Reported Net Revenues increased 5.1% in FY 2011. See GAAP to Non-GAAP reconciliation

at the end of this presentation.

(2)

Underlying Operating Income margin excludes Integration Program costs, acquisition-related

costs and costs associated with the proposed spin-off of the North American grocery

business. See GAAP to Non-GAAP reconciliation at the end of this

presentation.

(3)

Reported Operating Income increased 3.6%. See GAAP to Non-GAAP reconciliation at the

end of this presentation. |

Kraft Foods

Europe 67

Organic Net

Revenue

Growth

(1)

•

Strong performance in each

quarter this year

–

8 straight quarters of top-

and

bottom-line gains

–

Positive vol/mix despite significant

pricing

•

Power Brands +7%

•

Underlying SOI +19%

(3)

–

Pricing and productivity essentially

covered increase in raw material

costs

FY 2011

+4.6%

Pricing

+4.4 pp

Vol/Mix

+0.2 pp

Segment Operating

Income Margin

FY 2010

FY 2011

9.6%

(reported)

12.4%

12.0%

(1)

Reported Net Revenues increased 14.9% in FY 2011. See GAAP to Non-GAAP

reconciliation at the end of this presentation. (2)

Underlying Operating Income margin excludes Integration Program costs, acquisition-related

costs and costs associated with the proposed spin-off of the North American grocery

business. See GAAP to Non-GAAP reconciliation at the end of this

presentation

(3)

Reported Operating Income increased 26.1%. See GAAP to Non-GAAP reconciliation at

the end of this presentation. 10.5%

(reported)

(2)

(2) |

Kraft Foods

Developing Markets 68

Organic Net

Revenue

Growth

(1)

•

Strong revenue performance in

each region despite volatile

market conditions

–

Latin America and Asia Pacific

both up double-digits

–

CEEMA up high single-digits

•

Power Brands +17%

•

Underlying SOI +24%

–

Pricing fully covered increase in

raw material costs

–

Vol/mix and overhead leverage

drove margin expansion

FY 2011

+11.2%

Pricing

+7.3 pp

Vol/Mix

+3.9 pp

Segment Operating

Income Margin

FY 2010

FY 2011

11.6%

(reported)

14.0%

13.1%

13.0%

(reported)

(2)

(2)

(1)

Reported Net Revenues increased 16.2% in FY 2011. See GAAP to Non-GAAP

reconciliation at the end of this presentation.

(2)

Underlying Operating Income margin excludes Integration Program costs, acquisition-related

costs and costs associated with the proposed spin-off of the North American grocery

business. See GAAP to Non-GAAP reconciliation at the end of this presentation

(3)

Reported Operating Income increased 30.2%. See GAAP to Non-GAAP reconciliation at

the end of this presentation. |

GAAP to

Non-GAAP Reconciliation 69

As Reported

(GAAP)

Impact of

Divestitures

Impact of

Acquisitions

(2)

Impact of

Integration

Program

Impact of

Accounting

Calendar

Changes

(3)

Impact of

Currency

Organic

(Non-GAAP)

As Reported

(GAAP)

Organic

(Non-GAAP)

2011

Biscuits

12,010

$

-

$

-

$

-

$

(235)

$

(219)

$

11,556

$

11.5%

8.7%

Confectionery

Chocolate

9,607

-

(287)

-

(143)

(361)

8,816

16.1%

6.4%

Gum & Candy

5,575

-

(379)

1

(2)

(151)

5,044

11.6%

1.0%

Other Confectionery

293

-

(3)

-

(6)

(7)

277

(32.6)%

(12.9)%

15,475

-

(669)

1

(151)

(519)

14,137

12.9%

4.0%

Snacks

(1)

27,485

$

-

$

(669)

$

1

$

(386)

$

(738)

$

25,693

$

12.3%

6.1%

2010

Biscuits

10,775

$

-

$

-

$

-

$

(147)

$

-

$

10,628

$

Confectionery

Chocolate

8,276

11

-

1

(3)

-

8,285

Gum & Candy

4,996

-

-

-

-

-

4,996

Other Confectionery

435

(117)

-

-

-

-

318

13,707

(106)

-

1

(3)

-

13,599

Snacks

(1)

24,482

$

(106)

$

-

$

1

$

(150)

$

-

$

24,227

$

Net Revenues to Organic Net Revenues by Consumer Sector

For the Twelve Months Ended December 31,

($ in millions, except percentages) (Unaudited)

Kraft Foods

% Change

(1)

Snacks is defined as the combination of the Biscuits sector, which includes cookies,

crackers and salted snacks, and the Confectionery sector, which includes

chocolate, gum & candy and other confectionery. (2)

Impact of acquisitions reflects the incremental January 2011 operating results from

our Cadbury acquisition on February 2, 2010. (3)

Includes

the

impacts

of

accounting

calendar

changes

and

the

53

week

of

shipments

in

2011.

rd |

GAAP to

Non-GAAP Reconciliation 70

(1)

Impact of divestitures includes for reporting purposes Starbucks CPG business.

(2)

Impact of acquisitions reflects the incremental January 2011 operating results from

our Cadbury acquisition on February 2, 2010. (3)

As Reported

(GAAP)

Impact of

Divestitures

(1)

Impact of

Acquisitions

(2)

Impact of

Integration

Program

Impact of

Accounting

Calendar

Changes

(3)

Impact of

Currency

Organic

(Non-GAAP)

As Reported

(GAAP)

Organic

(Non-GAAP)

2011

Kraft Foods North America

25,188

$

(91)

$

(117)

$

-

$

(294)

$

(136)

$

24,550

$

5.1%

4.8%

Kraft Foods Europe

13,356

-

(201)

-

(403)

(632)

12,120

14.9%

4.6%

Kraft Foods Developing Markets

15,821

-

(379)

1

(183)

(397)

14,863

16.2%

11.2%

Kraft Foods

54,365

$

(91)

$

(697)

$

1

$

(880)

$

(1,165)

$

51,533

$

10.5%

6.6%

2010

Kraft Foods North America

23,966

$

(547)

$

-

$

-

$

-

$

-

$

23,419

$

Kraft Foods Europe

11,628

-

-

-

(45)

-

11,583

Kraft Foods Developing Markets

13,613

(105)

-

1

(148)

-

13,361

Kraft Foods

49,207

$

(652)

$

-

$

1

$

(193)

$

-

$

48,363

$

Net Revenues to Organic Net Revenues

For the Twelve Months Ended December 31,

($ in millions, except percentages) (Unaudited)

% Change

Includes

the

impacts

of

accounting

calendar

changes

and

the

53

week

of

shipments

in

2011.

rd |

GAAP to

Non-GAAP Reconciliation 71

As Reported

(GAAP)

Impact of

Divestitures

Impact of

Acquisitions

(1)

Impact of

Integration

Programs

Impact of

Accounting

Calendar

Changes

Impact of

Currency

Organic

(Non-GAAP)

Impact of

Acquisitions -

Cadbury

(1)

Divestitures -

Cadbury's

Poland and

Romania

Operations

(1)

Impact of

Currency -

Cadbury

(1)

Cadbury

Organic

(Non-GAAP)

(1)

Combined

Organic

(Non-GAAP)

As Reported

(GAAP)

Organic

(Non-GAAP)

Cadbury

Organic

(Non-GAAP)

(1)

Combined

Organic

(Non-GAAP)

2010

Kraft Foods North America

23,966

$

(21)

$

(1,498)

$

-

$

-

$

(251)

$

22,196

$

1,498

$

-

$

(35)

$

1,463

$

23,659

$

8.8%

1.1%

0.8%

1.1%

Kraft Foods Europe

11,628

-

(2,892)

-

(51)

267

8,952

2,892

-

91

2,983

11,935

32.6%

2.3%

0.7%

1.9%

Kraft Foods Developing Markets

13,613

-

(4,753)

1

(150)

15

8,726

4,753

(105)

(302)

4,346

13,072

71.1%

9.9%

5.1%

8.2%

Kraft Foods

49,207

$

(21)

$

(9,143)

$

1

$

(201)

$

31

$

39,874

$

9,143

$

(105)

$

(246)

$

8,792

$

48,666

$

27.0%

3.2%

2.9%

3.1%

2009

Kraft Foods North America

22,030

$

(80)

$

-

$

-

$

-

$

-

$

21,950

$

1,452

$

-

$

-

$

1,452

$

23,402

$

Kraft Foods Europe

8,768

(15)

-

-

-

-

8,753

2,961

-

-

2,961

11,714

Kraft Foods Developing Markets

7,956

(14)

-

-

-

-

7,942

4,341

(207)

-

4,134

12,076

Kraft Foods

38,754

$

(109)

$

-

$

-

$

-

$

-

$

38,645

$

8,754

$

(207)

$

-

$

8,547

$

47,192

$

(1)

Kraft Foods acquired Cadbury plc on February 2, 2010. Cadbury data, shown above, is for

February through December 2010 and 2009, adjusted from IFRS to U.S. GAAP and translated to US$ from local countries' currencies.

Net Revenues to Combined Organic Net Revenues

For the Twelve Months Ended December 31,

($ in millions, except percentages) (Unaudited)

Add back:

% Change |

GAAP to

Non-GAAP Reconciliation 72

As Reported

(GAAP)

Integration

Program Costs

(1)

Acquisition-

Related Costs

(2)

Spin-off Costs

(3)

Underlying

(Non-GAAP)

As Reported

(GAAP)

Integration

Program Costs

(1)

Acquisition-

Related Costs

(2)

Underlying

(Non-GAAP)

Kraft Foods

Operating Income

6,657

$

521

$

-

$

46

$

7,224

$

5,666

$

646

$

273

$

6,585

$

Growth vs. Prior Year

17.5%

9.7%

Operating Income Margin

12.2%

13.3%

11.5%

13.4%

Kraft Foods North America

Segment Operating Income

4,167

$

66

$

-

$

-

$

4,233

$

4,021

$

54

$

7

$

4,082

$

Growth vs. Prior Year

3.6%

3.7%

Segment Operating Income Margin

16.5%

16.8%

16.8%

17.0%

Kraft Foods Europe

Segment Operating Income

1,406

$

256

$

-

$

-

$

1,662

$

1,115

$

256

$

23

$

1,394

$

Growth vs. Prior Year

26.1%

19.2%

Segment Operating Income Margin

10.5%

12.4%

9.6%

12.0%

Kraft Foods Developing Markets

Segment Operating Income

2,053

$

161

$

-

$

-

$

2,214

$

1,577

$

181

$

25

$

1,783

$

Growth vs. Prior Year

30.2%

24.2%

Segment Operating Income Margin

13.0%

14.0%

11.6%

13.1%

(1)

Integration Program costs are defined as the costs associated with combining the Kraft Foods and

Cadbury businesses, and are separate from those costs associated with

the acquisition. (2)

Acquisition-related costs include transaction advisory fees, U.K. stamp taxes and the impact

of the Cadbury inventory revaluation. (3)

Spin-off costs include transaction fees and other costs associated with the proposed

spin-off of the North American grocery business. Operating Income To Underlying Operating

Income For the Twelve Months Ended December 31,

($ in millions, except percentages) (Unaudited)

2011

2010 |

GAAP to

Non-GAAP Reconciliation 73

2011

As

Reported

(GAAP)

Integration

Program

Costs

(1)

Acquisition-

Related Costs

(2)

and Financing

Fees

(3)

U.S. Health Care

Legislation

Impact on

Deferred Taxes

Spin-off Costs

(4)

Operating

(Non-GAAP)

Currency

Operating

Constant Fx

(Non-GAAP)

As

Reported

EPS Growth

(GAAP)

Operating

EPS Growth

(Non-GAAP)

Operating

Constant

Fx EPS

Growth

(Non-GAAP)

Diluted EPS

-

Continuing operations

1.99

$

0.28

$

-

$

-

$

0.02

$

2.29

$

(0.06)

$

2.23

$

38.2%

13.4%

10.4%

-

Discontinued operations

-

-

Net earnings attributable to Kraft Foods

1.99

$

(16.7)%

2010

Diluted EPS

-

Continuing operations

1.44

$

0.29

$

0.21

$

0.08

$

-

$

2.02

$

-

$

2.02

$

-

Discontinued operations

0.95

-

Net earnings attributable to Kraft Foods

2.39

$

(1)

Integration Program costs are defined as the costs associated with combining the

Kraft Foods and Cadbury businesses, and are separate from those costs

associated with the acquisition. Integration Program costs were $521 million,

or $497 million after-tax including certain tax costs associated with the integration of Cadbury,

for the twelve months ended December 31, 2011, as compared to $657 million, or $497

million after-tax for the twelve months ended December 31, 2010. (2)

Acquisition-related costs include transaction advisory fees, U.K. stamp

taxes and the impact of the Cadbury inventory revaluation. (3)

Acquisition-related financing fees include hedging and foreign currency impacts

associated with the Cadbury acquisition and other fees associated with the

Cadbury bridge facility. (4)

Spin-off costs include transaction fees and other costs associated with the

proposed spin-off of the North American grocery business. Diluted Earnings

per Share to Operating EPS For the Twelve Months Ended December 31,

(Unaudited)

% Growth |

GAAP to

Non-GAAP Reconciliation 74

As Reported

(GAAP)

Integration

Program

Costs

(1)

Acquisition-

Related Costs

(2)

and Financing

Fees

(3)

U.S. Health Care

Legislation

Impact on

Deferred Taxes

Operating

(Non-GAAP)

As Reported

EPS Growth

(GAAP)

Operating

EPS Growth

(Non-GAAP)

2010

Diluted EPS

- Continuing operations

1.44

$

0.29

$

0.21

$

0.08

$

2.02

$

(23.8)%

4.7%

- Discontinued operations

0.95

- Net earnings attributable to Kraft Foods

2.39

$

17.7%

2009

Diluted EPS

- Continuing operations

1.89

$

-

$

0.04

$

-

$

1.93

$

- Discontinued operations

0.14

- Net earnings attributable to Kraft Foods

2.03

$

(1)

Integration Program costs are defined as the costs associated with combining the Kraft Foods

and Cadbury businesses, and are separate from those costs associated with the

acquisition. (2)

Acquisition-related costs include transaction advisory fees, U.K. stamp taxes and the

impact of the Cadbury inventory revaluation. (3)

Acquisition-related financing fees include hedging and foreign currency impacts associated

with the Cadbury acquisition and other fees associated with the Cadbury bridge

facility. Diluted Earnings per Share to Operating EPS

For the Twelve Months Ended December 31,

(Unaudited)

% Growth |

GAAP to

Non-GAAP Reconciliation 75

As Reported

(GAAP)

Integration

Program

Costs

(1)

Acquisition-

Related

Costs

(2)

Spin-off

Costs

(3)

Underlying

(Non-GAAP)

Currency

Underlying

Constant Fx

(Non-GAAP)

As Reported

(GAAP)

Integration

Program

Costs

Acquisition-

Related

Costs

(2)

Underlying

(Non-GAAP)

As Reported

(GAAP)

Underlying

(Non-GAAP)

Underlying

Constant Fx

(Non-GAAP)

Kraft Foods

Net Revenues

54,365

$

1

$

-

$

-

$

54,366

$

(1,165)

$

53,201

$

49,207

$

1

$

-

$

49,208

$

Overheads

7,980

$

(405)

$

-

$

(46)

$

7,529

$

(174)

$

7,355

$

7,894

$

(574)

$

(218)

$

7,102

$

1.1%

6.0%

3.6%

Overheads as % of Net Revenues

14.7%

13.8%

13.8%

16.0%

14.4%

(1.3)pp

(0.6)pp

(0.6)pp

Kraft Foods North America

Net Revenues

25,188

$

-

$

-

$

-

$

25,188

$

(136)

$

25,052

$

23,966

$

-

$

-

$

23,966

$

Overheads

2,932

$

(52)

$

-

$

-

$

2,880

$

(14)

$

2,866

$

2,933

$

(51)

$

-

$

2,882

$

-

(0.1%)

(0.6%)

Overheads as % of Net Revenues

11.6%

11.4%

11.4%

12.2%

12.0%

(0.6)pp

(0.6)pp

(0.6)pp

Kraft Foods Europe

Net Revenues

13,356

$

-

$

-

$

-

$

13,356

$

(632)

$

12,724

$

11,628

$

-

$

-

$

11,628

$

Overheads

2,072

$

(170)

$

-

$

-

$

1,902

$

(93)

$

1,809

$

2,031

$

(209)

$

-

$

1,822

$

2.0%

4.4%

(0.7%)

Overheads as % of Net Revenues

15.5%

14.2%

14.2%

17.5%

15.7%

(2.0)pp

(1.5)pp

(1.5)pp

Kraft Foods Developing Markets

Net Revenues

15,821

$

1

$

-

$

-

$

15,822

$

(397)

$

15,425

$

13,613

$

1

$

-

$

13,614

$

Overheads

2,476

$

(145)

$

-

$

-

$

2,331

$

(65)

$

2,266

$

2,187

$

(158)

$

-

$

2,029

$

13.2%

14.9%

11.7%

Overheads as % of Net Revenues

15.7%

14.7%

14.7%

16.1%

14.9%

(0.4)pp

(0.2)pp

(0.2)pp

(1)

Integration Program costs are defined as the costs associated with combining the

Kraft Foods and Cadbury businesses, and are separate from those costs associated with the acquisition.

(2)

Acquisition-related costs include transaction advisory fees, U.K. stamp taxes

and the impact of the Cadbury inventory revaluation. (3)

Spin-off costs include transaction fees and other costs associated with the

proposed spin-off of the North American grocery business. Overheads

For the Twelve Months Ended December 31,

($

in

millions,

except

percentages)

(Unaudited)

2011

2010

Increase/(Decrease)

(1) |

GAAP to

Non-GAAP Reconciliation 76

2007

2008

2009

2010

2011

Net Cash Provided by Operating Activities (GAAP)

3.6

$

4.1

$

5.1

$

3.7

$

4.5

$

Capital Expenditures

(1.2)

(1.4)

(1.3)

(1.7)

(1.8)

Free Cash Flow (Non-GAAP)

(1)

2.3

$

2.8

$

3.8

$

2.1

$

2.7

$

Taxes Paid on Frozen Pizza Business Divestiture

-

-

-

1.2

-

Voluntary Pension Contributions

-

-

0.4

-

0.5

Adjusted Free Cash Flow (Non-GAAP)

2.3

$

2.8

$

4.2

$

3.3

$

3.2

$

(1)

May not add due to rounding

Net Cash Provided by Operating Activities to Adjusted Free Cash Flow

For the Twelve Months Ended December 31,

($ in billions) (Unaudited) |