Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PDL BIOPHARMA, INC. | pdlbio_8k-021312.htm |

Exhibit 99.1

14th Annual BIO CEO & Investor Conference February 13, 2012 1

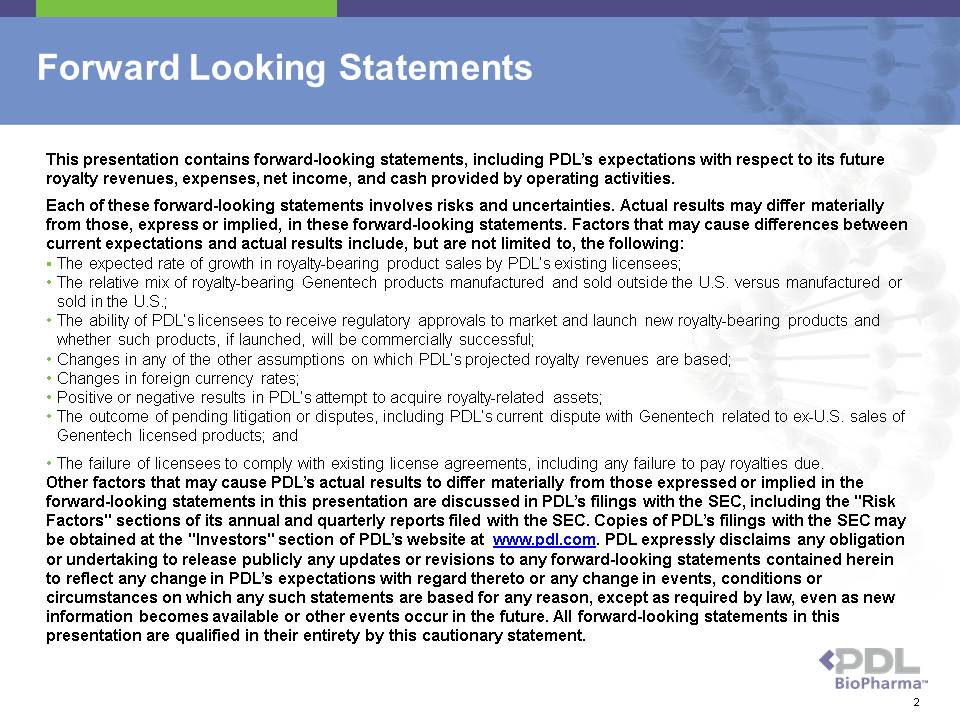

Forward Looking Statements This presentation contains forward-looking statements, including PDL’s expectations with respect to its future royalty revenues, expenses, net income, and cash provided by operating activities. Each of these forward-looking statements involves risks and uncertainties. Actual results may differ materially from those, express or implied, in these forward-looking statements. Factors that may cause differences between current expectations and actual results include, but are not limited to, the following: ? The expected rate of growth in royalty-bearing product sales by PDL’s existing licensees; • The relative mix of royalty-bearing Genentech products manufactured and sold outside the U.S. versus manufactured or sold in the U.S.; • The ability of PDL’s licensees to receive regulatory approvals to market and launch new royalty-bearing products and whether such products, if launched, will be commercially successful; • Changes in any of the other assumptions on which PDL’s projected royalty revenues are based; • Changes in foreign currency rates; • Positive or negative results in PDL’s attempt to acquire royalty-related assets; • The outcome of pending litigation or disputes, including PDL’s current dispute with Genentech related to ex-U.S. sales of Genentech licensed products; and • The failure of licensees to comply with existing license agreements, including any failure to pay royalties due. Other factors that may cause PDL’s actual results to differ materially from those expressed or implied in the forward-looking statements in this presentation are discussed in PDL’s filings with the SEC, including the "Risk Factors" sections of its annual and quarterly reports filed with the SEC. Copies of PDL’s filings with the SEC may be obtained at the "Investors" section of PDL’s website at www.pdl.com. PDL expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in PDL’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based for any reason, except as required by law, even as new information becomes available or other events occur in the future. All forward-looking statements in this presentation are qualified in their entirety by this cautionary statement. 2

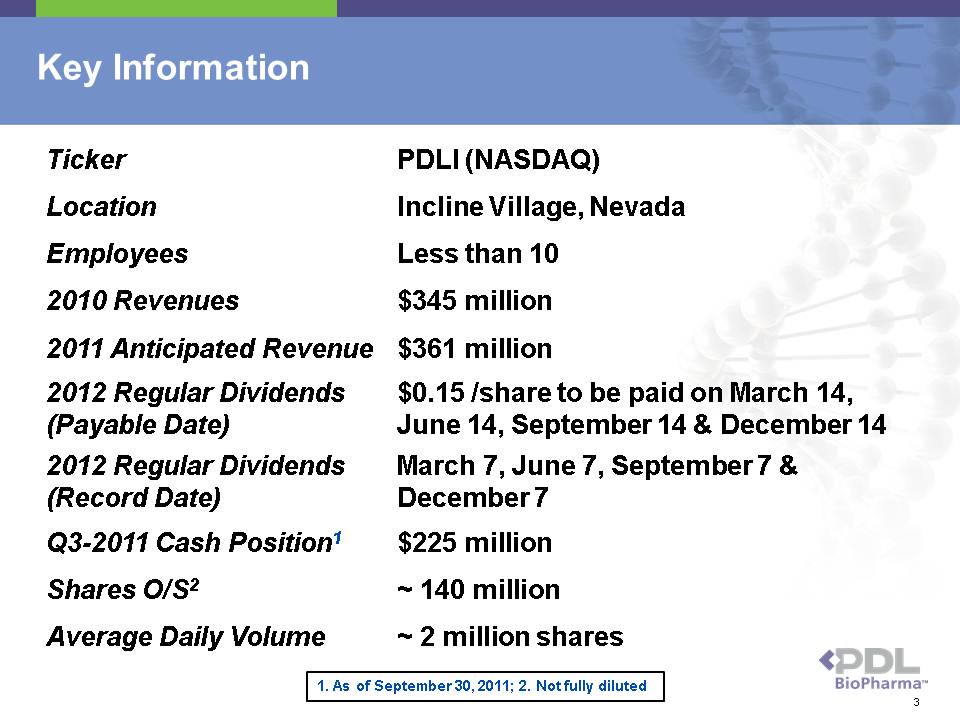

Ticker PDLI (NASDAQ) Location Incline Village, Nevada Employees Less than 10 2010 Revenues $345 million 2011 Anticipated Revenue $361 million 2012 Regular Dividends (Payable Date) $0.15 /share to be paid on March 14, June 14, September 14 & December 14 2012 Regular Dividends (Record Date) March 7, June 7, September 7 & December 7 Q3-2011 Cash Position1 $225 million Shares O/S2 ~ 140 million Average Daily Volume ~ 2 million shares Key Information 1. As of September 30, 2011; 2. Not fully diluted 3

Overview of PDL BioPharma 4

Antibody Humanization Technology • Antibodies are naturally produced by humans to fight foreign substances, such as bacteria and viruses • In the 1980’s, scientists began creating antibodies in non-human immune systems, such as those of mice, that could target specific sites on cells to fight various human diseases • However, mouse derived antibodies are recognized by the human body as foreign substances and may be rejected by the human immune system • PDL’s technology allows for the “humanization” of mouse derived antibodies by moving the important binding regions from the mouse antibody onto a human framework • PDL’s humanization technology is important because the humanized antibodies retain the binding and activity levels from the original mouse antibody • PDL’s technology has been incorporated into antibodies to treat cancer, eye diseases, arthritis, multiple sclerosis and other health conditions with aggregate annual sales of over $17 billion 5

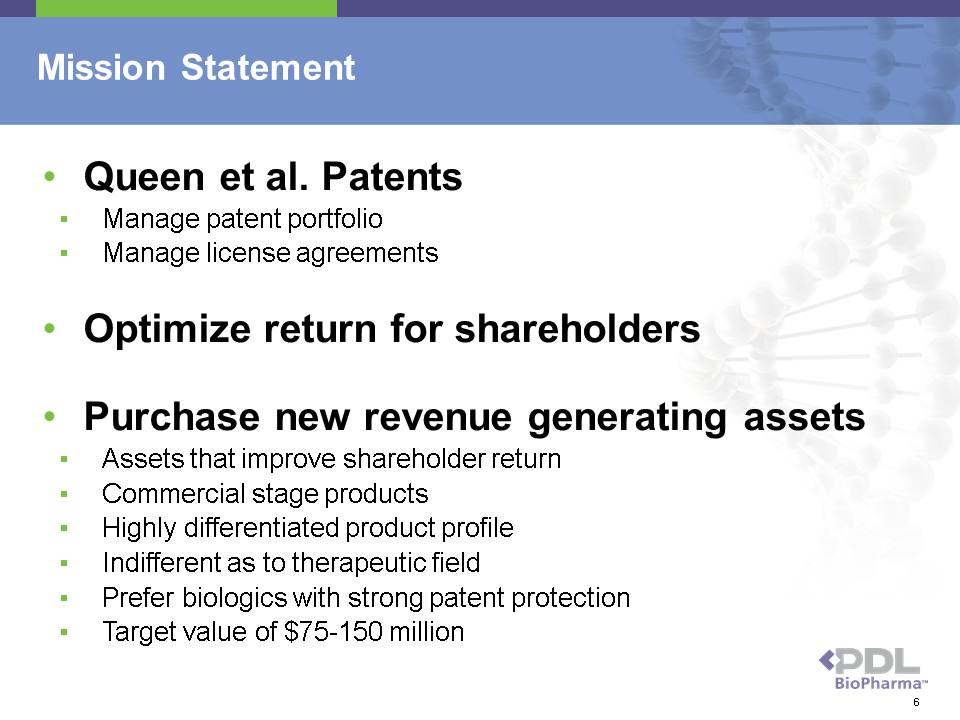

Mission Statement • Queen et al. Patents ? Manage patent portfolio ? Manage license agreements • Optimize return for shareholders • Purchase new revenue generating assets ? Assets that improve shareholder return ? Commercial stage products ? Highly differentiated product profile ? Indifferent as to therapeutic field ? Prefer biologics with strong patent protection ? Target value of $75-150 million 6

Corporate Governance Management • John McLaughlin President & CEO • Christopher Stone VP, General Counsel & Secretary • Caroline Krumel VP of Finance • Danny Hart Deputy General Counsel Board of Directors • Fred Frank Lead Director • Jody Lindell • John McLaughlin • Paul Sandman • Harold Selick 7

Licensed Products and Royalty Revenue 8

Product Licensee 2011 WW Sales Approved Indications Avastin Genentech (US) and Roche (ex-US) $5.7 billion ? Metastatic colorectal cancer ? Advanced non-small cell lung cancer ? Renal cancer ? Metastatic HER2- breast cancer ? Glioblastoma ? Ovarian cancer Herceptin Genentech (US) and Roche (ex-US) $5.7 billion ? Metastatic HER2+ breast cancer ? Metastatic HER2+ stomach cancer Lucentis Genentech (US) and Novartis (ex-US) $3.6 billion ? Wet age-related macular degeneration (AMD) ? Macular edema or swelling following retinal vein occlusion ? Diabetic macular edema Xolair Genentech (US) and Novartis (ex-US) $1.1 billion ? Moderate to severe persistent allergic asthma ? First approved therapy designed to target the antibody IgE, a key underlying cause of the symptoms of allergy related asthma Tysabri Biogen Idec and Elan $1.1 billion ? Multiple Sclerosis (MS) in adult patients with relapsing forms of the disease ? Crohn’s disease in adult patients with moderate-to-severe forms of the disease who have had an inadequate response to or are unable to tolerate conventional therapies Actemra Roche and Chugai $0.7 billion ? Rheumatoid arthritis (RA) Approved Licensed Products: Overview Roche sales assumes 1.08775 CHF/USD 9

How Long Will PDL Receive Royalties from Queen et al. Patents? • PDL’s revenues consist of royalties generated on sales of licensed products ? Sold in a patented jurisdiction before the expiration of the Queen et al. patents in mid-2013 through end of 2014 or ? Made prior to the expiration of the Queen et al. patents in a patented jurisdiction and sold anytime thereafter Example of Antibody Formulation, Fill and Finish Schedule ½ month 1 month ½ month 2-3 months Thaw, Formulation & Vial Filling Quality Release Packaging & Quality Inventory Example of Antibody Bulk Manufacturing Schedule Cell Culture Quality Release Testing Bulk Frozen Storage 1 mo 3 mos 5 mos 10 mos 15 mos 20 mos 27 mos 3 mos 1mo 1mo 2-18 months Purification to Concentrated Bulk/Frozen 10

Genentech Product Made or Sold in U.S. Net Sales up to $1.5 Billion 3.0% Net Sales Between $1.5 Billion and $2.5 Billion 2.5% Net Sales Between $2.5 Billion and $4.0 Billion 2.0% Net Sales Over $4.0 Billion 1.0% Genentech Product Made and Sold Ex-U.S. Net Sales 3.0% Queen et al Patents - Royalty Rates • Tysabri and Actemra • Flat, low single-digit royalty • Genentech Products (Avastin, Herceptin, Lucentis1 and Xolair) • Tiered royalties on product made or sold in US • Flat, 3% royalty on product made and sold outside US • Blended global royalty rate on Genentech Products in 2011 was 1.8% • Blended royalty rate on Genentech Products in 2011 made or sold in US was 1.4% 1. As part of a settlement with Novartis, which commercializes Lucentis outside US, PDL agreed to pay to Novartis certain amounts based on net sales of Lucentis made by Novartis during calendar year 2011 and beyond. The amounts to be paid are less than we receive in royalties on such sales and we do not currently expect such amount to materially impact our total annual revenues in 2012. 11

Potential Shift to Ex-US Manufacturing Sites = Higher Royalties • Roche is moving some manufacturing ex-US which may result in higher royalties to PDL due to the flat 3% royalty for Genentech Products made and sold ex-US ? Current production at Penzburg (Herceptin) and Basel (Avastin) plants - In June 2011, Roche completed 191 million SFr upgrade and expansion of Penzberg facility ? Two new plants in Singapore (CHO = antibody and e. coli = antibody fragment) - E. coli (Lucentis) and CHO (Avastin) plants are approved for commercial supply to the US - E. coli and CHO plants are expected to be approved for commercial supply to the EU - Currently, all Lucentis is made in the US Percent of Net Worldwide Sales1 1. As reported to PDL by its licensee 12

Royalty Products – Approved 13

Royalty Products - Avastin Avastin Herceptin Lucentis Xolair Tysabri Actemra ?On December 23, 2011, Roche announced that the EU approved its use in combination with standard chemotherapy for the treatment of newly diagnosed ovarian cancer. ?On December 28, data from a Phase 3 trial in patients with advanced, previously untreated ovarian cancer was published in NEJM showing an improvement in the primary endpoint of progression-free survival but not the secondary endpoint of overall survival. ? Roche said that it is unlikely to seek approval in the US, but will not make final decision until overall survival data expected in 2013. ?On January 26, 2012, Genentech and Roche reported that Phase 3 trial in patients with metastatic colorectal cancer who received Avastin plus chemotherapy as initial treatment and then Avastin plus a different chemotherapeutic after disease progression met its primary endpoint of overall survival when compared to patients who received only chemotherapy when the disease progressed. ?In its February 1, 2012 conference call with the financial community, Roche reported: ? Market share in first line metastatic breast cancer had stabilized in EU as of 4Q11 and bottomed out in US subsequent to November 11, 2011 FDA withdrawal of approval for this indication; and ? Continued uptake in Japan for first line metastatic colorectal and non-small cell lung cancers. 14

Royalty Products - Herceptin Avastin Herceptin Lucentis Xolair Tysabri Actemra ? On October 18, 2011, Roche announced Phase 3 results that showed that subcutaneous (SQ) formulation of Herceptin has comparable safety and efficacy to intravenous (IV) formulation. ? SQ formulation is ready-to-use and requires about 5 minutes to administer compared to 30 minutes administration time for IV formulation. ? In its February 1, 2012 conference call with the financial community, Roche reported HER2 testing rates of >88% in EU and US in metastatic gastric cancer patients. 15

Royalty Products - Lucentis 16

Avastin Herceptin Lucentis Xolair Tysabri Actemra ? On November 18, 2011, FDA approved Regeneron and Bayer’s Eylea for the treatment of age-related macular degeneration (AMD) with a dosing schedule of monthly injections for the first three months and bimonthly injections thereafter. ? Many physicians currently give AMD patients monthly injections of Lucentis for the first few months and then treat on an “as needed to maintain vision” basis. ? Eylea is priced at $100 less per injection than Lucentis (Lucentis = $1,950 per injection) ? In its February 1, 2012 call with the financial community, Roche reported: ? Lucentis market share was stable following release of one year CATT data; ? Lucentis market share in retinal vein occlusion was up 27% in 4Q11 compared to 4Q10; ? PDUFA date for visual impairment due to diabetic macular edema (DME) is August 2012 – Lucentis is already approved for DME in EU; and ? 2012 sales will be flat to declining year-over-year. Royalty Products - Tysabri Avastin Herceptin Lucentis Xolair Tysabri Actemra ? On January 20, 2012, Biogen Idec and Elan announced that FDA approved a label change that identifies anti-JCV antibody status as a risk factor for developing an infrequent but serious brain infection known as progressive multifocal leukoencephalopathy (PML). ? In its January 31, 2012 earnings release, Biogen Idec reported that an estimated 64,400 patients were on commercial and clinical therapy worldwide as of the end of 2011. 17

Royalty Products - Actemra Avastin Herceptin Lucentis Xolair Tysabri Actemra ? In its February 1, 2012 call with the financial community, Roche reported: ? Results from head-to-head trial with Humira expected in 1H2012 ? Plan to file for approval of SQ formulation in US and EU in 2012 18

Potential Royalty Products – Development Stage 19

Potential Royalty Products – T-DM1 T-DM1 Breast HER2+ Cancer ? In its February 1, 2012 call with the financial community, Roche estimated annual sales in excess of $1 billion when approved. ? Roche/Genentech expect to file for second line approval in 2012 and first line in 2014. Ocrelizumab Multiple Sclerosis Pertuzumab Breast HER2+ Cancer Afutuzumab Chronic Lymphocytic Leukemia Solanezumab Alzheimer’s Disease Daclizumab Multiple Sclerosis Datoluzumab Colorectal Cancer Bapineuzumab Alzheimer’s Disease Farletuzumab Ovarian Cancer 20

Potential Royalty Products – Pertuzumab 21

? Pertuzumab + Herceptin + docetaxel improved PFS by 6.1 months in first line treatment of HER2+ breast cancer patients compared to placebo + Herceptin + docetaxel (18.5 months v. 12.4 months, respectively). ? In its February 1, 2012 call with the financial community, Roche estimated annual sales in excess of $1 billion when approved. ? On December 7, 2011, Genentech and Roche announced that they had filed applications for approval in US and EU for treatment of patients with previously untreated, HER2-positive metastatic breast cancer. ? On February 7, 2012, Genentech and Roche announced that the FDA had granted priority review of this application with a PDUFA date of June 8, 2012. T-DM1 Breast HER2+ Cancer Ocrelizumab Multiple Sclerosis Pertuzumab Breast HER2+ Cancer Afutuzumab Chronic Lymphocytic Leukemia Solanezumab Alzheimer’s Disease Daclizumab Multiple Sclerosis Datoluzumab Colorectal Cancer Bapineuzumab Alzheimer’s Disease Farletuzumab Ovarian Cancer

Potential Royalty Products – Bapineuzumab ? 4 Phase 3 trials with more than 4,000 patients stratified by apoE carrier status and three Phase 3 extension studies. ? Pfizer/J&J/Elan confirmed Phase 3 data expected in second half of 2012. 22

T-DM1 Breast HER2+ Cancer Ocrelizumab Multiple Sclerosis Pertuzumab Breast HER2+ Cancer Afutuzumab Chronic Lymphocytic Leukemia Solanezumab Alzheimer’s Disease Daclizumab Multiple Sclerosis Datoluzumab Colorectal Cancer Bapineuzumab Alzheimer’s Disease Farletuzumab Ovarian Cancer

Potential Royalty Products – Solanezumab ? 2 Phase 3 trials with approximately 2,000 patients and 1 Phase 3 extension study. ? In its 2011 earnings call, Lilly reported that an independent monitoring committee conducted interim safety and futility analyses and recommended that the trials continue. ? Lilly confirmed that Phase 3 data expected in second half of 2012. ? PDL receives 12.5 year know-how royalty from date of first sale in addition to patent royalty. 23

T-DM1 Breast HER2+ Cancer Ocrelizumab Multiple Sclerosis Pertuzumab Breast HER2+ Cancer Afutuzumab Chronic Lymphocytic Leukemia Solanezumab Alzheimer’s Disease Daclizumab Multiple Sclerosis Datoluzumab Colorectal Cancer Bapineuzumab Alzheimer’s Disease Farletuzumab Ovarian Cancer

Genentech / Roche – Product Pipeline 24

2012 T-DM1 HER 2+ Advanced mBC Actemra RA DMARD H2H (EU) Herceptin Subcutaneous Formulation Avastin mCRC TML Actemra SC Formulation (EU) Afutuzumab (GA101) Chronic Lymphocytic Leukemia Actemra Early RA Avastin BC Adjuvant HER2+ Avastin BC Adj Triple Negative Herceptin BC HER 2+ Adj 2 Year Xolair Chronic Urticaria Avastin Glioblastoma 1st Line T-DM1 HER 2+ mBC 1st Line Ocrelizumab1 PPMS & RRMS 1.Not a licensed product Source: Roche investor update, February 1, 2012 US & EU Filings Calendar Avastin MBC 2nd line (EU) 2013 2014 Avastin Ovarian Cancer 1st Line (US) Avastin Relapsed Ovarian (US) Financials 25

Financials 25

Financial Overview 26

Year to Date 2009 2010 1 Q3-2011 2 12/31/2010 9/30/2011 Revenue $ 318 $ 345 $ 289 3 Cash, Cash Equivalents Expenses 2 1 134 14 & Investments $ 248 $ 225 EBIT 297 211 275 Total Assets $ 317 $ 271 Net Interest Expense 1 7 61 28 Pre-Tax Profit 280 150 247 Total Debt $ 517 $ 450 Taxes 91 58 87 Total Stockholders' Deficit $ (324) $ (243) Net Income $ 189 $ 92 $ 160 INCOME STATEMENT BALANCE SHEET 31-Dec Fiscal Year Ending As of 1. Includes $92.5 million one time legal settlement to MedImmune. Net interest expense includes $17.6 million 2. Includes $10.0 million one time legal settlement from UCB. 3. We have provided Q4-2011 revenue guidance of approximately $72.0 million and full year 2011 revenue guidance of approximately $361.0 million.

Debt 27

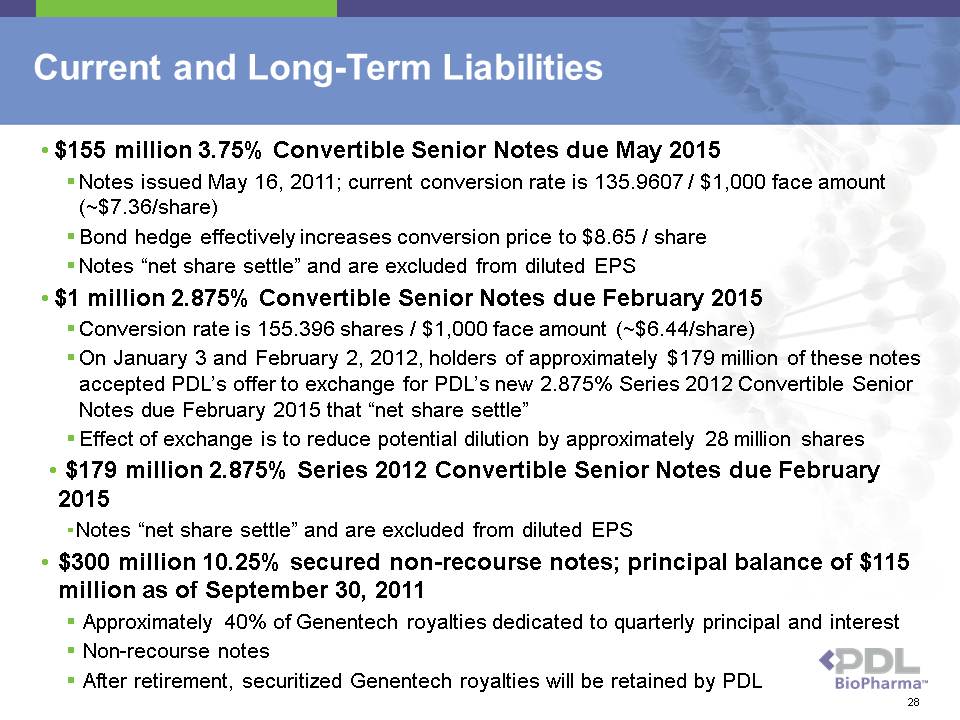

Current and Long-Term Liabilities • $155 million 3.75% Convertible Senior Notes due May 2015 ? Notes issued May 16, 2011; current conversion rate is 135.9607 / $1,000 face amount (~$7.36/share) ? Bond hedge effectively increases conversion price to $8.65 / share ? Notes “net share settle” and are excluded from diluted EPS • $1 million 2.875% Convertible Senior Notes due February 2015 ? Conversion rate is 155.396 shares / $1,000 face amount (~$6.44/share) ? On January 3 and February 2, 2012, holders of approximately $179 million of these notes accepted PDL’s offer to exchange for PDL’s new 2.875% Series 2012 Convertible Senior Notes due February 2015 that “net share settle” ? Effect of exchange is to reduce potential dilution by approximately 28 million shares • $179 million 2.875% Series 2012 Convertible Senior Notes due February 2015 ?Notes “net share settle” and are excluded from diluted EPS • $300 million 10.25% secured non-recourse notes; principal balance of $115 million as of September 30, 2011 ? Approximately 40% of Genentech royalties dedicated to quarterly principal and interest ? Non-recourse notes ? After retirement, securitized Genentech royalties will be retained by PDL 28

Legal Matters 29

Pending Dispute with Genentech and Roche • In August 2010, Genentech sent a fax on behalf of Roche and Novartis asserting its products do not infringe PDL’s supplementary protection certificates (SPCs) ? Products include Avastin, Herceptin, Lucentis and Xolair ? SPCs are patent extensions in Europe that are issued on a country-by-country and productby- product basis • PDL Response ? Genentech’s assertions are without merit ? PDL disagrees with Genentech’s assertions of non-infringement ? Genentech had waived its rights to challenge our patents, including SPCs in its 2003 Settlement Agreement with PDL • 2003 Settlement Agreement ? Resolved intellectual property disputes between the two companies at that time ? Limits Genentech’s ability to challenge infringement of PDL’s patent rights, including SPCs, and waives Genentech’s right to challenge or assist other in challenging the validity of our patent rights 30

Nevada Lawsuit Against Genentech/Roche • PDL filed a lawsuit against Genentech and Roche in Nevada state court ? Lawsuit states that fax constitutes a breach of 2003 Settlement Agreement because Genentech assisted Roche in challenging PDL’s patents and SPCs ? Complaint seeks compensatory damages, including liquidated damages and other monetary remedies set forth in the 2003 Settlement Agreement, punitive damages and attorney’s fees • In November 2010, Genentech and Roche filed two motions to dismiss ? They contend that 2003 Settlement Agreement applies only to PDL’s U.S. patents ? They asserted that the Nevada court lacks personal jurisdiction over Roche • On July 11, 2011, court denied Genentech and Roche's motion to dismiss four of PDL's five claims for relief and denied Roche's separate motion to dismiss for lack of personal jurisdiction. ? The court dismissed one of PDL's claims that Genentech committed a bad-faith breach of the covenant of good faith and fair dealing ? Subsequent to the ruling, Roche has waived its defense that the Nevada court lacks personal jurisdiction for the purposes of this lawsuit • The court ruling allows PDL to continue to pursue its claims that: ? Genentech is obligated to pay royalties to PDL on international sales of the Genentech Products ? Genentech, by challenging, at the behest of Roche and Novartis, whether PDL's SPCs cover the Genentech Products breached its contractual obligations to PDL under the 2003 settlement agreement ? Genentech breached the implied covenant of good faith and fair dealing with respect to the 2003 settlement agreement ? Roche intentionally and knowingly interfered with PDL's contractual relationship with Genentech in conscious disregard of PDL's rights • Parties are currently in discovery and trial is scheduled for May 2013 31

Optimizing Stockholder Return 32

Business Strategy • Purchase new revenue generating assets ? Continue to reinvest in new assets and pay dividends - Commercial stage products - Sweet spot $75MM to $150MM ? Company continues as long as it can generate satisfactory return • If unable to acquire royalty assets on attractive terms ? Repay debt ? Use all excess cash to pay dividends and/or buy shares to enhance shareholder return ? Wind-up company in 2016 timeframe • Queen et al. patents expire in mid-2013 to December 2014; we anticipate royalties will likely continue to ~2016 • PDL has two possible future pathways 33

Optimizing Stockholder Return • Continuously evaluating alternatives ? Dividends ? Capital restructure ? Share repurchase ? Company sale ? Purchase of commercial stage, royalty generating assets 34

Investment Highlights • Strong historic revenue growth from approved products • Potential for additional indications from existing products, new product approvals and purchase of new revenue generating assets • Potential to grow and diversify revenues with the addition of new royalty assets • Significantly reduced expenses with no R&D burn • Liquidity – volume averages 2 million shares/day • Return to stockholders ? In 2011, paid regular, quarterly dividends totaling $0.60/share ? In 2012, will pay regular, quarterly dividends of $0.15/share on March 14, June 14, September 14 and December 14 35