Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Park Sterling Corp | park_8k-020912.htm |

Exhibit 99.1

Sterne Agee Investor Conference February 12-14, 2012

Disclosures 2 Forward Looking Statements This presentation contains, and Park Sterling Corporation (“Park Sterling”) and its management may make, certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts and often use words such as “may,” “plan,” “contemplate,” “anticipate,” “believe,” “intend,” “continue,” “expect,” “project,” “predict,” “estimate,” “could,” “should,” “would,” “will,” “goal,” “target” and similar expressions. These forward-looking statements express management’s current expectations, plans or forecasts of future events, results and condition, including financial and other estimates and expectations regarding the merger with Community Capital Corporation, the general business strategy of engaging in bank mergers, organic growth including branch openings and anticipated asset size, expansion or addition of product capabilities, anticipated loan growth, refinement of the loan loss allowance methodology, recruiting of key leadership positions, increases in net interest margin, changes in loan mix, changes in deposit mix, capital and liquidity levels, net interest income, noninterest income, credit trends and conditions, including loan losses, allowance, charge-offs, delinquency trends and nonperforming loan and nonperforming asset levels, residential sales activity and other similar matters. These statements are not guarantees of future results or performance and by their nature involve certain risks and uncertainties that are based on management’s beliefs and assumptions and on the information available to management at the time that these disclosures were prepared. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider all of the following uncertainties and risks, as well as those more fully discussed in any of Park Sterling’s filings with the SEC: failure to realize synergies and other financial benefits from the merger with Community Capital within the expected time frame; increases in expected costs or difficulties related to integration of the Community Capital merger; inability to identify and successfully negotiate and complete additional combinations with potential merger partners or to successfully integrate such businesses into Park Sterling, including the company’s ability to realize the benefits and cost savings from and limit any unexpected liabilities acquired as a result of any such business combination; the effects of continued negative economic conditions, including stress in the commercial real estate markets or delay or failure of recovery in the residential real estate markets; changes in consumer and investor confidence and the related impact on financial markets and institutions; changes in interest rates; failure of assumptions underlying the establishment of our allowance; deterioration in the credit quality of our loan portfolios or in the value of the collateral securing those loans or in the value of guarantor support for those loans, where applicable; deterioration in the value of securities held in our investment securities portfolio; failure of assumptions underlying the utilization of our deferred tax assets; legal and regulatory developments; increased competition from both banks and nonbanks; changes in accounting standards, rules and interpretations, inaccurate estimates or assumptions in accounting, including accounting for purchase credit impaired loans under ASC 310-30, and the impact on Park Sterling’s financial statements; Park Sterling’s ability to attract and retain new employees; and management’s ability to effectively manage credit risk, market risk, operational risk, legal risk, and regulatory and compliance risk. Forward-looking statements speak only as of the date they are made, and Park Sterling undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. Additional Information Certain financial measures contained herein represent non-GAAP financial measures. For more information about these non-GAAP financial measures and the presentation of the most directly comparable financial measures calculated in accordance with GAAP and accompanying reconciliations, see the appendix in this presentation.

Introduction to Park Sterling 3 Well-positioned, with five unique operating characteristics … ?Raised gross proceeds of $150.2 million ?Supplemented management team ?Reconstituted board of directors ?Embarked on regional growth strategy Formed in October 2006 ?Largest de novo raise in NC history ($45 million) ?Experienced community and regional team ?Scalable Jack Henry Silverlake® platform Pre-Initial Public Offering Initial Public Offering (August 2010) ?Grew to $488 million in total assets ?Locations in Charlotte, NC and Wilmington, NC ?FDIC bid-eligible institution

Five Unique Characteristics Vision 4 ?Our vision is to capitalize on a unique opportunity to create an $8 to $10 billion highly respected community banking franchise ?Return to soundness, profitability and growth ?Diversified by geography and business mix ?Noted for exceptional risk management, market management, relationship management and client service ?Financial institution of choice for prospects, customers, employees, shareholders and communities Charleston Columbia Greenville/ Spartanburg Wilmington Charlotte Research Triangle Piedmont Triad Richmond Hampton Roads Create a Strong Regional Franchise

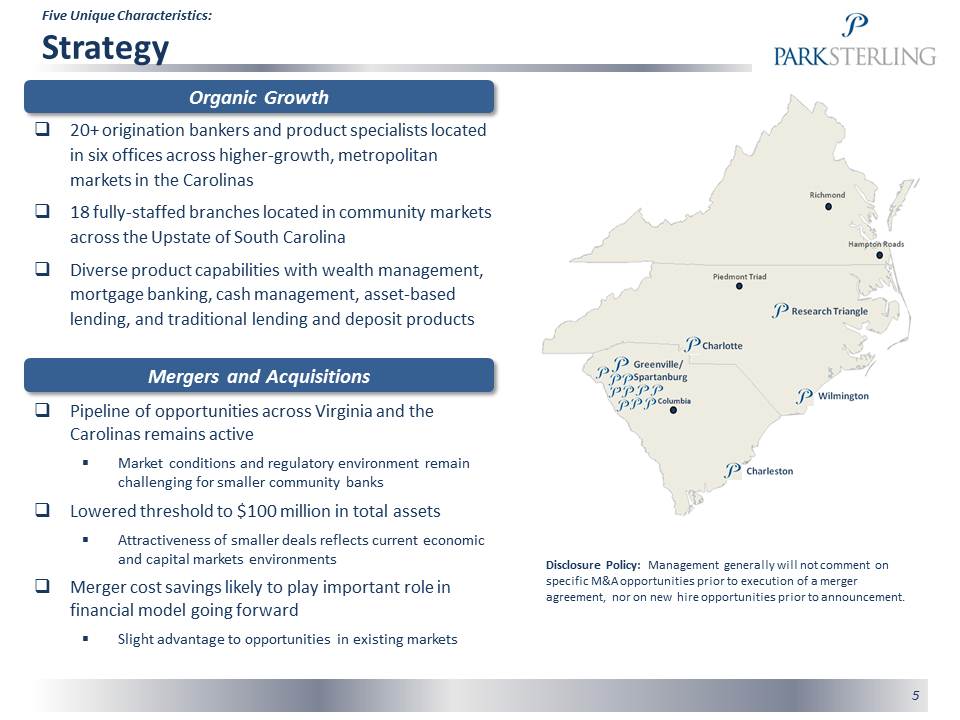

5 Disclosure Policy: Management generally will not comment on specific M&A opportunities prior to execution of a merger agreement, nor on new hire opportunities prior to announcement. Mergers and Acquisitions Organic Growth ?20+ origination bankers and product specialists located in six offices across higher-growth, metropolitan markets in the Carolinas ?18 fully-staffed branches located in community markets across the Upstate of South Carolina ?Diverse product capabilities with wealth management, mortgage banking, cash management, asset-based lending, and traditional lending and deposit products ?Pipeline of opportunities across Virginia and the Carolinas remains active ?Market conditions and regulatory environment remain challenging for smaller community banks ?Lowered threshold to $100 million in total assets ?Attractiveness of smaller deals reflects current economic and capital markets environments ?Merger cost savings likely to play important role in financial model going forward ?Slight advantage to opportunities in existing markets Five Unique Characteristics: Strategy

James C. Cherry Chief Executive Officer 6 Bryan F. Kennedy, III President David L. Gaines Chief Financial Officer Nancy J. Foster Chief Risk Officer Executive Officers 32 years of banking experience including Chief Executive Officer of Mid-Atlantic Banking, President of Virginia Banking, Head of Trust and Investment Management for Wachovia Bank. 30 years of banking experience including President North Carolina, Regions Bank and Executive Vice President, Park Meridian Bank. Helped organize Park Sterling in October 2006. 24 years of banking experience including Chief Risk Officer for Corporate and Investment Banking, Senior VP and Comptroller, and Co-Manager of integration office for Wachovia Corporation. 28 years of banking experience including Chief Risk Officer for CIT Group and Chief Credit Officer of Community Banking Group at LaSalle Bank. Independent Board Leslie M. (Bud) Baker, Jr. Chairman Retired Chairman of Wachovia Corporation. Also served Wachovia as Chairman, President, Chief Executive Officer, and Chief Credit Officer, as well as President of the North Carolina Bank. Walter C. Ayers Director Retired President and Chief Executive Officer of the Virginia Bankers Association. Served as member of ABA’s Communication Counsel, Government Relations Counsel and others. Larry W. Carroll Director President and Chief Executive Officer of Carroll Financial Associates, Inc, a registered investment advisory firm. CPA background. Park Sterling organizer in October 2006. Jean E. Davis Director Retired Executive and Head of Operations, Information Technology and e-Commerce at Wachovia Corporation. Also formerly Head of Human Resources, Head of Retail Banking. Thomas B. Henson Director President of Henson-Tomlin Interest, LLC and Senior Managing Director of Southeastern Private Investment Fund. Helped organize Park Sterling in October 2006. M&A attorney by background. Jeffrey S. Kane Director Retired Senior Vice President in charge of Charlotte office of Federal Reserve Bank of Richmond. Also served as head of Banking Supervision and Regulation. Patricia C. Hartung Director Executive Director of Upper Savannah Council of Governments. Founding member and former Chair of Community Capital Corporation. Five Unique Characteristics Leadership

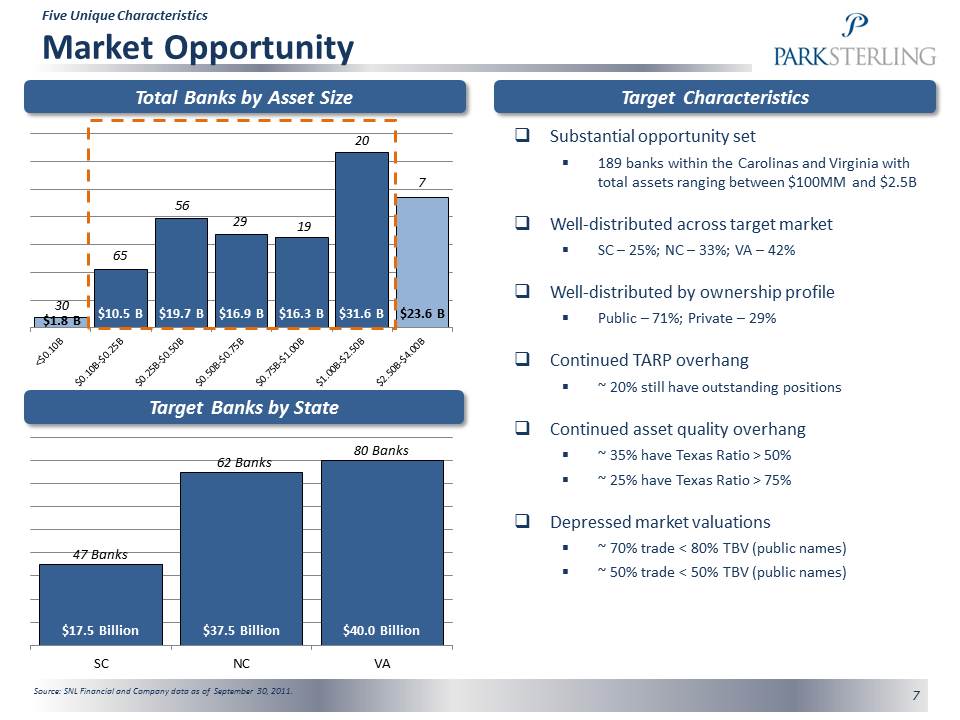

$1.8 B $10.5 B $19.7 B $16.9 B $16.3 B $31.6 B $23.6 B 7 Total Banks by Asset Size Source: SNL Financial and Company data as of September 30, 2011. Target Banks by State Target Characteristics ?Substantial opportunity set ?189 banks within the Carolinas and Virginia with total assets ranging between $100MM and $2.5B ?Well-distributed across target market ?SC – 25%; NC – 33%; VA – 42% ?Well-distributed by ownership profile ?Public – 71%; Private – 29% ?Continued TARP overhang ?~ 20% still have outstanding positions ?Continued asset quality overhang ?~ 35% have Texas Ratio > 50% ?~ 25% have Texas Ratio > 75% ?Depressed market valuations ?~ 70% trade < 80% TBV (public names) ?~ 50% trade < 50% TBV (public names) 30 65 56 29 19 20 7 $17.5 Billion $37.5 Billion $40.0 Billion SC NC VA 62 Banks 80 Banks 47 Banks Five Unique Characteristics Market Opportunity

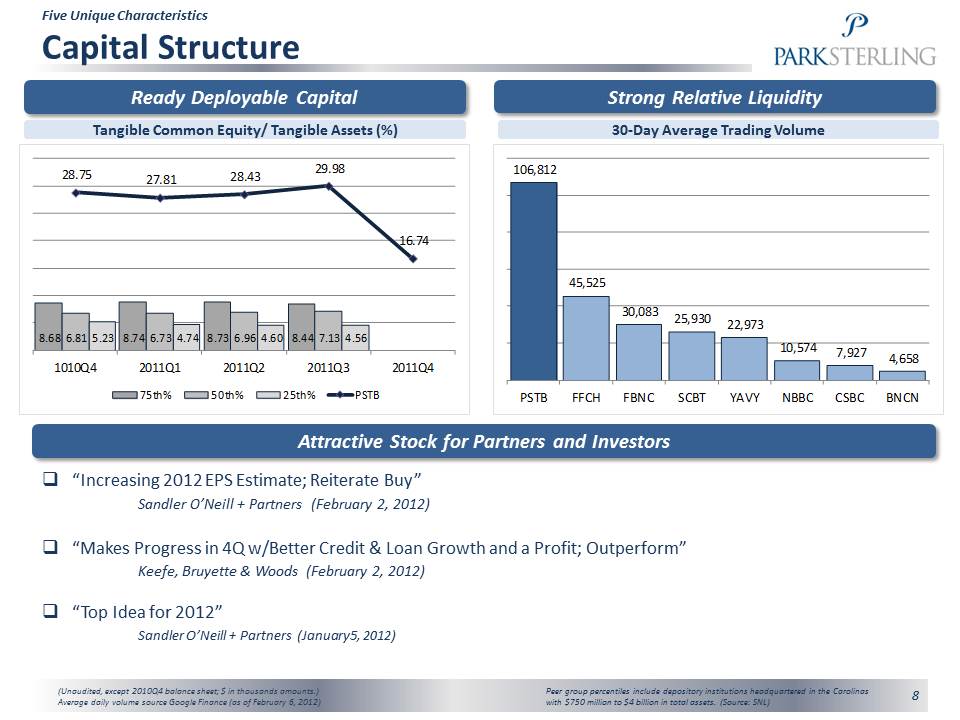

8 Ready Deployable Capital Strong Relative Liquidity Peer group percentiles include depository institutions headquartered in the Carolinas with $750 million to $4 billion in total assets. (Source: SNL) (Unaudited, except 2010Q4 balance sheet; $ in thousands amounts.) Average daily volume source Google Finance (as of February 6, 2012) Attractive Stock for Partners and Investors Five Unique Characteristics Capital Structure ? “Increasing 2012 EPS Estimate; Reiterate Buy” Sandler O’Neill + Partners (February 2, 2012) ? “Makes Progress in 4Q w/Better Credit & Loan Growth and a Profit; Outperform” Keefe, Bruyette & Woods (February 2, 2012) ? “Top Idea for 2012” Sandler O’Neill + Partners (January5, 2012) Tangible Common Equity/ Tangible Assets (%) 30-Day Average Trading Volume 106,812 45,525 30,083 25,930 22,973 10,574 7,927 4,658 PSTB FFCH FBNC SCBT YAVY NBBC CSBC BNCN 8.68 6.81 5.23 8.74 6.73 4.74 8.73 6.96 4.60 8.44 7.13 4.56 28.75 27.81 28.43 29.98 16.74 1010Q4 2011Q1 2011Q2 2011Q3 2011Q4 75th% 50th% 25th% PSTB

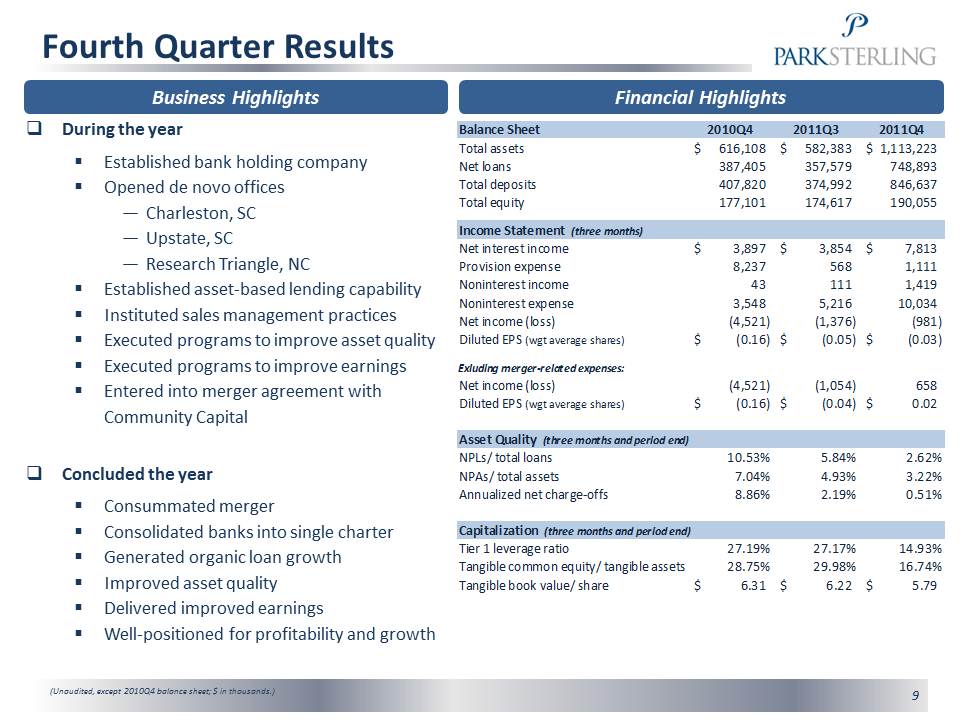

Fourth Quarter Results 9 Business Highlights ?During the year ?Established bank holding company ?Opened de novo offices —Charleston, SC —Upstate, SC —Research Triangle, NC ?Established asset-based lending capability ?Instituted sales management practices ?Executed programs to improve asset quality ?Executed programs to improve earnings ?Entered into merger agreement with Community Capital ?Concluded the year ?Consummated merger ?Consolidated banks into single charter ?Generated organic loan growth ?Improved asset quality ?Delivered improved earnings ?Well-positioned for profitability and growth (Unaudited, except 2010Q4 balance sheet; $ in thousands.) Financial Highlights Balance Sheet2010Q42011Q32011Q4Total assets616,108$ 582,383$ 1,113,223$ Net loans387,405 357,579 748,893 Total deposits407,820 374,992 846,637 Total equity177,101 174,617 190,055 Income Statement (three months) Net interest income3,897$ 3,854$ 7,813$ Provision expense8,237 568 1,111 Noninterest income43 111 1,419 Noninterest expense3,548 5,216 10,034 Net income (loss)(4,521) (1,376) (981) Diluted EPS (wgt average shares)(0.16)$ (0.05)$ (0.03)$ Exluding merger-related expenses: Net income (loss)(4,521) (1,054) 658 Diluted EPS (wgt average shares)(0.16)$ (0.04)$ 0.02$ Asset Quality (three months and period end) NPLs/ total loans10.53%5.84%2.62%NPAs/ total assets7.04%4.93%3.22%Annualized net charge-offs8.86%2.19%0.51%Capitalization (three months and period end) Tier 1 leverage ratio27.19%27.17%14.93%Tangible common equity/ tangible assets28.75%29.98%16.74%Tangible book value/ share6.31$ 6.22$ 5.79$

Q & A 10

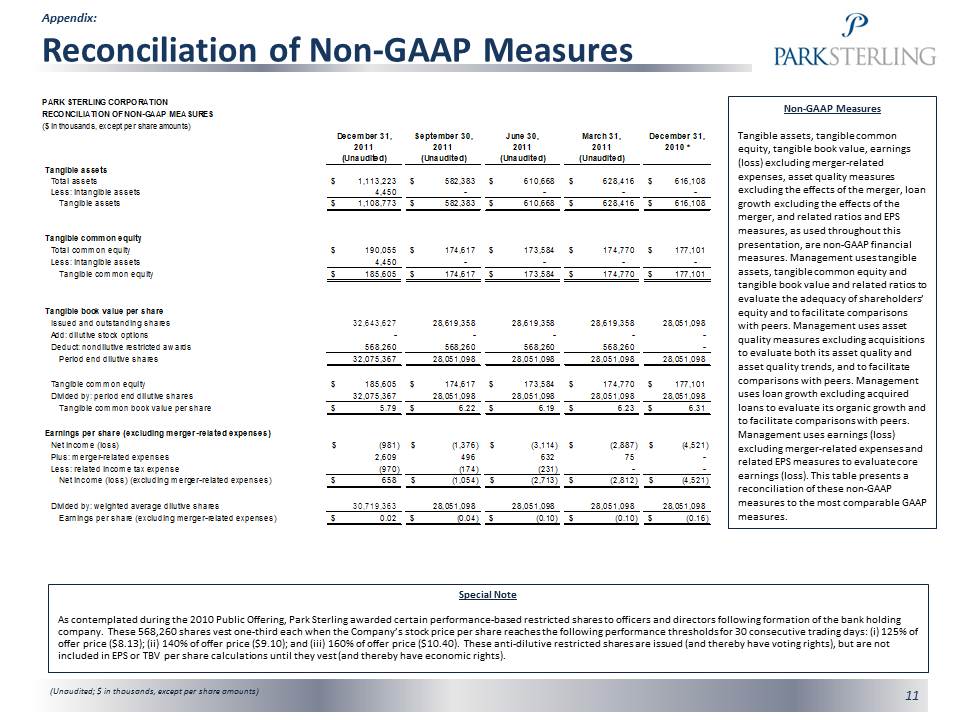

11 Appendix: Reconciliation of Non-GAAP Measures (Unaudited; $ in thousands, except per share amounts) PARK STERLING CORPORATION RECONCILIATION OF NON-GAAP MEASURES ($ in thousands, except per share amounts) December 31, September 30, June 30, March 31, December 31, 2011 2011 2011 2011 2010 * (Unaudited) (Unaudited) (Unaudited) (Unaudited) Tangible assets Total assets $ 1,113,223 $ 582,383 $ 610,668 $ 628,416 $ 616,108 Less: intangible assets 4,450 - - - - Tangible assets $ 1,108,773 $ 582,383 $ 610,668 $ 628,416 $ 616,108 Tangible common equity Total common equity $ 190,055 $ 174,617 $ 173,584 $ 174,770 $ 177,101 Less: intangible assets 4,450 - - - - Tangible common equity $ 185,605 $ 174,617 $ 173,584 $ 174,770 $ 177,101 Tangible book value per share Issued and outstanding shares 32,643,627 28,619,358 28,619,358 28,619,358 28,051,098 Add: dilutive stock options - - - - - Deduct: nondilutive restricted awards 568,260 568,260 568,260 568,260 - Period end dilutive shares 32,075,367 28,051,098 28,051,098 28,051,098 28,051,098 Tangible common equity $ 185,605 $ 174,617 $ 173,584 $ 174,770 $ 177,101 Divided by: period end dilutive shares 32,075,367 28,051,098 28,051,098 28,051,098 28,051,098 Tangible common book value per share $ 5.79 $ 6.22 $ 6.19 $ 6.23 $ 6.31 Earnings per share (excluding merger-related expenses) Net income (loss) $ (981) $ (1,376) $ (3,114) $ (2,887) $ (4,521) Plus: merger-related expenses 2,609 496 632 75 - Less: related income tax expense (970) (174) (231) - - Net income (loss) (excluding merger-related expenses) $ 658 $ (1,054) $ (2,713) $ (2,812) $ (4,521) Divided by: weighted average dilutive shares 30,719,363 28,051,098 28,051,098 28,051,098 28,051,098 Earnings per share (excluding merger-related expenses) $ 0.02 $ (0.04) $ (0.10) $ (0.10) $ (0.16) Non-GAAP Measures Tangible assets, tangible common equity, tangible book value, earnings (loss) excluding merger-related expenses, asset quality measures excluding the effects of the merger, loan growth excluding the effects of the merger, and related ratios and EPS measures, as used throughout this presentation, are non-GAAP financial measures. Management uses tangible assets, tangible common equity and tangible book value and related ratios to evaluate the adequacy of shareholders’ equity and to facilitate comparisons with peers. Management uses asset quality measures excluding acquisitions to evaluate both its asset quality and asset quality trends, and to facilitate comparisons with peers. Management uses loan growth excluding acquired loans to evaluate its organic growth and to facilitate comparisons with peers. Management uses earnings (loss) excluding merger-related expenses and related EPS measures to evaluate core earnings (loss). This table presents a reconciliation of these non-GAAP measures to the most comparable GAAP measures. Special Note As contemplated during the 2010 Public Offering, Park Sterling awarded certain performance-based restricted shares to officers and directors following formation of the bank holding company. These 568,260 shares vest one-third each when the Company’s stock price per share reaches the following performance thresholds for 30 consecutive trading days: (i) 125% of offer price ($8.13); (ii) 140% of offer price ($9.10); and (iii) 160% of offer price ($10.40). These anti-dilutive restricted shares are issued (and thereby have voting rights), but are not included in EPS or TBV per share calculations until they vest (and thereby have economic rights).

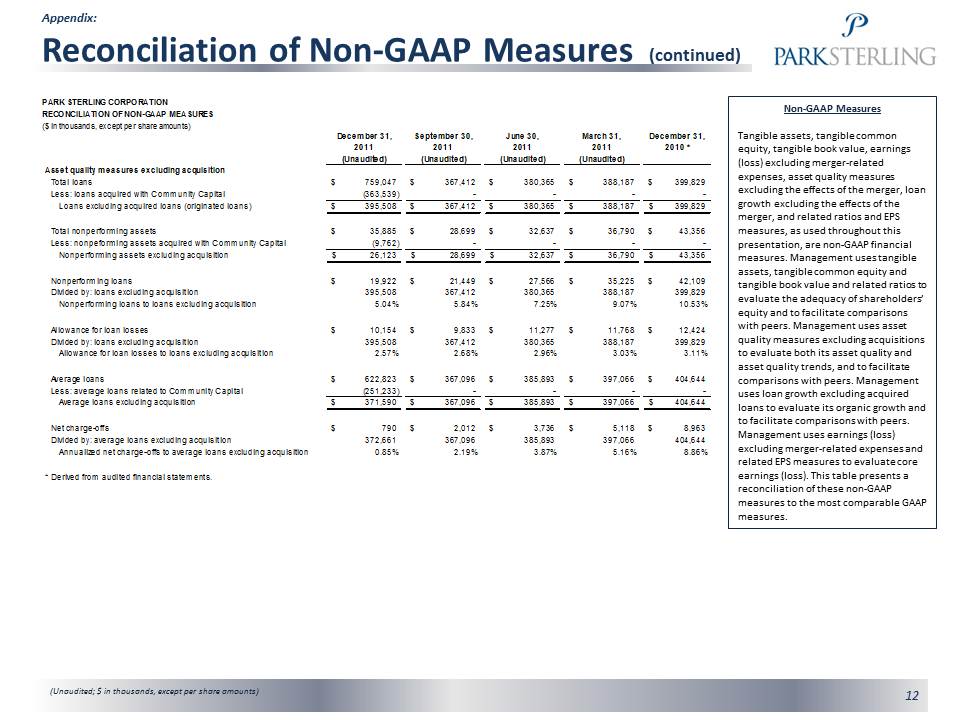

12 Appendix: Reconciliation of Non-GAAP Measures (continued) (Unaudited; $ in thousands, except per share amounts) PARK STERLING CORPORATION RECONCILIATION OF NON-GAAP MEASURES ($ in thousands, except per share amounts) December 31, September 30, June 30, March 31, December 31, 2011 2011 2011 2011 2010 * (Unaudited) (Unaudited) (Unaudited) (Unaudited) Asset quality measures excluding acquisition Total loans $ 759,047 $ 367,412 $ 380,365 $ 388,187 $ 399,829 Less: loans acquired with Community Capital (363,539) - - - - Loans excluding acquired loans (originated loans) $ 395,508 $ 367,412 $ 380,365 $ 388,187 $ 399,829 Total nonperforming assets $ 35,885 $ 28,699 $ 32,637 $ 36,790 $ 43,356 Less: nonpeforming assets acquired with Community Capital (9,762) - - - - Nonperforming assets excluding acquisition $ 26,123 $ 28,699 $ 32,637 $ 36,790 $ 43,356 Nonperforming loans $ 19,922 $ 21,449 $ 27,566 $ 35,225 $ 42,109 Divided by: loans excluding acquisition 395,508 367,412 380,365 388,187 399,829 Nonperforming loans to loans excluding acquisition 5.04% 5.84% 7.25% 9.07% 10.53% Allowance for loan losses $ 10,154 $ 9,833 $ 11,277 $ 11,768 $ 12,424 Divided by: loans excluding acquisition 395,508 367,412 380,365 388,187 399,829 Allowance for loan losses to loans excluding acquisition 2.57% 2.68% 2.96% 3.03% 3.11% Average loans $ 622,823 $ 367,096 $ 385,893 $ 397,066 $ 404,644 Less: average loans related to Community Capital (251,233) - - - - Average loans excluding acquisition $ 371,590 $ 367,096 $ 385,893 $ 397,066 $ 404,644 Net charge-offs $ 790 $ 2,012 $ 3,736 $ 5,118 $ 8,963 Divided by: average loans excluding acquisition 372,661 367,096 385,893 397,066 404,644 Annualized net charge-offs to average loans excluding acquisition 0.85% 2.19% 3.87% 5.16% 8.86% * Derived from audited financial statements. Non-GAAP Measures Tangible assets, tangible common equity, tangible book value, earnings (loss) excluding merger-related expenses, asset quality measures excluding the effects of the merger, loan growth excluding the effects of the merger, and related ratios and EPS measures, as used throughout this presentation, are non-GAAP financial measures. Management uses tangible assets, tangible common equity and tangible book value and related ratios to evaluate the adequacy of shareholders’ equity and to facilitate comparisons with peers. Management uses asset quality measures excluding acquisitions to evaluate both its asset quality and asset quality trends, and to facilitate comparisons with peers. Management uses loan growth excluding acquired loans to evaluate its organic growth and to facilitate comparisons with peers. Management uses earnings (loss) excluding merger-related expenses and related EPS measures to evaluate core earnings (loss). This table presents a reconciliation of these non-GAAP measures to the most comparable GAAP measures.