Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Speed Commerce, Inc. | d296759d8k.htm |

Exhibit 99.1

| Nasdaq: NAVR |

| Page 2 Safe Harbor FORWARD-LOOKING STATEMENTS This presentation contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements relate to future activities, events or developments. All statements, other than statements of fact, that address activities, events or developments that we or our management, expect, project, believe or anticipate will or may occur in the future, or that relate to historical periods that will be reported in future filings with the Securities and Exchange Commission, are forward-looking statements. Forward- looking statements are made based on management's assumptions and assessments in light of past experience and trends, current conditions, expected future developments and other relevant factors.Forward-looking statements are not guarantees of future performance, and actual results, developments and business decisions may differ from those envisaged by our forward-looking statements. Our forward-looking statements are also subject to risks and uncertainties which can affect our performance in both the near-and long-term. We identify the principal risks and uncertainties that affect our performance in our Form 10-K and other filings with the Securities and Exchange Commission. We disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the foregoing. |

| Use of Non-GAAP Information The Company provides non-GAAP adjusted pro forma information and references to "adjusted pro forma" information are references to non-GAAP measures. The Company provides adjusted pro forma information to assist investors in assessing its current and future operations in the way that its management evaluates those operations. Adjusted pro forma information is not a substitute for any performance measure derived in accordance with GAAP. The Company's management has evaluated and made operating decisions about its business operations primarily based upon these adjusted pro forma financial metrics. For each such adjusted pro forma financial measure, the adjustment provides the Company's management with information about the Company's underlying operating performance that enables a more meaningful comparison of its financial results in different reporting periods. The Company recognizes that the use of adjusted pro forma measures has limitations, including the need to exercise judgment in determining which types of charges should be excluded from the adjusted pro forma financial information. The Company provides adjusted pro forma financial information to the investment community, not as an alternative, but as an important supplement to GAAP financial information; to enable investors to evaluate the Company's core operating performance in the same way that its management does. Reconciliations between historical pro forma and adjusted pro forma results of operations are available on the Company's website located at www.navarre.com in the "Investors" section. Page 3 |

| Page 4 Largest distributor of consumer software in the United States and CanadaStrong reputation for value and service with the world's largest and most sophisticated retailersUnique offering of multi-channel sales solutions with retail distribution programs, e-commerce fulfillment and 3PL servicesExplosive growth in distribution of Consumer Electronics & Accessories productsHeadquartered in Minneapolis MN with logistics facilities and offices in Minneapolis, MN, Toronto, Canada, Bentonville, AR and Cedar Rapids, IANo debt at any quarterly period end in fiscal year 2012Ticker: NAVR - Website: www.Navarre.com Business Overview |

| Page 5 Increase market share of software to maximize this important category through opportunistic product line wins and expansion in the Canadian marketFurther expand base of vendor partnerships and retail relationships to continue rapid growth in CE&A productsContinue to enhance 3PL service offering to capture revenue streams across multiple sales channels with vendor partnersMaximize software publishing (Encore) profitability with lower cost base and pursuit of new contentAggressively pursue the underserviced Canadian marketConstant vigil for further cost reductionsPursue acquisitions in existing and adjacent markets Strategic Summary |

| 2012 Restructuring: The Reset Realignment and RepositioningRefocusing on growing product lines and core competenciesTransitioning away from facilities, business processes and assets related to now divested and non-core businessesSenior Management ChangesRichard Wills Appointed CEO September 2011Over half of executives no longer with the Company at conclusion of FY 2012Cost ReductionsUnderutilized 120,000 sq. ft. storage and manufacturing facility taken offline - $1 million/yr. savingsEncore moved from Los Angeles and consolidated into Minneapolis headquarters - $300,000/yr. savings Headcount reduced by 30% - $4.6 million/yr. savingsTotal annualized savings expected to be $5.5 and $6.5 million Page 6 |

| Seasoned Leadership Team Page 7 Richard Willis, Chief Executive OfficerAppointed CEO in September 2011, member of Board of DirectorsCEO experience SFC, Inc., Baker & Taylor, Troll Communications and Bell SportsDiane Lapp, Interim Chief Financial OfficerJoined Navarre in October 2003, appointed Interim CFO in October 201120 years of senior management experience in public accounting and financeJoyce Fleck, President of Navarre Distribution ServicesJoined Navarre in May 199920 years of senior management experience in sales, merchandising and marketingWard Thomas, President of Business Services and EncorePresident of Business Services since August 2010, President of Encore since October 2011Executive sales and management experience at Trend Micro and FUNimation Entertainment Ryan Urness, General Counsel and Investor RelationsJoined Navarre in January 2003Former head of intellectual property practice at Winthrop & Weinstine, P.A. |

| Our Markets Software DistributionLargest software publishers in the world trust Navarre to service the retail channel with their products Retail software is a mature market in overall declineConsumer Electronics & AccessoriesRapidly expanding list of vendor partners Creating new customer relationships at a rate of 10+ per monthHigh growth retail opportunity with no possibility of sales migrating to digital delivery3PL and E-CommerceStrong and growing base of e-commerce partners Growth opportunities with current and new vendor partnersSoftware PublishingSolid stable of strong consumer software offeringsSignificantly growing proprietary e-commerce sales channelGrowth through the acquisition of content Page 8 |

| Key Customers Page 9 |

| Software Distribution Page 10 |

| Software Distribution Page 11 Market leading distribution solution for the United States and Canada marketStrong longstanding relationships with retail customers and publisher/vendor partnersWe provide our vendor partners a full array of services to support sales to retail customersRetail customers look to us to provide a lower all-in cost of placing product on shelf Sophisticated systems allows flexibility to offer a wide variety of programs and deep customer integrationProprietary vendor managed inventory (VMI) programsPoint of sale activation (POSA) programsConsignment programs |

| Software Publishers/Vendors Page 12 |

| Consumer Electronics & Accessories Page 13 |

| Consumer Electronics & Accessories Page 14 High growth opportunity with market rapidly expanding across the full spectrum of retailersProvides opportunities to expand Navarre's reach to new retail customers and sales channelsRecent customer additions include: RadioShack, Nordstrom, Urban Outfitters, American Eagle, Bass Pro Shops, Brookstone, and Home Shopping NetworkStrong partnerships with key trend-setting retail customers drives new vendor partners to NavarreRapidly expanding base of vendor partnersMore than 100 new vendor partners added during the first three quarters of FY 2012, and more than 200 new vendor partners brought on board during the past 24 monthsExcellent reputation for value and high service levels is developing among the vendor and customer community |

| CE&A Manufacturers/Vendors Page 15 |

| 3PL & E-Commerce Page 16 |

| 3PL & E-Commerce:Logistics Services Page 17 Our supply chain and logistics services allow our partners to look to Navarre for all of their product handling and sales channel service needsDistribution vendor partners are built-in customer base for our 3PL services offering Broad service offering includes:Complete solutions to coordinate overseas product receipt and import/export customs managementInventory storage, tracking and portal visibilityStreamlined EDI ordering servicesRapid order turnaround - same day fulfillmentReverse logistics, quality assurance and returns disposition solutions Customizable packaging design and marketing services |

| 3PL & E-Commerce:Web Storefront Solutions Page 18 Vendor/client partners often are looking to operate a proprietary e- commerce sales channel for their productsNavarre builds and operates web storefront technologies that offer these partners with a solution that is integrated into our other product handling servicesIntegrated fulfillment and returnsDigital delivery options Marketing and creative servicesCustomer support call center |

| 3PL & E-Commerce Clients Page 19 |

| Software Publishing Page 20 |

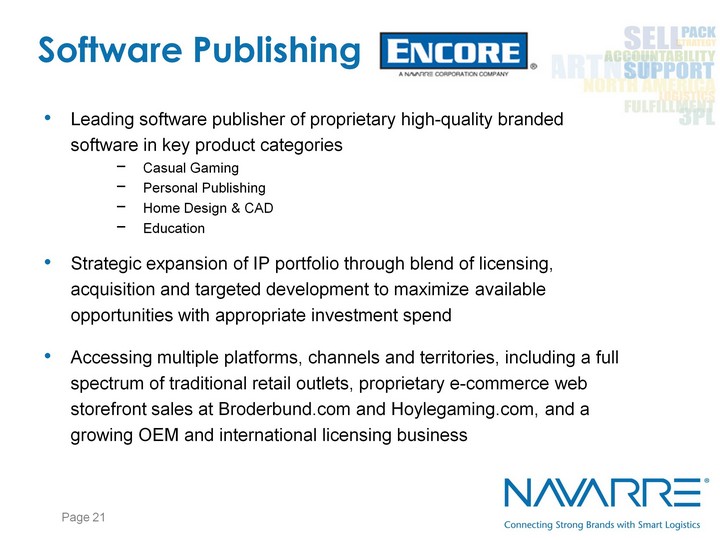

| Software Publishing Leading software publisher of proprietary high-quality branded software in key product categoriesCasual GamingPersonal PublishingHome Design & CADEducationStrategic expansion of IP portfolio through blend of licensing, acquisition and targeted development to maximize available opportunities with appropriate investment spendAccessing multiple platforms, channels and territories, including a full spectrum of traditional retail outlets, proprietary e-commerce web storefront sales at Broderbund.com and Hoylegaming.com, and a growing OEM and international licensing business Page 21 |

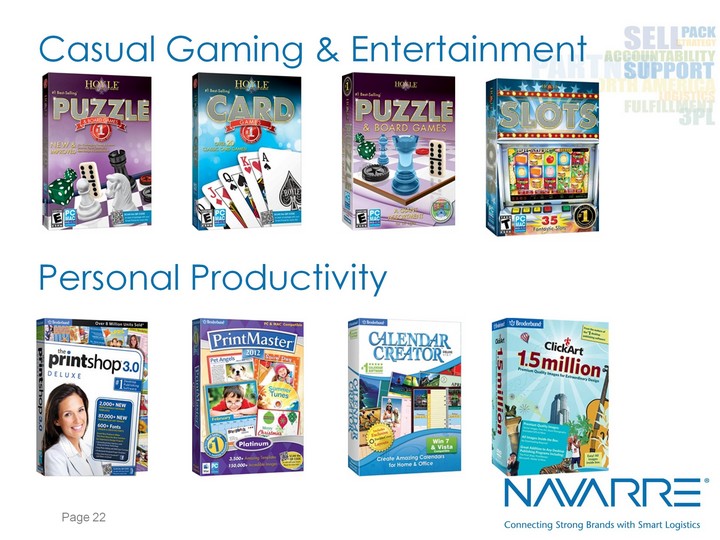

| Page 22 Casual Gaming & Entertainment Personal Productivity |

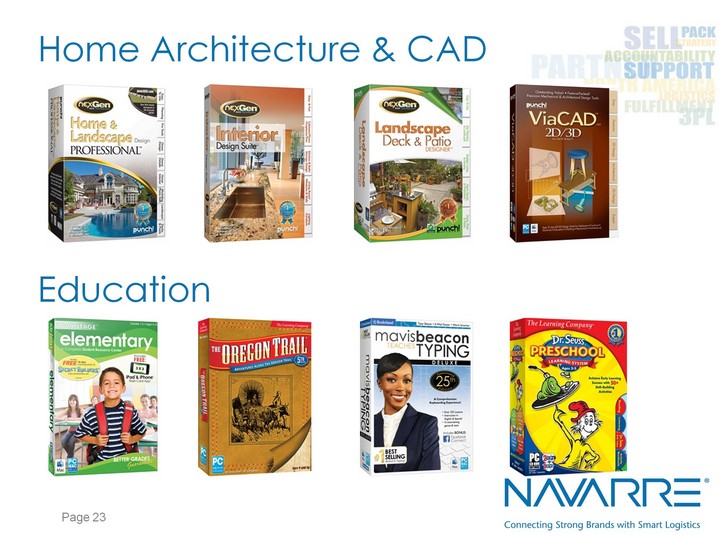

| Page 23 Home Architecture & CAD Education |

| Key Financials Page 24 |

| Page 25 78% Software 69% 8% CE&A 22% 14% Other 9% 3rd Quarter Percent of Sales Composition Overview (Distribution Only) 11% Canada 17% 12% E-Commerce 16% Other select business categories*: * Revenues included in product category totals listed above 189% 67% 36% Product categories: Q3 Fiscal 2011 Q3 Fiscal 2012 |

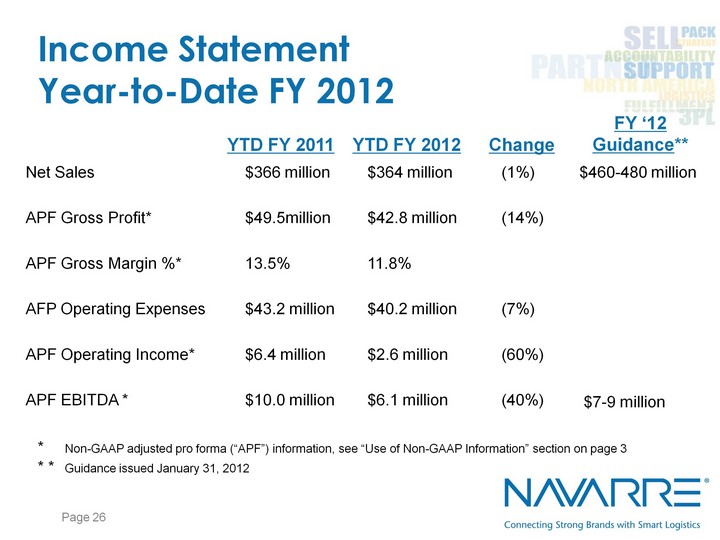

| Income Statement Year-to-Date FY 2012 Page 26 * Non-GAAP adjusted pro forma ("APF") information, see "Use of Non-GAAP Information" section on page 3* * Guidance issued January 31, 2012 YTD FY 2011 YTD FY 2012 Change FY '12 Guidance** Net Sales $366 million $364 million (1%) $460-480 million APF Gross Profit* $49.5million $42.8 million (14%) APF Gross Margin %* 13.5% 11.8% AFP Operating Expenses $43.2 million $40.2 million (7%) APF Operating Income* $6.4 million $2.6 million (60%) APF EBITDA * $10.0 million $6.1 million (40%) $7-9 million |

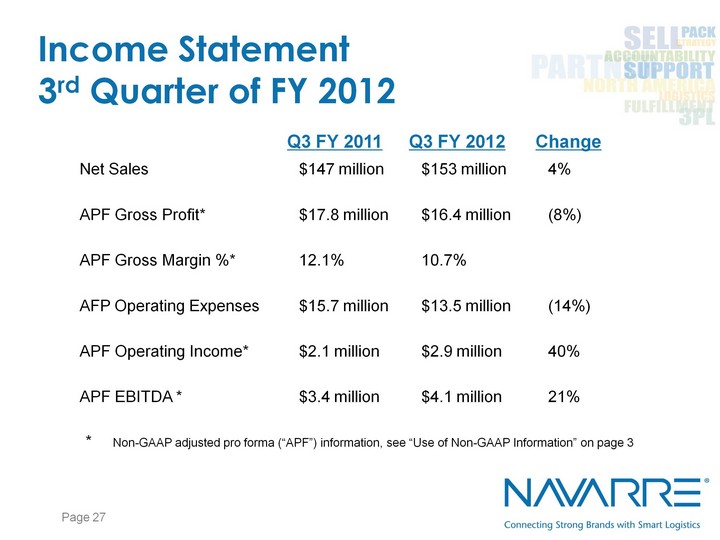

| Income Statement 3rd Quarter of FY 2012 Page 27 * Non-GAAP adjusted pro forma ("APF") information, see "Use of Non-GAAP Information" on page 3 Q3 FY 2011 Q3 FY 2012 Change Net Sales $147 million $153 million 4% APF Gross Profit* $17.8 million $16.4 million (8%) APF Gross Margin %* 12.1% 10.7% AFP Operating Expenses $15.7 million $13.5 million (14%) APF Operating Income* $2.1 million $2.9 million 40% APF EBITDA * $3.4 million $4.1 million 21% |

| December 31, 2011 (Unaudited) December 31, 2010 (Unaudited) Assets: Current assets: Cash and cash equivalents $ 1,882 $ - Accounts receivable, net 92,144 79,330 Inventories 32,784 28,469 Other assets - current 6,065 9,242 Current assets of discontinued operations - 5,339 Total current assets 132,875 122,380 Property and equipment, net 7,534 9,758 Other assets 24,485 36,161 Non-current assets of discontinued operations - 30,716 Total assets $ 164,894 $ 199,015 Liabilities and shareholders' equity: Current liabilities: Revolving line of credit $ - $ 12,547 Accounts payable 112,855 92,640 Other 7,447 14,789 Current liabilities of discontinued operations - 7,543 Total current liabilities 120,302 127,519 Long-term liabilities 1,629 2,606 Total liabilities 121,931 130,125 Shareholders' equity 42,963 68,890 Total liabilities and shareholders' equity $ 164,894 $ 199,015 Solid Balance Sheet Page 28 |

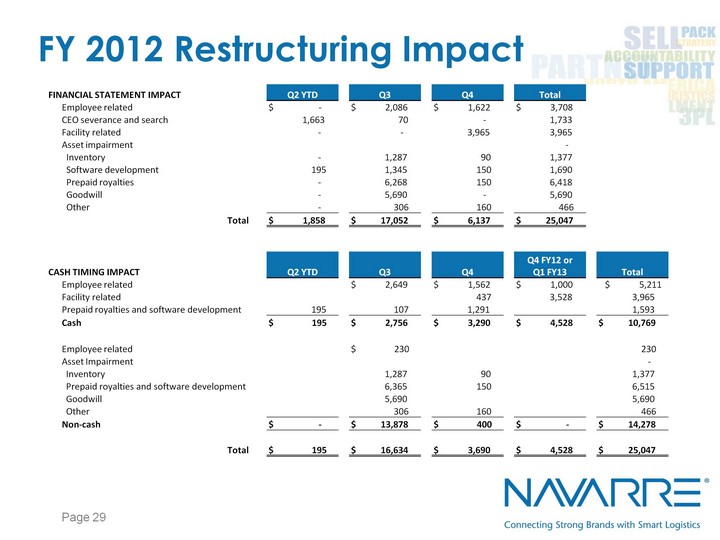

| FY 2012 Restructuring Impact Page 29 FINANCIAL STATEMENT IMPACT FINANCIAL STATEMENT IMPACT Q2 YTD Q3 Q4 Total Employee related $ - $ 2,086 $ 1,622 $ 3,708 CEO severance and search 1,663 70 - 1,733 Facility related - - 3,965 3,965 Asset impairment - Inventory - 1,287 90 1,377 Software development 195 1,345 150 1,690 Prepaid royalties - 6,268 150 6,418 Goodwill - 5,690 - 5,690 Other - 306 160 466 Total $ 1,858 $ 17,052 $ 6,137 $ 25,047 CASH TIMING IMPACT CASH TIMING IMPACT Q2 YTD Q3 Q4 Q4 FY12 or Q1 FY13 Total Employee related $ 2,649 $ 1,562 $ 1,000 $ 5,211 Facility related 437 3,528 3,965 Prepaid royalties and software development 195 107 1,291 1,593 Cash $ 195 $ 2,756 $ 3,290 $ 4,528 $ 10,769 Employee related $ 230 230 Asset Impairment - Inventory 1,287 90 1,377 Prepaid royalties and software development 6,365 150 6,515 Goodwill 5,690 5,690 Other 306 160 466 Non-cash $ - $ 13,878 $ 400 $ - $ 14,278 Total $ 195 $ 16,634 $ 3,690 $ 4,528 $ 25,047 |

| Strategic Summary Page 30 |

| Page 31 Solid Reputation and RelationshipsConsistent high service levels create a significant value proposition to vendor partners and customersNavarre provides a single-source solution to retailers simplifying the landscape of supplier relationshipsMarket PresenceIndustry leading position in software distribution Unique offering of multi-channel sales solutions with flexible retail distribution programs, e-commerce fulfillment, and 3PL servicesFacilities and SystemsInfrastructure operates on highly scalable platform of industry-leading systems and strategically placed distribution assetsAble to add significant volume with little additional capital spendCapabilities Enhancement OpportunityAddition of more robust E-Commerce platform solution would greatly enhance 3PL service offering and generate new revenue streams with vendor partners Strategic Assets |

| Page 32 Increase market share of software to maximize this important category through opportunistic product line wins and expansion in the Canadian marketFurther expand base of vendor partnerships and retail relationships to continue rapid growth in CE&A productsContinue to enhance 3PL service offering to capture revenue streams across multiple sales channels with vendor partnersMaximize software publishing (Encore) profitability with lower cost base and pursuit of new contentAggressively pursue the underserviced Canadian marketConstant vigil for further cost reductionsPursue acquisitions in existing and adjacent markets Strategic Summary |

| Page 33 Q&A |