Attached files

| file | filename |

|---|---|

| EX-99.3 - FINANCIAL STATEMENTS - KEYCORP /NEW/ | d286107dex993.htm |

| EX-99.1 - PRESS RELEASE, DATED JANUARY 24, 2012 - KEYCORP /NEW/ | d286107dex991.htm |

| 8-K - FORM 8-K - KEYCORP /NEW/ | d286107d8k.htm |

| KeyCorp

Fourth Quarter 2011 Earnings Review

January 24, 2012

Beth E. Mooney

Chairman and

Chief Executive Officer

Jeffrey B. Weeden

Chief Financial Officer

Exhibit 99.2 |

| 2

This presentation contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including statements about

Key’s financial condition, results of operations, earnings outlook, asset quality trends

and profitability. Forward-looking statements are not historical facts

but instead represent only management’s current expectations and

forecasts regarding future events, many of which, by their nature, are inherently uncertain and outside

of Key’s control. Key’s actual results and financial condition may

differ, possibly materially, from the anticipated results and financial

condition indicated in these forward-looking statements. Factors that could cause Key’s actual results to

differ materially from those described in the forward-looking statements can be

found in KeyCorp’s Annual Report on Form 10-K for the year ended

December 31, 2010, and its Quarterly Reports on Form 10-Q for the periods ended March

31, 2011, June 30, 2011 and September 30, 2011, which have been filed with the

Securities and Exchange Commission and are available on Key’s website

(www.key.com/ir) and on the Securities and Exchange Commission’s website

(www.sec.gov). Forward-looking statements are not guarantees of future

performance and should not be relied upon as representing management’s

views as of any subsequent date. Key does not undertake any obligation to update the

forward-looking statements to reflect the impact of circumstances or events

that may arise after the date of the forward- looking statements.

PRIVATE SECURITIES LITIGATION REFORM ACT OF

1995 FORWARD-LOOKING STATEMENT DISCLOSURE |

3

Returned to solid profitability

Continued improvement in credit quality

New leadership team committed to focused strategy execution

Reached inflection point for loan portfolio

Leveraged differentiated business model to build sustainable momentum

Continued investment in the business

Growing the

Franchise

Maintained strong balance sheet and moderate risk profile

Disciplined approach to capital management to maximize shareholder value

Positioned to meet Basel III requirements

Execution of

Business Plan

Investor Highlights –

Full Year 2011

Strategic statement: Key grows by building enduring relationships

through client-focused solutions and extraordinary service

Disciplined

Capital

Management |

4

(a) Continuing operations, unless otherwise noted

(b) Represents period-end consolidated total loans and loans held for

sale (excluding education loans in the securitization trusts) divided by

period-end consolidated total deposits (excluding deposits in foreign office)

Executing Business Plan: Progress on Targets for Success

1.17%

68%

44%

3.16%

1.11%

87%

KEY

FY 2011

Improve funding mix

Focus on risk-adjusted returns

Grow client relationships

Leverage Key’s total client solutions and

cross-selling capabilities

>3.50%

3.13%

Net interest margin

Growing high

quality, diverse

revenue streams

>40%

42%

Noninterest income

to total revenue

Improve efficiency and effectiveness

Leverage technology

Change cost base to more variable from

fixed

60-65%

73%

Efficiency ratio

Creating positive

operating

leverage

Execute our client insight-driven

relationship model

Focus on operating leverage

Improved funding mix with lower cost core

deposits

1.00-1.25%

1.01%

Return on average

assets

Executing our

strategies

Focus on relationship clients

Exit noncore portfolios

Limit concentrations

Focus on risk-adjusted returns

40-50 bps

.86%

NCOs to average loans

Returning to a

moderate risk

profile

Leverage integrated model to grow

relationships and loans

Improve deposit mix

90-100%

87%

Loan to deposit ratio

(b)

Core funded

Action Plans

Targets

KEY

4Q11

KEY Metrics

(a)

KEY Business

Model |

5

Financial Review |

6

Financial Summary –

Fourth Quarter 2011

Capital

(b)

Asset Quality

(a)

Financial

Performance

(a)

TE = Taxable equivalent, EOP = End of Period

(a) From continuing operations

(b) From consolidated operations

(c) 12-31-11 ratios are estimated

Income from continuing operations attributable to Key

$.21

$.24

$.33

common shareholders

Net interest margin (TE)

3.13%

3.09%

3.31%

Return on average total assets

1.01

1.14

1.53

Tier 1 common equity

(c)

11.28%

11.28%

9.34%

Tier 1 risk-based capital

(c)

13.01

13.49

15.16

Tangible common equity to tangible assets

9.88

9.82

8.19

Book value per common share

$10.09

$10.09

$9.52

Net loan charge-offs to average loans

.86%

.90%

2.00%

NPLs to EOP portfolio loans

1.47

1.64

2.13

NPAs to EOP portfolio loans + OREO + Other NPAs

1.73

1.89

2.66

Allowance for loan losses to period-end loans

2.03

2.35

3.20

Allowance for loan losses to NPLs

138.10

143.53

150.19

Metrics

4Q11

3Q11 4Q10 |

7

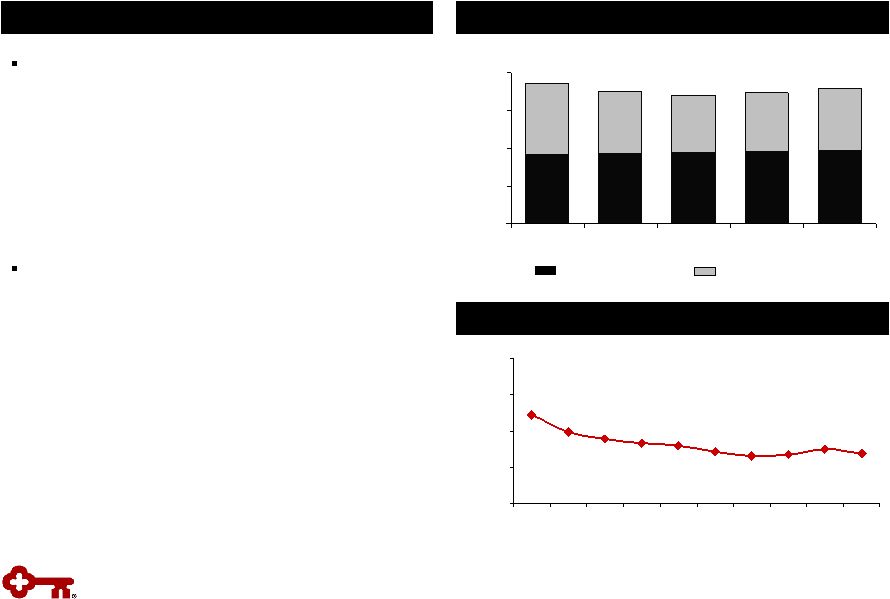

Period-end loans grew for the second consecutive

quarter and average balances increased for the

first time since 4Q08

Average CF&A loans increased 5.4% in 4Q11

Positioned to continue to grow loans by

leveraging integrated business model and

focusing on targeted segments

$0

$10

$20

$30

$40

$50

$60

4Q10

1Q11

2Q11

3Q11

4Q11

Loan Growth –

Past the Inflection Point

$ in billions

Highlights

Average Commercial, Financial & Agricultural Loans

CF&A loans

Utilization rate

Quarterly % Change in Average CF&A Loans

Average Loans

Exit Portfolios

Home Equity & Other

CF&A & Leasing

Commercial Real Estate

$ in billions

$50.8

$49.3

$48.5

$18.3

$17.4

$16.9

$16.3

$16.6

46.3%

44.4%

43.4%

43.2%

42.9%

$0

$5

$10

$15

$20

4Q10

1Q11

2Q11

3Q11

4Q11

30%

40%

50%

60%

(10.3)%

(5.2)%

(5.7)%

(4.4)%

(2.3)%

3.7%

2.7%

5.4%

(1.5)%

(12.0)%

(8.0)%

(4.0)%

.0%

4.0%

8.0%

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

$48.0

$48.7 |

8

$10.8

$11.7

$12.4

$13.6

$15.0

2.66%

2.60%

2.69%

2.59%

2.53%

$0

$5

$10

$15

$20

4Q10

1Q11

2Q11

3Q11

4Q11

.00%

1.00%

2.00%

3.00%

4.00%

5.00%

$45.8

$45.4

$45.3

$46.5

$48.2

.13%

.15%

.18%

.17%

.18%

$20

$30

$40

$50

4Q10

1Q11

2Q11

3Q11

4Q11

.00%

.10%

.20%

.30%

85%

85%

81%

80%

82%

0%

25%

50%

75%

100%

4Q10

1Q11

2Q11

3Q11

4Q11

Improving Deposit Mix

Highlights

Average Non-time Deposits

(a)

Higher cost CDs continue to decline, while lower

cost deposits have remained strong

Improved funding mix has reduced the cost of

total deposits, which is down 7 bps from 3Q11

Total CD maturities and average cost

–

2012 Q1: $2.4 billion at 0.89%

–

2012 Q2: $1.8 billion at 2.00%

–

2012 Q3: $1.6 billion at 3.40%

–

2012 Q4: $1.0 billion at 2.73%

–

2013 & beyond: $3.5 billion at 3.28%

Average

CD Balances

$ in billions

$ in billions

(a) Excludes time deposits and deposits in foreign office

(b) Represents period-end consolidated total loans and loans held for

sale (excluding education loans in the securitization trusts) divided by

period-end consolidated total deposits (excluding deposits in foreign office)

Loan to Deposit Ratio

(b)

Continuing operations

Discontinued operations

90%

91%

Cost of non-time deposits

Non-time deposits

Average rate on CDs

Total average CDs

86%

86%

87% |

9

$859

$914

$950

$1,089

1.47%

1.64%

1.76%

1.82%

2.13%

$0

$500

$1,000

$1,500

$2,000

4Q10

1Q11

2Q11

3Q11

4Q11

0.00%

1.00%

2.00%

3.00%

4.00%

$1,338

$1,004

$1,131

$1,230

$1,372

$1,604

2.83%

2.57%

3.20%

2.35%

2.03%

$0

$500

$1,000

$1,500

$2,000

4Q10

1Q11

2Q11

3Q11

4Q11

0.00%

2.00%

4.00%

6.00%

138.1%

143.5%

146.1%

155.0%

150.2%

0%

50%

100%

150%

200%

4Q10

1Q11

2Q11

3Q11

4Q11

$256

$193

$134

$109

$105

$(22)

$10

$(8)

$(40)

$(97)

2.00%

1.59%

.90%

.86%

1.11%

-$100

$0

$100

$200

$300

$400

4Q10

1Q11

2Q11

3Q11

4Q11

-1.00%

.00%

1.00%

2.00%

3.00%

4.00%

Nonperforming Assets

Net Charge-offs & Provision for Loan Losses

NPLs

NPLs to period-end loans

NCOs

Provision for loan losses

NCOs to average loans

Allowance for Loan Losses

Allowance to Nonperforming Loans

Allowance for loan losses

ALLL to period-end loans

$ in millions

$ in millions

$ in millions

NPLs held for sale,

OREO & other NPAs

Continued Improvement in Asset Quality |

10

Total Revenue

TE = Taxable equivalent

$ in millions

Continuing Operations

Net interest margin

Net interest income

Highlights

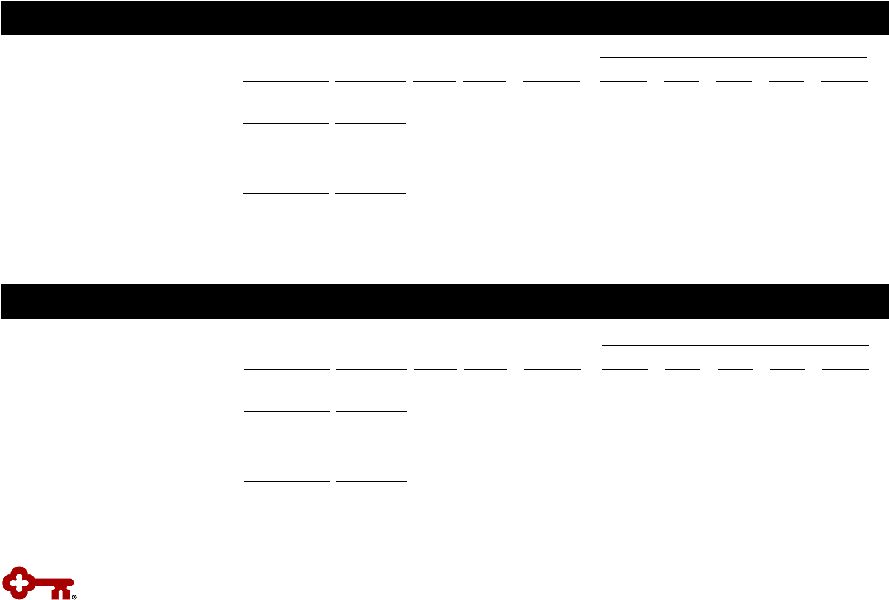

Net Interest Margin (TE) Trend

Continued funding cost reductions contribute

to stability and improvement in net interest

income

Lower noninterest income primarily driven by:

–

Volatility in principal investing income

–

Full quarter impact of debit price controls

–

Visa related charge -

$24 million in 4Q11

–

Trust Preferred redemptions

New client acquisition and execution of

relationship-based model provide opportunities

to grow noninterest income

Noninterest Income and % of Total Revenue

Noninterest income

Noninterest income to

total revenue

$ in millions

$563

$555

$570

$604

$635

3.25%

3.19%

3.31%

3.09%

3.13%

$0

$150

$300

$450

$600

$750

4Q10

1Q11

2Q11

3Q11

4Q11

0.00%

2.00%

4.00%

6.00%

$526

$457

$454

$483

$414

42.4%

46.5%

45.3%

44.3%

43.1%

$0

$200

$400

$600

4Q10

1Q11

2Q11

3Q11

4Q11

30.0%

40.0%

50.0%

60.0% |

11

$365

$371

$380

$382

$387

$379

$330

$300

$310

$330

$0

$200

$400

$600

$800

4Q10

1Q11

2Q11

3Q11

4Q11

Focused Expense Management

Noninterest Expense

Personnel expense

$ in millions

Highlights

Noninterest expense declined $27 million from the

prior year and increased $25 million compared to

3Q11

–

Improvement from prior year due to lower

FDIC expense, a decline in lease operating

expense and Key’s efficiency initiatives

–

4Q11 expense levels reflect higher business

services and marketing, offset by lower

provision for lending commitments

Key remains focused on operating leverage

–

Shifting FTE mix towards client-facing

positions

–

Leveraging continuous improvement

practices

–

Strengthening processes, alignment and

accountability across the organization

Average FTEs

Non-personnel expense

$680

$701

$744

15,973

15,349

15,381

15,772

16,436

15,665

15,584

15,424

15,301

15,490

14,000

15,000

16,000

17,000

18,000

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

$692

$717 |

12

$977

$717

$260

Total revenue

Noninterest

expense

PPNR

4Q11 Pre-Provision Net Revenue

Pre-Provision Net Revenue Trend

Pre-Provision Net Revenue

(a)

and ROAA

(b)

(a) Net interest income plus taxable-equivalent adjustment and

noninterest income less noninterest expense (b) From continuing

operations Return on Average Assets

$ in millions

$ in millions

Noninterest

income

42%

Personnel

expense

54%

$417

$360

$344

$346

$260

$0

$100

$200

$300

$400

$500

4Q10

1Q11

2Q11

3Q11

4Q11

1.01%

1.14%

1.23%

1.32%

1.53%

.00%

.50%

1.00%

1.50%

2.00%

4Q10

1Q11

2Q11

3Q11

4Q11

Net interest

income

58%

Non-personnel

expense

46% |

13

Peer leading capital position supports growth

Positioned for successful transition to Basel III

Continued capital generation through execution

of strategy

Disciplined approach to capital management

Tier 1 Common Equity

(a)

Tangible Common Equity to Tangible Assets

Strong Capital Ratios

Highlights

Book Value per Share

9.88%

9.82%

8.19%

9.16%

9.67%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

4Q10

1Q11

2Q11

3Q11

4Q11

$10.09

$10.09

$9.52

$9.58

$9.88

$8.00

$8.50

$9.00

$9.50

$10.00

$10.50

4Q10

1Q11

2Q11

3Q11

4Q11

11.28%

11.28%

9.34%

10.74%

11.14%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

4Q10

1Q11

2Q11

3Q11

4Q11

(a) 12-31-11 ratio is estimated |

14

Appendix |

15

3.07%

3.15%

3.20%

3.19%

3.44%

$0

$5

$10

$15

$20

$25

4Q10

1Q11

2Q11

3Q11

4Q11

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

$21.3

$21.2

$19.0

$18.5

$18.4

Average Total Investment Securities

Highlights

Average AFS securities

$ in billions

High Quality Investment Portfolio

Portfolio composed of Agency or GSE backed:

GNMA, Fannie & Freddie

–

No private label MBS or financial paper

Average portfolio maturity at 12/31/11: 2.2 years

Unrealized net gain of $522 million on available-

for-sale securities portfolio at 12/31/11

Mortgage paydowns

in 4Q11 were $1.5 billion vs.

$1.1 billion in 3Q11

4Q11 purchases classified as held-to-maturity

Securities to Total Assets

(a)

(a) Includes end of period held-to-maturity and

available-for-sale securities 20.4%

21.0%

23.9%

21.6%

21.1%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

4Q10

1Q11

2Q11

3Q11

4Q11

Average yield

Average HTM securities |

16

N/M = Not Meaningful

(a)

Net charge-off amounts are annualized in calculation. NCO ratios for

discontinued operations and consolidated Key exclude education loans in the

securitization trusts since valued at fair-market value (b)

12-31-11 allowance by portfolio is estimated. Allowance/period loans

ratios for discontinued operations and consolidated Key exclude education

loans in the securitization trusts since valued at fair-market value Credit

Quality Credit Quality by Portfolio

$ in millions

Period-end

loans

Average

loans

12/31/11

4Q11

4Q11

3Q11

4Q11

3Q11

12/31/11

9/30/11

12/31/11

12/31/11

12/31/11

Commercial, financial and agricultural

$19,378

$18,323

$28

$23

.61

%

.52

%

$188

$188

$334

1.72

%

177.66

%

Commercial real estate:

Commercial mortgage

8,037

8,090

23

25

1.13

1.24

218

237

272

3.38

124.77

Construction

1,312

1,380

(6)

8

(1.72)

2.05

54

93

63

4.80

116.67

Commercial lease financing

6,055

5,982

-

2

-

.13

27

31

78

1.29

288.89

Real estate -

residential mortgage

1,946

1,918

7

4

1.45

.86

87

88

37

1.90

42.53

Home equity:

Key Community Bank

9,229

9,280

20

18

.86

.76

108

102

103

1.12

95.37

Other

535

553

9

8

6.46

5.45

12

12

29

5.42

241.67

Consumer other—

Key Community Bank

1,192

1,191

9

9

3.00

3.05

1

4

41

3.44

N/M

Consumer other:

Marine

1,766

1,820

14

11

3.05

2.26

31

32

46

2.60

148.39

Other

125

127

1

1

3.12

2.85

1

1

1

.80

100.00

Continuing total

$49,575

$48,664

$105

$109

.86

%

.90

%

$727

$788

$1,004

2.03

%

138.10

%

Discontinued

operations

-

education

lending business

5,812

5,906

25

31

3.19

3.93

23

22

104

3.37

452.17

Consolidated total

$55,387

$54,570

$130

$140

1.00

%

1.09

%

$750

$810

$1,108

2.10

%

147.73

%

Allowance /

period-end

loans

(b)

Allowance /

NPLs

Net loan

charge-offs

Net

loan

charge-offs

(a)

/

average loans

Nonperforming

loans

Ending

allowance

(b) |

17

Commercial Real Estate by Property Type and Geography

N/M = Not Meaningful

(a) Nonresidential land and development loans

Commercial Real Estate Loans –

12/31/11

$ in millions

(a)

Geographic Region

% of

Commercial

West

Southwest

Central

Midwest

Southeast

Northeast

Total

Total CRE

Mortgage

Construction

Nonowner-occupied:

Retail properties

$341

$115

$207

$208

$365

$206

$1,442

15.4

%

$219

$1,223

Multifamily properties

194

131

212

312

258

203

1,310

14.0

383

927

Health facilities

110

-

105

154

164

229

762

8.2

-

762

Office buildings

118

37

110

168

46

199

678

7.3

84

594

Warehouses

230

34

44

76

106

83

573

6.1

18

555

Residential properties

48

14

25

65

42

46

240

2.6

165

75

Hotels/motels

71

-

23

6

81

20

201

2.1

40

161

Land and development

15

13

29

11

30

67

165

1.8

152

13

Manufacturing facilities

1

-

1

7

65

4

78

.8

-

78

Other

133

7

274

22

112

90

638

6.8

64

574

Total nonowner-occupied

1,261

351

1,030

1,029

1,269

1,147

6,087

65.1

1,125

4,962

Owner-occupied

1,309

37

331

722

124

739

3,262

34.9

187

3,075

Total

$2,570

$388

$1,361

$1,751

$1,393

$1,886

$9,349

100.0

%

$1,312

$8,037

Nonowner-occupied: December 31, 2011

Nonperforming loans

$41

$24

$2

$30

$33

$44

$174

N/M

$50

$124

90+ days past due

-

-

21

8

47

10

86

N/M

86

-

30-89 days past due

32

-

1

6

-

22

61

N/M

6

55

Nonowner-occupied: September 30, 2011

Nonperforming loans

$50

$49

$2

$39

$38

$50

$228

N/M

$141

$87

90+ days past due

-

-

-

-

-

8

8

N/M

-

8

30-89 days past due

14

-

7

14

47

23

105

N/M

97

8

|

18

(a) Nonresidential land and development loans

Commercial Real Estate

Commercial Real Estate Credit Quality

$ in millions

(a)

Period-end

loans

12-31-11

9-30-11

12-31-11

9-30-11

12-31-11

9-30-11

Retail properties

$1,442

$1,515

38

$63

$8

-

Multifamily properties

1,310

1,405

42

44

-

$10

Health facilities

762

855

8

10

-

-

Office builldings

678

671

20

26

7

7

Warehouses

573

539

8

10

-

-

Residential properties

240

292

32

49

(4)

13

Hotels/motels

201

216

3

4

1

1

Land and development

165

173

6

6

-

(8)

Other CRE

716

345

16

16

(1)

5

Total nonowner-occupied

6,087

6,011

173

228

11

28

Owner-occupied

3,262

3,403

99

102

6

5

Total

$9,349

$9,414

$271

$330

$17

$33

Nonperforming

loans

charge-offs

Net loan |

19

(a) Average

LTVs

are

at

origination.

Current

average

LTVs

for

Community

Bank

total

home

equity

loans

and

lines

is

approximately

78%,

which compares to 78% at the end of the third quarter 2011.

Community Bank –

Home Equity

Exit Portfolio –

Home Equity

$ in millions, except average loan size

$ in millions, except average loan size

(a)

(a)

Home Equity Loans –

12/31/11

Vintage (% of Loans)

Loan Balances

Average Loan

Size ($)

Average

FICO

Average

LTV

% of Loans

LTV>90%

2010 and

2011

2009

2008

2007

2006 and

prior

Home equity loans and lines

First lien

4,877

$

58,282

$

752

66

%

.6

%

21

%

9

%

11

%

8

%

51

%

Second lie

4,352

45,146

751

75

3.3

16

7

17

17

43

Total home equity loans and lines

9,229

$

51,251

$

751

70

1.9

19

8

14

12

47

Nonaccrual loans

First lien

58

$

63,993

$

712

74

%

.8

%

2

%

5

%

5

%

17

%

71

%

Second lie

50

53,650

713

78

4.9

2

5

13

22

58

Total home equity nonaccrual loans

108

$

58,724

$

713

75

2.6

2

5

8

19

66

Community Bank - Home Equity

Fourth quarter net charge-offs

20

$

-

3

%

21

%

27

%

49

%

Net loan charge-offs to average loans

.86

%

Vintage (% of Loans)

Loan Balances

Average Loan

Size ($)

Average

FICO

Average

LTV

% of Loans

LTV>90%

2010 and

2011

2009

2008

2007

2006 and

prior

Home equity loans and lines

First lien

23

$

22,950

$

747

33

%

.4

%

-

-

1

%

25

%

74

%

Second lien

512

$

24,837

730

82

32.7

-

-

1

41

58

Total home equity loans and lines

535

$

24,748

$

731

80

31.3

-

-

2

40

58

Nonaccrual loans

First lien

1

$

21,748

$

738

32

%

-

-

-

-

20

%

80

%

Second lien

11

27,033

711

83

36.9

%

-

-

2

%

42

56

Total home equity nonaccrual loans

12

$

26,631

$

712

81

34.7

-

-

2

40

58

Exit Portfolio -

Home Equity

Fourth quarter net charge-offs

9

$

-

-

1

%

48

%

51

%

Net loan charge-offs to average loans

6.46

% |

20

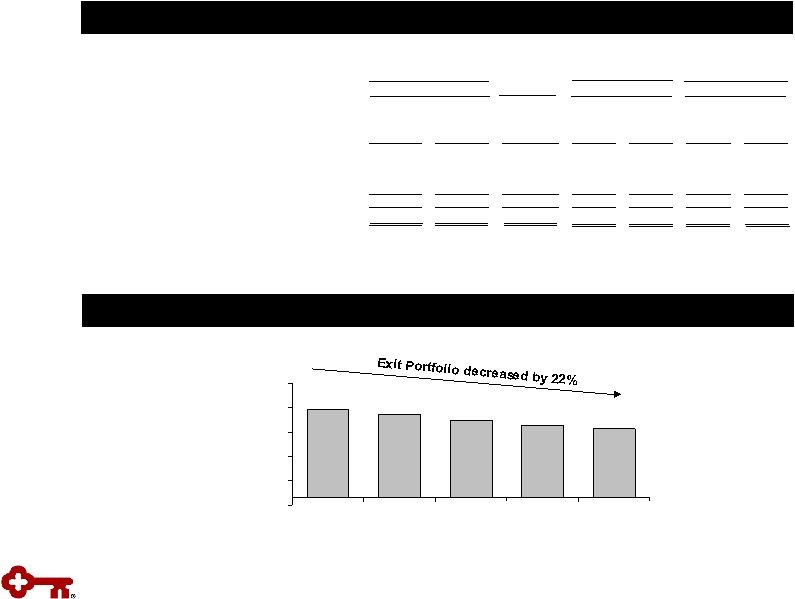

$4,217

$4,435

$5,388

$5,048

$4,736

-$500

$1,000

$2,500

$4,000

$5,500

$7,000

4Q10

1Q11

2Q11

3Q11

4Q11

Exit Loan Portfolio Trend (Excluding Discontinued Operations)

Exit Loan Portfolio

$ in millions

(a) Includes the business aviation, commercial vehicle, office products,

construction and industrial leases, and Canadian lease financing portfolios; and

all remaining balances related to lease in, lease out; sale in, sale out; service

contract leases; and qualified technological equipment leases (b) Includes

loans in Key’s consolidated education loan securitization trusts (c)

Credit amounts indicate recoveries exceeded charge-offs $ in

millions Exit Loan Portfolio

Change

12-31-11 vs.

12-31-11

9-30-11

9-30-11

4Q11

(c)

3Q11

12-31-11

9-30-11

Residential properties –

homebuilder

$41

$48

$(7)

$(2)

$4

$23

$28

Marine and RV floor plan

81

92

(11)

2

3

45

38

Commercial lease financing

(a)

1,669

1,728

(59)

(2)

-

7

9

Total commercial loans

1,791

1,868

(77)

(2)

7

75

75

Home equity –

Other

535

565

(30)

9

8

12

12

Marine

1,766

1,871

(105)

14

11

31

32

RV and other consumer

125

131

(6)

1

1

1

-

Total consumer loans

2,426

2,567

(141)

24

20

44

44

Total exit loans in loan portfolio

$4,217

$4,435

$(218)

$22

$27

$119

$119

Discontinued operations -

education

lending business (not included in exit loans above)

(b)

$5,812

$5,984

$(172)

$25

$31

$23

$22

Balance on

Nonperforming

Status

Balance

Outstanding

Charge-offs

Net Loan |

21

Credit Quality Trends

Quarterly Change in Criticized Outstandings

(a)

Delinquencies to Period-end Total Loans

(a)

Loan and Lease Outstandings

.89%

.99%

.97%

.98%

.95%

1.29%

1.14%

1.14%

1.59%

1.72%

1.61%

1.87%

1.69%

.33%

.24%

.25%

.32%

.48%

.30%

.45%

.78%

.56%

.60%

.82%

.62%

.57%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

30 –

89 days delinquent

90+ days delinquent

(13.6)%

(10.2)%

(12.3)%

(11.2)%

(16.7)%

(14.3)%

(12.8)%

(1.0)%

(8.1)%

(2.0)%

2.8%

35.1%

41.5%

-20%

-10%

0%

10%

20%

30%

40%

50%

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11 |