Attached files

| file | filename |

|---|---|

| 8-K - HANDENI GOLD INC. | f8k01232012.htm |

News Release

____________________________________________________________________________________________________________________________________________________________________________________________

Douglas Lake Intercepts 4.4 Grams per Tonne Gold Over 12 Meters and 4.2 Grams per Tonne Gold Over 5 Meters at Handeni Targets.

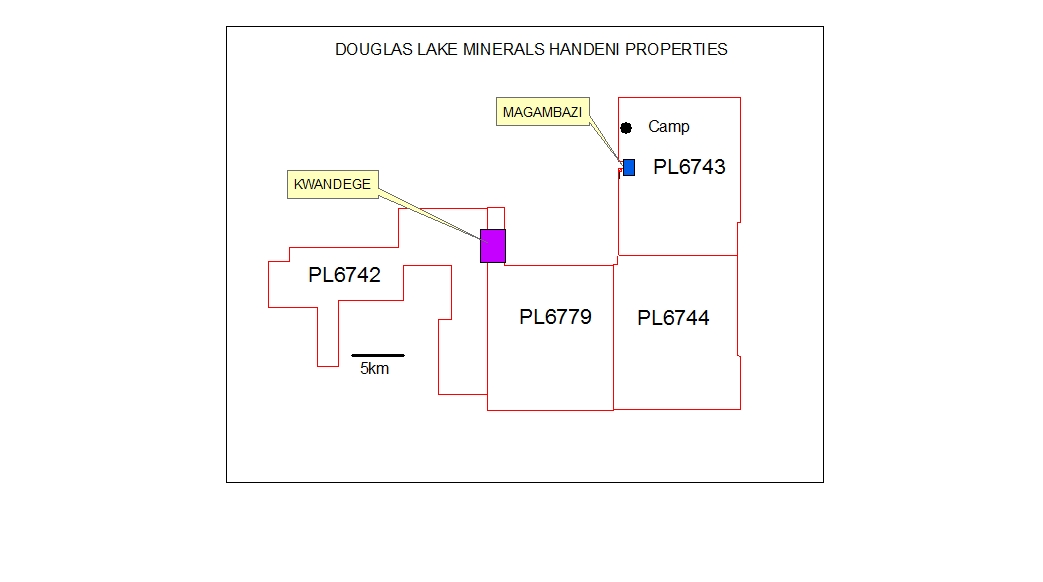

Vancouver, British Columbia, January 23, 2012 -- Douglas Lake Minerals Inc. (the "Company" or "Douglas Lake") (OTCBB: DLKM) is pleased to announce the initial drill results and assay values for their Magambazi East and Kwandege projects on their 800 km2 Handeni property in the United Republic of Tanzania (Fig. 1).

The drilling program commenced on July 26, 2011 on the Kwandege project and on August 24, 2011 on the Magambazi project. Designed to evaluate two geophysically and geochemically delineated gold targets in high metamorphic grade Proterozoic host rocks, the first phase drilling project aimed to establish the shape and extent of the mineralization zones along both localities.

"With only approximately 35% of our gold assay results received we can already confirm that a significant amount of gold is present in both our target areas," said Dr. Reyno Scheepers, President and CEO of Douglas Lake Minerals. "It is however Kwandege that really excites me, as the geophysical anomaly is around 3 times the size of Magambazi hill, with initial assays already showing gold values of 4.40 g/t over 12 meters - and we've barely begun to evaluate this extensive target," he added.

Phase one of the drilling program on the Magambazi East target is complete. A total of 5347 meters of diamond core drilling, 347 meters more than the originally planned, has been drilled to enable interpretation of the results obtained on this target. Phase one of the Kwandege drilling is nearing completion with 4386 meters of the planned 5000 meters already drilled.

HIGHLIGHTS

- The Magambazi East target yielded gold intercepts in 8 of the 9 holes for which assay values are available, drilled along a NW-SE trending mineralization zone along a distance of approximately 475 meters with several highly significant values.

- The best intercepts at Magambazi were 5 meters at 4.2 g/t as well as 10.8 g/t over 1 meter.

- At Kwandege greater than 0.5 g/t gold, with a minimum interval of 0.5 meters, was intercepted in all eleven holes on which assays are available, the most significant intercept being 4.40 g/t over 12 meters including 29.5 g/t over 1 meter as well as 1 g/t over 4.7 meters.

- The mineralization at Kwandege occurs over a distance of 1130 meters to date and is open ended for approximately 800 meters to the east and west.

Suite 500

- 666 Burrard Street, Vancouver, British Columbia, Canada V6C 3P6 T +1.604.642.6165 - F +1.604.642.6168www.douglaslakeminerals.com - Trading Symbol: DLKM

Fig. 1: Location of the Magambazi East (Blue rectangle) and Kwandege (Purple rectangle) targets within the four PL licenses of Douglas Lake Minerals in the Handeni district.

MAGAMBAZI

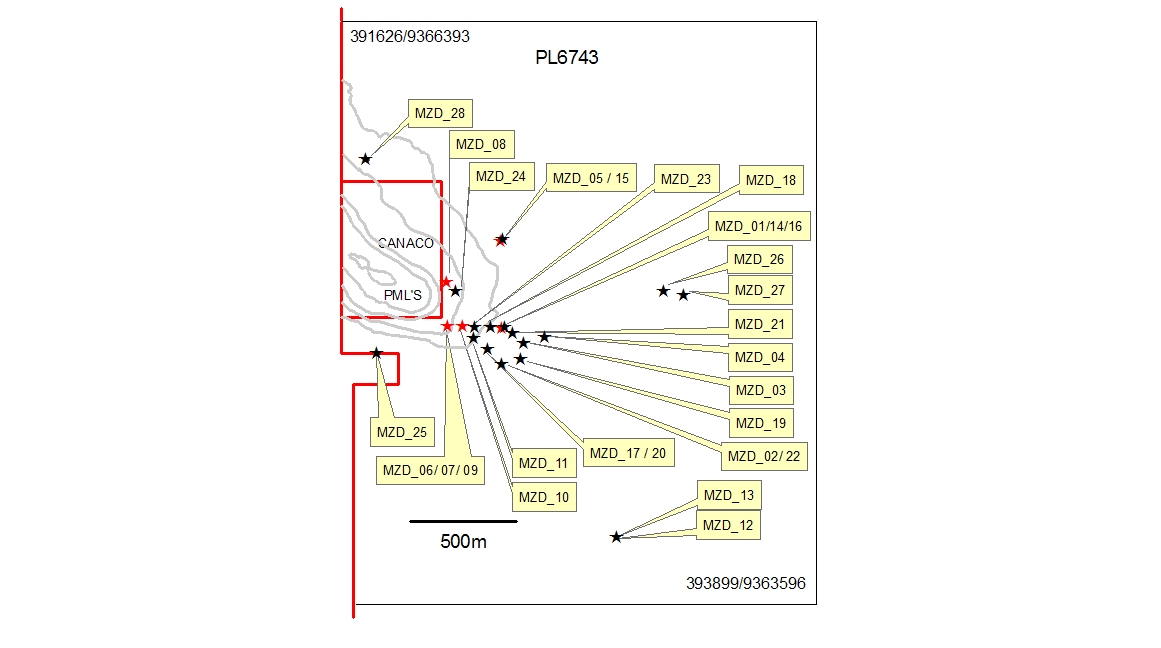

Twenty eight (28) diamond core holes (5347 meters) were drilled at Magambazi. This announcement reports on assay values on ten (10) of these holes (Fig. 2) representing 2600 meters (48.6%) of the meters drilled. A total of 9100 samples were submitted to various laboratories (SGS and ALS Chemex (Mwanza). Samples from the ten holes (3615 samples) represent 39.7% of the samples submitted. A summary of the assay highlights are presented in Table 1.

Fig. 2: Drill hole positions for the 28 drilled Magambazi holes. Holes with Au assay results are represented as red stars, holes for which assay results are pending as black stars.

Elevated gold values were intersected in 8 out of the 10 holes drilled with values in MZD_01 of 4.2g/t over 5 meters, MZD_04 with 10.8g/t over 1 meter, MZD_06 with 2.62g/t over 1 meter and MZD_10 with 1.60 g/t over 1 meter representing the best intersections. The highest sample value encountered was 24.7 g/t over 0.5 meters in MZD_01.

As is evident from Fig. 2, the gold intersections follow a previously defined NW-SE geophysical anomaly along a trend that may potentially be a continuation of the trend defined by Canaco Resources Inc. on Magambazi Hill. MZD_06 and MZD_04 represent the holes at the north western and south eastern extremes of the Magambazi East trend along a strike distance of approximately 475 meters.

Drill hole MZD_05 was drilled on a geophysical target off the NW-SE main Magambazi East trend and did not intercept any significant gold mineralization (Fig. 2).

Elevated gold values are closely related to silicified garnet amphibolite zones, often as free gold within quartz veins within amphibolite. Anomalous gold is however also found outside amphibolite zones in veins and veinlets contained within felsic gneiss units. The sequence containing anomalous gold is structurally highly complex with duplication through folding evident in all the drill holes.

Table 1: Gold assay values for the first 10 holes drilled on Magambazi East. Intervals do not represent true thicknesses which vary from drill hole to drill hole due to intensive folding. True thicknesses are estimated at an average of 65% of intercepts and will need to be verified by further drilling. Assays results for some drill holes are incomplete (MZD_02).

KWANDEGE

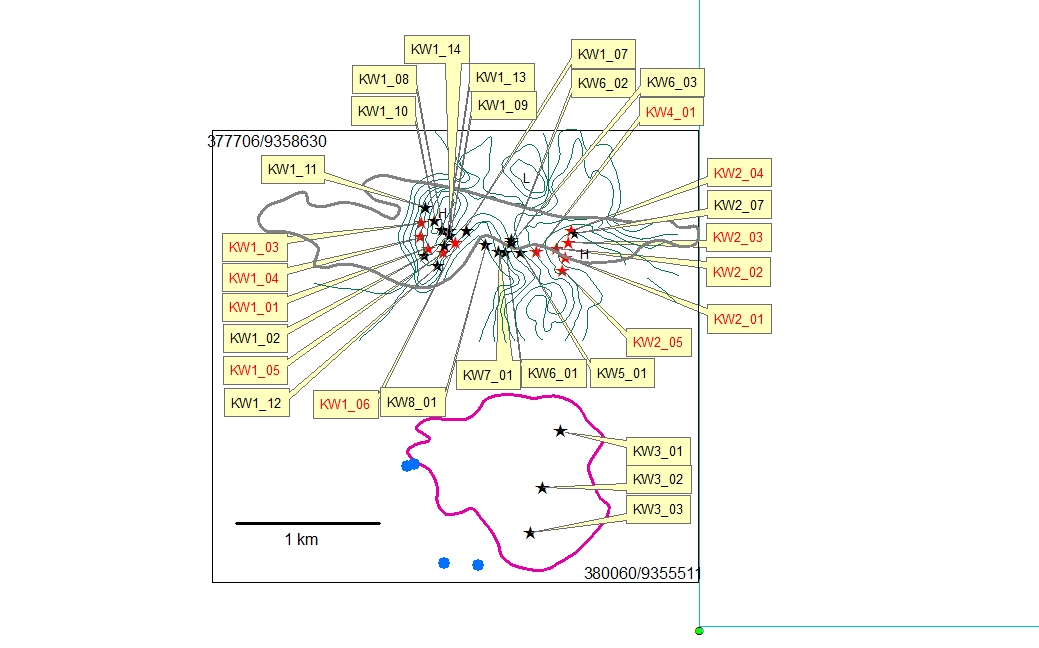

Thirty two (32) drill holes (4386 meters) have been drilled to date on the Kwandege project (Fig. 3). The eleven (11) drill holes of which assay results are reported represents 37.2% (1630 meters) of the meters drilled. A total of 8509 samples have been submitted to ALS and SGS (Mwanza), of which 2638 samples (31.0%) have been assayed.

Elevated gold values, greater than 0.5 g/t over a minimum interval of 0.5 meters, were encountered in all eleven holes on the Kwandege prospect for which gold assay data is available to date. The best intersections were KW2_01 with 4.40 g/t over 12 meters, including 29.5 g/t over 1 meter, as well as 3.54 g/t over 1 meter, KW1_05 with 3.68 g/t over 1 meter and 1 g/t over 4.7 meters, including 3.2 g/t over 1 meter, KW2_02 with 2.10 g/t over 1 meter, KW2_04 with 3.19 g/t over 1 meter, and KW4_01 with 1.46 g/t over 1 meter.

An important feature of the Kwandege target is the fact that low level gold values (0.5 g/t to 1 g/t) were encountered in numerous intersections in the drill holes. As indicated in Fig. 3, anomalous gold with some potentially economic intersections have been encountered in an E-W (strike) direction of 1130 meters and in a N-S (dip) direction of approximately 350 meters wide. This represents significant gold mineralization which will most likely be revealed by the down dip holes being assayed currently for gold.

Fig. 3: Drill hole positions for the 32 Kwandege drill holes. Drill holes with assay values are indicated by red stars and those with gold assay results pending with black stars. The Kwandege geophysical/geochemical target is outlined in grey and a high chargeability anomaly in purple. Artisanal workings are presented as blue dots.

The Company is now planning continuation of the evaluation of the Magambazi and Kwandege projects by a program of RC (reverse circulation) drilling to commence on Magambazi within the next month, followed by Kwandege. This program aims to evaluate the intercepted mineralization zones and gain a better understanding of the gold distribution by using the higher sample volumes obtainable by RC drilling. The Company will continuously take cognizance of the high percentage of free gold available and the specific challenges it may pose during the RC program. The RC drilling will furthermore be utilized in evaluating the open-cast potential of Kwandege.

Continuing parallel with the RC program and the continuous evaluation of our other already identified targets; an in-depth investigation of the drilled core will allow us to gain an even greater understanding of the mineralization style and the implications of this for the Handeni gold district as a whole.

Table 2: Gold assay values for the first 11 holes drilled on the Kwandege target. Intervals do not represent true thicknesses which vary from drill hole to drill hole due to intensive folding. True thicknesses are estimated at an average of 80% of intercepts and will need to be verified by further drilling. Assays results for some drill holes are incomplete (KW4_01).

The drilling, sampling and quality assurance/quality control programs are overseen by a team consisting of Reyno Scheepers Pr. Sci. Nat.;Ph.D.(CEO and a Qualified Person as designated by NI43-101), Bernard McDonald M.Sc. (Expl. Geol.; VP Exploration) and George Rwekiti (M.Sc.; Exploration Manager). SRK Consulting is externally monitoring the program.

Drill hole results are reported as received and in no preselected order. Intercepts are reported as drilling widths due to extreme folding of layers at both projects. More drilling will be needed to confirm true widths that are estimated to be approximately 65% at Magambazi and 80% at Kwandege. For the first two holes of the program at Magambazi and the first seven holes at Kwandege sampling was conducted along the entire drill core at 0.5 meters continuous intervals to determine the nature of mineralization. This was changed to 1 meter continuous intervals with subsequent drill holes and subsequently (following receipt of the first phase assay results) to perceived mineralized zones.

Splitting of samples (core saw) is conducted on site for each project and all samples submitted with QA and QC checks (approximately in the following variable sequence): Standard, 9 Samples, Blank, 1 Sample, Duplicate, 7 Samples, Standard. External laboratory checks are also conducted. Half core samples are retained on site. Samples were assayed at the SGS Laboratory in Mwanza, Tanzania by 50g gold fire assay. Samples are also submitted to ALS Chemex, Mwanza from where a < 75µm plit of the pulverized material is sent to ALS Chemex in Johannesburg for analyses by fire assay and ICP-AES.

For further information please contact:

Douglas Lake Minerals Inc.

Sam Sangha, Investor Relations

(604) 642-6165

About Douglas Lake

The Company is an emerging mineral exploration company focused on exploring and developing mining opportunities in Tanzania. For more information, go to www.douglaslakeminerals.com.

Safe Harbour Statements

Except for the statements of historical fact contained herein, the information presented in this news release constitutes "forward-looking statements" as such term is used in applicable United States and Canadian laws. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans, "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and should be viewed as "forward-looking statements". Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the actual results of exploration activities, the

availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, accidents, labour disputes and other risks of the mining industry including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, title disputes or claims limitations on insurance coverage. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release.

Forward looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable law. Such forward-looking statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions, including, the risks and uncertainties outlined in our most recent financial statements and reports and registration statement filed with the United States Securities and Exchange Commission (the "SEC") (available at www.sec.gov) and with Canadian securities administrators (available at www.sedar.com). Such risks and uncertainties may include, but are not limited to, the risks and uncertainties set forth in the Company's filings with the SEC, such as the ability to obtain additional financing, the effect of economic and business conditions, the ability to attract and retain skilled personnel and factors outside the control of the Company. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law. Although the Company believes that the beliefs, plans, expectations and intentions contained in this news release are reasonable, there can be no assurance those beliefs, plans, expectations or intentions will prove to be accurate. Investors should consider all of the information set forth herein and should also refer to the risk factors disclosed in the Company's periodic reports filed from time-to-time with the SEC. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities of the Company nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.