Attached files

| file | filename |

|---|---|

| EX-31.2 - SECTION 302 CERTIFICATION - HANDENI GOLD INC. | exhibit31-2.htm |

| EX-32.1 - SECTION 906 CERTIFICATION - HANDENI GOLD INC. | exhibit32-1.htm |

| EX-23.1 - CONSENT OF AUDITOR - HANDENI GOLD INC. | exhibit23-1.htm |

| EX-31.1 - SECTION 302 CERTIFICATION - HANDENI GOLD INC. | exhibit31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - HANDENI GOLD INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended May 31, 2012

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________.

Commission file number 000-50907

HANDENI GOLD INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0430222 |

| (State or other jurisdiction of incorporation of organization) | (I.R.S. Employer Identification No.) |

Plot 228, Regent Estate, Dar es Salaam, the United

Republic of Tanzania

(Address of Principal Executive Offices)

+255-222-70-0084

(Registrant’s

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

[

] Yes [X] No

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or 15(d) of the Exchange Act.

[ ]

Yes [X] No

Indicate by check mark whether the registrant (1) filed all

reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

[X] Yes

[ ] No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files.

[X]

Yes [ ] No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by checkmark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

i

The aggregate market value of the registrant’s stock held by non-affiliates of the registrant as of November 30, 2011, computed by reference to the price at which such stock was last sold on the OTC Bulletin Board ($0.11 per share) on that date, was approximately $17,499,165.

The registrant had 308,416,654 shares of common stock outstanding as of August 24, 2012.

__________

ii

TABLE OF CONTENTS

iii

FORWARD LOOKING STATEMENTS

This annual report on Form 10-K and the documents incorporated herein by reference contain forward-looking statements that involve risks and uncertainties. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and, if warranted, development of our properties, plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements contained herein that are not statements of historical fact and that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “might”, “could”, “will”, “would”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology. In evaluating these statements, you should consider various factors, including the assumptions, risks and uncertainties outlined in this annual report under “Risk Factors”. These factors or any of them may cause our actual results to differ materially from any forward-looking statement made in this annual report. Forward-looking statements in this annual report include, among others, statements regarding:

-

our capital needs;

-

business plans;

-

drilling plans, timing of drilling and costs;

-

results of our various projects;

-

ability to lower cost structure in certain of our projects;

-

our growth expectations;

-

timing of exploration of the Company’s properties;

-

the performance and characteristics of the Company’s mineral properties;

-

capital expenditure programs;

-

the impact of national, federal, provincial, and state governmental regulation on the Company;

-

expected levels of exploration costs, general administrative costs, costs of services and other costs and expenses;

-

expectations regarding our ability to raise capital and to add reserves through acquisitions, exploration and development; and

-

other expectations.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events, the forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors. Our actual results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Some of the risks and assumptions include, without limitation:

-

our need for additional financing;

-

our limited operating history;

-

our history of operating losses;

-

our exploration activities may not result in commercially exploitable quantities of ore on our current or any future mineral properties;

-

the risks inherent in the exploration for minerals such as geologic formation, weather, accidents, equipment failures and governmental restrictions;

-

the competitive environment in which we operate;

-

changes in governmental regulation and administrative practices;

-

our dependence on key personnel;

-

conflicts of interest of our directors and officers;

-

our ability to fully implement our business plan;

-

our ability to effectively manage our growth;

-

risks related to our ability to execute projects being dependent on factors outside our control;

-

risks related to seasonal factors and unexpected weather;

-

risks related to title to our properties;

1

-

risks related to our being able to find, acquire, develop and commercially produce mineral reserves;

-

risks related to our stock price being volatile; and

-

other regulatory, legislative and judicial developments.

This list is not exhaustive of the factors that may affect any of our forward-looking statements. We advise the reader that these cautionary remarks expressly qualify in their entirety all forward-looking statements attributable to us or persons acting on our behalf. Important factors that you should also consider, include, but are not limited to, the factors discussed under “Risk Factors” in this annual report. If one or more of these risks or uncertainties materializes, or if underlying assumptions prove incorrect, our actual results may vary materially from those expected, estimated or projected.

Forward-looking statements in this document are not a prediction of future events or circumstances, and those future events or circumstances may not occur. Given these uncertainties, users of the information included herein, including investors and prospective investors are cautioned not to place undue reliance on such forward-looking statements. Investors should consult our quarterly and annual filings with U.S. securities commissions for additional information on risks and uncertainties relating to forward-looking statements. We do not assume responsibility for the accuracy and completeness of these statements.

The forward-looking statements in this annual report are made as of the date of this annual report and based on our beliefs, opinions and expectations at the time they are made. We do not assume any obligation to update our forward-looking statements if those beliefs, opinions, or expectations, or other circumstances, should change, to conform these statements to actual results, except as required by applicable law, including the securities laws of the United States.

AVAILABLE INFORMATION

Handeni Gold Inc. (formerly Douglas Lake Minerals Inc.) files annual, quarterly and current reports, proxy statements, and other information with the Securities and Exchange Commission (the “Commission” or “SEC”). You may read and copy documents referred to in this Annual Report on Form 10-K that have been filed with the Commission at the Commission’s Public Reference Room, 450 Fifth Street, N.W., Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. You can also obtain copies of our Commission filings by going to the Commission’s website at http://www.sec.gov.

REFERENCES

As used in this annual report on Form 10-K: (i) the terms “we”, “us”, “our”, “Handeni”, “Handeni Gold”, “Douglas Lake” and the “Company” mean Handeni Gold Inc. (formerly Douglas Lake Minerals Inc.); (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the United States Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

2

PART I

ITEM 1. BUSINESS

Corporate Organization

We were incorporated on January 5, 2004 under the laws of the State of Nevada. Effective January 21, 2009, we effected a five for one stock split of our common stock and increased our authorized capital to 500,000,000 shares of common stock having a $0.001 par value. On February 14, 2012, the Company changed its name from Douglas Lake Minerals Inc. to Handeni Gold Inc.

Our principal office is located at Plot 228, Regent Estate, Dar es Salaam, the United Republic of Tanzania, with the phone number of +255 222 70 0084 and the fax number of +255 222 70 00 52. Our Vancouver office is located at Suite 500, 666 Burrard Street, Vancouver, British Columbia, V6C 3P6, with the telephone number of (604) 642-6164 and the fax number of (604) 642-6168.

General

Handeni Gold Inc. is an exploration stage company engaged in the acquisition and exploration of mineral properties. We have interests in mineral claims known as the Handeni District Project and the Mkuvia Alluvial Gold Project, located in the Republic of Tanzania in East Africa, through prospecting licenses issued by the government of the Republic of Tanzania.

None of our mineral claims contain any substantiated mineral deposits, resources or reserves of minerals to date. Exploration has been carried out on these claims, in particular the 4 PLs (prospecting licenses) of 800 km2 in the Handeni District. Accordingly, additional exploration of these mineral claims is required before any conclusion can be drawn as to whether any commercially viable mineral deposit may exist on any of our mineral claims. Our plan of operations is to continue exploration and drilling work in order to ascertain whether our mineral claims warrant further advanced exploration to determine whether they possess commercially exploitable deposits of minerals. We will not be able to determine whether or not any of our mineral claims contain a commercially exploitable mineral deposit, resource or reserve, until appropriate exploratory work has been completed and an economic evaluation based on that work concludes economic viability.

We are considered an exploration or exploratory stage company, because we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral deposit exists on the properties underlying our mineral claim interests, and considerable further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined.

Our Mineral Claims

Handeni District Prospecting Licenses

Currently, our primary focus is on the Handeni District Project. Effective September 21, 2010, our Board of Directors ratified the entering into of and immediate closing of a certain Mineral Property Acquisition Agreement (the “Acquisition Agreement”) dated September 15, 2010 with IPP Gold Limited (“IPP Gold”), pursuant to which we acquired an undivided 100% legal, beneficial and registerable interest in and to four prospecting licences (the “PLs”), totaling approximately 800 square kilometres, located in the Handeni District of Tanzania and which were owned or controlled by IPP Gold and its affiliates.

In accordance with the terms of the Acquisition Agreement, effective September 21, 2010, IPP Gold has now become a major stakeholder in our Company. Pursuant to the terms of the Acquisition Agreement, we issued 133,333,333 restricted shares of common stock to IPP Gold in exchange for 100% interest in the four PLs of the Handeni Project, with no further payments in shares or cash required.

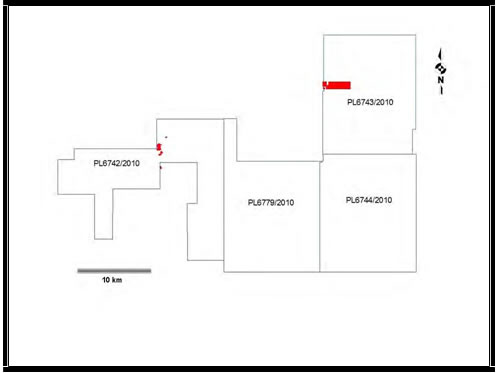

The Commissioner for Minerals of Tanzania has confirmed the recording in the Central Register and the transfer of 100% of each of the Prospecting License Nos. 6742/2010, 6743/2010, 6744/2010 and 6779/2010, which comprise the Handeni Project, from IPP Gold to our Company, and that such transfer has been duly recorded on the terms and conditions contained in such Prospecting Licenses.

We obtained a Technical Report on the Handeni Property (the “Handeni Report”), dated April 25, 2011, as prepared at our request by Avrom E. Howard, MSc, FGA, PGeol (Ontario), Principal Consultant at Nebu Consulting LLC. Mr. Howard is a Qualified Person in accordance with Canadian National Instrument 43-101 “Standards for Disclosure of Mineral Projects” and its Companion Policy (collectively, “NI 43-101”) and is a Practicing Professional Geologist registered with the Association of Professional Geoscientists of Ontario (registration number 0380). The Handeni Report follows on the heels of a detailed geological compilation and exploration report prepared in 2010 by Dr. Reyno Scheepers, a South African professional geologist who has been a director of our Company since 2010 and is our current Chief Executive Officer. Upon independent review by, and to the satisfaction of Mr. Howard, much of the content from Dr. Scheepers’s report has been referred to and referenced in the Handeni Report.

3

On August 5, 2011, the Company entered a Mineral Property Acquisition Agreement (the “2011 Acquisition Agreement”) with Handeni Resources Limited (“Handeni Resources”), a limited liability company registered under the laws of Tanzania. The Chairman of the Board of Directors of the Company has an existing ownership and/or beneficial interest(s) in Handeni Resources. Pursuant to the 2011 Acquisition Agreement, the Company had an exclusive option to acquire from Handeni Resources a 100% interest in mineral licenses covering an area of approximately 2.67 square kilometers to the east of Magambazi Hill, which is adjacent to the area covered by the Company’s four existing prospecting licenses (totaling approximately 800 square kilometers) in the Handeni District.

On November 30, 2011, the Company completed the 2011 Acquisition Agreement and issued 15,000,000 restricted common shares to Handeni Resources as payment. As at November 30, 2011, the fair market price of the Company’s common stock was $0.11 per share; accordingly, the Company recorded a total fair market value of $1,650,000 as the mineral licenses acquisition cost.

To comply with the laws and regulations of the Republic of Tanzania whereby foreign companies may not own primary mining licenses (“PMLs”), on July 19, 2012, the Company:

| (1) |

entered into an Addendum agreement to the 2011 Acquisition Agreement whereby Handeni Resources will administer the 32 PMLs until such time as a mining license (“ML”) on the 32 PMLs (2.67 km2 ) have been allocated; and | |

| (2) |

during this period Handeni Resources will be conducting exploration and mining activities on the PMLs as directed by the Company. |

Much of the information regarding the Handeni District Project as provided below is based on information provided in the Handeni Report.

The author of the Handeni Report visited the Handeni property on February 26, 2011, accompanied by Dr. Scheepers. Given the almost total absence of outcrop across the property area, on the one hand, and the abundance of district to regional scale geological data, recent exploration data, intensive artisanal mining activity in the boundary area between the Company’s Handeni property and the adjacent Magambazi property belonging to Canaco Resources Inc. and their well-publicized news releases and developments, on the other, the author of the Handeni Report determined that he was able to complete a meaningful property visit within the timeframe of a single day to his technical satisfaction sufficient for the purpose of preparing the Handeni Report.

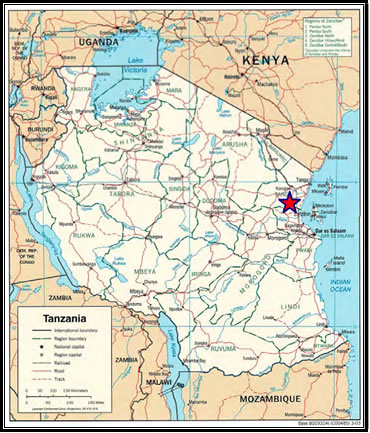

Location and Access

The Handeni property lies within the historic Handeni artisanal gold mining district, located in Tanga Province, roughly 175 kilometers northwest of Tanzania’s largest city, Dar Es Salaam, and 100 kilometers southwest of the more northerly coastal city of Tanga. The road from Dar Es Salaam to Tanga is paved; the secondary road that heads northwest from this road to the town of Handeni, a distance of 65 kilometers, is currently being upgraded and paved. The Handeni property is located roughly 35 kilometers south of the town of Handeni. From this point, a number of dirt roads head south across various portions of the Handeni property and beyond. Driving time from Dar Es Salaam is approximately five hours, depending on traffic and the weather.

Access during the dry season is not difficult and does not even require a 4X4 vehicle. Roads within the licenses are mostly tracks, some of which are not accessible during the rainy season. The area experiences two rainy seasons, namely a short wet period during November and December and the main rain season lasting from April to June. Exploration conditions during the rainy periods may be difficult, specifically during the April to June period. Fuel is available at a number of points along the north - south portion of the journey and in Handeni town itself.

The average elevation in the Company’s license area is 450 meters above sea level. The area is densely vegetated with tall trees and grass over undulating hills of gneiss that comprise the main topographic feature in the area. Muddy, slow moving rivers and creeks crisscross the valleys and plains; some of the larger streams may experience high flow during intense rainfalls.

The area is scarcely populated with occasional small villages where people are engaged in small scale mixed farming and artisanal gold mining. Handeni town is a community of several thousand inhabitants haphazardly spread over a series of small, rounded hills, where basic services and accommodation are available.

4

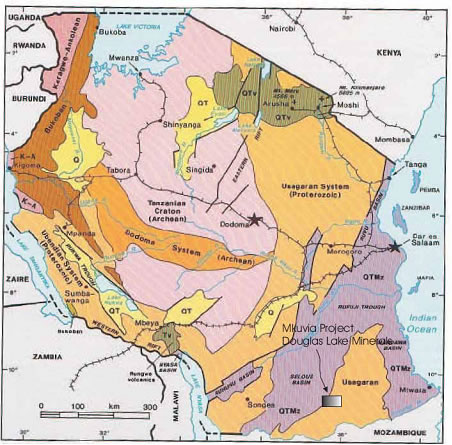

LOCATION MAP: HANDENI PROPERTY IN TANZANIA

Property Description

The property comprises four PLs encompassing nearly 800 square kilometers, all of which are in good standing.

The following table provides details about each PL.

List of Prospecting Licenses, Handeni Property

| PL No. |

Area (Sq Km) |

Issue Date |

Original Recipient |

Transfer Date (To IPP Gold) |

Transfer Date (To Handeni Gold) |

Expiry Date |

Renewal Date |

| 6742/2010 | 197.98 | 05/10/10 | Diamonds Africa Ltd. | 18/11/10 | 12/12/10 | 04/10/13 | 05/10/13 |

| 6743/2010 | 195.48 | 13/10/10 | Gold Africa Ltd. | 18/11/10 | 12/12/10 | 12/10/13 | 13/10/13 |

| 6744/2010 | 198.70 | 13/09/10 | M-Mining Ltd. | 18/11/10 | 12/12/10 | 12/09/13 | 13/09/13 |

| 6779/2010 | 197.74 | 13/09/10 | Tanzania Gem Center Ltd. | 18/11/10 | 12/12/10 | 12/09/13 | 13/09/13 |

Within the property are several, smaller areas that belong to small scale artisanal miners, all of which are indicated in red in the license map presented below. The areas found within PL 6742/2010 predate the arrival of IPP Gold and remain in the hands of the local artisanal miners to whom Primary Licenses, or what are informally known as “Primary Mining Licenses” or PMLs have been issued. The rectangular area in red on PL6743/2010 belonged to Handeni Resources as discussed below. Artisanal gold mining activity remains ongoing in some of these areas.

5

License Map, Handeni Property Prospecting Licenses, showing excluded areas in red

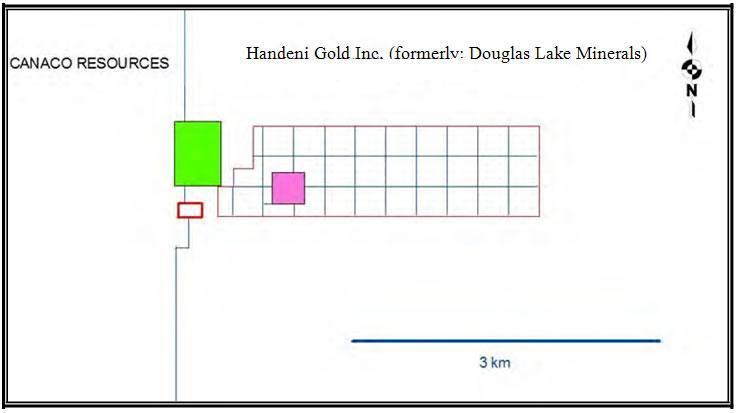

Toward the western edge of PL 6743/2010 are several more PMLs that do not belong to the Company. The area colored in green in the figure below is a unitized block of four PMLs that were acquired by Canaco Resources Inc. (“CRI”) from their owners; this is where the most intensive artisanal gold mining activity is currently taking place, with laborers working at a variety of mining and milling sites adjacent to and up the hill from a shanty town of huts that is found just north of Magambazi hill. It is the Company’s understanding that CRI has reached an agreement with the original owners of these PMLs and the people currently working there which will lead to their ceasing artisanal operations and vacating the site.

Ownership of a single, isolated claim block, depicted in fuchsia below remains uncertain; and which is something that IPP Gold and the Company are attempting to ascertain. Ownership of the smaller, rectangular red block that overlies the CRI-Company boundary also remains unknown; and which again is another matter that IPP Gold and the Company are currently pursuing. The remaining block of 32 PMLs, shown as a grid of blue lines below, belongs to the Company as described above.

6

History

General. Mining in Tanzania in the modern era dates back over one hundred years, first under German colonial rule; during the First World War a number of military engagements took place there. After the war ended control of the area was ceded to the British, under whose colonial authority mining and other activities continued and expanded. Mining focused on gold, diamonds and a variety of colored gemstones, notably including the discovery and development of the world’s largest diamondiferous kimberlite pipe (to date) by Canadian geologist John Williamson, a deposit that remains in production to this day. Shortly after achieving independence from the British in 1961, Tanzania nationalized most private sector industries, in turn resulting in the exodus of foreign investment and private capital and the consequent decline in economic activity in all sectors, including mining. Finally, beginning in the 1990s, in line with many other developing countries around the world, the Tanzanian government instituted several reforms to move towards a free market economy, privatize the mining industry and encourage both domestic and foreign investment in all economic sectors. In the case of the mining industry, this was supplemented, in 1998, through the passage of a new, more industry-friendly mining code. This code has been streamlined under the Mining Act of 1998 (revised 2010) (the “Mining Act”) currently controlling exploration, mining and related activities in the country.

Tanzania is a significant producer of gold, diamonds and a variety of colored gemstones including tanzanite; the trade name for generally heat treated, bluish-purple epidote. The Merelani Hills, east of Arusha, is the only place o n e a r t h where this gemstone variety of V-rich zoisite is found in commercial quantities. A recently discovered uranium deposit is currently under development, as well, in the southeast area of the country. Tanzania is Africa’s third leading gold producer, after Ghana and South Africa, with several major and junior companies producing and exploring for gold, mostly in northwestern Tanzania, south of Lake Victoria, in an area informally known as the Lake Victoria gold belt.

The Handeni Property. Gold has been known in the Handeni area for many years with some attributing its discovery to the Germans prior to World War One; however, it was the increase in gold prices and consequent increase in artisanal gold mining activity in the Handeni area that led to the discovery of larger deposits of placer gold, in turn leading in 2003 to a classic gold rush. The discovery and mining of lode deposits followed, soon after, along with the growth of a shanty mining town at the northern base of Magambazi Hill.

In 2005, the Company’s majority shareholder, IPP Gold, entered into negotiations with a group of 34 local artisanal miners that collectively controlled four PMLs on and near Magambazi Hill, site of the area’s known lode mineralization, and upon failing in this endeavor acquired a number of PMLs east of Magambazi Hill from other local owners. A portion of a large (1,200 km2) Prospecting Reconnaissance License (“PLR”) which belonged to Midlands Minerals Tanzania Limited was also acquired by IPP Gold.

Between 2005 and 2010, IPP Gold carried out exploration over its PLR leading to the upgrading of its holdings from one PLR to four PLs of 800 km2, in August 2010. Exploration work included airborne magnetic and radiometric surveys, ground magnetic surveys, reconnaissance geological mapping, soil sampling, pitting and trenching. It is these four PLs that were acquired by the Company from IPP Gold.

Geological Setting

Regional Geology. The geological framework of Tanzania reflects the geologic history of the African continent as a whole. Its present appearance is a result of a series of events that began with the evolution of the Archean shield, followed by its modification through metamorphic reworking and accretion of other continental rocks, in turn covered by continentally derived sediments. Pre-rift magmatism followed by active rifting has also left a major mark upon the Tanzanian landscape.

Several regional geological mapping programs have been carried out across the country over the past one hundred plus years, which has led to the recognition of several major litho-structural provinces from Archean to recent age. The Archean craton covers most of the western two thirds of the country, roughly bounded to the east by the East African Rift. Archean rocks host all of the country’s kimberlite pipes and contained lode diamond deposits, and most of its lode gold deposits. The Archean basement terrain is bounded to the east and west by a series of Proterozoic mobile belts; this area, particularly that to the east, hosts most of the country’s wide variety of colored gemstone deposits. Some recent research suggests that portions of this assumed Proterozoic terrane may actually consist of Archean crust that has undergone a later phase of higher grade metamorphism.

The Phanerozoic is represented by a series of sedimentary units of Paleozoic to Mesozoic age, in turn followed by a pre-rift period of kimberlitic and related, alkalic, mantle-derived intrusive and extrusive activity that presaged active rifting. Rocks related to this event intrude up to Upper Mesozoic and Lower Cenozoic sedimentary formations. Next came a period of rift-related intrusive and extrusive activity concentrated in the Arusha area – to the northeast and Mbeya area – to the southwest, which is responsible for volcanoes such as Mt. Meru and Mt. Kilimanjaro. Finally, a wide variety of recent and largely semi- to un-consolidated wind, water and weathering-derived recent formations are found across the country, a number of which host placer gold, diamond and colored gemstone deposits.

Property Geology. The geology of t h e Handeni area comprises amphibolite to granulite facies metamorphic rocks interpreted to originally have formed a sequence of ultramafic to felsic volcanic flows, black shales and quartz-bearing sedimentary rocks. High grade metamorphism has converted these original lithologies to a variety of metamorphic equivalents, including biotite-hornblende-garnet-pyroxene gneiss, migmatitic augen garnet- hornblende-pyroxene gneiss, quartzo-feldspathic hornblende-biotite-pyroxene gneiss, pyroxene-hornblende-biotite-garnet granulite and others. The entire assemblage has been folded into a synform with a northwest-southeast axis, complicated by numerous faults, some of which are spatially associated with gold mineralization.

7

Recent research by geologists from the University of Western Australia suggests that much of what has previously been considered to be of Proterozic age (Usagaran System) may in fact be overprinted Archean crust. This hypothesis has been invoked to help interpret the geology within which gold in this area is found and as the basis for an analogy between this gold mineralization and that found in less metamorphosed, bona fide Archean rocks in the Lake Victoria gold district, a few hundred km to the northwest. However, this is a hypothesis, only, one that may be used for exploration modeling purposes but one that still requires more work.

Mineralization

The Handeni property is at an early stage of exploration. There are no known mineral resources or reserves on the Handeni property, nor are there any known deposits on the property.

Insufficient work has been completed on the Company’s property to be able to comment to any significant extent about the nature of gold mineralization found and that may be found therein. However, comments regarding mineralization may be made upon the basis of information released by CRI, the company that owns the immediately adjacent Magambazi gold deposit, a deposit that remains the subject of an ongoing drilling program and geological studies and which is considered to be the type occurrence/deposit for the evolving Handeni district. The hill within which this deposit is found extends southeast onto the Company’s property.

According to the aforementioned report prepared by Dr. Scheepers, gold is found within garnet-amphibolite zones within biotite-feldspar gneiss at three locations in the Company’s property, locations where historical lode gold occurrences have been documented. Gold occurs in quartz veins as well as within the garnet amphibolites adjacent to the quartz veins. Proof of this association is informally corroborated by the testimony of local, artisanal miners, who apparently recover gold both from quartz veins and gold-bearing gneiss that is not quartz vein bearing. Gold in the Company’s property has also been documented in soils and placers, at a variety of locations, as well.

Exploration Activities

Whereas gold was known in the Handeni area prior to the arrival in 2005 of the Company’s predecessor, IPP Gold, there is no history of any formal exploration in the area aside from limited work at Magambazi Hill itself. IPP Gold’s initial work consisted of soil sampling and a ground magnetic survey over an area of 200 square kilometers covering the area now located within PL6743/2010 immediately east of Magambazi Hill. Over the five years that ensued, this was followed by a series of exploration campaigns involving a variety of exploration methods, in turn followed by interpretation and further work in an iterative fashion. A table summarizing the work completed by IPP Gold (much of which was completed under the supervision of Dr. Scheepers) may be found below.

Summary of Historical Exploration Work, Handeni Property

| Work | Year | Location(s) | Worker |

| Trenching, Pitting & Sampling | 2009 | Magambazi Hill | IPP Gold |

| Stream Sediment Sampling | 2008 | Northeast quadrant of PL6744/2010 | IPP Gold |

| Soil Sampling | 2009 2010 |

East of Magambazi Hill Over geophysically delineated zones in PL6779/2010 & PL6742/2010 |

IPP Gold IPP Gold IPP Gold |

| Airborne Magnetic & Radiometric Survey |

2009 | PL6744/2010, PL6744/2010 & PL6779/2010 | South African Council for Geoscience |

| Geological Mapping | 2008 2010 |

Over geochemically anomalous and artisanal mining areas |

IPP Gold IPP Gold |

| Ground Magnetic Survey | 2009 2010 |

PL6743/2010 | IPP Gold |

| Regional Structural Interpretation | 2009 2010 |

Entire property | IPP Gold The Company |

Several exploration targets were delineated on the basis of the aforementioned work either based upon anomalous gold soil geochemical results alone, or other features singly or in combination, that based upon gold deposit models have been deemed significant. Paramount among these are structural features are folds, shear zones, faults and thrust faults that have been interpreted on the basis of the magnetic and radiometric data, particularly where they have been seen to be coincident with anomalous gold in soils or locations of historical artisanal mining. Regardless of the gold deposit model one favors, structure is of fundamental significance as a conduit for and host to gold bearing solutions and, in this light therefore, all locations where anomalous gold has been found coincident with interpreted structures must be considered significant, particularly at this early stage of exploration on the Handeni property and in the district as a whole.

8

Conclusions and Recommendations

The author of the Handeni Report indicated that the most important conclusions to be derived at this juncture are:

| 1. |

Based upon CRI’s public disclosure, it appears as if a bona fide gold deposit has been discovered at Magambazi Hill, a deposit where ongoing drilling is finding more gold; | |

| 2. |

The southeast extension of Magambazi Hill and, presumably, gold mineralization found within, continues onto the Company’s PL6743/2010; | |

| 3. |

Historical placer and lode artisanal mining was a guide to Magambazi’s potential; | |

| 4. |

There are a number of other locations where intensive placer and artisanal gold mining took place within the Handeni property, notably the Kwandege and Mjembe areas; | |

| 5. |

Processed airborne magnetic and radiometric data have delineated linear features that have been interpreted to represent a variety of structures such as shears, thrust faults and cross faults; | |

| 6. |

Limited soil geochemical surveying, carried out across some of these interpreted northwest-southeast trending structural features, has revealed several locations hosting anomalous gold in soils (statistically established to be gold values exceeding 10 parts per billion); | |

| 7. |

G old appears to be further concentrated at the intersection between the northwest-southeast trending structural features and northeast-southwest trending structural features, interpreted to represent later cross faults; and | |

| 8. |

These associations suggest a relationship between structures and gold, in turn providing a basis upon which to select additional areas within the Handeni property for more detailed gold exploration. |

Exploration conducted 2011/2012.

During our fiscal year ended May 31, 2012, we achieved the following:

| a) |

A helicopter based TEM electromagnetic and radiometric aerial survey program was completed by FUGRO over the entire Company licence area (800 km2 ) at 200 meter spaced flight lines in a north-south direction. Electromagnetic (TEM) as well as radiometric data for K (Potassium), U (Uranium), and Th (Thorium), as well as total count was collected simultaneously for the 4740 line kilometres flown. Selected areas were flown at a line spacing of 100 meters. |

|

The interpreted data clearly delineated subsurface geological features of importance to gold and base metal mineralization in this high grade metamorphic terrain. The data proved to be invaluable in the definition of structurally important sites and target definition. | |

| b) |

An intensive ground based geophysical program on the Magambazi East as well as the Kwandege target zones was completed. This data (combined with geochemical results) were used to create drill targets on the two selected areas, the results of which are reported below. |

| c) |

A multi-element soil geochemical program was completed on the Kwandege target delineating the extent of the mineralization zone and assisting the interpretation of the geophysical data to locate drill positions. |

| d) |

A large soil sampling program of two targets in PL6743/2010 was initiated and is still continuing. |

| e) |

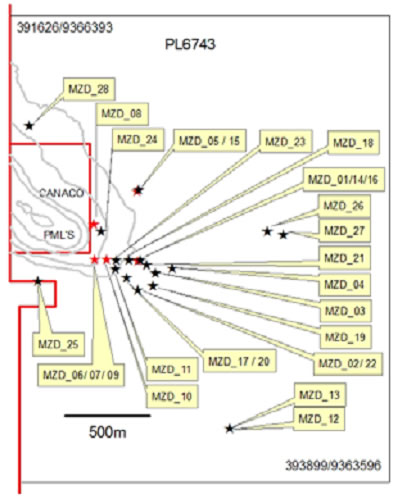

28 diamond core holes (5,347 meters) were drilled on the Magambazi East and related targets (figure below). 20 of these holes (4228 m or 79.1% of the total 5347 meters of drilling) were drilled on the main geophysical and geochemical anomaly considered to be an extension of the main Magambazi Hill mineralization zone. A single hole (MZD 28; 159 m or 3.0%) was drilled on a potential mineralization zone north of the main Magambazi mineralization trend and one hole (MZD 25; 201 m or 3.8%) was drilled on a potential mineralization zone south of the main mineralization zone. Both these zones were delineated by ground geophysics and soil geochemistry producing well defined drill targets. Six holes (MZD 05, MZD 12, MZD 13, MZD 15, MZD 26 and MZD 27 totaling 445 m or 14.2%) were drilled on targets potentially related to the Magambazi Hill mineralization zones by faulting and / or folding. |

9

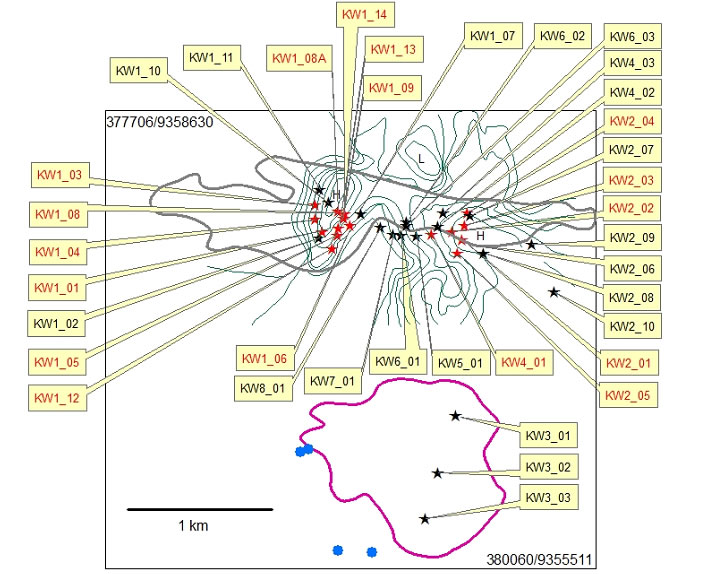

Drill hole positions for the 28 drilled Magambazi core drill holes.

The drilling program on the Magambazi East targets outlined the following:

| i) |

A gold enriched mineralization zone extends for a distance of approximately 500 m to the south east of the Magambazi Hill mineralization as defined by CRI. Gold mineralization along the zone is related to a folded sequence of garnet amphibolite and consists of free gold closely related to quartz veins as well as gold related to sulphides within this zone. The mineralization is structurally complex and is most likely part of a synclinal structure plunging to the north west with higher grade gold zones confined to the fold axis of steeply northwest plunging secondary fold structures on the limbs of the syncline. The repetition distances of these structures are unpredictable based on the current results and drill spacing and an intensive and directed drilling program will be needed to investigate their economic potential. The best intersection achieved on the main zone was 4.2 g/t over 5 meters. | |

| ii) |

A mineralization zone to the north of the main zone (the North eastern Zone) shows gold potential. The strike distance of this zone on the Handeni Gold property is approximately 330 m. Three mineralized intersections were obtained. The zone may be interpreted as refolded main zone on the north eastern flank of the syncline or a “lower amphibolite zone” at a lower level of the main Magambazi synclinal structure. The most promising intersection on this zone was 3.75 g/t over 1 meter. | |

| iii) |

A mineralization zone with a strike distance of approximately 450 m to the south of the main zone (the South western Zone) was intersected. The geological interpretation is the same as for the North eastern zone. Four mineralized intersections were obtained in this zone of which 1.31 g/t over 1 meter was the intersection obtained. | |

|

Evaluation of the economic potential of the three mineralization zones will only be possible with closely spaced directional drilling to follow out the mineralization. We will continue its evaluation of the Magambazi East project based on a detailed interpretation of the available drill core and an intensive program of close spaced ground geophysics. The project will finally be ranked against 15 other already identified targets (the decision to continue drilling on its Kwandege project has already been taken) before a decision on a possible continuation of the drilling program on Magambazi East will be taken. Intercepts were reported as drilling widths due to extreme folding of layers. More drilling will be needed to confirm true widths. For the holes reported for this phase of the assay program sampling was conducted along one meter continuous intervals of the core. |

| f) |

37 drill holes (4,989 meters in total) have been drilled on the Kwandege mineralized zone, completing the first phase drilling program on this project. The total number of drill holes on the main Kwandege target for the first phase drilling phase were 33, including a single hole abandoned due to bad drilling ground. 26 of the 32 drill holes on the main Kwandege target yielded gold assay values of more than 0.5 g/t over a one-meter interval or thicker intersection, whereas four of the remaining holes had anomalous gold values of up to 0.49 g/t. Three holes were drilled on a chargeability and radiometric target south of the main Kwandege target and one on a potential south eastern extension of the main Kwandege target (Figure below). |

10

Kwandege drill hole positions.

|

||

Blue dots represent positions of

current artisanal workings and the area outlined in purple is an approximately

1km2 sulphide and radioelement enriched zone. Hole KW2_10 was drilled

on a potential south eastward extension of the main Kwandege mineralized zone. |

Of the three drill holes drilled on the chargeability zone (outlined in purple on figure above (KW3_01, KW3_02 and KW3_03) (Fig. 1), all three intersected the zone associated with gold mineralization in the Handeni area but only KW3_01 yielded anomalous gold values of 0.24 g/t over 1 m intersections. Thus, despite large percentages of pyrite, as well as some arsenopyrite being present in most of the core intersected on the chargeability anomaly as outlined, general gold values over this anomaly are unexpectedly low. The potential for gold on the perimeter of the chargeability zone however remains high and further drilling is required.

Anomalous gold values were intercepted over large portions of drill core in KW2_10, drilled on a potential south eastern extension of the main Kwandege mineralization zone. Although no values of economic grade are present in this single drill hole, the garnet amphibolite (the favourable zone for gold mineralization) was intersected. The lower values are most likely due to an unfavourable sub-surface structural intersection and further drilling is necessary to assess the (new) south eastern extension of the main Kwandege target.

The best intersections obtained on the first phase of the Kwandege drilling project (32 holes) were:

| i) |

KW2_01 with 4.40 g/t over 12 meters, including 29.5 g/t over 1 m as well as 3.54 g/t over 1 m; | |

| ii) |

KW2_07 with 6.20 g/t over 5 m including 29.60 g/t over 1 m; | |

| iii) |

KW1_08 with 1.1 g/t over 9 m including 5.67 g/t over 1 m; | |

| iv) |

KW1_14 with 1.74 g/t over 6 m including 2.45 g/t over 2m and 3.51 g/t over 1m; | |

| v) |

KW1_07 and KW4_03 each with 2.11 g/t over 1 m, and | |

| vi) |

KW2_08 with 3.70 g/t over 1 m. |

|

An important feature of the Kwandege target is the fact that low level gold values (0.5 g/t to 1 g/t) were encountered in numerous intersections in the drill holes and also confirmed by the latest assay results. Anomalous gold with some potentially economic intersections have been encountered in an E - W (strike) direction of 1,501 meters (based on the results of the completed phase 1 drilling program). The open ended nature of the mineralization in an E-W direction was confirmed. | |

|

The structural control on the gold mineralization is an important feature of mineralization at Kwandege. Based on the current results, gold is particularly enriched in the upper of two garnet amphibolite layers separated by a felsic gneiss unit. Within the garnet amphibolite, gold is most likely concentrated in the proximity of fold noses. The package of garnet amphibolite as well as felsic gneiss units are contained within a SSW towards NNE thrust unit. | |

| g) |

A confined alluvial mining evaluation program was initiated to investigate the potential to economically mine alluvial gold on the prospecting licenses. |

The Company is currently focusing its exploration efforts on:

| a) |

the ranking of its seventeen identified targets and upgrading of the most promising targets to drill target status; | |

| b) |

detailed work on the Kwandege project to plan the second phase of drilling; and | |

| c) |

the evaluation of selected alluvial targets. |

The estimated budget for the completion of these exploration programs is provided below:

11

| EXPLORATION WORK | BUDGET (US$) |

| Ground Geophysics | 250,000 |

| Mapping, trenching, sampling, etc. | 250,000 |

| Drilling | 950,000 |

| Geologists, field personnel and general exploration | 550,000 |

| Sundry & contingencies | 500,000 |

| TOTAL | $2,500,000 |

Mkuvia Alluvial Gold Project

Our other property of interest is the Mkuvia Alluvial Gold Project. On June 27, 2008 but effective on August 4, 2008 when ratified by our Board of Directors, we entered into a Joint Venture Agreement with Mkuvia Maita (“Mr. Maita”), the registered holder of certain PLs over certain areas covering approximately 430 square kilometers located in the Liwale and Nachigwea Districts of Tanzania. Pursuant to this agreement we had the right to enter, sample, drill and otherwise explore for minerals on the property underlying the prospecting licenses as granted by the Government of Tanzania under the Mining Act, subject to a perpetual net smelter royalty return of 3% payable to Mr. Maita.

Effective on July 14, 2009, our Board of Directors ratified, confirmed and approved our entering into of a new Joint Venture Agreement (the “New Mkuvia Agreement”) with Mr. Maita. The New Mkuvia Agreement covers a slightly smaller area than the original agreement, covering an area of approximately 380 square kilometers located in the Liwale and Nachigwea Districts of Tanzania, and more particularly described as follows:

-

Prospecting License No. 5673/2009;

-

Prospecting License No. 5669/2009;

-

Prospecting License No. 5664/2009; and

-

Prospecting License No. 5662/2009.

The New Mkuvia Agreement, which is dated for reference June 5, 2009, supersedes and replaces the prior joint venture agreement as entered into by and between our Company and Mr. Maita (the “Prior Agreement”) regarding prior prospecting licenses held by Mr. Maita over substantially the same area, known as the “Mkuvia Project”, which is the focus of our current exploration and development efforts.

Pursuant to the terms of the New Mkuvia Agreement we shall continue to have the right to enter, sample, drill and otherwise explore for minerals on the property underlying the new PLs as granted by the Government of Tanzania under the Mining Act and any other rights covered by the PLs listed above.

In consideration for the entry into of the New Mkuvia Agreement, we were required to pay Mr. Maita US$40,000 upon signing of the New Mkuvia Agreement. In addition, and upon commencement of any production on the property underlying the prospecting licenses, Mr. Maita is still entitled to receive a perpetual net smelter royalty return of 3% from any product realized from the property underlying the PLs under the New Mkuvia Agreement. By entering into the New Mkuvia Agreement, we are no longer required to pay Mr. Maita the balance of approximately US$460,000 in aggregate yearly cash payments previously due under the Prior Agreement in consideration, in part, of our Company reducing the current unexplored property area underlying the prospecting licenses under the New Mkuvia Agreement by approximately 50 square kilometers.

The Company is informed that these PLs expired during May and June of 2012. The Company is also informed that renewal applications were submitted (50% of each of the four properties) by the owner, Mr. Maita, as renewal licenses, and that applications for the remaining 50% of each of the four licenses were submitted. If there are other applicants for the remaining 50% of each of the four PLs, the Company understands that there will be a tender process for the same. At this time the Company is considering its interest in the same going forward but no final determination has been made as of yet.

The property has several overlying primary mining licenses (again PMLs) that have mineral rights that lie within the boundaries of the Mkuvia property. Generally, PMLs represent limited mining rights which allow the small scale exploration of minerals by local miners and must predate the establishment of a prospecting license. PMLs are retained exclusively for Tanzanian citizens. The maximum size of the demarcated area for a PML for all minerals other than building materials is 10 hectares. The PML is granted for a period of five years, renewable once upon request. When a PML expires, the mineral rights succeed to the underlying PL and cannot be renewed or re-staked thereafter, so long as the PL remains valid. Specifically, the PMLs on the Mkuvia property consist of approximately 115 licenses owned by Mr. Maita, and have been provided for in the New Mkuvia Agreement. Upon a successful mining permit application and receipt, the PMLs will be collapsed and superseded by the PL rights.

We obtained a Technical and Recourse Report on the Mkuvia Alluvial Gold Project, dated July 24, 2009, as prepared by Laurence Stephenson, P. Eng., and Ross McMaster, MAusIMM. This report was prepared in accordance with NI 43-101. Much of the information regarding the Mkuvia Alluvial Gold Project as provided below is based on information provided in that NI 43-technical report.

12

Effective November 7, 2009, we entered into a purchase agreement (the “Purchase Agreement”) with Ruby Creek Resources, Inc. (“Ruby Creek”), pursuant to which Ruby Creek has the right to purchase a 70 percent interest in 125 square kilometres of our 380 square kilometre Mkuvia Alluvial Gold Project upon payment of $3,000,000 over a three-year period. The schedule by which Ruby Creek is to pay such $3,000,000 to our Company is as follows:

- $100,000 within five business days of signing of the Purchase Agreement (received);

- $150,000 within 15 business days of signing of the Purchase Agreement (received);

- $100,000 upon satisfactory completion of Ruby Creek’s due diligence (received);

- $400,000 upon closing under the Purchase Agreement and receipt of the first mining license;

- $750,000 within 12 months of closing;

- $750,000 within 24 months of closing and

- $750,000 within 36 months of closing (this final payment may be made, in Ruby Creek’s discretion, in cash or shares of Ruby Creek).

In a further purchase agreement between our Company and Ruby Creek dated for reference May 19, 2010 and fully executed on June 16, 2010 (the “Further Purchase Agreement”), Ruby Creek agreed to purchase 70% of the remaining 255 sq km of the Mkuvia Alluvial Gold Project in accordance with the terms of such Further Purchase Agreement. Under the terms of the Further Purchase Agreement, Ruby Creek will earn a 70 percent interest in the remaining 255 square kilometres of our 380 square kilometre Mkuvia Alluvial Gold Project by making payments totaling $6,000,000 to us. The schedule by which Ruby Creek is to pay such $6,000,000 to us is as follows:

- $200,000 due within seven days of execution of the Further Purchase Agreement (received);

- $150,000 (received) plus the issuance of 4 million restricted shares of common stock of Ruby Creek, with an agreed upon value of $0.80 per share for a stated valuation of $3.2 million, within 30 days of the receipt of Certificates of Acknowledgement for all underlying and related Agreements from the Commissioner for Minerals in Tanzania as required by the Mining Act of Tanzania (Certificates of Acknowledgement received August 12, 2010, and shares issued on December 16, 2010);

- $450,000 on June 1, 2011 (unpaid);

- $1,000,000 on June 1, 2012 (unpaid); and

- $1,000,000 on June 1, 2013 (which may be satisfied by the issuance of stock by Ruby Creek).

Thus, the combined payments under the November 2009 and the June 2010 Purchase Agreement and Further Purchase Agreement provide for a total commitment of $9,000,000 payable to our Company by Ruby Creek to purchase a 70% interest in the entire 380 square kilometre Mkuvia Alluvial Gold Project.

The ownership structure of the interest in the Mkuvia Alluvial Gold Project shall be a 70% interest for Ruby Creek, a 25% interest for our Company and a 5% interest for Mr. Mkuvia Maita, the original owner of the underlying PLs. In addition, Mr. Maita retains a 3% net smelter royalty. However, the Further Purchase Agreement also provides that Ruby Creek may increase its ownership position from a 70% interest to 75%, reducing our position to 20%, by giving notice to us and paying $1,000,000 to us by June 1, 2011 (unpaid).

As indicated in Item 3 of this Annual Report – “Legal Proceedings”, on February 8, 2012, Ruby Creek filed a lawsuit against the Company in the Supreme Court, State of New York, in which Ruby Creek alleges that the Company participated in a fraudulent transfer of the mineral property interests that Ruby Creek had the right to purchase pursuant to the above-referenced Purchase Agreement and Further Purchase Agreement with the Company. The Company is of the view that such allegations are without merit and intends to vigorously contest the action. On February 23, 2012, the Company filed a lawsuit against Ruby Creek in the Supreme Court of British Columbia, seeking relief for Ruby Creek’s breach of its payment obligations under the above-referenced Purchase Agreement and Further Purchase Agreement and seeking an order that Ruby Creek remove the U.S. restrictive legend from Ruby Creek shares issued to the Company under the agreements. To date, Ruby Creek is in default with respect to over $1.3 million in scheduled payments due to the Company under the Purchase Agreement and Further Purchase Agreement.

Location and Access

The 380 square kilometers Mkuvia Project is located in the Nachingwea District, Lindi Region of the United Republic of Tanzania, and approximately 140 kilometers west of Nachingwea town. Lindi Region is one of the three regions forming Southern Zone of United Republic of Tanzania, the other regions being Mtwara and Ruvuma. The Mtwara and Ruvuma regions border northern Mozambique and eastern Malawi. A central point in the mining license is located at 361600 mE, 8856946 mN, UTM Zone 37 Southern Hemisphere (WGS 84)

13

The Lindi Region is one of the 20 Regions in Tanzania Mainland. The Region lies between South latitude 08°30’ and 10°30’ and East longitude 37°30’ and 39°30’. It is bordered by four other regions, the Coastal and Morogoro regions to the North, the Ruvuma region to the West, the Mtwara region to the South and the Indian Ocean to the East.

The main road from Dar es Salaam to the southern regions passes through the Coastal, Lindi, Mtwara and Ruvuma regions. The road connects to northern Mozambique and eastern Malawi via the Mtwara and Ruvuma regions. Recently funding from external donors and the central government have significantly improved the road from Dar Es Salaam to the Lindi and Mtwara regions from gravel to tarmac level, covering a total distance of about 700 kilometres, including the construction of 1 kilometre long bridge across the Rufiji River.

The Lindi Region is served by 4 airstrips, in Lindi, Nachingwea, Liwale and Kilwa Masoko. These gravel strips are capable of supporting small to medium size planes only. There is no commercial air service to the region.

LOCATION MAP: MKUVIA PROPERTY IN TANZANIA

The Mkuvia Property is accessible by dirt gravel road from Nachingwea town via Mbondo, Kilimarondo and Kiegeyi villages. However, during intense rain, access to the property from Kiegeyi village can only be achieved by using 4 x 4 trucks. Operations for the exploration of the Mkuvia Property would be based out of the town of Nachingwea located 140 kilometres east of the property and about 600 kilometres southwest of Dar es Salaam, the capital of Tanzania. Nachingwea town, which is one of the districts within Lindi Region, has an airstrip facility on which up to medium size aircrafts can safely be utilized.

Access to the property is via main Tanzanian highways to the village of Kiegeyi and then by field road to our main field camp. Field roads exist throughout the property.

Although the electrical power grid is reaching most areas of Tanzania it does not extend to the area of the Mkuvia property and will not likely be available in the near future. Since Tanzania has a vibrant mining community, a large pool of experienced mining personnel and equipment is available, some of it locally.

There are no waste treatment plants in the immediate area.

Topography and Climate

The topography of the area ranges between 480 to 760 metres and is relatively moderately rugged to the central, west and the southwest, and flat to the eastern part. Many of the rivers and streams which are flowing to the south, north and east directions are seasonally dry. The main Mbwemkuru River flows all year round and water availability for all aspects of the exploration and development program will not be a problem. The area is dense vegetated with thick bushes along the rivers and streams valleys.

14

There are four main climatic zones that can affect the whole of Tanzania: the coastal area where conditions are tropical; the central plateau, which is hot and dry; the semi-temperate highland areas; and the high, moist lake regions. There are two rainy seasons in the north, from November to January and from March through May. In the Lindi Region, annual rainfall ranges from 600mm in low lands to 1200mm in the highland plateau. Most parts of the coastal, central and north eastern highlands are currently experiencing extreme drought conditions after a prolonged period of below average annual rainfall in consecutive seasons. Plans to develop water resources could not only facilitate operations but might provide a local resource that will attract government approval and funding.

The mean annual temperatures vary with altitude from the valley bottom to the mountain top. The average annual temperature varies between 18 degrees C on the mountains to 30 degrees C in river valleys. In most parts of the region, the average temperatures are almost uniform at 25 degrees C. In general the hot season runs from July to September.

History

Gold mineralization in the area was first discovered at the time of the government’s Geological Survey of Tanzania, a countrywide geochemical survey program conducted in the 1990s. The property is part of a previously described gold district, the Kitowero Prospect, in which a State Mining Corporation reported mineral concentrates in the current rivers, including the Mbwemkuru River. The authors of the 43-101 Report have advised that they have not been able to verify this information, and no historical estimates or details is available on the source of this information.

Small scale artisanal mining activities commenced in 2002 by local miners, with the aim of exploring and mining gemstone along the main Mbwemkuru River and its tributaries. However, gold was recovered from the concentrates and hence the area turned from gemstone to alluvial gold mining. The current production from artisanal mining work by local miners, as reported by them averages between 1.5 to 2 kilograms of gold per month, recovered from loose sands and gravels. The authors of the 43-101 Report have not been able to verify this information.

Geological Setting

Tanzania has a geological environment representing all the known chronostratigraphical units of the world ranging from Archaean, Proterozoic, Phanerozoic to Quarternary ages. These geological formations host a variety of minerals such as gold, base metals, diverse types of gemstones (including tanzanite, diamonds, emerald, sapphires, colored quartz, ruby, beryl, tourmaline, garnet), various industrial minerals, building materials, phosphate, coal, salt, kaolin, tin, water and hydrocarbons.

Regional Geology. Much of the central and northern part of the country is underlain by the Tanzania Archaean Craton. The central part of the country is composed of the high grade metamorphic terrain (the Dodoman Supergroup dominated by rafts of amphibolite to granulite facies metamorphic rocks in migmatitic granite terrain), whereas the northern part is covered by the Greenstone Belt (the Nyazian – Kavirondian Supergroup comprising sequences of mafic to felsic volcanics, chert/banded iron formation and clastic sediments). The Tanzania Archaean Craton is well known as a host for world-class gold deposits similar to other Archaean Cratons around the world. The Craton is also intruded by a number of diamondiferous kimberlite pipes.

The Tanzania Archaean Craton is engulfed to southeast and southwest by Palaeaproterozoic Usagaran and Ubendian mobile belts respectively, with high grade crystalline metamorphic rocks with a number of postorogenic gabbroic and granitic intrusives hosting base metals, shear zone hosted gold, various types of gemstones and industrial minerals. The eastern part of the Usagaran Belt is mobilized by the Neoproterozoic Pan African Orogeny forming the Mozambique Belt with lithological, structural and metallurgical characteristics similar to that of the Usagaran - Ubendian Belt.

The Palaeoproterozoic Ubendian mobile belt is bound to the west by the mildly metamorphosed Mesoproterozoic Fold Belt (the Kibaran –Bukoban - Karagwe-Ankolean Supergroup). The supercrustal rocks of this Belt (mainly meta – argillites, phyllites, low-grade sericite schists and quartzites) are intruded by post orogenic granites which have alteration haloes containing veins with tin and tungsten mineralization. The Belt is also characterized by post – orogenic basic intrusives hosting platinum group metals (PGMs).

The Uha - Malagarasi Neoproterozoic to early Palaeozoic age is an intracratonic formation consisting of sedimentary – volcanic depositional sequences of sandstones, quartzites, shales, red beds, dolomitic limestones, cherts and amygdaloidal lavas with indications of strata-bound copper deposits and various industrial minerals.

Phanerozoic formations in Tanzania include the following:

-

the Karoo Supergroup of Late carboniferous to Jurassic age made up of continental sedimentary rocks famous for hosting good-quality coal resources occurring in several isolated coalfields located in south west of Tanzania;

-

Marine Formations that are dominated by shelf-facies clay bound sands, marls and some isolated coral reefs good for production of portland cement, lime and construction aggregates. The marls and sands are respectively, good source and reservoir rocks of hydrocarbons. At Mandawa there are salt domes made up of gypsums and other evaporates salts that can be used for various industrial purposes; and

15

-

Neogene to Quarternary continental formations in isolated basins and river channels composed of clays (red soils, ochre, kaolin, bentonites, meerschaum, bauxite), limestone, evaporates (gypsum, nitrates and halides) and sands; volcanic rocks ranging in composition from lavas (basalts, andesites, and phonolites) good for aggregates, apatite and niobium bearing carbonatites (good for fertilizers), tuffs, ash and pumice (good for production of pozzolana cement) and dimension stones; volcanic fumarolic exhalative deposits (mainly sulphur and fluorites).

Property Geology. The Mkuvia Project is situated at the eastern margin of the Selous Basin where Karoo and young sedimentary rock are in fault contact with low to high-grade metamorphosed rocks of Neoproterozoic age belonging to the Mozambique Belt. The Proterozoic basement rocks are bounded by Palaeozoic, Mesozoic and Cenozoic basins to the east, north and west. The dominant rocks are biotite schist and gneiss, granitic gneiss, garnetiferous amphibolites, quartzite, pegmatite dyke and mafic sills which are unconformably overlain by palaeo-placer sand and pebble beds and recent superficial deposits. The regional structural trends that control the deposition appear to be trending at northwest and northeast.

The geology of the property is dominated by thick (up to 10 m) of transported cover consisting of palaeo-placer sand, gravel and pebble beds derived from Karoo to the west and younger sedimentary rocks. The sand horizon is massive, graded from fine to coarse grained, characterized by orange-yellow sands, well exposed at Old Matandani Prospect, and white-grey sands which cover the large part of the property. The basal conglomerate pebbles (auriferous pebbles and cobbles beds) are well rounded, well sorted, dominantly made of quartzite, quartz rocks, and other basement rocks.

The thickness of palaeo-placer sand–pebble beds and the overlaying black clays material increase toward the eastern part of Mbwemkuru River as observed at Mkilikage Prospect. This would be expected if the source of the deltaic or beach placer material is from the west. At Mkilikage Prospect, a thick layer of medium to coarse grained sandy bed (~ 2.5 m thick) resulted from modern river deposition is overlaying palaeo-placer sand-pebble beds. This sandy bed is characterized by well developed cross bedding sedimentary structures with minimal gold content until the lower reaches.

The red-brown sands are massive with no obvious bedding. They comprise subangular quartz grains with a matrix of hematite clay. They range from <1 m up to 3 m thickness, and generally appear to be thicker upslope, particularly at the western extremity of the property, well exposed at Old Matandani workings. They have been reworked in the current river bed, with removal of the clay, to produce white friable sands that extend for up to 300 m, but generally less, upslope. These are clearly gold-bearing as they have been extensively mined by artisanals, but panning suggests that they are low grade.

The sands overlie a polymictic conglomerate sequence that comprises several clay-rich, horizontally bedded units interlayered with sandy beds. The clasts range from pebbles through cobbles to boulders, the latter being only sporadically developed, but suggesting that there may be distinct channels in the conglomerate sequence upslope from the present river. Artisanal activity and panning indicate that the conglomerates have higher gold grades than the overlying sands. This feature would be anticipated in a delta or beach placer forming river fan.

Most of the Neoproterozoic basement rocks are exposed on the NE-SW trending ridge located in the central-eastern portion of the property with few outcrops observed in the south part, exposed on the river banks and beds. The basement geology consists of granite-gneisses, biotite gneiss, schists and quartzo-feldspathic gneiss and quartzite, which have been intruded by pegmatite veins and mafic dykes and quartz veins.

The quartzite has a bedded sugary texture. The biotite gneiss is fine grained, well bedded with biotite, feldspar and quartz. Quartz-feldspar gneiss additionally contains minor biotite and was also observed to contain some large augen like feldspar crystals. Pegmatite was generally seen to have graphic texture with very coarse grained feldspar and smaller quartz crystals, and with only biotite or chlorite as an accessory mineral. The granite-gneiss characterized by granoblastic texture and weakly developed foliation fabrics.

Mineralization

Thus far, the known gold mineralization in Mkuvia Property occurs as placer deposits comprising of a significant, but unquantified accumulation of gold in alluvium hosted by: 1) reworked palaeo-placer by the Mbwemkuru River and its tributaries; and 2) an over 10 m thick zone of palaeo-placer sand and pebble beds non-conformably overlying biotite schist, gneiss, quartzite, garnet-amphibolite and granitoids. The latter comprises a poorly sorted palaeo-beach placer plateau extending over 29 km along a NW-SE direction and ~5 km wide along a NE-SW direction. In addition there are extensive troughs with similar continental alluvium further west in the Karroo Basin. It is however notable that at the highest point on the property, pebble conglomerates were noted on the surface that have been worked sporadically by the artisanal miners (due to lack of water resources) suggesting that gold is present. This is consistent with the proposition that the mineralization is associated with a wide spread beach placer environment.

Gold-bearing alluvium along the Mbwemkuru River occurs within a 0.35 to 2.0 m thick zone between the bedrock and sandy-gravelly material related to present drainage active channels and terraces. This zone contains an estimated 1.0 grams per cubic metre that the small-scale miners are currently reportedly recovering.

16

Gold is very fine-grained in general, suggesting a distal source, although some coarser-grained flakes are present. The gold is associated with the black sands that comprise fine-grained ilmenite and pink garnet and minor magnetite. These may be represented by distinct ferruginous layers in the conglomerate sequence. The minerals in the black sand are consistent with the beach placer model.

Artisanal miners have been active since 2002 exploiting these deposits using simple sluice techniques and hence dependant on water for treatment. Placer type gold occurs as very fine flat pieces implying reworking or a distal source. Other elements (such as Pt, Pd, Ag, U and Th) in the placer are of passing interest only. Pt and Pd do not appear to be a consistent constituent.

The area was loosely defined by the surface inspection of the beach placer type gravel formations in place. The wide spread area remains to definitively be surveyed to confirm that the boundaries indicated are correctly delineated. This delineation should be treated as speculative and will need further exploration work to define.

Exploration Activities

The Mkuvia Property is without known reserves and our activities to date have been exploratory in nature.

An estimated total of US$2.1 million has been spent on Mkuvia property during the period from April to December 2008 for various exploration activities, which include casual labour salaries, transport, field costs, office and administration and hardware. Reconnaissance exploration work on the project to date has consisted of pitting and sampling, geological mapping and bedrock sampling, and stream and sediments sampling, as described below.

Pitting and Sampling. Pitting work commenced in June 2008 and continued throughout to March 2009. The initial pit sampling program on the Mkuvia property was undertaken at the Matandani Main workings, along the Mbwemkuru River. A total of 161 pits consisting of 498 samples were completed from 10 sections during the period from June to December 2008. These pits were deepened and sampled trying to reach bedrock (12-15 m estimate, bedrock was not encountered) where possible. Analysis of the gold content in the pit samples continued through to May 2009.

Lines were run north south across the area on a line spacing of 500 m and with a pit being dug to the bedrock refusal at 50 m intervals along the line. The sampling was done volumetrically from the surface, where a 100 litre sample was collected from each cubic meter of material recovered. The pit sampling was done based on the geological control. Each individual horizon (sand, gravel, pebble) was sampled separately, maintaining a 100 litre sample size.

The pit samples were then treated using a Knelson Concentrator on site in September 2008.

The compilation of all heavy mineral and gold results was completed by TMEx staff in laboratory conditions at Arusha, Tanzania, which included separating and weighing the gold recovered from each sample where measurable gold was observed. Each sample was taken from a designated and mapped stratigraphy as a measured volume of loose material (e.g.: sands, gravel) and usually were 100 litres in field estimated volume. Sample treatment was by a 7.5 inch Knelson concentrator to produce a heavy mineral concentrate. After further hand panning in the TMEx laboratory reduced the concentrate, it was dried and the gold was finally separated from all other minerals, described and weighed to give a result in g/Lcm. (A loose cubic metre (Lcm) is defined as the expansion of the in situ measurement of material that once excavated increases by a 20-30% factor that will be determined exactly in further test work.) TMEx took charge of the concentrate from the Knelson concentrator and proceeded to calculate the weight of gold.

All pits were geologically mapped, level surveyed and generated cross sections. Of significance is that where the test pits were able to penetrate below the pebble conglomerate the encountered clay rich units were significantly devoid of gold colour counts and assay analysis.

The pit sampling has successfully identified the sand and pebble conglomerates as auriferous in the area of the Matandani Main workings, along the Mbwemkuru River.

Geological Mapping and Bedrock Sampling. Geological mapping work is ongoing in the Mkuvia Project. The mapping is conducted at scale of 1:20,000. However, most of the Mkuvia Property lies under superficial covers, with outcrops being exposed on the NE-SW trending Mbwemkuru ridge located in the central - eastern portion of the property and along rivers and streams beds flowing in the southern portion. The dominant basement lithologies encountered during the mapping, stream sampling and pitting activities are biotite-hornblende gneiss, which developed strong foliation fabrics and compositional banding and weakly foliated to massive quartzo-feldspathic gneiss referred as granite-gneiss, with granular igneous texture being preserved. The granite-gneiss is characterized by granoblastic texture and weak foliation fabrics. Quartz-magnetite subcrops and rubbles are exposed on the northern part along Mbwemkuru ridge. The rock is characterized by alternating narrow bands/layers of quartz and magnetite. The basement rocks have been intruded by the late pegmatite dykes and veins and quartz veins.

The superficial covers which dominated the western part of the project consist of palaeo-sands, gravels, pebbles and cobbles deposition, with recent river deposition and clayey material. The pebbles and cobbles are well rounded, made up of mainly quartzite and quartz vein.

17

Calcrete formations have been observed, mostly formed in the swamps.

Bedrock sampling work is taking place concurrently with the geological mapping. Thus far, a total of 60 bedrock samples were collected for gold and base metals assaying and references. The samples for assaying were sent to SGS Laboratory, Mwanza for analysis. Many of the bedrock samples were collected from the central-eastern portion of the property where basement rocks are well exposed along Mbwemkuru Hill and river beds.

Stream and Sediments Sampling. Reconnaissance stream sediments sampling work commenced in September 2008 in all prioritized rivers and streams within the Mkuvia Property. The objective of the program was to quickly define the pattern and limit of the placer gold mineralization within the property. The program was undertaken in the eastern and northeast part of the property. The stream samples were taken from at least one meter deep pits dug to the base of the selected part of the stream where gravels and heavy minerals are concentrated. A total of 73 stream sediments samples were collected during the period from September to December 2008.

From September 2008, sample treatment was by a 7.5 inch Knelson Concentrator to produce a heavy mineral concentrate. This concentrate was dried and examined under a binocular microscope to identify heavy minerals of interest and gold. The gold was recovered, described, and gold grain counts were recorded to guide exploration in the reconnaissance stream samples.

A preliminary review heavy mineral stream sampling, field observations and interpretation of available aerial photography has resulted in the identification of substantial additional areas of recent palaeo-alluvial deposits in the Mkuvia project area. The initial reconnaissance heavy mineral sampling has highlighted several drainages and gravel ridges that warrant exploration and further evaluation.