Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - Discovery Energy Corp. | ex10_2.htm |

| EX-10.3 - EXHIBIT 10.3 - Discovery Energy Corp. | ex10_3.htm |

| EX-10.4 - EXHIBIT 10.4 - Discovery Energy Corp. | ex10_4.htm |

| EX-10.1 - EXHIBIT 10.1 - Discovery Energy Corp. | ex10_1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 29, 2011

|

SANTOS RESOURCE CORP.

|

||

|

(Exact name of registrant as specified in its Charter)

|

||

|

Nevada

|

000-53520

|

98-0507846

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

One Riverway Drive, Suite 1700

Houston, Texas 77056

713-840-6495

|

||

|

(Address and telephone number of principal executive offices, including zip code)

|

||

|

11450 - 201A Street

Maple Ridge, British Columbia V2X 0Y4

|

||

|

(Former address if changed since last report)

|

||

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

The information included in Item 2.01 of this Report is also incorporated by reference into this Item 1.01 of this Report.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

Background

Santos Resource Corp. ("Registrant") was incorporated under the laws of the state of Nevada on May 24, 2006. Until recently, it had not commenced business operations. Registrant’s original plan of business was to explore and develop a 75% interest in and to 18 mineral claims covering approximately 900.75 hectares (9.01 km2) called the Lourdeau Claims. The Lourdeau Claims are located in the La Grande geological area of Quebec, Canada, in the James Bay Territory about 620 miles (1,000 km) north of Montreal, Quebec. Registrant had abandoned this original plan of business, and had been looking for another business opportunity. Until the completion of the acquisition described herein, Registrant has been a "shell company" as defined in the Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended. For reasons given hereinafter, Registrant has adopted a significant change in its corporate direction. It has decided to focus its efforts on the acquisition of an attractive crude oil and natural gas prospect located in Australia, and the exploration, development and production of oil and gas on this prospect.

Registrant now proposes to pursue a new business plan involving the development of the Petroleum Exploration License (PEL) 512 (the “Prospect”) in the State of South Australia. The Prospect involves 584,651 gross acres overlaying portions of the geological system generally referred to as the Cooper and Eromanga basins. The Prospect is flanked by offset production totaling approximately 4,200,000 barrels since 2001. Nearby fields have produced approximately 16,296,000 barrels of oil. Since the early 1980s, the oil fairway on which the Prospect sits has produced over 23,600,000 barrels of oil. The Prospect features access to markets via existing and expanding pipeline capacity. During the late 1980s and again during 2005-2006, various operators in the extreme southeast corner of the Prospect drilled 11 wells. Reports filed with the South Australian government indicate that some of these wells exhibited "oil shows" but none were completed to enable production. For more information about the Prospect, see the section captioned "Description of Prospect” below.

In connection with the change in Registrant's business focus, a change of the control of Registrant has taken place, and this change of control is described in Item 5.01 of this Report. Such change of control involved a change in management and will involve further changes in management, as described in Item 5.01 of this Report. Moreover, Registrant has raised some “seed” capital in a private placement that is described in Item 3.02. Finally, in connection with the change in Registrant's business focus, Registrant acquired a significant asset, which is described below.

2

Forward-Looking Statements

The description of Registrant's new oil and gas exploration and production business contained herein includes forward-looking statements. Registrant has based these forward-looking statements largely on its current expectations and projections about future events and financial trends affecting the financial condition of oil and gas business that Registrant will now undertake. The forward-looking statements are generally accompanied by words such as "plan," "intend," "estimate," "expect," "believe," "should," "would," "could," "anticipate" or other words that convey uncertainty of future events or outcomes. One should not place undue reliance on these forward-looking statements, which apply only as of the date of this Report. Registrant's actual results could differ materially from those stated or implied by these forward-looking statements due to risks and uncertainties associated with Registrant's business. The principal risks and uncertainties associated with Registrant's business will be described in Registrant's next Annual Report on Form 10-K due near the end of May 2012. Registrant is under no duty to update any of the forward-looking statements contained in this Report after the date hereof to conform such statements to actual results.

Current Status of the Ownership of the Prospect

Liberty Petroleum Corporation (“Liberty”) was the winning bidder for the Prospect. In order for the Prospect to be vested in Liberty, it needs only to complete negotiation of an access and royalty arrangement with the relevant Aboriginal native title holders, who have certain historic rights on the Prospect land. On September 12, 2011, in consideration of a US$50,000 deposit, Liberty entered into a legal document (as amended and restated, the “Liberty Agreement”) with Keith D. Spickelmier whereby Liberty granted to Mr. Spickelmier an exclusive right to negotiate an option to acquire the Prospect (the “Option”). The Liberty Agreement was later amended and restated so that this exclusive right remained in effect until January 28, 2012. Moreover, in anticipation of the assignment of the Liberty Agreement to it, on December 29, 2011 Registrant and Liberty entered into an agreement modifying certain terms of the Liberty Agreement, including extending the exclusive right to remain in effect until January 31, 2012. As a result of such modification, the Option’s exercise price for the Prospect is a deemed total of US$4.05 million payable as follows:

|

|

*

|

Cash in the amount of US$800,000

|

|

|

*

|

Two promissory notes with an aggregate principal amount of US$750,000, one becoming due six months after Registrant’s acquisition of the Prospect, and the other becoming due nine months after Registrant’s acquisition of the Prospect

|

|

|

*

|

Twelve million shares of Registrant’s common stock

|

After any exercise of the Option, Liberty would retain a 7.0% overriding royalty interest.

Per the terms of the Liberty Agreement, Mr. Spickelmier paid to Liberty a $50,000 initial deposit. In anticipation of the assignment of the Liberty Agreement to it, Registrant paid an additional $100,000 deposit to extend the exclusive right provided for by the Liberty Agreement, and an additional $200,000 deposit to modify certain terms of the Liberty Agreement. The preceding amounts will be applied to the Option’s exercise price upon exercise. If the South Australian Minister of Regional Development (the “Minister”) does not grant the petroleum exploration license allowing the exploration and drilling rights related to the Prospect (the “License”) within a certain period of time, Registrant will have the option to cancel the transaction, and Liberty is required to refund all moneys paid to it.

3

Assuming the sale of all of the shares being offered in the private placement described in Item 3.02 below, the 12.0 million shares that may be issued to Liberty will constitute approximately 9.3% of the shares of Registrant's common stock outstanding after the completion of all of the stock issuance described herein, including the shares to be issued to acquire rights under the Liberty Agreement described in the section immediately following (outright or pursuant to the full conversion of the convertible promissory note). Because the shares of common stock to be received by Liberty will not be registered under the Securities Act, such shares will be "restricted securities" (as defined in Rule 144 promulgated under the Securities Act) and accordingly, may not be sold or transferred by Liberty unless such shares are registered under the Securities Act or are sold or transferred pursuant to an exemption therefrom.

All descriptions of the terms, provisions and conditions of the Liberty Agreement are qualified in their entirety by reference to the first amended and restated Liberty Agreement, which is attached as Exhibit 10.1 hereto and is incorporated herein by reference for all purposes hereof.

Registrant’s Acquisition of Rights Under the Liberty Agreement

Pursuant to the terms, provisions and conditions of an assignment (the “Assignment”) dated effective January 10, 2012 executed by Mr. Spickelmier and Registrant, Registrant acquired all of Mr. Spickelmier’s rights in the Liberty Agreement. The purchase price for the assignment of Mr. Spickelmier’s rights in the Liberty Agreement was follows:

|

*

|

$50,000 in cash, payable as soon as Registrant has funds therefore.

|

|

|

*

|

$100,000 payable upon notice from the Minister that the Minister has granted and issued the License in the name of Registrant.

|

|

|

*

|

20.0 million shares of Registrant’s common shares issued upon delivery of the Assignment.

|

|

|

*

|

A convertible promissory note for $55,000 convertible at $0.001 into 55.0 million common shares at any time after Registrant has increased its authorized common shares to at least 125.0 million or has undertaken a reverse stock split in which at least two or more shares are combined into one share, issuable upon notice from the Minister that the Minister has granted and issued the License in the name of Registrant.

|

In the Assignment, Mr. Spickelmier has agreed that, if the Minister ever definitively decides not to grant and issue the License in the name of Registrant, or has failed to grant and issue the License in the name of Registrant prior to April 30, 2012, whichever occurs first, then Mr. Spickelmier shall return immediately to Registrant the 20.0 million shares issued to him in connection with the delivery of the Assignment.

4

In the Assignment, Registrant immediately assumed Mr. Spickelmier’s obligations under the Liberty Agreement, and Registrant agreed that, if it ever realizes that it will be unable to honor this assumption agreement, Registrant would give written notice to Mr. Spickelmier to such effect, and Mr. Spickelmier would be entitled to require a re-assignment of the rights under the Liberty Agreement to him, provided that prior to any re-assignment Mr. Spickelmier reimburse Registrant for any cash deposits that it has made directly to Liberty pursuant to the Liberty Agreement and Mr. Spickelmier return to Registrant the 20.0 million shares issued to him in connection with the delivery of the Assignment.

Assuming the sale of all of the shares being offered in the private placement described in Item 3.02 below, the 75.0 million shares that have been or may be issued to Mr. Spickelmier will constitute approximately 58.9% of the shares of Registrant's common stock outstanding after the completion of all of the stock issuance described herein, including the 12.0 million share issuance to Liberty. Because the shares of common stock received by Mr. Spickelmier will not be registered under the Securities Act, such shares will be "restricted securities" (as defined in Rule 144 promulgated under the Securities Act) and accordingly, may not be sold or transferred by Mr. Spickelmier unless such shares are registered under the Securities Act or are sold or transferred pursuant to an exemption therefrom.

All descriptions of the assignment of the Liberty Agreement contained herein and all references to the terms, provisions and conditions of the Assignment are qualified in their entirety by reference to the Assignment, which is attached as Exhibit 10.2 hereto and is incorporated herein by reference for all purposes hereof.

The consideration for the acquisition of Mr. Spickelmier’s rights in the Liberty Agreement (including the number of shares issued to Mr. Spickelmier) was determined in arms-length negotiations between Mr. Spickelmier and the prospective management of Registrant (particularly Keith J. McKenzie), on behalf of Registrant. The factors addressed by Mr. McKenzie in negotiating this consideration included the ability to establish business relationships and acquire required financing for the development of the Prospect; the future likelihood for success with the Prospect in terms of hydrocarbon production, revenues and earnings; the present developmental status of the Prospect and surrounding area, including the ability to transport captured hydrocarbons; and an assessment of Mr. Spickelmier's ability to contribute to the management of Registrant's business if the Prospect were acquired and he joined Registrant's management.

Mr. McKenzie's large percentage ownership of Registrant's outstanding common stock gives to him an interest in assuring that the terms of Registrant's acquisition of Mr. Spickelmier’s rights in the Liberty Agreement are commercially reasonable. Accordingly, Mr. McKenzie does not believe that his prior and current relationship with Mr. Spickelmier impaired his ability to negotiate commercially reasonable terms in connection with Registrant's acquisition of Mr. Spickelmier’s rights in the Liberty Agreement.

5

Proposed Acquisition of the Prospect

Registrant is striving to close the acquisition of the Prospect pursuant to the Liberty Agreement as soon as possible. To do this, Registrant will need to raise additional funds, and to complete the negotiations and documentation of the acquisition to do so. Registrant is currently involved in serious negotiations with Liberty regarding the documentation of the acquisition, and Registrant is currently attempting to raise sufficient funds to complete the acquisition. Registrant has no assurance that it will be able to accomplish the preceding. Consequently, neither Registrant nor anyone else has any assurance that Registrant will be able to consummate the acquisition of the Prospect.

Description of Prospect – Petroleum Exploration License (PEL) 512

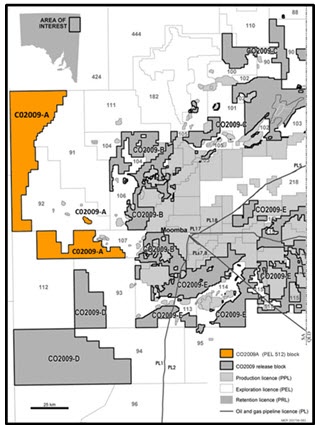

The Prospect covers 584,651 gross acres in the State of South Australia that overlays portions of geological systems commonly referred to as the Cooper and Eromanga basins. The Prospect is flanked by offset production totaling approximately 4,200,000 barrels of oil since 2001. Since the early 1980s, nearby fields have produced nearly 16,300,000 barrels of oil and the oil fairway running through the Prospect has produced over 23,600,000 barrels of oil. The Prospect area is connected to eastern and southern Australian petroleum markets by large diameter oil and gas pipelines, as further described below in the section captioned “Plan of Operation - Proposed Initial Activities.” During the late 1980s and again in 2005-2006, various operators drilled a total of 11 wells in the extreme southeast corner of the Prospect. Reports filed with the South Australian government indicate that some of these wells exhibited "oil shows" but none were completed to enable production. A general idea of the location of the Prospect, which has something of an L-shape, can be gathered from the map that follows this paragraph. Focusing on PEL 92, seen toward the left side of the map that follows this paragraph, the Prospect is generally west of the western boundary of the PEL 92 and south of the southern boundary of the PEL 92.

6

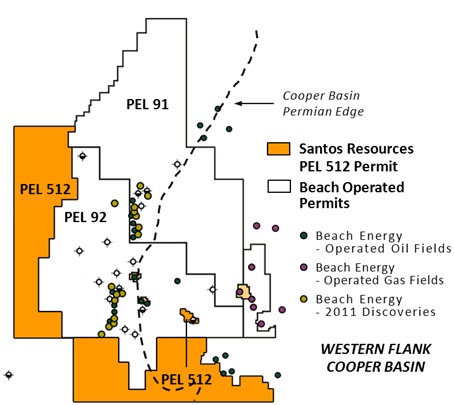

The location of the CO2009-A Permit known as the PEL 512 can be better seen in the enlarged map that follows this paragraph.

The Cooper Basin is comprised of 32 million acres. It developed in late Carboniferous/early Permian, and features a maximum thickness of sediments of about 9,000 feet. This basin is divided into several depo-centers by faulted anticlinal trends. The Permian era formations within the Cooper Basin are characterized by alternating fluvial sandstones/floodplain siltstones. Overlaying the Permian are Triassic era formations characterized by fluvial/floodplain sediments. The Eromanga Basin is comprised of 250 million acres. It developed as an interior sag over central and eastern Australia. In the south, depo-centers coincide with underlying Cooper Basin synclines, thus in some areas causing the Eromanga Basin to be on top of the Cooper Basin. The geological characteristics of these two basins cause them in effect to form a basin system that for many purposes can best be thought of in terms of a single geological phenomenon rather than two. The following table gives additional information about this system.

|

Age Late Carboniferous:

|

Middle Triassic

|

|

Area in South Australia:

|

35,000 km2 (13,510 sq. miles)

|

|

Depth to Target Zones:

|

1,250–3,670 m. (4,101 ft. – 12,040 ft.)

|

|

Thickness:

|

2,500 m. (8,202 ft.)

|

7

|

Hydrocarbon Shows:

|

Widespread over 8 formations

|

|

First commercial Discovery:

|

1963 gas (Gidgealpa 2)

|

|

Basin Type:

|

Intracratonic

|

|

Depositional Setting:

|

Non-marine

|

|

Reservoirs:

|

Fluvial, deltaic, shoreface sandstones

|

|

Regional Structure:

|

Faulted anticlines

|

|

Seals:

|

Lacustrine shale, coal

|

|

Source Rocks:

|

Carbonaceous shale, thick coal

|

|

Depth to Oil/Gas Window:

|

1,250 m. (4,101 ft.)

|

|

Crude Oil:

|

Avg 43 degree API

|

|

Number of Wells:

|

~1900

|

Hydrocarbons were first discovered in this system in the early 1960’s when gas was discovered in 1963 by the Gidgealpa-2 well. The prolific Moomba gas field was discovered in 1966. The first commercial oil was discovered in 1970 in the Tirrawarra oil field. Currently, this system has produced 57 oil fields and 149 gas fields. While natural gas production and associated liquids at the giant Moomba gas field have been in decline, crude oil production has seen a resurgence due to access to 3-D seismic data and greater drilling activity resulting from higher oil prices and re-leasing of inactive acreage. Since January 2002, new Cooper Basin explorers have drilled 160 exploration wells and 55 appraisal/development wells. Most wells have targeted oil, although both oil and gas have been discovered. New explorers found new pools in 80 of these wells, representing a technical success rate of 50%, and 67 were cased and suspended as future producers representing a 42% commercial success rate. Forty-three (43) exploration wells and 321 appraisal/development wells have been drilled in the Petroleum Production Licenses (PPLs) that are operated by Santos Limited and that existed before 2000. (Santos Limited is another company that is in no way related to Registrant.) The success rate for appraisal and development drilling in these PPLs was a very respectable 96%. Cumulative production crude oil and condensate has been 229 million barrels since 1983. Nearly 500 trillion cubic feet of natural gas bas been produced since 1970. Current daily production is approximately 11,000 barrels of oil/condensate, 125,000 Mcf of natural gas, and 2,200 barrels per day of associated liquids.

Drilling activity has recently increased in certain areas bordering or in close proximity to the Prospect. The following table features locations (mostly to the northwest of the Prospect) at which wells have been drilled.

8

Plan of Operation

General

Registrant intends to engage primarily in the exploration and development of oil and gas on the Prospect in an effort to develop oil and gas reserves. Registrant's principal products will be crude oil and natural gas. For the foreseeable future, Registrant does not expect to acquire additional interests in unimproved acreage (other than the Prospect) or producing oil or gas properties, or to participate in third party drilling operations. Registrant’s development strategy will be directed in the multi-pay target areas of South Australia, with principal focus on the prolific Cooper/Eromanga Basin, towards rapidly expanding production rates and proving up significant reserves primarily through exploratory drilling. Registrant’s mission will be to generate superior returns for its stockholders by working with industry partners, suppliers and the community to build a focused exploration and production company with strong development assets in the oil and gas sector.

In the right circumstances, Registrant might assume the entire risk of the drilling and development of the Prospect. More likely, Registrant will determine that the drilling and development of the Prospect can be more effectively pursued by inviting industry participants to share the risk and the reward of the Prospect by financing some or all of the costs of drilling wells. Such arrangements are frequently referred to as "farm-outs." In such cases, Registrant may retain a carried working interest, a reversionary interest, or may be required to finance all or a portion of Registrant's proportional interest in the Prospect. Although this approach will reduce Registrant's potential return should the drilling operations prove successful, it will also reduce Registrant's risk and financial commitment to a particular prospect. Prospective participants regarding possible “farm-out” arrangements have already approached Registrant.

9

There can be no assurance that Registrant will be successful in its exploratory and production activities. The oil and gas business involves numerous risks, the principal ones of which will be described in Registrant's next Annual Report on Form 10-K due near the end of May 2012.

Proposed Initial Activities

Currently, Registrant is striving to close the acquisition of the Prospect pursuant to the Liberty Agreement as soon as possible. To do this, Registrant will need to raise additional funds, and to complete the negotiations and documentation of the acquisition to do so. Registrant is currently involved in serious negotiations with Liberty regarding the documentation of the acquisition, and Registrant is currently attempting to raise sufficient funds to complete the acquisition. Registrant has no assurance that it will be able to accomplish the preceding. Consequently, neither Registrant nor anyone else has any assurance that Registrant will be able to consummate the acquisition of the Prospect.

Registrant has just begun the initial phase of its plan of operation. To date Registrant has not commenced any drilling or other exploration activities on any properties, and thus Registrant does not have any estimates of oil and gas reserves. Consequently Registrant has not reported its reserve estimates to any governmental authority. Registrant cannot assure anyone that it will find commercially producible amounts of oil and gas. Moreover, at the present time, Registrant cannot finance the initial phase of its plan of operation solely through its own current resources. Consequently, Registrant plans on undertaking certain financing activities described in "Plan of Operation - Capital Requirements" herein. The success of the initial phase of Registrant's plan of operation depends upon Registrant's ability to obtain additional capital to acquire the Prospect, to acquire seismic data with respect to the Prospect, and to drill exploratory and developmental wells. Registrant cannot assure anyone that it will obtain the necessary capital.

The initial phase of Registrant's plan of operation will involve the acquisition of the Prospect. For the terms of this acquisition, see the section captioned “Current Status of the Ownership of the Prospect.” If this acquisition is completed, the Prospect will be subject to a five-year work commitment, which involves the following (the following dollar figures represent Australian dollars, but the US dollar and Australian dollar conversion rate is almost within a penny of being one-to-one as of the date of this Report):

|

|

*

|

Year 1 - AUS$200,000 must be expended for geological studies and interpretation of existing seismic

|

|

|

*

|

Year 2 - AUS$1,250,000 must be expended to shoot 250 square kilometers of new 2D seismic

|

10

|

|

*

|

Year 3 - AUS$5,000,000 must be expended to shoot 400 square kilometers of new 3D seismic and AUS$3,600,000 must be expended to drill two wells

|

|

|

*

|

Year 4 - AUS$9,000,000 must be expended to drill five wells

|

|

|

*

|

Year 5 - AUS$9,000,000 must be expended to drill five wells

|

If this acquisition is completed, Registrant intends to pursue a program more ambitious than that required by the preceding work commitment. Subject to the availability of funds therefore, this accelerated developmental program is expected to involve approximately $8.5 million for the first two years. Not only is this program contingent on Registrant’s procurement of sufficient funds therefore, it may also be subject to governmental approval to vary the work commitment already in place. If pursued, this program is expected to entail the following:

|

|

*

|

The shooting of about 100 square kilometers of new 3D during the second quarter after the acquisition of the Prospect, at an estimated cost of AUS$1.25 million

|

|

|

*

|

The drilling and completion of two to four exploratory wells during the fourth quarter after the acquisition of the Prospect, at an estimated aggregate cost of between AUS$3.0 million and AUS$6.0 million, with the expectation of between one to three new field discoveries

|

|

|

*

|

If Registrant is successful in its initial exploratory activities, it will continue with a full development plan, the scope of which is now uncertain but will be based on engineering reports. The full development plan will again be subject to funds available therefor and any required governmental approval.

|

Registrant anticipates that its first wells will each cost about AUS$1.5 million to drill and complete. This estimate is based on information provided by Liberty, which is believed to be accurate based on generally available information in the industry. However, the actual costs of such operations may be more or less than the estimates contained herein. If actual costs of operations exceed Registrant's estimates to any significant degree, Registrant may require additional funding to achieve its initial objectives. The holes for the first wells are expected to be drilled vertically to a depth of about 7,000 feet. Between 800 and 900 feet of surface casing is expected to be required to get below the water table. The completion and engineering for these wells are expected to be standard, and no frac job is expected to be required. The first wells are expected to involve a complete logging suite.

Registrant has not yet identified any specific drill sites. Registrant will select drill sites based on a variety of factors, including information gathered from historic records and drill logs, proximity to existing pipelines, ease of access for drilling equipment, the presence of oil and natural gas in the immediate vicinity, and consultations with Registrant's geologist, drilling contractor and other oil field service providers. As discussed above, Registrant is required to expend AUS$200,000 for geological studies and interpretation of existing seismic data during the first year after the Prospect is acquired. Subject to the availability of funds therefore, Registrant would like to expend approximately AUS$1.25 million for new 3D seismic data.

11

Registrant intends to seek a joint venture partner that might act as the operator of Registrant’s wells. If Registrant is unsuccessful in procuring such a partner, it will engage the services of a third party once it has identified a proposed drilling site. Management foresees no problem in procuring the services of one or more qualified operators and drillers in connection with the initial phase of Registrant’s plan of operation, although a considerable increase in drilling activities in the area of Registrant’s properties could make difficult (and perhaps expensive) the procurement of operating and drilling services. In all cases, the operator will be responsible for permitting the well. In addition to the permitting process, the operator will be responsible for hiring the drilling contractor, geologist and petroleum engineer to make final decisions relative to the zones to be targeted, well design, and bore-hole drilling and logging. Should the well be successful, the operator would thereafter be responsible for completing the well, installing production facilities and interconnecting with gathering or transmission pipelines if economically appropriate Registrant expects to pay third party operators (i.e. not joint venture partner with Registrant) commercially prevailing rates.

The operator will be the caretaker of the well once production has commenced. Additionally, the operator will formulate and deliver to all interest owners an operating agreement establishing each participant’s rights and obligations in that particular well based on the location of the well and the ownership. The operator will also be responsible for paying bills related to the well, billing working interest owners for their proportionate expenses in drilling and completing the well, and selling the production from the well. Unless each interest owner sells its production separately, the operator will collect sale proceeds from oil and gas purchasers, and, once a division order has been established and confirmed by the interest owners, the operator will issue the checks to each interest owner in accordance with its appropriate interest. The operator will not perform these functions when each interest owner sells its production separately, in which case the interest owners will undertake these activities separately. After production commences on a well, the operator also will be responsible for maintaining the well and the wellhead site during the entire term of the production or until such time as the operator has been replaced.

The principal oil, natural gas and gas liquids transportation hub for the region of South Australia surrounding the Prospect is located in the vicinity of Moomba. This processing and transportation center is approximately 60 km (36 miles) due east of the Prospect’s eastern boundary. Large diameter pipelines deliver oil and gas liquids from Moomba south to Port Bonython (Whyalla). Natural gas is also moved south to Adelaide or east to Sydney. A gas transmission pipeline also connects Moomba to Ballera, which is located northeastward in the State of Queensland. From Ballera gas can be moved to Brisbane and Gladstone, where a Liquefied Natural Gas (LNG) project is under development. The Moomba treating and transportation facilities and the southward pipelines where developed and are operated by a producer consortium led by Santos Ltd (no relation to Registrant).

Registrant cannot accurately predict the costs of transporting its production until it locates its first successful well. The cost of installing infrastructure to deliver Registrant's production to Moomba or elsewhere will vary depending upon distance traversed, negotiated handling/treating fees, and pipeline tariffs.

12

Capital Requirements

Registrant will need to obtain additional financing before Registrant can acquire the Prospect and implement the initial phase of its current plan of operation. To acquire the Prospect, Registrant must pay an additional US$450,000 in cash. In connection with this acquisition, Registrant will also incur a deferred payment in the form of two promissory notes in the aggregate amount of US$750,000 payable to Liberty, one becoming due six months after Registrant’s acquisition of the Prospect, and the other becoming due nine months after Registrant’s acquisition of the Prospect. Furthermore, the acquisition of the Prospect will obligate Registrant to pay US$100,000 in cash to Keith D. Spickelmier. Moreover, after the acquisition, Registrant will have a work commitment with respect to the Prospect requiring Registrant to expend AU$200,000 in the first year after the acquisition and AU$1.25 million in the second year. Some of these amounts will become due before Registrant is able to commence production on the Prospect. Accordingly, some of these amounts must be raised. Moreover, Registrant expects to need a substantial amount of funds to develop the Prospect. In addition to the preceding, Registrant will need working capital in amounts not now determinable.

Registrant’s plan is to try to satisfy a large portion of the post-acquisition amounts and develop the Prospect by selling a portion of its interest in the Prospect to a joint venture partner for a substantial cash payment or work commitment. Registrant will strive to procure in such a sale a combination of cash and work commitment sufficient for Registrant to meet its financial obligations for about three years after the Prospect is acquired. Registrant has had very preliminary discussions with several companies to become joint venture partners. To obtain the maximum combination of cash and work commitment in connection with the sale of an interest in the Prospect, Registrant may seek to add value by completing a 3D seismic survey over a portion of the property and/or re-processing existing seismic data related to the Prospect. Unless Registrant is able to sell such an interest for such a payment, Registrant will need to raise additional funds in an institutional financing to satisfy the deferred payments and to develop the Prospect. The amount sought would be $5.0 to $7.0 million.

Registrant believes at least $3.0 million would be required to satisfy its obligations in connection with the acquisition of the Prospect and for two years after the Prospect is acquired, but this amount would not allow Registrant to develop the Prospect in any meaningful way. Somewhat less than half of the preceding $3.0 million amount would need to be raised within about the next 18 months to satisfy amounts becoming due within such time period, while somewhat more than half of the preceding $3.0 million amount would need to be raised within about the next 30 months to satisfy amounts becoming due near the end of such time period.

If institutional financing were required, Registrant would need to identify various sources of such capital, including private sales of equity securities or the incurrence of indebtedness. However, Registrant currently does not have any binding commitments for, or readily available sources of, additional financing. Moreover, additional financing may not be available on favorable terms or at all.

13

If required financing is not available on acceptable terms, Registrant could be prevented from satisfying its debt obligations or developing the Prospect. In such event, Registrant would be forced to seek an extension of the due date of the amount owed to Liberty or Mr. Spickelmier, or else default on one or more of these amounts. If a default occurs, Liberty or Mr. Spickelmier could exercise the rights of an unsecured creditor and possibly levy encumbrances on all or a large part of Registrant’s assets. Moreover, Registrant’s failure to honor its work commitment could result in its loss of the Prospect. If any of the preceding events were to occur, Registrant could be forced to cease its new business plan altogether, which could result in a complete loss of stockholders’ equity.

If Registrant does not obtain additional financing through an equity or debt offering, Registrant may be constrained to attempt to sell some portion of the Prospect under unfavorable circumstances and at an undesirable price. However, Registrant cannot assure anyone that Registrant will be able to find interested buyers or that the funds received from any such sale would be adequate to fund its activities. Registrant’s future liquidity will depend upon numerous factors, including the success of its business efforts and its capital raising activities.

Registrant presently intends to begin the exploration in the second quarter after it acquires the Prospect by shooting of about 100 square kilometers of new 3D seismic at an estimated cost of AUS$1.25 million. Registrant also presently intends to continue the exploration of the Prospect by drilling two or three wells during the fourth quarter after the acquisition of the Prospect, at an estimated aggregate cost of between AUS$3.0 million and AUS$4.5 million.

If Registrant is successful with these wells, it will continue with a full development plan, the scope of which is now uncertain but will be based on technical analysis of acquired seismic data collected and/or reprocessed, field drilling reports and well log reports. However, all of the preceding plans are subject to the availability of sufficient funding and the procurement of all governmental approvals. Registrant does not now have sufficient available funds to undertake these tasks, and will need to procure a joint venture partner or raise additional funds as described above. The failure to procure a joint venture partner or raise additional funds will preclude Registrant from pursuing its business plan, as well as exposing it to the loss of the Prospect, as discussed immediately above. Moreover, if Registrant’s business plan proceeds as just described, but Registrant’s first wells do not prove to hold producible reserves, Registrant could be forced to cease its exploration efforts on the Prospect.

Production from Registrant’s exploration and drilling efforts would provide Registrant with cash flow. The proven reserves associated with production would increase the value of Registrant's rights in the Prospect. This, in turn, should enable Registrant to obtain bank financing (after the wells have produced for a period of time to satisfy the related lender). Both of these results would enable Registrant to continue with its initial drilling activities. In fact, cash flow and conventional bank financing are as critical to Registrant’s plan of operation in the long run as the procurement of a joint venture partner or completion of a significant institutional financing. Management believes that, if Registrant’s plan of operation progresses (and production is realized) as planned, sufficient cash flow and conventional bank financing will be available for purposes of properly pursuing Registrant’s plan of operation, although Registrant can make no assurances in this regard.

14

Registrant has already raised "seed" capital in the amount of approximately $375,000 in a private placement that is described in Item 3.02. Registrant is continuing efforts to raise funds in this private placement through the end of January 2012.

To conserve on Registrant's cash requirements, Registrant may try to satisfy its obligations by issuing shares of its common stock, which will result in dilution to Registrant’s existing stockholders.

Markets and Marketing

The petroleum industry has been characterized historically by crude oil and natural gas commodity prices that fluctuate (sometimes dramatically), and supplier costs can rise significantly during industry booms. For example, crude oil and natural gas prices increased to historical highs in 2008 and then declined significantly over the last two quarters of 2008. Since this period, prices have improved, but have not returned to historical highs. Crude oil and gas prices and markets are likely to be volatile again in the future. Crude oil and natural gas are commodities and their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand for oil and gas, market uncertainty, and a variety of additional factors beyond Registrant’s control. Those factors include:

|

*

|

international political conditions (including wars and civil unrest, such as the recent unrest in the Middle East);

|

|

*

|

the domestic and foreign supply of oil and gas;

|

|

*

|

the level of consumer demand;

|

|

*

|

weather conditions;

|

|

*

|

domestic and foreign governmental regulations and other actions;

|

|

*

|

actions taken by the Organization of Petroleum Exporting Countries (OPEC);

|

|

*

|

the price and availability of alternative fuels; and

|

|

*

|

overall economic conditions.

|

Lower oil and natural gas prices may not only decrease Registrant’s revenues on a per unit basis, but may also reduce the amount of oil and natural gas Registrant can produce economically, if any. A sustained decline in oil and natural gas prices may materially affect Registrant’s future business, financial condition, results of operations, liquidity and borrowing capacity, and may require a reduction in the carrying value of Registrant’s oil and gas properties. While Registrant’s revenues may increase if prevailing oil and gas prices increase significantly, exploration and production costs and acquisition costs for additional properties and reserves may also increase. Registrant may not enter into hedging arrangements or use derivative financial instruments such as crude oil forward and swap contracts to hedge Registrant’s risk associated with fluctuations in commodity prices.

15

Registrant does not expect to refine any of its production, although Registrant may have to treat or process some of its production to meet the quality standards of purchasing or transportation companies. Instead, Registrant expects that all or nearly all of its production will be sold to a relatively small number of customers. Production from Registrant's properties will be marketed consistent with industry practices. Registrant does not now have any long-term sales contracts for any crude oil and natural gas production that it realizes, but it expects that it will generally sell any production that it develops pursuant to these types of contracts. Registrant does not believe that it will have any difficulty in entering into long-term sales contracts for its production, although there can be no assurance in this regard.

The availability of a ready market for Registrant's production will depend upon a number of factors beyond Registrant's control, including the availability of other production in the Prospect’s region, the proximity and capacity of oil and gas pipelines, and fluctuations in supply and demand. Although the effect of these factors cannot be accurately predicted or anticipated, Registrant does not anticipate any unusual difficulty in contracting to sell its production of oil and gas to purchasers at prevailing market prices and under arrangements that are usual and customary in the industry. However, there can be no assurance that market, economic and regulatory factors will not in the future materially adversely affect Registrant's ability to sell its production.

Registrant expects that most of the natural gas that Registrant is able to find (if any) will be transported through gas gathering systems and gas pipelines that are not owned by Registrant. The Prospect is in fairly close proximity to gas pipelines suitable for carrying Registrant's production. Transportation capacity on gas gathering systems and pipelines is occasionally limited and at times unavailable due to repairs or improvements being made to the facilities or due to use by other gas shippers with priority transportation agreements or who own or control the relevant pipeline. If transportation space is restricted or is unavailable, Registrant's cash flow from the affected properties could be adversely affected.

Sales prices for oil and gas production are negotiated based on factors normally considered in the industry, such as the reported trading prices for oil and gas on local or international commodity exchanges, distance from the well to the pipeline, well pressure, estimated reserves, commodity quality and prevailing supply conditions. Historically, crude oil and natural gas market prices have experienced high volatility, which is a result of ever changing perceptions throughout the industry centered on supply and demand. Registrant cannot predict the occurrence of events that may affect oil and gas prices or the degree to which such prices will be affected. However, the oil or gas prices realized by the Registrant should be equivalent to current market prices in the geographic region of the Prospect. Typically, oil prices in Australia reflect or are “benchmarked” against European commodity market trading settlement prices. Recent price levels in this market have been at a premium to those settled in the United States. During certain periods, the differential has been substantial. The Registrant cannot predict the future level of this price differential or be assured that such differential will reflect a discount in the future.

The Registrant will strive to obtain the best price in the area of its production. Registrant's revenues, profitability and future growth will depend substantially on prevailing prices for crude oil and natural gas. Decreases in the prices of oil and gas would likely adversely affect the carrying value of any proved reserves Registrant is successful in establishing and Registrant's prospects, revenues, profitability and cash flow.

16

Competition

Registrant operates in the highly competitive areas of oil and gas exploration, development and production. Registrant believes that the level of competition in these areas will continue into the future and may even intensify. In the areas of oil and gas exploration, development and production, competitive advantage is gained through superior capital investment decisions, technological innovation and costs management. Registrant's competitors include major oil and gas firms and a large number of independent oil and gas companies. Because Registrant expects to have control over acreage sufficient for its exploration and production efforts for the foreseeable future, it does not expect to compete for the acquisitions of properties for the exploration for oil and gas. However, Registrant will compete for the equipment, services and labor required to operate and to develop its properties and to transport its production. Many of Registrant's competitors have substantially larger operating staffs and greater financial and other resources. In addition, larger competitors may be able to absorb the burden of any changes in laws and regulations more easily than Registrant can, which would adversely affect Registrant's competitive position. Moreover, most of Registrant's competitors have been operating for a much longer time than Registrant and have demonstrated the ability to operate through a number of industry cycles. The effect of the intense competition that Registrant will face cannot now be determined.

Regulation

Registrant expects to operate in a highly regulated environment. Registrant expects that the scope of regulation applicable to it will expand as it moves forward with its business plan. Registrant intends to be advised by legal counsel as to the laws and regulations becoming applicable to it, particularly with respect to the exploration, development and production of oil and gas in Australia. As Registrant is advised as to these laws and regulations, it intends to disclose the materials features and effects of these in future Annual Reports on Form 10-K and Registration Statements.

Legal Proceedings

Registrant is not now involved in any legal proceedings. There can be no assurance, however, that Registrant will not in the future be involved in litigation incidental to the conduct of its business.

Employees

As of the date of this filing, Registrant had no employees. Registrant expects that it will have no employee for the foreseeable future, although Registrant expects to enter into consulting agreements with members of its management at some time in the future. The market for qualified oil and gas professionals and craftsmen can be very competitive during periods of strong commodity prices. Such a period is currently being experienced. Registrant anticipates that it will be able to offer compensation and an interesting work environment that will enable it to attract employees to meet its labor needs.

17

Facilities

Registrant's maintains its principal executive offices at One Riverway Drive, Suite 1700, Houston, Texas 77056 through an office rental package on essentially a month-to-month basis. Management believes that any needed additional or alternative office space can be readily obtained.

ITEM 3.02 UNREGISTERED SALES OF EQUITY SECURITIES

The information included in Item 2.01 of this Report is also incorporated by reference into this Item 3.02 of this Report.

In addition to the issuances of the shares described in Item 2.01 of this Report, in a private placement commencing November 17, 2011 and continuing through the date of this Report, Registrant has sold an aggregate of 3.0 million shares of its common stock (“Shares”), $.001 par value, at a price of $0.125 per Share. The cash offering has thus far resulted in $375,000 in proceeds to Registrant. The Shares were issued to a total of six investors, all of whom are accredited. Registrant intends to continue the preceding private placement, possibly through the end of January 2012, with a view of selling an additional 6.6 million Shares for an additional $825,000 in proceeds to Registrant. This Report is neither an offer to sell nor the solicitation of an offer to buy the Shares or any other securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offering, solicitation or sale would be unlawful.

The issuances of the Shares described in Item 2.01 or this Item 3.02 of this Report are claimed to be exempt pursuant to Section 4(2) of the Securities Act and Rule 506 of Regulation D under the Securities Act. No advertising or general solicitation was employed in offering these securities. The offering and sale was made only to accredited investors, and subsequent transfers were restricted in accordance with the requirements of the Securities Act.

None of the securities the issuances of which are described in Item 2.01 or this Item 3.02 of this Report were registered under the Securities Act, and may not be offered or sold in the United States in the absence of an effective registration statement or exemption from registration requirements.

ITEM 5.01 CHANGES IN CONTROL OF REGISTRANT

A change in control of Registrant occurred effective on January 13, 2012 pursuant to the terms, provisions and conditions of a Common Stock Purchase Agreement dated as of such date (the "Stock Agreement") by and between (a) Shih-Yi Chuang, Richard Bruce Pierce, Andrew Lee Smith, David W. Smalley and Robert Birarda, as sellers (collectively “Sellers”), and (b) Keith J. McKenzie. In connection with the closing of the transactions provided for by the Stock Agreement, Mr. McKenzie, William E. Begley and Michael D. Dahlke (collectively “Purchasers”) acquired an aggregate of 25,310,000 shares of Registrant’s common stock (“Shares”), $.001 par value, theretofore owned separately by Sellers at a price of $0.0001 per Share. This number of Shares represents 78.9% of Registrant’s outstanding Shares, prior to taking into account the transactions described in Item 2.01 of this Report, and 19.7% of Registrant’s outstanding Shares, after taking into account the transactions described in Item 2.01 of this Report. As of the date of this Report, 18,240,000 Shares have been transferred to Purchasers, and Sellers have agreed to transfer an additional 7,070,000 Shares to Purchasers as soon as is possible after the date of this Report. Because Registrant has heretofore been a “shell” company, the Shares purchased by Purchasers may not be sold or transferred by Purchasers unless such shares are registered under the Securities Act or are sold or transferred pursuant to an exemption therefrom, such as Rule 144 promulgated under the Securities Act, which will not be available for at least one year. All descriptions of the sale and purchase of the Shares contained herein and all references to the terms, provisions and conditions of the Stock Agreement are qualified in their entirety by reference to the Stock Agreement, which is attached as Exhibit 10.3 hereto and is incorporated herein by reference for all purposes hereof.

18

Registrant believes that, prior to the sale and purchase of the Shares, control of Registrant was dispersed among Registrant's largest stockholders who (to the best of Registrant's knowledge) had not agreed to act collectively as a group. These stockholders included Shih-Yi Chuang, Richard Bruce Pierce, Andrew Lee Smith and David W. Smalley. Particularly prior to the time of the sale and purchase of the Shares, Mr. Pierce (who was Registrant’s sole director, as well as one of Registrant’s largest stockholders) probably held primary control of Registrant. At a time shortly prior to the time of the sale and purchase of the Shares, Mr. Pierce probably shared control of Registrant with Mr. Smith, who was also a director of Registrant until November 14, 2011, as well as one of Registrant's largest stockholders. After the sale and purchase of the Shares and the issuance of 20.0 million Shares to Keith D. Spickelmier in connection with Registrant’s acquisition of all of Mr. Spickelmier’s rights in the Liberty Agreement, Keith J. McKenzie and Mr. Spickelmier probably hold primary control of Registrant, although they have not agreed to act in concert. Mr. McKenzie is now a director of Registrant, and it is expected that Mr. Spickelmier will be elected as a director of Registrant in the fairly near future.

In connection with the sale and purchase of the Shares, the following events occurred:

|

|

1.

|

The number of directors constituting the Board of Directors of Registrant was expanded from one to two, and Keith J. McKenzie was elected to the Board of Directors of Registrant to fill the newly created vacancy.

|

|

|

2.

|

All Registrant’s officers resigned from their positions as such.

|

|

|

3.

|

The following persons were elected to the one or more offices of Registrant set forth opposite their respective names below as Registrant's new slate of officers:

|

19

|

Keith J. McKenzie

|

Chief Executive Officer

|

|

|

Michael D. Dahlke

|

President and Chief Operating Officer

|

|

|

William E. Begley

|

Chief Financial Officer,

|

|

|

Treasurer & Secretary

|

|

|

4.

|

Richard Bruce Pierce agreed to resign from his seat on the Board of Directors of Registrant promptly after Registrant has fully complied with Rule 14f-1 under the Exchange Act.

|

After Mr. Pierce resigns from his seat on the Board of Directors of Registrant, the Board of Directors of Registrant expects to increase the number of directors constituting the Board of Directors of Registrant from two to three and to elect Keith Spickelmier and William E. Begley to fill the vacancies created by such resignation and increase. Like all of Registrant directors, Messrs. Spickelmier and Begley will (if so elected) serve as such until the next annual meeting of the stockholders, and until their respective successors have been duly elected and qualified. Messrs. Spickelmier and Begley have consented to serve as directors of Registrant if so elected.

The following table sets forth as of the date of this Report information regarding the beneficial ownership of Common Stock (i) by each person who is known by Registrant to own beneficially more than 5% of the outstanding Common Stock; (ii) by each director and executive officer; and (iii) by all directors and executive officers as a group. Unless otherwise indicated in the table, each person named in the table has sole voting power and sole investment power over these shares held by him, and the address of each person named in the table is One Riverway Drive, Suite 1700, Houston, Texas 77056.

|

Name and Address of

Beneficial Owner

|

Beneficial Ownership (1)

|

||||

|

Number

|

Percent

|

||||

|

Keith D. Spickelmier

|

20,000,000 | (2) | 36.1 | % | |

|

Keith J. McKenzie

|

20,005,460 | (3) | 36.1 | % | |

|

William E. Begley

|

3,602,924 | 6.5 | % | ||

|

Michael D. Dahlke

|

2,501,616 | 4.5 | % | ||

|

Richard Bruce Pierce

11450 - 201A Street

Maple Ridge, British Columbia V2X 0Y4

|

73,000 | * | |||

|

All directors and executive officers as a group (five persons)

|

26,183,000 | (4) | 47.3 | % | |

|

*

|

Less than one percent

|

|

(1)

|

Includes shares beneficially owned pursuant to options, warrants and convertible securities exercisable or convertible within 60 days.

|

|

(2)

|

Does not includes 55.0 million shares that may be acquired pursuant to the conversion of a convertible promissory note that may be converted only after Registrant has increased its authorized common shares to at least 125.0 million or has undertaken a reverse stock split in which at least two or more shares are combined into one share.

|

|

(3)

|

Represents 12,935,460 shares owned outright, and 7,070,000 shares that may be acquired within 60 days.

|

|

(4)

|

Represents 19,123,000 shares owned outright, and 7,070,000 shares that may be acquired within 60 days.

|

The following Information is biographical information about the newly elected director and officers, and proposed new directors:

20

Keith J. McKenzie –Keith McKenzie has over 25 years of experience working with public companies in the Industrial and Resource sectors. Over the past 13 years in the Oil & Gas sector, Mr. McKenzie has been engaged in various executive, finance, start-up, and consulting capacities. He is currently the CEO of Star Oil Company a private start-up oil and gas exploration and production company he founded in September 2009 to acquire oil and gas resources in the United States. In 2004, he was a founding principal and later served as the Chief Operating Officer of Paxton Energy, Inc., with responsibility for the company’s development and operations at the Cooke Ranch project located in La Salle County, Texas. Mr. McKenzie has consulted to numerous public and private Oil & Gas, Mining and industrial companies with both domestic and international operations.

Michael D. Dahlke –At present, Mr. Dahlke is President of Star Oil Company and the principal of CSB Partners, LLC that he founded in 2008. CSB Partners provides strategic and business development consulting service to firms operating in the oil field services, upstream and mid-stream oil and gas industries. Prior to founding CSB Partners, Mr. Dahlke was a member of the Jefferies & Company oil and gas banking and consulting group. He joined Jefferies after a 30-year career with Enron Corp (and predecessors), where, at various times, he held the positions of President, Enron Americas, Managing Director, Corporate Development, and Vice President, Enron Gas Processing. Mr. Dahlke holds a B.S. and M.S. in Economics from Iowa State University.

William E. Begley –Mr. Begley has more than 25 years of energy industry and finance experience, and began his career with British Petroleum (BP). He has also held senior positions in energy banking including Solomon, Inc. and was recently President of Stone & Webster Management Consulting, specializing in the design and development of major energy projects. As a leading energy advisor in Australia, Mr. Begley was instrumental in the development of the liberalized natural gas markets in Australia and Victoria specifically, with Gas & Fuel Victoria, and in the development of VENCorp, the natural gas trading and scheduling exchange in Australia. Mr. Begley also has a strong background in leading major capital energy projects including LNG, Methanol, and related petro-chemical and gas monetization projects, which will complement ongoing Company initiatives. In addition, he has also been involved in over $100 billion in energy related mergers and acquisitions, initially with Solomon, Inc. and more recently on an independent basis through WEB Gruppe GmbH. Mr. Begley recently served as Chief Financial Officer and Treasurer for Magellan Petroleum Corporation. His graduate JD/MBA studies are in international business and energy law. Mr. Begley graduated in 1976 with a B.A. from St. Michaels’ College in Vermont.

Keith D. Spickelmier - Mr. Spickelmier is the Executive Chairman of Sintana Energy Inc. (SNN:TSX-V), a public company with oil and gas operations in South America, He was a founding partner of Northbrook Energy LLC, which subsequently completed a business combination with Sintana Energy (previously Drift Lake Resources). He was the founder and Chairman of Westside Energy a Company he grew from a start-up in May 2002 to US $200 million sale in 2008. Prior to joining Westside Energy, he was a partner with the law firm Verner, Liipfert, Bernhard, McPherson and Hand. From April 2001 through July 2003, Mr. Spickelmier was of counsel with the law firm Haynes and Boone, LLP. Mr. Spickelmier holds a B.A. from the University of Nebraska at Kearney and a J.D. from the University of Houston.

21

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

The information included in Item 5.01 of this Report is also incorporated by reference into this Item 5.02 of this Report. Information about the background of Registrant’s new directors and officers can be found in Item 5.01.

As of the date of this Report, Registrant had paid no compensation to any member of management during its past two fiscal years. In addition, Registrant has not adopted any retirement, pension, profit sharing, stock option or insurance programs or other similar programs for the benefit of its management or employees. Registrant expects to enter into consulting agreements with members of its management at some time in the future. The terms of these agreements are uncertain at this time. Although negotiations surrounding such agreements will not necessarily be at arms-length, the terms of these agreements (once they are completed) are expected to be fair to Registrant. Registrant expects that the remuneration provided for by these agreements will actually be below market levels until Registrant achieves a sufficient level of financial stability, after which time such remuneration may be increased to market levels. Registrant does not expect to pay cash remuneration until it achieves a sufficient level of financial stability, but the Registrant may issue shares of its common stock to satisfy contractual remuneration obligations. Registrant expects that all remuneration that it may pay to management will be subject to any and all restrictions on remuneration imposed by investors providing the funds to Registrant.

Registrant’s Board of Directors has not established any standing committees, including an Audit Committee, Compensation Committee or a Nominating Committee. The Board of Directors as a whole undertakes the functions of those committees. The Board of Directors may establish one or more of these committees whenever it believes that doing so would benefit Registrant.

ITEM 5.06 -CHANGE IN SHELL COMPANY STATUS.

The information included in Item 2.01 of this Report is also incorporated by reference into this Item 5.06 of this Report.

As a result of the acquisition of the rights in the Liberty Agreement, Registrant is no longer a shell corporation as that term is defined in Rule 405 of the Securities Act and Rule 12b-2 under the Exchange Act.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(a) Financial Statements of Business Acquired

|

|

Because the assets, which required the filing of this Report, were not being actively utilized in any business endeavor at the time of their acquisition and for the prior two years, Registrant believes it is not required to file financial statements regarding these assets as an exhibit to this filing.

|

22

(b) Pro Forma Financial Information

|

|

Because the assets, which required the filing of this Report, were not being actively utilized in any business endeavor at the time of their acquisition and for the prior two years, Registrant believes it is not required to file pro forma financial information reflecting Registrant’s acquisition as an exhibit to this filing.

|

(c) Exhibits

|

|

First Amended and Restated Document dated December 1, 2011 by and between Liberty Petroleum Corporation and Keith D. Spickelmier

|

|

|

Agreement dated December 29, 2011 between Liberty Petroleum Corporation and Registrant, as the designate of Keith D. Spickelmier

|

|

|

Assignment dated effective January 13, 2012 executed by Keith D. Spickelmier and Registrant

|

|

|

Common Stock Purchase Agreement dated effective January 13, 2012 by and between (a) Shih-Yi Chuang, Richard Bruce Pierce, Andrew Lee Smith, David W. Smalley and Robert Birarda as sellers, and (b) Keith J. McKenzie, as purchaser

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SANTOS RESOURCE CORP.

|

|

|

|

(Registrant)

|

|

|

Date: January _____, 2012

|

By: /s/ Keith J. McKenzie

|

|

|

Keith J. McKenzie,

|

||

|

Chief Executive Officer

|

23