Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CEDAR FAIR L P | d284326d8k.htm |

Investor Presentation

January 19, 2012

Exhibit 99.1 |

2

Forward Looking Statements

Some slides and comments included here, particularly related to estimates,

comments on expectations about future performance or business conditions,

may contain “forward looking statements”

within the meaning of the federal

securities laws which involve risks and uncertainties. You can identify

forward- looking statements because they contain words such as

“believes,” “project,”

“might,”

“expects,”

“may,”

“will,”

“should,”

“seeks,”

“approximately,”

“intends,”

“plans,”

“estimates”

or “anticipates”

or similar expressions that concern our

strategy, plans or intentions. These forward-looking statements are subject to

risks and uncertainties that may change at any time, and could cause actual

results to differ materially from those that we anticipate. While we believe

that the expectations reflected in such forward-looking statements are

reasonable, we caution that it is very difficult to predict the impact of

unknown factors, and it is impossible for us to anticipate all factors that

could affect our actual results. Important factors, including those listed

under Item 1A in the Partnership’s Form 10-K could adversely affect

our future financial performance and cause actual results to differ

materially from our expectations. |

Investor Presentation

January 19, 2012 |

4

*

*

*

*

*

*

*

*

*

*

*

*

* |

5

AGENDA

Company Overview &

Key Investment Considerations

Matt Ouimet

Park Review

Richard Zimmerman

Financial Review

Brian Witherow

Strategic Growth Opportunities

Matt Ouimet

Financial Goals

Matt Ouimet

Summary

Matt Ouimet

Q&A |

Net

Revenue 2011E: ~$1,028

2011E Adj. EBITDA

(a)

~$375

Market Capitalization

(b)

$1,283

($ in millions)

Headquartered in Sandusky, OH

Full-Time Employees

~1,700

Seasonal/Part-Time Employees

~35,000

Facilities:

11

Best-in-Class Amusement Parks

1 Amusement Park Under Contract

6 Separately Gated Water Parks

5 Hotels

(c)

-

~1,700 Rooms

5 Campgrounds, including deluxe RV sites and cabins

2

Marinas

850+ rides and attractions

120+ roller coasters

(a)

As defined on slide 39

(b)

Based on $23.18 unit price as of January 13, 2012 and 55.4 million units

outstanding (c)

One hotel with indoor water park

We entertain more than

23 million guests

annually, generating

more than

$1 billion in revenue

Company Overview

6 |

7

People Have Choices…

Entertainment of Choice

•

Deliver the “best-day-of-the-year”

experience for our guests

Employer of Choice

•

Respect, value and appreciate

our employees

Investment of Choice

•

Drive attractive total return

Our Approach |

8

•

Smooth leadership transition

•

Record year in 2011, on top of

record 2010

•

2010 refinancing created significant

financial flexibility

•

Restoration of meaningful unit

distributions

Building Positive Momentum |

9

Favorable Industry Dynamics

•

Significant barriers to entry

•

Compelling value compared with

other forms of entertainment

•

Recession resilient

•

Loyal, high-repeat customer base

(75%+ repeat visitation)

•

No comparable at-home digital

experience

•

North American focus

Key Investment Considerations |

10

Proven Ability to Deliver

Results

•

2010 and 2011 –

Record

attendance and Adjusted EBITDA

•

Decades-long, industry-leading

Adjusted EBITDA margins

•

Stable and diversified cash flows

•

Experienced management team

Key Investment Considerations |

11

Attractive Strategic Growth

Opportunities Exist

•

Enhanced guest experience

•

Improved consumer messaging

•

Dynamic pricing and advance

purchase commitments

•

Premium product offerings

•

Strategic alliance fees and

promotional leverage

•

Capital and expense productivity

Key Investment Considerations |

12

Total Return Investment

•

Anchored by attractive

distribution yield

•

Unit price appreciation driven by

earnings growth

•

Balanced approach to allocation

of excess cash

Key Investment Considerations |

Capital Costs

Estimated cost of approximately $500+ million to construct a quality

regional park

•

Limited visibility on return on capital at inception

Real Estate

Requirements

Minimum requirement of 100-150 acres for park

•

Additional

land

generally

required

for

construction

of

roads

and

local

businesses that are complementary to the park (i.e., lodging and

restaurants)

•

Transportation infrastructure in close proximity to the park

Zoning Restrictions

Local governments often believe the negative impact of increased

traffic and environmental effects outweigh promise of increased tax

revenue and job creation

Long Development

Times

Generally requires approximately three years

•

One year used for planning process—feasibility analysis, public approval

process, design development and financing

•

Two years used for construction—procuring and installing rides, show

facilities and other equipment

Few Viable Markets

First mover advantage already taken in key domestic markets

Favorable Industry Dynamics

Significant Barriers to Entry

13 |

Industry-Leading Adjusted EBITDA Margins

Adjusted

EBITDA

Margins

The Company has some of

the highest Adjusted EBITDA

margins in the industry

We maintain strict cost controls

•

Carefully manage seasonal

staffing levels

•

Minimal corporate overhead

Pricing integrity

•

Strategic use of marketable

discounts to create urgency

•

Value-enhancing special events

and offerings

14

(a)

Source: SEC filings for 2007 –

2010

(b)

Information not available for Six Flags

(a) |

15

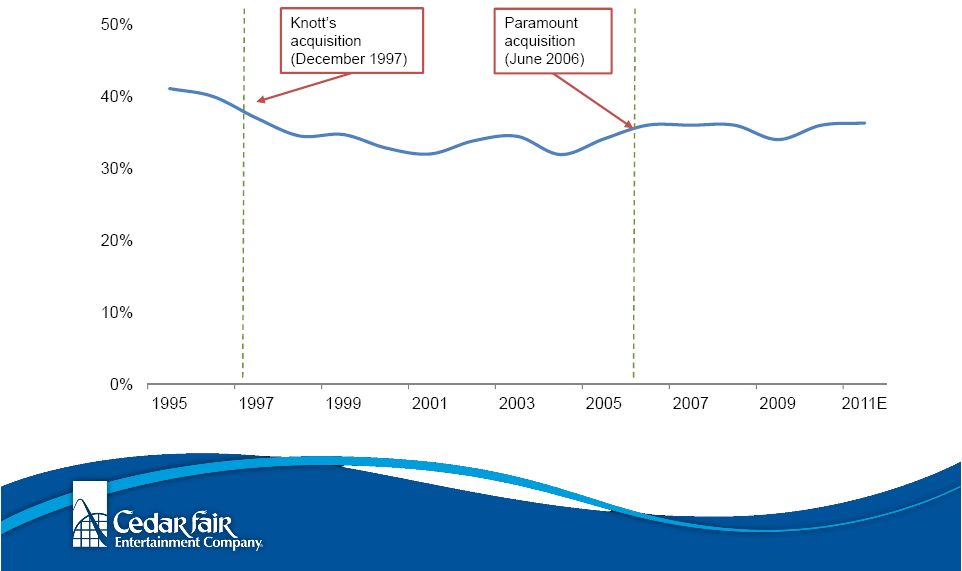

Historical Adjusted EBITDA Margin |

16

(d)

Acquisition of Geauga Lake in 2004

(e)

Acquisition of Kings Island, Canada’s Wonderland, Kings Dominion, Carowinds

and California’s Great America in 2006

(f)

As defined on slide 39

Note: 2007 to 2011E Adjusted EBITDA represents

Consolidated EBITDA as defined in the 2010 Credit *Agreement (a)

Includes attendance for amusement parks and separately-gated outdoor water

parks (b)

Acquisition of Knott’s Berry Farm in December 1997

(c)

Acquisition

of

Michigan’s

Adventure

and

Knott’s

Soak

City

–

Palm

Springs

in

2001

Stable and Diversified Cash Flows

We generate consistent revenue and cash flow |

Stable

and Diversified Cash Flows 17

Resilient performance during recessions

(a)

Acquisition of Knott’s Berry Farm in December 1997

(b)

Acquisition

of

Michigan’s

Adventure

and

Knott’s

Soak

City

–

Palm

Springs

in

2001

(c)

Acquisition of Geauga Lake in 2004

(d)

Acquisition of Kings Island, Canada’s Wonderland, Kings Dominion, Carowinds

and California’s Great America in 2006

(e)

As defined on slide 39 |

Stable

and Diversified Cash Flows The Company has a national footprint that mitigates

regional economic and weather risk

18 |

Stable

and Diversified Cash Flows We are not dependent on any one park or region

19 |

Experienced Management Team

Management team with proven experience both with

Cedar Fair and in the leisure and hospitality industry

Name

Position

Years with

Cedar Fair

Years In

Industry

Matt

A.

Ouimet

(53)

President and Chief Executive Officer

6 mos

22

Richard

A.

Zimmerman

(51)

Chief Operating Officer

21

25

Brian

C.

Witherow

(45)

Executive Vice President and Chief Financial Officer

17

17

H.

Philip

Bender

(56)

Executive Vice President

33

40

David

R.

Hoffman

(43)

Senior Vice President and Chief Accounting Officer

6

6

Craig

J.

Freeman

(58)

Corporate Vice President of Administration

32

32

Duffield

E.

Milkie

(46)

Corporate Vice President and General Counsel

4

4

Robert

A.

Decker

(51)

Corporate Vice President of Planning & Design

13

23

Lee

A.

Alexakos

(55)

Corporate Vice President of Marketing

33

33

20 |

21

AGENDA

Company Overview &

Key Investment Considerations

Matt Ouimet

Park Review

Richard Zimmerman

Financial Review

Brian Witherow

Strategic Growth Opportunities

Matt Ouimet

Financial Goals

Matt Ouimet

Summary

Matt Ouimet

Q&A |

Leading operator of high-quality,

well-maintained parks

Balanced mix of families and thrill

seekers

Innovation leader

Seasoned, dedicated management

22

Our Core Strengths |

23

Our Cornerstones |

Industry-leading attractions with

long useful lives

•

Thrill rides are unique content that

drive attendance

•

Family rides appeal to all generations

•

Minimal IP royalty payments

Capital investments average 9% of

net revenues

•

Excludes annual maintenance

expense (included in operating

expense on income statement)

•

Combined, capital expenditures and

maintenance represent approximately

18% of revenue spent annually to

maintain and improve asset base

High-Quality, Well-Maintained Parks

24 |

Innovation Leader

25+ years of record-breaking rides

•

Introduced the world’s first 200-foot,

300-foot and 400-foot-tall coasters

•

Introduced the world’s first corkscrew

element and magnetic launched

coasters

First Halloween Haunt event

•

Successfully rolled out to other parks

within our portfolio

Develop new attraction concepts

•

Low-cost laboratory

•

Dinosaurs Alive!

•

Wind Seeker –

300-foot-tall swing

ride

25

Create and dominate entire

categories of new rides and

attractions |

Provide the best and highest value

family entertainment in each market

•

Strong regional identity

•

Multi-generational appeal

•

Lifetime guests

•

Extensive presence of classic and

timeless PEANUTS characters

•

High guest satisfaction and repeat

visitation

Balanced Mix of Families and Thrill Seekers

26 |

Seasoned, Dedicated Management

Our park General Managers have an average of 25 years of

experience with Cedar Fair and 27 years within the industry

27

Name

Park

Years with

Cedar Fair

Years In

Industry

H.

John

Hildebrandt

(62)

Cedar Point

38

38

Raffi

Kaprelyan

(49)

Knott’s Berry Farm

33

33

Norm

Pirtovshek

(57)

Canada’s Wonderland

32

32

Greg

Scheid

(48)

Kings Island

23

24

Bart

Kinzel

(45)

Carowinds

21

21

Pat

Jones

(50)

Kings Dominion

32

32

Jason

McClure

(41)

Dorney Park

11

11

Raul

Rehnborg

(42)

California’s Great America

25

25

Larry

MacKenzie

(55)

Valleyfair

34

34

Frank

Wilburn

(46)

Worlds of Fun

17

21

Camille

Jourden-Mark

(45)

Michigan’s Adventure

11

24 |

Parks that entertain ~3.0+

million guests on an annual

basis include:

•

Cedar Point –

Sandusky, OH

•

Knott’s Berry Farm –

Buena Park, CA

•

Canada’s Wonderland –

Toronto, ON

•

Kings Island –

Cincinnati, OH

28

Our Parks |

Parks that entertain ~1.5+

million guests on an annual

basis include:

•

Carowinds –

Charlotte, NC

•

Kings Dominion –

Richmond, VA

•

Dorney Park –

Allentown, PA

•

California’s Great America –

Santa Clara, CA

29

Our Parks |

Parks that entertain ~1.0

million or fewer guests on an

annual basis include:

•

Valleyfair –

Shakopee, MN

•

Worlds of Fun –

Kansas City, MO

•

Michigan’s Adventure –

Muskegon, MI

30

Our Parks |

Cedar Point

31

Sandusky, Ohio

Super regional draw –

largest seasonal

amusement park in the U.S.

Named the “Best Amusement Park in

the World”

for 14 consecutive years

(a)

Features five of the top 25 steel roller

coasters in the world

(a)

, four hotels,

two marinas and an upscale campsite

Serves a six-state region in the

Midwest that is home to approximately

26 million people

(a)

Source: Amusement Today, September 2011 |

Orange County, California

32

Year-round park with renowned

seasonal events including one of the

top-rated Halloween events in the

country

(a)

Includes three separately gated water

parks in California and an adjacent

320-room, full-service hotel

Located in Southern California serving

a market of approximately 20 million

people with a large tourism industry

(a)

Source: Amusement Today, September 2011 |

33

One of the largest seasonal

amusement parks in the U.S.

Features a children’s area named

“Best

Kids’

Area

in

the

World”

for

eleven

consecutive

years

(a)

Local market includes approximately

15 million people

Cincinnati, Ohio

(a)

Source: Amusement Today, September 2011 |

34

Toronto, Canada

Largest amusement park in Canada

Hosts several cultural festivals per year

in the park

Serves diverse Toronto metropolitan

market of approximately nine million

people

One of the “Top Three”

destinations in

the world for coaster quantity |

Broad and compelling rides,

attractions and events

Investing ~$90 million across all of

our properties

Leviathan

–

306-foot-tall, 92-mph roller

coaster at Canada’s Wonderland

•

One of the tallest and fastest roller

coasters in the world

Stinger

–

138-foot-tall inverted shuttle

coaster at Dorney Park

WindSeeker

–

300-foot-tall thrill ride

providing guests with panoramic views at

Carowinds and Kings Dominion

New Fun For 2012

35 |

Focus on balancing family

attractions and thrill rides

Dinosaurs Alive! –

coming to Cedar Point,

Canada’s Wonderland, Dorney Park and

Kings Dominion

Soak City Water Park –

rebranding and

expansion of water park at Kings Island,

including the addition of a new wave pool

“Luminosity -

Ignite the Night!”

–

a new

night time celebration at Cedar Point

More than 25 new live entertainment shows

General infrastructure improvements and

upgrades include resort refreshment, new

point-of-sale system, and premium guest

experiences

36

New Fun For 2012 |

37

New Fun for 2012

Leviathan Video |

38

AGENDA

Company Overview &

Key Investment Considerations

Matt Ouimet

Park Review

Richard Zimmerman

Financial Review

Brian Witherow

Strategic Growth Opportunities

Matt Ouimet

Financial Goals

Matt Ouimet

Summary

Matt Ouimet

Q&A |

39

Updated Guidance

•

Preliminary results project Net Revenues of ~$1.028 billion

•

Preliminary

results

project

Adjusted

EBITDA(a)

of

~$375

million

•

Both net revenues and Adjusted EBITDA at the high end of previous

guidance

Highlights

•

Entertained

a

record

23.4

million

guests

–

up

3%

year-over-year

•

Average in-park guest per capita spending increased to

$40.03 –

up 2% year-over-year

•

Costs in line with our expectations

2011 Financial Highlights

(a) Adjusted

EBITDA

represents

earnings

before

interest,

taxes, depreciation,

amortization, other non-cash items, and adjustments as defined in the

Amended 2010 Credit Agreement. |

2011

Financial Highlights Year-over-year record attendance

trends

Season pass visits up significantly

•

High perceived value

•

Strong “influence factor”

Group business improving

Successfully converted some front

gate admissions into season

passes

40

Attendance Breakdown |

Cash Flow Outlook

41

Cash Flow Outlook

Capital Expenditures

•

~$75 million in 2011

•

~$90 million in 2012

•

~9% of net revenues going forward for organic growth

Cash Interest Costs

•

~$150 million in 2011

•

~$100 million in 2012 and beyond |

42

Cash Flow Outlook

Cash Taxes

•

~$10 million in 2011

•

Modest increases through 2014 as revenues and income increase

•

Approaching ~$35 million in 2015 as NOLs are exhausted

One-Time Items

•

~$50 million for the termination of a Canadian swap

(February 2012)

•

~$11 million in retirement costs (mid-year 2012)

|

43

(in millions)

12/31/2011

Revolving

Credit

Loans

(due

2015)

$

– Term Debt:

Term loan averaging 4.0%

(due 2017)

1,156

Notes:

9.125% senior unsecured notes

(due 2018)

400

Less Current Portion

–

Total Long-Term Debt

$ 1,556

Total Leverage Ratio

~4.2x

Senior Secured Leverage Ratio

~3.1x

Debt Profile |

Debt Profile

44

Debt Profile

•

~$800 million of outstanding term debt has been converted to a

fixed-rate through the use of several interest rate swap

agreements

•

No debt maturities until our revolving credit facility matures in

2015

Revolver capacity = $260 million

•

Cost of debt is expected to be ~6.3% in 2012 down from 9.5% in

2011 |

Key

Financial Considerations We generate a significant amount of free cash flow

(FCF) •

Record guest attendance and financial results in 2011

•

Additional revenue and FCF growth opportunities in 2012 and beyond

•

Additional FCF from ~$50 million reduction of debt service costs

beginning in 2013

Capital structure provides substantial operating flexibility

•

No longer constrained by credit agreements

•

Staggered debt maturities

•

Predictable financing costs

45

Year-end

earnings

conference

call

on

February

21,

2012

at

10:00

am

ET |

46

AGENDA

Company Overview &

Key Investment Considerations

Matt Ouimet

Park Review

Richard Zimmerman

Financial Review

Brian Witherow

Strategic Growth Opportunities

Matt Ouimet

Financial Goals

Matt Ouimet

Summary

Matt Ouimet

Q&A |

Strategic Growth Opportunities

47

There are six key growth

drivers in our business

1.

Enhanced guest experience

2.

Improved consumer messaging

3.

Dynamic pricing and advanced

4.

Premium product offerings

5.

Strategic alliance fees and

6. Capital and expense productivity

purchase commitments

promotional leverage |

Enhanced Guest

Experience

We deliver compelling value for

the price paid, at every park on

every day

48

“New Fun”

–

Compelling new rides,

shows and events at rational capital

levels

•

Balancing of thrill and family-friendly

offerings to sustain valuable

family

:

teen audience mix

Quality enhancements in food and

resorts to drive greater capture and

support pricing premiums

Extending length-of-stay through

evening events

•

“Luminosity –

Ignite the Night!”

at

Cedar Point in 2012

•

Highly marketable, reprogrammable

seasonally/annually

We deliver compelling

value for the price paid, at

every park, every day |

Improved Consumer Messaging and

Relationship Management

49

Added resources and capabilities to

modernize our marketing and sales

strategy and execution

•

New agency of record –

Cramer-Krasselt

•

Internal resources added selectively

to support best practice transfer and

enhanced consumer insights

•

Incentive compensation program

implemented for sales force

We speak to consumers

with messages that break

through the noise and

create action within our

operating season

(i.e., urgency) |

Improved Consumer Messaging and

Relationship Management

50

Improve messaging to drive greater

emotional response

•

Leverages off existing, strong

emotional attachment and multi-

generation memories

•

Supports pricing growth in difficult

economy and re-invigorates lapsed

users

•

“Thrills Connect”

underpinning

designed to encourage larger party

sizes

Adapt media mix to evolving

consumer channels

We speak to consumers

with messages that break

through the noise and

create action within our

operating season

(i.e., urgency) |

51 |

52 |

53 |

Dynamic Pricing and Advance Purchase

Commitments

54

We offer all consumers

the right price (and no

less), focused on true

incremental behavior

New “accesso”

e-commerce

platform installed

•

Common to other industry players

•

Provides real-time data and dynamic

pricing modification

•

Supports incremental programs

Season pass installment sales and

intelligent up-sell of benefits and

value

•

Reduces reliance on non-aligned

intermediaries

Multi-year migration to “Best Value

Guarantee”

on our site |

Dynamic Pricing and Advance Purchase

Commitments

55

New “accesso”

e-commerce

platform installed (cont.)

•

Data capture supports customer

relationship management

Advance purchase commitments

provide protection against visitation

disruption events and drives in-park

spending elasticity

We offer all consumers

the right price (and no

less), focused on true

incremental behavior |

56

Fast Lane to be launched in all

parks; Fright Lane at Halloween

Early entry for resort guests and

strategic partners

Premium parking and dining

experiences

Others under development

Premium Product Offerings

We will continue to

expand our premium

offerings to benefit-

oriented consumers |

57

•

Experienced business development executive added to drive

appropriate relationships

•

Develops over multiple years

Strategic Alliance Fees and Promotional

Leverage

Industry benchmarking indicates an opportunity to

expand our strategic alliances while still protecting

the integrity of the guest experience |

Capital and Expense Productivity

58

•

Multi-year strategic plan for capital that protects the base and

supports new reasons to visit

Encouraging manufacturers to innovate at lower costs

•

Avoiding creep in the fixed cost base through removal of inefficient

capacity

•

IT system investments to reduce costs and drive revenue

:

labor

management, POS, financial reporting

•

Undeveloped land reserved for activities and investments that

leverage the installed asset base

“Strategic Admission Drivers”

We apply disciplined metrics to the prioritization of

capital and management of expenses |

59

AGENDA

Company Overview &

Key Investment Considerations

Matt Ouimet

Park Review

Richard Zimmerman

Financial Review

Brian Witherow

Strategic Growth Opportunities

Matt Ouimet

Financial Goals

Matt Ouimet

Summary

Matt Ouimet

Q&A |

60

•

Disciplined execution of our business plan

•

Solid balance sheet

FUN is a Total Return Investment

Total Return

1. Quality Distribution

2. Unit Price Appreciation

Reliable and Growing

Sustainable Earnings Growth

Achieved

by

Driving

•

An attractive distribution yield in a low yield environment

•

Record distribution target for 2013 |

Financial Performance Objectives

•

Target $450+ million in Adjusted EBITDA by 2016

~4% CAGR

•

Sustain margin discipline

•

Target total leverage ratio of <4.0x

Repayment of $25 million term debt in 2012

Opportunistic prepayments beyond 2012

61 |

Financial Performance Objectives

62

Adjusted EBITDA

(a)

Growth

•

Enhanced guest experience

•

Improved consumer messaging

•

Dynamic pricing and advance

purchase commitments

•

Premium product offerings

•

Strategic alliance fees and

promotional leverage

•

Capital and expense productivity

($ in millions)

Strategic Growth Drivers

(a) As defined on slide 39 |

Distribution Outlook

•

Anticipate 2012 annual distribution of $1.60 per LP unit

Pay out in $0.40 quarterly cash installments

Implied yield of ~7% at $23 unit price

•

Target record

distribution in excess of $2.00 per LP unit in 2013

•

Considerations for future distribution growth

Growth of FCF

Investment opportunities

Capital structure opportunities

Distribution yield / unit price

63 |

Distribution Outlook

64

$1.29

$1.43

$1.53

$1.60

$1.66

$1.76

$1.80

$1.84

$1.87

$1.90

$1.92

$1.23

$0.25

$1.00

$1.60

More than

$2.00

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Restoring historical distribution commitment |

65

AGENDA

Company Overview &

Key Investment Considerations

Matt Ouimet

Park Review

Richard Zimmerman

Financial Review

Brian Witherow

Strategic Growth Opportunities

Matt Ouimet

Financial Goals

Matt Ouimet

Summary

Matt Ouimet

Q&A |

66

Favorable industry dynamics

Proven ability to deliver results

Attractive strategic growth

opportunities exist

Total Return Investment

•

Anchored by attractive

distribution yield

•

Unit price appreciation driven by

earnings growth

•

Balanced approach to allocation

of excess cash

Key Investment Considerations |

*

*

*

*

*

* |

APPENDIX |

EBITDA Adjustments

EBITDA Adjustments

($ in millions)

12/31/10

12/31/09

EBITDA

$247.6

$307.8

Plus: loss on early extinguishment of debt

35.3

--

Plus: net effect of swaps

18.2

9.2

Plus: unrealized foreign exchange (gain) on Note

(17.5)

--

Plus: equity-based compensation

(0.1)

(0.0)

Plus: loss on impairment of goodwill and other intangibles

2.3

4.5

Plus: loss on impairment / retirement of fixed assets, net

62.8

0.2

Plus: (gain) on sale of other assets

--

(23.1)

Plus: terminated merger costs

10.4

5.6

Plus: refinancing costs

--

0.8

Plus: licensing dispute settlement costs

--

2.0

Plus: class action settlement costs

0.3

9.5

Adjusted EBITDA

$359.2

$316.5

For years prior to 2009, a reconciliation of Adjusted EBITDA to net income (loss)

can be found in our Annual Report on Form 10-K for that year.

|