Attached files

| file | filename |

|---|---|

| 8-K - U. S. Premium Beef, LLC | esuspb8k1-12.htm |

|

We look forward to building on our past successes By Steven D. Hunt, CEO The last few years for USPB have been extraordinary. Members are managing their cattle to a record quality level garnering record grid premiums. The company just completed record earnings for the fourth straight year. And, we just closed the Leucadia National Corporation (LUK) transaction that recognizes over 15 years of tremendous strategic positioning, effort and tenacity on the part of the members, board and management that resulted in financial rewards unimaginable by most. So what should you expect of USPB now? I have noticed that there are many who are not quite sure how to look at USPB since we made the decision to sell a material stake in our processing company. It is not unexpected for those on the outside to wonder what we did, why we did it, and if our commitment to our company and the industry has changed. As you interact with industry participants and the recent transaction becomes a topic of discussion, here are some thoughts to consider. Let’s begin with why. For most successful closely held family businesses, natural financial exits are facilitated by owners and their heirs with one principal interest and goal in mind. For successful widely held public companies owned by individuals with unlimited interests and goals, financial exits are available every day through a public stock exchange at efficient prices. For large companies owned by a wide diverse group of partners with varying interests, such as USPB, achieving timely financial exits for individual minority partners is difficult and often inefficient. “While we have

set the bar pretty high, with to ongoing successes in the next fifteen years and beyond.” Over the years, our success has created a good problem. How do we address the natural liquidity needs of our unitholders at a fair price? We have strategically pursued solutions to this challenge such as de-linking Class A and B units and initiating an online trading service. And, we realized some success as evidenced in the recent unit price increases. However, we have not experienced the volume of trades necessary to fully assess the success of these initiatives. Now, here’s what we did. The concept of USPB creating liquidity through a divestiture of part of its ownership interest in National Beef is not a new one. We publicly considered it in 2008 with the JBS transaction where we would sell a substantial interest, maintain our cattle delivery system and grow our program into a number of new plant locations. ...continued on page 2 Did You Know... üAs a reminder, Age and Source Verified (ASV) cattle projections are required from feedyards who want to receive USPB’s ASV premiums. ASV premiums are based on market conditions and will be adjusted accordingly as conditions warrant. Please call our office at 866-877-2525 when you place ASV cattle on feed to ensure that your cattle have a reservation in our program. USPB’s ASV premium is $35 through March 2012. It will be adjusted to a $25 per head floor for April 2012 and a $20 per head floor for May and June. |

||

|

Net income was $8.9 million Company Reports First Quarter Results U.S. Premium Beef realized a net income of $8.9 million in the first quarter of fiscal year 2012, which ended November 26, 2011. This compared to a net income of $35.4 million in the same period of the prior fiscal year, a decrease of approximately $26.5 million. The decrease in net income was primarily a result of decreased gross processing margins attributable to an increase in average cattle prices during the first quarter compared to the same period a year ago. “Regarding the first quarter fiscal year of 2012 results, our sales were higher primarily from an increase in the net sales per head compared to the same period in the prior year, as the demand for beef products remained strong, and the price of beef products increased during the period,” CEO Steve Hunt said.

As has always been the case, USPB’s unique advantage continues to be the superior quality cattle

delivered by our producers, which

enables National Beef to generate more value

from the cattle it harvests and provides more opportunities in the consumer

marketplace. Please call our office if you have questions about USPB’s

financial results.w |

||

|

Benchmark Performance Data Table |

||

|

Base Grid Cattle Harvested in KS Plants 12/11/11 to 01/08/12 |

||

|

(Numbers Percent) |

Base Grid |

|

|

All |

Top 25% |

|

|

Yield |

63.87 |

64.30 |

|

Prime |

2.38 |

5.14 |

|

CH & PR |

73.06 |

87.09 |

|

CAB |

20.55 |

33.10 |

|

BCP |

16.54 |

20.71 |

|

Ungraded |

1.05 |

0.49 |

|

Hard Bone |

0.85 |

0.39 |

|

YG1 |

10.97 |

5.98 |

|

YG2 |

40.47 |

34.52 |

|

YG3 |

39.64 |

46.47 |

|

YG4 |

8.39 |

12.17 |

|

YG5 |

0.53 |

0.86 |

|

Light Weight |

0.40 |

0.13 |

|

Heavy Weight |

2.09 |

2.99 |

|

Average Grid Premiums/Discounts ($/Head) |

||

|

Quality Grade |

$46.25 |

$83.19 |

|

Yield Benefit |

$8.36 |

$20.81 |

|

Yield Grade |

-$4.61 |

-$8.49 |

|

Out Weight |

-$3.20 |

-$4.18 |

|

ASV |

$3.89 |

$9.36 |

|

Natural |

$1.74 |

$5.15 |

|

Total Premium |

$52.43 |

$105.84 |

|

üIf you have delivery rights you do not plan on using in delivery year 2012 and would like USPB to help you get them leased to other producers, please call our office at 866-877-2525.w |

||

Reproduction of any part of this newsletter is expressly forbidden without written permission of U.S. Premium Beef.

| USPB—The Next 15 Years and Beyond... |

continued from page 1 |

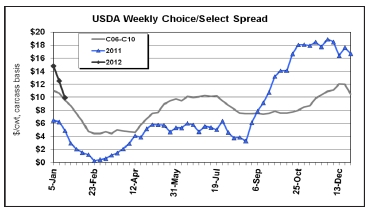

We have covered a lot of ground over the last 30 days and I hope this review has been helpful. While we have set the bar pretty high, with your continued commitment, we look forward to ongoing successes over the next 15 years and beyond.w Non Breed Specific NatureSource® Introduced National Beef has introduced a NatureSource® Natural Beef product line that is a non-breed specific program. The requirements for producing this NatureSource product are similar for NatureSource® Natural Angus Beef with the following exceptions: Cattle can be any hide color. Brahman influence is allowed. Cattle cannot have horns past the ears and cannot exhibit any dairy characteristics. As with NatureSource Natural Angus Beef, cattle must be enrolled in the program well in advance of delivery and fed at a feedyard approved by National Beef or IMI Global for natural beef production. Currently, there are three members of USPB’s Qualified Custom Feedyard list approved to finish natural cattle: Fairleigh Feedyard and High Choice Feeders, LLC II, both at Scott City, KS, and Tiffany Cattle Co. at Herington, KS. For more information on the natural beef product lines, please select the “USPB Natural Beef Programs” link at www.uspremiumbeef.com. There is also a NatureSource grid example on USPB’s home page under the “USPB Grids” link.w USDA’s C/S Spread Narrows After running substantially higher than previous years during the end of calendar 2011, the Choice/Select spread appears to have started its usual seasonal decrease during recent weeks.w

|

|

|

We attempted it again in 2009 when we pursued an initial public offering. As any good business with our level of success would expect, from time to time we are also approached by parties who have an interest in purchasing or investing in our company. In March, one such company, LUK, approached us. As a non-strategic passive investor, LUK offered a unique partnership consideration. Their interest in investing in our company, National Beef, wasn’t to change it or to create merge synergies, but in what we are. Their interest was based on our successful unique partnership between producers and processors, our management, our modern facilities and sound business strategies. This passive interest was different, but enticing. After a long eight months of exploring interests and negotiating, we agreed to terms that would best ensure a continued successful partnership by entering into a deal to sell a material stake in National Beef, while retaining our cattle delivery system and continuing to have a sizable investment in National Beef. The deal addressed the upcoming liquidity desires of our unitholders while sustaining the original components of our success: Assurance of market access, value-based pricing and ownership in processing. As to the final question, how does this change USPB’s commitment to the business and the industry? Unitholders who attended our field meetings likely know the answer. But, for those who could not attend and for other stakeholders in the industry, this is a very appropriate question. For members, you agreed to a 79% divestiture of our ownership interest in National Beef at a fair price, addressing future liquidity challenges of the unitholders and the company, and retaining what is most important to you in our successful unique cattle delivery system. For industry stakeholders with whom we work shoulder-to-shoulder in pursuit of common interests, whether they are customers, suppliers, trade associations or legislators: USPB’s interests and commitment to the success and fulfillment of our industry goals are as strong as ever. Our cattle delivery system remains unchanged and we will retain a material investment of over $160 million (based on transaction price) in processing. We have a lot at stake. I have found that being able to confidently respond to questions by our industry friends and neighbors without hesitation increases the likelihood of successfully communicating our objectives.

|

|||