Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[ x ] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2011

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number 000-52940

American Nano Silicon Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

California

|

33-0726410

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Nanchong Shili Industrial Street, Economic and Technology Development Zone, Xiaolong Chunfei Industrial Park

|

||

|

Sichuan, China

|

637005

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

86-817-3634888

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act: Common Stock, $.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act. Yes __ No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes __ No X

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (ss.229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X No __

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer ___ Accelerated filer ___ Non-accelerated filer ___ Smaller reporting company X

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No X

As of December 29, 2011, 36,210,558 shares of common stock, par value $.0001 per share, were outstanding.

The aggregate market value of Common Stock held by non-affiliates of the Registrant on March 31, 2011, the last business day of the Company's second fiscal quarter, was $24,106,832 (19,285,466 shares of common stock held by non-affiliates) based upon the closing price of $1.25 as quoted by OTC Bulletin Board on such date. Shares of common stock held by each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily conclusive.

Documents incorporated by reference: NONE

TABLE OF CONTENTS

|

Page

|

||

|

Part I

|

||

|

ITEM 1

|

DESCRIPTION OF BUSINESS

|

1 |

|

ITEM 1A.

|

RISK FACTORS

|

7 |

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

19 |

|

ITEM 2.

|

DESCRIPTION OF PROPERTY

|

20 |

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

20 |

|

ITEM 4.

|

REMOVED AND RESERVED

|

20 |

|

Part II

|

||

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS

|

20 |

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

21 |

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS

|

21 |

|

ITEM 7A

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

26 |

|

ITEM 8

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

26 |

|

ITEM 9

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

47 |

|

ITEM 9A

|

CONTROLS AND PROCEDURES

|

47 |

|

ITEM 9B

|

OTHER INFORMATION

|

48 |

|

Part III

|

||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERANCE

|

48 |

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

50 |

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

52 |

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

52 |

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

53 |

|

Part IV

|

||

|

ITEM 15.

|

EXHIBITS

|

54 |

|

SIGNATURES

|

55 | |

PART I

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including "anticipates", "believes", "expects", "can", "continue", "could", "estimates", "expects", "intends", "may", "plans", "potential", "predict", "should" or "will" or the negative of these terms or other comparable terminology. These statements are only predictions. Uncertainties and other factors may

cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements after the filing date to conform these statements to actual results, unless required by law.

ITEM 1. DESCRIPTION OF BUSINESS

We are a nano-technology chemical manufacturer. We manufacture and market “Micro Nano Silicon™” our own proprietary product in China. Micro Nano Silicon is an ultra fine crystal that can be utilized as a non-phosphorous additive in detergents, as an accelerant additive in cement, as a flame retardant additive in rubber and plastics and as a pigment for paint. Micro Nano Silicon can replicate the chemical additives that are utilized in these products, but is less expensive and more environmentally friendly than competitive products. We are in the process of developing additional uses for Micro Nano Silicon for the petrochemical, plastic, rubber, paint and

ceramic industries. We have entered into a long-term joint research and development agreement with the China Academy of Science, a technology research institution, and Southwest University of Science and Technology’s Department of Material Science and Engineering to assist us in our research and development activities.

The primary use for Micro Nano Silicon to date has been as a synthetic additive in non-phosphorous detergent products. Micro Nano Silicon has significant competitive advantages over its primary competition in the non-phosphate detergent market. Micro Nano Silicon is less expensive and has greater stain removal capability than competitive products. In addition, Micro Nano Silicon is less damaging to the environment than its primary industry competitors.

Our Industry

Non-phosphate detergent additive

According to "China Industry Detergent Product" 2010 volume number 2, the worldwide annual demand for non-phosphorous additives for detergents and washing products is in excess of one million tons and in excess of 300,000 tons in China. In 2009 worldwide revenue from sales of household detergents was in excess of $64 billion, of which $3.6 billion was attributable to China. In China the revenue generated from the sale of non-phosphorous detergents has grown at a compounded annual growth rate of 22% for the period from 2005 to 2010 to $2.4 billion and in excess of 26 billion tons.

Commencing in the 1970s the United States, Japan and other developed countries began banning the use of phosphates in detergent products. In the United States nonphosphate detergents account for approximately 56% of the market and in Japan close to 100% of the market. Management believes that the market for non-phosphorous detergent additives in China will continue to grow as wider areas of China adopt the common international practice of banning the use of phosphates in household detergents.

1

The primary ultra fine crystal nonphosphate auxiliary agent in the detergent industry is 4A- zeolite. Auxilliary agents in detergents are builders that enhance detergency and are essential to creating a cost effective detergent product for consumer use. It is estimated that the annual demand for 4A-zeolite is in excess of 300,000 tons. Based on our own research, we believe that Micro Nano Silicon is a more effective auxiliary agent than 4A-zeolite. 4A zeolite is less effective than Micro-Nano Silicon™ at ion-exchange and is slow-acting at energy-saving lower wash temperatures. In addition, 4A Zeolite is insoluble in water, has the

potential to re-deposit dirt, and tends to dull the color of clothes after washing. Micro-Nano Silicon™ has a higher level of performance in each of these aspects.

Accelerator additive for cement

Currently, in China the increasing number of infrastructure projects drives the demand for cement and other construction materials. In 2009 approximately two billion square meters of cement were produced in China, approximately half of worldwide production. In addition, the number of cement production plants and concrete production facilities has continued to increase. It is estimated that the production of concrete will increase by 10% over the next 10 years. However, energy consumption in China’s cement production industry is approximately 15% higher than the average level of energy utilized in the cement production industry in the United States and other western

countries. Cement accelerators speed the cure time of cement and enables concrete to be placed in the winter without the concern for frost damage. As an accelerator agent Micro Nano Silicon can be utilized in a chemical rotary kiln to lower production costs as compared to more expensive lime rotary kilns. The Chinese government has announced a goal to reduce energy consumption by 20%. Management believes that we will be able to market Micro Nano Silicon to the cement industry to lower production costs and assist cement manufacturers’ compliance with energy saving regulations.

Flame retardant additive for rubber and plastic

Micro-Nano Silicon can be utilized as a flame retardant additive for rubber and plastic materials. Materials using Micro Nano Silicon additives have passed our own stringent flame retardancy tests.

Currently, halogenated products have a 90% share of the flame retardant additive market. In early 2000, the Chinese government banned the use of halogenated additives in certain rubber and plastic products. Accordingly, management believes that environmental concerns will cause a market shift to non-halogenated flame retardant additives, such as Micro Nano Silicon. According to baike.baidu.com, in 2009, the annual global production of plastic material was over 300 million tons with an annual demand for flame retardant additives in excess of 24 million tons. We commenced limited production of Micro Nano Silicon as a flame retardant additive on January 2, 2012.

Our Competitive Strengths

We believe the following strengths contribute to our competitive advantages and differentiate us from our competitors:

|

-

|

Proprietary Product: Micro Nano Silicon™ is a proprietary product with uses as a non-phosphorous additive in detergent, as an accelerant additive in cement, as a flame retardant additive in rubber and plastics and as a pigment for paint. In addition, we believe that we will be able to develop additional uses for Micro Nano Silicon in the petrochemical, plastic, rubber, paint and ceramic industries.

|

|

-

|

Cost Effectiveness. Micro Nano Silicon is significantly less expensive and is more effective as a non-phosporous additive in the detergent market than its primary competition. Micro Nano Silicon provides cost savings as an accelerant in the cement market and can be sold at a fraction of the cost of its primary competition in the paint pigment market. In addition, as a result of its flame retardant capabilities, we believe that Micro Nano Silicon will be less expensive as a flame retardant product in the

plastic and rubber industries than comparable products.

|

2

|

-

|

Environmentally-friendly: Micro Nano Silicon™ is a non-halogenated and non-phosphorous additive. We believe that we will be able to capitalize on the Chinese government’s desire to promote products which are less harmful to the environment than those that are currently being utilized.

|

|

-

|

Large Distribution Network: Our largest distribution partner is Chongqing Trading Company, a state owned enterprise, with a sales network throughout China. The sales network encompasses seven districts and eight major cities.

|

|

-

|

Proximity to local customers and low transportation cost: We are the only supplier of nonphosphate additives in southwestern China. Accordingly, we can ship our products to customers in local areas at considerably lower transportation costs than our competitors.

|

Our Strategy

Our goal is to establish Micro Nano Silicon as a chemical additive in a wide range of products and industries. We intend to achieve this goal by implementing the following strategies:

|

●

|

Expand the uses for Micro Nano Silicon™ : We have recently entered into an agreement to produce Micro Nano Silicon as an accelerator agent for use in the cement industry. We intend to increase our efforts to market Micro Nano Silicon for use in the cement industry. In addition, we intend to commence marketing Micro Nano Silicon as a flame retardant additive for rubber and plastics and as a pigment for paints.

|

|

●

|

Research and development effort: We are in the process of developing additional uses for Micro Nano Silicon for the petrochemical, plastic, rubber, paint and ceramic industries. We have entered into a long-term joint research and development agreement with the China Academy of Science, a technology research institution, and Southwest University of Science and Technology’s Department of Material Science and Engineering to assist us in our research and development activities.

|

|

●

|

Expand our production capacity: We intend to further increase production capacity to the extent that Micro Nano Silicon becomes more widely accepted in the market place.

|

|

●

|

Increase sales force and distribution channels: We distribute Micro Nano Silicon primarily through distributors. We intend to increase our sales force in order to establish additional distribution relationships to increase our distribution network and the availability of our products throughout China.

|

History of the Company

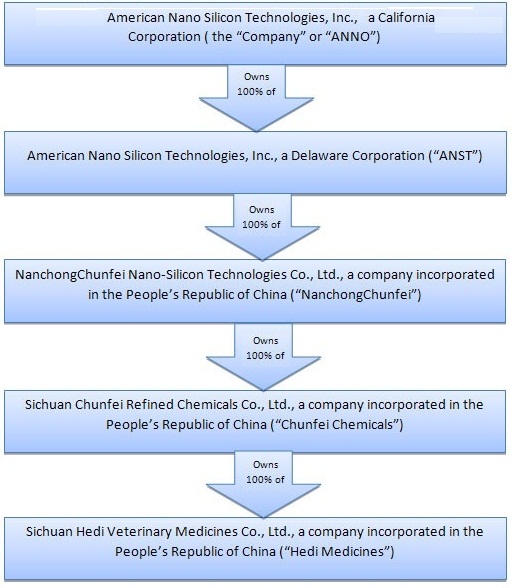

Nanchong Chunfei Nano-Silicon Technologies Co., Ltd. (“Nanchong Chunfei”) was incorporated in the People’s Republic of China (the “PRC” or “China”) in August 2006. Nanchong Chunfei directly owned 90% of Sichuan Chunfei Refined Chemicals Co., Ltd. (“Chunfei Chemicals”), a Chinese corporation established under the laws of PRC on January 6, 2006. Chunfei Chemicals itself owned 92% of Sichuan Hedi Veterinary Medicines Co., Ltd. (“Hedi Medicines”), also a Chinese company incorporated under the law of PRC on June 27, 2002.

3

On August 26, 2006, American Nano-Silicon Technologies, Inc., a Delaware corporation (“ANST”), acquired a 95% interest in Nanchong Chunfei. On May 24, 2007, American Nano Silicon Technologies, Inc., a California corporation (“we” or the “Company”), acquired ANST in exchange for 25,181,450 shares of our common stock. On September 6, 2011, the Company acquired all of the minority interests in its subsidiaries by issuing 1,650,636 shares of common stock to Pu Fachun, who was the holder of the minority interests.

The issued shares represented five percent of the outstanding shares after the issuance. Thereafter, Nanchong Chunfei, Chunfei Chemicals, and Hedi Medicines became wholly owned subsidiaries of ANST. The Company’s current corporate structure is below.

4

Our Core Product

Our core product, Micro-Nano Silicon™, is an ultra-fine crystal structure consisting of silicon dioxide and quartz. Under the effect of a special catalyst, those materials polymerize and crystallize. The crystal is three-dimensional with a tetravalent and electrically neutral silicon atom. The aluminum atom is a trivalent atom sharing four oxygen atoms with one negative charge combined. The hole in the middle of the crystal can capture a positive ion. The compound can have a complex reaction with ions of calcium, magnesium, iron, copper, and manganese. Since it is ultra-white, ultra-fine, phosphorus-free, with a special crystalline structure, chelating and filtering

performance lends itself to a use in washing products cosmetics and other products.

Micro-Nano Silicon™ can effectively chelate calcium and magnesium ions in water, softening it in order to improve the washing effect and to prevent damage to clothes. In this way the product actually reduces the amount of detergent required for washing a load of laundry, and accordingly is a more cost efficient to use.

Research and Development

Our business model is based upon developing additional uses for Micro Nano Silicon. Our research and development activities are focuses on developing such uses as well developing nano filitering technology and the production processes for our product.

We have entered into cooperative research and development agreements with the China Academy of Science, a technology research institution, and Southwest University of Science and Technology’s Department of Material Science and Engineering to assist us in our research and development activities.

These cooperative agreements allow us to tap into the innovative process without having to expend up front capital toward the development.

During the year ended September 30, 2011, our staff was primarily focused on the relocation of our manufacturing operations to a new facility. As a result, we conducted no new research. For the years ended September 30, 2011, and 2010, we expended approximately $296 and $82,934 respectively, on research and development.

We believe that the future success of our business depends upon our ability to improve our production processes and develop additional uses for Micro Nano Silicon. To avoid product obsolescence, we will continue to monitor technological changes in our industry as well as users' demands for new products. Failure to keep pace with future technological changes could adversely affect our revenues and operating results in the future. Although we believe that Micro Nano Silicon can be utilized in a number of industries, there can be no assurance that we will gain market acceptance of our products in such industries.

Raw Materials and Production

Our facilities are located in close proximity to our suppliers. Quartz and bauxite are the primary raw materials used in the production of Micro-Nano Silicon™ There are abundant quartz mineral resources in nearby Chinese districts such as Hechuan and Qingchuan and abundant supplies of bauxite in Hechuan and nearby Chongqing and Guizhou. Similarly other raw materials such as caustic soda, calcined soda, sodium sulphate anhydrous and calcium carbonate powder are also available in sufficient quantities, good quality and competitive cost in Sichuan province. One major vendor, Chongqing Trading Company, also one of our major customers, provided

approximately 99% and 98% of the Company’s purchases of raw materials for the years ended September 30, 2011 and 2010, respectively. We recognize this concentration risk and will actively seek to reduce this risk in fiscal year 2012.

5

Employees

As of September 30, 2011 we had approximately 120 full-time employees. The breakdown of our employees is as follows:

|

Production Line

|

36 | |||

|

Quality Control and Workshop

|

11 | |||

|

Foreman/Production Line managers

|

8 | |||

|

Engineers

|

10 | |||

|

Warehouse

|

4 | |||

|

Cooks/Cleaners/Guards

|

8 | |||

|

Senior Management

|

7 | |||

|

Office Administrators

|

15 | |||

|

Accounting

|

9 | |||

|

Sales and Marketing

|

12 | |||

|

Total

|

120 |

All of our full-time employees are based inside China. Our employees are not represented by any labor union and are not organized under a collective bargaining agreement, and we have never experienced a work stoppage. We believe that our relationships with our employees are generally good.

We do not have any payment obligations for any retirees and we do not currently retain any independent contractors. We purchase pension insurance, medical insurance and unemployment insurance for all full time employees in accordance with China's Labor Law. We believe that should we require additional employees at any of our facilities that we will be able to meet our needs from the locally available labor pool.

Intellectual Property

We rely on a combination of patent, trademark and trade secret protection and other unpatented proprietary information to protect our intellectual property rights in Micro Nano Silicon. Our success will depend in part on our ability to obtain patents and preserve other intellectual property rights covering our products. We intend to continue to seek patents on our inventions when we deem it commercially appropriate. The process of seeking patent protection can be lengthy and expensive, and there can be no assurance that patents will be issued for currently pending or future applications or that our existing patents or any new patents issued will be of sufficient scope or strength or

provide meaningful protection or any commercial advantage to us. We may be subject to, or may initiate, litigation or patent office interference proceedings, which may require significant financial and management resources. The failure to obtain necessary licenses or other rights or the advent of litigation arising out of any such intellectual property claims could have a material adverse effect on our operations.

Distribution and Customers

We are currently selling Micro Nano Silicon through distributors and our own sales staff. During the fiscal year ended September 30, 2011, two distributors, Chongqing Trading Company, Ltd., and Chengdu Blue Wind Company accounted for approximately 44% and 32% of our revenue, respectively. Chongqing Trading Company is a state owned enterprise, and distributes our product in seven districts and eight major cities. Our in-house sales staff of 12 employees seeks to establish relationships with additional distributors of our products. We intend to increase the size of our sales force as we increase our production capacity. In order to create awareness and

acceptance of our products we occasionally sponsor charitable events.

6

Competition

We face competition from many other chemical suppliers and manufacturers, many of which have significantly greater name recognition and financial, technical, manufacturing, personnel, marketing, and other resources than we have. The geographic market in which we compete is in China. Our competitors may be able to devote greater resources to the development, promotion and sale of their products than we do.

We compete primarily on the effectiveness and the price of our products. The detergent additive market is a highly fragmented market with approximately 300 detergent additive manufactures throughout the country. Although we believe that Micro Nano Silicon is more cost effective and provides better performance than 4A-Zeolite, the primary non-phosphate additive in the detergent industry, we cannot assure you that we will be able to obtain wide spread market acceptance of Micro Nano Silicon as a non-phosphate detergent additive. With respect to Micro Nano Silicon, as an accelerator additive in cement, as a flame retardant additive in rubber and plastics and as a pigment in paints, we

believe that we will be able to gain market acceptance of our product as a result of the potential cost savings from the use of our product. However, we cannot assure you that this will be the case.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR OPERATIONS

If one of our principal suppliers ceased to provide raw materials to us, it could disrupt our production activities, reduce our sales, and result in a loss of customers.

We depend on a limited number of suppliers. We do not have long-term contracts with our suppliers. Because we do not have long-term contracts, our suppliers generally are not required to provide us with any guaranteed minimum production levels. As a result, we may not be able to obtain sufficient quantities of critical raw materials in the future. Although we have access to other available sources for the supply of raw materials, a delay or interruption by our suppliers may harm our business. In addition, the lead time needed to establish a relationship with a new supplier can be lengthy, and we may experience delays in meeting demand in the event we must switch to a new supplier. The time and

effort to obtain a new supplier could result in additional costs, diversion of resources or reduced manufacturing yields, any of which would negatively impact our operating results. Our dependence on a limited number of suppliers exposes us to numerous risks, including the following:

|

§

|

our suppliers may cease or reduce production or deliveries, raise prices or renegotiate terms;

|

|

§

|

delays by our suppliers could significantly limit our ability to meet customer demand;

|

|

§

|

we may be unable to locate a suitable replacement on acceptable terms or on a timely basis, if at all; and

|

|

§

|

delays caused by supply issues may harm our reputation, frustrate our customers and cause them to turn to our competitors for future projects.

|

Our lack of long-term purchase orders and commitments could lead to a rapid decline in our sales and profitability.

All of our significant customers issue purchase orders solely in their own discretion, often only 4 or 5 weeks before the requested date of shipment. Our customers are generally able to cancel orders or delay the delivery of products on relatively short notice. In addition, our customers may decide not to purchase products from us for any reason. Accordingly, we cannot assure you that any of our current customers will continue to purchase our products in the future. As a result, our sales volume and profitability could decline rapidly with little or no warning whatsoever.

7

We cannot rely on long-term purchase orders or commitments to protect us from the negative financial effects of a decline in demand for our products. The limited certainty of product orders can make it difficult for us to forecast our sales and allocate our resources in a manner consistent with our actual sales. Moreover, our expense levels are based in part on our expectations of future sales and, if our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls. Furthermore, because we depend on a small number of customers for the vast majority of our sales, the magnitude of the ramifications of these risks is

greater than if our sales were less concentrated with a small number of customers. As a result of our lack of long-term purchase orders and purchase commitments we may experience a rapid decline in our sales and profitability.

Historically, a substantial portion of our assets has been comprised of accounts receivable representing amounts owed by a small number of customers. If any of these customers fails to timely pay us amounts owed, we could suffer a significant decline in cash flow and liquidity which, in turn, could cause us to be unable pay our liabilities and purchase an adequate amount of inventory to sustain or expand our sales volume.

Our business is characterized by long periods for collection from our customers and short periods for payment to our suppliers, the combination of which may cause us to have liquidity problems. We experience an average accounts settlement period ranging from one month to as high as three months from the time we sell our products to the time we receive payment from our customers. In contrast, we typically need to place certain deposits and advances with our suppliers on a portion of the purchase price in advance and for some suppliers we must maintain a deposit for future orders. Because our payment cycle is considerably shorter than our receivable cycle, we may experience working

capital shortages. Working capital management, including prompt and diligent billing and collection, is an important factor in our results of operations and liquidity. We cannot assure you that system problems, industry trends or other issues will not extend our collection period, adversely impact our working capital.

Adverse capital and credit market conditions may significantly affect our ability to meet liquidity needs, access to capital and cost of capital.

The capital and credit markets have been experiencing extreme volatility and disruption for more than twelve months. In recent months, the volatility and disruption have reached unprecedented levels. In some cases, the markets have exerted downward pressure on availability of liquidity and credit capacity for certain issuers. We have historically relied on credit to fund our business and we need liquidity to pay our operating expenses. Without sufficient liquidity, we will be forced to curtail our operations, and our business will suffer. Disruptions, uncertainty or volatility in the capital and credit markets may also limit our access to capital required to operate our

business. Such market conditions may limit our ability to replace, in a timely manner, maturing liabilities and access the capital necessary to operate and grow our business. As such, we may be forced to delay raising capital or bear an unattractive cost of capital which could decrease our profitability and significantly reduce our financial flexibility. Our results of operations, financial condition, cash flows and capital position could be materially adversely affected by disruptions in the financial markets.

We may need additional capital to implement our current business strategy, which may not be available to us, and if we raise additional capital, it may dilute your ownership in us.

We may require additional financing to implement our business plan and to cover anticipated expenses. Obtaining additional financing will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. These factors may make the timing, amount, terms and conditions of additional financing unattractive to us. We cannot assure you that we will be able to obtain any additional financing.

8

If we are unable to obtain the financing needed to implement our business strategy, our ability to increase revenues will be impaired and we may not be able to sustain profitability.

We do not carry any business interruption insurance, products liability insurance or any other insurance policy. As a result, we may incur uninsured losses, increasing the possibility that you would lose your entire investment in our company.

We could be exposed to liabilities or other claims for which we would have no insurance protection. We do not currently maintain any business interruption insurance, products liability insurance, or any other comprehensive insurance policy. As a result, we may incur uninsured liabilities and losses as a result of the conduct of our business. There can be no guarantee that we will be able to obtain additional insurance coverage in the future, and even if we are able to obtain additional coverage, we may not carry sufficient insurance coverage to satisfy potential claims. Should uninsured losses occur, any purchasers of our common stock could lose their entire

investment.

Because we do not carry products liability insurance, a failure of any of the products marketed by us may subject us to the risk of product liability claims and litigation arising from injuries allegedly caused by our products. We cannot assure that we will have enough funds to defend or pay for liabilities arising out of a products liability claim. To the extent we incur any product liability or other litigation losses, our expenses could materially increase substantially. There can be no assurance that we will have sufficient funds to pay for such expenses, which could end our operations and you would lose your entire investment.

We could be liable for damages for defects in our products pursuant to the Tort Liability Law and Product Liability Law of the PRC.

The Tort Liability Law of the People’s Republic of China, which was passed during the 12th Session of the Standing Committee of the 11th National People’s Congress on December 26, 2009, states that manufacturers are liable for damages caused by defects in their products and sellers are liable for damages attributable to their fault. If the defects are caused by the fault of third parties such as the transporter or storekeeper, manufacturers and sellers are entitled to claim for compensation from these third parties after paying the compensation amount.

We rely heavily on our founder, Chairman, Chief Executive Officer, Chief Financial Officer and President, Mr. Pu Fachun. The loss of his services could adversely affect our ability to source products from our key suppliers and our ability to sell our products to our customers.

Our success depends, to a significant extent, upon the continued services of Mr. Pu who is our founder, Chairman of the Board, Chief Executive Officer, Chief Financial Officer and President. Mr. Pu has, among other things, developed key personal relationships with our suppliers and customers. We greatly rely on these relationships in the conduct of our operations and the execution of our business strategies. The loss of Mr. Pu could, therefore, result in the loss of favorable relationships with one or more of our suppliers and/or customers. We do not maintain "key person" life insurance covering Mr. Pu or any other executive officer. The loss of Mr. Pu could significantly

delay or prevent the achievement of our business objectives and adversely affect our business, financial condition and results of operations.

We may not be able to effectively recruit and retain skilled employees, particularly scientific, technical and management professionals.

Our ability to compete effectively depends largely on our ability to attract and retain certain key personnel, including scientific, technical and management professionals. We anticipate that we will need to hire additional skilled personnel in all areas of our business. Industry demand for such employees, however, exceeds the number of personnel available, and the competition for attracting and retaining these employees is intense. Because of this intense competition for skilled employees, we may be unable to retain our existing personnel or attract additional qualified employees to keep up with future business

needs. If this should happen, our business, operating results and financial condition could be adversely affected.

9

Our labor costs are likely to increase as a result of changes in Chinese labor laws.

We expect to experience an increase in our cost of labor due to recent changes in Chinese labor laws which are likely to increase costs further and impose restrictions on our relationship with our employees. In June 2007, the National People’s Congress of the PRC enacted new labor law legislation called the Labor Contract Law and more strictly enforced existing labor laws. The new law, which became effective on January 1, 2008, amended and formalized workers’ rights concerning overtime hours, pensions, layoffs, employment contracts and the role of trade unions. As a result of the new law, we have had to increase the salaries of our employees, provide additional benefits to our

employees, and revise certain other of our labor practices. The increase in labor costs has increased our operating costs, which increase we have not always been able to pass through to our customers. In addition, under the new law, employees who either have worked for us for 10 years or more or who have had two consecutive fixed-term contracts must be given an “open-ended employment contract” that, in effect, constitutes a lifetime, permanent contract, which is terminable only in the event the employee materially breaches our rules and regulations or is in serious dereliction of his or her duties. Such non-cancelable employment contracts will substantially increase our employment related risks and limit our ability to downsize our workforce in the event of an economic downturn. No assurance can be given that we will not in the future be subject to labor strikes or that we

will not have to make other payments to resolve future labor issues caused by the new laws. Furthermore, there can be no assurance that the labor laws will not change further or that their interpretation and implementation will vary, which may have a negative effect upon our business and results of operations.

Our business could be materially adversely affected if we cannot protect our patents and intellectual property rights or if we infringe on the intellectual property rights of others.

Our intellectual property rights are important to our business. Currently, there are limited safeguards in place to protect our intellectual property rights, and the protective steps we intend to take may be inadequate to deter misappropriation of those rights. We have filed and intend to continue to file patent applications. If a particular patent is not granted, the value of the invention described in the patent would be diminished. Further, even if these patents are granted, they may be difficult to enforce. Efforts to enforce our patent rights could be expensive, distracting for management, unsuccessful, cause our patents to be invalidated, and frustrate commercialization

of products. Additionally, even if patents are issued, and are enforceable, others may independently develop similar, superior, or parallel technologies to any technology developed by us, or our technology may prove to infringe upon patents or rights owned by others. Thus, the patents held by us may not afford us any meaningful competitive advantage. Our inability to maintain our intellectual property rights could have a material adverse effect on our business, financial condition and ability to implement our business plan. If we are unable to derive value from our intellectual property, the value of your investment in us will decline.

Our failure to effectively manage growth could harm our business.

We have rapidly and significantly expanded our business and we will endeavor to further expand our business. Our recent and anticipated growth is expected to place, a significant strain on our managerial, operational, and financial resources. To manage our potential growth, we must implement and improve our operational and financial systems and to expand, train, and manage our employee base. We can not assure you that our systems, procedures, or controls will be adequate to support our operations. Our inability to effectively manage growth, if any, could harm our business.

Our facilities and information systems could be damaged as a result of disasters or unpredictable events, which could have an adverse effect on our business operations.

Our headquarters and major facilities including manufacturing plants and research and development centers are located in China. If major disasters such as earthquakes, fires, floods, wars, terrorist attacks, computer viruses, transportation disasters or other events occur, or our information system or communications network breaks down or operates improperly as a result of such events, our facilities may be seriously damaged, and we may have to stop or delay production and shipment. We may incur expenses relating to such damages.

We currently have a negative cash flow, negative working capital, and may not be able to fully resume operations without additional injections of capital.

As shown in the accompanying financial statements, the Company has negative cash flow for the year ended September 30, 2011 and at September 30, 2011 the Company’s current liabilities exceeded its current assets by $5.1 million. In addition, approximately $3.2 million of the Company’s loans will be due in fiscal year 2012. The Company suspended manufacturing operations in May 2011 as part of an effort to relocate the production facilities. The Company resumed limited production on January 2, 2012 in its new facilities. However, the current cash and inventory level will not be sufficient to support the Company’s

resumption of its normal operations and repayments of the loans. As a result of these factors, our independent registered public accountant has, in the audit opinion included in this Report, expressed substantial doubt about the Company’s ability to continue as a going concern. The Company will need additional funds to meet its operating and financing obligations until sufficient cash flows are generated from production to sustain operations and to fund future development and financing obligations. The Company’s largest shareholder and President, Mr. Pu Fachun has the intention to continue providing necessary funding for the Company’s normal operations. It is not certain, however, that he will be able to provide sufficient funds. The financial statements do not include any adjustments that might be necessary if the Company is

unable to continue as a going concern.

10

Our quarterly results may fluctuate because of many factors and, as a result, investors should not rely on quarterly operating results as indicative of future results.

Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the value of our securities. Quarterly operating results may fluctuate in the future due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in quarterly operating results could cause the value of our securities to decline. Investors should not rely on quarter-to-quarter comparisons of results of operations as an indication of future performance. As a result of the factors listed below, it is possible that in future periods results of operations may be below the expectations of public

market analysts and investors. This could cause the market price of our securities to decline.

Factors that may affect our quarterly results include:

|

·

|

vulnerability of our business to a general economic downturn in China and globally;

|

|

·

|

fluctuation and unpredictability of costs related to raw materials used to manufacture our products;

|

|

·

|

changes in the laws of the PRC that affect our operations;

|

|

·

|

competition;

|

|

·

|

compensation related expenses;

|

|

·

|

application of accounting standards;

|

|

·

|

our ability to obtain and maintain all necessary government certifications and/or licenses to conduct our business; and

|

We face significant competition and may not be able to successfully compete.

Our current and future competitors are likely to have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, more developed infrastructures, greater brand recognition, and more established relationships in the industry than we have, each of which may allow them to gain greater market share. As a result, our competitors may be able to develop and expand their offerings more rapidly, adapt to new or emerging technologies and changes more quickly, take advantage of acquisitions and other opportunities more readily, achieve greater economies of scale and devote greater resources to the marketing and sale of their technology and

products than we can. We can not assure you that we will successfully differentiate our current and proposed technology and products from the technologies and products of our competitors, that the marketplace will consider our technology and products to be superior to competing technologies and products, or that we will be able to compete successfully with our competitors.

RISKS RELATED TO DOING BUSINESS IN CHINA

Substantially all of our assets are located in the PRC and substantially all of our revenues are derived from our operations in China, and changes in the political and economic policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition.

11

Our business operations may be adversely affected by the current and future political environment in the PRC. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. Our ability to operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under the current government leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no

assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

Our operations are subject to PRC laws and regulations that are sometimes vague and uncertain. Any changes in such PRC laws and regulations, or the interpretations thereof, may have a material and adverse effect on our business.

The PRC’s legal system is a civil law system based on written statutes. Unlike the common law system prevalent in the United States, decided legal cases have little value as precedent in China. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to, governmental approvals required for conducting business and investments, laws and regulations governing the chemical business and product safety, national security-related laws and regulations and export/import laws and regulations, as well as commercial, antitrust, patent, product liability, environmental laws and regulations, consumer

protection, labor, and financial and business taxation laws and regulations.

The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

Our principal operating subsidiary, Nanchong Chunfei, is considered a foreign invested enterprise under PRC laws, and as a result is required to comply with PRC laws and regulations, including laws and regulations specifically governing the activities and conduct of foreign invested enterprises. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation

|

—

|

levying fines;

|

|

—

|

revoking our business license, other licenses or authorities;

|

|

—

|

requiring that we restructure our ownership or operations.

|

Investors may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based upon U.S. laws, including the federal securities laws or other foreign laws against us or our management.

All of our current operations, including the manufacturing and distribution of our products, are conducted in China. Moreover, most of our directors and officers are nationals and residents of China. All or substantially all of the assets of these persons are located outside the United States and in the PRC. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon these persons. In addition, uncertainty exists as to whether the courts of China would recognize or enforce judgments of U.S. courts obtained against us or such officers and/or directors predicated upon the civil liability provisions of the securities laws of

the

United States or any state thereof, or be competent to hear original actions brought in China against us or such persons predicated upon the securities laws of the United States or any state thereof.

12

We are subject to a variety of environmental laws and regulations related to our manufacturing operations, and we may become subject to forthcoming environmental regulations enacted in response to climate change. Our failure to comply with environmental laws and regulations may have a material adverse effect on our business and results of operations.

Our management believes that our factory standards meet the requirements of the China Government and local environmental laws and other related regulations, workers security regulations, Air Protection Law, Water Resources Protection Act, Resource Conservation Recovery Act, and so on. We have all licenses required for our production, and we have been in compliance with all applicable governmental laws and regulations.

Management believes that our products are environmentally-friendly green products, producing no pollution to the environment. So the cost of environmental protection will not cause any significant impact on our operations, production costs, and our profitability and competitiveness. However, management can give no assurance that new or additional laws or regulations relating to the environment will not result in material costs in the future.

In addition, future environmental regulations that are enacted in response to global and regional climate change could place additional burdens on our manufacturing operations. Public attention has focused on the environmental impact of chemical manufacturing and the risk to neighbors of chemical releases from such operations. Complying with existing and possible future environmental laws and regulations, including laws and regulations relating to climate change, may impose upon us the need for additional capital equipment or other process requirements, restrict our ability to expand our operations, disrupt our operations, increase costs, subject us to liability or cause us to

curtail our operations.

Recent PRC regulations relating to acquisitions of PRC companies by foreign entities may create regulatory uncertainties that could restrict or limit our ability to operate. Our failure to obtain the prior approval of the China Securities Regulatory Commission, or the CSRC, for the listing and trading of our common stock could have a material adverse effect on our business, operating results, reputation and trading price of our common stock, and may also create uncertainties in the future.

The PRC State Administration of Foreign Exchange, or “SAFE,” issued a public notice in November 2005, known as Circular 75, concerning the use of offshore holding companies in mergers and acquisitions in China. The public notice provides that if an offshore company controlled by PRC residents intends to acquire a PRC company, such acquisition will be subject to registration with the relevant foreign exchange authorities. The public notice also suggests that registration with the relevant foreign exchange authorities is required for any sale or transfer by the PRC residents of shares in an offshore holding company that owns an onshore company. The PRC residents must each submit a

registration form to the local SAFE branch with respect to their ownership interests in the offshore company, and must also file an amendment to such registration if the offshore company experiences material events, such as changes in the share capital, share transfer, mergers and acquisitions, spin-off transactions or use of assets in China to guarantee offshore obligations. On May 29, 2007, SAFE released implementation rules for Circular 75, known as Circular 106. Under Circular 106, the acquired PRC company may be prohibited from distributing dividends to its offshore acquirer if the PRC residents fail to register with SAFE in accordance with the requirement under Circular 75.

On August 8, 2006, the PRC Ministry of Commerce (“MOFCOM”), joined by the State-owned Assets Supervision and Administration Commission of the State Council, the State Administration of Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission and SAFE, released a substantially amended version of the Provisions for Foreign Investors to Merge with or Acquire Domestic Enterprises (the “Revised M&A Regulations”), which took effect on September 8, 2006 and was further amended on June 22, 2009. These new rules significantly revised China’s regulatory framework governing onshore-to-offshore

restructurings and foreign acquisitions of domestic enterprises. These new rules signify greater PRC government attention to cross-border merger, acquisition and other investment activities, by confirming MOFCOM as a key regulator for issues related to mergers and acquisitions in China and requiring MOFCOM approval of a broad range of merger, acquisition and investment transactions. Further, the new rules establish reporting requirements for acquisition of control by foreigners of companies in key industries, and reinforce the ability of the Chinese government to monitor and prohibit foreign control transactions in key industries.

13

Among other things, the revised M&A Regulations include new provisions that purport to require that an offshore special purpose vehicle, or SPV, formed for listing purposes and controlled directly or indirectly by PRC companies or individuals must obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website procedures specifying documents and materials required to be submitted to it by SPVs seeking CSRC approval of their overseas listings. However, the application of this PRC regulation remains unclear with no consensus currently existing among the leading PRC

law firms regarding the scope and applicability of the CSRC approval requirement. We have been advised that because we completed our onshore-to-offshore restructuring before September 8, 2006, the effective date of the Revised M&A Regulations, it is not necessary for us to submit the application to the CSRC for its approval, and the listing and trading of our common stock does not require CSRC approval.

If the CSRC or another PRC regulatory agency subsequently determines that CSRC approval was required for our restructuring, we may face regulatory actions or other sanctions from the CSRC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our common stock.

Also, if later the CSRC requires that we obtain its approval, we may be unable to obtain a waiver of the CSRC approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties and/or negative publicity regarding this CSRC approval requirement could have a material adverse effect on the trading price of our common stock. Furthermore, published news reports in China recently indicated that the CSRC may have curtailed or suspended overseas listings for Chinese private companies.

It is uncertain how our business operations or future strategy will be affected by the interpretations and implementation of Circular 75 and the Revised M&A Regulations. It is anticipated that application of the new rules will be subject to significant administrative interpretation, and we will need to closely monitor how MOFCOM, SAFE, CSRC and other ministries apply the rules to ensure that our domestic and offshore activities continue to comply with PRC law. Given the uncertainties regarding interpretation and application of the new rules, we may need to expend significant time and resources to maintain compliance.

If our land use rights are revoked, we would have no operational capabilities.

Under Chinese law land is owned by the state or rural collective economic organizations. The state issues to the land users the land use right certificate. Land use rights can be revoked and the land users forced to vacate at any time when redevelopment of the land is in the public interest. The public interest rationale is interpreted quite broadly and the process of land appropriation may be less than transparent. We rely on these land use rights and the loss of such rights would have a material adverse effect on our company.

The ability of our Chinese operating subsidiaries to pay dividends may be restricted due to foreign exchange control regulations of China.

The ability of our Chinese operating subsidiaries to pay dividends may be restricted due to the foreign exchange control policies and availability of cash balance of the Chinese operating subsidiaries. Because substantially all of our operations are conducted in China and substantially all of our revenues is generated in China, substantially all of our revenue being earned and currency received are denominated in Renminbi (RMB).

14

RMB is subject to the exchange control regulation in China, and, as a result, we may be unable to distribute any dividends outside of China due to PRC exchange control regulations that restrict our ability to convert RMB into US Dollars. Accordingly, we may not be able to access Nanchong Chunfei’s funds which may not be readily available to us to satisfy obligations which have been incurred outside the PRC, which could adversely affect our business and prospects or our ability to meet our cash obligations.

We will not be able to complete an acquisition of prospective acquisition targets in the PRC unless their financial statements can be reconciled to U.S. generally accepted accounting principles in a timely manner.

Companies based in the PRC may not have properly kept financial books and records that may be reconciled with U.S. generally accepted accounting principles. If we attempt to acquire a significant PRC target company and/or its assets, we would be required to obtain or prepare financial statements of the target that are prepared in accordance with and reconciled to U.S. generally accepted accounting principles. Federal securities laws require that a business combination meeting certain financial significance tests require the public acquirer to prepare and file historical and/or pro forma financial statement disclosure with the SEC. These financial statements must be prepared in accordance with,

or be reconciled to U.S. generally accepted accounting principles and the historical financial statements must be audited in accordance with the standards of the Public Company Accounting Oversight Board (United States), or PCAOB. If a proposed acquisition target does not have financial statements that have been prepared in accordance with, or that can be reconciled to, U.S. generally accepted accounting principles and audited in accordance with the standards of the PCAOB, we will not be able to acquire that proposed acquisition target. These financial statement requirements may limit the pool of potential acquisition targets with which we may acquire and hinder our ability to expand our operations.

We face risks related to natural disasters, terrorist attacks or other events in China that may affect usage of public transportation, which could have a material adverse effect on our business and results of operations.

Our business could be materially and adversely affected by natural disasters, terrorist attacks or other events in China. For example, in early 2008, parts of China suffered a wave of strong snow storms that severely impacted public transportation systems. In May 2008, Sichuan Province in China suffered a strong earthquake measuring approximately 8.0 on the Richter scale that caused widespread damage and casualties. The May 2008 Sichuan earthquake has had a material adverse effect on the general economic conditions in the areas affected by the earthquake. Any future natural disasters, terrorist attacks or other events in China could cause a reduction in usage

of or other severe disruptions to, public transportation systems and could have a material adverse effect on our business and results of operations.

We face uncertainty from China’s Circular on Strengthening the Administration of Enterprise Income Tax on Non-Resident Enterprises' Share Transfer (“Circular 698”) that was released in December 2009 with retroactive effect from January 1, 2008.

The Chinese State Administration of Taxation (SAT) released a circular (Guoshuihan No. 698 – Circular 698) on December 15, 2009 that addresses the transfer of shares by nonresident companies. Circular 698, which is effective retroactively to January 1, 2008, may have a significant impact on many companies that use offshore holding companies to invest in China. Circular 698, which provides parties with a short period of time to comply with its requirements, indirectly taxes foreign companies on gains derived from the indirect sale of a Chinese company. Where a foreign investor indirectly transfers equity interests in a Chinese resident enterprise by

selling the shares in an offshore holding company, and the latter is located in a country or jurisdiction where the effective tax burden is less than 12.5% or where the offshore income of his, her, or its residents is not taxable, the foreign investor is required to provide the tax authority in charge of that Chinese resident enterprise with the relevant information within 30 days of the transfers. Moreover, where a foreign investor indirectly transfers equity interests in a Chinese resident enterprise through an abuse of form of organization and there are no reasonable commercial purposes such that the corporate income tax liability is avoided, the PRC tax authority will have the power to re-assess the nature of the equity transfer in accordance with PRC’s “substance-over-form” principle and deny the existence of the offshore holding company that is used for tax

planning purposes.

15

There is uncertainty as to the application of Circular 698. For example, while the term "indirectly transfer" is not defined, it is understood that the relevant PRC tax authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with China. Moreover, the relevant authority has not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax in the country or jurisdiction and to what extent and the process of the disclosure to the tax authority in charge of that Chinese resident enterprise. In addition, there are not any formal declarations with regard to how to

decide “abuse of form of organization” and “reasonable commercial purpose,” which can be utilized by us to balance if our company complies with the Circular 698. As a result, we may become at risk of being taxed under Circular 698 and we may be required to expend valuable resources to comply with Circular 698 or to establish that we should not be taxed under Circular 698, which could have a material adverse effect on our financial condition and results of operations.

The foreign currency exchange rate between U.S. Dollars and Renminbi could adversely affect our financial condition.

To the extent that we need to convert U.S. Dollars into Renminbi for our operational needs, our financial position and the price of our common stock may be adversely affected should the Renminbi appreciate against the U.S. Dollar at that time. Conversely, if we decide to convert our Renminbi into U.S. Dollars for the operational needs or paying dividends on our common stock, the dollar equivalent of our earnings from our subsidiaries in China would be reduced should the dollar appreciate against the Renminbi. We currently do not hedge our exposure to fluctuations in currency exchange rates.

Until 1994, the Renminbi experienced a gradual but significant devaluation against most major currencies, including dollars, and there was a significant devaluation of the Renminbi on January 1, 1994 in connection with the replacement of the dual exchange rate system with a unified managed floating rate foreign exchange system. Since 1994, the value of the Renminbi relative to the U.S. Dollar has remained stable and has appreciated slightly against the U.S. Dollar. Countries, including the United States, have argued that the Renminbi is artificially undervalued due to China’s current monetary policies and have pressured China to allow the Renminbi to float freely in world markets. In

July 2005, the PRC government changed its policy of pegging the value of the Renminbi to the dollar. Under the new policy the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of designated foreign currencies. While the international reaction to the Renminbi revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in further and more significant appreciation of the Renminbi against the dollar.

Inflation in the PRC could negatively affect our profitability and growth.

While the PRC economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth can lead to growth in the money supply and rising inflation. According to the National Bureau of Statistics of China, in November 2011, the consumer price index went up by 4.2 percent year-on-year. The price grew by 4.2 percent in cities and 4.3 percent in rural areas. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies such as raw materials, it may have an adverse effect on our profitability.

Furthermore, in order to control inflation in the past, the PRC government has imposed controls on bank credits, limits on loans for fixed assets and restrictions on state bank lending. In January 2010, the Chinese government took steps to tighten the availability of credit including ordering banks to increase the amount of reserves they hold and to reduce or limit their lending. The implementation of such policies may impede economic growth. In October 2004, the People’s Bank of China, the PRC’s central bank, raised interest rates for the first time in nearly a decade and indicated in a statement that the measure was prompted by inflationary

concerns in the Chinese economy. In April 2006, the People’s Bank of China raised the interest rate again. Repeated rises in interest rates by the central bank, in addition to tighter credit and lending restrictions on banks, would likely slow economic activity in China which could, in turn, materially increase our costs and also reduce demand for our products.

16

Because our funds are held in banks which do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue in business.

Banks and other financial institutions in the PRC do not provide insurance for funds held on deposit. A significant portion of our assets may be in the form of cash deposited with banks in the PRC, and in the event of a bank failure, we may not have access to our funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue in business.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

As our ultimate holding company is a California corporation, we are subject to the United States Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some that may compete with us, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur from time-to-time in the PRC. We can make no assurance, however, that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are

found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

If we make equity compensation grants to persons who are PRC citizens, they may be required to register with the State Administration of Foreign Exchange of the PRC, or SAFE. We may also face regulatory uncertainties that could restrict our ability to adopt an equity compensation plan for our directors and employees and other parties under PRC law.

On April 6, 2007, SAFE issued the “Operating Procedures for Administration of Domestic Individuals Participating in the Employee Stock Ownership Plan or Stock Option Plan of An Overseas Listed Company, also know as “Circular 78.” It is not clear whether Circular 78 covers all forms of equity compensation plans or only those which provide for the granting of stock options. For any plans which are so covered and are adopted by a non-PRC listed company after April 6, 2007, Circular 78 requires all participants who are PRC citizens to register with and obtain approvals from SAFE prior to their participation in the plan. In addition, Circular 78 also requires PRC citizens to

register with SAFE and make the necessary applications and filings if they participated in an overseas listed company’s covered equity compensation plan prior to April 6, 2007. We believe that the registration and approval requirements contemplated in Circular 78 will be burdensome and time consuming. If it is determined that any of our equity compensation plans are subject to Circular 78, failure to comply with such provisions may subject us and participants of our equity incentive plan who are PRC citizens to fines and legal sanctions and prevent us from being able to grant equity compensation to our PRC employees. In that case, our ability to compensate our employees and directors through equity compensation would be hindered and our business operations may be adversely affected.

Under the New EIT Law, we and Nanchong Chunfei may be classified as “resident enterprises” of China for tax purpose, which may subject us and Nanchong Chunfei PRC income tax on taxable global income.

Under the new PRC Enterprise Income Tax Law (the “New EIT Law”) and its implementing rules, both of which became effective on January 1, 2008. Under the New EIT Law, enterprises are classified as resident enterprises and non-resident enterprises. An enterprise established outside of China with its “de facto management bodies” located within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese domestic enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define a de facto

management body as a managing body that in practice exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. Due to the short history of the New EIT law and lack of applicable legal precedents, it remains unclear how the PRC tax authorities will determine the PRC tax resident treatment of a foreign company such as us and American Nano Delaware. Both us and American Nano Delaware have all members of management team located in China. If the PRC tax authorities determine that we or Nanchong Chunfei is a “resident enterprise” for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income, as well as PRC enterprise income tax reporting

obligations. Second, the New EIT Law provides that dividend paid between “qualified resident enterprises” is exempted from enterprise income tax. A recent circular issued by the State Administration of Taxation regarding the standards used to classify certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese group enterprises and established outside of China as “resident enterprises” clarified that dividends and other income paid by such “resident enterprises” will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC shareholders. It is unclear whether the dividends that we or American Nano Delaware receives from Nanchong Chunfei will constitute dividends between “qualified resident enterprises” and would therefore qualify for tax

exemption, because the definition of qualified resident enterprises is unclear and the relevant PRC government authorities have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. We are actively monitoring the possibility of “resident enterprise” treatment for the applicable tax years and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible. As a result of the New EIT Law, our historical operating results will not be indicative of our operating results for future periods and the value of our common stock may be adversely affected.

17

Dividends payable by us to our foreign investors and any gain on the sale of our shares may be subject to taxes under PRC tax laws.

If dividends payable to our shareholders are treated as income derived from sources within China, then the dividends that shareholders receive from us, and any gain on the sale or transfer of our shares, may be subject to taxes under PRC tax laws.