Attached files

| file | filename |

|---|---|

| 8-K - 8-K_01/11/2012_TRANSMISSION PRESENTATION - NORTHWESTERN CORP | ek_01112012.htm |

Williams Capital Research Transmission Conference

January 11, 2012

Presented by:

Mike Cashell, Vice President - Transmission

Brian Bird, Vice President, CFO & Treasurer

Forward looking statements

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof unless otherwise noted. Our actual

future business and financial performance may differ materially and

adversely from our expectations expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

expectations as of the date hereof unless otherwise noted. Our actual

future business and financial performance may differ materially and

adversely from our expectations expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

2

Outline

Who we are

Financial update

Investment opportunities

Transmission development

Public policy

Financial update

Investment opportunities

Transmission development

Public policy

3

Geographically positioned for success

ð Our service territory covers some of the

best wind regimes in the nation

best wind regimes in the nation

ð We have the opportunity to provide

transmission services into two different

markets (West and Midwest)

transmission services into two different

markets (West and Midwest)

Low unemployment rates

ð A fully-regulated utility located in states

with relatively stable economies with

opportunity for system investment and

grid expansion

with relatively stable economies with

opportunity for system investment and

grid expansion

4

5

Note: Statistics above are as of 12/31/2010, except SD peak MW as a new summer peak was set in 2011

(1) Nebraska is a natural gas only jurisdiction

(1)

We are a fully regulated utility with a significant opportunity to fill a

needed supply gap in addition to other investment projects.

needed supply gap in addition to other investment projects.

A multi-state electric & natural gas utility

6

The “80 / 20” rules of NorthWestern. We are approximately 80% electric / 20% natural gas

Note: Data above reflects full year 2010 results .

Outline

Who we are

Financial update

Investment opportunities

Transmission development

Public policy

Financial update

Investment opportunities

Transmission development

Public policy

7

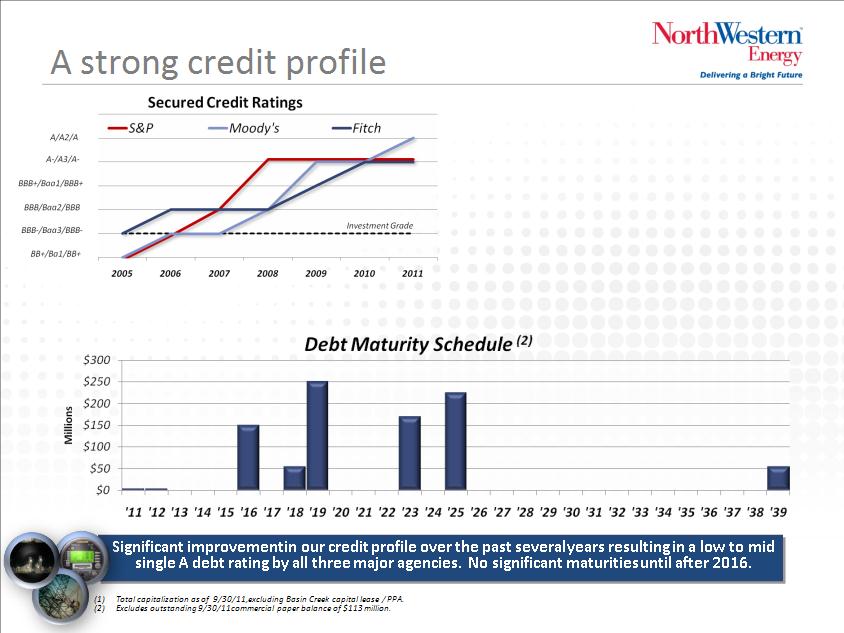

ð Long-term targeted total debt to

capitalization of 50-55% with a current

capitalization of 54.9%(1)

capitalization of 50-55% with a current

capitalization of 54.9%(1)

ð Total liquidity of $210 million as of Oct 21, ’11

ð Refinanced nearly all debt in the last 2 years

– Lowered average coupon on long-term

debt by 1.2% and extended maturities

debt by 1.2% and extended maturities

– Amended and restated revolving credit

facility extending term, increasing size

and lowering costs.

facility extending term, increasing size

and lowering costs.

A security rating is not a recommendation to buy, sell or hold securities. Such rating may be subject to revision or withdrawal

at any time by the credit rating agency and each rating should be evaluated independently of any other rating.

at any time by the credit rating agency and each rating should be evaluated independently of any other rating.

8

A history of earnings and dividend growth

9

8.3% Cash From

Operations

Operations

6.6% Dividend Growth

Compounded Annual

Growth Rate (CAGR)

Growth Rate (CAGR)

10

2005-07 valuation affected by pending and

ultimately terminated acquisition

ultimately terminated acquisition

Outline

Who we are

Financial update

Investment opportunities

Transmission development

Public policy

Financial update

Investment opportunities

Transmission development

Public policy

12

Investment opportunity outlook

ð Energy Supply

– Big Stone/Neal pollution control

– South Dakota natural gas peaking generation

– Montana Spion Kop Wind facility

– South Dakota Titan Wind facility buyout

– Other vertical integration opportunities in Montana

ð Transmission

– Network upgrades and large generation

interconnections

interconnections

– Colstrip 500kV upgrade

– Mountain States Transmission Intertie (MSTI)

– 230kV Renewable Collector System

– South Dakota transmission opportunities

ð Distribution

Outline

Who we are

Financial update

Investment opportunities

Transmission development

Public policy

Financial update

Investment opportunities

Transmission development

Public policy

14

Transmission

15

Regional planning process

ð Coordination with other sub-

regional planning groups and

WECC

regional planning groups and

WECC

RED INDICATES EXISTING NTTG MEMBER TRANSMISSION

16

Intermountain region - Today

17

Intermountain region - Tomorrow

Some potential additional projects

ð 62 projects listed in the

WECC project portal are

proceeding through path

rating

WECC project portal are

proceeding through path

rating

ð Some are shown in the

graphic

graphic

18

WECC TEPPC 10-Year Regional Transmission Plan

ð Transmission Expansion Planning Policy Committee (TEPPC)

– Funded, in part, by a grant from the U.S. Department of Energy (DOE)

– First Interconnection-wide transmission plan

– Some key findings

• Some long-distance transmission to access remote renewable

resources appears to be cost-effective under certain conditions

resources appears to be cost-effective under certain conditions

• Utilization and congestion consistently high increases under a

variety of conditions for:

variety of conditions for:

• Montana to Northwest path

• Pacific DC Intertie and California-Oregon Intertie

• High levels of variable generation caused unprecedented levels of

conventional generation ramping and cycling

conventional generation ramping and cycling

19

WECC Path Rating process

ð Purpose

– Provide a formal process for rating a transmission line

– A demonstration how a project will meet the NERC Reliability Standards

and WECC Criteria

and WECC Criteria

• Attain a WECC Accepted Rating

ð This means…

– The rating defines the capability or capacity of a transmission circuit or

path to transfer power reliably and in accordance with prescribed

Reliability Criteria in concert with other interacting paths, circuits or

generators

path to transfer power reliably and in accordance with prescribed

Reliability Criteria in concert with other interacting paths, circuits or

generators

ð MSTI’s Path Rating

– Final in late September 2011 - several year process

– 1500 MW north-to-south & 1100 MW south-to-north

20

Federal accelerated permitting

Pilot demonstration to streamline federal permitting

and increased cooperation at federal, state and

tribal levels

and increased cooperation at federal, state and

tribal levels

WECC

Rating

Rating

ð Projects kV Miles States Process

– Boardman-Hemingway 500 AC 300 OR-ID P2

– Gateway West Project 500 AC 1,100 WY-ID P3

– Hampton-Rochester-La Crosse 345 MN-WI NA

– Cascade Crossing 500 AC 210 OR P2

– SunZia Transmission, LLC 2-500 AC 500 NM-AR P3

– Susquehanna to Roseland Line 500 145 PA-NJ NA

– Transwest Express 500 DC 725 WY-UT P2

ð The focus of program is to remove remaining significant hurdles that are

within jurisdiction of the executive branch of the Federal Government

within jurisdiction of the executive branch of the Federal Government

21

ð Transmission planning

– Regional transmission planning expanded

– Include transmission needs driven by

public policy

– Coordination of transmission plans with

neighboring regions

– Federal right of first refusal to build

eliminated (applies to RTOs only)

ð Transmission cost allocation

onal

ð Observations

– Potential change for non-RTO regions of the western interconnection

– Informational regional plan (not a construction plan)

– Regional cost allocation is not cost recovery

– Does not replace or repeal states’ rights

FERC Order 1000

Preceded by Orders No. 888 and 890

22

What’s in it for customers?

ð Access to the highest quality renewable generation

– Driven by regional renewable needs and opportunity for development

ð Reduce overall regional costs to customers

ð Access to markets

ð Support public policy initiatives

ð Doing the right things for the right reasons

23

Montana interconnection queue status

24

Montana is between resources & loads

25

NWE proposed transmission projects

Collector System

Colstrip Upgrade

MSTI

26

Our transmission developments

ð Observations

– Montana major facility siting act does not easily apply to non local

load service transmission development strategy

load service transmission development strategy

– Transmission enables new resource to reach distant markets

– Transmission needs must be understood in the context and time

it will be needed (7-10 years in the future)

it will be needed (7-10 years in the future)

27

ð Currently being developed primarily by BPA and NWE with the other owners

having various levels of interest.

having various levels of interest.

Avista Corporation 10% 12%

Pacificorp 7% 8%

ð Initiallly idendified in RMATs study as being a piece of "low hanging fruit"

ð No new linear facilities requiredð 600-800 MW potential

ð BPA/NWE collaboration

Colstrip 500 kV Transmission Upgrade

28

Garrison

Townsend

Broadview

Colstrip

MT Intertie

BPA

CTS

(Approx. 30% owner of total line)

Mountain States Transmission Intertie

ð 500 kV AC line from Townsend MT to

Midpoint Substation near Twin Falls ID

Midpoint Substation near Twin Falls ID

ð Approximately 430 miles depending

on final route

on final route

– 70% on State and Federal Public Lands

ð 1500 miles of alternatives

ð Advanced Stages of public siting and

Review - began in 2007

Review - began in 2007

ð 1500 MW Path Rating

ð Current Project cost is approximately

$1 billion

$1 billion

29

Who pays for export transmission?

ð In NWE’s case

– The filings made at the Federal Energy Regulatory Commission (FERC)

clearly show that:

clearly show that:

• MSTI and Collector are being primarily built to serve new generation

for export

for export

• These documents also clearly show that those customers who directly

benefit from the line, rather than the existing retail customers of

NorthWestern Energy will pay costs

benefit from the line, rather than the existing retail customers of

NorthWestern Energy will pay costs

ð MSTI will be separate from the utility

– Assets are intended to be held in a separate corporation

– Debt will be non-recourse to the utility

30

MSTI Public Outreach - Where have we been?

ð Public participation and involvement

– NWE has always encouraged healthy and robust public debate!

ð A robust open process with all Stakeholders

– Federal and state agencies, counties, landowners and project developers

ð Public Open House Meetings

– 24 open house meetings in local communities since 2007

– The last round in January/February 2010

ð Elected Officials Briefings

– Over 100 and counting since 2007

ð Agency sponsored EIS Scoping Meetings

– 2008 - 3 meetings in MT and 3 in ID

– 2011 - 12 Agency meetings, 7 in MT and 5 in ID

– Ad hoc meetings continuing

– Future public meetings and comments after DEIS issued

31

ð NorthWestern Energy supports this third-party, independent

review

review

– Review will evaluate impacts and use a modeling process to

analyze unbiased policy data, scientific data and community

values

analyze unbiased policy data, scientific data and community

values

– The process will also assess the economic impacts of the project

to each county

to each county

– All counties throughout the MSTI project area will be invited to

participate

participate

ð The MSTI Review Group includes: Madison County, MT; Jefferson

County, MT; Western Environmental Law Center; Headwaters

Economics; Sonoran Institute; Craighead Institute and Future West

County, MT; Western Environmental Law Center; Headwaters

Economics; Sonoran Institute; Craighead Institute and Future West

MSTI review process

32

MSTI siting and permitting schedule

ð MFSA Application Filed June 2008/Accepted December 2008

ð Open Season tentatively planned for late 2012 to early 2013

depending on market readiness

depending on market readiness

ð Draft EIS Published 3rd Qtr 2012

ð Final EIS 3rd Qtr 2013

ð ROD & MT Certificate of Compliance - 4th Qtr 2013

ð Notice to Proceed - 3rd Qtr 2014

ð Start Construction 2015

ð Target Energization 2017

33

MSTI public vs. private land

ð Extensive review of local routing alternatives to maximize

the use of public lands

the use of public lands

ð NWE Preferred Route

– 54% Public Land 46% Private Montana

– 73% Public Land Idaho

ð Parallel existing BPA 500 kV Route

– 63% Public Land 37% Private Montana

– 73% Public Land Idaho

ð Former Agency Preferred Alternative (Jefferson Valley Route)

– 66% Public Land 34% Private Montana

– 73% Public Land Idaho

34

35

Network Upgrades and Large Generation Interconnections

the cost of joining MISO as compared to the opportunities and

other benefits that membership may provide. Investment

opportunities are currently estimated to be between

$300-500 million. The map below is from a

September 2011 MVP Business Case Workshop

and expanded to show the overlay of

our South Dakota transmission

system relative to these

MVP projects.

Outline

Who we are

Financial update

Investment opportunities

Transmission development

Public policy

Financial update

Investment opportunities

Transmission development

Public policy

36

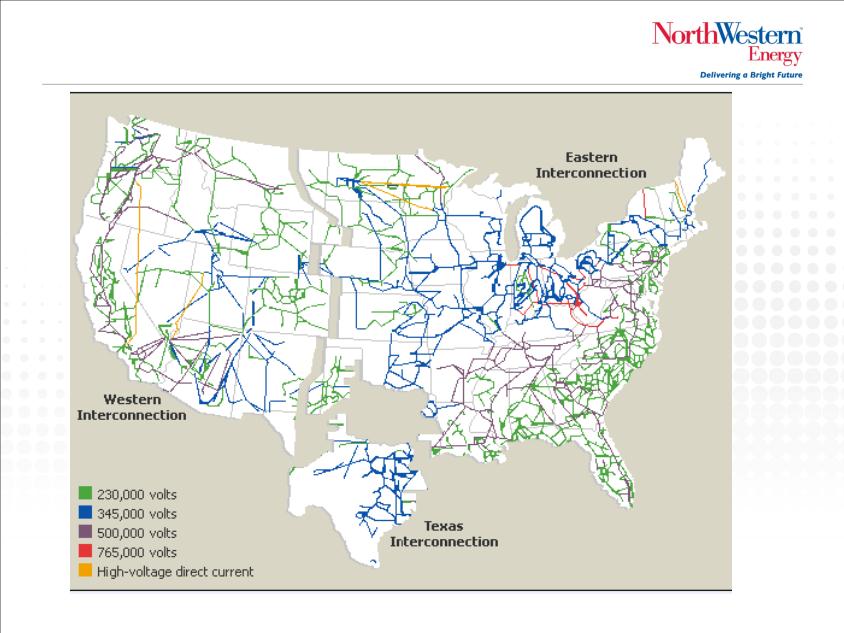

A lot of dirt between light bulbs in the West

ð Loads are sometimes a long way from generation

– The same is true for access to the highest quality renewables

– Often, the transmission necessary to deliver generation to the market

spans company, geographic and political boundaries.

spans company, geographic and political boundaries.

ð Cost allocation is one of major issues facing transmission development

– Pancaked rates

– Regulatory reform at the federal level is behind the curve

– Local and state concerns at both ends of the transmission line

• Who pays for export transmission?

• Regulation for intermittent generation?

• Protection for retail customers

ð The independent West said no to a region wide RTO - yet elements are

being developed

being developed

– NTTG is making progress with several initiatives:

• ADI

• Dynamic Scheduling

• Changes to the scheduling period (from an hour to 30 minutes)

– The risk is sub-optimization of the grid and of new resources

37

Policy issues affecting transmission development

ð Lack of coordinated and comprehensive regulatory process

– Difficulty in satisfying competing federal, state and local needs

– No RTO in western U.S., unorganized markets

– Need centralized siting process for interstate transmission that serves

regional or national interests

regional or national interests

ð State level market protection

– Mainly CA - preference to in-state renewable projects for job growth

– Restrictions placed on out of state wind even if lower cost

ð Need clarity on federal policy for ITC and PTC

– Without clarity, renewable initiatives don’t make near term financial sense

– Treasury grants expired YE 2011, wind tax credits expire YE 2012

ð Uncertainty increasing from state economic challenges, budget issues,

political change

political change

– Potential impacts - reduction or delay of RPS standards, incentive phase

outs

outs

ð Montana Issues

– Efforts to nullify the new HB 198 eminent domain law are ongoing

despite failure of a citizens’ referendum

despite failure of a citizens’ referendum

38

39

QUESTIONS

Thank You