Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NOVANTA INC | d280204d8k.htm |

CJS

Securities 2012 Investor Conference CJS Securities 2012 Investor

Conference “New Ideas for the New Year”

“New Ideas for the New Year”

January 11, 2012

January 11, 2012

Exhibit 99.1

Exhibit 99.1 |

2

Factors affecting future performance…

Factors affecting future performance…

…and use of Non-GAAP financial measures

…and use of Non-GAAP financial measures

Forward-Looking

Statements

The statements in this presentation that relate to guidance, future plans, business

opportunities, events or performance are forward-looking statements that

involve risks and uncertainties, including risks associated with business and

economic conditions, customer and/or supplier contract cancellations, manufacturing

risks, competitive factors, ability to successfully introduce new products,

uncertainties pertaining to customer orders, demand for products and services,

growth and development of markets for the Company's products

and

services,

and

other

risks

identified

in

our

filings

made

with

the

Securities

and

Exchange

Commission, including, most recently, our Form 10-K for the year ended December

31, 2010. Actual results, events and performance may differ materially.

Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this presentation, January 11, 2012. The

Company disclaims any obligation to update these forward-looking statements as a

result of developments occurring after the date of this presentation. Readers

are encouraged to refer to the risk disclosures described in the

Company’s Form 10-K for the year ended December 31, 2010 and subsequent filings with

the

SEC,

as

applicable.

Please

see

“Safe

Harbor

and

Forward-Looking

Information”

in

the

Appendix

to

this

presentation for more information.

Non-GAAP

Measurement

The Company’s statements regarding its historical and projected revenues,

adjusted EBITDA, and net debt are

non-GAAP

financial

measures.

Please

see

“Use

of

Non-GAAP

Financial

Measures”

and

the

subsequent

slides in the Appendix to this presentation for the reasons we use these measures, a

reconciliation of these measures

to

the

most

directly

comparable

GAAP

measures

and

other

information

relating

to

these

measures.

The

Company

neither

updates

nor

confirms

any

guidance

regarding

the

operating

results

of

the Company

which may have been given prior to this presentation. |

We

are a leading supplier… …of precision motion and laser

technology Expertise to Drive Results

Capabilities to Innovate & Grow

Positioned in Growth Segments

Global Presence and Reach

3

Note: Revenue is 2011E, based on financial guidance provided on

November 10, 2011 •

Leading

provider

of

precision

laser,

optical

and

motion

control

technology

and

semiconductor systems

•

•

Founded

Founded

in

in

1968,

1968,

headquartered

headquartered

in

in

Bedford,

Bedford,

MA

MA

-

-

major

major

presence

presence

in

in

North

North

America,

Europe,

and

Asia-Pacific

•

~$365M in revenue, approximately 1600 employees

•

Trade on NASDAQ (GSIG)

Leading Technology Franchises |

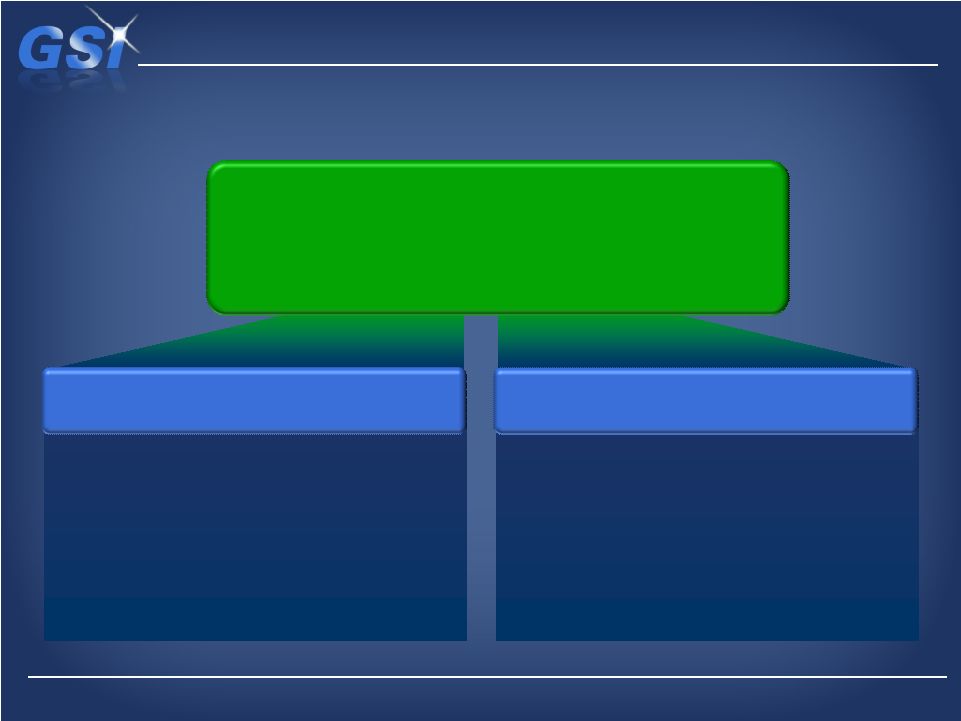

Our

aspirations… …are clear and achievable

Strategic Vision

•

Focus growth efforts on building out

key platforms (organic and M&A)

•

Improve mix (growth, volatility) –

more Medical, less Semiconductor

•

Simplify footprint and infrastructure

A leading provider of precision photonic and

A leading provider of precision photonic and

motion technologies for OEM’s in demanding

motion technologies for OEM’s in demanding

markets –

markets –

delivering attractive shareholder

delivering attractive shareholder

returns through sustained profitable growth

returns through sustained profitable growth

Strategic Priorities

Strategic Priorities

•

Organic growth mid to high

single digits

•

>20% EBITDA margins

•

Long term shareholder returns

above peer average

Performance Goals

Performance Goals

4 |

We

are on a journey towards our vision… …of being a focused, world

class technology company Revenue

Revenue

Growth

Growth

EBITDA**

EBITDA**

Value Chain

Value Chain

Focus

Focus

Structure

Structure

Mix

Mix

Growth

Growth

Strategy

Strategy

Performance

Performance

Focus

Focus

~$480M*

Low single digit

~$70M

33% systems

67% OEM

<20 distinct P&L’s

>30 sites

>50% Semi

<10% Medical

Unrelated

acquisitions

Maximize margins

Pre 2008

Pre 2008

~$365M

Mid single digit

~$65M

18% systems

72% OEM

3 focused groups

<20 sites

~31% Semi

~31% Semi

~15% Medical

~15% Medical

Build out growth

platforms via focused

R&D and bolt-on M&A

Profit growth

Current

Current

* pro forma Excel Technologies + GSI Group Inc results as reported in GSI Group Inc.

8K filed on 07/18/08 ** adjusted EBITDA, non-GAAP financial metric

5

$500M+

High single digit

$100M+

~100% OEM

2 focused groups

<15 sites

<15% Semi

~40% Medical

Current approach

plus selective

transformative M&A

Sustained

profitability via

revenue growth

Vision |

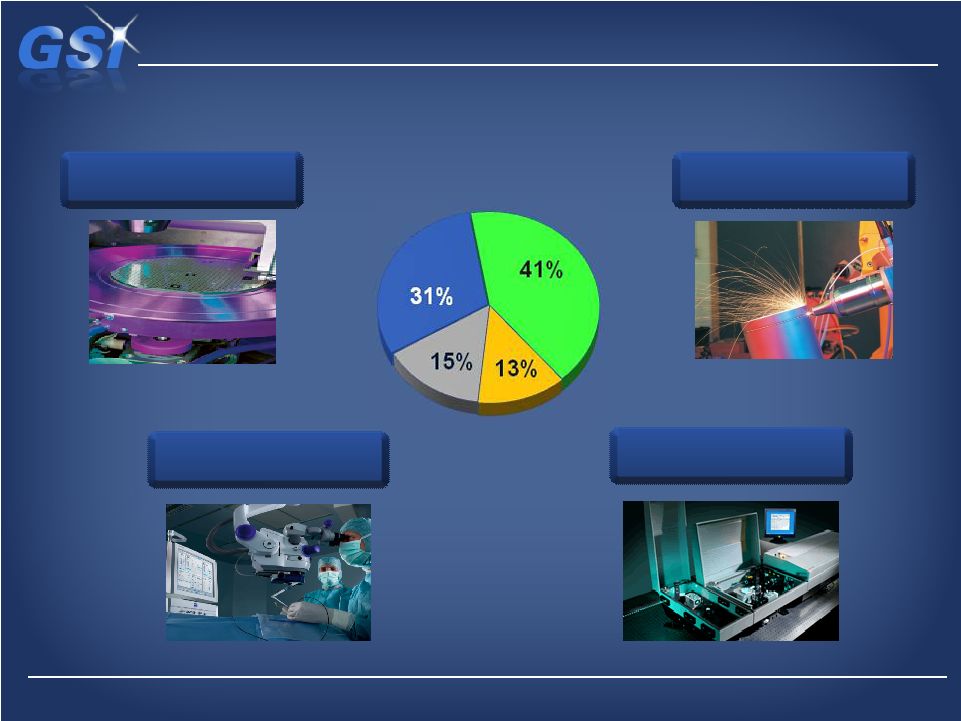

We

have three businesses… …with Precision Motion contributing the

largest portion Laser

Laser

Products

Products

Semiconductor

Semiconductor

Systems

Systems

Revenue Breakdown

Revenue Breakdown

Precision

Precision

Motion

Motion

6

Note:

Percentages

based

on

3Q

2011

actual

financials |

We

serve several major markets… …with Medical targeted for growth

End Market Mix

End Market Mix

Semiconductor

Semiconductor

Semiconductor

Medical

Medical

Medical

Industrial

Industrial

Industrial

Scientific

Scientific

Scientific

7

Note: Percentages based on 3Q 2011 actual financials |

GSI

has a strong global presence… …with

significant

reach

into

the

Pacific

Rim

•

Strong international presence; 66% of revenue from outside U.S.

•

Production sites in the U.S., U.K., Germany and China

Revenue by Geography

Revenue by Geography

FY2010

FY2010

Mukilteo, WA

Mukilteo, WA

Santa Clara, CA

Santa Clara, CA

Oxnard, CA

Oxnard, CA

Chatsworth, CA

Chatsworth, CA

Bedford, MA

Bedford, MA

Lexington, MA

Lexington, MA

East Setauket, NY

East Setauket, NY

Orlando, FL

Orlando, FL

Rugby, UK

Rugby, UK

Poole, UK

Poole, UK

Taunton, UK

Taunton, UK

Suzhou, PRC

Suzhou, PRC

Shanghai, PRC

Shanghai, PRC

Tokyo, Japan

Tokyo, Japan

Seoul, Korea

Seoul, Korea

Taipei, Taiwan

Taipei, Taiwan

Malaysia

Malaysia

Sri Lanka

Sri Lanka

Italy

Italy

France

France

Darmstadt, Germany

Darmstadt, Germany

Ludwigsburg, Germany

Ludwigsburg, Germany

Munich, Germany

Munich, Germany

India

India

Global Presence

Global Presence

8 |

•

Over 1000 active OEM customers

•

Existing penetration in over 100

major application areas

Our capabilities…

…support our focus on OEM businesses

Our Core Competencies

Our Core Competencies

•

Sub-micron location sensing

•

3-axis scanning within 1 micron

•

Spindles rotating at 250,000 RPM

•

Femtosecond lasers

Precision Technology

Precision Technology

High Quality Production

High Quality Production

OEM Sales Channels

OEM Sales Channels

Collaborative Design

Collaborative Design

•

Designed into state-of-the-art OEM

systems in demanding applications:

-

Robotic surgery

-

DNA sequencing

-

Disk drive track writing

•

ISO 13485 certification (medical device

quality standard)

•

Factories in U.S, UK and China

9 |

We

have strong franchises… …in the Precision Motion space

Precision Motion Overview

Precision Motion Overview

Brand

Brand

Technology

Technology

Location

Location

Primary

Primary

Applications

Applications

Galvanometers

Galvanometers

Scan Heads

Scan Heads

Lexington, MA

Lexington, MA

Material

Material

Processing

Processing

Marking

Marking

Ophthalmology

Ophthalmology

PCB Drilling

PCB Drilling

Optical Encoders

Optical Encoders

Bedford, MA

Bedford, MA

Robotic Surgery

Robotic Surgery

DNA Sequencing

DNA Sequencing

Wire Bonding

Wire Bonding

Disk Drives

Disk Drives

Air Bearing Spindles

Air Bearing Spindles

Poole, UK

Poole, UK

Suzhou, China

Suzhou, China

PCB Drilling

PCB Drilling

Semiconductor

Semiconductor

Thermal Printers

Thermal Printers

Bedford, MA

Bedford, MA

Patient Monitoring

Patient Monitoring

Defibrillators

Defibrillators

EKG

EKG

LTM* Revenue

LTM* Revenue

~$200M

~$200M

Industrial

Industrial

Scientific

Scientific

Semi

Semi

Medical

Medical

Scanners

Scanners

Encoders

Encoders

Spindles

Spindles

Recorders

Recorders

10

**Last Twelve Months (LTM) is defined as Q4 2010 through Q3 2011

|

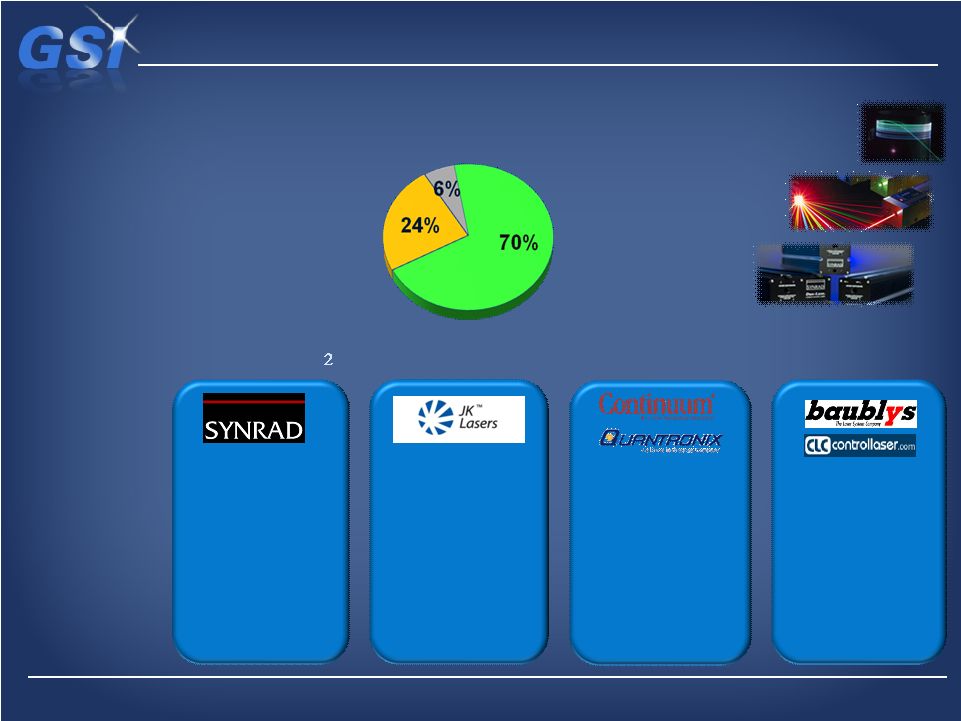

We

have a strong laser offering… …focused on industrial and scientific

markets Laser Products Overview

Laser Products Overview

LTM Revenue

LTM Revenue

~$133M

~$133M

Industrial

Industrial

Scientific

Scientific

Semi

Semi

Brands

Brands

Range

Range

Location

Location

Primary

Primary

Applications

Applications

Sealed CO

Sealed CO

10W to 400W

10W to 400W

Mukilteo, WA

Mukilteo, WA

Marking,

Engraving,

Date Coding of

non-metals

Fiber Lasers

Fiber Lasers

50W to 1kW

Rugby, UK

Metal cutting,

welding, drilling

Specialty

Specialty

High Speed/Power

Santa Clara, CA

Scientific Research

Specialty Industrial

Systems

Systems

10W to 2kW

Orlando, FL

Ludwigsburg, Ger.

Marking

Engraving

Failure Analysis

11 |

We

are investing for growth… …in several attractive platforms

Attractive Growth Platforms

Attractive Growth Platforms

•

Beam

delivery

for

lasers

–

market

growth

~8%

•

Leverage our #1 position in Galvanometers to

enter Scan Head market (modules)

•

Double addressable market up to ~$200M

•

ASP goes from ~$750 to ~$2500

•

~$25M revenue opportunity by 2015

Scanning Solutions

Scanning Solutions

•

~$600M market growing ~20%

•

Our range: 50W to 1kW, multi kW in R&D

•

Leverage our large historical installed base to

convert long-time customers to fiber

•

Expanded production capacity

•

New applications centers in U.S. and China

•

~$25M revenue opportunity by 2015

Fiber Lasers

Fiber Lasers

•

~$50M business today, growing 20%+

•

Numerous design wins with leading OEM’s

•

Key Applications: Robotic Surgery, DNA Sequencing, OCT,

Patient Monitoring, Defibrillation, EKG, Dermatology

•

Expansion into adjacent technologies & customer platforms

Medical Components

Medical Components

12

Source: Strategies Unlimited, Management Estimates

|

Overall market conditions…

…suggest challenging Q1 with moderate full-year growth

Market Outlook

Market Outlook

•

•

Solid growth in U.S.

Solid growth in U.S.

•

•

New technologies create opportunities

New technologies create opportunities

-

-

Robotics

Robotics

-

-

Next Gen. DNA sequencing

Next Gen. DNA sequencing

•

•

Europe potentially sluggish

Europe potentially sluggish

•

Significant Q4/Q1 downturn of > 30%

•

Major customers reporting “bottoming

out”

has occurred

•

Expect weak Q1 with recovery Q2 and

beyond

•

•

Continued sluggish recovery

Continued sluggish recovery

•

•

Technology platforms create share

Technology platforms create share

opportunities (fiber lasers, scan heads)

opportunities (fiber lasers, scan heads)

•

•

Mature technologies seeing faster

Mature technologies seeing faster

declines (e.g. lamp pumped YAG)

declines (e.g. lamp pumped YAG)

•

•

China is a question mark

China is a question mark

•

•

Government fiscal pressures keep

Government fiscal pressures keep

overall growth flat

overall growth flat

•

•

Large program opportunities exist but

Large program opportunities exist but

are binary

are binary

Industrial

Industrial

Semiconductor

Semiconductor

Scientific

Scientific

Medical

Medical

13 |

Financial Overview

Financial Overview

14 |

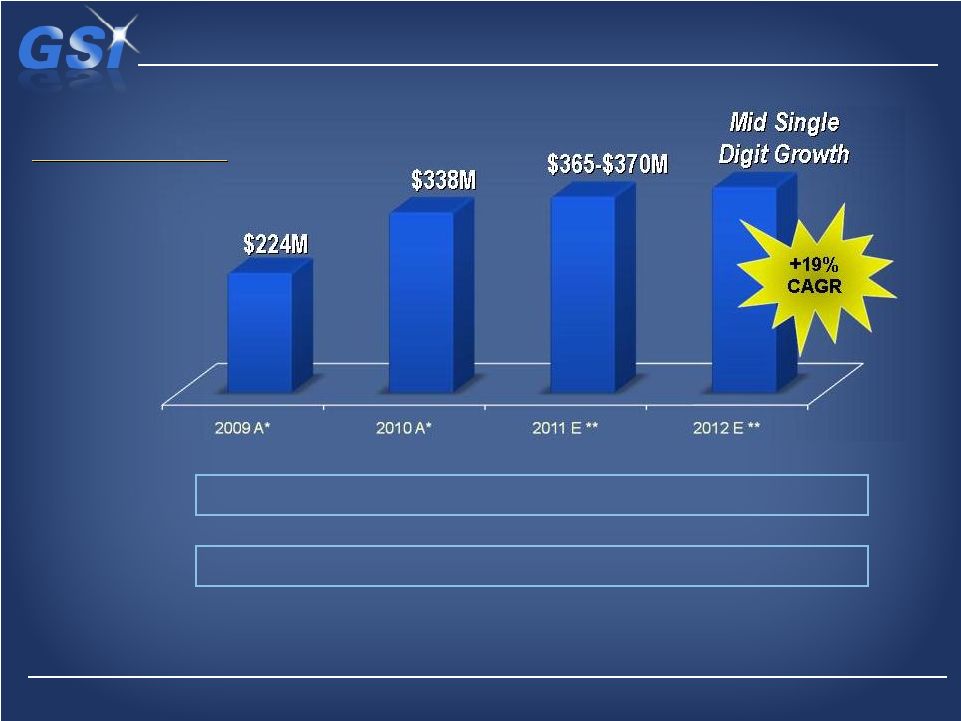

Solid revenue growth driven by economic recovery…

…with a strategy to drive high-single digit growth

$254M

$384M

n/a

n/a

US GAAP

US GAAP

Revenues

Revenues

($30.4M)

($45.7M)

n/a

n/a

Semiconductor

Adjustments*

* 2009 and 2010 (in graph) exclude revenues Company recognized

in its Semiconductor Systems segment that had been deferred from orders

placed by customers prior to 2009. See SEC

filing for further info. See Non-GAAP reconciliation in appendix herein.

** 2011E and 2012E are based on financial guidance provided on November 10,

2011 Adj. Revenue:

Adj. Revenue:

15 |

Business continues to generate solid profitability…

…with a roadmap to continued double-digit growth

$23.4M

$74.7M

n/a

n/a

EBITDA***

EBITDA***

($16.5M)

($20.0M) n/a

n/a

Semiconductor

Adjustments*

* 2009 and 2010 (in graph) exclude revenues and cost of revenues the Company

recognized in its Semiconductor Systems segment that had been deferred from

orders placed by customers prior to 2009. See SEC filing for further info. **

2011E and 2012E are based on financial guidance provided on November 10, 2011

*** Includes income associated with Semiconductor Systems Segment revenue that had

been deferred from orders placed by customers prior to 2009

Adjusted EBITDA:

Adjusted EBITDA:

16 |

Demonstrated history of strong cash generation…

…on an accelerated path to a net cash position

$63.3M

$56.8M

$50.7M

Total Cash &

Total Cash &

Cash Equivalent

Cash Equivalent

($146.7M)

($50.8M)

($22.5M)

Net Debt*

Leverage Ratios*

Total Debt / Adjusted EBITDA

30.3x

2.0x

1.4x

Total Debt / Equity

249%

60%

35%

Gross Debt:

Gross Debt:

* Non-GAAP financial measure

17 |

•

•

Strengthen our strategic position

Strengthen our strategic position

•

•

Enhance our customer offering

Enhance our customer offering

•

•

Strong growth prospects

Strong growth prospects

•

•

Innovation driven

Innovation driven

•

•

Create shareholder value above

Create shareholder value above

the alternatives

the alternatives

Our strategy for Capital Deployment…

Maximize Return on Capital

through Internal Investments and

Complementary Acquisitions

Acquisition Criteria:

Acquisition Criteria:

•

•

Complementary technologies to

Complementary technologies to

existing business lines

existing business lines

•

•

Photonic components &

Photonic components &

associated technologies

associated technologies

•

•

Medical components to OEM

Medical components to OEM

manufacturers

manufacturers

Acquisition Focus:

Acquisition Focus:

…focuses on high returning, manageable investments

18 |

We

are establishing a continuous improvement culture…

…through formalized productivity programs / initiatives

Current

Current

12 x 12 Integration and Realignment Program

Target: Up to $5 million in annualized cost

savings, with a goal of eliminating up to 12 facilities

Future

Future

Operational Excellence

Target: Consistent margin expansion

Continuous Improvement Culture

Continuous Improvement Culture

19 |

We

have clear focus… …for success in 2012

Key Priorities for 2012

Key Priorities for 2012

•

•

Execute on 12 X 12 plan

Execute on 12 X 12 plan

•

•

Build momentum on Growth Platforms

Build momentum on Growth Platforms

•

•

Build pipeline of bolt-on acquisitions

Build pipeline of bolt-on acquisitions

•

•

Finalize Strategic Review process

Finalize Strategic Review process

•

•

Build on our core competencies

Build on our core competencies

•

•

Engage with investment community

Engage with investment community

20 |

•

•

Experienced

Experienced

new

new

management

management

team

team

with

with

demonstrated

demonstrated

track

track

record

record

of

of

value

value

creation

creation

(GE,

(GE,

Honeywell,

Honeywell,

PerkinElmer,

PerkinElmer,

IBM,

IBM,

Millipore,

Millipore,

Analog

Analog

Devices,

Devices,

Boston

Boston

Scientific,

Scientific,

McKinsey,

McKinsey,

Bain)

Bain)

•

•

Unique technology

Unique technology

position with

position with

capability in both lasers and related

capability in both lasers and related

precision photonic technologies

precision photonic technologies

•

•

Positioned in attractive applications

Positioned in attractive applications

with untapped growth

with untapped growth

potential

potential

•

•

Global

Global

presence with strong positions

presence with strong positions

in growing markets in Asia

in growing markets in Asia

•

•

Strong

Strong

balance

balance

sheet

sheet

with

with

significant

significant

cash

cash

generation

generation

capability

capability

•

•

Low profile stock with reasonable

Low profile stock with reasonable

entry multiple

entry multiple

GSIG offers a distinctive opportunity…

…for shareholder value creation

An Attractive Investment

An Attractive Investment

21 |

Questions

Questions?

Thank you for your

Thank you for your

interest in GSI

interest in GSI

*****

22 |

Appendix

Appendix

23 |

Certain

statements

in

this

presentation

are

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

and

are

based

on

current

expectations

and

assumptions

that

are

subject

to

risks

and

uncertainties.

All

statements

contained

in

this

presentation

that

do

not

relate

to

matters

of

historical

fact

should

be

considered

forward-looking

statements,

and

are

generally

identified

by

words

such

as

“expect,”

“intend,”

“anticipate,”

“estimate,”

“plan,”

and

other

similar

expressions.

These

forward-looking

statements

include,

but

are

not

limited

to,

statements

related

to:

market

outlooks;

the

expected

growth

in

the

Company’s

revenues

and

profits;

the

expected

timing,

scope

and

benefits

of

the

12x12

Program;

the

Company’s

expected

future

financial

results;

the

Company’s

expected

growth,

revenue

opportunities,

financial

results,

structure

and

end-market

mix;

the

Company’s

optimism

regarding

its

prospects for the future; and other statements that are not historical facts.

These forward-looking statements involve a number of risks, uncertainties,

assumptions and other factors that could affect future results and cause actual

results and events to differ materially from historical and expected results and

those expressed or implied in the forward-looking statements, including, but not

limited to, the following: our failure to develop, implement and

maintain appropriate internal controls; changes in our management on our

relationships with key employees,

suppliers

and

customers;

economic

and

political

conditions;

our

dependence

on

our

customers’

capital

expenditures;

our

ability

to

respond

to

fluctuations in product demand; the need to continually innovate; the effects of

delays in delivery of new products; our reliance upon third party distribution

channels;

our

failure

to

meet

or

exceed

the

expectations

of

securities

analysts

or

investors;

timing

of

customer

orders;

changes

in

interest

rates,

credit

ratings

or foreign currency rates; risks associated with our operations in foreign

countries; our increased use of outsourcing in foreign countries; any failure to comply

with

local

customs

regulations;

our

history

of

operating

losses;

our

exposure

to

the

credit

risk

of

some

of

our

customers;

violations

of

our

intellectual

property

rights; our ability to protect our intellectual property and successfully defend

against claims of infringement by third parties; the competitive nature of our

industries; our failure to achieve anticipated benefits from acquisitions or

divestitures; our failure to successfully complete restructuring or reorganization of our

businesses; our inability to retain our key personnel; our ongoing assessment of

our operating structure; the expected consolidation of some of our operations;

product

defects

or

problems

with

integrating

our

products

with

other

vendors’

products;

disruptions

in

the

supply

of

or

defects

in

raw

materials,

certain

key

components and other goods from our suppliers; changes in governmental regulation;

a significant disruption in our information technology systems or failure to

implement new systems and software successfully; failure to realize the full value of our intangible assets; need to make additional tax payments and/or

recalculate

certain

of

our

tax

attributes;

limits

on

our

ability

to

utilize

our

net

operating

loss

carry-forwards

and

other

tax

attributes;

fluctuations

in

our

effective

tax rates; the potential to be subject to U.S. federal income taxation even though

the Company is a non-U.S. corporation; the potential to be subject to the AMT

for

U.S.

federal

income

tax

purposes;

our

limited

ability

to

carry

back

certain

losses

for

U.S.

federal

income

tax

purposes;

our

need

for

additional

capital;

the

volatility of the market for our common shares; our ability to generate cash; our

access to the cash flow and other assets of our subsidiaries; the substantial

control

of

our

significant

shareholders

over

our

outstanding

common

shares;

provisions

of

our

articles

of

incorporation

that

may

delay

or

prevent

a

change

in

control of our Company; our substantial debt; our intention not to pay dividends in

the near future; our potential inability to timely file certain periodic reports

with the Securities and Exchange Commission and Canadian Securities Administration;

or our failure to file a registration statement relating to securities issued

under our 2006 Equity Incentive Plan.

Other

important

risk

factors

that

could

affect

the

outcome

of

the

events

set

forth

in

these

statements

and

that

could

affect

the

Company’s

operating

results

and

financial condition are discussed in the Company’s Annual Report on Form

10-K for the year ended December 31, 2010, and in the Company’s subsequent

filings with the SEC made prior to or after the date hereof. Such statements are

based on the Company’s management’s beliefs and assumptions and on

information

currently

available

to

the

Company’s

management.

The

Company

disclaims

any

obligation

to

update

any

forward-looking

statements

as

a

result

of

developments

occurring

after

the

date

of

this

document

except

as

required

by

law.

Safe Harbor and Forward Looking Information

24 |

GSI Group Reconciliation of GAAP to Non-GAAP Financials and other Financial

Information In addition to the financial measures prepared in accordance with

generally accepted accounting principles (GAAP), we use certain non-GAAP financial

measures, including non-GAAP revenues, adjusted EBITDA, and net debt.

Non-GAAP adjustments include: net interest expense, income taxes, depreciation

and amortization, Semiconductor Systems revenues and cost of sales adjustments that

had been deferred from customer orders shipped prior to 2009, but had not

been recognized in the period in which the orders were shipped due to previously undelivered elements or unresolved commitments; share-based

compensation; impairment of intangibles; restructuring and restatement costs;

pre-petition and post-emergence professional fees; reorganization costs,

earnings from equity method investments, loss on discontinued operations, and other

non-recurring items. Net debt is defined as total debt less cash and

cash equivalents.

Management believes non-GAAP financial measures provide meaningful supplemental

information regarding the Company’s operating results because it

excludes amounts that management does not consider part of operating results when

assessing and measuring the operational and financial performance of the

Company. Management believes non-GAAP measures allow a useful alternative for viewing operating trends and performing analytical comparisons.

Accordingly, the Company believes non-GAAP measures provide greater

transparency and insight into management’s method of analysis. While

management believes non-GAAP financial measures provide useful

information, these are not measures under U.S. GAAP, and therefore, should not be

considered in isolation from, or as a substitute for, GAAP financial measures such

as income from operations or net income. Non-GAAP

financial

measures

are

also

used

by

our

management

to

evaluate

our

operating

performance,

communicate

our

financial

results

to

our Board of

Directors, benchmark our operating results against our historical performance and

the performance of our peers, evaluate investment opportunities including

acquisitions and divestitures, and determine the bonus payments for senior

management and other employees. Use of Non-GAAP Financial Measures

25 |

GSI Group, Inc.

GSI Group, Inc.

Non-GAAP Revenue

(in thousands of dollars)

(in thousands of dollars)

2010

2010

2009

2009

GAAP revenue

GAAP revenue

$ 383,516

$ 383,516

$ 254,388

$ 254,388

Semiconductor revenue adjustments (a)

Semiconductor revenue adjustments (a)

(45,722)

(45,722)

(30,364)

(30,364)

Non-GAAP revenue

$ 337,794

$ 337,794

$ 224,024

$ 224,024

(a)

(a)

The excluded items from revenues include revenues that had been deferred from

customer orders shipped prior to 2009, but had not been recognized in the

period shipped prior to 2009, but had not been recognized in the period

in which the orders were shipped

in which the orders were shipped

due to previously undelivered elements or unresolved commitments.

Non-GAAP Revenue Reconciliation

26 |

YTD2011

FY2010

FY2009

Net Income / (loss) attributable to GSI Group Inc.

25,118

$

(687)

$

(71,330)

$

Interest expense, net

10,298

19,821

27,457

Income tax provision (benefit)

4,012

10,739

(773)

Depreciation and amortization

11,463

15,652

17,330

EBITDA (a)

50,891

$

45,525

$

(27,316)

$

Semiconductor revenue adjustments (b)

(456)

(45,722)

$

(30,364)

$

Semiconductor cost of sales adjustments (b)

191

25,768

13,917

Share-based compensation

2,518

1,871

2,052

Impairment of intangible assets

-

-

1,045

Restructuring, restatement and other nonrecurring costs (c)

136

2,592

16,291

Pre-petition and post-emergence professional fees (d)

296

727

6,966

Other expense (income), net (e)

(1,016)

(2,168)

610

Reorganization items (f)

-

26,156

23,606

Loss on discontinued operations, net of tax

-

-

132

Adjusted EBITDA

52,560

$

54,749

$

6,939

$

(in thousands of dollars)

Non-GAAP EBITDA Reconciliation

$

27

Note:

Year-to-Date

(YTD)

is

defined

as

Q1

2011

through

Q3

2011

actual

reported results

(a)

(a)

The Company defines EBITDA, a non-GAAP financial measure, as the net income /

(loss) attributable to GSI Group Inc. before deducting net interest expense,

income taxes, depreciation and amortization.

(b)

(b)

Semiconductor revenue adjustments and cost of sales adjustments include revenues

and cost of sales that had been deferred from customer orders shipped prior to

2009, but had not been recognized in the period in which the orders were shipped

due to previously undelivered elements or unresolved commitments. (c)

(c)

Restructuring, restatement and other related costs primarily consist of fees

related to third parties for services performed in connection with the review and

investigation of revenue transactions examined and the restatement of the

Company’s 2004 through 2008 financial statements (d)

(d)

Pre-petition professional fees incurred during 2009 prior to the bankruptcy,

consist primarily of costs for legal and financial advisors to assist in the analysis of debt

alternatives, as well as other related costs. Post-emergence professional

fees represent professional fees incurred subsequent to emergence from

bankruptcy to finalize the bankruptcy process.

(e)

(e)

Other items excluded represent foreign exchange transaction gains (losses), gains

on the sale of auction rate securities, and earnings on equity method investments.

(f)

(f)

Reorganization items represent amounts recorded in the consolidated financial

statements as a result of the bankruptcy proceedings. |

Net

Debt & Leverage Ratios Net Debt and Leverage Ratios

Net Debt and Leverage Ratios

(in thousands of dollars, except ratio information)

(in thousands of dollars, except ratio information)

YTD2011

YTD2011

FY2010

FY2010

FY2009

FY2009

Debt

Debt

($73,107)

($73,107)

($107,575)

($107,575)

($210,000)

($210,000)

Less: cash and cash equivalents

Less: cash and cash equivalents

50,655

50,655

56,781

56,781

63,328

63,328

Net debt (a)

Net debt (a)

($22,452)

($22,452)

($50,794)

($50,794)

($146,672)

($146,672)

Total Debt

Total Debt

($73,107)

($73,107)

($107,575)

($107,575)

($210,000)

($210,000)

Total Adjusted EBITDA

Total Adjusted EBITDA

$52,560

$52,560

$54,749

$54,749

$6,939

$6,939

Total Debt/Adjusted EBITDA

Total Debt/Adjusted EBITDA

1.4

1.4

2.0

2.0

30.3

30.3

Total Equity

Total Equity

$207,924

$207,924

$178,678

$178,678

$84,311

$84,311

Total Debt/Total Equity

Total Debt/Total Equity

35%

35%

60%

60%

249%

249%

(a)

(a)

Net debt is defined as total debt less cash and cash equivalents.

(b)

(b)

Adjusted EBITDA is defined as the net income / (loss) attributable to GSI Group

Inc. before deducting net interest expense, income taxes, depreciation and

amortization, Semiconductor Systems revenues and cost of sales adjustments, share-based compensation, impairment of

intangibles, restructuring and restatement costs, pre-petition and

post-emergence professional fees, reorganization costs, foreign exchange gains

(losses), earnings on equity method investments, and loss on discontinued

operations. 28

Note:

Year-to-Date

(YTD)

is

defined

as

Q1

2011

through

Q3

2011

actual

reported

results |