Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - QUESTCOR PHARMACEUTICALS INC | d278517d8k.htm |

| EX-99.1 - QUESTCOR PHARMACEUTICALS, INC. PRESS RELEASE DATED JANUARY 6, 2012 - QUESTCOR PHARMACEUTICALS INC | d278517dex991.htm |

1

1

January 2012

JP Morgan Healthcare Conference

January 2012

JP Morgan Healthcare Conference

Exhibit 99.2 |

2

Safe Harbor Statement

Except for the historical information contained herein, this presentation contains

forward-looking statements that are based on management's current expectations and

beliefs and are subject to a number of risks, uncertainties and assumptions that could

cause actual results to differ materially from those described. All such statements have

been made pursuant to the Private Securities Litigation Reform Act of 1995, as amended.

These statements relate to future events or our future financial performance. In some

cases, you can identify forward-looking statements by terminology such as "may," "will," "if," "should,"

"forecasts," “intends,” “exploring,” "expects,"

"plans," “appears,” “grows,” "believes," "estimates," "predicts," "potential,"

"continue" or “trends” or the negative of such terms and other comparable

terminology. These statements are only predictions. Actual events or results may differ

materially. Factors that could cause or contribute to such differences include, but are not

limited to, the following: Our reliance on Acthar for substantially all of our net sales and

profits; Reductions in vials used per prescription resulting from changes in treatment

regimens by physicians or patient compliance with physician recommendations; The complex

nature of our manufacturing process and the potential for supply disruptions or other business disruptions; The lack

of patent protection for Acthar; and the possible FDA approval and market introduction of

competitive products; Our ability to generate revenue from sales of Acthar to treat

on-label indications associated with NS, and our ability to develop other therapeutic

uses for Acthar including SLE; Research and development risks, including risks associated with Questcor's work in the

area of nephrotic syndrome and potential work in the area of SLE, and our reliance on

third-parties to conduct research and development and the ability of research and

development to generate successful results; Regulatory changes or other policy actions by

governmental authorities and other third parties in connection with U.S. health care reform or efforts to reduce

federal and state government deficits; Our ability to receive high reimbursement levels from

third party payers; An increase in the proportion of our Acthar unit sales comprised of

Medicaid-eligible patients and government entities; Our ability to estimate reserves

required for Acthar used by government entities and Medicaid-eligible patients and the impact that unforeseen

invoicing of historical Medicaid prescriptions may have upon our results; Our ability to operate

within an industry that is highly regulated at both the Federal and state level; Our

ability to effectively manage our growth, including the expansion of our NS selling

effort, and our reliance on key personnel; The impact to our business caused by economic conditions; Our ability to

protect our proprietary rights; Our ability to maintain effective controls over financial

reporting; The risk of product liability lawsuits; Unforeseen business interruptions;

Volatility in Questcor's monthly and quarterly Acthar shipments and end-user demand,

as well as volatility in our stock price; and Other risks discussed in Questcor's annual report on Form 10-K for the year

ended December 31, 2010, and other documents filed with the Securities and Exchange

Commission.

The risk factors and other information contained in these documents should be considered in

evaluating Questcor's prospects and future financial performance. |

3

A biopharmaceutical company whose

product, Acthar, helps patients with serious,

difficult-to-treat medical conditions

A biopharmaceutical company whose

product, Acthar, helps patients with serious,

difficult-to-treat medical conditions

Questcor |

4

Questcor Overview

Flagship Product:

Flagship Product:

•

Profitable, cash flow positive, $209M* in cash, debt-free

•

Profitable, cash flow positive, $209M* in cash, debt-free

•

19 approved indications

•

19 approved indications

Key Markets:

Key Markets:

•

Multiple Sclerosis, Nephrotic Syndrome, Infantile Spasms

•

Several billion dollar market opportunity

•

Multiple Sclerosis, Nephrotic Syndrome, Infantile Spasms

•

Several billion dollar market opportunity

Strategy:

Strategy:

•

Grow Acthar sales in each key market

•

Develop other on-label markets for Acthar

•

Grow Acthar sales in each key market

•

Develop other on-label markets for Acthar

Financials:

Financials:

* As of 01/04/12 |

Multiple

Sclerosis (MS) Multiple Sclerosis (MS)

Nephrotic Syndrome (NS)

Nephrotic Syndrome (NS)

Infantile Spasms (IS)

Infantile Spasms (IS)

Systemic Lupus Erythematosus

Systemic Lupus Erythematosus

Questcor Strategy -

Pursue Acthar Markets

5 |

Acthar and

Multiple Sclerosis (MS) *Nickerson, et al (2011)

Neurodegenerative disorder

Acute treatment for relapses

Neurodegenerative disorder

Acute treatment for relapses

Potential

target for

43% get better or

43% get better or

much better

much better

27% get only a

27% get only a

little better

little better

30% stay the same

30% stay the same

or get worse

or get worse

6 |

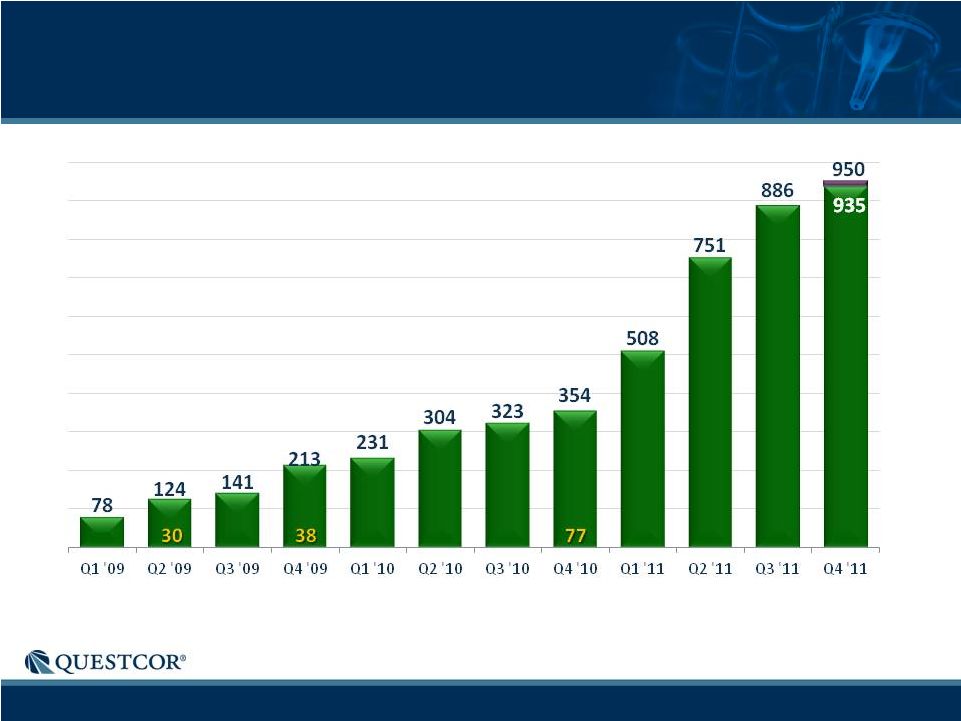

7

Paid Rxs

Paid Rxs

MS Scripts-Record of Consistent Growth

Notes: Historical trend information is not necessarily indicative of future results.

Chart includes "Related Conditions" - diagnoses that are either alternative

descriptions of the condition or are closely related to the medical condition which is the focus of the chart.

Yellow numbers in the bars show the number of MS sales

representatives making calls for the majority of the quarter

|

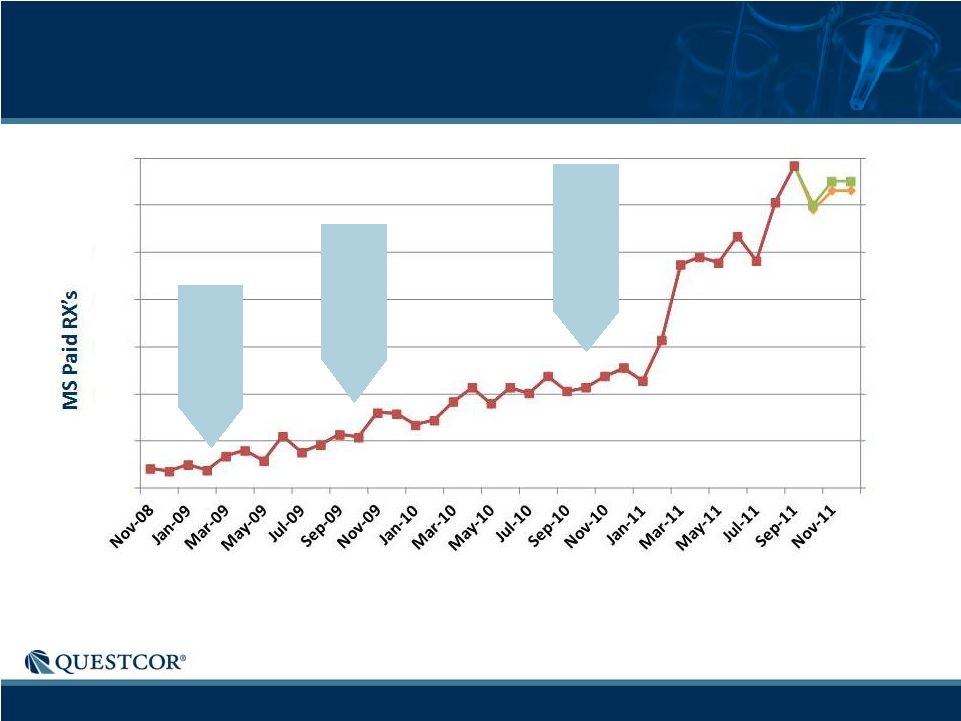

8

15-30

reps

30-38

reps

38-77

reps

Monthly MS Scripts History

0

50

100

150

200

250

300

350

0

50

100

150

200

250

300

350

Notes: Historical trend information is not necessarily indicative of future results.

Chart includes "Related Conditions" - diagnoses that are either alternative

descriptions of the condition or are closely related to the medical condition which is the focus of the chart.

8 |

•

Characterized by excessive spilling of protein

from the kidneys into the urine (proteinuria)

•

Can result in end-stage renal disease (ESRD),

dialysis, transplant

•

Significant unmet need

–

Few treatment options

–

Goal of therapy is the significant reduction

of proteinuria

•

Characterized by excessive spilling of protein

from the kidneys into the urine (proteinuria)

•

Can result in end-stage renal disease (ESRD),

dialysis, transplant

•

Significant unmet need

–

Few treatment options

–

Goal of therapy is the significant reduction

of proteinuria

Acthar and Nephrotic Syndrome (NS)

9 |

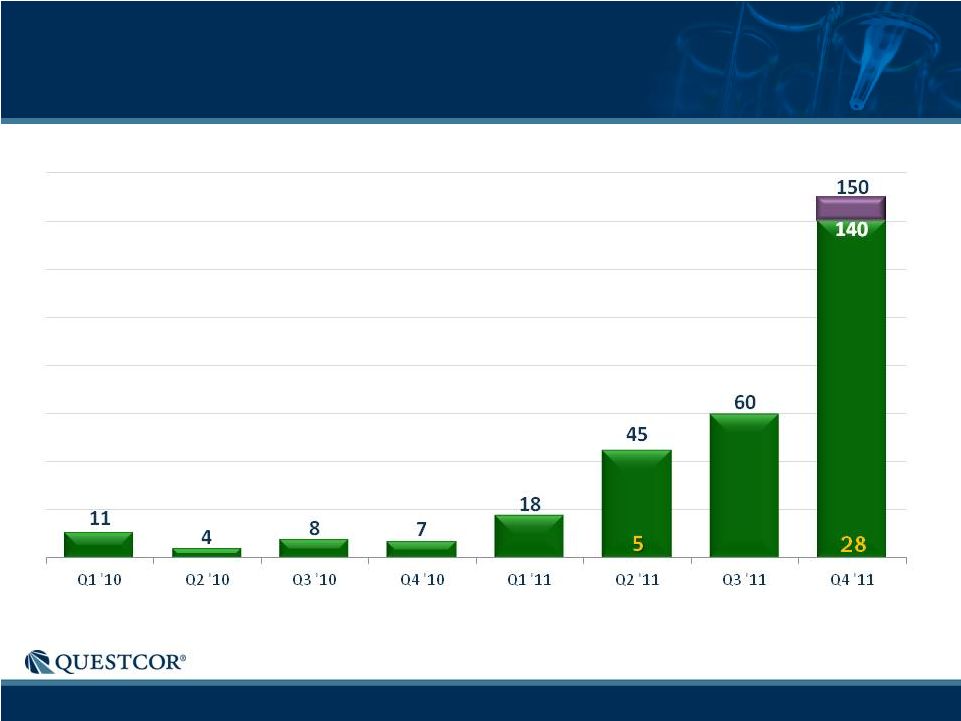

10

Paid Rxs

Paid Rxs

NS Scripts-Strong Q4 Growth

Yellow numbers in the bars show the number of NS sales

representatives making calls for the majority of the quarter. Q3 ‘11

included expansion and training of new sales people.

Notes: Historical trend information is not necessarily indicative of future results.

Chart includes "Related Conditions" - diagnoses that are either alternative

descriptions of the condition or are closely related to the medical condition which is the focus of the chart. |

11

•

FDA approval 10/15/10

•

Devastating, refractory form of childhood epilepsy

•

IS not responsive to standard anti-epileptic drugs

•

Unsuccessful treatment may leave infant with permanent

developmental disabilities

•

Considered a medical emergency

•

Ultra-rare orphan disorder

•

About half of IS patients receive Acthar via Acthar patient

support programs and Medicaid

•

FDA approval 10/15/10

•

Devastating, refractory form of childhood epilepsy

•

IS not responsive to standard anti-epileptic drugs

•

Unsuccessful treatment may leave infant with permanent

developmental disabilities

•

Considered a medical emergency

•

Ultra-rare orphan disorder

•

About half of IS patients receive Acthar via Acthar patient

support programs and Medicaid

Acthar and Infantile Spasms (IS)

11 |

12

•

Acthar currently used to treat 40-50% of IS patients

•

Targeting select institutions

•

Significant variability in quarterly Rxs

•

Q4-2011 paid Rxs above historic range

IS Scripts-Higher numbers in H2 2011 |

13

•

High unmet need; difficult to treat

•

Serious health risk if unsuccessfully treated

•

Multiple on-label indications for Acthar

–

Exacerbations

–

Maintenance therapy

–

Lupus nephritis

•

Large patient population

•

High unmet need; difficult to treat

•

Serious health risk if unsuccessfully treated

•

Multiple on-label indications for Acthar

–

Exacerbations

–

Maintenance therapy

–

Lupus nephritis

•

Large patient population

Systemic Lupus Erythematosus (Lupus) |

14

Financials

Profitable

Profitable

Debt Free

Debt Free

Cash Flow Positive

Cash Flow Positive |

15

Q3 –

2011

Q3 –

2010

Net Sales ($M)

$59.8

$31.3

Gross Margin

94%

93%

Operating Income ($M)

$33.6

$16.8

Fully Diluted, GAAP EPS

$0.35

$0.18

Q3-2011 Financial Results

•

Third quarter vials shipped: 2,910

•

Third quarter cash flow from operations: $32.6M

•

Channel inventory estimated to be within historic range

•

Medicaid reserves continue to appear adequate

•

No shares repurchased

•

Third quarter vials shipped: 2,910

•

Third quarter cash flow from operations: $32.6M

•

Channel inventory estimated to be within historic range

•

Medicaid reserves continue to appear adequate

•

No shares repurchased

Record Net Sales (up 91%) and Solid Earnings (EPS up 94%)

Record Net Sales (up 91%) and Solid Earnings (EPS up 94%) |

16

01/04/12

Cash / ST Investments

$209M*

Accounts Receivable

$28M

Questcor is Cash Flow Positive

Debt-free balance sheet

Debt-free balance sheet

*After return of $78 million of cash to shareholders through share repurchases.

*After return of $78 million of cash to shareholders through share repurchases.

16 |

17

•

2.2 Million Preferred share buyback

•

13.2 Common share buyback

•

$78 million returned to shareholders in stock buybacks

•

63.6

million shares currently outstanding

•

4.3 million shares remain on buyback authorization

•

2.2 Million Preferred share buyback

•

13.2 Common share buyback

•

$78 million returned to shareholders in stock buybacks

•

63.6

million shares currently outstanding

•

4.3 million shares remain on buyback authorization

Share Repurchases: 15 Million Shares

Repurchased shares significantly improved EPS

Repurchased shares significantly improved EPS |

18

•

Paid Rxs (Approximate)

–

MS—935-950

•

October 295-300

•

November 320-325

•

December 320-325

–

NS—140-150

–

IS—120-125

•

3,360 Vials Shipped

•

Operating expenses expected to be up

20-30% from Q3-2011

•

Paid Rxs (Approximate)

–

MS—935-950

•

October 295-300

•

November 320-325

•

December 320-325

–

NS—140-150

–

IS—120-125

•

3,360 Vials Shipped

•

Operating expenses expected to be up

20-30% from Q3-2011

Preliminary Q4-2011 Operating Metrics |

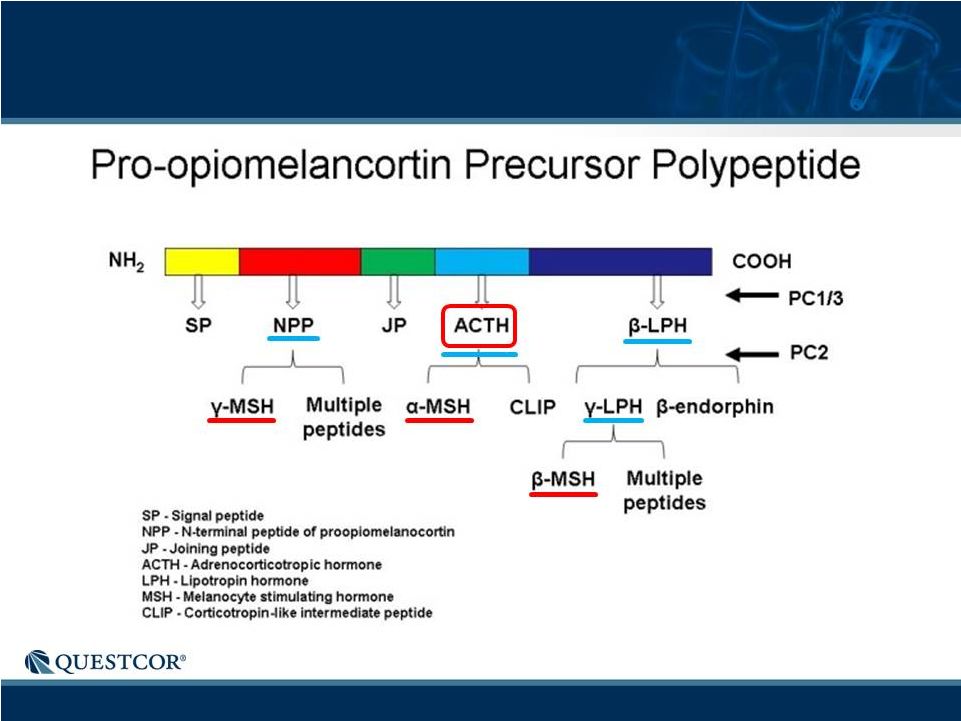

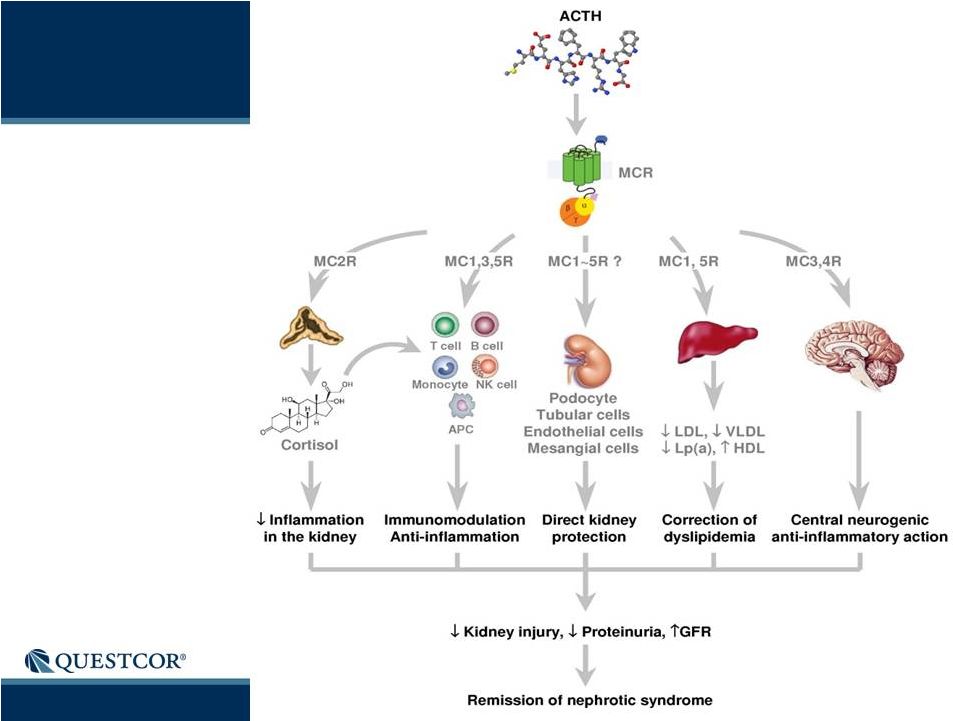

19

How Does Acthar Work?

•

Acthar treats autoimmune conditions across a variety of organ systems (CNS,

kidney, etc.)

•

Acthar appears to modulate the immune system and associated inflammatory

response through binding to melanocortin receptors

•

The

primary

melanocortin

peptide

(ACTH)

in

Acthar

binds

to

all

5

melanocortin

receptors (MCR1-5); other active peptides are in Acthar as well

–

Indirect effect: Acthar triggers the production of cortisol and

other adrenal

compounds through binding to MCR2 receptors

–

Direct effect: Acthar acts directly at the cellular level by binding to melanocortin

receptors on immune cells and cells in the targeted tissues (e.g., kidney podocytes)

•

All the active ingredients of Acthar have yet to be fully characterized and the

mechanism of action and pharmacokinetic profile of Acthar are not fully known

•

Acthar treats autoimmune conditions across a variety of organ systems (CNS,

kidney, etc.)

•

Acthar appears to modulate the immune system and associated inflammatory

response through binding to melanocortin receptors

•

The

primary

melanocortin

peptide

(ACTH)

in

Acthar

binds

to

all

5

melanocortin

receptors (MCR1-5); other active peptides are in Acthar as well

–

Indirect effect: Acthar triggers the production of cortisol and

other adrenal

compounds through binding to MCR2 receptors

–

Direct effect: Acthar acts directly at the cellular level by binding to melanocortin

receptors on immune cells and cells in the targeted tissues (e.g., kidney podocytes)

•

All the active ingredients of Acthar have yet to be fully characterized and the

mechanism of action and pharmacokinetic profile of Acthar are not fully known

|

20

Generic Pathway

Requires reverse engineering

--

a difficult barrier

Must prove pharmaceutical &

biological equivalence

Immune system impact unknown

Generic Pathway

Requires reverse engineering

--

a difficult barrier

Must prove pharmaceutical &

biological equivalence

Immune system impact unknown

New Chemical Entity or

Biosimilar Pathway

Trial(s) required

Limited exclusivity

Results in duopoly

New Chemical Entity or

Biosimilar Pathway

Trial(s) required

Limited exclusivity

Results in duopoly

SUBSTITUTABILITY

SUBSTITUTABILITY

SINGLE INDICATION

COMPETITION

SINGLE INDICATION

COMPETITION

Competitive Pathways

Acthar competitive barrier similar to Premarin |

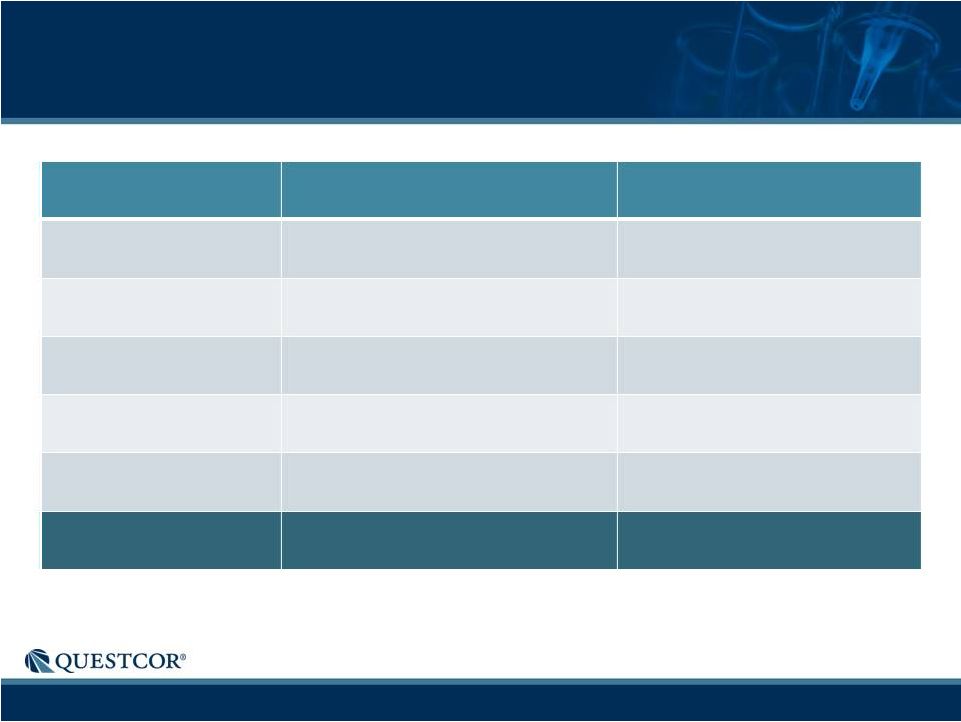

21

Acthar Market Opportunity

Market

Rx Value

Market Size

MS

$40-50K

$1B+

NS

$150-250K

$1B+

IS

$100-125K

$100M

Lupus

Unknown

Unknown

Other

Various

Unknown

Total

$2B+ |

22

Market

Approximate

Annualized Net Sales

Run Rate*

Approximate

Annualized Level of

Business**

MS

$145-160M

$145-160M

NS

$60-70M

$100-110M

IS

$40-50M

$40-50M

NS Business Already Significant

Note: Figures do not based on actual net sales ranges for the quarter or year ended December

31, 2011 * Figures based on estimates of vials shipped to patients within

each therapeutic area in the quarter, multiplied by 4.

** Figures represent Q4-2011 new paid prescriptions times estimated vials per script over

treatment regimen, multiplied by 4. |

23

•

Expand NS promotion effort

•

Expand MS promotion effort

•

Maintain IS promotion effort

•

Develop pilot rheumatology promotion activity

•

Develop other markets for Acthar

Acthar is its own pipeline with many other on-label indications

and many possible other therapeutic uses

Further define and develop the unique characteristics of Acthar

•

No unrelated business development efforts planned

•

Expand NS promotion effort

•

Expand MS promotion effort

•

Maintain IS promotion effort

•

Develop pilot rheumatology promotion activity

•

Develop other markets for Acthar

Acthar is its own pipeline with many other on-label indications

and many possible other therapeutic uses

Further define and develop the unique characteristics of Acthar

•

No unrelated business development efforts planned

Strategic Plan-

Focus on the Embedded Pipeline in Acthar |

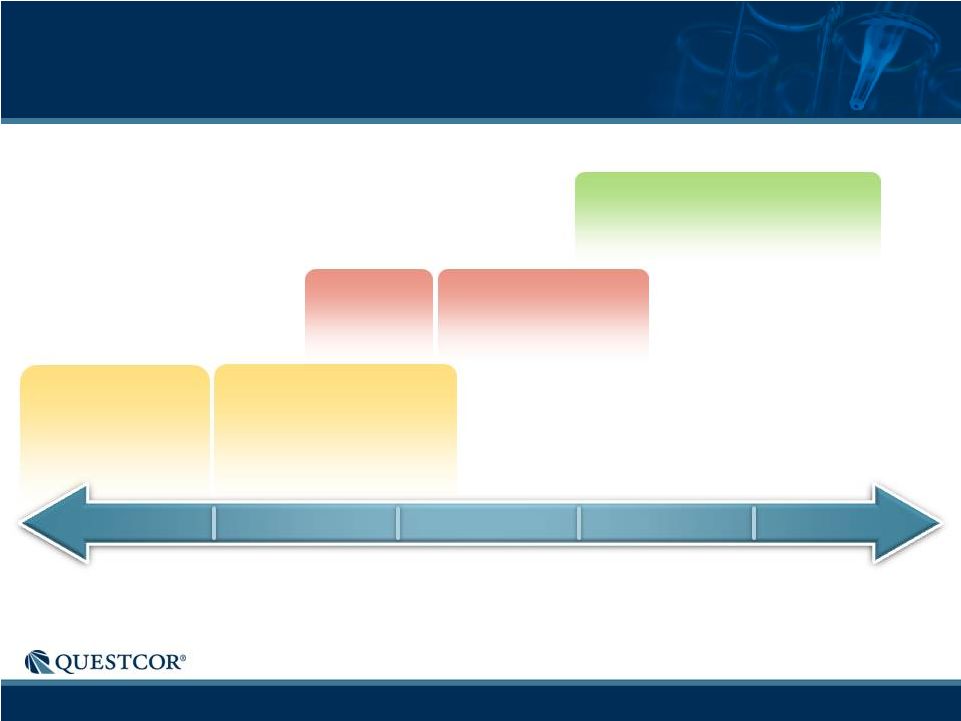

24

Possible Rheumatology

Possible Rheumatology

Sales Pilot

Sales Pilot

Neuro Hiring &

Neuro Hiring &

Training

Training

Neuro

Neuro

Sizing &

Sizing &

Alignment

Alignment

Neph Hiring &

Neph Hiring &

Training

Training

Neph Sizing &

Neph Sizing &

Alignment

Alignment

Sales Force Expansion-

Preliminary Outlook for 2012

Q1-12

Q1-12

Q2

Q2

Q3

Q3

Q4

Q4

Q1-13

Q1-13 |

25

Acthar has sustainable competitive

Acthar has sustainable competitive

advantages-without FDA approval risk

advantages-without FDA approval risk

Acthar is approved for 19 indications-many

Acthar is approved for 19 indications-many

in large markets with sizable unmet need

in large markets with sizable unmet need

Sales in MS and NS are growing rapidly,

Sales in MS and NS are growing rapidly,

yet market penetration is low

yet market penetration is low

Developing new vertical market -

Developing new vertical market -

Lupus

Lupus

High margins provide good

High margins provide good

operating leverage

operating leverage

Profitable, cash flow positive, no debt

Profitable, cash flow positive, no debt

Investment Highlights |

26

26

January 2012

JP Morgan Healthcare Conference

NASDAQ:

QCOR

NASDAQ:

QCOR |

27

ACTH is a Melanocortin Peptide Derived from

Pro-opiomelanocortin (POMC) in the Pituitary |

28

MCR

Prevalent Tissue/Cells with Receptor

MC1R

Podocytes

Renal Mesangial Cells

Endothelial Cells (Glomerular, Tubular, Vascular)

Tubular Epithelial Cells

Macrophages

Melanocytes

Immune/Inflammatory Cells

Kerantinocytes

CNS

MC2R

Adrenal Cortex (Steroidogenesis), Adipocytes

Adapted from Gong 2011, Catania 2004, Schioth 1997

Affinity of Melanocortin Peptides and

Distribution of Receptor Subtypes |

29

MCR

Prevalent Tissue/Cells with Receptor

MC3R

CNS

Macrophages

MC4R

Podocytes

Renal Mesangial Cells (?)

Endothelial Cells (Glomerular, Tubular)

Tubular Epithelial Cells

CNS

MC5R

CNS

Exocrine Glands

Lymphocytes

Podocytes

Adapted from Gong 2011, Catania 2004, Schioth 1997

Affinity of Melanocortin Peptides and

Distribution of Receptor Subtypes |

30

MOA of

Acthar in NS

Adapted From Gong 2011

Acthar,

Melanocortin Peptides

Acthar,

Melanocortin Peptides |