Attached files

| file | filename |

|---|---|

| 8-K - EXHIBIT 8-K - Impax Laboratories, LLC | c26614e8vk.htm |

Exhibit 99.1

| ...Improving Health Through Technology J.P. Morgan Healthcare Conference January 9, 2012 Larry Hsu - President & CEO Art Koch - Chief Financial Officer |

| 2 Safe Harbor Statement "Safe Harbor" Statement under the Private Securities Litigation Reform Act of 1995: To the extent any statements made in this presentation contain information that is not historical, these statements are forward-looking in nature and express the beliefs and expectations of management. Such statements are based on current expectations and involve a number of known and unknown risks and uncertainties that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the effect of current economic conditions on the Company's industry, business, financial position and results of operations, the ability to maintain an effective system of internal control over financial reporting, fluctuations in revenues and operating income, the ability to successfully develop and commercialize pharmaceutical products, reductions or loss of business with any significant customer or a reduction in sales of any significant product, the impact of competition, the ability to sustain profitability and positive cash flows, any delays or unanticipated expenses in connection with the operation of the Taiwan facility, the effect of foreign economic, political, legal and other risks on operations abroad, the uncertainty of patent litigation, consumer acceptance and demand for new pharmaceutical products, the difficulty of predicting Food and Drug Administration filings and approvals, the inexperience of the Company in conducting clinical trials and submitting new drug applications, the ability to successfully conduct clinical trials, reliance on alliance and collaboration agreements, the availability of raw materials, the ability to comply with legal and regulatory requirements governing the pharmaceutical and healthcare industries, the regulatory environment, the ability to protect the Company's intellectual property, exposure to product liability claims and other risks described in the Company's periodic reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as to the date on which they are made, and Impax undertakes no obligation to update publicly or revise any forward- looking statement, regardless of whether new information becomes available, future developments occur or otherwise. The following described agent(s) and/or use(s) is investigational, as efficacy and safety have not been established. This information is what is known or hypothesized about each agent's biologic mechanisms or effects and is not intended to convey clinical efficacy and safety prior to any approval by applicable health authorities. There is no guarantee that the agent(s) will successfully complete clinical development, gain applicable health authority approval, or become available commercially. Note: All product sales data included herein are derived from data published by Wolters Kluwer Health for the 12 months ended November 2011. Trademarks referenced herein are the property of their respective owners. (c)2012 Impax Laboratories, Inc. All Rights Reserved. |

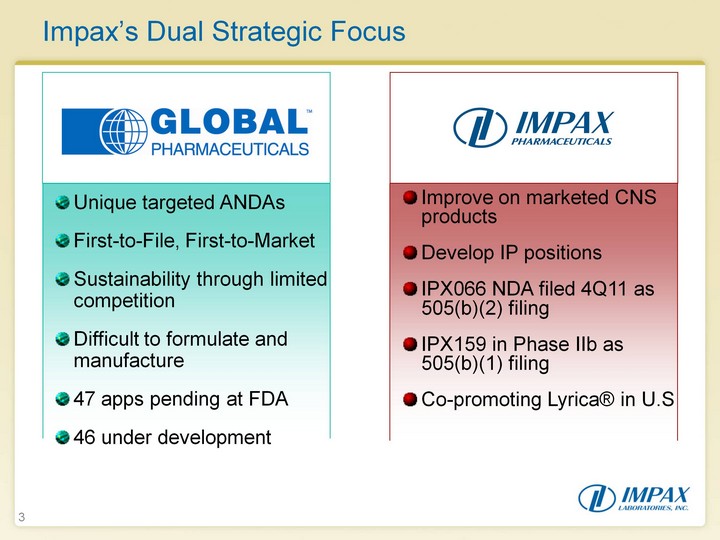

| 3 Impax's Dual Strategic Focus Unique targeted ANDAs First-to-File, First-to-Market Sustainability through limited competition Difficult to formulate and manufacture 47 apps pending at FDA 46 under development Improve on marketed CNS products Develop IP positions IPX066 NDA filed 4Q11 as 505(b)(2) filing IPX159 in Phase IIb as 505(b)(1) filing Co-promoting Lyrica(r) in U.S |

| Quality Improvements Responded to all warning letter observations Upgraded quality and operations management teams Implemented global Quality Improvement Program Continue to update and communicate with FDA Goal to close out warning letter by end of February 2012 Timing dependent on FDA availability for review 4 Update on Quality Improvements |

| ...A Leader in Generic Medicines |

| 6 Generic Growth Initiatives |

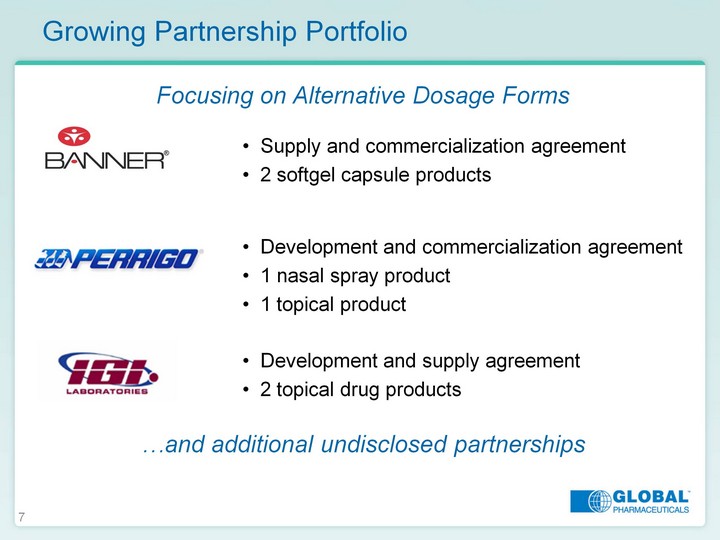

| Growing Partnership Portfolio 7 Supply and commercialization agreement 2 softgel capsule products Development and commercialization agreement 1 nasal spray product 1 topical product Development and supply agreement 2 topical drug products Focusing on Alternative Dosage Forms ...and additional undisclosed partnerships |

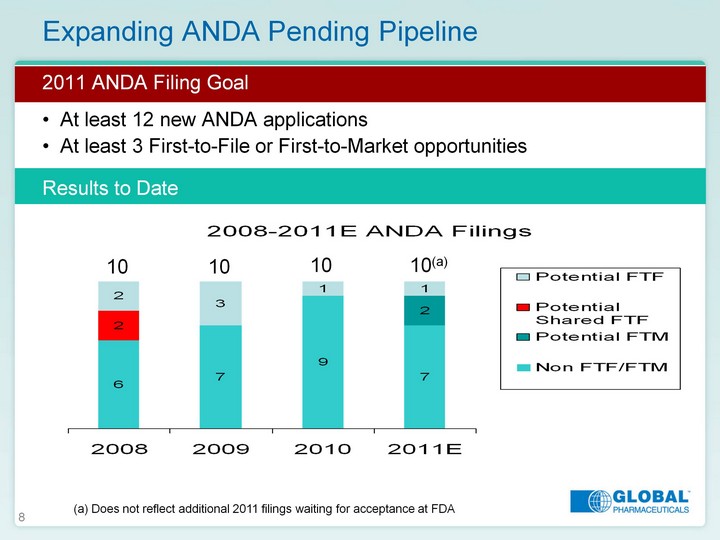

| 8 Expanding ANDA Pending Pipeline 2011 ANDA Filing Goal At least 12 new ANDA applications At least 3 First-to-File or First-to-Market opportunities Results to Date 2008 2009 2010 2011E Non FTF/FTM 6 7 9 7 Potential FTM 2 Potential Shared FTF 2 Potential FTF 2 3 1 1 10 10 10 10(a) (a) Does not reflect additional 2011 filings waiting for acceptance at FDA |

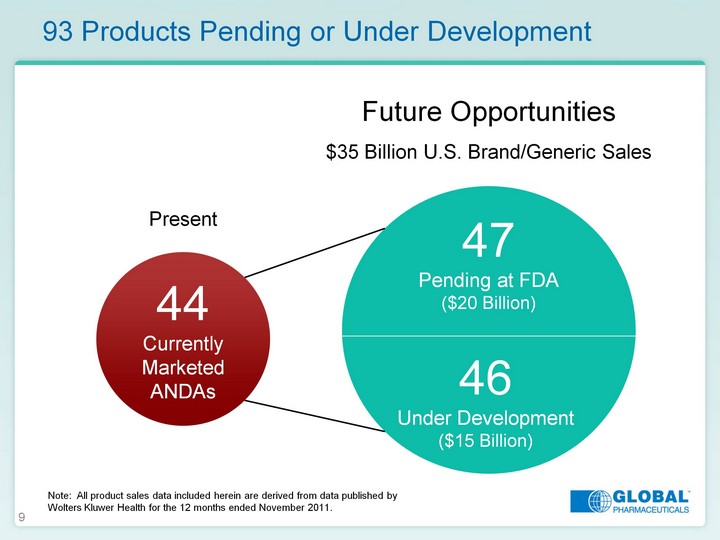

| 9 93 Products Pending or Under Development 44 Currently Marketed ANDAs 46 Under Development ($15 Billion) 47 Pending at FDA ($20 Billion) Present Future Opportunities $35 Billion U.S. Brand/Generic Sales Note: All product sales data included herein are derived from data published by Wolters Kluwer Health for the 12 months ended November 2011. |

| 10 Disclosed ANDA Pending Pipeline Offers Growth Opportunities Disclosed ANDA Pending Pipeline Offers Growth Opportunities Disclosed ANDA Pending Pipeline Offers Growth Opportunities Impax is aware of additional lawsuits containing similar patent infringement claims and believes filers of ANDAs will be entitled to 180 days of exclusivity. Note: All product sales data included herein are derived from data published by Wolters Kluwer Health for the 12 months ended November 2011. |

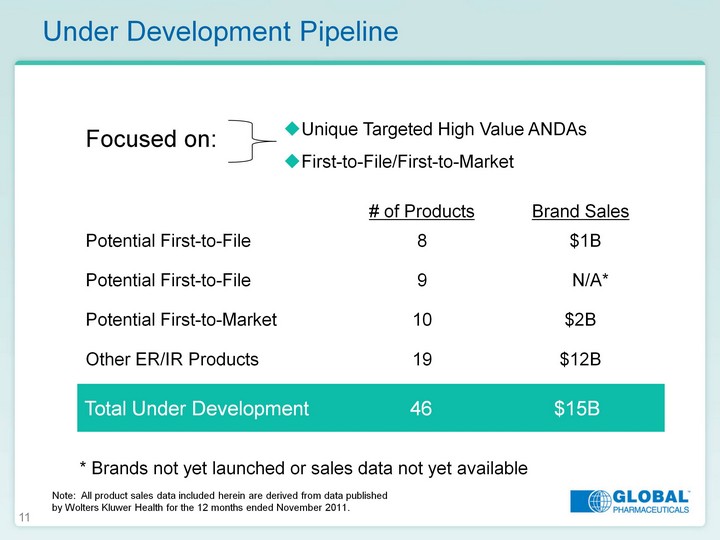

| 11 Under Development Pipeline Total Under Development 46 $15B * Brands not yet launched or sales data not yet available Unique Targeted High Value ANDAs First-to-File/First-to-Market First-to-File/First-to-Market First-to-File/First-to-Market Focused on: Note: All product sales data included herein are derived from data published by Wolters Kluwer Health for the 12 months ended November 2011. |

| ...Advancing CNS Treatment |

| 13 Brand Growth Initiatives |

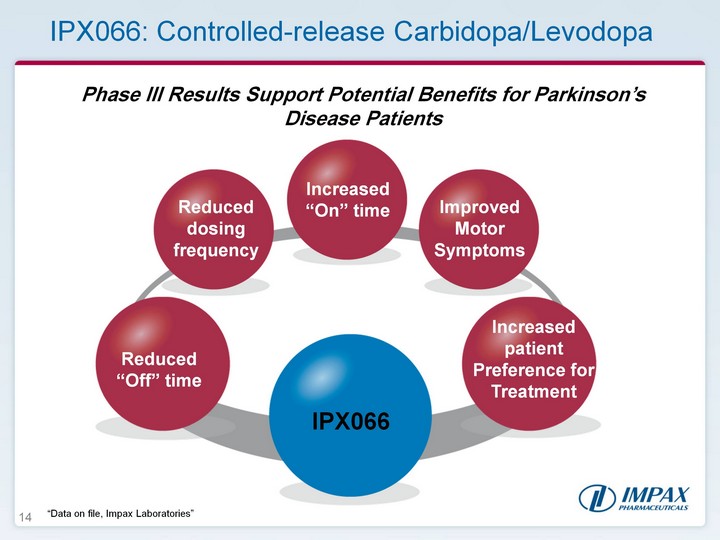

| 14 Phase III Results Support Potential Benefits for Parkinson's Disease Patients Reduced "Off" time Reduced dosing frequency Increased patient Preference for Treatment Increased "On" time IPX066: Controlled-release Carbidopa/Levodopa IPX066 Improved Motor Symptoms "Data on file, Impax Laboratories" |

| 15 IPX066: Next Steps in 2012 Dec. 2011 Feb./Mar -2012 4Q 2012 Throughout 2012 NDA filed Pre-launch preparation and launch planning Building marketing and sales team Conducting commercial pre-launch activities Expected FDA acceptance of NDA Possible NDA approval |

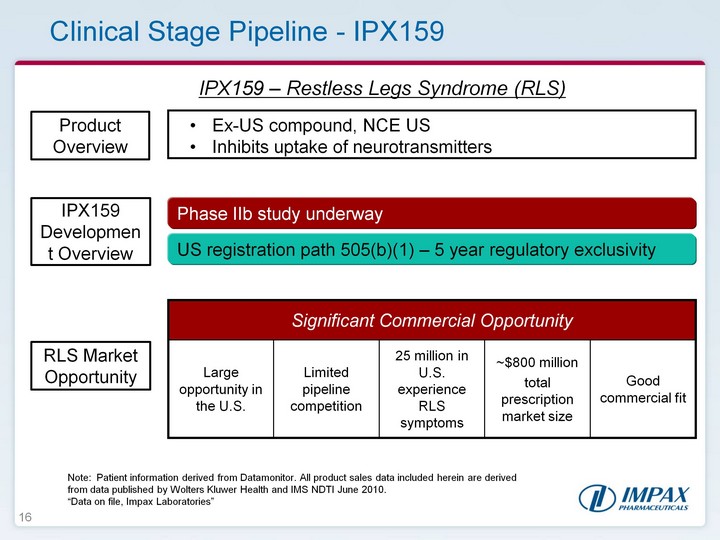

| 16 Clinical Stage Pipeline - IPX159 IPX159 - Restless Legs Syndrome (RLS) IPX159 Development Overview Product Overview Ex-US compound, NCE US Inhibits uptake of neurotransmitters RLS Market Opportunity US registration path 505(b)(1) - 5 year regulatory exclusivity Significant Commercial Opportunity Significant Commercial Opportunity Significant Commercial Opportunity Significant Commercial Opportunity Significant Commercial Opportunity Large opportunity in the U.S. Limited pipeline competition 25 million in U.S. experience RLS symptoms ~$800 milliontotal prescription market size Good commercial fit Note: Patient information derived from Datamonitor. All product sales data included herein are derived from data published by Wolters Kluwer Health and IMS NDTI June 2010. "Data on file, Impax Laboratories" Phase IIb study underway |

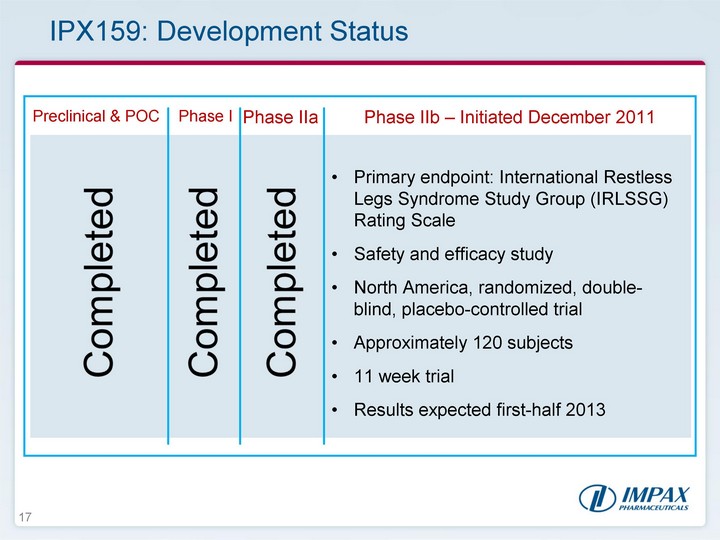

| 17 IPX159: Development Status Preclinical & POC Phase I Phase IIa Phase IIb - Initiated December 2011 Completed Completed Completed Primary endpoint: International Restless Legs Syndrome Study Group (IRLSSG) Rating Scale Safety and efficacy study North America, randomized, double- blind, placebo-controlled trial Approximately 120 subjects 11 week trial Results expected first-half 2013 |

| 2012 Financial Outlook ...Improving Health Through Technology |

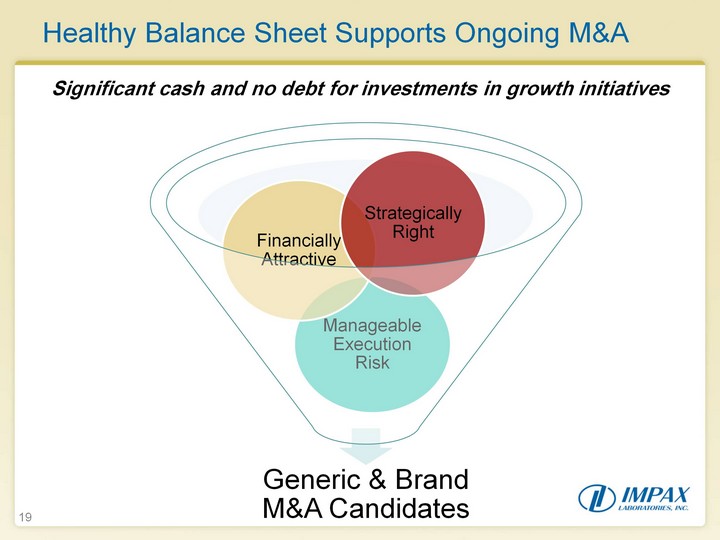

| Healthy Balance Sheet Supports Ongoing M&A 19 Significant cash and no debt for investments in growth initiatives |

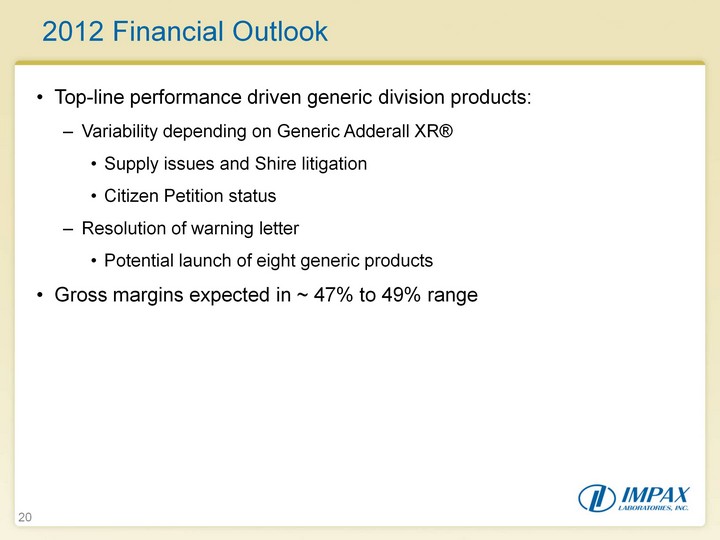

| 20 2012 Financial Outlook Top-line performance driven generic division products: Variability depending on Generic Adderall XR(r) Supply issues and Shire litigation Citizen Petition status Resolution of warning letter Potential launch of eight generic products Gross margins expected in ~ 47% to 49% range |

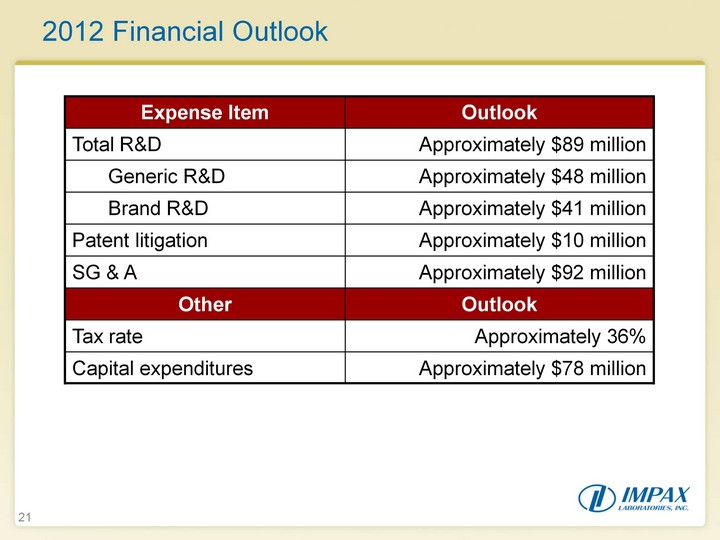

| 21 2012 Financial Outlook 2012 Financial Outlook |

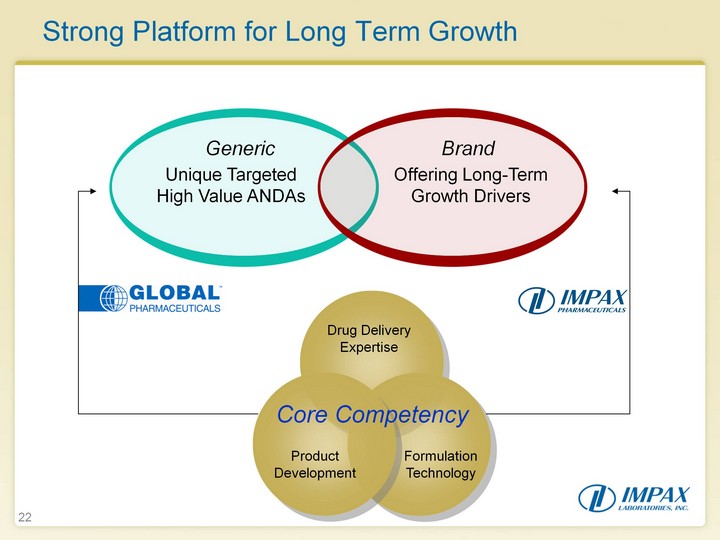

| 22 22 Strong Platform for Long Term Growth Unique Targeted High Value ANDAs Offering Long-Term Growth Drivers Generic Brand Drug Delivery Expertise Product Development Formulation Technology Core Competency |