Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CADENCE PHARMACEUTICALS INC | d279355d8k.htm |

Improving the lives of hospitalized patients

Corporate Overview

January 2012

Exhibit 99.1 |

2

This presentation includes forward-looking statements, which are based on our

current beliefs and expectations. Such statements include, without

limitation, statements regarding: the anticipated U.S. market opportunity for OFIRMEV; our projections regarding sales and the

number of formulary approvals of OFIRMEV, and the potential for those formulary

approvals to create early and broad market adoption and rapidly accelerate

sales of OFIRMEV; the potential for us to ultimately acquire Incline Therapeutics, Inc. or other product candidates; the

sufficiency

of

our

capital

resources

to

fund

our

operations;

all

of

our

financial

estimates;

and

our

strategy

for

building

a

long-term

hospital

pain franchise.

You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. Our actual future

results may differ materially from our current expectations due to the risks and uncertainties inherent in our business. In addition, past

results and trends may not be indicative or a guarantee of future results or

trends. These risks include, but are not limited to: our dependence

on

the

successful

commercialization

of

OFIRMEV,

which

is

our

only

product;

our

ability

to

achieve

broad

market

acceptance

and generate revenues from sales of OFIRMEV; our ability to continue to increase

growth in sales of OFIRMEV; our ability to successfully enforce our

marketing exclusivities and intellectual property rights, and to defend the patents covering OFIRMEV, including our current

patent litigation; the potential product liability exposure associated with

OFIRMEV; the risk that we may not be able to raise sufficient capital

when

needed,

or

at

all;

and

other

risks

detailed

under

“Risk

Factors”

and

elsewhere

in

our

Annual

Report

on

Form

10-K

for

the

period

ended December 31, 2010, and our other filings made with the Securities and

Exchange Commission from time to time. All forward-looking statements

are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of

Section 21E of the Private Securities Litigation Reform Act of 1995 and we

undertake no obligation to revise or update this presentation to reflect

events or circumstances after the date hereof. Caution on forward-looking

statements CADENCE and OFIRMEV are trademarks of

Cadence Pharmaceuticals, Inc. ©

2011 Cadence Pharmaceuticals, Inc. All rights reserved.

®

® |

3

Company Highlights

Specialty biopharmaceutical company, focused on developing and

commercializing proprietary therapeutics utilized in the hospital setting

–

Sustainable

core

business

of

OFIRMEV

®

with

opportunities

to

diversify

product portfolio

OFIRMEV -

a differentiated, new class of IV pain medication

–

Non-opioid, non-NSAID analgesic

–

Foundation for multi-modal approach to pain management

Strong uptake of hospital formulary adoption and positive physician

feedback

Solid revenue growth driven by a growing customer base, increasing re-

order rates and penetration in a variety of surgical settings

Experienced management team with a track record of commercializing

hospital-based products |

4

Overview of Cadence

OFIRMEV

®

(IV Acetaminophen)

–

U.S. and Canadian rights licensed from Bristol Myers Squibb

–

FDA approved in Nov. 2010 and commercially launched Jan. 2011

with broad indications for management of pain and fever

–

Established

hospital

sales

team

with

extensive

relationships

and

years

of hospital sales experience

Option to acquire Incline Therapeutics

–

IONSYS™

transdermal PCA system

–

Represents a potentially significant commercial opportunity and an

excellent strategic fit with OFIRMEV

IONSYS™

is a trademark of Incline Therapeutics, Inc. |

5

OFIRMEV

®

: product overview

OFIRMEV

®

(acetaminophen) injection

–

Proprietary IV acetaminophen formulation

–

First and only IV formulation of acetaminophen

approved in the United States

–

New class of IV medication

•

non-narcotic / opioid

•

non-NSAID

–

Same formulation of IV acetaminophen marketed

by

BMS

in

Europe

since

2002

as

Perfalgan

™

PERFALGAN™

is a trademark of Bristol Myers Squibb Company. |

6

OFIRMEV

®

:

strong foundation for commercial success

•

Sales force average >10 years hospital selling experience

•

Extensive relationships, significant overlap with prior

territory

•

Substantial hospital commercial experience throughout

management

–

CEO > 25 years, CCO > 15 years, VP of Sales > 25 years

•

$10.75/ vial

•

Diagnosis-related group payment range for common

procedures: $12,000 -

$31,000

(5)

•

OFIRMEV may help reduce post surgical ambulation

time

(6)

and

time

to

extubation

in

the

ICU

(3)

•

Significant

pain

relief

•

Reduced

opioid

consumption*

-4

•

Improved patient satisfaction

1,2

* Clinical benefit of opioid reduction not demonstrated

References: (1) Sinatra, et al., 2005, (2) Data on file, (3) Memis, et al., 2010,

(4) Atef, et al., 2008 (5) Birkmeyer,et al., 2010 (6) Ohnesorge, et al.,

2009 Effective Pain

Control

Experienced

Hospital Sales

Force

Economic

Value

1

1 |

7

OFIRMEV

®

: indication supports message

Broad Indication

•

Mild to moderate pain

•

Moderate to severe pain with adjunctive opioids

•

Reduction of fever

•

Adults and children 2 and older

Message

•

Significant pain relief

•

Reduced opioid consumption*

•

Improved patient satisfaction

•

Established safety profile

* Clinical benefit of opioid reduction not demonstrated

|

8

Limitations of other IV pain therapies

Sedation

Nausea

Vomiting

Constipation

Headache

Cognitive impairment

Respiratory depression

Opioids

NSAIDs

Black Box Warning

Bleeding

GI complications

Kidney complications

Cardiovascular risks

Prolonged recovery

Increased length of stay

Higher costs to the institution

Limited use |

9

Pain Intensity

Current US Approach

Current EU Approach

Severe

Opioids

IV

acetaminophen

+ opioids

Moderate

Opioids

IV

acetaminophen

+/-

opioids*

Mild

Opioids

IV

acetaminophen

Multi-modal analgesia:

the norms

* First post-operative analgesic drug, then add opioids if necessary

|

10

Sinatra,

et

al.

Anesthesiology,

V

102,

No.

4,

April 2005.

placebo

IV acetaminophen

Placebo-controlled, total hip or total knee replacement

(n=49/52)

p<0.001

.

.

Sinatra Study:

pivotal acute pain clinical trial

* Post hoc analysis based on currently acceptable regulatory

endpoint ** Clinical benefit of opioid reduction was not demonstrated

IV acetaminophen

placebo

p-value

Sum of pain intensity differences over 24hrs*

-2.8

-242.3

<0.001

Weighted sums of pain relief over 6hrs

6.6

2.2

<0.05

41%

23%

<0.01

Morphine consumption over 24hrs**

38.3 mg(33%

)

57.4 mg

<0.001

Safety

IV acetaminophen comparable to placebo

Patient Satisfaction (Good/excellent – 24hrs) |

11

Consistent opioid reduction across studies

*Reduction

in

number

of

patients

requiring

analgesic

rescue

with

ketorolac

and

fentanyl

1)

Sinatra, et all.,2005;

2)

Memis, et al., 2005;

3)

Viscusi, et al., 2005;

4)

Hong, et a., 2010

5)

Atef, et al., 2008

Pain Intensity

Opioid Reduction*

Time

p Value

Severe

33%

1

24h

<0.01

61%

2

24h

<0.05

Moderate

53%

3

0-6h

0.016

Mild

86%

4

24h

<0.001

78%

5

24h

<0.001 |

12

OFIRMEV

®

:

economic

value

Placebo-controlled studies using IV acetaminophen demonstrated

results that may be associated with possible hospital cost savings:

–

Decreased opioid consumption *

•

Total hip/knee replacement

(1)

•

Total hip replacement

(2, 3)

•

Adult tonsillectomy

(4)

•

Endoscopic thyroidectomy

(5)

–

Decreased

time

in

PACU

(post-anesthesia

care

unit)

(6)

–

Decreased time to ambulation

(7)

–

Decreased time to extubation in ICU

(8)

* Note: Clinical

benefit of opioid reduction was not demonstrated

References: (1) Sinatra, et al., 2005; (2) Viscusi, et al., 2008; (3) Gimbel, et

al., 2008; (4) Atef, et al., 2007; (5) Hong, et al., 2010a; (6) Salihoglu,

et al., 2009; (7) Ohnesorge, et al., 2009; (8) Memis, et al., 2010

|

13

The UK experience

UK treatment paradigms for moderate

and acute pain are similar to those in

the US

–

Higher opioid than NSAID usage

–

Multimodal pain therapy

Perfalgan, BMY’s IV acetaminophen

–

Launched in 2004

–

Most share taken from opioids,

some from NSAIDS

Used alone and in combination with

opioids

–

Multimodal therapy provides broader

market opportunity

UK Injectable Analgesics

(Unit Share of Market)

Source: IMS data, 2009

2004

2009

Opioids

Perfalgan

NSAIDS

89%

2%

35%

1%

9%

63% |

14

Oral

opioids:

acetaminophen

combinations

dominate

Opioid-acetaminophen combinations

Opioid-only products

Opioid-NSAID combinations

74%

25%

1%

Source: IMS data, 2008.

74% of oral opioid doses sold in U.S. contain acetaminophen

Approximately 14.4 billion total doses sold in 2008

Acetaminophen + hydrocodone is the most frequently dispensed Rx

drug in the US (FDA, 2009) |

15

Hospital

products:

multi-step

launch

process

Regulatory

Approval

Physician

Access

Formulary

Access

Sales |

16

Stage III

Increase Doses Per

Patient

Stage II

Broaden Physician

Utilization

Stage I

Create Access

OFIRMEV

®

:

adoption

process |

17

OFIRMEV

®

:

strong early launch indicators

Rapid formulary adoption

–

On formulary in approx. 1,580 hospitals*

–

Mix of formulary wins is representative of overall target market

–

Includes major academic medical centers and large community

healthcare systems

Most hospitals approved OFIRMEV with minimal or no restrictions

–

Allows access across the hospital by range of physicians

–

Minimally restricted to patients who cannot take oral medication

Physician support and early experience positive

–

Physician support strong driver of formulary success

–

Physician feedback:

•

Significant pain relief

•

Utilization of less opioids

•

Improved patient satisfaction

–

Over 400,000 patients treated**

* Launch through December 31, 2011

** Based on our estimate of 2.5 doses per patient |

18

Revenue growth:

three main drivers

Growth in customer base

–

Number of unique customer accounts

in Q4 increased 23% from Q3 to

2,200+

Increase in frequency of product use

–

~1,600 of 2,200 hospitals reordered

product through end of Q4

Increase in average quantity of product

order per customer

–

Customer shift from adoption phase

toward use on broader patient

population

–

Anticipate increasing number of vials

per patient as adoption by surgeons

broadens

Product Revenue |

19

Formulary

approvals

have

exceeded

Company

projections

through

Q4

2011

–

Approx. 1,580

hospital

formulary

approvals

achieved

through

December

31,

2011

Rapid Formulary Penetration

Source: Cadence Internal Data |

20

OFIRMEV sales continue to accelerate

•

Q4

sales

exceeded

cumulative

sales

during

1

st

9

months

of

2011

Significant Sales Growth Through Q4

Source:

Wolters

Kluwer

Pharma

Solutions,

Source®

PHAST

Institution.

*December

sales

estimate

derived

from

Cadence

internal

data. |

21

Significant Growth in New Customers

Significant growth in new and repeat customers each quarter

23%

growth

in

unique

accounts

ordering

OFIRMEV

®

in

Q4

33% increase in accounts that placed multiple orders in Q4

|

22

Growing

demand:

consistent

order

frequency

growth

(est.) |

23

Growing demand: average order size growing

steadily Note: Sales data as reported through 12/22/12

|

24

Surgery penetration:

deepening penetration of a growing base of hospitals

* Assumptions:

# Patients

Treated

in

On-Formulary

Accts

=

Vial

Sales

in

On-Formulary

Accts

÷

2.5

vials/patient

Estimated U.S. Surgical Procedures = 30MM hospital-based surgical

procedures/yr. Estimated Procedures in On-Formulary Accts = [U.S.

Surgical Procedures] * [% Formulary penetration] Share

of

Procedures

=

#

Patients

Treated

in

On

Formulary

Accts

÷

Estimated

Procedures

in

On-Formulary

Accts

* Estimated 2.5 vials/patient and

30MM hospital-based surgical procedures/yr |

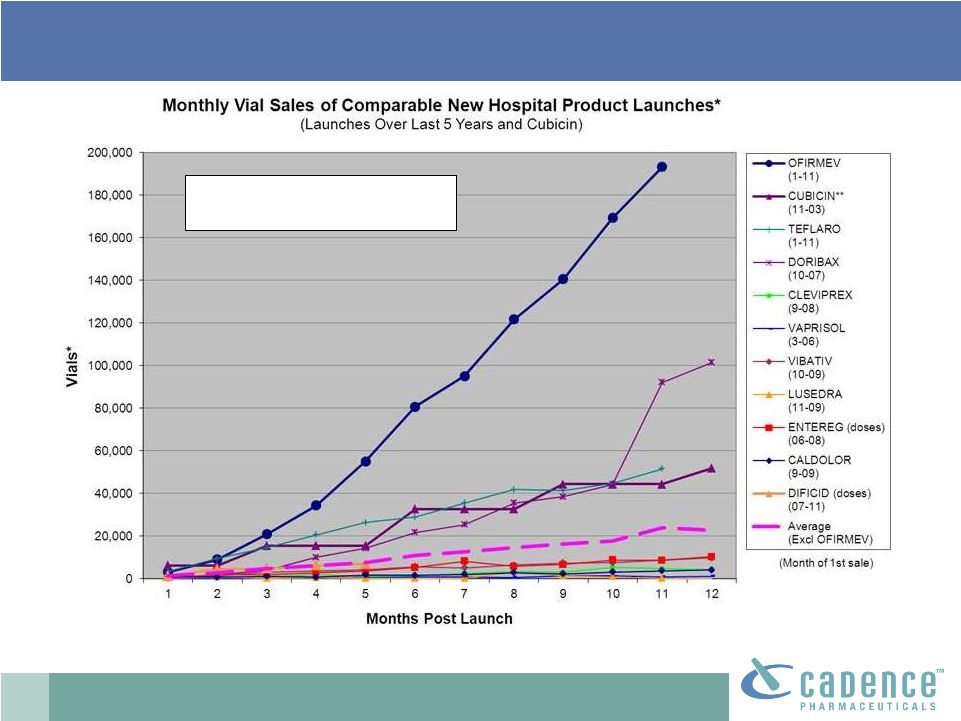

25

OFIRMEV

®

: vial sales off to strong start

* # of doses are shown for Entereg and Dificid, which are oral products

** Cubicin monthly sales are averaged within each quarter

OFIRMEV vs Avg:

7.8X

OFIRMEV Rank:

1

Source: Wolters Kluwer Pharma Solutions, Source® PHAST Institution. Cubist

Pharmaceuticals, Inc. Form 10-Q reports. Based on Cadence comparison to other

selected product launches in hospital market over period March 2006 – Dec 2011.

|

26

OFIRMEV

®

: strong revenue ramp

** Cubicin monthly sales are averaged within each quarter

OFIRMEV hospital sales growth compares favorably vs. recent launches

despite significantly lower price.

Source: Wolters Kluwer Pharma Solutions, Source® PHAST Institution. Cubist Pharmaceuticals, Inc.

Form 10-Q reports. Based on Cadence comparison to other selected product launches in

hospital market over period March 2006 – Dec 2011.

OPAT utilization from Cubist Corporate Presentation, Cubist.IP.9.06.

|

27

Experienced Management & Commercial Team

CEO > 25 years

CFO > 25 years

CMO > 25 years

Commercial Team

CCO > 15 years commercial management experience

VP Sales > 25 years sales management experience

3 Regional Business Directors:

–

Avg. 21 years industry experience, 13 years hospital sales management

experience

18 District Sales Managers:

–

Avg. 16 years industry experience, 7 years hospital sales management

experience

147 Hospital Sales Specialists -

extensive hospital selling experience |

28

Company Highlights

Specialty biopharmaceutical company, focused on developing and

commercializing proprietary therapeutics utilized in the hospital setting

–

Sustainable core business of OFIRMEV

®

with opportunities to diversify

product portfolio

OFIRMEV -

a differentiated, new class of IV pain medication

–

Non-opioid, non-NSAID analgesic

–

Foundation for multi-modal approach to pain management

Strong uptake of hospital formulary adoption and positive physician

feedback

Solid revenue growth driven by a growing customer base, increasing re-

order rates and penetration in a variety of surgical settings

Experienced management team with a track record of commercializing

hospital-based products |

29

Cadence:

financial

position

12 Months

Ended

12/31/10

(MM)

9 Months

Ended

9/30/11

(MM)

Net Product Revenue

$ 0.0

$

5.6

Operating expenses

$ 54.9

$ 68.0

Cash, cash equivalents &

short-term investments

$134.1

$145.0

(1)

Shares outstanding

63.1

63.6

(1)

Pro forma cash including net proceeds of $77.3MM raised in an equity follow-on

offering in November 2011. |