Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ISTA PHARMACEUTICALS INC | d274572d8k.htm |

Investor

Presentation December 2011

Exhibit 99.1 |

ISTA PHARMACEUTICALS

2

Certain statements contained herein are “forward-looking”

statements (as such term is defined in the Private Securities

Litigation Reform Act of 1995). Because such statements include

risks and uncertainties, actual results may differ materially from

those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially from those

expressed or implied by such forward-looking statements include,

but are not limited to, failure to initiate clinical studies, failure to

achieve positive results in clinical trials, failure to receive market

clearance from regulatory agencies, and those risks and

uncertainties discussed in filings made by ISTA Pharmaceuticals,

Inc.,

with the Securities and Exchange Commission.

Safe

Harbor

Statement |

ISTA PHARMACEUTICALS

3

3

1992

2000

2002

2004

2005

2009

2010

Founded as Advanced

Corneal Systems

Acquired ISTALOL & XIBROM

Name change

to

ISTA Pharmaceuticals, Inc.

IPO on NASDAQ

ISTALOL®

VITRASE®

XIBROM™

BEPREVE®

Revenue

>$100 million

BROMDAY™

ISTA

Profitable*

* On an adjusted cash net income basis

Company Timeline |

ISTA PHARMACEUTICALS

4

•

Thriving core Rx eye business, emerging Rx allergy franchise

–

Third largest branded Rx eye care company in U.S.

•

Obtained 5 Rx eye and allergy product approvals in 6 years

–

ISTALOL, VITRASE, XIBROM, BEPREVE, BROMDAY

–

Products are #1 or #2 in their markets with market share growth potential

•

Deep R&D pipeline of new product candidates

–

Anticipate 5 new products < 5 years

•

Assembled experienced management team, formidable specialty sales

force:

~ 340 employees –

half are field based

•

Five-year (2006 –

2011)* compounded growth rate of 38%

•

Achieved profitability in 2010**

* Based on estimated 2011 revenues

Rx = Prescription

** On an

adjusted cash net income basis

ISTA’s Track Record

of Success |

ISTA PHARMACEUTICALS

•

Highly successful switch from XIBROM to BROMDAY

•

BEPREVE projected to increase significantly over 2010

•

Strong pipeline progress, de-risking of programs

–

PROLENSA™

Phase 3 successful

–

BEPOMAX™

Phase 2 successful, BEPOSONE™

to enter Phase 2 shortly

–

OTC tear product formulated and successfully tested

–

T-PRED™

path forward clarified

5

2011 –

Solid Commercial and

Pipeline Progress |

ISTA PHARMACEUTICALS

6

BEPREVE®

Fast growing, twice-daily

prescription eye drop for

ocular itching associated

with allergic conjunctivitis

ISTALOL®

Leading once-daily beta-

blocker eye drop for the

treatment of glaucoma

VITRASE®

Leading spreading agent

used to enhance absorption

and dispersion of other

injected drugs

BROMDAY™

Only once-daily

prescription eye drop for

postoperative

inflammation and

reduction of ocular pain in

patients who have

undergone cataract

extraction

Current Commercial

Products

$300 Million Mid-Term Potential Revenue |

ISTA PHARMACEUTICALS

7

•

BROMDAY October 2011 prescriptions

equal to highest level achieved by

XIBROM

•

Major new managed care account wins

to drive increased share

•

Introduction of Twin Pack

–

5% of new prescriptions are Twin Pack as of

early December 2011

•

This added approximately $5 to the list price

•

No generic to BROMDAY until October

2013

–

Planning synchronized switch to PROLENSA™

in 2013

•

Patents pending 2024

The ONLY

approved once-daily

Rx non-steroidal

anti-inflammatory (NSAID) eye drop for pain and

inflammation post-cataract surgery

Estimated

NSAID

2011

Market

Size

TRx

$:

~$367MM

BRANDED

KETOROLAC

4%

GENERIC

KETOROLAC

27%

XIBROM+

BROMDAY

35%

NEVANAC

29%

GENERIC

BROMFENAC

2%

DICLOFENAC

3%

OTHER

0%

Based on Nov 2011 Twelve Month Rolling TRx$

BROMDAY

TM

Convenient Once-Daily Dosing |

ISTA PHARMACEUTICALS

8

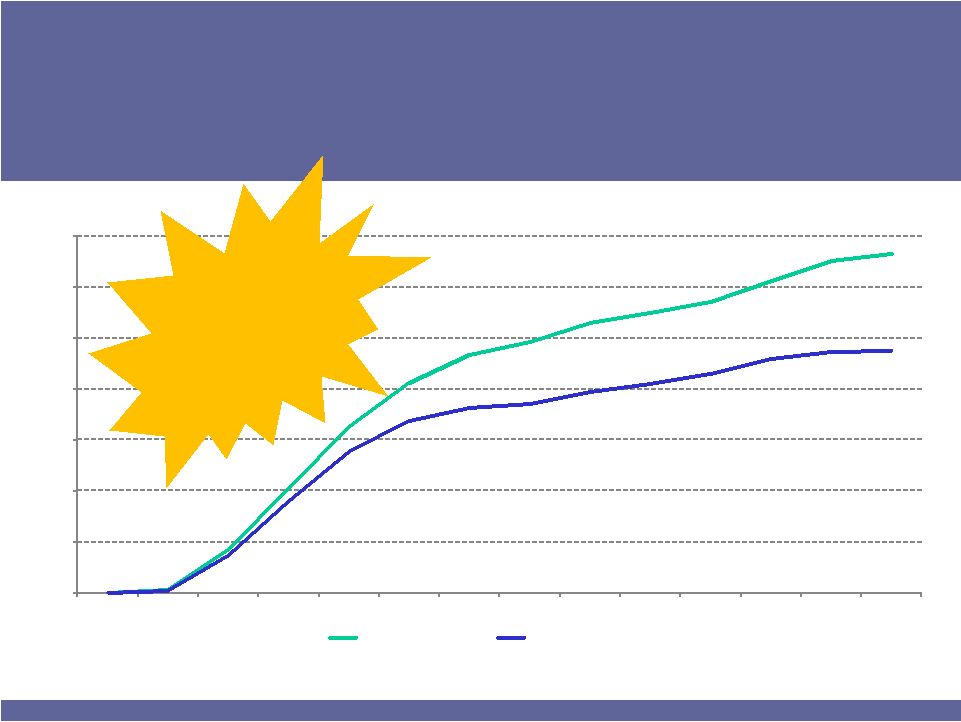

Source –

IMS Health Monthly NPA –

All MDs

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

BROMDAY TRX$ MS

BROMDAY TRX MS

33%

24%

BROMDAY Market Shares

#1 in Total

Prescription

Dollars (TRx$)

Achieved 33%

TRx$ share in

only 13 months

BROMDAY Outlook Strong

Prescription Dollars Reflect Increasing Average Price

|

ISTA PHARMACEUTICALS

9

•

Twice-daily antihistamine eye drop to treat

itching associated with allergic conjunctivitis

•

Projected 2011 revenues to grow significantly

•

Major new managed care formulary wins to

drive market share in 2012

–

Currently #2 branded in NRx$ behind

Patanol/Pataday

•

Rx of BEPREVE generates 35-60% more

revenues than competitors

–

Larger package size

•

Patents to 2017 with extension expected to

2019

–

Additional patents pending through 2023

Patanol, Pataday and Lastacaft are trademarks of their respective owners

Opportunity for BEPREVE to gain additional market share

2011

Estimated

Allergy

Market

:

~$780

MM

PATADAY

40%

PATANOL

37%

BEPREVE

5%

LASTACAFT

2%

EPINASTINE

3%

AZELASTINE

5%

ALL

OTHER

8%

Nov 2011 Rolling 12 Month TRx

BEPREVE

®

Near-term tactical drivers in place |

ISTA PHARMACEUTICALS

•

ISTALOL

–

Market-leading once daily beta-blocker eye drop for glaucoma

–

Growth through share gain and pricing

–

2010 market size: ~$ 180 million

–

Patent protection to 2018

•

VITRASE

–

Injectable biologic spreading agent, hyaluronidase, used to

enhance absorption and dispersion of other injected drugs

–

100% market share while competitors continue to deal with

manufacturing issues (likely through 2012)

–

2010 market size: ~$13 million

10

ISTALOL and VITRASE

Established base products |

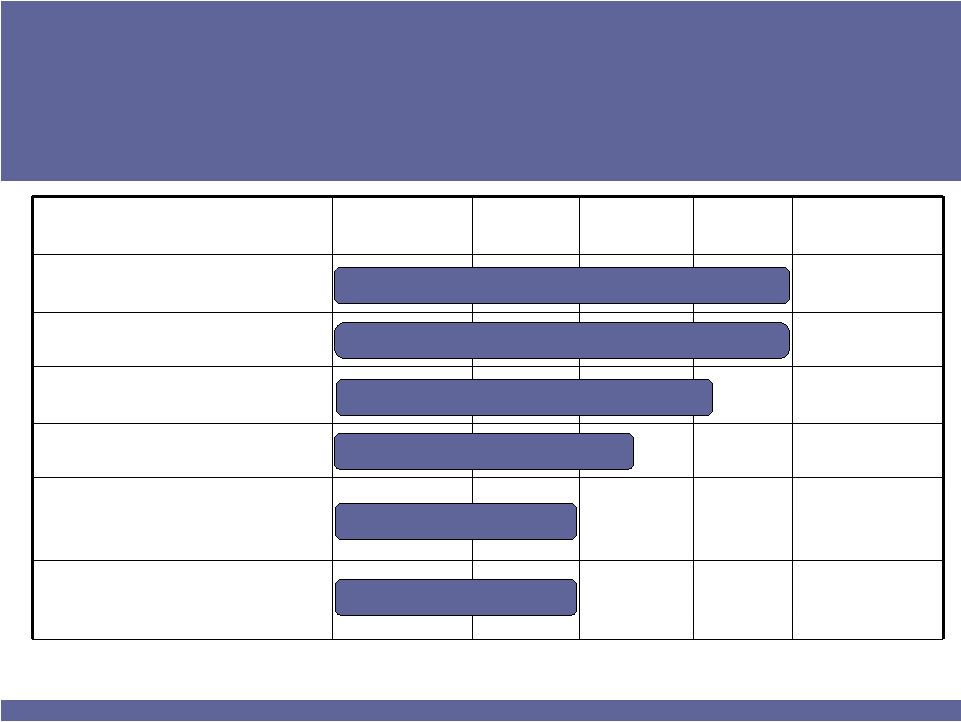

ISTA PHARMACEUTICALS

11

Candidates**

Formulation

Phase 1

Phase 2

Phase 3

2015 Est.

Market Size

OTC eye products

$300 million

PROLENSA

Low-concentration bromfenac

$500+ million

T-PRED

Antibiotic/steroid

$150 million

BEPOMAX

Bepotastine nasal spray

$400 million

BEPOSONE

Bepotastine/steroid

combo nasal spray

$2+ billion

Bromfenac Adjunct

for Age-related Macular

Degeneration

$400+ million

Allergic Rhinitis

Ocular Inflammation / Infection

* Includes BEPOMAX/BEPOSONE partnership

** Does not include all pre-clinical candidates

Ocular Inflammation & Pain

Dry eye

AMD

Allergic Rhinitis

Total Market Opportunity >$3.5 billion

ISTA’s Robust Near-Term Pipeline

Launches Drive Revenues to $500 by 2015* |

ISTA PHARMACEUTICALS

•

Over-the-Counter eye drops for treatment of dry eye and other

ocular conditions

•

OTC developed and tested in 2011 during prescription dry eye

Phase 3 studies

–

Statistically significant improvements from patient baselines

•

Complete stability testing -

1H 2012

•

2015 market potential: ~$300

million

•

Looking to acquire OTC business to jump-start launch

12

Existing sales force to drive practitioner-recommended sales

OTC Eye Products

Expansion of Rx Business into High-

Operating Margin Consumer Cash Business |

ISTA PHARMACEUTICALS

13

•

Bromfenac-based NSAID for ocular pain and

inflammation

associated

with

cataract

extraction

–

projected

to

replace

BROMDAY

•

Positive

Phase

3

Study

Results

Reported

Oct.

2011

–

Clinical

work

done

•

Plan to file NDA with U.S. FDA 1H 2012

•

Launch by early 2013

•

2015 market potential: $500+ million

•

Patents pending through 2024

Key extension of successful bromfenac business

PROLENSA

™

New Formula with Pending Patents through 2024

–

Lowest number of adverse events (greater than 2%) vs. prior bromfenac trials

–

Optimized, lower concentration formula enhances penetration into ocular tissues

–

Will implement switch strategy similar to XIBROM to BROMDAY

–

Complete switch before BROMDAY Hatch-Waxman exclusivity expires in October 2013 |

ISTA PHARMACEUTICALS

14

•

Fixed combination prednisolone & tobramycin prescription eye

drop

•

For steroid-responsive inflammatory ocular conditions for which

a corticosteroid is indicated and where superficial bacterial

ocular infection or risk of infection exists

•

Initiate Phase 3 trials 2H 2012

•

2015 market potential: ~$150

million

•

Potential primary care market

•

Pending patent through 2025

Ideal supplemental product to leverage sales infrastructure

T-Pred

Promising Anti-Infective/Steroid |

ISTA PHARMACEUTICALS

15

•

Single agent antihistamine nasal spray

•

Active ingredient, bepotastine, already approved in Rx eye drop BEPREVE

•

For treatment of seasonal allergic rhinitis

•

Positive Phase 2 Study results reported April 2011

•

Safety similar to placebo and other antihistamine nasal sprays

•

Patented through 2017

–

Pending patent through 2023

–

Additional patents filed through 2031

Large Market Opportunity Exists

2015 Potential: ~$400+ million

BEPOMAX

Major

Extension of Allergy Franchise |

ISTA PHARMACEUTICALS

16

•

Combination patented antihistamine / steroid

•

Antihistamine, bepotastine, already approved in Rx eye drop BEPREVE

•

For treatment of seasonal allergic rhinitis

•

Filed Investigational New Drug (IND) Q4 2011

•

Plan to initiate 4-armed Phase 2 Mountain Cedar Pollen study in December

2011

•

To accelerate growth, seek marketing partner for access to primary care MDs

•

Launch expected 2015

•

Patented through 2017

–

Pending patent through 2023

–

Additional patents to be filed

Large Market Opportunity Exists

2015 Potential: $2+ Billion

BEPOSONE ™

"Holy-Grail" Rx Nasal Allergy Product |

ISTA PHARMACEUTICALS

17

•

Higher-concentration, new formulation of bromfenac

•

For adjunctive treatment of age-related macular degeneration (AMD)

•

Paper published in Sept 2011 Issue of RETINA suggests bromfenac 0.09%

(XIBROM), administered twice daily may have an additive effect when used

with intravitreal ranibizumab (LUCENTIS®)

in reducing retinal thickness in

neovascular AMD

•

Determining path forward with FDA as adjunctive therapy with intravitreal

injections

•

2015 market potential: $400+ million

•

Pending patents through 2024 & 2028

Continued growth of successful bromfenac franchise

* Improvement in visual acuity not demonstrated in this study

LUCENTIS®

is a registered trademark of Genentech, a member of the Roche Group

Bromfenac Adjunct for AMD

Lower-Risk "Back of the Eye" Approach

|

ISTA PHARMACEUTICALS

18

PRODUCT(S)

PATENT(S) AND EXPIRATION

KEY CLAIM(S)

BEPREVE

BEPOSONE

ISSUED

Exp: Dec 2017 , filed for extension to Sept 2019

Bepotastine API and methods of mfg.

(composition of matter for

Bepotastine besilate)

APPLICATION

Estimated Exp: July 2023

Aqueous formulation

BEPOMAX

APPLICATION

Estimated Exp: October 2031

Formulation and use

PROLENSA

APPLICATION

Estimated Exp: Jan 2024

Formulation containing tyloxapol

APPLICATION

Estimated Exp: Jan 2024

Formulation and method of use

Bromfenac adjunctive

therapy

APPLICATION

Estimated Exp: Feb 2028

Method of use in AMD (also covered

by PROLENSA patent apps)

ISTALOL

ISSUED

Exp: Nov 2018

Method of use in eye drops

T-PRED

APPLICATION

Estimated Exp: April 2025

Formulation and method of use

ISTA’s Key Patents and

Applications |

ISTA PHARMACEUTICALS

19

~$1 billion annual revenues*

* Includes BEPOMAX/BEPOSONE partnership

Marketed

Products

Product

Pipeline

Business

Development

•

BEPOMAX nasal spray

•

BEPOSONE combo

nasal spray

•

Acquire OTC

business platform

•

Add bolt-on deals

> $300 million annual revenues

> $500 million annual revenues*

•

Acquire marketed products

•

License late stage assets

in 2013+

•

Acquire marketed products

•

Partner for access to

primary care physicians

and consumer branding

•

PROLENSA

(low-

concentration bromfenac)

•

T-PRED

•

OTC tear products

BROMDAY

ISTALOL

VITRASE BEPREVE

ISTA Strategy for Long-Term Success |

ISTA PHARMACEUTICALS

•

Disciplined approach to evaluation of opportunities

•

Rx Eye and Rx Allergy for growth and commercial synergy

–

Acquire marketed or soon-to-be marketed products

–

License late-stage products

–

Partner for access to primary care physicians and consumer branding

•

OTC Eye and Allergy for growth without heavy R&D investment

–

Acquire OTC business platform

–

License and/or develop new OTC products

•

Artificial tears

•

Ocular vitamins

•

Other

Goal –

To Become $1 Billion Specialty Pharmaceutical Firm

20

Business Development

External Value Creation |

ISTA PHARMACEUTICALS

Outlook

$160 –

$175

21

ISTA

Fast-Growing, Niche Pharmaceutical Company |

ISTA PHARMACEUTICALS

•

Webcast

and

Conference

call

–

Jan.

4,

2012

4:30

pm

ET

–

Internet: http://www.istavision.com/investors.html

–

Domestic dial-in:

866-270-6057

International : 617-213-8891

–

Passcode: 58694464

22

2012

Guidance

and Pipeline Update |

ISTA PHARMACEUTICALS

•

"5 in 5"

–

5 new product launches in next 5 years

•

Rx Eye, Rx Allergy, Over-the-Counter

–

$500 million in revenues by 2015

•

Forecasted compounded 5-year revenue growth rate ~ 40%

•

Organic growth from current products drives revenues majority of

growth

•

Revenues include partnering for primary care access –

BEPOMAX/BEPOSONE

•

Accelerate revenue growth through:

–

Establishment of OTC business, de-risks future sales

–

Licensing of late-stage assets

–

Acquisition of marketed drugs

23

Realizing Value -

Looking to

2015 and Beyond |

|