Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DREAMS INC | d271601d8k.htm |

NYSE Amex:

DRJ Dreams, Inc. 2011 Shareholder Presentation

Tuesday, December 13, 2011

Exhibit 99.1 |

NYSE AMEX: DRJ

2

Statements contained in this presentation, which are not historical

facts, are forward-looking statements. The forward-looking

statements in this presentation are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act of

1995. Forward-looking statements made herein contain a number

of risks and uncertainties that could cause actual results to differ

materially. These risks and uncertainties include, but are not

limited to, specific factors impacting the company’s business

including increased competition; the ability of the company to

expand its operations and attract and retain qualified personnel,

the uncertainty of consumer’s desires for sports and celebrity

memorabilia; the availability of product; availability of financing;

and general economic conditions.

Important Cautions Regarding

Forward-Looking Statements

This

presentation

is

©

2010

and

2011

Dreams,

Inc.

–

All

Rights

Reserved |

NYSE AMEX: DRJ

3

Multi-Channel Retailing Strategy

We leverage our internet presence through multiple retail channels:

Diversified

Revenue

Stream

Web

Syndication

Owned Sites

Bricks & Mortar

Catalogues & Trade Shows |

NYSE AMEX: DRJ

4

2011 Accomplishments

Successful launch of

NBA,

NHL,

MLB

Photo

Stores

10

th

fastest-growing

e-commerce website

in the retail chain

category

40

th

fastest-growing

e-retailer overall

2011 Web Syndication Wins

Chicago Bulls

Linens N’

Things

Sportswear, Inc.

eCampus

Chicago Fire

One Stop Plus

Charlotte Bobcats

College Gear

Beyond Graduation

Café

Press

Golden State Warriors

Portland Trailblazers

Purdue University

Hibbett Sports

Miami Dolphins

Scheels Sports

Comcast Sports Group

Redcats

Univ. of Louisville

MLS Collectibles Shop

Indiana Univ. |

NYSE AMEX: DRJ

5

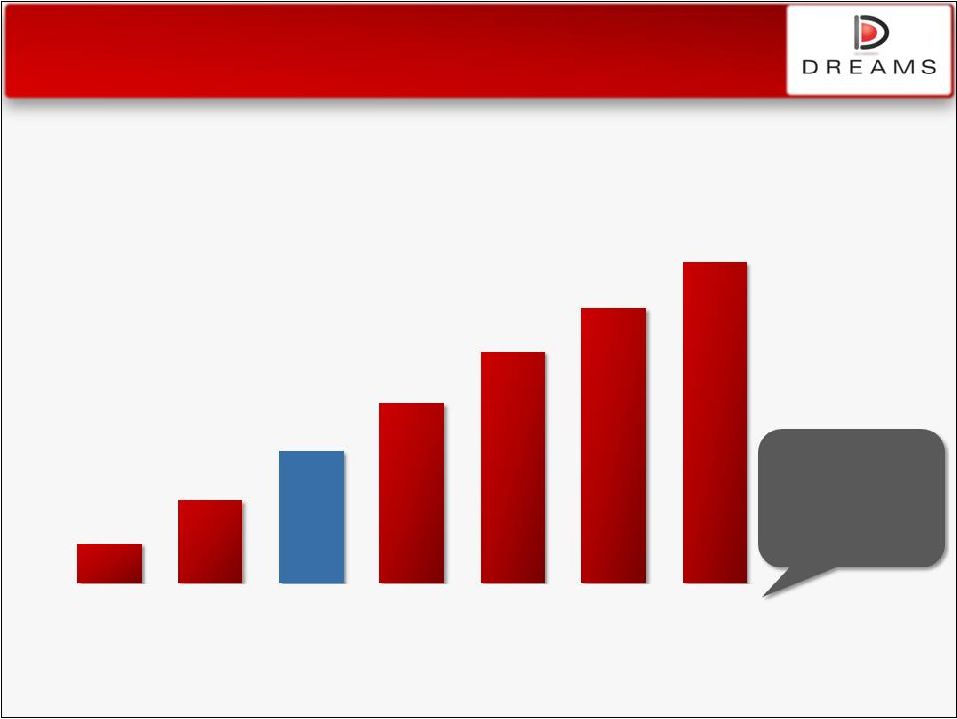

¹Forrester Research, Feb 2011

The Retail Marketplace is Increasingly

Moving Online

$157B

$176B

$197B

$218B

$240B

$259B

$279B

2009

2010

2011

2012

2013

2014

2015

U.S. E-Commerce Sales to Reach $279B in 2015

In 2015, the web

will account for

11% of all retail

sales¹ |

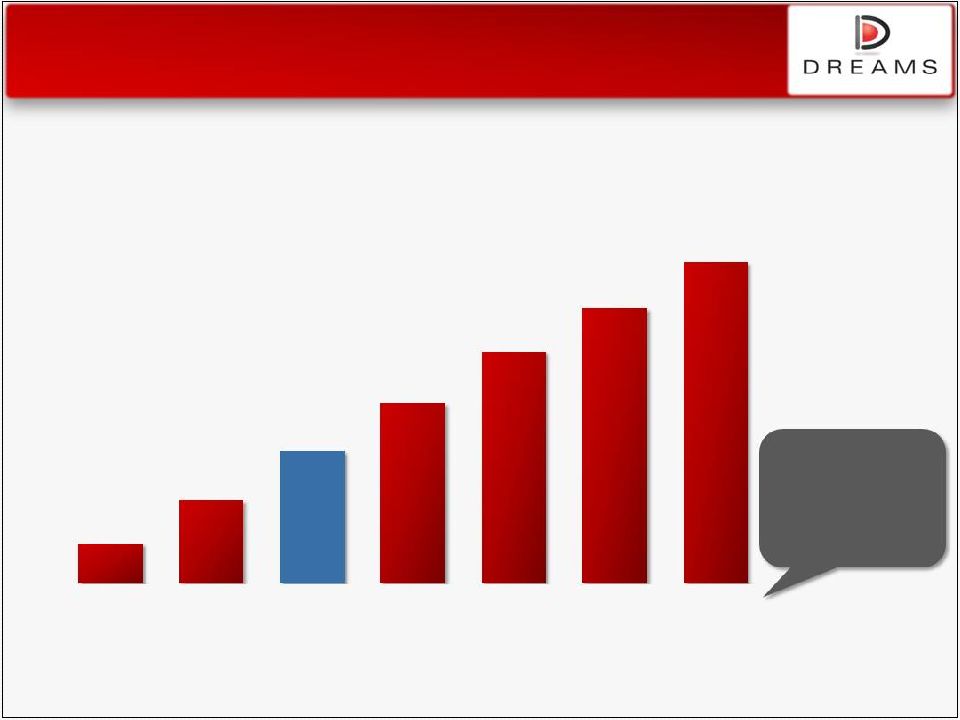

NYSE AMEX: DRJ

6

Revenue Drivers

¹2011 guidance issued and effective March 31, 2011.

$20M

$31M

$47M

$60M

$85M

$112M

2006

2007

2008

2009

2010

2011P¹

Dreams E-Commerce Revenue

Robust E-Commerce Platform:

•

FansEdge.com site

•

Web syndication business |

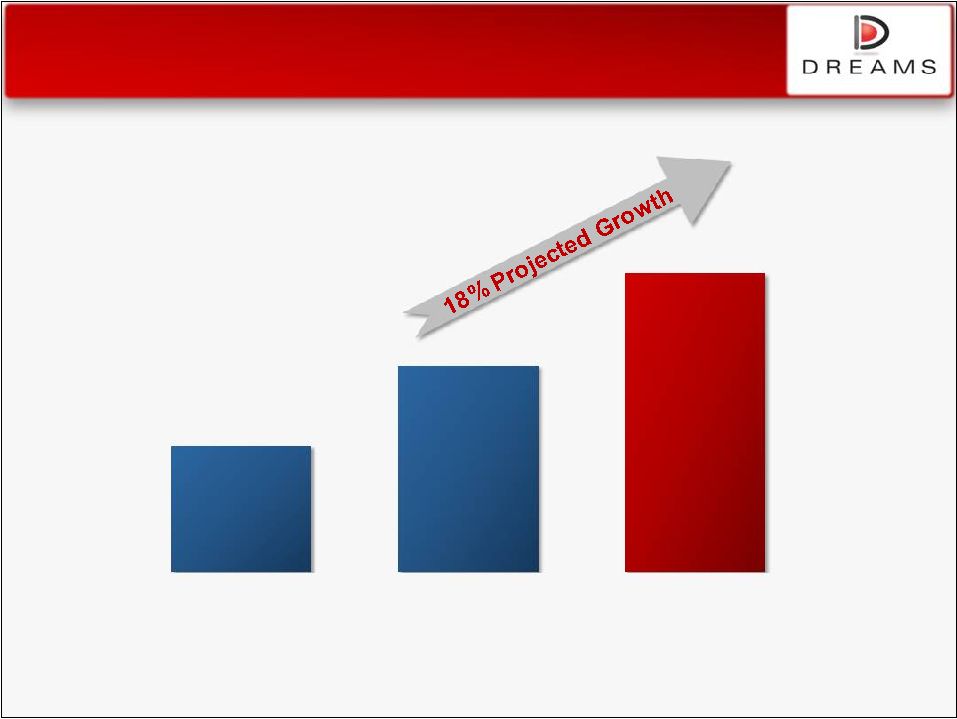

NYSE AMEX: DRJ

7

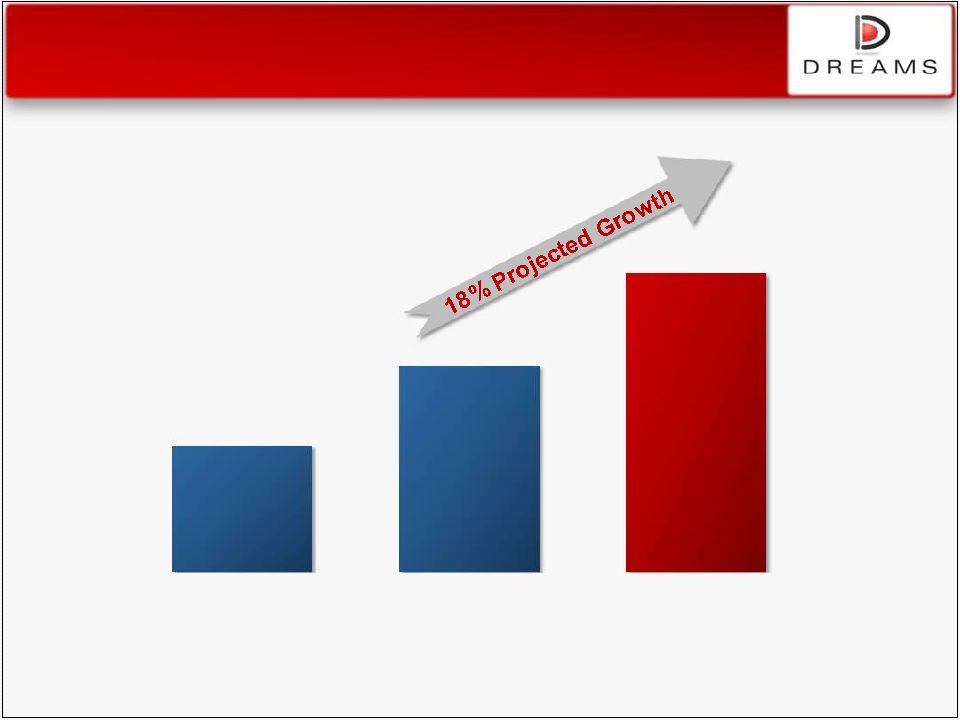

Owned Brands Online Revenues

¹2011 guidance issued and effective March 31, 2011.

$42.7M

$50.7M

$60.0M

2009

2010

2011P¹ |

NYSE AMEX: DRJ

8

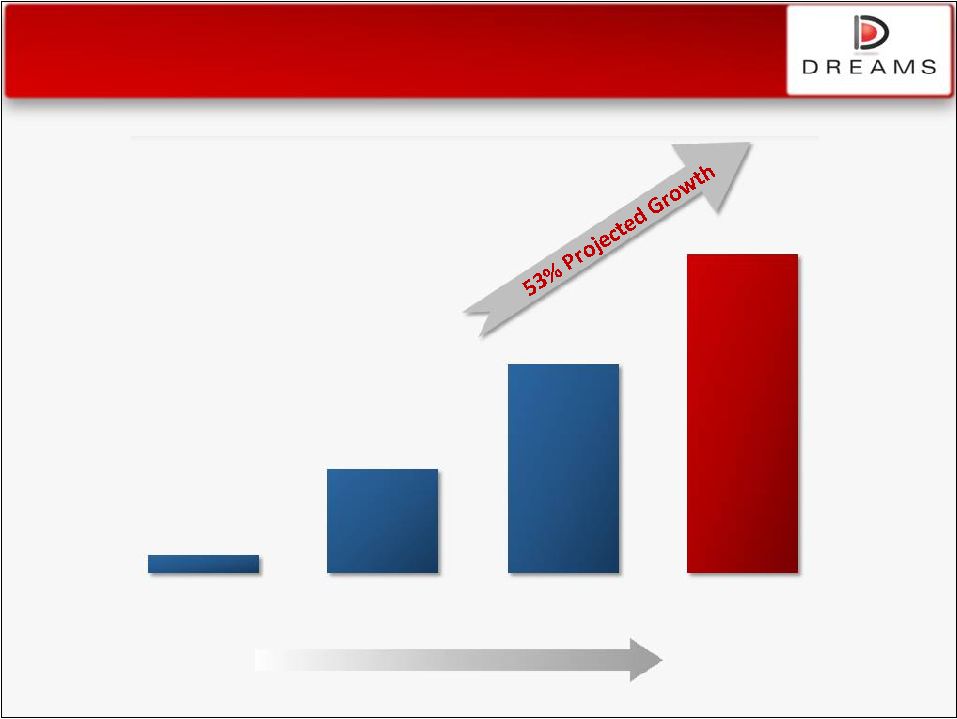

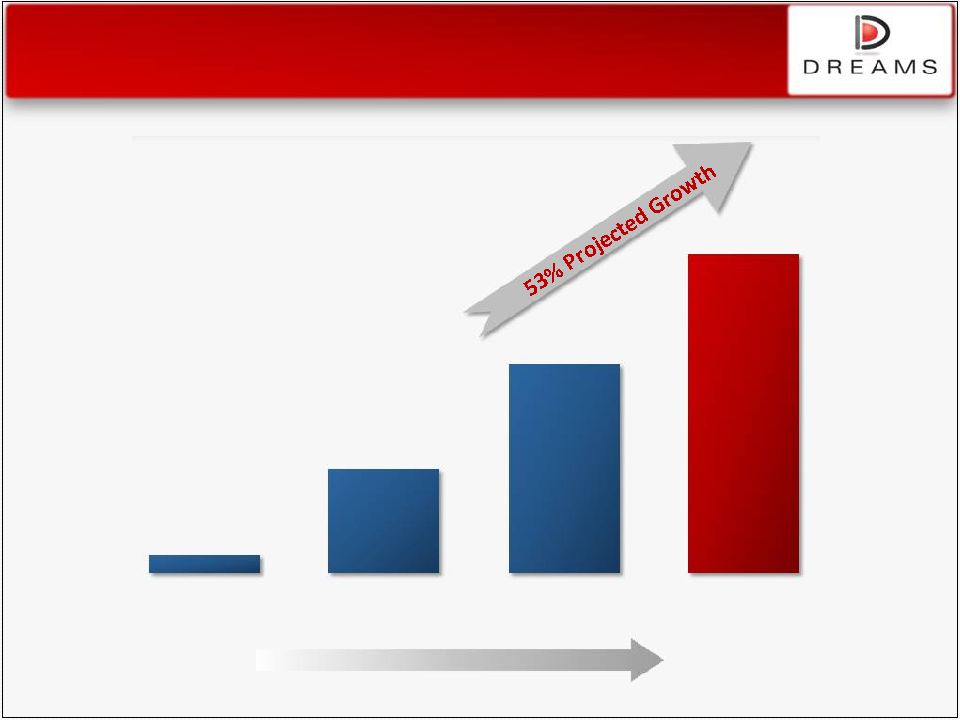

Web Syndication Revenues

31 clients

70 clients @

Sep 30, 2011

¹2011 guidance issued and effective March 31, 2011.

$3.0M

$17.0M

$34.0M

$52.0M

2008

2009

2010

2011P¹ |

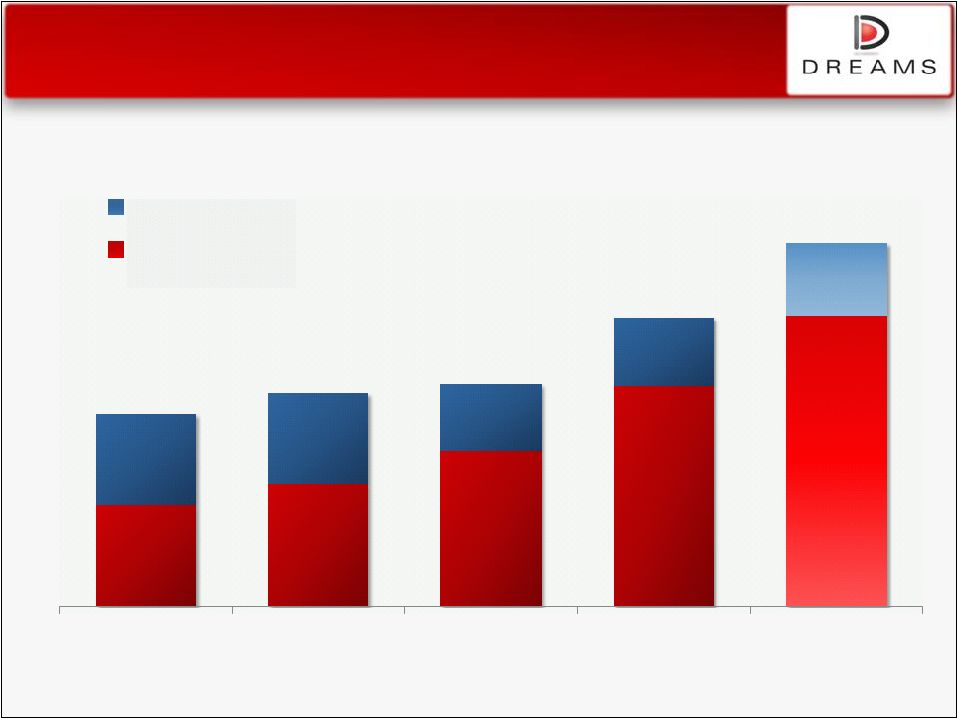

NYSE AMEX: DRJ

9

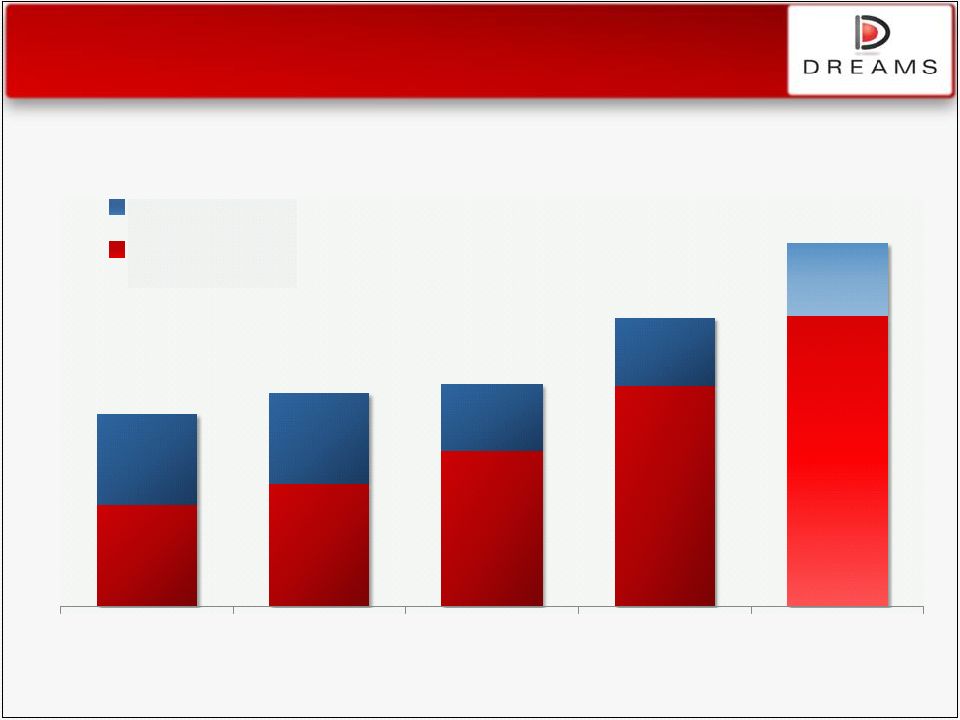

Annual Revenue:

E-Commerce vs. Total Revenue

¹2011 guidance issued and effective March 31, 2011.

$82.0M

$85.5M

$111.4

$140.0M

(proj.)

53%

57%

70%

76%

80%

47%

43%

30%

24%

20%

$73.0M

2007

2008

2009

2010

2011P¹

Other

E-Commerce |

NYSE AMEX: DRJ

10

IR Activity Overview –

(May 9¹

-

Dec 7)

Over 50 introductions in 7 months

20

introductory

conference

calls

with

over

30

new

buy

and sell-side institutions

2 sell-side

conferences

(ROTH

Capital

&

Craig-Hallum)

with 15+ 1x1 meetings

1 non-deal

road

show

in

New

York

with

6

buy-side

meetings

2

new

Top

10

institutional

holders

(Diker,

Wells

Capital)

Top

10

institutional

holders

increased

their

positions

by 5%

¹LG engagement began. |

NYSE AMEX: DRJ

11

Sell-Side Analyst Ratings

Institution

Analyst

Rating

Price Target –

Pre Q3 Earnings

Price Target –

Post Q3 Earnings

Gilford Securities

Casey Alexander

BUY

$4.00

$5.50

Ladenburg

Mickey Schleien

BUY

$3.00

$2.75

ROTH Capital

Jared Schramm

BUY

$5.00

$5.00

Mean Price Target

$4.00

$4.42

Potential Upside¹

83.5%

81%

Source: Analyst reports.

¹Potential upside calculated using market value of $2.18 and $2.44 on September 6, 2011

and December 7, 2011, respectively. |

NYSE AMEX: DRJ

12

6-Month Conference Outlook

6-Month Investor Conference Outlook

Date

Institution

Focus

Location

Status

Jan 17-18

Noble

Technology

Hollywood, FL

Attending

Mar (TBD)

Wedbush

Technology

New York, NY

Invited

Mar 11-14

ROTH

Growth

Dana Point, CA

Invited

May 8-10

Baird

Growth

Chicago, IL

Target |

NYSE AMEX: DRJ

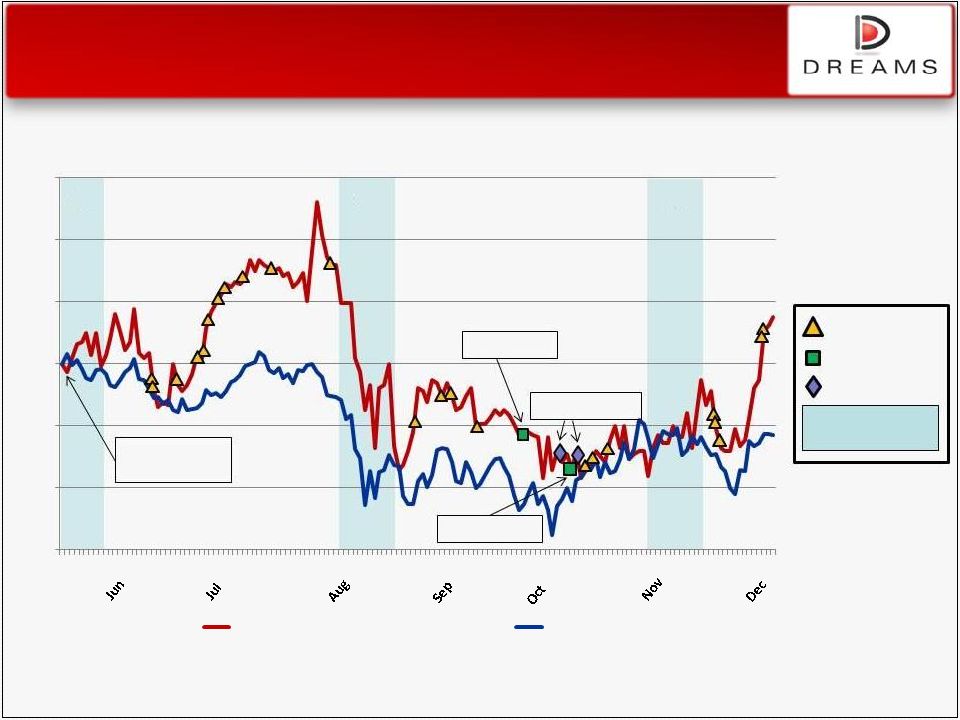

13

DRJ

vs.

Russell

2000

Index

(May

9

–

Dec 7)¹

¹The graph compares the DRJ cumulative three-month stockholder return to that of the

Russell 2000 Index. The graph assumes an investment of $100 on the day that the LG

engagement began, May 9, 2011. Relative Stock Price Performance

Q3

Q1

Q2

Intro Call/Meeting

Conference

Marketing

Quarterly Earnings +

Preparation

$70

$80

$90

$100

$110

$120

$130

Dreams Inc. (NYSE Amex: DRJ)

Russell 2000 Index

NYC Marketing

Roth Capital

LG Engagement

Begins

Craig-Hallum |

NYSE AMEX: DRJ

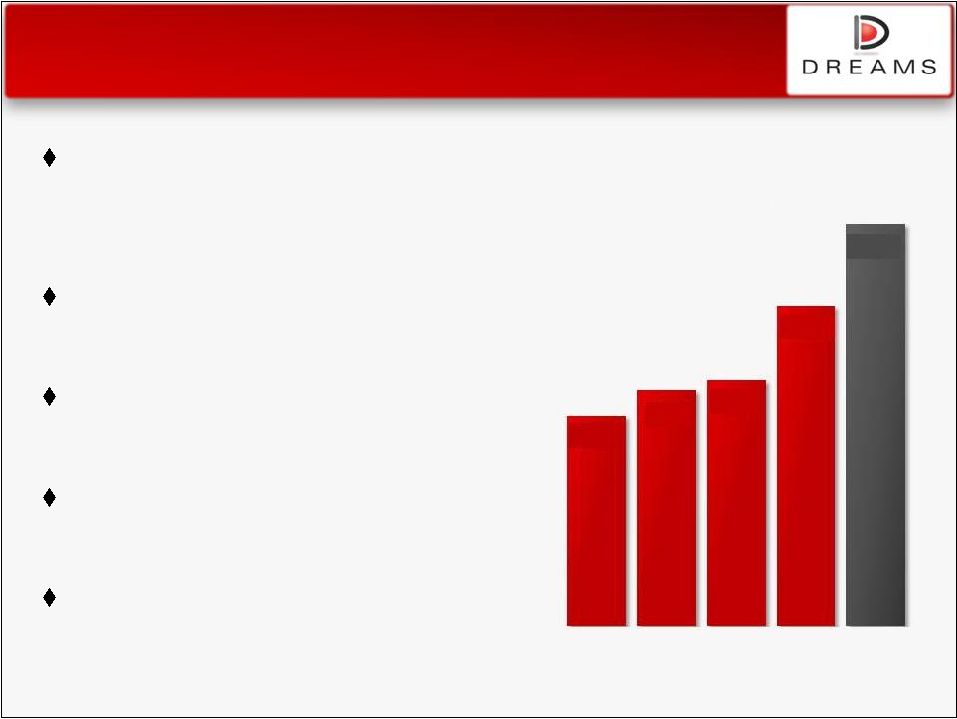

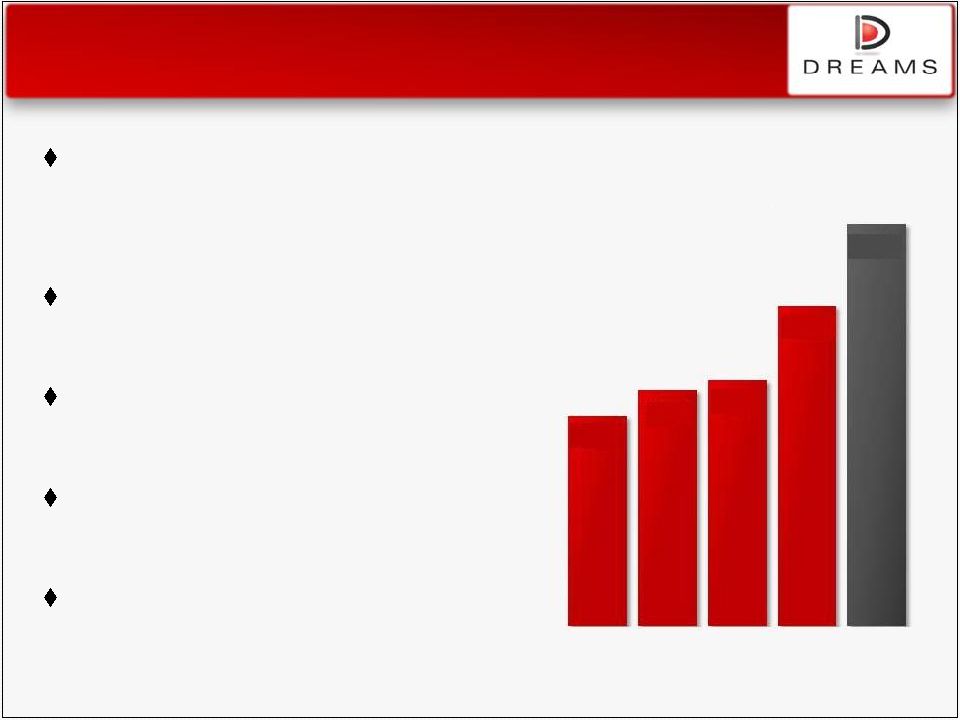

14

Dreams Key Takeaways

Industry-proven, proprietary

technology positioned in large &

growing online market

Vertical integration of product

leading to gross margin expansion

High inventory turnover through

multiple distribution channels

Strategic acquisitions leverage

strong brand

Q3’11 revenues up 23%;

e-commerce revenues up 39%

73.0

82.0

85.5

111.4

140P

07

08

09

10

11P¹

Annual Revenue

($ millions) |

15

NYSE AMEX: DRJ

Contact Us

NYSE Amex: DRJ

www.DreamsCorp.com

Investor Relations

Liolios Group

Scott Liolios or Cody Slach

Tel 949.574.3860

DRJ@liolios.com

Dreams, Inc.

2 South University Drive

Suite 325

Plantation, Fl 33324

954-377-0002 |