Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - T3M INC. | d268468d8k.htm |

T3 Motion, Inc.

AMEX: TTTM Exhibit 99.1 |

Some of the

statements that we make in this presentation may constitute forward- looking

statements. These statements reflect management’s expectations about our

business, operating plans and performance and speak only as of the date hereof. These

forward-looking statements involve a number of risks and uncertainties that could

cause actual results to differ materially from those anticipated by these

forward-looking statements. For a full discussion of the risks and

uncertainties that could cause actual results to differ materially from those expressed

or implied by any of these forward- looking

statements

please

review

the

“Risk

Factors”

section

in

the

prospectus,

as

filed

with the Securities and Exchange Commission. We undertake no obligation to update

publicly or revise these forward-looking statements for any reason even if experience or

future changes make it clear that any projected results expressed or implied therein

will not be realized.

Safe Harbor Statement

NYSE Amex: TTTM

2 |

Company

Overview T3 Motion, Inc. is a leading global brand

Technology company –

design and manufacture

personal electric vehicles

Current Product: T3 Series Electric Stand Up Vehicle

Target markets: Security, Law Enforcement, College

Campuses, Airports, etc.

Clients in 30 countries over 6 continents

Deployments approaching 3,000 vehicles worldwide

Annual capacity: 7,500 vehicles per year

Leverage brand to consumer market

NYSE Amex: TTTM

3

Leading provider of clean technology vehicles |

Current

Product Overview NYSE Amex: TTTM

4

T3 Series -

Professional

Zero gas emissions; Operating Cost -

$0.10/day

Elevated 9”

platform gives better visibility

In-field swappable power management system

MSRP -

$8,999

T3 Series -

Consumer

Leverage brand to introduce consumer to

market

High-end recreational vehicle

MSRP -

$9,500

Co-branding opportunities |

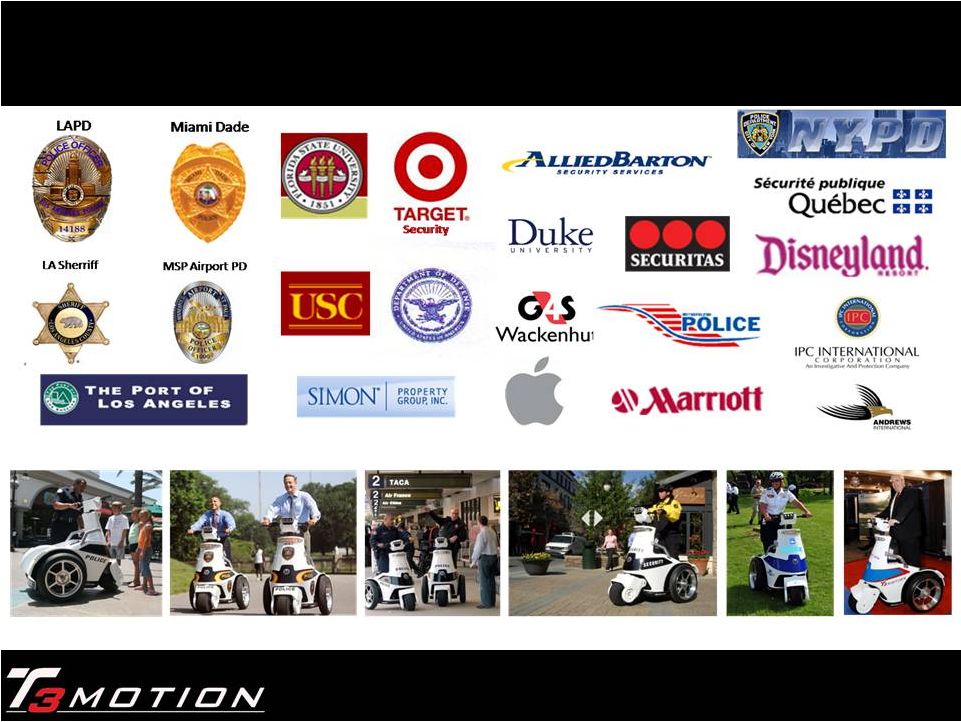

T3 Series

– Professional

Target markets: Security, Law Enforcement, College

Campuses, Airports, Parking Patrol, etc.

Clients in 30 countries over 6 continents

Deployments approaching 3,000 vehicles worldwide

Deployed in 175 police departments

Deployed in over 50 airports worldwide

Annual capacity: 7,500 vehicles per year

Cost effective:

ROI (6 months)

Reduces man hours in covering large areas

First

responders

–

able

to

cover

large

geographic

areas

NYSE Amex: TTTM

5 |

Operating Costs

= 10 Cents Per Day* -

Price per mile is less than 1 cent on average*

Equivalent of over 500 miles per gallon*

Save over $25,000 per year over gas-powered vehicles*

Clean Energy = “Green” Results

*Based on 1 kilowatt usage per day at an average cost of 10 cents per kilowatt/200

pound average rider/Li-Poly batteries/U.S. average cost of $4.00 per

gallon/Daily operation range of 15-20 miles NYSE Amex: TTTM

6 |

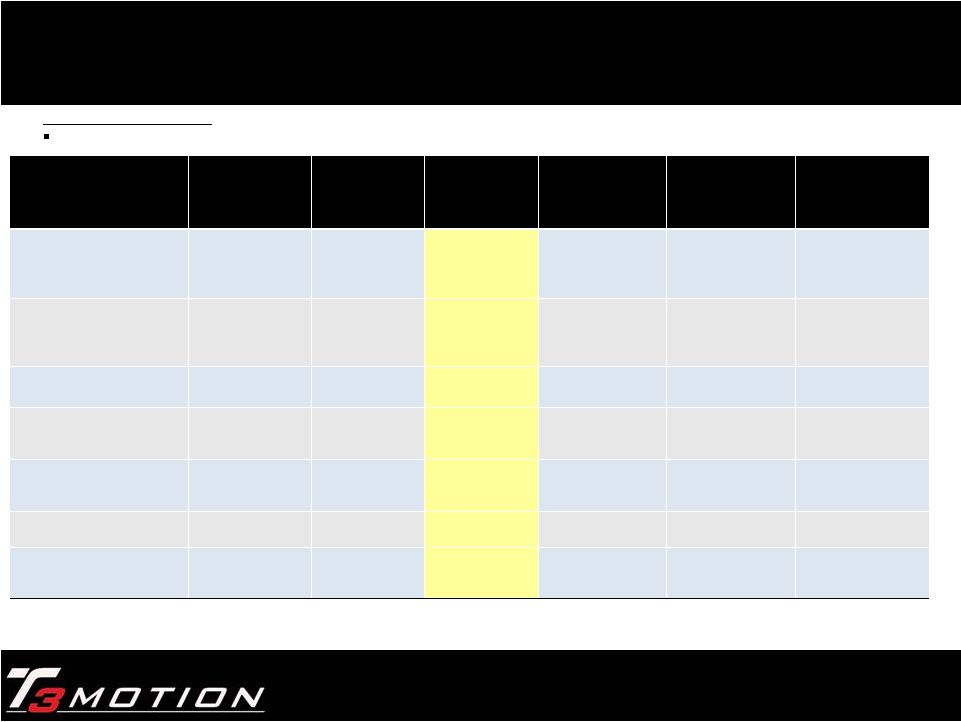

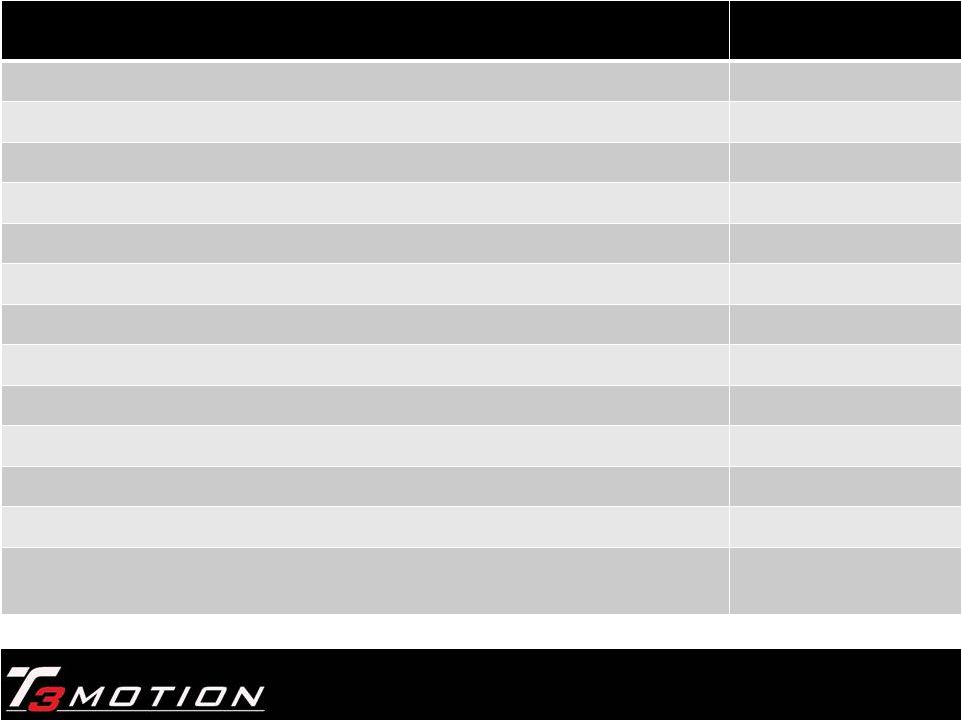

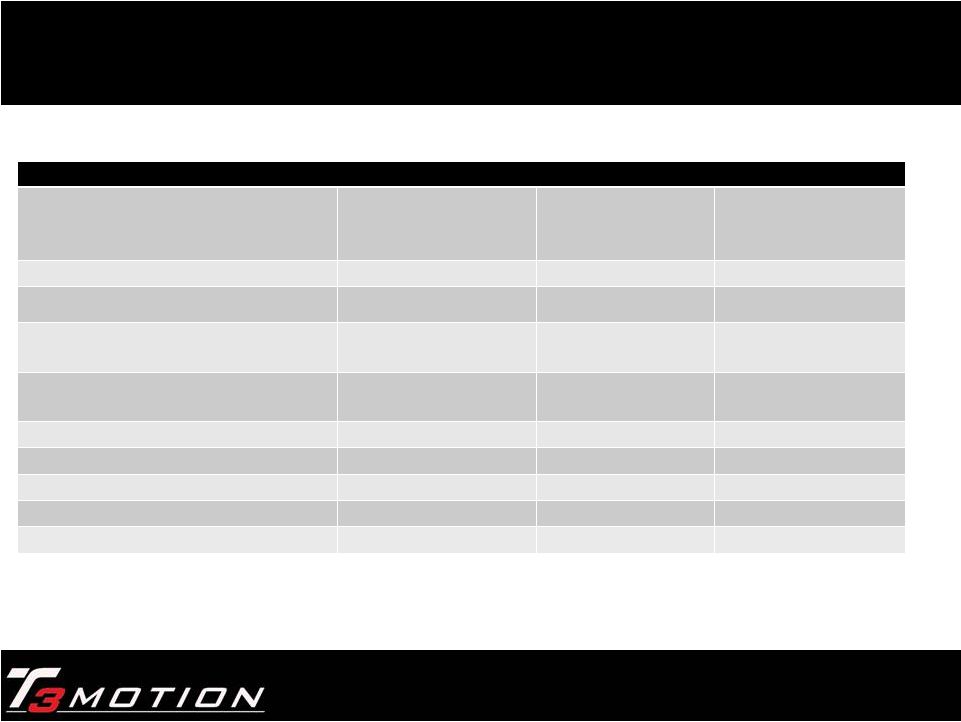

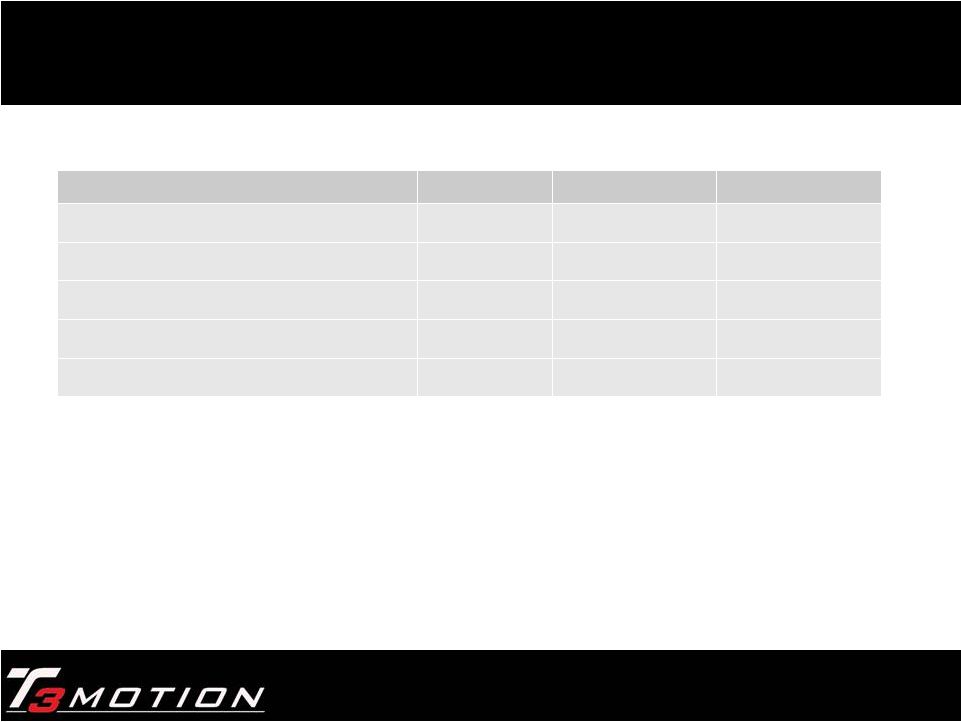

Market and

Industry Overview Industry Overview:

Billion dollar market potential for Personal Transport Vehicles

Market Overview

Total Agencies

Agencies with

T3s

Penetration

Miscellaneous

Average

units/agency

(assumption)

Estimated

Market

potential*

Law Enforcement

(include campus

police)

5,956

175

2.94%

1,017,984

Personnel

2

$107,208,000

Airports

5,202 public

use airports

(U.S.)

50+

0.96%

5

$234,090,000

Malls

48,000

303

0.63%

3

$1,296,000,000

Manufacturing and

Industrial Firms

293,919

6b Sq. Ft. Space

2

$5,290,542,000

Private Security

Companies

13,000

22

0.17%

13.3m

Employees

1

$117,000,000

Government Bases

5,311

3

0.06%

$13b Industry

2

$95,598,000

Government Buildings

10,000

7

0.07%

1.2m Security

Personnel

2

$180,000,000

Total

$7,320,438,000

NYSE Amex: TTTM

7 |

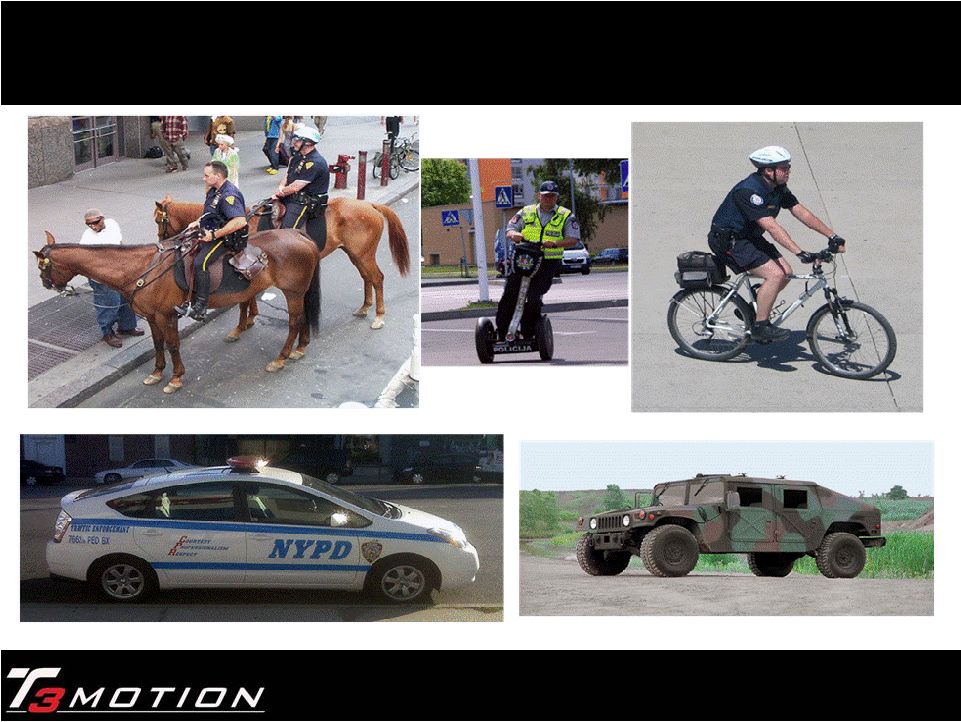

T3 Market

Competition NYSE Amex: TTTM

8 |

NYSE Amex:

TTTM 9

T3 Series Products

T3 Series with Non-Lethal Response Vehicle

T3 Series with LPRS

License Plate Recognition System

Automatically scans license plates -

7,500 vehicles per hour

Real-time notification of a wanted plate in 4 seconds

Wi-Fi enabled and allows plug ‘n play use

Connects directly to any handheld internet-enabled device

such as the Samsung Galaxy Tab, iPad, Motorola Droid,

Blackberry, iPod Touch or iPhone.

humane and safe initiatives used during riots and violent protests High-intensity LED deterrent light -- up to 40,000 lumens 700 rounds per minute, per gun, non-lethal shooting capabilities High-capacity air tanks with up to 10,000 round shooting capability PA system

Riot shield

Video recording capability

|

Selected T3

Series Customers NYSE Amex: TTTM

10 |

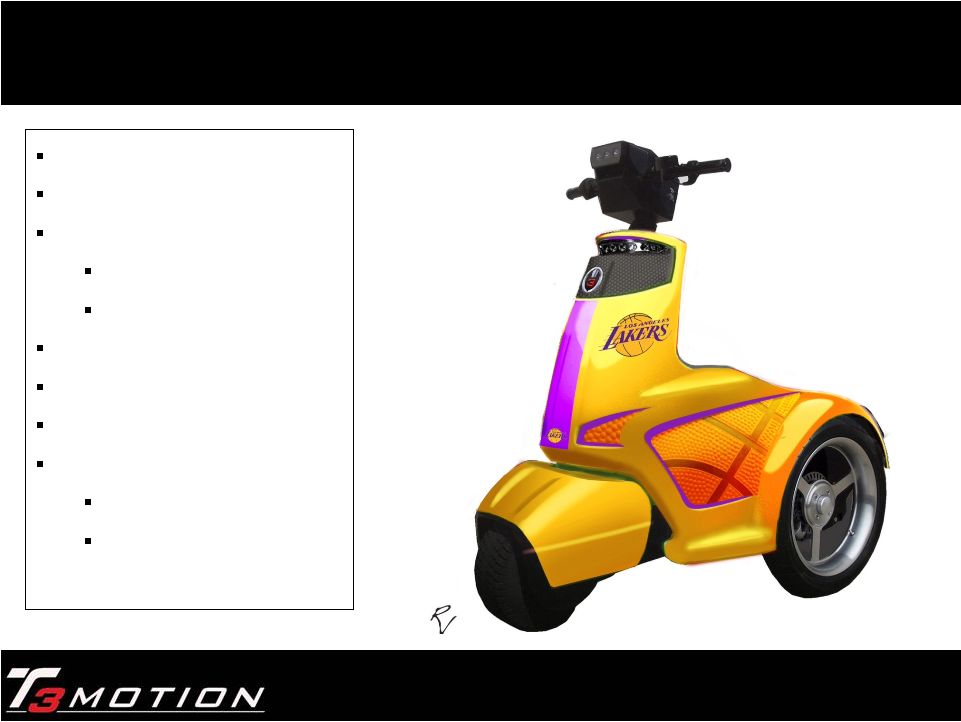

T3 Series

- Consumer

Launched December 2011

Full production: Q1-12

Market

Recreational vehicle

High-end consumers

Co-Branding opportunities

Custom graphic opportunities

MSPR: $9,500

Sales channel

Direct

Recreational vehicle

distribution network

NYSE Amex: TTTM

11 |

KEY FACTS

Symbol (NYSE:AMEX)

TTTM

Corporate Headquarters

Costa Mesa, CA

Stock Price (12/6/11) 52-Week Range

$0.48/ $0.36-$9.80

Shares Outstanding (September 30, 2011

12,881,027

Market Capitalization

$6.2M

Volume (daily 90-day average)

33,939

Debt (9/30/11)

$1.2M

Cash (9/30/11)

$3.75M

Revenue (2011 estimate)

$6.0M

Insider ownership

28%

Institutional

56%

Full-time employees

52

Accounting Firm

KMJ Corbin and

Company

NYSE Amex: TTTM

12 |

2007

2008

2009

2010

T3 Motion,

Inc.

founded on

March 16,

2006

T3 Series

introduced to

market –

IACP, Oct

2006

Customer

trials and

demos begin

–

January

2007

Production

shipments

begin –

July

2007

2006

USPS Trial

and initial 13

unit sale

DLA trial and

initial sale

NYPD

Subway

deployment

T3 deployed

in 25

countries

$40M Total Funding (including $11.1M closed May 2011)

$13M self-funded by CEO

T3

History

Approaching 3,000 vehicles deployed in 30 countries on 6 continents

2011

Debuted at

G20 Summit

in Seoul

Target deploys 157 vehicles

Simon Properties deploys first 50 vehicles saving over

$3.3M in operating costs (total deployments = 112)

13

NYSE Amex: TTTM |

Management

Team Mr.

Nam

has

served

as

CEO

of

T3

Motion

since

March

16,

2006.

In

2001,

Mr.

Nam

founded

Evolutionary

Electric

Vehicles

(EEV)

to

provide

high

performance

motor-controller

packages

to

the emerging hybrid and electric vehicle market.

Mr.

Nam founded Aircept in 2000, a leading developer, manufacturer, and service provider in the

Global Positioning System

(GPS)

marketplace;

and

Paradigm

Wireless

Company

in

1999,

a

supplier

of

quality

wireless

equipment

to

the telecom

industry.

Prior to founding his own companies, Mr.

Nam was the Executive Vice President of Business Development at Powerwave

Technologies Inc. (NASDAQ: PWAV), where he helped guide the company to number 5 in Business

Week’s list of Hot Growth Companies in 2000.

Kelly J. Anderson –

President, Executive VP & CFO

Hired in 2008 as Executive Vice President & CFO; Appointed Director in January 2009 and

President in April 2010. From

2006

until

2008,

Ms.

Anderson

was

Vice

President

at

Experian,

a

leading

credit

report

agency.

From

2004

until

2006,

Ms.

Anderson

was

Chief

Accounting

Officer

for

TripleNet

Properties,

G

REIT,

Inc.,

T

REIT,

Inc.,

NNN

2002 Value Fund, LLC; and Chief Financial Officer of NNN 2003 Value Fund, LLC and A REIT,

Inc., these entities were real estate investment funds managed by TripleNet Properties.

From

1996

to

2004,

Ms.

Anderson

held

senior

financial

positions

with

The

First

American

Corp

(NYSE:

FAF),

a

Fortune

500 title insurance company.

Ki Nam –

Chief Executive Officer

NYSE Amex: TTTM |

Noel

Cherowbrier - Vice President International Sales

David Fusco -

Vice President Domestic Sales

Management Team

NYSE Amex: TTTM

15

David Fusco was named Vice President of Domestic Sales in October 2010. Over the past 25 years David has held senior executive sales management positions at Texas

Instruments, Compaq Computer, and Hewlett-Packard. In 2006 David founded Andal Holdings, LLC, and provided sales and management consulting

services to a variety of companies. David holds a Bachelor of Science degree from Miami University in Oxford, OH. Noel Cherowbrier has been Vice President of International Sales since 2007. Mr. Cherowbrier was the President from 2004 to 2007 of Tecan UK and US, technology company

located in the UK, and Executive VP from 1995 to 2004. Noel holds 20 years of global sales management experience: from 1989-1995 he was the

Global Sales Manager at Homark; and from 1986-1995 he was the Sales and Marketing

Regional Manager at Fast Moving Consumer Goods.

|

•

Direct sales team

•

7 sales people

•

2 support

•

Distribution –

over 50 distributors worldwide

•

Sales cycle

•

PO Driven business

•

Ranges from 2 days to 2 years

•

Backlog at September 30, 2011 -

$3.3M

•

Sales Growth

•

70% of sales are from repeat customers

•

Brand awareness

•

Adaptation rate for corporate applications

•

Launch new products to existing channels

•

Consumer market

Sales and Distribution

NYSE Amex: TTTM

16 |

Capacity

Corporate and Manufacturing Facility

~ 50,000 sq ft in Costa Mesa, CA

Expandable by an additional ~ 30,000 sq ft

Production -

up to 750 T3 vehicles per

month

Manufacturing

Raw Materials and Supply Chain

70% suppliers are local; as sales increase, T3

will expand into other global alternatives

Supply chain could include material

sourcing and sub-assembly operations from

China, South Korea and Mexico

Final assembly, testing and inspection in

Costa Mesa, CA

NYSE Amex: TTTM

17 |

Objectives of

R&D: Research & Development

NYSE Amex: TTTM

18

•

To ensure the existing products

meet the current demands of

our target markets

•

To use the existing platform to

develop future products for the

personal mobility electric

vehicle space.

•

Current concepts under

development

•

Delivery solutions

•

Government & military

solutions

•

Non-lethal response

solutions

•

Un-manned vehicle

solutions

•

Consumer vehicle

solutions

|

Type of

Customer: Mall Property

Sales Process:

Initial Trial

Corporate certified security vehicle

Each mall property to include in their budget

Customer Objective:

To find lower cost security solutions, preferably alternative energy vehicle

Solution:

T3 Series ESV

Competition: Segway, gas-powered vehicle, golf cart, bicycle, walking

Cost of Solution: MSRP: $8,999

Result:

In the first year, our customer deployed 50 T3 Series ESV’s and replaced 50 gas powered

vehicles. The change in the method of patrol resulted in approximately $3.2M in

cost savings to the company. In addition, the first year of deployment, the

incidents in the parking lots decrease by approximately 25%. Each incident costs

the company approximately $10K (investigations, settlement, restitution, repairs,

etc.) Case Study

NYSE Amex: TTTM

19 |

R3

- Plug-In Hybrid and Electric

Patent-pending iconic rear wheel design

2011 -

partner with Panoz for production ready

MSRP -

$25,000 -

$35,000

Integrated Samsung Galaxy Tablet feature

Top Speed -

70 mph (Electric) 100 mph (Hybrid)

Range 75 miles (Electric) 300 miles (hybrid)

Engine/Motor power -

12kw (electric) 180hp (gas)

2012 –

2013 –

Find JV production partner

NYSE Amex: TTTM

20 |

R3

Prototype NYSE Amex: TTTM

21 |

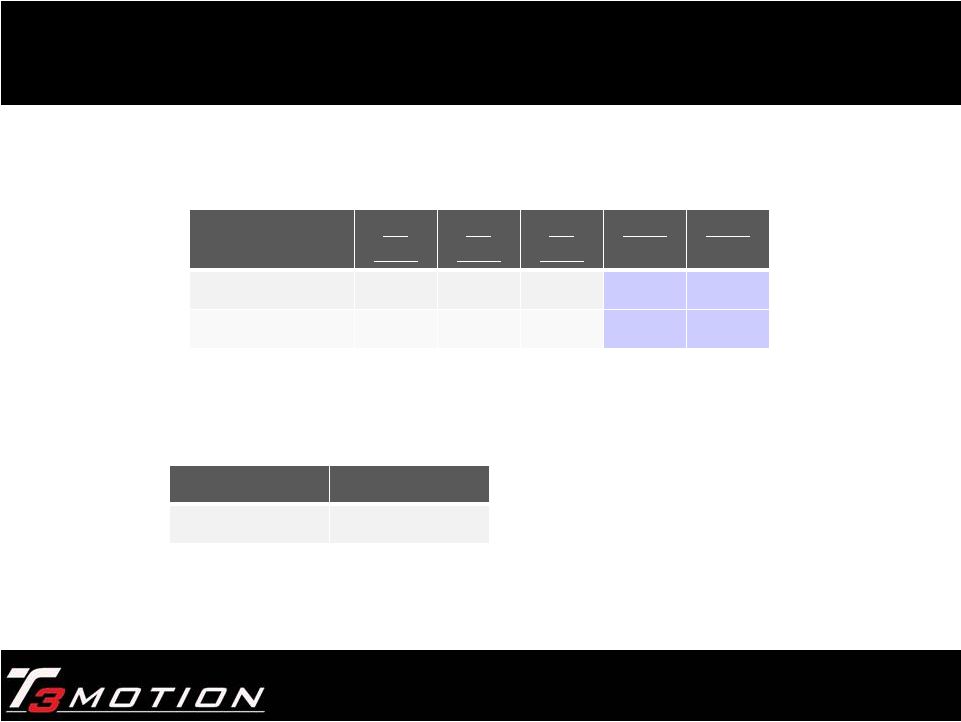

Capitalization Table

Equity (150,000,000 share

authorized)

Issued Shares

Strike Price

Fully Diluted

Common Stock

12,881,027

12,881,027

Warrants (exp 5-13)

$3.00

4,942,557

Warrants (exp 5-16)

$3.50

4,992,557

Warrants (exp 12-14 –

3-15)

$5.00

826,373

Warrants (exp 3-13 –

5-16)

$4.38-$15.40

386,099

Stock Options

$5.00 -

$7.70

947,351

Total

12,881,027

24,975,964

NYSE Amex: TTTM

22 |

Balance Sheet

September 30, 2011 T3 Motion, Inc. Balance Sheet Highlights –

September 30, 2011

ASSETS

$ thousands

Cash (including restricted)

3,764

Accounts Receivable

1,096

Inventory

1,523

Total Assets

8,104

LIABILITIES

Accounts Payable and Accrued Expenses

1,734

Derivatives Liability

130

Notes Payable

1,225

Total Liabilities

3,089

STOCKHOLDERS’

EQUITY

Total stockholders’

equity

5,015

NYSE Amex: TTTM

23 |

Income

Statement Highlights •

Select historical income statement

Q3

2011

Q2

2011

Q1

2011

2010

2009

Revenue

$1.9

$1.3

$1.0

$4.7

$4.6

Gross Margin

*

20.4%

11.4%

4.0%

3.6%

(7.4%)

2011E

Revenue

Approx $6.0

NYSE Amex: TTTM

24 |

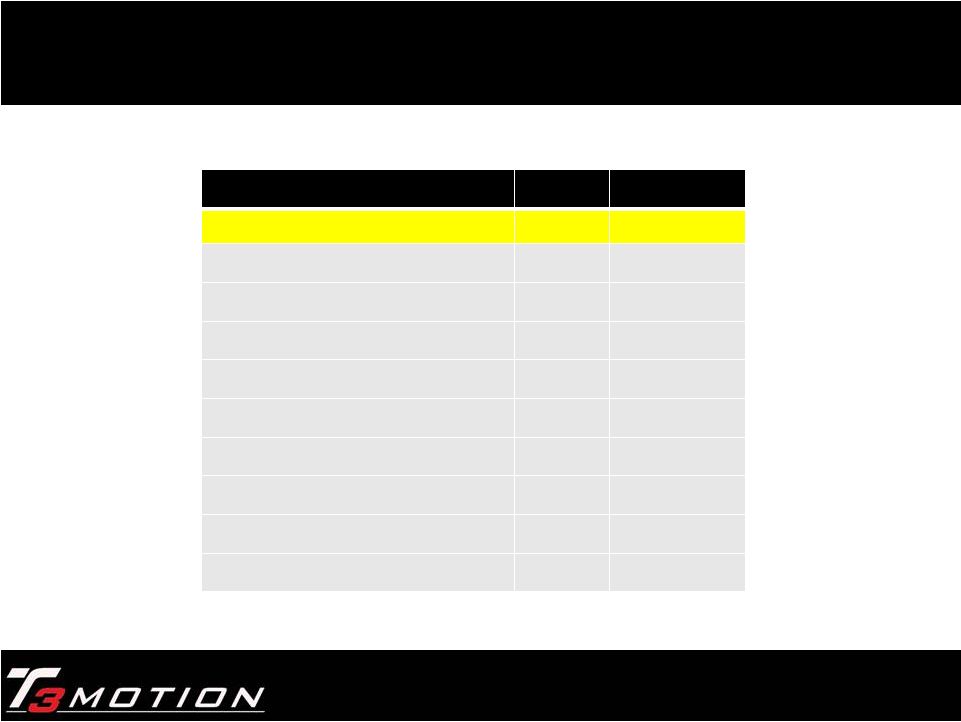

Name

Ticker

Market Cap

T3 Motion

TTTM

6

Tesla Motors

TSLA

3,580

A123 Systems

AONE

270

Azure Dynamics

AZD.TO

61

ZAP

ZAAP

57

Kandi Technologies

KNDI

81

ZENN Motor Company

ZNN

34

Balqon Corporation

BLQN

25

Li-ion Motors

LMCO

5

Leo Motors

LEOM

8

Comps

NYSE Amex: TTTM

25 |

Units

Sold 500

1,000

2,500

Revenue ($10K/unit)

$5,000,000

$10,000,000

$25,000,000

Gross Margin %

20%

30%

40%

Margin

1,000,000

3,000,000

10,000,000

R&D and SG&A

5,000,000

5,000,000

5,000,000

Operating Income

($4,000,000)

($2,000,000)

5,000,000

Metrics

NYSE Amex: TTTM

26 |

Investment

Summary Capitalize on Green

Does not rely on government funding for sustainability

Brand Value

•

•

Consumer launch will increase brand recognition

Market

New products to existing customers

Market penetration opportunity

Continued global expansion

Enter the consumer market

Valuation

Market doesn’t reflected brand value

NYSE Amex: TTTM

27

Potential has not been realized – foundation has been set, opportunity will sprout

EBITDA positive - obtainable at reasonable revenue |

Appendix

NYSE Amex: TTTM |

•

http://www.youtube.com/watch?v=XOs0s23nfh0

(T3-

Media Compilation)

•

http://www.youtube.com/watch?v=UvlXR_4QDnE&feature=r

elated

(T3-

Coconut Creek)

•

http://www.youtube.com/watch?v=p5OVsvj2HrQ

(T3-

Super Bowl Commercial)

•

http://www.youtube.com/watch?v=YXLtWAGczpc&feature=r

elated

(T3-

NYPD)

T3 Media Links

NYSE Amex: TTTM

29 |

Consumer

Market - Appendix

NYSE Amex: TTTM

30 |

Contact

Corporate Headquarters

2290 Air Avenue

Building A

Costa Mesa, CA 92626

P

(714) 619-3600

F (949) 269-0155

Kelly J. Anderson

Executive Vice President,

Chief Financial Officer

2290 Airway Avenue

Building A

Costa Mesa, CA 92626

(714) 619-3600

kanderson@t3motion.com

Ki Nam

Chief Executive Officer

2990 Airway Avenue,

Building

A

Costa Mesa, CA 92626

(714)

619-3600

knam@t3motion.com

Investor Relations Contact

Casey Stegman

Stonegate Securities, Inc.

(214) 987-4121

casey@stonegateinc.com

T3 Motion, Inc. (NYSE Amex: TTTM)

NYSE Amex: TTTM

31 |