Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Carbon Energy Corp | a11-31207_18k.htm |

Exhibit 99.1

|

|

December 2011 |

|

|

Appalachian and Illinois Basins Illinois Basin Properties Appalachian Basin Properties 1 |

|

|

Opportunity for Carbon to acquire producing assets in the south, expand existing operations, and consolidate a Southern Appalachian position. Northern and Southern Appalachian Basins have same geologic history, similar producing formations and age equivalent Devonian shale plays Marcellus and Utica Shales in North –High land, drilling and completion costs. Contentious political environment, intensely competitive Berea, Lower Huron,Chattanooga Shale in South – Reasonable costs, excellent response to horizontal drilling, oil development potential, no major competition Huron / Chat Marcellus Huron / Chat Marcellus Huron / Chat Marcellus Huron / Chat Marcellus Huron / Chat Marcellus Strategic Position in Southern Appalachia 2 |

|

|

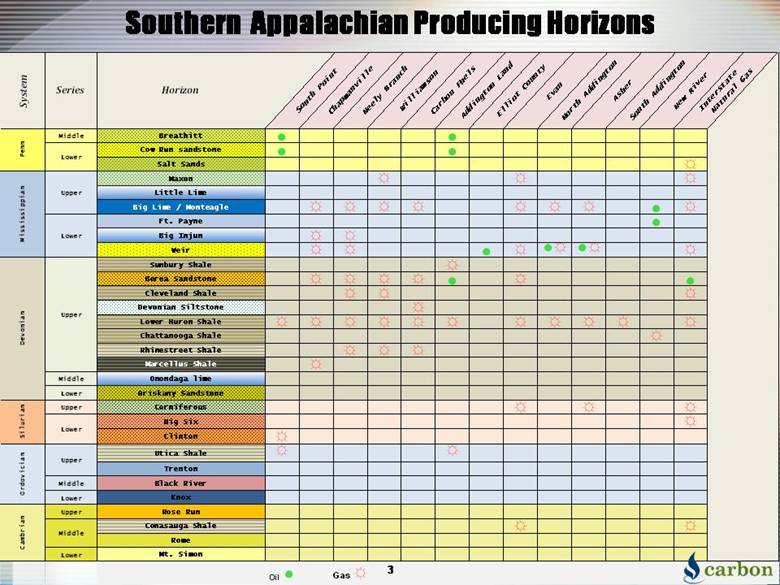

Southern Appalachian Producing Horizons 3 System Series Horizon South Point Chapmanville Neely Branch Williamson Carbon Fuels Addington Land Elliot County Evan North Addington Asher South Addington New River Interstate Natural Gas Penn Middle Breathitt ? ? Cow Run sandstone ? ? Salt Sands ? Maxon ? ? ? Little Lime Big Lime / Monteagle ? ? ? ? ? ? ? ? ? Ft. Payne ? Big Injun ? ? Weir ? ? ? ? ? ? ? ? ? Sunbury Shale ? Berea Sandstone ? ? ? ? ? ? ? Cleveland Shale ? ? ? Devonian Siltstone ? Lower Huron Shale ? ? ? ? ? ? ? ? ? ? ? Chattanooga Shale ? Rhinestreet Shale ? ? ? Marcellus Shale ? Middle Onondaga lime Lower Oriskany Sandstone Upper Corniferous ? ? ? Big Six ? Clinton ? Utica Shale ? ? Trenton Middle Black River Lower Knox Upper Rose Run Conasauga Shale ? ? Rome Lower Mt. Simon Oil ? Gas ? Middle Cambrian Penn Lower Mississippian Upper Lower Upper Ordovician Devonian Upper Silurian Lower |

|

|

7,000 mcfe net daily natural gas production Kentucky Horizontal Oil Development Program Expanding Illinois Basin Coalbed Methane production Multiple Horizontal Resource Play opportunities Devonian / Lower Huron Shale Seelyville Coal Berea Sandstone Oil Chattanooga Shale High BTU natural gas in close proximity to market Strong technical team with acquisition, production and drilling expertise Highlights 4 |

|

|

Significant opportunity for expansion of production, reserves and cash flow at low finding and development and operating costs Over 280,000 net acres of oil and gas and coalbed methane rights ~ 40% Held by Production ~ 40% expire greater than 5 years Significant Undeveloped Resource Potential Large inventory of proved undeveloped horizontal development drilling locations Large inventory of horizontal resource development drilling locations Highlights 5 |

|

|

Seelyville Coal Chattanooga Shale Lower Huron Shale Berea Sandstone Oil Horizontal Development Projects Lower Huron Shale Lower Huron Shale & Siltstone Lower Huron Shale 6 |

|

|

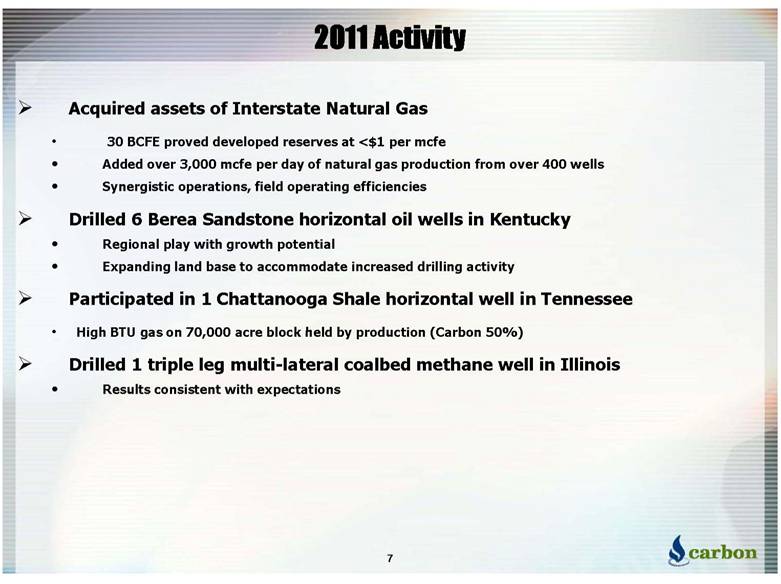

Acquired assets of Interstate Natural Gas 30 BCFE proved developed reserves at <$1 per mcfe Added over 3,000 mcfe per day of natural gas production from over 400 wells Synergistic operations, field operating efficiencies Drilled 6 Berea Sandstone horizontal oil wells in Kentucky Regional play with growth potential Expanding land base to accommodate increased drilling activity Participated in 1 Chattanooga Shale horizontal well in Tennessee High BTU gas on 70,000 acre block held by production (Carbon 50%) Drilled 1 triple leg multi-lateral coalbed methane well in Illinois Results consistent with expectations 2011 Activity 7 |

|

|

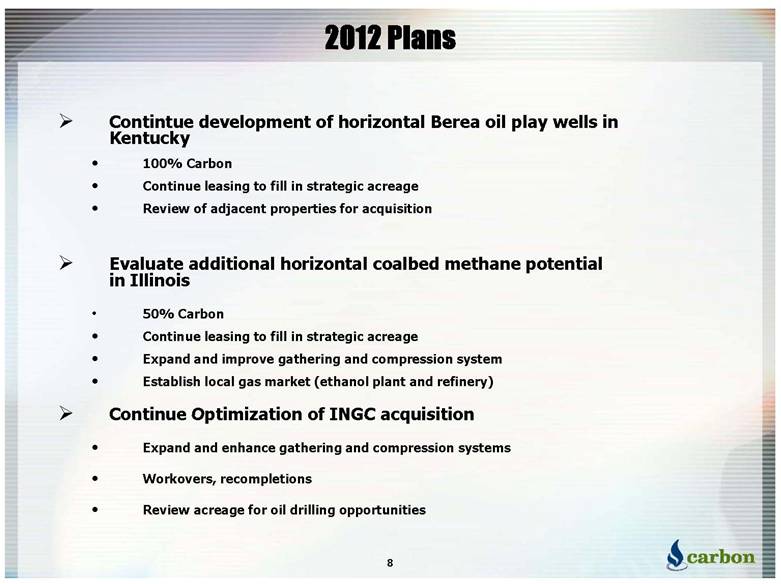

2012 Plans 8 Contintue development of horizontal Berea oil play wells in Kentucky 100% Carbon Continue leasing to fill in strategic acreage Review of adjacent properties for acquisition Evaluate additional horizontal coalbed methane potential in Illinois 50% Carbon Continue leasing to fill in strategic acreage Expand and improve gathering and compression system Establish local gas market (ethanol plant and refinery) Continue Optimization of INGC acquisition Expand and enhance gathering and compression systems Workovers, recompletions Review acreage for oil drilling opportunities |

|

|

Net Proved Reserves 9 Net Proved Reserves (BCFE) Internal Estimate as of 9/30/11 using SEC methodology and pricing |

|

|

Proved Reserves Base 10 * Proved Reserves of 81.4 BCFE include 331,000 bbls of oil. * Reserve Type Number of Wells Net Reserves (BCFE) Proved Developed Producing (Remaining) 777 45.3 Proved Developed Non-Producing 14 1.1 Proved Undeveloped 138 35 Total Proved Reserves 923 81.4* |

|

|

Acreage Position 11 |

|

|

Berea Sandstone Horizontal Oil Development Horizontal Berea Oil 600 sq. mi. prospective area +/-17,000 net oil & gas acres, Long term or HBP leases Current acreage potentially supports 300 horizontal well locations Currently leasing additional acreage 12 |

|

|

Carbon Acreage +/-17,000 Net Acres Oil Window Dry Gas Geology and reservoir work suggests large volume of oil in place Entire Berea trend has produced ~ 2 TCF of gas, little historical oil production Berea Thin or Absent 25 Miles OH WV KY Oil & Gas Productive Berea Sandstone Areas in Kentucky 13 |

|

|

Horizontal Berea Decline Curve Horizontal Berea IRR Cases 2,000’ lateral in Berea 27 year expected life EUR (bbls) IRR 30,000 20% 37,000 29 % 45,000 41 % Horizontal Berea Type Well Economics 14 Pricing - $85 per BBL WTI $4.00 per MMBTU Henry Hub 0 2 4 6 8 10 12 14 Feb-11 Feb-13 Feb-15 Feb-17 Feb-19 Feb-21 Feb-23 Feb-25 Feb-27 Feb-29 Feb-31 Feb-33 Feb-35 Feb-37 Feb-39 BO / Day 37,000 BO Case |

|

|

Illinois Basin Over 90,000 net acres in Illinois Basin 50% working interest in Wabash Valley coalbed methane 36 vertical producing wells 1 multi lateral horizontal producing well 1,500 mcfd gross production Wabash Valley CBM Joint Venture 15 |

|

|

Wabash Valley CBM Joint Venture First multi-lateral horizontal well drilled Sept 2011 Transition to multi lateral horizontal development Wabash Valley owns gathering, compression and Texas Gas delivery station Average vertical reserves of 150 mmcf of gas per well Horizontal Coal Bed Methane 16 Sullivan Co., IN Crawford Co., IL Clark Co., IL |

|

|

Horizontal CBM Decline Curve Horizontal CBM IRR Cases Fast drilling multilaterals ~ 10,000’ borehole in coal 27 year expected life Price ($/MCF) IRR $ 4.00 15 % $ 6.00 34 % $ 8.00 58 % Horizontal CBM Type Well Economics 17 Pricing: Henry Hub per mmbtu |

|

|

[LOGO] |