Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LODGENET INTERACTIVE CORP | d266563d8k.htm |

UBS Global

Media & Communications Conference

December 7, 2011

Exhibit 99.1 |

2

Certain statements in this presentation constitute “forward-looking

statements.” When used in this presentation, the words “intends,”

“expects,” “anticipates,” “estimates,” “believes,” “goal,” “no assurance” and similar expressions, and statements

which are made in the future tense or refer to future events or developments, including,

without limitation, Guest Entertainment revenue and cash flows per room, and expanded

services revenue, are intended to identify such forward-looking statements.

Such forward-looking statements are subject to risks, uncertainties and other factors that

could cause the actual results, performance or achievements to be materially different

from any future results, performance or achievements expressed or implied by such

forward-looking statements. Such factors include, among others, the following: the effects of economic

conditions, including general financial conditions; the economic condition of the lodging

industry, which can be particularly affected the financial conditions referenced above,

as well as by high gas prices, levels of unemployment, consumer confidence, acts or

threats of terrorism and public health issues; competition from providers of similar services and from alternative systems

for accessing in-room entertainment; competition from HSIA providers; changes in demand

for our products and services; programming availability, timeliness, quality and costs;

technological developments by competitors; developmental costs, difficulties and

delays; relationships with customers and property owners; the availability of capital to finance growth; compliance

with credit facility covenants; the impact of governmental regulations; potential effects of

litigation; risks of expansion into new markets; risks related to the security of our

data systems; and other factors detailed, from time to time, in our filings with the

Securities and Exchange Commission. For any of the foregoing reasons, our guidance and our

actual financial results may not meet our expectations. These forward-looking

statements speak only as of the date of this presentation. We expressly disclaim any

obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to

reflect any change in our expectations with regard thereto or any change in events, conditions

or circumstances on which any such statement is based. |

3

I.

Highly Attractive Market Position

Dominant Position: 85% Share of VOD Market

Affluent Consumer Demographic

Best Screen with Best Entertainment Options

Premium VOD Content: Top 5 Hotel Channel

Strong Free Cash Flow: Proven Ability to De-lever

II.

Proven & Impactful Growth Opportunities

New Four Screen Strategy: Expands Strategic & Economic Value

Transition to Higher-Revenue HDTV: Only 20% HD Penetration Today

Mobile App: Creates ‘Over The Top’

Relationship with Travelers

Targeted & Interactive Advertising: High Value Guest Demographic

Healthcare: Growth Opportunity that Leverages Core Technology

Investment Highlights |

Largest Provider

of Interactive Media & 1.7 Million Rooms

85% Share of VOD-Served Market

Reach Over 500 Million Consumers Annually

Highly Interactive Audience

Highly Attractive Demographic*

Guests Turn

on Television

Frequent Travelers

Carrying Smartphones**

Now “Going

Interactive”

60%

Business Overview

4

* Source: Neilson Demo Study, Oct 2011 ** SITA/ATW Survey, Oct

2011 98%

74%

Connectivity Services to Hospitality & Healthcare

-

Affluent:

2X

More

Likely

to

Have

Household

Income

Over

$100K

-

Educated:

57%

More

Likely

to

Have

College

Degree |

1.7 Million Rooms

(as of 12/31/10)

Attractive & Diversified Hotel Base

5

Luxury

2%

Upper-Upscale

17%

Upscale

23%

Midscale

w/ F&B

12%

Midscale

w/o F&B

26%

Economy

4%

Independent

16% |

1,500+

Ownership & Management

Groups

(as of 12/31/10)

(Based on Number of Rooms)

Focused by Brand…Diversified by Decision

6

Attractive & Diversified Hotel Base

Over 9,000 Property Level Agreements |

Advantage:

Premium VOD Day

1

Day

60

Day

120

Day

150

* Sources: National Association of Theater Owners, LodgeNet Interactive

(streaming)

60 days before DVD | 90 days before Netflix*

Early Window

Drives Majority

of Revenue

7 |

LodgeNet 150-Site Channel Viewing Data

LodgeNet VOD Top 5 Viewed Channel

8

Advantage: Premium VOD |

9

Expanded Mission Driving Growth

“Four Screen”

Strategy Expands LodgeNet Opportunity

Interactive TV + Web + Mobile + Tablets

Guest Entertainment + Hotel Services + Advertising Services

In-Room + On-Property + On the Way |

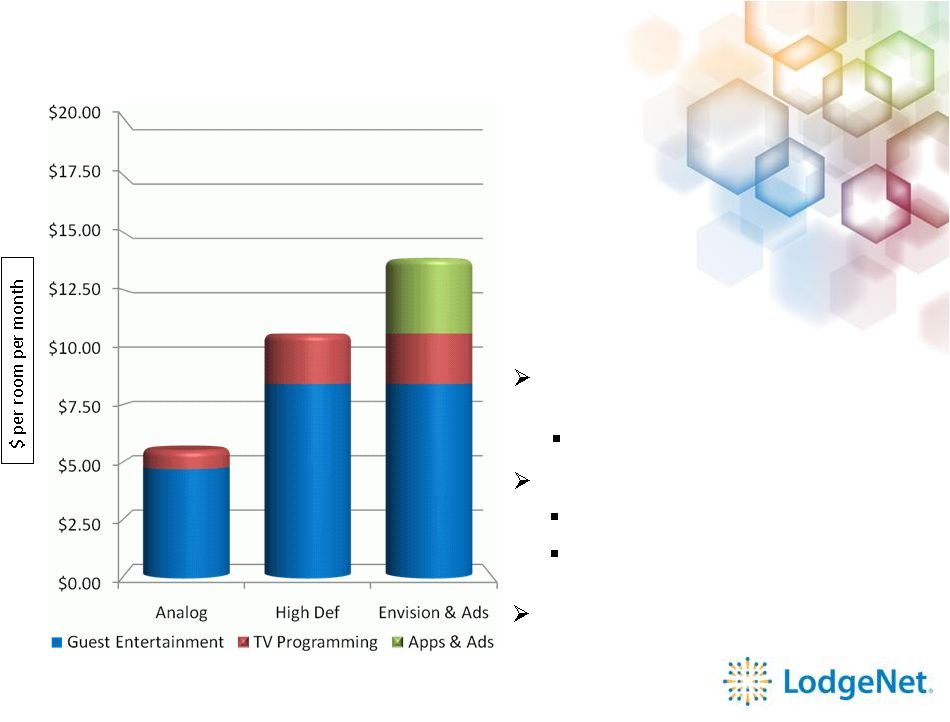

Yesterday

Today

Tomorrow

Diversified Revenue “Stack”

High Definition: Up 64% over Analog

Incremental Revenues: +25% Potential

-

Envision Apps

Hotel Subscriptions –

Consistent

Revenue

-

Mobile App

Hotel Subscriptions –

Services

Guest Transactions –

$$ Share

Advertising Services

TV, Mobile & Web Platforms

Attractive Demographic

10

Revenue Growth from Expanded Services |

New

Services Have High Margins with Minimal

Capex

Envision Apps: Software as

Mobile: Software Implementation

Software Upgrade to iTV

Software Download to Guests’

Smart Phones

11

Accelerated Cash Flow Growth

Yesterday

Today

Tomorrow

$10.50

$14.00

$5.50

Advertising: Low Fixed Cost

Operations

Service

Minimal Incremental Opex |

High

Definition TV Roll-Out 60% Greater Revenue than Analog

Hotels Aggressively Moving to HDTV

Only 20% Today Have Full iHDTV Systems

Enhanced: VOD 2.0 Entertainment

Marketing

Browsing Up Significantly

Hollywood Movie Revenue Up Since Intro

Envision Driving Engagement & Revenues

More Guests Now “Going Interactive”

More Hotels Subscribing to Apps

Increase in iTV Cash Flow Per Room

Robust iTV Growth Strategy

12 |

Compelling iHDTV

Economics iHDTV in 290,000 Rooms

(19% of

Room Base = Growth Opportunity) 13

HD Rooms = 64% Higher Revenue

Per Month vs. Analog Rooms

57% More Guest Entertainment

77% More TV Programming

Significantly Reduced Capex per Room

Solid Return on Capital Investment

Capital Returned in 12-18 Months

5 Year Contract with Upgrade

Supports Envision Platform

All Future HD Upgrades Support Envision Apps

Existing HD Rooms Upgradeable to Envision

Average

Investment

of

$144

Per

Room

Capex

Per

Room

Down

50%

in

Two

Years |

New

Marketing Increasing Usage June VOD 2.0 Launch –

1.1 Million Rooms

tiered pricing / new look

marketing earliest window

expanded payment options

promotional codes

Revenue Up

5%

Browsing Up

20-25%

more guests into

the system

higher theatrical

purchase rates

higher theatrical

revenue per room

Immediate results in Hollywood movie purchases:

LodgeNet Internal Data, June

2011 Premium VOD

buyers purchasing

premium titles

14

Buy Rates Up

10-15%

65% |

Envision =

Internet “Connected” Television

-

Exploding in consumer market

-

25% of sets sold this year

Subscribing Hotels Can Leverage Power of Interactive Platform

-

eCompendium App: Save Operating Costs –

More “Green”; Less Printing

-

eConcierge Apps: Drive More Revenue –

Room Service & Tickets

Standard Apps Deliver Great

Interactive TV Experience

-

Premium VOD

-

TV On Demand

-

Multiple Purchase Options

-

Basic Hotel Services –

eCheckout

15 |

Increasing

Consumer Engagement Accessing Interactive Services 3x more than Prior HD Platform

Gaining Hotel Adoption

19,000 Rooms Now Under Contract

Marquee Hotels in Four Seasons, Hilton, Hyatt, Marriott, Starwood

Over 1/3 Subscribing to One or More Envision Apps

Average Monthly Subscription Over $3.00 Per Room

16

Successful

Envision Rollout |

Mobile Launches

in January TV

Control

Hotel

Services

Local

Info

Interactive

Program

Guide (IPG)

17

17

Available on

Android, iPhone, iPad |

Increase Guest Engagement with iTV

TV Controls to Draw Interest

Interactive Program Guide

Apps Relevant for Busy Travelers

Available in 500,000 Rooms in 2012

Hotel Customization Services

Customized Apps for Individual Brands

In Room Dining, Guest Requests, Hotel Info

1:1 Marketing Relationship with Consumer

Mobile Growth Strategy

18

“Over the Top”

= New Opportunity for LodgeNet

Reservations, Promotions, Points & Credit Cards

In Room + On Property + On the Way |

LODGENET ADVERTISING PLATFORM

Current Platform

Expanded

Room Footprint

320,000 rooms

500,000+ rooms

Number of Channels

10 channels

20+ channels

Programming Format

Standard Def

High Def

Ability to Target Ads

National

Local

Content Distribution

LNET Leased Satellite

Access to DBS

Annual Impressions

1.2 Billion

5+ Billion

I.

Transition to Expanded HD Ad Platform in 2013

More Rooms and More Channels

Targeted Insertion Drives CPMs –

Taps New Advertising Budgets

Insertion Technology Similar to National DBS Providers

Network Installation & Testing Scheduled for 2012 with Launch in

Q1 2013

II.

Expand Focus on iTV + Mobile + Web

iTV: Expanded Interactive Channels w/ Telescoping

Mobile & Web: Targeted Demographic + Local

Advertising Growth Strategy

19 |

Healthcare

Drivers: Patient Education

Patient Safety

Patient

Satisfaction

LodgeNet Healthcare

Healthcare Economics:

Interactive System Sale Per Bed

$1,000 -

$1,500

Recurring Revenue Per Bed Per Month

Gross Profit Margin

Q3 2011 TTM Revenue: $10.1 Million

Interactive System Sales to Hospitals

One Million Beds in US –

Addressable Market: 40%

63 Hospitals Installed –

73 Under Contract

(as of 9/30/11)

$25 -

$35

20

40%+ |

Strong Free Cash

Flow* Quarterly Comparison

($ in millions)

*Free Cash Flow Definition see slide

24 ** Share Count with Preferred Stock Converted 40.42mm Shares

Q3 '11

Q3 '10

Q3 '11

W/Converted Share**

Adjusted Operating Cash Flow

$ 27.0

$ 27.9

$ 0.67

Interest Payments

(6.3)

(7.8)

Working Capital (net)

(7.3)

(0.1)

Pre-Investment Cash Flow

$ 13.4

$ 20.0

$ 0.33

Corporate Assets

(2.6)

(2.8)

HD Investments & Extensions

(3.5)

(1.9)

Total Capital Investment

(6.1)

(4.7)

Free Cash Flow

$ 7.3

$ 15.3

$ 0.18

Free Cash Flow Adjusted for Working Capital

$ 14.6

$ 15.4

$ 0.36

21 |

Proven Ability to

Reduce Leverage (in millions) 4.28x

3.72x

3.40x

Net Debt to Bank

AOCF Ratios

$469.9

$595.5

$382.3

$347.8

Company Has Paid Down Approximately $250 Million of Net Debt During Past 3 Years

LodgeNet Continues to Reduce Leverage

Lower Debt Level Enables Aggressive Investment into Strategic Growth Initiatives

22

3.33x

$300

$350

$400

$450

$500

$550

$600

$650

Q3 08

Q3 09

Q3 '10

Q3 '11

Covenant at 4.0x |

23

I.

Highly Attractive Market Position

Dominant Position: 85% Share of VOD Market

Affluent Consumer Demographic

Best Screen with Best Entertainment Options

Premium VOD Content: Top 5 Hotel Channel

Strong Free Cash Flow: Proven Ability to De-lever

II.

Proven & Impactful Growth Opportunities

New Four Screen Strategy: Expands Strategic & Economic Value

Transition to Higher-Revenue HDTV: Only 20% HD Penetration Today

Mobile App: Creates ‘Over The Top’

Relationship with Travelers

Targeted & Interactive Advertising: High Value Guest Demographic

Healthcare: Growth Opportunity that Leverages Core Technology

Investment Highlights |

Reconciliation

of Operating Income to Adjusted Operating Cash Flow

Operating Income

Plus: Depreciation and Amortization

Plus: Restructuring Charges and Integration Expenses

Plus: Share-Based Compensation

Plus: Impairment Charge

Equals: Adjusted Operating Cash Flow

Reconciliation of Free Cash Flow

Cash from Operations

Less: Cash Used for Investing Activities, including Growth-Related Capital

Equals: Free Cash Flow

24 |