Attached files

| file | filename |

|---|---|

| 8-K - LANDAUER INC | ldr_8k.htm |

| EX-99.1 - LANDAUER INC | exh_991.htm |

LANDAUER, INC. Fiscal 2011 Fourth Quarter and Year End Results December 6 th , 2011

This presentation may contain forward-looking statements, including statements about the outlook and prospects for Company and industry growth, as well as statements about the Company’s future financial and operating performance. Some of the information shared here constitutes forward-looking statements that are based on assumptions and involve certain risks and unce rtainties. These include the following, without limitation: assumptions, risks and uncertainties associated with the company's development and introduction of new technologies in general; introduction and cu stomer acceptance of the InLight technology; the adaptability of optically stimulated luminescence (OSL) technology to new platforms and formats, such as Luxel®+; the costs associated with the company's research and business development efforts; the usefulness of older technologies; the anticipated results of operations of the company and its subsidiaries or ventures; valuation of the company's long-lived assets or business units relative to future cash flows; changes in pricing of products and services; changes in postal and delivery practices; the company's business plans; anticipated revenue and cost growth; t he risks associated with conducting business internationally; other anticipated financial events; th e effects of changing economic and competitive conditions; foreign exchange rates; government regulations; accreditation requirements; and pending accounting pronouncements. These assumptions may not mat erialize to the extent assumed, and risks and uncertainties may cause actual results to be different from what is anticipated today. These risks and uncertainties also may result in changes to the compan y's business plans and prospects, and could create the need from time to time to write down the value of assets or otherwise cause the company to incur unanticipated expenses. You can find more information b y reviewing the "Significant Risk Factors" section in the company's Annual Report on Form 10 -K for the year ended September 30, 2010, and other reports filed by the company from time to time with the Securities and Exchange Commission. 2 Safe Harbor Statement

Recent Financial Performance 3 Fiscal 2011 Highlights Revenue grew 5.3 percent to $120.5 million. Gross profit grew 4.4 percent to $72.9 million on increased revenue and mix. Operating income increased $0.3 million, to $34.9 million Net income rose 3.6 percent to $24.5 million, or $2.58 per diluted share. Cash from operating activities of $31.2 million, an increase of 18.9%. Strong dividend policy of $0.55 per share for the first fiscal quarter of fiscal 2012, providing an annual dividend rate of $2.20 consistent with 2011 levels. The military issued orders totaling $14.5 million during the fiscal year for shipments in fiscal 2012 and beyond.

Value Creation Deliver Upside Growth 1.Optimize Core 2.Competitive Growth 3. Strategic Expansion Strategic Priorities Landauer Strategy Overview Strategic ExpansionOptimize the Core Competitive Growth New Management in 2006 Restructure: Cost IT/ERP system upgrades OSL / InLight –new international market access New Channels and Geographies ― Military, First Responder New Products/Existing/Channel ― Patient Monitoring Radiation Safety Continuum ― Medical Physics acquisition ― IZI Medical Products Acquisition ― Leverage core competencies and footprint to expand market opportunity 4

Radiation Safety Continuum Existing Services with Penetration Opportunities* Complementary Adjacent Products / Services _____________________ (1) Average Revenue per Facility greater than $400K. Along the Radiation Safety Continuum 5 IZI Medical Physics Core Business Greater than $1.1 Billion US Market Opportunity

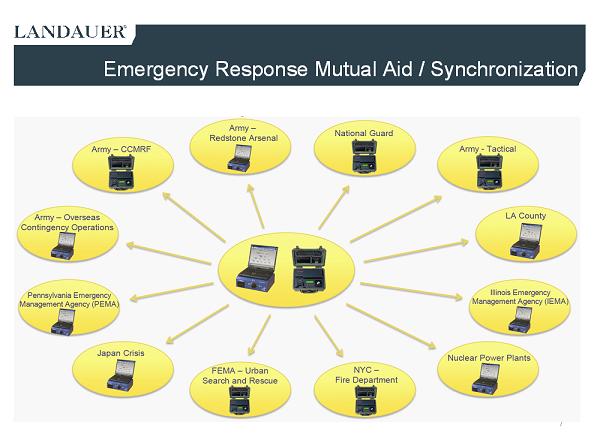

6 Competitive Growth Penetration with US Military Expanding application of next generation technology to pursue global military and first responder radiation monitoring markets The U.S. military issued orders totaling $14.5 million to upgrade the Army’s tactical dosimetry capabilities, which will be shared with our military partner and delivered in fiscal 2012 and beyond o Landauer’s portion of the orders issued to date is $11 million The U.S. Army’s Redstone Dosimetry Lab, which manages and controls medical andoccupational dosimetry to all U.S. Army personnel, placed an order to acquire Landauer’s OSL technology for $2 million. This order shipped in October 2011. Expansion of Nuclear Footprint Awarded contracts ~17 additional nuclear power plant facilities,increasing Landauer’s share of the nuclear power market above 40% Progress with Emergency Response Mutual Aid / Synchronization ▪ Developing mutual aid response strategy to synchronize first responders, military radiation monitoring strategies, and the nuclear industry ▪ Received the first FEMA emergency response order

Emergency Response Mutual Aid / Synchronization 7

Strategic Expansion –Medical Physics Market Dynamics / OpportunityHighlights x $1.0 billion domestic market (largest player in market –by 3x) x Approximately 6,000 hospitals perform 37 million nuclear medicine procedures per year (10 million in U.S.) x Radiopharmaceutical utilization growing at over 10% per year x Highly fragmented and regional, primarily small competitors – significant consolidation opportunities x Contractual relationship with ~5,000 hospitals for Occupational Radiation Monitoring provides significant cross-selling opportunities for Medical Physics business 8 Efforts to refine the medical physics sales cycle and improve LDR’s value add proposition have begun to have a positive impact as evidenced by positive operating earnings contribution in Q4’11 Completed 3 additional bolt-on acquisitions totaling ~$2.8million in consideration in fiscal year 2011 – Added imaging practices in St. Louis and North Carolina – The North Carolina group is highly regarded in the region and brings several unique competencies and service lines that we intend to leverage across our growing national footprint

Strategic Expansion –IZI Medical Products Acquired 100% of the outstanding equity of IZI Medical Products for approximately $93 million cash, subject to certain customary purchase price adjustments The acquisition is expected to be $0.12 to $0.16 accretive to EPS (earnings per share) in fiscal 2012 The structure of the transaction will provide a future tax benefit with a net present value of approximately $18.6 million Financed the entire purchase price (and refinanced Landauer’s existing debt) with a new $175 million revolving debt facility – Provides in excess of $40 million for future strategic transactions or working capital needs 9 Acquisition Overview

10 Strategic Expansion –IZI Medical Products IZI represents a logical extension of Landauer’s radiation safety continuum ― Significant channel leverage for expanded product offering ― Enhances complementary product / service offerings ― Accretive both financially and operationally ― Broadens addressable market ― Brings talented team with innovative culture Transaction Rationale

11 Optimize the Core Systems Initiative Update We are on schedule to support “Go-Live”of the final phase of the project in fiscal 2012 Substantial expense will be incurred in fiscal 2012 to support the successful launch of the system – $4.4 million ($2.9 million net of tax) of non-recurring expense spending in fiscal 2012 to support the successful completion of the Company’s systems initiative and the related post implementation support. – Incremental depreciation and amortization over fiscal 2011 of $1.8 million ($1.2 million net of tax) related to the deployment of the final phase of the Company’s systems initiative in the third fiscal quarter of fiscal 2012. Measured approach to the phased implementation has paid dividends – Minimize the risk of any disruptions to customers or daily business – Positioned to realize the operational efficiencies of the new systems over the long-term

12 LDR Dividend Policy We are committed to maintaining a competitive dividend and will continue to return cash to shareholders in this manner going forward Board of Directors declared a regular quarterly cash dividend of$0.55 per share for the first quarter of fiscal 2012 – This represents an annual rate of $2.20 per share, consistent with fiscal 2011 levels – The dividend will be paid on January 4, 2012 to shareholders of record on December 9, 2011

Guidance 13 Fiscal 2012 Outlook Expected Revenue $150 to $157 million, which includes 10 months of contributions from the recent IZI Medical Products acquisition. Also reflects: – $4.4 million ($2.9 million net of tax) of non-recurring expense spending to support the successful completion of the Company’s systems initiative and the related post implementation support. – Incremental depreciation and amortization over fiscal 2011 of $1.8 million ($1.2 million net of tax) related to the deployment of the final phase of the Company’s systems initiative in the third fiscal quarter of fiscal 2012. – The accretive impact of the November 2011 acquisition of IZI Medical Products producing $1.1 million to $1.5 million of net income for the 10 months included in fiscal 2012. Net Income of $21 to $23 million, including non recurring charges reflected above. EBITDA of $49 to $51 million, an increase of $5-$7 million over fiscal 2011.

Questions? Fiscal 2011 Fourth Quarter and Year End Results December 6 th , 2011