Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - LANDAUER INC | ldr-20160930xex32_2.htm |

| EX-32.1 - EX-32.1 - LANDAUER INC | ldr-20160930xex32_1.htm |

| EX-31.2 - EX-31.2 - LANDAUER INC | ldr-20160930xex31_2.htm |

| EX-31.1 - EX-31.1 - LANDAUER INC | ldr-20160930xex31_1.htm |

| EX-23.(B) - EX-23.(B) - LANDAUER INC | ldr-20160930xex23_b.htm |

| EX-23.(A) - EX-23.(A) - LANDAUER INC | ldr-20160930xex23_a.htm |

| EX-21 - EX-21 - LANDAUER INC | ldr-20160930xex21.htm |

| EX-3.(B) - EX-3.(B) - LANDAUER INC | ldr-20160930xex3_b.htm |

| EX-3.(A) - EX-3.(A) - LANDAUER INC | ldr-20160930xex3_a.htm |

Securities and Exchange Commission

Washington, DC 20549

form 10-K

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2016

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number 1-9788

LANDAUER, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

06-1218089 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

2 Science Road, Glenwood, Illinois 60425

(Address of Principal Executive Offices and Zip Code)

Registrant’s Telephone Number, Including Area Code: (708) 755-7000

Securities registered pursuant to Section 12(b) of the Act:

|

Common Stock with Par Value of $.10 |

New York Stock Exchange |

|

(Title of each class) |

(Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer |

[ ] |

|

Accelerated filer |

[ X ] |

|

|

|

Non-accelerated filer |

[ ] |

|

Smaller reporting company |

[ ] |

|

|

|

(Do not check if a smaller reporting company) |

|

|

|

||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [ X ]

As of March 31, 2016 the aggregate market value, based upon the closing price on the New York Stock Exchange, of the voting and non-voting common equity held by non-affiliates was approximately $314,000,000. The number of shares of common stock ($0.10 par value) outstanding as of December 9, 2016 was 9,621,927.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Part III of this Annual Report on Form 10-K is incorporated herein by reference to the Registrant’s definitive Proxy Statement in connection with the 2017 Annual Meeting of Stockholders (the “Proxy Statement”).

2

Landauer, Inc.

Table of Contents

For the Fiscal Year Ended September 30, 2016

|

|

|

|

|

|

|

Page |

|

4 |

||

|

|

|

|

|

PART I |

|

|

|

Item 1. |

4 |

|

|

|

4 |

|

|

|

6 |

|

|

|

7 |

|

|

|

7 |

|

|

|

7 |

|

|

|

8 |

|

|

|

8 |

|

|

|

8 |

|

|

|

9 |

|

|

|

11 |

|

|

|

11 |

|

|

Item 1A. |

11 |

|

|

Item 1B. |

19 |

|

|

Item 2. |

19 |

|

|

Item 3. |

19 |

|

|

Item 4. |

19 |

|

|

PART II |

||

|

Item 5. |

20 |

|

|

Item 6. |

24 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

25 |

|

Item 7A. |

37 |

|

|

Item 8. |

39 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

75 |

|

Item 9A. |

75 |

|

|

Item 9B. |

77 |

|

|

PART III |

||

|

Item 10. |

78 |

|

|

Item 11. |

78 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

78 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

78 |

|

Item 14. |

78 |

|

|

PART IV |

||

|

Item 15. |

79 |

|

|

|

79 |

|

|

|

80 |

|

|

|

|

|

|

82 |

||

3

Forward-Looking Statements

Certain matters contained in this report constitute forward-looking statements that are based on certain assumptions and involve certain risks and uncertainties. These include the following, without limitation: assumptions, risks and uncertainties associated with the Company’s future performance; the Company’s development and introduction of new technologies in general; the ability to protect and utilize the Company’s intellectual property; events or circumstances which result in an impairment of assets, including but not limited to, goodwill and identifiable intangible assets; continued customer acceptance of the InLight technology; the adaptability of optically stimulated luminescence (“OSL”) technology to new platforms and formats; military and other government funding for the purchase of certain of the Company’s equipment and services; the impact on sales and pricing of certain customer group purchasing arrangements; changes in spending or reimbursement for services; the costs associated with the Company’s research and business development efforts; the usefulness of older technologies and related licenses and intellectual property; the effectiveness of and costs associated with the Company’s IT platform enhancements and investments in cyber security enhancements; the anticipated results of operations of the Company and its subsidiaries or joint ventures; valuation of the Company’s long-lived assets or reporting units relative to future cash flows; changes in pricing of services and products; changes in postal and delivery practices; the Company’s business plans; anticipated revenue and cost growth; the ability to integrate the operations of acquired businesses and to realize the expected benefits of acquisitions; the risks associated with conducting business internationally; costs incurred for potential acquisitions or similar transactions; other anticipated financial events; the effects of changing economic and competitive conditions, including instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; foreign exchange rates; government regulations; accreditation requirements; changes in the trading market that affect the costs of obligations under the Company’s benefit plans; and pending accounting pronouncements. These assumptions may not materialize to the extent assumed, and risks and uncertainties may cause actual results to be different from what is anticipated today. These risks and uncertainties also may result in changes to the Company’s business plans and prospects, and could create the need from time to time to write down the value of assets or otherwise cause the Company to incur unanticipated expenses. Additional information may be obtained by reviewing the information set forth in Item 1A. “Risk Factors” and Item 7A. “Quantitative and Qualitative Disclosures about Market Risk” and information contained in the Company’s reports filed, from time to time, with the Securities and Exchange Commission (“SEC”). The Company does not undertake, and expressly disclaims, any duty to update any forward-looking statement whether as a result of new information, future events or changes in the Company’s expectations, except as required by law.

PART I

Landauer, Inc. is a Delaware corporation organized on December 22, 1987. As used herein, the “Company,” “we,” “our,” “us” or “Landauer” refers to Landauer, Inc. and its subsidiaries. The Company’s common stock is listed on the New York Stock Exchange under the ticker symbol “LDR.”

Landauer is a leading global provider of technical and analytical services to determine occupational and environmental radiation exposure and the leading domestic provider of outsourced medical physics services. The Company is organized into three reportable business segments: Radiation Measurement, Medical Physics and Medical Products. The Medical Products business was divested in May 2016.

4

Radiation Measurement

Radiation Measurement has been the core business for over 60 years. The Company has provided complete radiation dosimetry services to hospitals, medical and dental offices, universities, national laboratories, nuclear facilities and other industries in which radiation poses a potential threat to employees. Landauer’s services include the manufacture of various types of radiation detection monitors, the distribution and collection of the monitors to and from customers, and the analysis and reporting of exposure findings. These services are provided to approximately 1.8 million individuals globally. In addition to providing analytical services, the Company may sell dosimetry detectors and reading equipment to large customers that want to manage their own dosimetry programs, or into smaller international markets in which it is not economical to establish a direct service.

The majority of Radiation Measurement revenues are realized from radiation measurement services and other services incidental to radiation dose measurement. The Company enters into agreements with customers to provide them with radiation measurement services, generally for a twelve-month period. Such agreements generally have a high renewal rate, resulting in customer relationships that are generally stable and recurring. As part of its services, the Company provides to its customers radiation detection badges, which are produced and owned by the Company. The badges are worn for a period selected by the customer (“wear period”), which is usually one, two, or three months in duration. At the end of the wear period, the badges are returned to the Company for analysis. The Company analyzes the badges that have been worn and provides the customer with a report indicating their radiation exposures. The Company recycles certain badge components for reuse, while also producing replacement badges on a continual basis.

The Company offers its service for measuring the dosages of x-ray, gamma radiation and other penetrating ionizing radiations to which the wearer has been exposed, primarily through badges, which contain OSL material, and are worn by customer personnel. This technology is marketed under the trade names Luxel+® and InLight®.

A key component of the Company’s dosimetry system is OSL crystal material. Radiation Measurement operates a crystal manufacturing facility in Stillwater, Oklahoma. The Company’s base OSL material is manufactured utilizing a proprietary process to create aluminum oxide crystals in a unique structure that is able to retain charged electrons following the crystal’s exposure to radiation.

Radiation Measurement’s InLight dosimetry system provides in-house and commercial laboratories with the ability to provide in-house radiation measurement services using OSL technology. InLight services may involve a customer acquiring dosimetry devices as well as analytical reading equipment from the Company. The system is based on the Company’s proprietary technology and instruments. The InLight system allows customers the flexibility to tailor their precise dosimetry needs.

Radiation Measurement’s RadWatch and RadLight system provides the military and first responder user with a portable, field-ready option for tactical radiation monitoring using OSL technology. RadWatch and RadLight are offered through a joint venture with Yamasato, Fujiwara, Higa & Associates, Inc. (“YFH”), doing business as Aquila Group, a small business supplier to the International Atomic Energy Agency and the U.S. Military. The Company provides dosimetry parts to Aquila Group for their military contract. RadWatch and RadLight solution fulfills a recognized gap for acquiring a legal dose of record for radiation emergency response teams.

Other radiation measurement-related services augment the basic radiation measurement services that the Company offers, providing administrative and informational tools to customers for the management of their radiation safety programs.

Medical Physics

Medical physics services are provided through the Company’s Landauer Medical Physics (“LMP”) division. In November 2009, Landauer completed its first LMP acquisition by acquiring Global Physics Solutions, Inc. (“GPS”). Landauer acquired five regional practices from 2010 to 2012 to augment the LMP operations. With primary offices in Illinois and New York, LMP has operations throughout the United States (“U.S.”).

5

The Company uses LMP as a platform to expand into the medical physics services market, serving domestic hospitals, radiation therapy centers and imaging centers. LMP is the leading nationwide service provider of clinical physics support, equipment commissioning and accreditation support and imaging equipment testing. Clinical physics support is provided by medical physicists, who individually focus on either imaging or therapeutic medical physics. Imaging physicists are concerned primarily with the radiation delivered by imaging equipment, image quality and compliance with safe practices in nuclear pharmacies. Therapeutic physicists are concerned with the safe delivery of radiation in cancer treatment. Therapeutic physicists contribute to the development of therapeutic techniques, collaborate with radiation oncologists to design treatment plans, and monitor equipment and procedures to ensure that cancer patients receive the prescribed dose of radiation to the correct location. Both specialties are aligned with critical treatment trends in the continued increase in utilization of radiation for the diagnosis and treatment of disease. The ability to target treatments and reduce the impact of surgical procedures is often aided by imaging and therapeutic techniques. The Company reports the operating results of LMP in the Medical Physics reporting segment.

Medical Products

Landauer divested the Medical Products business in May 2016. The Medical Products business was a provider of high quality medical consumable accessories used in radiology, radiation therapy, and image guided surgical procedures. Medical products ranged from consumables used with magnetic resonance imaging (“MRI”), computed tomography (“CT”), and mammography technologies to highly engineered passive reflective markers used during image guided surgical procedures.

Landauer believes that its business is largely dependent upon the Company’s technical competence, the quality, reliability and price of its services and products, and its prompt and responsive service.

A summary of selected financial data for Landauer for the last five fiscal years is set forth in Part II – Item 6. “Selected Financial Data.” Financial information about geographic areas and segments is provided in Part II – Item 8. “Notes to Consolidated Financial Statements.”

Landauer’s Radiation Measurement services and products are marketed in the U.S. and Canada primarily by full-time Company personnel located in 11 sales regions. The Company’s non-U.S. and Canadian Radiation Measurement services and products are marketed through its wholly-owned subsidiaries operating in the United Kingdom, France and Sweden, its joint ventures in Japan and Turkey and its consolidated subsidiaries in Brazil, Australia, Mexico and China. Other firms and individuals market the Company’s radiation measurement products and services on a distributorship or commission basis, generally to small customers or in geographic regions in which the Company does not have a direct presence.

Worldwide, the Company’s Radiation Measurement segment serves approximately 51,000 customers representing approximately 1.8 million individuals annually. The customer base is diverse and fragmented with no single customer representing greater than 2% of revenue. Typically, a customer will contract on a subscription basis for one year of service in advance, representing monthly, bimonthly, quarterly, semi-annual or annual badges, readings and reports. Customer relationships in the radiation measurement market are generally stable and recurring. Details of the Company’s revenue recognition and deferred contract revenue policy are set forth in Part II – Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies and Estimates.”

The Company’s U.S. and Canadian Radiation Measurement services are largely based on the Luxel+ dosimeter system in which all analyses are performed at the Company’s laboratories in Glenwood, Illinois. Luxel+ employs the Company’s proprietary OSL technology. The Company’s InLight dosimetry system enables certain customers to make their own measurements using OSL technology.

6

For most radiation dosimetry laboratories operating around the world, the laboratory must maintain accreditation with a regulatory body to provide the user with a formal record of dose – a process that is expensive and time consuming. By combining the implementation of an InLight system in the laboratory and “dose of record” determination by Landauer or a Landauer affiliated and accredited facility, the user can provide its workers with the periodic radiation safety management infrastructure without the need to maintain its own accreditation. Additionally, dosimetry management software options provide the ability to measure the incremental radiation dose of workers at regular intervals over long periods of time.

InLight also forms the basis for Landauer’s operations in Europe, Asia, and Latin America and other future operations that might occur where local requirements preclude using a U.S. or other foreign-based laboratory.

Medical Physics outsourced services are marketed to hospitals and free-standing cancer centers or free-standing imaging centers across the U.S. The Company’s medical physicists partner with other healthcare professionals to deliver services to address evolving technology, safety and regulatory needs, with the objective of improving patient outcomes through safe and effective use of radiation in medicine. The services are marketed to radiation oncology and imaging customers by a team of business development professionals supported by LMP’s senior leadership and physicists.

The services provided by the Company to its Radiation Measurement customers are on-going and are of a subscription nature. As such, revenues are recognized in the periods in which such services are rendered, irrespective of whether invoiced in advance or in arrears. Given the subscription nature of Radiation Measurement services, quarterly revenues are fairly consistent.

There is no identifiable seasonality to the Company’s Medical Physics or Medical Products (for the periods owned) segments as their services and products are utilized in radiographic, radiation therapy and surgical procedures that are performed throughout the year.

Information regarding the Company’s activities by geographic region is contained in Part II – Item 8. “Notes to Consolidated Financial Statements.”

Patents, Proprietary Technologies and Licenses

The Company holds exclusive worldwide licenses to patent rights for certain technologies that measure and image radiation exposure to crystalline materials when stimulated with light. These licenses were acquired by the Company from Oklahoma State University (“OSU”) as part of collaborative efforts to develop and commercialize a new generation of radiation dosimetry technology. The underlying patents for these licenses expire in 2023. The OSU patents are specific to the stimulation process, imaging and data interpretation. As of September 30, 2016, the Company is using OSL technology to provide dosimetry services to the majority of its domestic and international customers. Landauer from time to time evaluates the continued need and benefits of licensing certain patent rights and may discontinue such licenses in instances where Landauer does not believe that such licenses remain necessary.

Additionally, the Company holds certain patents generated from the Company’s research and development activities that relate to various dosimeter designs, radiation measurement materials and methods, optical data storage techniques using aluminum oxide, and marking technologies used in radiology, radiation therapy and image-guided procedures. These patents expire between 2017 and 2035.

Rights to inventions of employees working for the Company are assigned to the Company.

7

Raw Materials

The Company has multiple sources for most of its raw materials and supplies, and believes that the number of sources and availability of these items are adequate. Landauer internally produces certain of its required materials, such as OSL detector materials and plastic badge holders. All crystal materials used in the Company’s OSL technology are produced at the Company’s crystal manufacturing facility in Stillwater, Oklahoma. The InLight dosimetry system and its components are manufactured by a Japanese company under an exclusive agreement. The Company sources the RadWatch and RadLight analytical instrument sold for military and emergency radiological response applications from its joint venture partner, YFH, on a sole source basis. The Company sources a key component of its medical products from a sole supplier. If the Company were to lose availability of its Stillwater facility or materials from its sole suppliers due to a fire, natural disaster or other disruptions, such loss could have a material adverse effect on the Company and its operations.

In the U.S., the Company competes against a number of dosimetry service providers. One of these providers is a division of Mirion Technologies, Inc., a significant competitor with substantial resources. Other competitors in the U.S. that provide dosimetry services tend to be smaller companies, some of which operate on a regional basis. Most government agencies in the U.S., such as the Department of Energy and Department of Defense, have their own in-house radiation measurement services, as do many large private nuclear power plants. Outside of the U.S., radiation measurement activities are conducted by a combination of private entities and government agencies.

The Company competes on the basis of advanced technologies, competent execution of these technologies, the quality, reliability and price of its services, and its prompt and responsive performance. The Company’s InLight dosimetry system competes with other dosimetry systems based on the technical advantages of OSL methods combined with an integrated systems approach featuring comprehensive software, automation and value. Changing market demand for combining active and passive dosimetry will be redefining the competition and the opportunities going forward.

Medical Physics outsourced services represent a large fragmented market where LMP has many small competitors. In addition, many facilities directly employ full-time physicists as an alternative for obtaining services from an outsourced provider. LMP competes with other outsourced medical physicists by having responsive regional practices that are backed by the safety, stability and standards of a global company. LMP offers a complementary alternative for clients who require support for their full-time staff in meeting patient care needs.

The Company’s technological expertise has been an important factor in its growth. The Company regularly pursues product improvements to maintain its technical position. The development of OSL dosimetry, announced in 1994, was funded by the Company in its collaborative effort with Battelle Memorial Institute and OSU. The Company commercialized this technology beginning in 1998 and has converted most of its customers to the technology. Current research efforts are focused on developing the VerifiiTM digital dosimetry platform (“Verifii”), a wireless wearable dosimeter with built-in compliance. Verifii dosimeters will connect, collect, and display exposure levels for frequent readings on laptops and mobile devices and will provide data to radiation safety officers for timely review and action. The Verifii dashboards will provide instant access to enterprise data or individual exposure readings.

The Company also participates regularly in several technical professional societies, both domestic and international, that are active in the fields of health physics and radiation detection and measurement.

The Company’s Medical Products segment has a product development process, which focuses on identifying products that will increase the accuracy of procedures and reduce procedural time. Current research efforts are focused on radiology products, which reduce radiation exposure to physicians and patients, as well as products that increase the accuracy of imaging by using reference markers.

8

The Company spent $4.0 million, $4.6 million, and $5.8 million in research and development activities during fiscal 2016, 2015 and 2014, respectively.

Domestic and International Regulations

The Company manufactures and markets products that are medical devices subject to regulation by numerous government agencies, including the U.S. Food and Drug Administration (“FDA”), and similar regulatory bodies outside the U.S. FDA regulations, and similar regulations outside the U.S., govern the following activities that the Company performs and will continue to perform: product design and development; document and purchasing controls; production and process controls; acceptance controls; product testing; product manufacturing; product safety; product labeling; product storage; recordkeeping; complaint handling; pre-market clearance; advertising and promotion; and product sales and distribution.

FDA pre-market clearance and approval requirements. Unless an exemption applies, each medical device the Company wishes to commercially distribute in the U.S. will require either prior 510(k) clearance or pre-market approval from the FDA. The FDA classifies medical devices into one of three classes. Devices deemed to pose lower risks are placed in either class I or II, which requires the manufacturer to submit to the FDA a pre-market notification to commercially distribute the device. This process is generally known as 510(k) clearance. Some low- risk devices are exempted from this requirement. Devices deemed by the FDA to pose the greatest risks, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a previously cleared 510(k) device, are placed in class III and require pre-market approval. All of the Company’s current products are either class I or class II devices.

Pervasive and continuing U.S. regulation. After a device is placed on the market in the U.S., numerous regulatory requirements apply. These include, but are not limited to:

|

· |

Quality System Regulation (“QSR”), which requires manufacturers, including third-party manufacturers, to follow stringent design, testing, documentation and other quality assurance procedures during product design and throughout the manufacturing process; |

|

· |

Labeling regulations and FDA prohibitions against the promotion of products for uncleared, unapproved or off-label uses and against making false and misleading claims; and |

|

· |

Medical device reporting regulations, which require that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction were to recur. |

The FDA has broad post-market and regulatory enforcement powers. Failure to comply with FDA requirements could result in criminal and civil penalties. The Company is subject to unannounced inspections by the FDA to determine its compliance with QSR and other regulations. The Company’s subcontractors also may be subject to FDA inspection. Refer to the following risk factors set forth in Item 1A. “Risk Factors” for additional information regarding FDA regulations that may impact the Company:

|

· |

“The Company’s medical device business is subject to many laws and government regulations governing the manufacture and sale of medical devices, including the FDA’s 510(k) clearance process.” |

|

· |

“The Company’s medical device business is subject to unannounced inspections by the FDA to determine our compliance with FDA requirements.” |

9

The Company’s Medical Physics business is subject to regulation by the U.S. Department of Health and Human Services and similar local, state and foreign health regulatory agencies. As a result of applicable regulatory requirements the Company’s arrangements with physicians and other health care professionals or entities must be structured appropriately to comply with applicable law, including but not limited to the federal Anti-kickback Statute. The Company may also be subject to certain transparency reporting requirements related to any payments or other transfers of value to physicians or teaching hospitals under the federal Physician Payment Sunshine Act and similar state laws. In addition, the Company may need to comply with applicable requirements of federal and state privacy and data security laws with respect to health care and other personally identifiable information that they may access, use, disclose, create, receive, transmit or maintain when conducting business. Finally, changes in health care delivery and reimbursement structures, particularly those brought about by federal and state health reform in the U.S., may impact the Company. Various penalties and sanctions exist for violations of these laws, including fines, imprisonment and exclusion from doing business with federal agencies in the U.S. Refer to the following risk factors set forth in Item 1A. “Risk Factors” for additional information regarding healthcare fraud and abuse, reimbursement, privacy and data security laws and policies that may impact the Company:

|

· |

“The current United States and state health reform legislative initiatives, and similar initiatives outside the United States, could adversely affect our operations and business condition.” |

|

· |

“The applicable healthcare fraud and abuse, privacy, and data security laws and regulations, along with the increased enforcement environment, may lead to an enforcement action targeting the Company, which could adversely affect our business.” |

Recently released U.S. accreditation standards. The Joint Commission (“TJC”) released new and revised Diagnostic Imaging Services Requirements (“Imaging Standards”) for accredited hospitals, critical access hospitals and certain ambulatory health care organizations that took effect July 1, 2015. The Imaging Standards incorporate recommendations from imaging experts, professional associations and accredited organizations about areas that must be evaluated to ensure the safe delivery of diagnostic imaging services, including the following:

|

· |

Requirements for annual performance evaluations of advanced imaging modalities (CT, Nuclear Medicine, magnetic resonance and positron emission tomography) by a medical physicist or MRI scientist (for MRI only); |

|

· |

Inspecting, testing and maintaining medical equipment; and |

|

· |

Ongoing annual education and training for CT and magnetic resonance technologists on radiation dose and patient safety concerns and screening criteria. |

The revised TJC requirements also specify that the radiation dose of every CT exam must be recorded, and that high radiation dose incidents must be evaluated against industry benchmarks. Although not directly applicable to the Company, these new standards may increase the need for the services of the Company’s Medical Physics business by existing customers, or result in the acquisition of new customers. The Company’s inability to comply with these Imaging Standards when providing such services to customers, however, may adversely impact the Company. See the following risk factor in Item 1A. “Risk Factors:” “The applicable healthcare fraud and abuse, privacy, and data security laws and regulations, along with the increased enforcement environment, may lead to an enforcement action targeting the Company, which could adversely affect our business.”

International Regulations. Outside the U.S., similar requirements and procedures related to the marketing of medical devices exist and must be complied with. For example, in the European Union (“EU”), medical devices must meet minimum standards of performance, safety and quality, and follow one of several conformity assessment routes, depending on their classification. Some of these conformity assessment routes involve an assessment and certification by a notified body. Manufacturers indicate compliance with applicable EU medical device regulations by preparing a Declaration of Conformity and by applying a CE Mark to their medical devices before placing them on the market in the EU. An appropriate quality system is required and manufacturers must report certain product and safety-related information to government agencies of individual EU Member States. Various penalties and sanctions exist in different EU Member States for non-compliance with EU medical device regulations and related requirements, for example with respect to data protection and privacy.

10

Environmental Regulations

The Company believes that it complies with international, federal, state and local provisions that have been enacted or adopted regulating the discharge of materials into the environment or otherwise protecting the environment. This compliance has not had, nor is it expected to have, a material effect on the capital expenditures, financial condition, liquidity, results of operations, or competitive position of the Company.

Other Governmental Regulations

Many of the Company’s technology-based services must comply with various national and international standards that are used by regulatory and accreditation bodies for approving such services and products. These accreditation bodies include, for example, the National Voluntary Laboratory Accreditation Program in the U.S. and governmental agencies, generally, in international markets. Changes in these standards and accreditation requirements can result in the Company having to incur costs to adapt its offerings and procedures. Such adaptations may introduce quality assurance issues during transition that need to be addressed to ensure timely and accurate analyses and data reporting. Additionally, changes affecting radiation protection practices, including new understandings of the hazards of radiation exposure and amended regulations, may impact how the Company’s services are used by its customers and may, in some circumstances, cause the Company to alter its products and delivery of its services.

As of September 30, 2016, the Company employed approximately 600 full-time employees worldwide, of which 182 employees were in the Company’s Medical Physics segment. None of the Company’s employees are represented by labor organizations. The Company believes that it generally maintains good relations with employees at all locations.

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) may be accessed free of charge through the Company’s website, www.landauer.com/investor, as soon as reasonably practicable after they are filed electronically with, or furnished to, the SEC. We are providing the address to our internet site solely for the information of investors. We do not intend the address to be an active link or to otherwise incorporate the contents of the website into this report. A copy of any of these reports is available free of charge upon the written request from any shareholder. Requests should be submitted to the following address: Landauer, Inc., Attention: Corporate Secretary, 2 Science Road, Glenwood, Illinois 60425.

Pursuant to Section 303A.12(a) of the New York Stock Exchange Listed Company Manual, Landauer, Inc. has complied with the New York Stock Exchange requirement to provide an annual CEO certification no later than 30 days following the Company’s annual meeting.

In addition to factors discussed elsewhere in this Annual Report on Form 10-K, set forth below are certain risks and uncertainties that could adversely affect the Company’s results of operations or financial condition and cause actual results or events to differ materially from those expressed in any forward-looking statements made by or on behalf of the Company.

11

We rely on a single facility for the primary manufacturing and processing of our dosimetry services and products.

The Company conducts its primary dosimetry manufacturing and laboratory processing operations and performs significant functions for some of its international operations from a single facility in Glenwood, Illinois. If the Company were to lose availability of this facility due to fire, natural disaster or other disruptions, the Company’s operations could be significantly impaired. Despite the Company’s business continuity preparedness efforts, there can be no assurance that such plan could ensure the Company’s ability to rapidly respond to a disaster. Although the Company maintains business interruption insurance, there can be no assurance that the proceeds of such insurance would be sufficient to offset any loss the Company might incur or that the Company would be able to retain its customer base if operations were so disrupted.

Increased IT security threats and more sophisticated and targeted computer crime could pose a risk to our systems, networks, products, solutions and services.

Increased global IT security threats and more sophisticated and targeted computer crime pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. While we attempt to mitigate these risks by employing a number of measures, including employee training; comprehensive monitoring of our networks and systems; and maintenance of backup and protective systems, our systems, networks, products, solutions and services remain potentially vulnerable to advanced persistent threats. Depending on their nature and scope, such threats could potentially lead to the compromising of confidential information; improper use of our systems and networks; manipulation and destruction of data; defective products; production downtimes; and operational disruptions, which in turn could adversely affect our reputation, competitiveness, and operating results.

We rely on a single source for the manufacturing of crystal material, a key component in our OSL technology, and a single vendor for the manufacturing of InLight products.

Crystal material is a key component in Landauer’s OSL technology. The Company operates a single crystal manufacturing facility in Stillwater, Oklahoma that currently supplies all OSL crystal radiation measurement material used by the Company. Although multiple sources for raw crystal material exist and inventory levels provide a significant reduction of risk, there can be no assurance that the Company could secure another source to produce finished crystal materials to Landauer’s specification in the event of a disruption at the Stillwater facility. The InLight dosimetry system and its components are manufactured by Panasonic Communications Company (“Panasonic”) under an exclusive agreement. If the Company were to lose availability of its Stillwater facility or materials from Panasonic due to a fire, natural disaster or other disruptions, such loss could have a material adverse effect on the Company and its operations.

If we are not successful in the development or introduction of new technologies and products, our financial condition and results of operations could be materially and adversely affected.

The Company’s radiation measurement business is a mature business and the number of workers being monitored for radiation exposure has not grown in recent years. Additionally, economic pressures can adversely affect the value of occupational measurement perceived by customers or increase pricing pressures. The Company believes that the development and introduction of new technologies and products will be essential to help counter these pressures. The development and introduction of new products generally requires substantial and effective research, development and marketing expenditures, some or all of which may be unrecoverable if the new products do not gain market acceptance. New product development itself is inherently risky, as research failures, competitive barriers arising out of the intellectual property rights of others, launch and production difficulties, customer rejection and unexpectedly short product life cycles may occur even after substantial effort and expense on our part. Even in the case of a successful launch of a new product, the ultimate benefit we realize may be uncertain.

12

In addition, the Company regularly pursues improvements to existing products to maintain its technical position. The adaptability of OSL to new platforms and new formats, the usefulness of older technologies and the introduction of new technologies by the competition all also present various risks to the Company’s business. The failure or lack of market acceptance of a new or updated technology or the inability to respond to market requirements for new technologies could adversely affect the Company’s operations or reputation with customers. The cancellation of technology projects or the cessation of use of an existing technology could result in write-downs and charges to the Company’s earnings.

We may fail to adequately protect our customer data.

We may fail to adequately protect our customer data. In the normal course of operations, we collect and maintain confidential data from our customers. Our failure to adequately preserve the security of this data, whether due to technological failures or errors in or deviations from our data maintenance policies and procedures, could result in data loss or corruption. If we fail to adequately maintain and protect our customer data, we could be exposed to government enforcement actions or potential litigation from our customers and could face risk for loss or breach of customer data under state privacy laws or applicable data privacy laws outside the U.S. Additionally, our reputation could be harmed, and we could lose existing and have difficulty attracting new customers, all of which could adversely affect our operating results.

If we are unable to successfully execute business development activities and diversification such as the acquisition and integration of strategic businesses, our on-going business and results of operations may be adversely affected.

A growth strategy of the Company is to explore opportunities to selectively enhance its business through development activities, such as strategic acquisitions, investments and alliances. The Company may not be able to identify appropriate acquisition candidates or successfully negotiate, finance or integrate acquisitions. Covenants in the Company’s revolving credit facility may also limit the amount and types of indebtedness that it may incur to finance acquisitions. If the Company is unable to make further acquisitions, it may be unable to realize its growth strategy. Additionally, if the Company is unable to successfully manage acquisition risks, future earnings may be adversely affected. Acquisitions and other business development activities involve various significant challenges and risks, including the following:

|

· |

Difficulty in acquiring desired businesses or assets on economically acceptable terms; |

|

· |

Difficulty in integrating new employees, business systems and technology; |

|

· |

Difficulty in consolidating facilities and infrastructure; |

|

· |

Potential need to operate and manage new lines of business; |

|

· |

Potential loss of key personnel; |

|

· |

Diversion of management’s attention from on-going operations; |

|

· |

Realization of satisfactory returns on investments; and |

|

· |

Disputes with strategic partners, due to conflicting priorities or conflicts of interest. |

Development activities could result in the incurrence of debt, contingent liabilities, interest and amortization expenses or periodic impairment charges related to goodwill and other intangible assets as well as significant charges related to integration costs. If the Company is unable to successfully integrate and manage businesses that it acquires within expected terms and in a timely manner, its business and results of operations could be adversely affected.

13

Unforeseen problems with the stabilization and maintenance of our equipment and information systems could interfere with our operations.

In the normal course of its business, the Company must record and process significant amounts of data quickly and accurately and relies on various computer and telecommunications equipment and information technology systems. Any failure of such equipment or systems could adversely affect the Company’s operations.

Certain of our operations are conducted through joint ventures in which we rely significantly on our joint venture partners.

A substantial portion of the Company’s operations are conducted through joint ventures with third parties. In Australia, Brazil, China, and Mexico, the Company has a controlling interest in the related joint ventures. The Company has a 50% equity interest in Nagase-Landauer, Ltd. (“Nagase”), a radiation measurement company located in Japan, a 50% equity interest in Epsilon-Landauer Dozimetri, a radiation measurement company located in Turkey, as well as a 49% equity interest in YFH, located in New Mexico. In all of these joint ventures and others, the Company relies significantly on the services and skills of its joint venture partners to manage and conduct the local operations and ensure compliance with local laws and regulations. If the joint venture partners were unable to perform these functions adequately, the Company’s operations in such regions could be adversely affected.

There can be no assurances that our operations will generate cash flows in an amount sufficient to enable us to pay our indebtedness.

The Company’s ability to make scheduled payments on its existing or future debt obligations and fund operations will depend on its future financial and operating performance. While the Company believes it will continue to have sufficient cash flows to operate its businesses, there can be no assurances that its operations will generate sufficient cash flows to enable it to pay its remaining indebtedness or to fund its other liquidity needs. If the Company cannot make scheduled payments on its debt, the Company will be in default and, as a result, among other things, all outstanding principal and interest under its revolving credit facility will automatically be due and payable which could force the Company to liquidate certain assets or substantially restructure or alter its business operations or debt obligations. Moreover, if the Company is unable to obtain additional capital or if its current sources of financing are reduced or unavailable, the Company may be required to eliminate or reduce the scope of its plans for expansion and growth and this could affect its overall operations.

If we experience decreasing prices for our goods and services and we are unable to reduce our expenses, our results of operations could suffer.

The Company may experience decreasing prices for the goods and services it offers due to customer consolidation, increased influence of hospital group purchasing organizations, and pricing pressure experienced by its customers from managed care organizations, the Medicare and Medicaid programs and other third-party payers, including outside the U.S. Decreasing prices may also be due to increased market power of its customers as the medical industry consolidates and increased competition among dosimetry and physics services providers. If the prices for its goods and services decrease and it is unable to reduce its expenses, the Company’s results of operations could be adversely affected.

We may be subject to future impairment losses due to potential declines in the fair value of our assets.

As a result of acquisitions and capital expenditures, the Company has goodwill, intangible assets and fixed assets on our balance sheets. The Company tests goodwill, intangible assets and fixed assets for impairment on a periodic basis as required and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. The events or changes that could require the Company to test its goodwill, intangible assets and fixed assets for impairment include a reduction in the Company’s stock price and market capitalization, changes in estimated future cash flows and changes in rates of growth in the Company’s industry or in any of the Company’s reporting units.

The potential for goodwill impairment is increased during a period of economic uncertainty. To the extent the Company acquires a company at a negotiated price based on anticipated future performance, subsequent market

14

conditions may result in the acquired business performing at a lower level than was anticipated at the time of the acquisition. Any of these charges would reduce our operating results and could cause the price of our common stock to decline. A slowing recovery in the U.S., a prolonged recovery or second recession in Europe, and slowing growth in the global economy may result in declining performance that would require the Company to examine its goodwill for potential additional impairment.

The Company will continue to evaluate the carrying value of the remaining goodwill, intangible assets and fixed assets, and if it determines in the future that there is a potential further impairment, the Company may be required to record additional losses, which could materially and adversely affect operating results.

Restrictions in our revolving credit facility could adversely affect our business, financial condition, and results of operations.

The Company has a committed $140.0 million, secured revolving credit facility syndicated with a group of commercial banks that expires on August 2, 2018. The Company reduced the commitment from $175.0 million to $140.0 million in December 2016 based on the Company’s forecast of excess borrowing capacity through August 2, 2018.

The facility also contains certain financial covenants, which were amended in June 2014. The maximum leverage ratio covenant is 3.50 to 1.00 for the remaining loan. The minimum fixed charge coverage ratio covenant is 1.10 to 1.00 for the remaining loan. The facility’s interest rate is equal to the London Interbank Offered Rate (“LIBOR”) plus a margin of between 1.25% and 2.50% and for the base rate a margin of between 0.25% and 1.50%.

If the Company has significant borrowings under the facility and it violates a covenant or an event of default occurs and the lenders accelerate the maturity of any outstanding borrowings and terminate their commitment to make future loans, it could have a material adverse effect on the Company’s business, results of operations and financial condition. There can be no assurance that the Company will be able to comply with its financial or other covenants or that any covenant violations will be waived. In addition, if the Company fails to comply with its financial or other covenants, it may need additional financing in order to service or extinguish its indebtedness. In the future, the Company may not be able to obtain financing or refinancing on terms acceptable to it, if at all.

Our radiation-measurement and technology-based services business is subject to extensive domestic and foreign government regulations, which could increase our costs, cause us to incur liabilities and adversely affect our results of operations.

Regulation, present and future, is a constant factor affecting the Company’s business. The radiation measurement industry is subject to federal, state and international governmental regulation. Unknown matters, new laws and regulations, or stricter interpretations of existing laws or regulations may materially affect the Company’s business or operations in the future and/or could increase the cost of compliance. The equipment commissioning business of LMP, which the Company acquired in November 2009, and the employment of physicists and other healthcare professionals also are subject to federal, state and international governmental regulation and licensing requirements.

Many of the Company’s technology-based services must comply with various domestic and international standards that are used by regulatory and accreditation bodies for approving such services and products. The failure of the Company to obtain accreditation for its services and products may adversely affect the Company’s business, require the Company to alter its products or procedures or adversely affect the market perception of the effectiveness of its services and products. Changes in these standards and accreditation requirements may also result in the Company having to incur substantial costs to adapt its offerings and procedures to maintain accreditations and approvals. Such adaptations may introduce quality assurance issues during transition that need to be addressed to ensure timely and accurate analyses and data reporting. Additionally, changes affecting radiation protection practices, including new understandings of the hazards of radiation exposure and amended regulations, may impact how the Company’s services are used by its customers and may, in some circumstances, cause the Company to alter its products and delivery of its services.

15

Proposed new EU medical device regulations, and changed enforcement practices, could adversely affect our marketing of medical devices in the EU.

New EU medical device regulations intended to replace the existing EU legal framework are under consideration and may become applicable to medical devices placed on the EU market. The requirements imposed by the proposed new EU medical device requirements, and related implementing regulations or guidelines, may be more stringent and comprehensive than existing requirements, and, if adopted, could adversely affect our marketing of medical devices in the EU. In addition, notified bodies and government agencies in the EU may change their enforcement practices, both with respect to the existing and proposed new regulations, including by performing unannounced inspections to determine compliance with applicable regulation, and by imposing different or more stringent penalties or sanctions. These and other regulatory and enforcement developments in the EU may also have a material adverse effect on our business and reputation.

The current United States and state health reform legislative initiatives, and similar initiatives outside the United States, could adversely affect our operations and business condition.

In both the U.S. and some foreign jurisdictions, there have been a number of legislative and regulatory proposals to change the health care system in ways that might affect the Company’s business. In March 2010, President Obama signed into law the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, or collectively, the Health Care Reform Law, a sweeping law intended to broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against fraud and abuse, add new transparency requirements for healthcare and health insurance industries, impose new taxes and fees on the health industry and impose additional health policy reforms. This legislation includes reforms and reductions that could affect Medicare reimbursements and health insurance coverage for certain services and treatments. Effective January 1, 2013, the Health Reform Law also imposed a 2.3% excise tax on the sale of certain medical devices by manufacturers or importers in the U.S., and the new American Health Benefit Insurance Exchanges and their qualified health plans began offering coverage on January 1, 2014. Some states also have pending health reform legislative initiatives. Further, the Joint Select Committee on Deficit Reduction, which was created by the Budget Control Act of 2011, concluded its work in November 2011, and issued a statement that it was not able to make a bipartisan agreement, thus triggering the sequestration process. The sequestration process combined with past and potential future government shutdowns have resulted and may result in spending reductions and have and could result in reduced Medicare, Medicaid and other Federal health care reimbursements for the Company’s services and products. Changes in reimbursements and coverages, including risk-sharing arrangements and quality-based reimbursement initiatives, could adversely affect hospitals and other medical services and products providers, which could result in reduced demand for certain services and products offered by the Company, including services offered by its Medical Physics business. Similarly, as the Health Care Reform Law continues to be implemented various states and large insurance companies continue to make decisions about the extent to which they will participate in the programs offered under the law. Reduced participation could also adversely affect hospitals and other medical services and products providers, which could result in reduced demand for certain services and products offered by the Company, including services offered by its Medical Physics business. The Company cannot predict whether or when future healthcare reform initiatives at the Federal or state level or other initiatives affecting its business will be proposed, enacted, implemented or repealed or what impact those initiatives may have on its business, financial condition or results of operations. The Company’s customers and the other entities with which it has a business relationship could react to these initiatives and the uncertainty surrounding these proposals by curtailing or deferring investments, including those for the Company’s services and products.

16

The applicable healthcare fraud and abuse, privacy, and data security laws and regulations, along with the increased enforcement environment, may lead to an enforcement action targeting the Company, which could adversely affect our business.

Our business is subject to healthcare fraud and abuse laws and regulations including, but not limited to, the Federal Anti-Kickback Statute, state anti-kickback statutes, the Federal False Claims Act, and state false claims acts, as well as similar regulations outside the U.S. Additionally, to the extent the Company maintains financial relationships with physicians and other healthcare providers, the Company may be subject to Federal and state physician payment sunshine laws and regulations, and similar regulations outside the U.S., which require the Company to track and disclose these financial relationships. These and other laws regulate interactions amongst health care entities and with sources of referrals of business, among other things. The Federal Anti-Kickback Statute is a criminal statute that imposes substantial penalties on persons or entities that offer, solicit, pay or receive payments in return for referrals, recommendations, purchases or orders of items or services that are reimbursable by Federal healthcare programs. The False Claims Act imposes liability on any person or entity that submits or causes to be submitted a claim to the Federal government that he or she knows (or should know) is false. The Health Reform Law further provides that a claim submitted for items or services, the provision of which resulted from a violation of the Anti-Kickback Statute, is “false” under the False Claims Act and certain other false claims statutes. In addition, many of the Company’s customers must now comply with the TJC’s new Imaging Standards to maintain accreditation, which among other things, is typically needed to bill and receive payment from government and private payors. To the extent that the Company’s Medical Physics or other businesses provide services subject to these Imaging Standards, it may be adversely affected by potential government enforcement actions, or similar adverse actions by its customers, should its services, or those of its customers, fail to meet the Imaging Standards or reimbursement requirements related to such standards.

Changes in, or interpretations of, tax rules and regulations may adversely affect our effective tax rates.

The Company is subject to income and other taxes in the U.S. and several foreign jurisdictions. Significant judgment is required in evaluating our provision for income taxes. During the ordinary course of business, there are many transactions for which the ultimate tax determination is uncertain. For example, there could be changes in the valuation of our deferred income tax assets and liabilities; or changes in the relevant tax, accounting, and other laws, regulations, principles and interpretations. The Company is subject to audits in various jurisdictions, and such jurisdictions may assess additional tax against us. Although the Company believes our tax estimates are reasonable, the final determination of tax audits and any related litigation could be materially different from our historical income tax provisions and accruals. The results of an audit or litigation, or the effects of a change in tax policy in the U.S. or international jurisdictions where we do business, could have a material effect on our operating results in the period or periods for which that determination is made.

As a portion of our business is conducted outside of the United States, adverse international developments could negatively impact our business and results of operations.

The Company conducts business in numerous international markets such as Australia, Brazil, Canada, China, France, Germany, Japan, Mexico, Sweden, Turkey and the United Kingdom. Foreign operations are subject to a number of special risks, including, among others, currency exchange rate fluctuations; disruption in relations; changes in a specific country’s or region’s political, social or economic conditions; political and economic unrest; trade barriers; exchange controls; expropriation; restrictions on the Company’s ability to own or operate subsidiaries; the burden of complying with numerous and potentially conflicting laws; and changes in laws and policies, including those governing foreign owned operations.

Fluctuations in currency exchange rates could adversely affect our results.

The Company is exposed to market risk, including changes in foreign currency exchange rates. The financial statements of the Company’s non-U.S. subsidiaries are remeasured into U.S. dollars monthly using the U.S. dollar as the reporting currency. To date, the market risk associated with foreign currency exchange rates has not been material in relation to the Company’s financial position, results of operations or cash flows. These risks could increase, however, as the Company expands in international markets.

17

Several of our current and potential competitors have significantly greater resources and increased competition could impair sales of our products.

The Company competes on the basis of advanced technologies, competent execution of these technologies, the quality, reliability and price of its services and its prompt and responsive performance. In much of the world, radiation measurement activities are conducted by a combination of private entities and governmental agencies. The Company’s primary radiation measurement and medical physics competitor in the U.S., Global Dosimetry Solutions, a division of Mirion Technologies, is large, has substantial resources, and has been particularly active in recent years in soliciting business from the Company’s customers.

Our failure to attract, motivate and retain qualified and key personnel to support our business may have a material adverse effect on our business plans, prospects, results of operations and financial condition.

The Company’s success depends, in large part, upon the talent and efforts of key individuals including highly skilled scientists, physicists and engineers, as well as experienced senior management, sales, marketing and finance personnel. Competition for these individuals is intense and there can be no assurance that the Company will be successful in attracting, motivating, or retaining key personnel. The loss of the services of one or more of these senior executives or key employees, or the inability to continue to attract these personnel may have a material effect on its business plans, prospects, results of operations and financial condition. The Company’s continued ability to compete effectively depends on its ability to attract new skilled employees and to retain and motivate its existing employees.

The Medical Physics business involves the delivery of professional services and is highly labor-intensive. Its success depends largely on its general ability to attract, develop, motivate and retain highly skilled licensed medical physicists. Further, the Company must successfully maintain the right mix of physicists with relevant experience and skill sets as it expands into new service offerings, and as the market evolves. The loss of a significant number of its physicists, the inability to attract, hire, develop, train and retain additional skilled personnel, or not maintaining the right mix of professionals could have a serious negative effect on the Company, including its ability to manage, staff and successfully complete its existing engagements and obtain new engagements. Qualified physicists are in great demand, and the Company faces significant competition for both senior and junior physicists with the requisite credentials and experience. The Company’s principal competition for talent comes from other outsourced medical physicist firms, hospitals and free-standing radiation therapy centers. Many of these competitors may be able to offer significantly greater compensation and benefits or more attractive lifestyle choices, career paths or geographic locations than those of the Company. Therefore, the Company may not be successful in attracting and retaining the skilled physicists it requires to conduct and expand its operations successfully. Increasing competition for these revenue-generating physicists may also significantly increase the Company’s labor costs, which could negatively affect its margins and results of operations.

We could be subject to professional liability lawsuits, some of which we may not be fully insured against or reserved for, which could adversely affect our financial condition and results of operations.

In recent years, physicians, hospitals and other participants in the healthcare industry have become subject to an increasing number of lawsuits alleging medical malpractice and related legal theories such as negligent hiring, supervision and credentialing, and vicarious liability for acts of their employees or independent contractors. In addition, the level and effect of radiation being administered by certain radiation equipment is also attracting increased scrutiny and giving rise to patient safety claims. Many of these lawsuits involve large claims and substantial defense costs. As the Company increases its presence in the healthcare industry, through the Medical Physics business, it could be exposed to litigation or subject to fines, penalties or suspension of services relating to the compliance with regulatory requirements.

18

Our business could be negatively affected as a result of actions of activist shareholder Gilead Capital, LP.

On November 22, 2016, Gilead Capital LP (together with its affiliates, “Gilead”) filed a Schedule 13D with the SEC, reporting a 5% ownership of the Company’s outstanding shares of Common Stock. On November 28, 2016, Gilead filed a Schedule 13D/A (Amendment No. 1) with the SEC, suggesting that it intended to run a slate of directors in opposition to the Board’s nominees at the 2017 annual meeting of the Company’s stockholders. If Gilead nominates a slate of directors, and does not subsequently withdraw its nominations, a proxy contest is likely to occur and it may require us to incur legal fees and proxy solicitation expenses in addition to those normally expended for a solicitation. The perceived uncertainties as to our future direction also could affect the market price and volatility of our securities.

Item 1B. Unresolved Staff Comments.

None.

The Company owns three adjacent buildings totaling approximately 59,100 square feet in Glenwood, Illinois, about 30 miles south of Chicago, leases a 23,600 square foot warehouse in Chicago Heights, Illinois and leases 6,100 square feet of office space in Chicago. The properties house the Company’s administrative offices, information technology resources, and laboratory, assembly and reading operations. The properties and equipment of the Company are in good condition and, in the opinion of management, are suitable and adequate for the Company’s operations. For its Radiation Measurement operations, the Company leases a crystal growth facility in Stillwater, Oklahoma and laboratories in Australia, Brazil, China, France, Mexico, Sweden, and Turkey, as well as a sales office in England. The Company leases offices in New York, North Carolina and Missouri for its Medical Physics operations.

The Company is a party, from time to time, to various legal proceedings, lawsuits and other claims arising in the ordinary course of its business. The Company does not believe that any such litigation pending as of September 30, 2016, if adversely determined, would have a material effect on its business, financial position, results of operations, or cash flows.

Item 4. Mine Safety Disclosures.

Not Applicable.

19

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock is listed on the New York Stock Exchange under the ticker symbol “LDR.” The following table shows, for the periods indicated, the high and low sales prices per share of the Company’s common stock and dividends paid per share for each quarterly period during the last two fiscal years:

|

|

||||||||||

|

Year |

Quarter |

High |

Low |

Dividends |

||||||

|

2016 |

||||||||||

|

|

First |

$ |

41.69 |

$ |

28.35 |

$ |

0.275 | |||

|

|

Second |

$ |

33.39 |

$ |

26.99 |

$ |

0.275 | |||

|

|

Third |

$ |

41.25 |

$ |

31.65 |

$ |

0.275 | |||

|

|

Fourth |

$ |

49.74 |

$ |

37.89 |

$ |

0.275 | |||

|

2015 |

||||||||||

|

|

First |

$ |

36.25 |

$ |

32.02 |

$ |

0.550 | |||

|

|

Second |

$ |

38.78 |

$ |

27.87 |

$ |

0.550 | |||

|

|

Third |

$ |

37.38 |

$ |

29.36 |

$ |

0.275 | |||

|

|

Fourth |

$ |

42.90 |

$ |

34.31 |

$ |

0.275 |

The Board of Directors continually reviews the appropriateness of the quarterly cash dividends policy and its status is reviewed based on future earnings, capital requirements and financial condition. On November 30, 2016, the Board of Directors declared a cash dividend of $0.275 per common share.

As of December 9, 2016, there were 218 shareholders of record.

20

Issuer Purchases of Equity Securities

The following table provides information about Company purchases of equity securities that are registered by the Company pursuant to Section 12 of the Exchange Act during the quarter ended September 30, 2016:

|

|

|||||||||

|

Period |

Total Number of Shares Purchased (a) |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs |

|||||

|

October 1 - October 31, 2015 |

608 |

$ |

39.58 |

- |

- |

||||

|

November 1 - November 30, 2015 |

278 | 40.83 |

- |

- |

|||||

|

December 1 - December 31, 2015 |

433 | 37.01 |

- |

- |

|||||

|

Quarter ended December 31, 2015 |

1,319 |

$ |

39.00 |

- |

- |

||||

|

|

|||||||||

|

January 1 - January 31, 2016 |

- |

- |

- |

- |

|||||

|

February 1 - February 29, 2016 |

342 | 29.12 |

- |

- |

|||||

|

March 1 - March 31, 2016 |

- |

- |

- |

- |

|||||

|

Quarter ended March 31, 2016 |

342 |

$ |

29.12 |

- |

- |

||||

|

|

|||||||||

|

April 1 - April 30, 2016 |

1,157 | 33.35 |

- |

- |

|||||

|

May 1 - May 31, 2016 |

1,206 | 35.05 |

- |

- |

|||||

|

June 1 - June 30, 2016 |

- |

- |

- |

- |

|||||

|

Quarter ended June 30, 2016 |

2,363 |

$ |

34.22 |

- |

- |

||||

|

|

|||||||||

|

July 1 – July 31, 2016 |

- |

- |

- |

- |

|||||

|

August 1 – August 31, 2016 |

- |

- |

- |

- |

|||||

|

September 1 – September 30, 2016 |

5,422 | 44.49 |

- |

- |

|||||

|

Quarter ended September 30, 2016 |

5,422 |

$ |

44.49 |

- |

- |

|

(a) |

This column includes the deemed surrender of existing shares of the Company’s common stock to the Company by stock-based compensation plan participants to satisfy the exercise price or tax liability of employee stock awards at the time of exercise or vesting. These surrendered shares are not part of any publicly announced share repurchase program. |

21

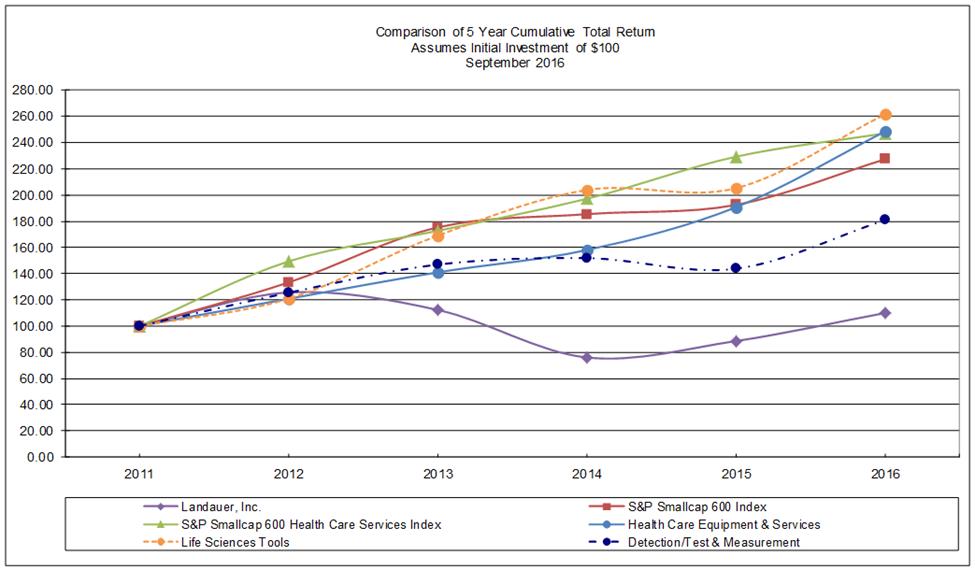

Performance Graph

The following graph reflects a comparison of the cumulative total return (change in stock price plus reinvested dividends) assuming $100 invested in: (a) Landauer’s common stock, (b) the S&P Smallcap 600 index, (c) the S&P Smallcap 600 industry index represented by a group of health care services companies, (d) a group of twenty-one health care and equipment services companies discussed in further detail below, (e) a group of life science tool companies composed of ticker symbols QGEN, SIAL, BRKR, PKI, TMO, A, WAT, FEIC and MTD, and (f) a group of detection/test and measurement companies composed of ticker symbols OSIS, VAR and ASEI during the period from September 30, 2011 through September 30, 2016.