Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Alta Mesa Holdings, LP | d265972d8k.htm |

Alta Mesa

Holdings, LP Wells

Fargo

Securities

10

th

Annual

Pipeline, MLP, and E&P, Services

and Utility Symposium

Alta Mesa Holdings, LP

December 6, 2011

Confidential

Exhibit 99.1 |

| Forward Looking Statements

2

Confidential

This material includes “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements, other than statements of historical fact, regarding our strategy, future operations, financial

position, estimated revenues and losses, projected costs, prospects, plans and objectives of

management are forward-looking statements. These forward- looking statements are

based on our current expectations and assumptions about future events and are based on currently available information as to the

outcome and timing of future events. You should not place undue reliance on

forward-looking statements. They are subject to known and unknown risks,

uncertainties and other factors that may affect the company’s operations, markets,

products, services and prices and cause its actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Forward-looking statements may include statements about our: business strategy; reserves,

including changes to our reserves presentation in accordance with newly adopted SEC

rules; financial strategy, liquidity and capital required for our development program; realized natural gas and oil prices; timing and amount

of future production of natural gas and oil; hedging strategy and results; future drilling

plans; competition and government regulations; marketing of natural gas and oil;

leasehold or business acquisitions; costs of developing our properties and conducting our gathering and other midstream operations; general

economic conditions; credit markets; liquidity and access to capital; uncertainty regarding

our future operating results; and plans, objectives, expectations and intentions that

are not historical. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are

difficult to predict and many of which are beyond our control, incident to the exploration for

and development, production, gathering and sale of natural gas and oil. These risks

include, but are not limited to: commodity price volatility; inflation; lack of availability of drilling and production equipment and services;

environmental risks; drilling and other operating risks; regulatory changes; the uncertainty

inherent in estimating natural gas and oil reserves and in projecting future rates of

production, cash flow and access to capital; the timing of development expenditures; and other risks. Except as otherwise required by

applicable law, we disclaim any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information, future events

or otherwise. The SEC requires oil and gas companies, in their filings with the SEC, to disclose proved

reserves that a company has demonstrated by actual production or conclusive formation

tests to be economically and legally producible under existing economic and operating conditions. We use the terms “estimated ultimate

recovery,” “EUR,” “probable,” “3P,” “possible,”

and “non-proven” reserves, reserve “potential” or “upside,” “unrisked potential” or other descriptions of

volumes of reserves potentially recoverable through additional drilling or recovery techniques

that are not classified as proved reserves, may not have been calculated as defined by

SEC regulations and SEC’s guidelines may prohibit us from including in any future filings with the SEC. These estimates are by their

nature more speculative than estimates of proved reserves and accordingly are subject to

substantially greater risk of being actually realized by the company. We believe

these estimates are reasonable, but such estimates have not been reviewed by independent engineers. Estimates may change significantly as

development provides additional data, and actual quantities that are ultimately recovered may

differ substantially from prior estimates. Our production forecasts are dependent

upon many assumptions, including estimates of production decline rates from existing wells and the outcome of future drilling activity

Although we believe the forecasts are reasonable, we can give no assurance they will prove to

have been correct. They can be affected by inaccurate assumptions and data or by known

or unknown risks and uncertainties. Market and industry data and forecasts used in this presentation have been obtained from

independent industry sources as well as from research reports prepared for other

purposes. Although we believe these third-party sources to be reliable, we have not independently verified the data obtained from these

sources and we cannot assure you of the accuracy or completeness of the data. Forecasts and

other forward-looking information obtained from these sources are subject to the

same qualifications and uncertainties as the other forward-looking statements in this presentation.

Alta Mesa Holdings, LP |

3

Confidential

Proved Reserves (SEC Case)

Proved Reserves PV10 (SEC Case)

Crude Oil Proved Reserves

Future Total Proved Revenue from Oil

% Proved Developed

R/P

Q3’2011 Production

2011E CAPEX (Drill, Workovers, Facilities)

Net Acreage

325 BCFE

$705 Million

26%

54%

66%

8.1x

119 MMCFED

$180 Million

172,000+

Key Metrics

1

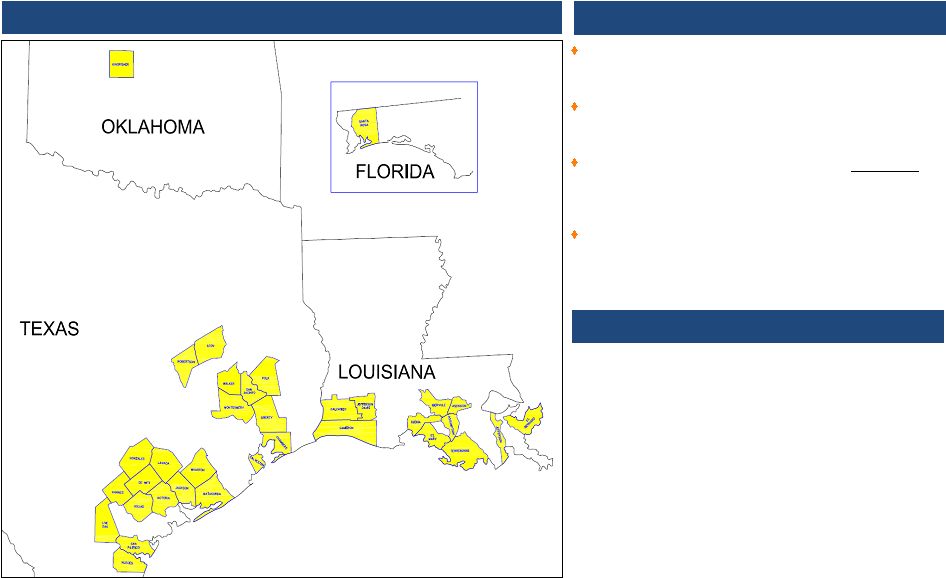

Core Operating Areas

Alta Mesa Overview

1

Reserve statistics and R/P metric as of Year End 2010 SEC Reserve Report

Privately held company, founded in 1987, engaged in onshore

conventional oil and gas acquisition, exploitation, exploration and

production

Our diverse asset base is characterized by low-risk, repeatable

opportunities in well-established fields, which allows us to cost

effectively grow reserves and production

Seasoned management and technical team that creates value

by

rigorously applying new technology and new knowledge in

established fields and areas that are under-developed or over-

looked

Since 2007, increased proved reserves and production at 40% and

65% CAGR, respectively

Corporate Overview

High Quality & Diversified Asset Portfolio |

Low-Risk

Business Model Attractive Economics

Repeatability

Control Over Pace of Development

Available Rigs and Services

Proven Geology

Established Infrastructure

Stable Regulatory Environment

We create value in under-developed and over-looked areas

with the following characteristics

Multiple Pay Zones

4

Confidential |

Alta

Mesa’s Focus Areas 5

Confidential

Reserve statistics and R/P metric as of Year End 2010 SEC Reserve Report

44 BCFE

$129.2

46%

62%

19.9x

946 BOEPD

48%

36,878

Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

Oklahoma

East Texas

Hilltop

South Louisiana

Eagle Ford Shale

Other AMH Properties

93 BCFE

$111.9

100%

56%

5.5x

55.2 MMCFED

100%

16,998

Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

63 BCFE

$153.9

74%

84%

11.2x

15.3 MMCFED

61%

41,594

Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

76 BCFE

$229.2

72%

74%

6.1x

30.5 MMCFED

52%

36,505

Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

47 BCFE

$67.7

58%

53%

14.9x

6.4 MMCFED

65%

36,627

Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

3 BCFE

$13.2

13%

52%

6.5x

964 BOEPD

10%

3,611 |

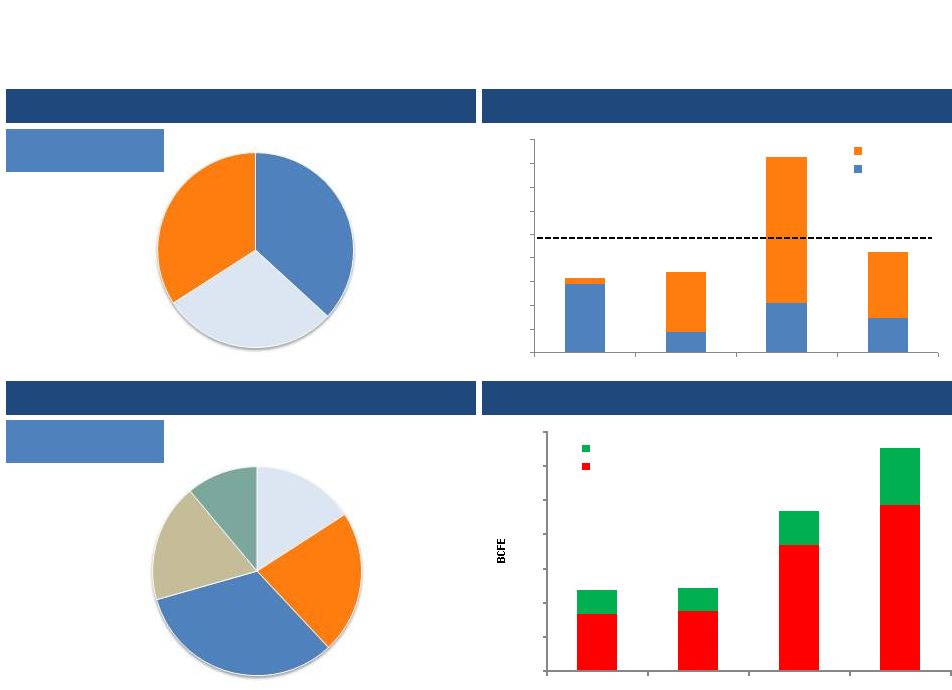

Proved

Reserves 1

Includes revisions.

Reserve statistics as of Year End 2010 SEC Reserve Report

6

Proved Reserves by Type (Bcfe)

Annual Reserve Additions as a % of Production

Proved Reserves by Commodity (Bcfe)

Proved PV-10 by Region ($MM)

PV-10 Value of $705.2

million

66% of Proved Reserves

are Developed

Confidential

0%

100%

200%

300%

400%

500%

600%

700%

800%

900%

2007

2008

2009

2010

Purchases

Extensions

Average Annual Reserve Replacement Rate of 495%

0

50

100

150

200

250

300

350

2007

2008

2009

2010

Oil

Gas

PDP

120 BCFE

37%

PDNP

95 BCFE

29%

PUD

111 BCFE

34%

Deep Bossier

$112 MM

East TX

$154 MM

South

Louisiana

$229 MM

Oklahoma

$129 MM

Other

$81 MM

1 |

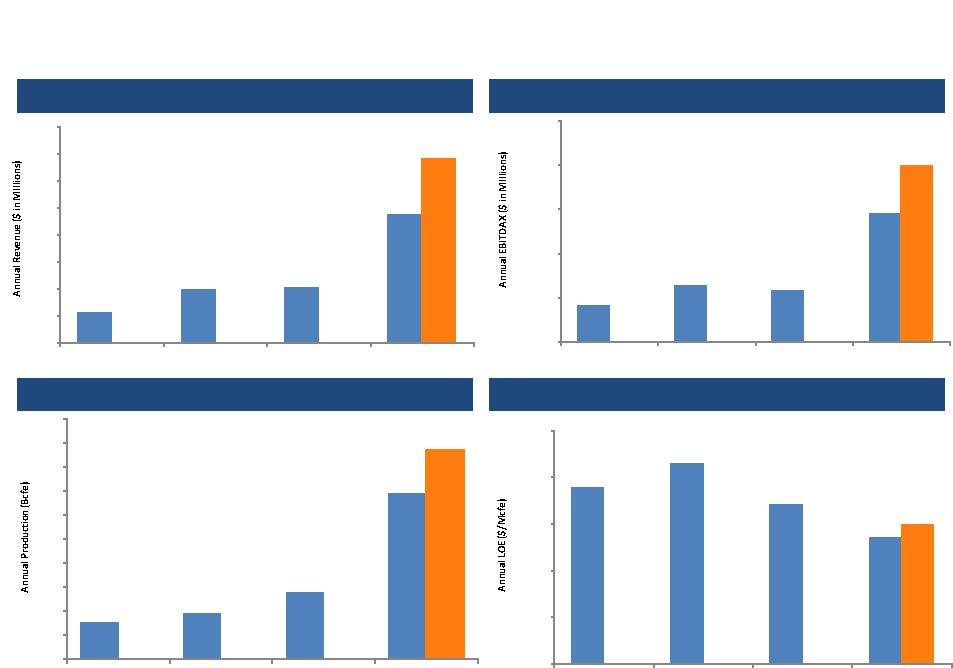

Revenue

1

Growth ($MM)

EBITDAX Growth ($MM)

Production Growth (Bcfe)

Lease and Plant Operating Expense ($/Mcfe)

Operating Efficiency & Profitable Growth

7

1

Excludes unrealized hedging gains and other revenues.

2

Pro forma adjustments for Meridian for entire 1H 2010.

Confidential

$56.7

$99.0

$102.3

$238.4

$341.9

0

50

100

150

200

250

300

350

400

2007

2008

2009

PF 2010 & Q3 2011

Annualized²

$40.9

$63.9

$58.2

$145.5

$200.0

$-

$50.0

$100.0

$150.0

$200.0

$250.0

2007

2008

2009

PF 2010 & Q3 2011

Annualized²

7.7

9.6

13.9

34.5

43.7

0

5

10

15

20

25

30

35

40

45

50

2007

2008

2009

PF 2010 & Q3 2011

Annualized²

$1.89

$2.15

$1.71

$1.35

$1.49

$-

$0.50

$1.00

$1.50

$2.00

$2.50

2007

2008

2009

PF 2010 & Q3 2011

Actual² |

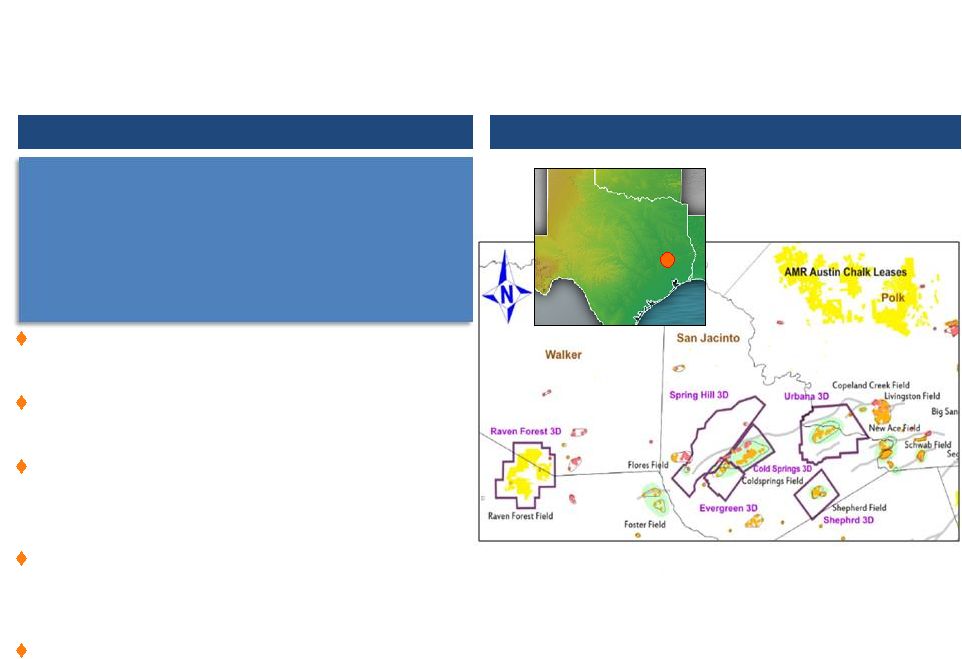

Liquids-rich gas from over 40 potential pay

sands in the Yegua and Wilcox formations

Anne Parsons field produces out of the Austin

Chalk formation

Low-risk expansions of well established fields

discovered in 1950s and 1960s by Amoco and

other large companies

Applying modern geological analysis and

engineering techniques to drive production and

reserve growth

Took over Cold Springs operations in Q2’2011

East Texas –

Overview

Increasing Reserves and Production from Established Fields

8

Confidential

Overview

1

East Texas Assets Map

1

Reserve data as of YE 2010 SEC reserve report

Proved Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

63 BCFE

$153.9

74%

84%

11.2x

15.3 MMCFED

61%

41,594 |

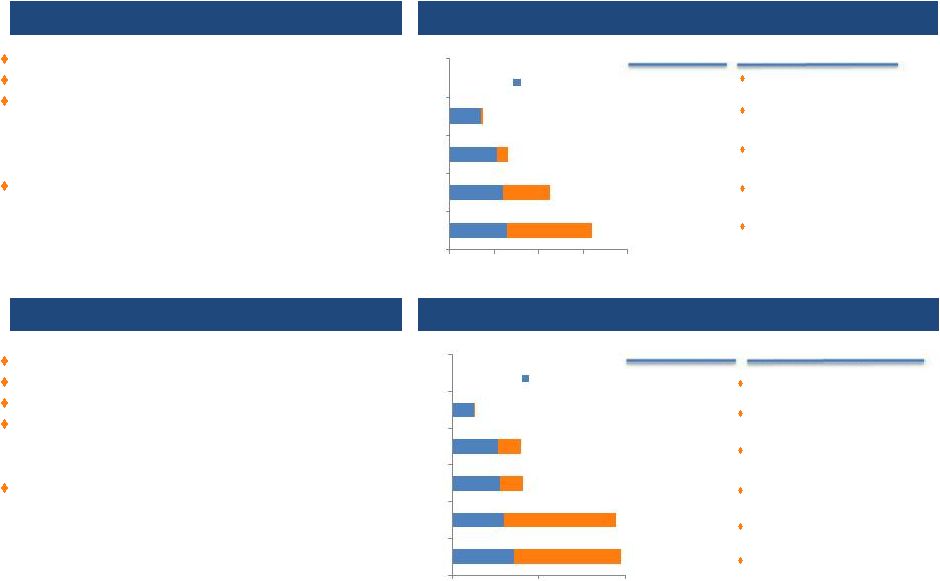

Urbana

– 3P EUR (Bcfe)

Cold Springs –

3P EUR (Bcfe)

Urbana –

Overview

Cold Springs –

Overview

Urbana and Cold Springs Field

Source: Internal reserve report.

9

Confidential

Wilcox Discovery

Famcor Purchase

Purchased remaining 50% of

Famcor East CS WI; Rediscover

7900’

oil sand

Urbana A-8 confirms low-

resistivity pay

Alta Mesa purchases 50%

Famcor, other WI

West Cold Springs extension

proved

Milestones

*Does not include oil/condensate, 60 BO/MM

Reserves (BCF)

Cum

EUR*

0

0

25

27

53

80

55

82

60

189

72

195

Known structure with multiple pay zones

Like Urbana, but larger with more development potential

Acquired > 50% working interest in past three years

Initiated development drilling and recompletions

–

Very low-resistivity pay (<0.8 ohms)

–

Modern logging technology and fracture stimulations

Field re-development and expansion

–

Confirmed 1,500-acre western field extension in multiple

Wilcox Sands

–

3D survey planned to identify Yegua potential and

delineate the Wilcox formation

–

19 PUDs documented

Known structure with multiple pay zones

Field re-development since buying Famcor WI

Recent advances have led to increased reserves

–

Low resistivity pay: modern logging

–

Fracture stimulations

–

Gas lifting and lowering surface system pressure

New 3D data will drive additional development

–

One of four new fault blocks to be tested in Dec’2011

–

Deeper pay potential to be tested in 2012-2013

Wilcox Discovery

Amoco sale to Famcor & Alta

Mesa

Urbana A-8 confirms low-

resistivity pay

Alta Mesa drilling confirms

added pay

Urbana 3-D complete

Milestones

*Does not include oil/condensate, 25 BO/MM

0

0

35

37

53

65

60

113

64

160

Reserves (BCF)

Cum

EUR*

0

50

100

150

200

1951

1989

2005

2008

2009

BCF

Cumulative to Date

0

100

200

1951

1989

2005

2007

2009

2011

BCF

Cumulative to Date |

Overview

1

Oil Zones Actively Being Pursued Along Trend

2

Hilltop –

Overview

Primary objective is lower Bossier sand between

15,000 and 20,000 feet deep

Field is highly productive with multiple pays, low

F&D and low LOE

Value derived through active participation with

Operator on engineering, operations and

geology/geophysics

–

EnCana operates approximately 85% of Alta

Mesa’s production

Large Position in a Highly Prolific, Expanding Play

10

Confidential

1

Reserve data as of YE 2010 SEC reserve report

2

Only HZL wells with permitted target of Woodbine and Eagle Ford formations

Permitted

HZL

Wells¹

(Since

January

1,

2010)

Producing

HZL

Wells¹

(Drilled

Post

-

January

1,2010)

93 BCFE

$111.9

100%

56%

5.5x

55.2 MMCFED

100%

16,998

Proved Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage |

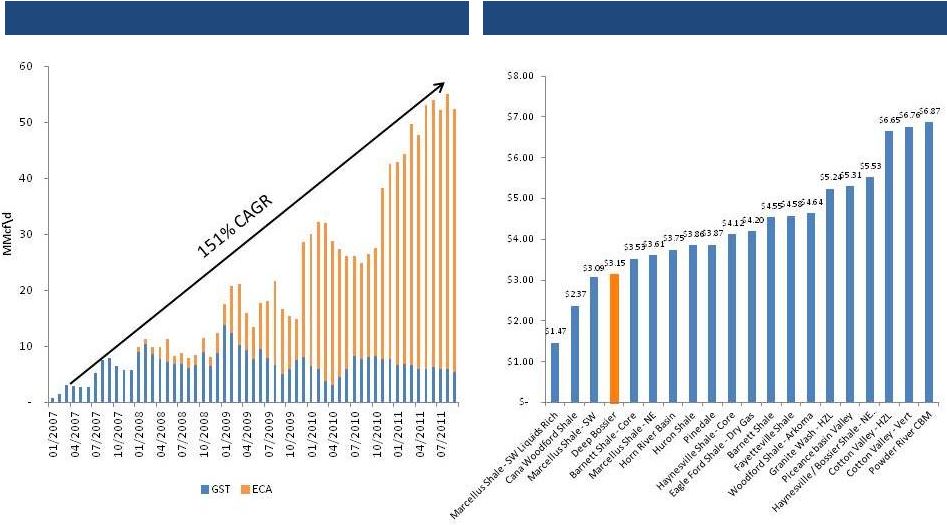

Hilltop Net

Production by Operator (MMcf/d) Prolific, Low Cost Gas Play

Major

North

American

Gas

Basin

Breakevens

¹

11

Confidential

Additional potential in other zones and application of horizontal drilling

Source: Credit Suisse. Data excludes land costs. Deep Bossier breakeven based on

AMH analysis. 1 |

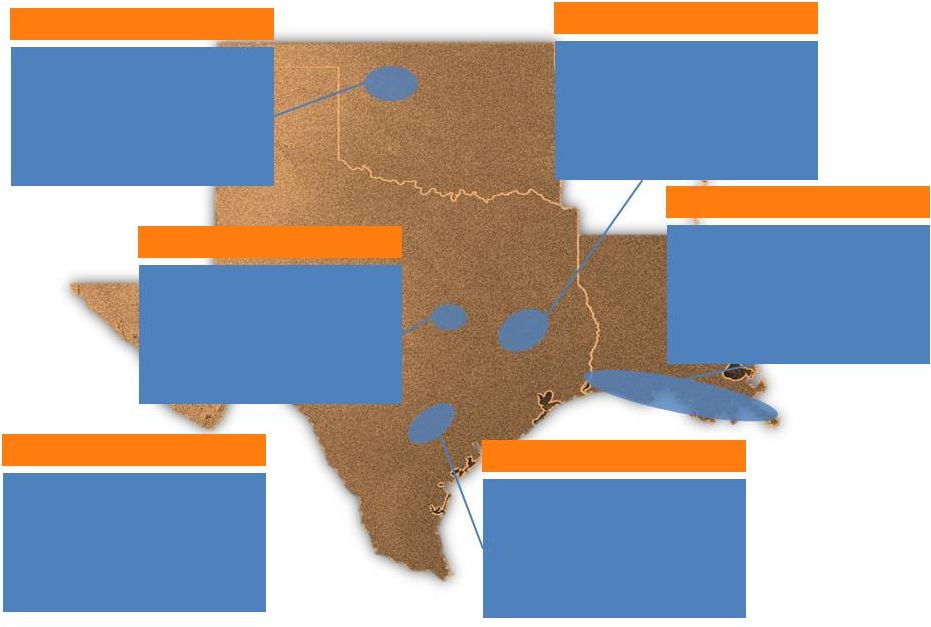

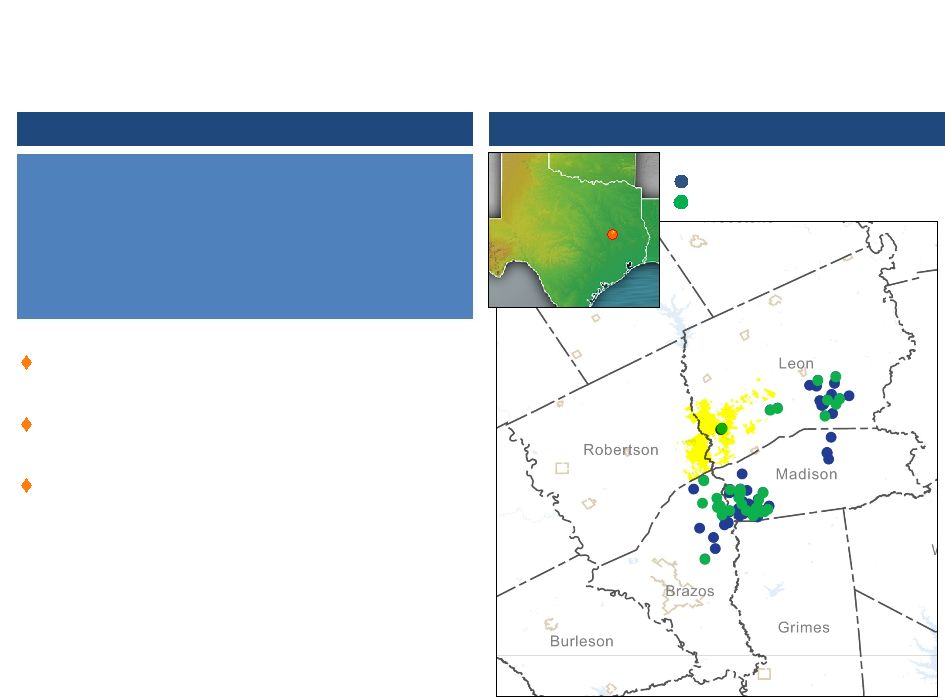

Overview

1

Oklahoma Activity Map

Oklahoma –

Current Activity

Long-lived, Stable Oil Production

12

Confidential

East Hennessey

Waterflood

Expansion

Re-Drill

Locations

Lincoln North Unit

Waterflood Expansion

Dover Unit

Infill Drilling

Lincoln North Unit

Infill Drilling

Lincoln Southeast

Waterflood Expansion

Principal assets are large fields developed by

Conoco, Texaco and Exxon on 80-acre spacing,

unitized and waterflooded

Oil dominated, long life assets with shallow

declines and steady cash flow

Potential to more than double production and

reserves with down-spacing and waterflood

Key area players include: Chaparral, Chesapeake

and Devon

1

Reserve data as of YE 2010 SEC reserve report

Proved Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

7.3 MMBOE

$129.2

46%

62%

19.9x

946 BOEPD

48%

36,878 |

Oklahoma

Production Growth 13

Confidential

Historic 8/8ths Field Production (BOEPD)

Oklahoma Assets Producing at Multi-Decade High

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Actual Field Production

Projected Field Decline

Wedge Equates to ~4

MMBOE of added

production since AMH took over assets |

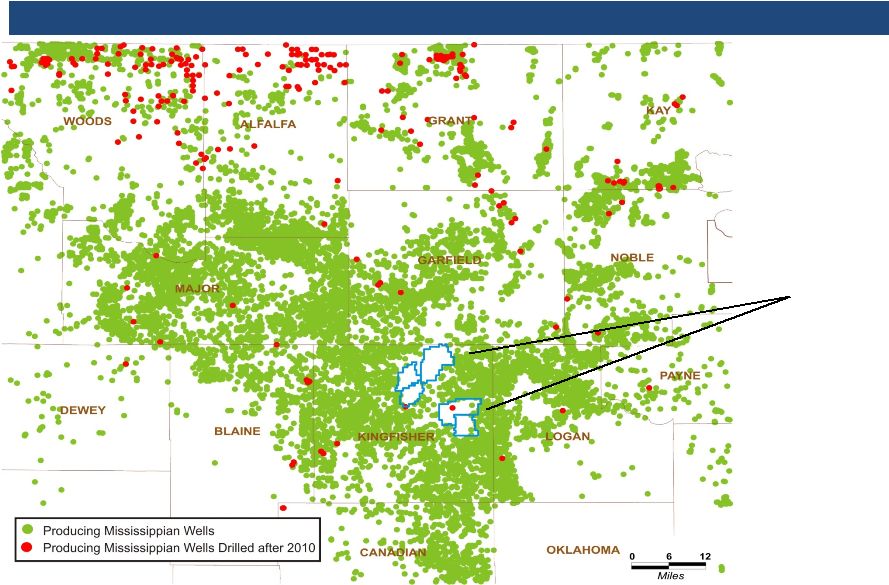

Regional

Development of Mississippian Formation Wells Targeting Mississippian Formation

AMH Currently Identifying and Testing Mississippi Locations on its Acreage

14

Confidential

AMH

Acreage |

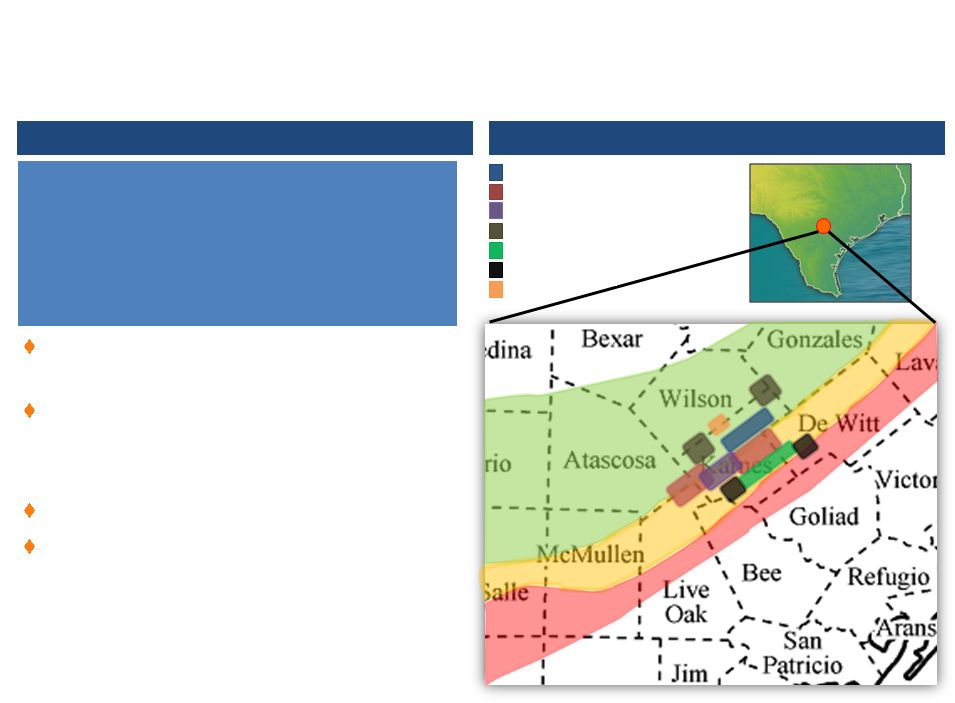

Eagle Ford

Shale – Overview

Significant Acreage Position Concentrated in Karnes County

15

Confidential

Karnes County is industry recognized core area

of Eagle Ford Trend

120 well development program underway with

operator Murphy; 2 rigs currently operating

•

Based on 160 acre spacing

Infrastructure & facilities to handle production

Optimizing initial rates to maximize ultimate

recovery

1

Reserve data as of YE 2010 SEC reserve report

Proved Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

Enduring Resources

PXP

AMH / Murphy

Conoco

Marathon

EOG

Pioneer

Eagle Ford Map

Overview

1

0.6 MMBOE

$13.2

13%

52%

6.5x

964 BOEPD

10%

3,611 |

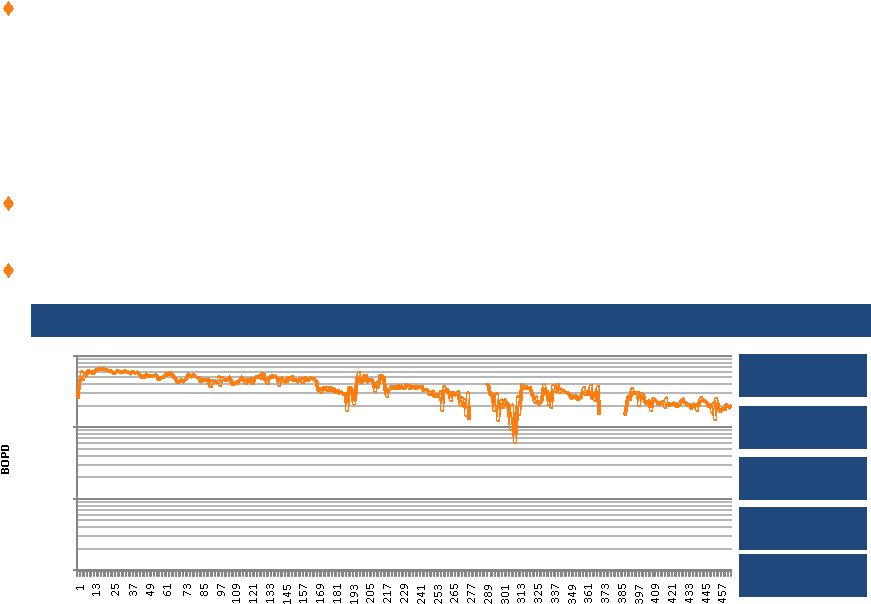

Production and

EUR highly sensitive to drawdown –

Early EFS wells exhibit severe well damage from high drawdown

–

Theoretically, high drawdown may be “collapsing”

the near well bore frac zone, crushing proppant, and limiting connectivity to

the reservoir

–

Since mechanism of failure is mechanical, it is unlikely that damaged wells can be repaired by

restricting the rate once the damage is done

–

Recent presentations/discussions by PetroHawk, Pioneer, and Chesapeake support this

theory Our wells demonstrate positive effects with restricting rate early in well

life –

Post high IP’s, wells experience severe decline; lower IP’s equate to lower

decline Restricting rate has flattened decline and potentially enhanced EUR

Eagle Ford Shale –

Maximizing EUR and Profitability

16

Confidential

Time Normalized Average AMH Karnes County Oil Well Decline Profile

30 Day Average Rate

670 BOEPD

60 Day Average Rate

652 BOEPD

90 Day Average Rate

626 BOEPD

120 Day Average Rate

598 BOEPD

150 Day Average Rate

588 BOEPD

1

10

100

1,000

Days |

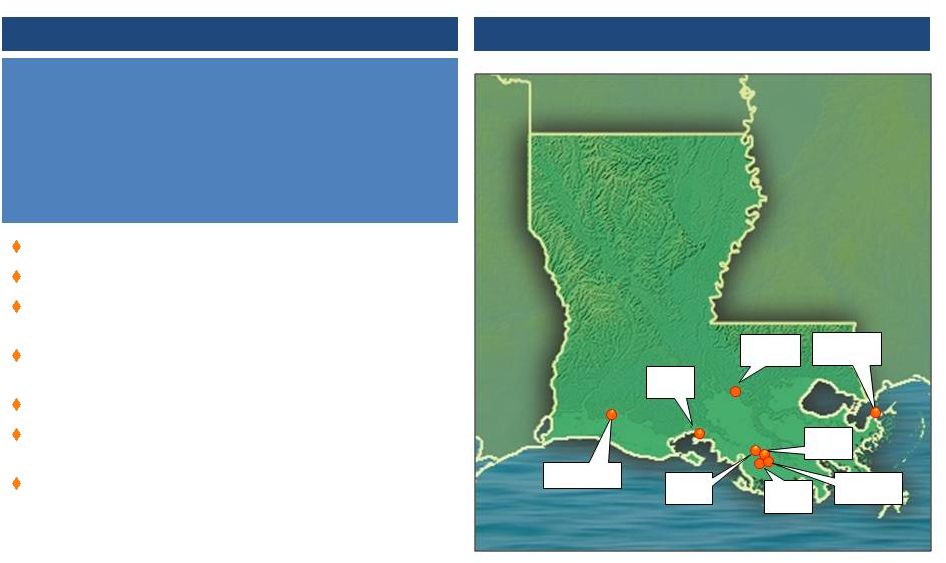

South

Louisiana – Overview

Long-standing focus area of Alta Mesa team

Primary fields are South Hayes and Weeks Island

Historically prolific areas originally developed by Shell,

Texaco and Exxon

Significant multi-pay opportunities with oil and liquids

rich gas targets

Multiple low risk exploration and development targets

Outstanding reservoir quality that yields high rates,

quick payouts and strong ROI

Expect to materially increase PDP, PDNP and PUD

reserves through rigorous analysis and development of

fields

Historically Prolific Area Originally Developed by Majors

17

Confidential

1

Data is inclusive of all assets in Louisiana.

2

Reserve data as of YE 2010 SEC reserve report

Proved Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

76 BCFE

$229.2

72%

74%

6.1x

30.5 MMCFED

52%

36,505

Overview

1,2

South Louisiana Assets

Weeks

Island

Biloxi

Marshland

South Hayes

Ramos

Turtle

Bayou

Humphreys

St Gabriel

Gibson |

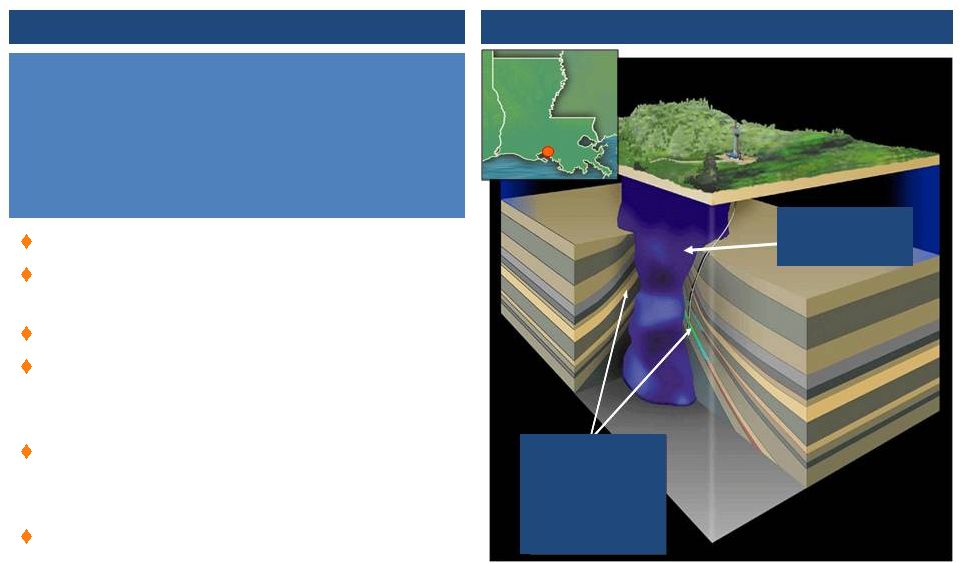

Weeks Island

- Overview

High Value Oil Field with Significant Upside Potential

18

Confidential

Discovered by Shell in 1945

Significant oil field characterized by low-risk,

multi-pay targets

Continuous 2H’2011 drilling program underway

18 PDNP and 13 PUD locations booked, with

multiple additional locations identified for 20+

MMBOE potential

Drilling targets developed through intense,

multi-discipline analysis of geologic,

geophysical, and engineering data

Ability to increase production and lower costs

by optimizing facilities

Proved Reserves

PV10 ($MM)

% Gas (Reserves)

% Proved Developed

R/P

Q3 2011 Production

% Gas (Production)

Net Acreage

3.0 MMBOE

$81.1

30%

57%

4.9x

1,923 BOEPD

5%

5,256

Oil & Gas

bearing

sediments

Piercement

Salt Dome

Overview

1

Weeks Island: Multiple Oil Pay Zones

Reserve data as of YE 2010 SEC reserve report

1 |

Weeks Island

Development 19

Confidential

Development Drilling

Exploration Drilling

Secondary Recovery

Facility Optimization

Exploitation Opportunities

Drilling Results -

Past 36 Months

Well Costs

($MM)

IP

(BOEPD)

Current Rate

(BOEPD)

EUR

(MBOE)

Goodrich Cocke #6ST

$5.21

250

80

162

Goodrich Cocke #7ST

$3.30

800

800

969

State Weeks Bay #15ST

$4.20

350

150

269

Goodrich Cocke #5

$2.76

150

70

82

State Weeks Bay #19ST

$3.34

600

1180

65

State Weeks Bay #20ST

$2.24

250

50

77

Goodrich #25ST

$2.23

200

65

164

Myles Salt #34ST

$2.94

350

350

745

Goodrich Cocke #9*

$4.80

800

800

1825

Myles Salt #45

$0.31

500

800

832

*Production number is estimate, awaiting completion.

Historic Field Production (BOPD)

Cumulative Field Production of 280 MMBO & 1 TCF

Exxon / Shell

Stone / Meridian

AMH

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

11,000 |

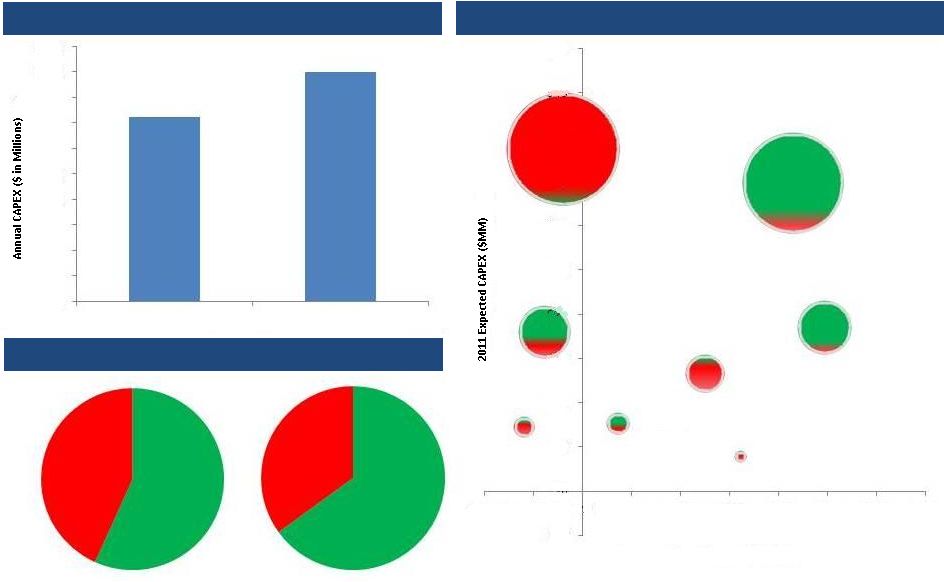

2011 CAPEX

Forecast Planned Drilling & Recompletion CAPEX by Field ($000s)

2010E

2011E

20

Confidential

%

Liquids

57%

% Gas

43%

%

Liquids

67%

% Gas

33%

$144

$180

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

2010E

2011E

Other

Other SLA

Oklahoma

Other South

Texas

Weeks Island

Eagle Ford

East Texas

Deep Bossier

($5)

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

-100%

-50%

0%

50%

100%

150%

200%

250%

300%

350%

Projected Annual CAPEX

CAPEX Focus

Year over Year Change in CAPEX

$50 |

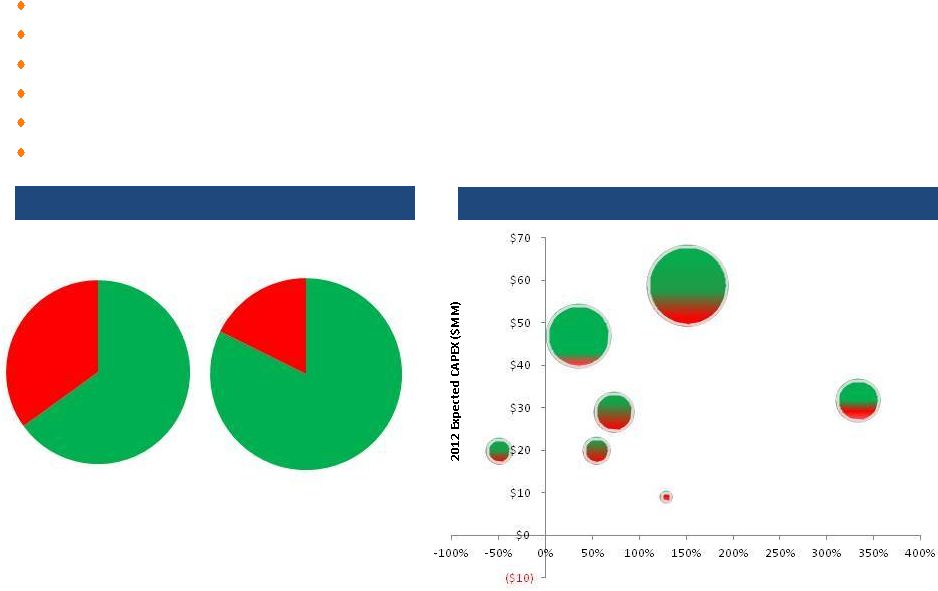

2012 CAPEX

Plan Planned Drilling & Recompletion CAPEX by Field ($000s)

Manage to cash flow neutral position, with total Capex for the year expected to range between

$220 and $240 million Significant HBP positions in core areas allow management to

accelerate / defer projects as economics dictate Over 80% of 2012E drilling and

recompletion dollars directed to oil and liquids rich properties Capital

reallocated

from

“gas

only”

Deep

Bossier

to

oily

prospects

at

Weeks

Island,

Oklahoma,

East

Texas

and

Eagle

Ford

Oil and liquids expected to generate greater than 35% of production (equivalent basis) in

2012 Multi-year drilling inventory with over 125 identified PUD locations

CAPEX Focus

21

Confidential

Continued Focus on High Margin Liquids Rich Projects

2011E

2012E

Other

SLA

Oklahoma

Other South

Eagle Ford

East Texas

Year over Year Change in CAPEX

%

Liquids

67%

% Gas

33%

% Gas

82%

%

Liquids

18%

Hilltop

Texas |

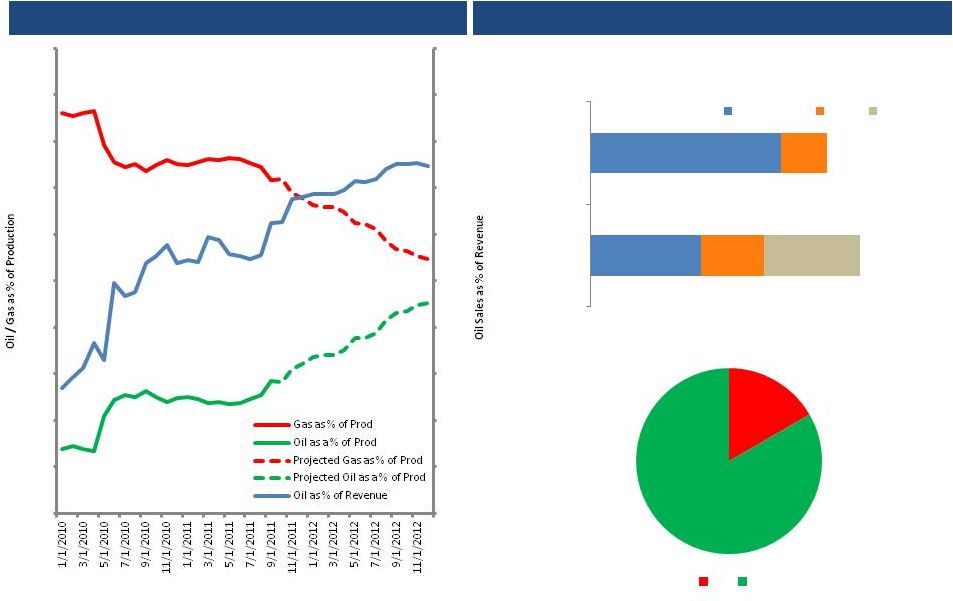

Production

Shift from Gas to Oil Historic and Projected Production Mix

Oil Production is Expected to Grow from 14% of Production to >40% Over Next 18 Months

Confidential

22

Future Oil Growth Driven by Weeks Island and Eagle Ford

Material Oil Reserves Remain to be Developed

Production from these Fields is Primarily Oil

50% Proved Developed

52% Proved Developed

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Gas

Oil

83%

17%

Eagle Ford

Weeks Island

Total Proved

PROB

POSS |

23

Confidential

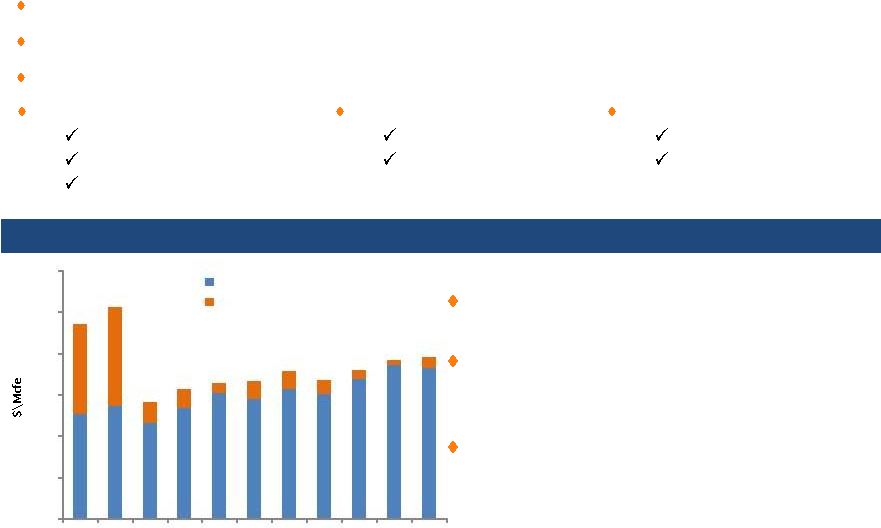

Balance Sheet Protection, Active Management of Portfolio

Management of Commodity Price Risk

Cost-effectively limit downside risk, while minimizing cash outlays

Active management across a five-year window

Tactically switching portion of WTI for Brent due to high correlation of LLS / Brent

Portfolio

Swaps

Put Spreads, Call Spreads

3-Way Collars

Natural Gas

Henry Hub

HSC Basis

Crude oil

Brent

WTI

Strong Track Record of Using Hedges to Maximize Profitability

Since 2009, hedges have increased revenue by

$67mm or 13%

As of November 1

st

, AMH’s hedge book ensures a

minimum of $545mm of revenue over the next 5

years

Over 55% of 2012 expected production is hedged

at an average $8.68/mcfe

$0

$2

$4

$6

$8

$10

$12

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

Avg Sales Price (per Mcfe) Unhedged

Incremental Sales Gain due to Hedges |

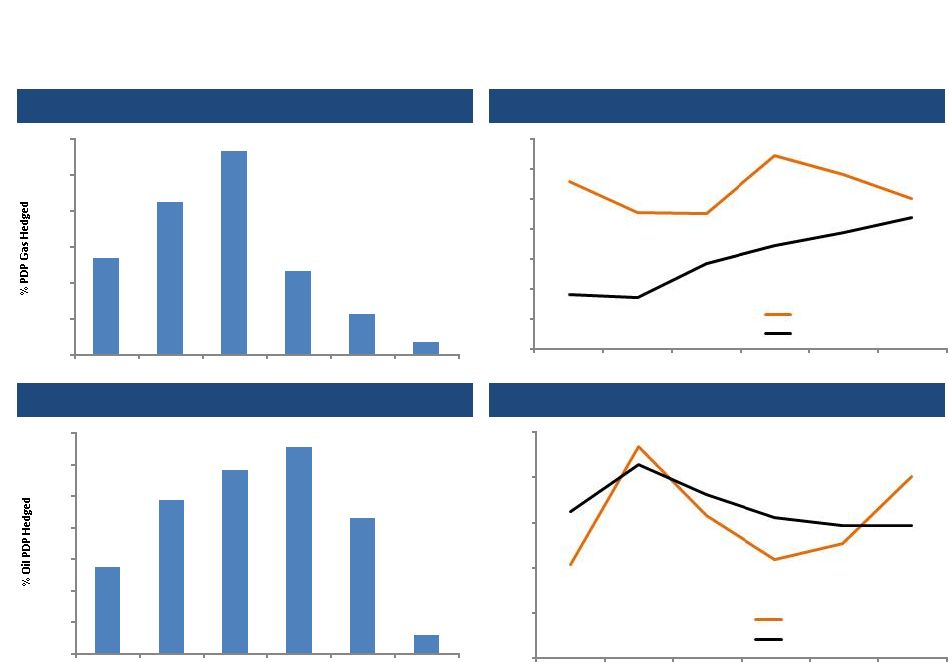

% of PDP

Hedged - Natural Gas

Average Floor Price –

Natural Gas

Note: Hedge positions as of 12/2/11; NYMEX strip as of 11/25/11.

2011 calculations are for Oct 1, 2011 forward.

Commodity Price Risk Management

Confidential

24

% of PDP Hedged -

Oil

Average Floor Price –

Oil

55%

97%

116%

131%

86%

12%

0%

20%

40%

60%

80%

100%

120%

140%

Q4'2011

2012

2013

2014

2015

2016

$85.28

$98.39

$90.69

$85.81

$87.57

$95.00

$75

$80

$85

$90

$95

$100

Q4'2011

2012

2013

2014

2015

2016

AMH Average Floor Price

NYMEX as of 11/25/2011

54%

85%

113%

46%

22%

7%

0%

20%

40%

60%

80%

100%

120%

Q4'2011

2012

2013

2014

2015

2016

$5.80

$5.27

$5.25

$6.23

$5.91

$5.50

$3.00

$3.50

$4.00

$4.50

$5.00

$5.50

$6.00

$6.50

Q4'2011

2012

2013

2014

2015

2016

AMH Average Floor Price

NYMEX as of 11/25/2011 |

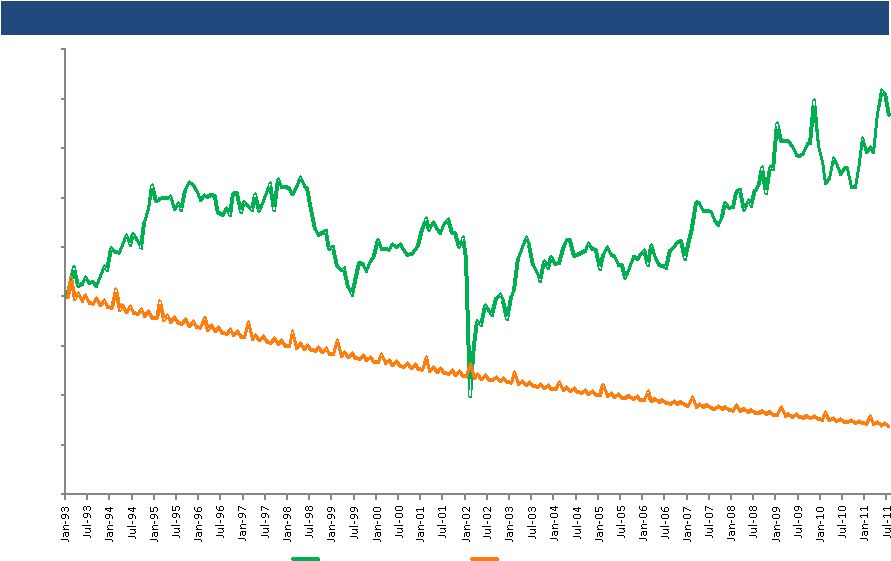

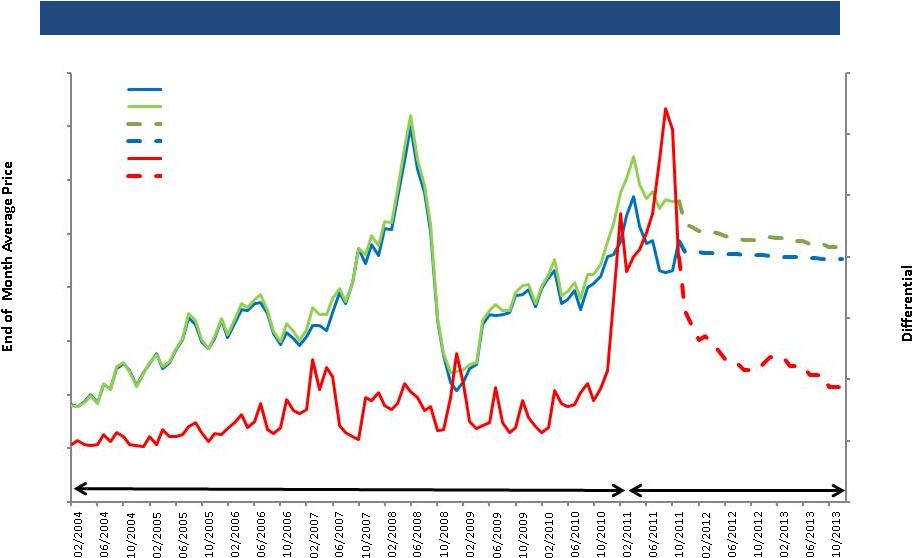

LLS Basis

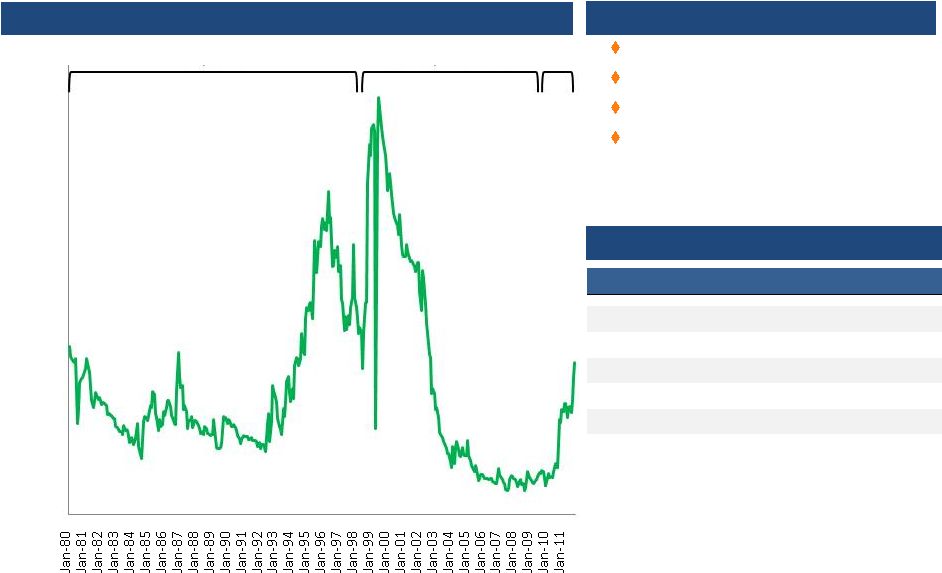

Trading at Premium to WTI Historic and Forward LLS vs WTI Spread

69% of Q3 oil production indexed against LLS, resulting in $12.51 spread to WTI

$5

$0

$5

$10

$15

$20

$25

$30

$0

$20

$40

$60

$80

$100

$120

$140

$160

25

Confidential

WTI

LLS

LLS (Forecast)

WTI (Forecast)

Spread

Spread (Forecast)

2004 Through

2010

Average

Differential of $1.95/BBL

2011 Forward

Average

Differential of

$10.07/BBL |

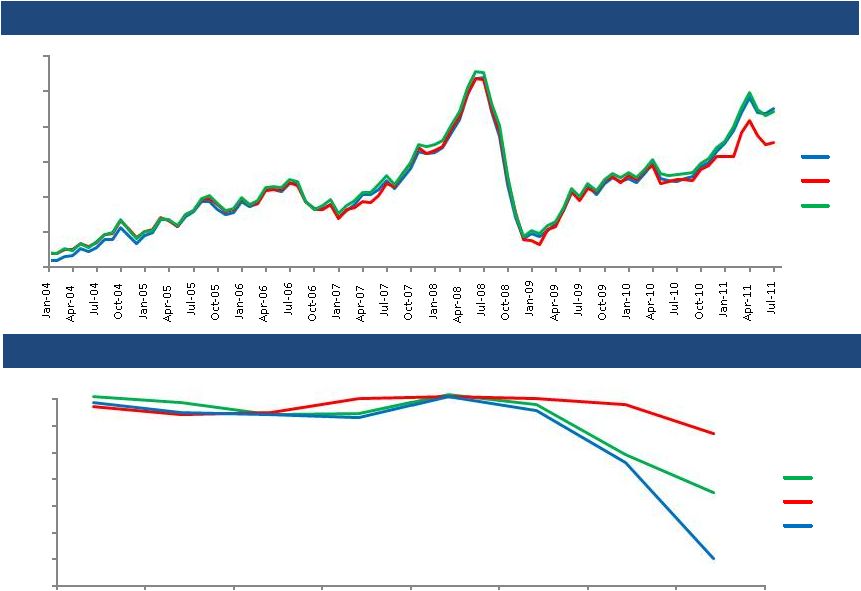

Divergence in

Historic LLS Correlations from WTI to Brent 26

Confidential

Historic Prices

Price Correlation

$25

$45

$65

$85

$105

$125

$145

Brent

WTI

LLS

86%

88%

90%

92%

94%

96%

98%

100%

2004

2005

2006

2007

2008

2009

2010

2011

WTI:LLS

Brent:LLS

Brent:WTI |

Strong

Management Team

with Proven

Track Record

Average 25+ years industry and technical experience

Successfully

completed

over

$250mm

of

acquisitions

at

$1.27/mcfe

1

Since 2007, increased proved reserves and production at 40% and 65%

CAGR, respectively

Operational

Control and Low

F&D Costs

83%

of

wells

are

controlled

by

operations

3

All-source 4-year avg. F&D of $2.14/Mcfe compares favorably to

peers Less than 9% of core property leases expire by end of 2011

Low-Risk &

Multi-Year Drilling

Inventory

Multi-year drilling inventory with 125 current PUD locations

Significant positions in Deep Bossier play, East Texas Wilcox and South

Louisiana; upside potential from Eagle Ford shale position

72% of PDP volume hedged through 2016

High Quality &

Diversified

Asset Portfolio

Diverse asset base with significant drilling opportunities

25%

of

Q3’11

production

from

oil

and

liquids

(53%

of

Q3’11

revenue

2

)

2010 LOE of $1.37/mcfe

Key Considerations

27

1

Statistic for 2007 through 2010.

2

Excludes unrealized hedging gains and other revenues.

3

Excludes Deep Bossier resource play which constitutes approximately 16% of AMH’s

PV-10 value and where EnCana is the principal operator. Confidential

|

Hal

Chappelle, President & CEO Phone: 281-943-1353

Email:

hchappelle@altamesa.net

Michael McCabe, Vice President & CFO

Phone: 281-530-0991

Email:

mmcabe@altamesa.net

Lance Weaver, Investor Relations Manager

Phone: 281-943-5597

Email:

lweaver@altamesa.net

www.altamesa.net

Contact Information

28

Confidential |