Attached files

| file | filename |

|---|---|

| 8-K - ALEX FORM 8-K - Matson, Inc. | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Matson, Inc. | exh99_1.htm |

| EX-99.2 - EXHIBIT 99.2 - Matson, Inc. | exh99_2.htm |

Separation Plan Announcement

Friday, December 2, 2011

Friday, December 2, 2011

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Statements in this call and presentation that set forth expectations or

predictions are based on facts and situations that are known to us as of

today, December 2, 2011.

predictions are based on facts and situations that are known to us as of

today, December 2, 2011.

Actual results may differ materially, due to risks and uncertainties, such

as those described in our December 1 press release announcing the

separation plan and on pages 17-25 of our 2010 Form 10-K and our

other subsequent filings with the SEC. Statements in this call and

presentation are not guarantees of future performance. We do not

undertake any obligation to update our forward-looking statements.

as those described in our December 1 press release announcing the

separation plan and on pages 17-25 of our 2010 Form 10-K and our

other subsequent filings with the SEC. Statements in this call and

presentation are not guarantees of future performance. We do not

undertake any obligation to update our forward-looking statements.

Disclosure

2

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

A New Chapter in Alexander & Baldwin’s History

Alexander & Baldwin’s Board of Directors has approved a plan to

pursue the separation of the Company creating two companies better

positioned to enhance long-term shareholder value. The separate

companies will continue to reliably serve our customers and the

Hawaii community

pursue the separation of the Company creating two companies better

positioned to enhance long-term shareholder value. The separate

companies will continue to reliably serve our customers and the

Hawaii community

§ A&B: A Hawaii-based real estate and agricultural company with high-

quality assets and operations that are well positioned for growth

quality assets and operations that are well positioned for growth

§ Matson: A Hawaii-based transportation company with a prominent

brand, a superior fleet, complementary logistics services

and the financial and operating capability to grow in other markets

brand, a superior fleet, complementary logistics services

and the financial and operating capability to grow in other markets

3

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Call Agenda

Business Evolution and Transaction Summary -

S. Kuriyama

1

4

5

A&B Overview and Strategic Outlook - C. Benjamin

Matson Overview and Strategic Outlook - M. Cox

Transaction Overview - J. Wine

2

Transaction Strategic Rationale - J. Wine

7

Concluding Remarks - S. Kuriyama

6

Q&A

3

4

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Real Estate (1949)

Agribusiness (1870)

§Sugar plantation served as the foundation of the Company, eventually leading to energy

production, property development, commercial real estate and shipping

production, property development, commercial real estate and shipping

Alexander & Baldwin: The Evolution of Our Business

Transportation (1969)

§Matson founded in 1882

§Sugar transport to the West Coast was the beginning of the core Hawaii trade

§Matson became a wholly-owned subsidiary of A&B in 1969

§Expansion to Guam and China followed

§Logistics business began in 1987 in response to customer demand for coordination of

transportation activities across multiple modes, including rail and highway

transportation activities across multiple modes, including rail and highway

§Development of homes for plantation workers evolved into residential and commercial

development across the state

development across the state

§Commercial property experience commenced with commercial properties on Maui to service

the local community, and through tax-deferred (1031) exchanges, has grown into a

substantial portfolio of commercial properties in Hawaii and on the Mainland

the local community, and through tax-deferred (1031) exchanges, has grown into a

substantial portfolio of commercial properties in Hawaii and on the Mainland

Successful track

record of

strategically

entering and

exiting industries

over the years,

including:

record of

strategically

entering and

exiting industries

over the years,

including:

Retail

Insurance

Container

Leasing

Hospitality

Oil Refining

5

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Operating Profit Mix*

LTM Revenue and

Operating Profit*

Operating Profit*

Leadership Team

Key Business Lines

Operating Profit $102M

Operating Profit $104M

Premier Hawaii Real Estate and

Agricultural Company

Agricultural Company

Two Independent, Publicly Traded Companies

A&B

Matson

* Based on LTM segment performance for the Real Estate and Agribusiness segments (A&B) and the Transportation segments (Matson) as of

9/30/2011. Revenue and operating profit for A&B includes the results from income properties that were sold and classified as discontinued

operations. Operating profit for Matson excludes losses from CLX2. Segment operating profit also excludes corporate overhead expenses not

allocated to the segments.

9/30/2011. Revenue and operating profit for A&B includes the results from income properties that were sold and classified as discontinued

operations. Operating profit for Matson excludes losses from CLX2. Segment operating profit also excludes corporate overhead expenses not

allocated to the segments.

Chairman & CEO - Stan Kuriyama

President & COO - Chris Benjamin

CFO - Paul Ito

Chairman - Walter Dods

President & CEO - Matt Cox

CFO - Joel Wine

Market Leading Ocean

Transportation and Logistics

Company

Transportation and Logistics

Company

Focus

6

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

34%

39%

62%

Real Estate and

Agribusiness Five-

Year Operating Profit

Agribusiness Five-

Year Operating Profit

(Millions)

Transportation Segments

Five-Year Operating Profit

Five-Year Operating Profit

(Millions)

Transportation Segments Assets

(Millions)

Real Estate and Agribusiness

Assets

Assets

(Millions)

41%

7

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

|

Enhanced Strategic

Direction and Focus |

§ Each company is now of sufficient scale to independently establish and achieve

strategic priorities, growth strategies and financial objectives § Board and management of each company will be able to focus exclusively on the

operation and strategic direction of each business with more direct alignment of incentives |

|

|

|

|

Growth Oriented

Capital Structure |

§ Each company will be able to allocate capital in a manner best tailored to its business

and have more direct access to capital to fund future growth |

|

|

|

|

Separate Stock

|

§ Each company will have its own separate stock, which can be used to facilitate

acquisition opportunities and equity-based compensation arrangements |

|

|

|

|

Greater

Transparency |

§ Separation will allow for greater visibility into relative financial and

operating performance |

|

|

|

|

Sector-Specific

Investors and Research Coverage |

§ Each company will appeal to a more focused shareholder base attracted to the

particular business profile of that company and the specific industries in which it operates § Each company expects to attract coverage by additional industry-specific analysts,

providing the public and investment community with more information and perspectives on the two companies |

|

|

|

|

Timing

|

§ Relatively stable point in each business’ investment cycle

§ Businesses are poised for further growth

|

|

|

n

|

8

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

§ 88,000 acres of land in Hawaii

§ Fourth-largest private land-owner in the State

§ Portfolio of 44 commercial properties in

Hawaii and 8 Mainland states

(7.9 million square feet with 2010 NOI of $56M)

Hawaii and 8 Mainland states

(7.9 million square feet with 2010 NOI of $56M)

§ Resort, primary residential and commercial

development portfolio (2,500 units)

development portfolio (2,500 units)

§ Largest agricultural operation in Hawaii

§ Significant producer of renewable energy

Both Companies’ Unique Assets Position Them Well to

Deliver Shareholder Value

Deliver Shareholder Value

A&B

§ 17 Jones Act Vessels

§ 47,000 company-owned containers and

equipment

equipment

§ Dedicated terminal facilities in Hawaii

§ 35 percent ownership in SSA Terminals

§ Top 10 domestic logistics company

Matson

9

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Hawaii: Poised for Growth

§ Positive economic trends in the State are

expected to support future growth for both

A&B and Matson

expected to support future growth for both

A&B and Matson

‒ Visitor expenditures on near-record pace

‒ Unemployment of 6.4 percent is well below

the national average

the national average

§ International tourism, especially from China

and Korea, presents a huge growth

opportunity for Hawaii tourism and the

economy generally

and Korea, presents a huge growth

opportunity for Hawaii tourism and the

economy generally

‒ Hawaii is among the world’s most desirable

vacation destinations

vacation destinations

‒ Experience catering to Asian tourists

§ Real estate has bottomed and is poised

for recovery

for recovery

§ Infrastructure projects, like the planned

$5 billion rail project for Honolulu, are

expected to support expansion of Hawaii’s

construction industry

$5 billion rail project for Honolulu, are

expected to support expansion of Hawaii’s

construction industry

10

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

A&B: Deep Knowledge and Expertise in Hawaii Real Estate

Competitive Advantages

Strategy

§ Focus on entitlement / development of core

Hawaii lands

Hawaii lands

§ Position portfolio of pipeline projects for

market recovery

market recovery

§ Investment in high-returning real estate

opportunities across Hawaii

opportunities across Hawaii

§ Targeted investment in complementary

Hawaii markets

Hawaii markets

§ Optimize returns from diversified Hawaii commercial

portfolio with targeted Mainland commercial assets

portfolio with targeted Mainland commercial assets

§ Leverage joint venture opportunities to maximize risk

adjusted return

adjusted return

§ Grow renewable energy operations

§ Extensive expertise in entitling and developing

Hawaii real estate

Hawaii real estate

§ Established track record of working with

communities and government agencies to meet

Hawaii’s needs

communities and government agencies to meet

Hawaii’s needs

§ Over a century of farming and renewable

energy expertise

energy expertise

§ Strong investment discipline embedded in culture

§ Wide range of in house resources with full

spectrum of development capabilities

spectrum of development capabilities

§ Strong balance sheet

11

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

§ Original developer in the early 1970s

§ Sold in 1989, repurchased 270 acres in 2003

§ Sold/developed 100 acres, recapturing

investment

investment

§ 170 remaining acres fully zoned for

residential and commercial uses with a plan

for up to 700 units

residential and commercial uses with a plan

for up to 700 units

§ 27 acres in active development

A&B: Successful Development Track Record

Wailea

§ Completed in 2008

§ 352 residential units

§ Located near downtown Honolulu

Urban Oahu Condos

§ Completed in 2005

§ 100 two-bedroom units

§ Located in the heart of Waikiki

§ First condo development in

Waikiki in 10 years

Waikiki in 10 years

§ Completed in 2006

§ 347 luxury residential units

§ Overlooks Ala Moana Beach Park

Lanikea

Hokua

Keola La’i

12

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

A&B: Development Pipeline

13

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

A&B: Value Creation Drivers and Metrics

|

Key Metrics

|

||

|

Business

|

Statistical Drivers

|

Performance Measures

|

|

Commercial Real Estate

|

§ Occupancy

§ “Same Store” performance

|

§ Net operating income

§ Funds from operations

|

|

Property Development

|

§ Acres entitled and/or permitted

§ Development inventory

§ Development sales

(Lot/unit closings) |

§ Sales margin

§ Long-term returns on

development capital |

|

New Growth Initiatives

|

§ Opportunities evaluated and

investments made |

§ Earnings and returns on

new growth investments |

|

Agribusiness

and Land Stewardship |

§ Pricing

§ Sugar/power production/sales

§ Sugar yields (TSA)

§ New energy initiatives

|

§ Operating profit

§ Operating cash flow

|

14

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

A&B: A Unique and Differentiated Investment in a

Hawaii-Focused Real Estate Company

Hawaii-Focused Real Estate Company

§ “Hawaii Play”: public real estate company

positioned to capitalize on Hawaii upside

positioned to capitalize on Hawaii upside

§ Strong track record in creating shareholder

value from real estate investments and deep

understanding of Hawaii

value from real estate investments and deep

understanding of Hawaii

§ Irreplaceable asset base

§ Large and diversified commercial

real estate portfolio

real estate portfolio

§ Substantial embedded internal growth

opportunities with a pipeline of over a dozen

development projects

opportunities with a pipeline of over a dozen

development projects

§ Growth-oriented capital structure with healthy

balance sheet and strong liquidity

balance sheet and strong liquidity

§ Experienced management team with

aligned incentives

aligned incentives

15

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Matson:

A Premier Ocean Transportation and Logistics Company

A Premier Ocean Transportation and Logistics Company

Competitive Advantages

Strategy

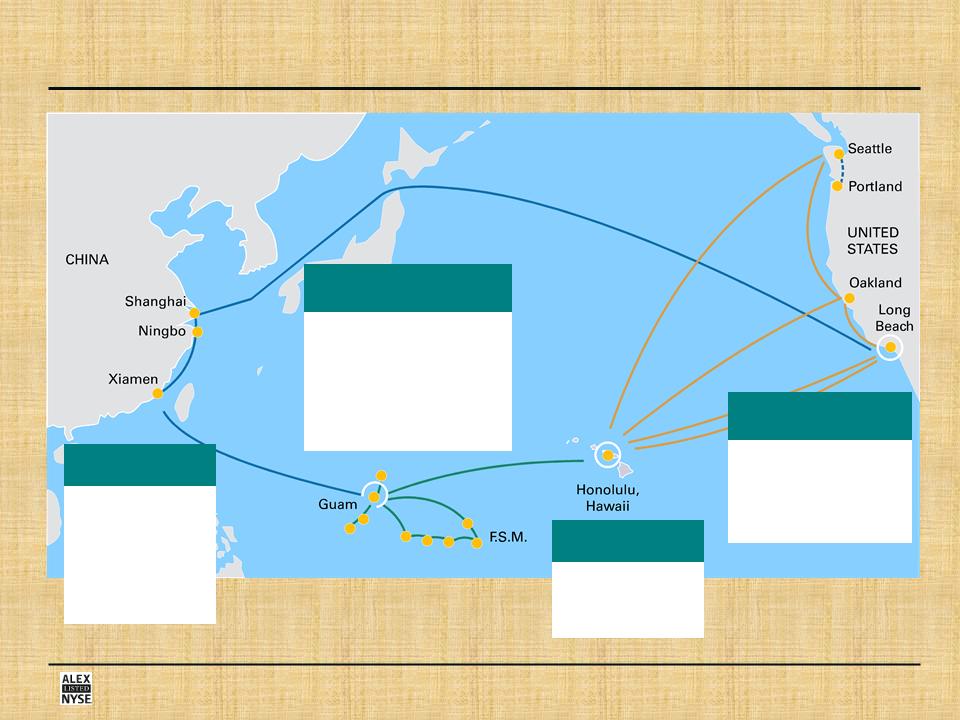

§ Focus on world class customer service

§ Position to grow faster than the overall

Hawaii economy

Hawaii economy

§ Pursue growth in Guam routes through the

upcoming U.S. military realignment toward Asia

upcoming U.S. military realignment toward Asia

§ Pursue other expansion

§ Capitalize on global trade growth through SSA

Terminals joint venture

Terminals joint venture

§ Organic expansion of highway brokerage,

intermodal and warehousing services

intermodal and warehousing services

§ Develop international freight forwarding and

consolidation offerings with a focus on China

consolidation offerings with a focus on China

§ Powerful brand name

§ Leading position in two domestic markets—Hawaii

and Guam

and Guam

§ Outstanding reputation in China

§ Excel at serving niche markets

§ Strategically located terminals in Hawaii

§ Dedicated West Coast terminals through ownership

in one of the largest West Coast terminal operators

in one of the largest West Coast terminal operators

§ Strong operating discipline

§ Strong cash flows, balance sheet, and liquidity

§ Integrated top-tier logistics capability to meet

customer needs

customer needs

16

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Matson: Connecting the Pacific Unlike Anyone Else

|

Reserve Vessels -

4 Ships & 1 Barge

|

|

SS Kauai

|

|

SS Lihue

|

|

SS Lurline

|

|

SS Matsonia

|

|

Mauna Kea

|

|

Hawaii / Guam / China

Service - 5 Ships |

|

MV Manukai

|

|

MV Manulani

|

|

MV Maunalei

|

|

MV Maunawili

|

|

MV RJ Pfeiffer

|

|

Inter-Island

Barge Network

|

|

Haleakala

|

|

Mauna Loa

|

|

Waialeale

|

|

Hawaii Turnaround

Service - 4 Ships |

|

MV Mahimahi

|

|

MV Manoa

|

|

MV Mokihana

|

|

SS Maui

|

17

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Matson: Value Creation Drivers and Metrics

|

Key Metrics

|

||

|

Business

|

Statistical Drivers

|

Performance Measures

|

|

Ocean Transportation

|

§ Vessel on-time performance

§ Capacity utilization

§ Freight rates and volumes

|

§ EBITDA

§ Operating profit

§ Operating margin

§ Return on invested capital

§ EPS

|

|

Logistics

|

§ Volumes

§ Gross profit margin

|

§ Revenue growth

§ Operating profit

§ Operating margin

§ Return on invested capital

|

|

SSAT

|

§ Lifts

§ Profit by terminal

§ Stevedoring productivity

|

§ Interest in joint venture earnings

|

18

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Matson: A Premier Transportation Company Poised to

Deliver Value

Deliver Value

§ Leading shipping company in the Pacific with strong

brand reputation

brand reputation

§ Unmatched customer service and best-in-class

on-time delivery

on-time delivery

§ Competitive advantage in premium

China-Long Beach service

China-Long Beach service

§ Well-positioned for market recoveries in core trades

and military build up in Guam trade

and military build up in Guam trade

§ Superior asset quality - fleet (18-year average age of

active fleet) and harbor infrastructure

active fleet) and harbor infrastructure

§ Logistics creates a strong, viable growth platform

§ Highly strategic 35 percent ownership in

SSA Terminals joint venture

SSA Terminals joint venture

§ Attractive dividend to complement core business growth

§ Experienced management team with aligned incentives

19

Alexander & Baldwin Separation Plan Announcement ● December 2, 2011

Transaction Overview

|

Structure

|

§ As of the record date, shareholders of Alexander & Baldwin will own one share of A&B stock

and one share of Matson stock for each existing share § Tax-free spin

|

|

|

|

|

Timing &

Approvals |

§ Expect transaction to close in the 2H of 2012

§ Receipt of favorable IRS ruling and tax opinion

§ Filing and effectiveness of registration statement with the SEC

§ Final approval by board of directors

|

|

|

|

|

Capital Structures

& Financial Policies |

§ Approximately 40 percent of debt will be allocated to A&B

§ Approximately 60 percent of debt will be allocated to Matson

§ Both companies will retain strong credit metrics and balance sheets

§ Matson will pay an attractive dividend at or above market averages, currently project to be in

the range of 50 to 70 cents per share annually § A&B will not pay a dividend, consistent with other real estate development peers, in order to

maximize investment potential in new, high-returning opportunities § Until the separation is completed, the Company expects to maintain its regular quarterly

dividend |

|

|

|

|

Business Impact

|

§ Both companies will be incorporated and headquartered in Hawaii, and thus, will remain a

driving force in the Hawaii economy § No interruption in operations or service to our communities, our customers, vendors or

government officials § The general public will not experience any changes in the way we do business or the people

they do business with § As the land and transportation businesses already perform their day-to-day functions

independently, there will be very little change to each business’ organizational structure § No net loss in jobs

|

|

|

n

|

20

Separation Plan Announcement

Friday, December 2, 2011

Friday, December 2, 2011