Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - WEGENER CORP | v241695_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - WEGENER CORP | v241695_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - WEGENER CORP | v241695_ex32-1.htm |

| EX-23.1 - EXHIBIT 23.1 - WEGENER CORP | v241695_ex23-1.htm |

| EX-10.8 - EXHIBIT 10.8 - WEGENER CORP | v241695_ex10-8.htm |

| EX-32.2 - WEGENER CORP | v241695_ex32-2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 2, 2011

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission file No. 0-11003

WEGENER CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

81–0371341

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

11350 Technology Circle, Johns Creek, Georgia

|

30097-1502

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (770) 623-0096

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

Traded Over the Counter

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes oNo x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of March 4, 2011 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the Common Stock held by non-affiliates was $1,730,951 based on the last sale price of the Common Stock as as reported on the OTCQB market place on such date. (The officers and directors of the registrant, and owners of over 10% of the registrant’s common stock, are considered affiliates for purposes of this calculation.)

As of November 15, 2011, 13,147,051 shares of registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement pertaining to the 2012 Annual Meeting of Stockholders, only to the extent expressly so stated herein, are incorporated herein by reference into Part III.

WEGENER CORPORATION

FORM 10-K

YEAR ENDED SEPTEMBER 2, 2011

INDEX

|

|

Page | |

| PART I | ||

|

Item 1.

|

Business

|

2

|

|

Item 1A.

|

Risk Factors

|

11

|

|

Item 1B.

|

Unresolved Staff Comments

|

14

|

|

Item 2.

|

Properties

|

15

|

|

Item 3.

|

Legal Proceedings

|

15

|

|

Item 4.

|

(Removed and Reserved)

|

16

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

16

|

|

Item 6.

|

Selected Financial Data

|

18

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

18

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

28

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

28

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

49

|

|

Item 9A.

|

Controls and Procedures

|

49

|

|

Item 9B.

|

Other Information

|

49

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

50

|

|

Item 11.

|

Executive Compensation

|

50

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

50

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

50

|

|

Item 14.

|

Principal Accountant Fees and Services

|

50

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

50

|

1

PART I

ITEM 1. BUSINESS

Wegener® Corporation, the Registrant, together with its subsidiary, is referred to herein as “we,” “our,” “us,” the “Company” or “Wegener.” All references herein to 2011 and 2010 refer to the fiscal years ended September 2, 2011 and September 3, 2010, respectively. All references to year(s) or fiscal refer to our fiscal year(s).

Wegener Corporation was formed in 1977 and is a Delaware corporation. We conduct our continuing business through Wegener Communications, Inc. (WCI), a wholly-owned subsidiary. WCI was formed in April 1978 and is a Georgia corporation. WCI is an international provider of digital video and audio solutions for broadcast television, radio, telco, private and cable networks. With over 30 years experience in optimizing point-to-multipoint multimedia distribution over satellite, fiber, and IP networks, WCI offers a comprehensive product line that handles the scheduling, management and delivery of media rich content to multiple devices, including video screens, computers and audio devices. WCI focuses on long and short-term strategies for bandwidth savings, dynamic advertising, live events and affiliate management.

WCI’s product line includes: iPump® media servers for file-based and live broadcasts; Compel® Network Control and Compel® Conditional Access for dynamic command, monitoring and addressing of multi-site video, audio, and data networks; and the Unity® satellite media receivers for live radio and video broadcasts. Applications served include: digital signage, linear and file-based TV distribution, linear and file-based radio distribution, Nielsen rating information, broadcast news distribution, business music distribution, corporate communications, video and audio simulcasts.

Recent Developments

The accompanying consolidated financial statements have been prepared on a going concern basis which contemplates the realization of assets and liquidation of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recoverability and classification of assets or the amounts and classification of liabilities that may be necessary in the event the Company cannot continue as a going concern.

Net loss for the year ended September 2, 2011, was $(1,466,000) or $(0.11) per share, compared to a net loss of $(2,313,000) or $(0.18) per share for the year ended September 3, 2010. Revenues for fiscal 2011 increased $189,000, or 2.1%, to $9,110,000 from $8,921,000 in fiscal 2010.

During the first, second, third and fourth quarters of fiscal 2011 bookings were approximately $3.2, $0.7, $1.6 and $0.9 million, respectively. During fiscal 2010 bookings were $8.3 million. These bookings were well below our expectations primarily as a result of customer delays in purchasing decisions, deferral of project expenditures and general adverse economic and credit conditions.

During the prior three fiscal years, we made reductions in headcount, engineering consulting, and other operating and overhead expenses. Throughout fiscal 2010, we continued a reduction in paid working hours Company-wide of approximately 10%. During the first quarter of fiscal 2011, to increase engineering capacity, the 10% reduction in paid working hours was eliminated for engineering personnel.

At September 2, 2011, our primary source of liquidity for cash flows was our $4,250,000 loan facility, which initially matured on April 7, 2011. The loan facility automatically renews for successive twelve (12) month periods provided, however, the lender may terminate the facility by providing a ninety (90) day written notice of termination at any time after April 7, 2011. No assurances may be given that our loan facility will continue for the duration of the twelve month renewal period. In the event of a ninety day notice of termination of our loan facility, we would need to obtain additional credit facilities or raise additional capital to continue as a going concern and to execute our business plan. There is no assurance that such financing would be available or, if available, that we would be able to complete financing on satisfactory terms.

2

Segment Information and Financial Information by Geographical Area

Segment information and financial information by geographical area contained in Note 13 to the consolidated financial statements contained in this report are incorporated herein by reference in response to this item.

MARKETS AND INDUSTRY OVERVIEW

The primary markets we serve are business and private networks, broadcast television and program originators and radio broadcasters.

Business/Private Networks

Business networks consist of corporations and enterprises distributing video, audio and/or data among their sites. Private networks consist of networks that target video, audio and/or data to a select group of subscribers or viewers. Our equipment is currently used for a large percentage of the horse racing video distribution to off-track betting locations in the United States and Sweden. We also have a strong presence in background music networks and faith-based networks. We continue to expand a global footprint of digital signage networks, providing networked equipment to distribute and display information and advertisements dynamically to retail customers and employees. Business and private network customers include Muzak, The Church of Jesus Christ of Latter-day Saints and Kanal 75. We work through third-party integrators, such as SSL Digital S.A. de C.V. Comtelsat, Kanal75 and Microspace to reach this market.

Business and private networks are interested in developing dynamic multi-platform (television, web, mobile) communication strategies to reach consumers and empower employees. Organizations also look for technology to conserve bandwidth, provide simple network integration, while supporting remote monitoring and trouble shooting. Many networks prefer to have hybrid distribution options so they can use IP or satellite to deliver content. Private and business networks continue to show strong interest in store-forward technology to localize their messaging on a site-by-site basis, support on-demand education and reduce overall network bandwidth demands.. Digital signage is one of the largest growth areas within the business and private networks market. Digital signage is a broad term which can include kiosk, screen, wayfinder, video playlist, video wall, billboard, menu boards and interactive environments. Digital signage networks can be used in to educate consumers, advertise products and brand the environment in a dynamic fashion. Digital signage networks are also often used to educate employees. It is making inroads with non-profit organizations to share information.

Broadcast Television and Program Originators

Broadcast television consists of (1) broadcast networks (companies that distribute broadcast television channels nationally to their affiliates typically via satellite); and (2) broadcast stations (local stations which are typically affiliates of national broadcasters that distribute typically free-to-air television to local viewers). Program originators consist of programmers that provide television programming to cable, DTH satellite (direct-to-home) and telecom companies for distribution to consumers. Broadcast television and programmer customers include HDNet and Worship Network.

Broadcast networks have launched high definition channels of all their primary broadcast channels and broadcast stations have launched high definition channels in most markets throughout the United States. Broadcast networks continue to see their viewership eroded by program originators.

Program originators continue to distribute their programming over satellite to cable, DTH satellite, and telecom companies. In addition, many offer programming through other means such as the internet and mobile phones. Program originators continue to launch new channels and original programming to compete for advertising dollars and are offering increasing numbers of HD channels, as well as distributing video-on-demand content. They are concerned about the effect that personal video recorders could potentially have on their advertising revenue as well as the security of their high value content being stored in consumers’ homes in a digital and potentially easy to copy format.

3

Broadcast Radio

Broadcast radio consists of companies that broadcast, typically free-to-air, radio signals to local listeners. Radio network customers include BBC World Service, EMF Broadcasting, Dial Global, Christian Radio Consortium, and Salem Radio Network.

Broadcast radio operators are interested in regionalizing their broadcasts to give a local feel to the programming. Where possible, they wish to offer affiliates flexibility to custom local broadcasts by shifting their programming for time-zones so that “drive times” are able to be addressed with particular morning and afternoon shows and advertisements, which can demand higher advertising dollars. In addition, they continue to come under pressure from advertisers to ensure verification and accuracy of advertisements.

PRODUCTS

Our products include: iPump® Media Servers, Unity® Satellite Receivers, Compel® Network Control and Content Management Systems, Nielsen Media Research Products, Digital Television (DTV) Digital Stream Processors, third-party uplink products and customized products. See Note 13 to the consolidated financial statements for information on the concentration of products representing 10% or more of revenues the past two fiscal years.

iPump® Media Servers

The iPump® product line combines the features of our integrated receiver decoders (IRD) with advanced media server functionality and IP router capabilities. The iPump® receives and stores television, radio and other digital files from broadcast, cable and business network operations utilizing file-based broadcasting technology compared to traditional real-time linear broadcasts. File-based broadcasting technology allows network operators to store content at receive locations with an iPump® and then play back the content locally either based on schedules or on-demand user selection. Network operators with repetitive content in their programming line-up can reduce their satellite space segment costs by sending programming, advertising and playback schedules via stored files into the iPump® for later playback according to the schedules. The network operator can then utilize limited satellite time to refresh the programming, advertising and play-out schedules without the necessity to maintain a constant signal on the satellite.

A feature of the iPump® and Compel® system is IP network delivery of files and commands to the iPump®. With this ability, network operators can launch iPump® networks over the internet or private IP networks. Additionally, they can control their network from one integrated Compel® control system while feeding select sites via IP that they cannot reach with their satellite either due to location outside of the satellite footprint or inability to place a satellite dish.

There are four models of the iPump® that utilize file-based broadcasting technology. The iPump® 6400 Professional Media Server is designed for broadcast television and private network customers. The iPump® 6420 Audio Media Server is designed specifically to meet the needs of radio broadcasters. The iPump® 562 and iPump® 525 Enterprise Media Servers are designed specifically for private network and enterprise applications, such as digital signage. The iPump® 562 and iPump® 525 Media Servers support MPEG-4/h.264 video decoding for high definition and standard definition video. In addition, the iPump® 562 supports Digital Video Broadcast (DVB)-S2 satellite demodulation. The iPump® 525 is designed specifically to support terrestrial content distribution and control.

We are targeting all of our core markets for the iPump® product line. Within these markets, applications for the iPump® products include: digital signage, corporate communications, training/education, time-zone shifting, regional advertising insertion, and news distribution.

Unity Receivers

The Unity® 552 is targeted to meet the needs of private and business television networks. The Unity® 552 supports MPEG-2 and MPEG-4/h.264 video with high definition support and DVB-S and DVB-S2 demodulation. By upgrading to MPEG-4/h.264 video and DVB-S2 modulation, network operators can reduce their bandwidth utilization by approximately half. This allows them to launch additional services, reduce their expenses or convert to high definition video. The Unity® 551 utilizes MPEG-2 for video distribution and is also targeted for private and business television networks.

4

The Unity® 4600 receiver is a digital satellite receiver used primarily by program originators to distribute analog and digital programming. DVB-S2 satellite demodulation support is available on the product.

The Unity® 202 audio receiver is designed for business music providers. It allows users to select audio formats and offers audio storage for advertising insertion and disaster recovery. It is our second generation file-based broadcasting business music receiver.

Compel® Network Control Systems

Our Compel® Network Control System has been a key differentiator to our products since 1989. Compel® is used in networks worldwide to control over 100,000 receivers, and it features grouping and addressing controls that provide flexibility in network management. Receivers can be controlled as individual sites and as groups. Commands are synchronized with video and audio programming, which allows users to regionalize programming and blackout programming from nonsubscribers, as well as target commercials to subscribers. Compel® network control systems include Compel® for radio broadcasting and background music applications and Compel® 2 for advanced content ingest, content management, digital signage, live and file-based video applications.

Compel® option modules include Conditional Access for satellite-enabled broadcasts. Conditional Access utilizes a secure microprocessor in Unity® and iPump® receiver to deliver fast, secure conditional access to a network without the high cost of smart card systems. Unity® satellite receivers and iPump® media servers are controlled by the Compel® Network Control System, so the markets for Compel® are the same as for iPump® and Unity® receivers.

The next generation of Compel® is the Compel® 2 network control system. Compel® 2 retains the features of the Compel® network control system while adding new features designed to enhance the user interface and simplify operations for dynamic media distribution. Compel® 2 supports multiple applications, users and networks. For digital signage applications, Compel® 2 features integrated standards-based ingest tools to streamline content management and optimize media player output and user friendly screens to help design, schedule and sequence custom combinations of video, graphics and text overlays. The control system has been streamlined by unifying many different screens and utilities within a single, user friendly, web-based graphical user interface. Using a web browser access, operators can control live and file-based media distribution networks from any web-enabled remote location. Built upon a scalable open architecture, Compel® 2 also makes it easier for network administrators to limit access of employees or affiliates to only those features and functions their jobs require. New set-up features allow administrators to create classes of users that designate each user’s level of access.

CompelConnect.com™ provides the operations available in Compel® 2 as a software as a service (SaaS) offering. Customers can purchase rights to use Compel® 2 via the Internet on a monthly basis. We are targeting smaller networks where the economics of the network could not support a Compel® purchase for the service. CompelConnect.com service revenues were less than 1% of total revenues in fiscal 2011.

Nielsen Media Research Products

We offer two products to encode Nielsen Media Research identification tags into media for Nielsen program ratings: the NAVE IIc® and SpoTTrac® Encoders.

The NAVE IIc® watermarks program audio with tagging information that identifies the television program and the television station that originated the program. The watermarks are used by Nielsen devices to automate the process of cataloging viewers’ television viewing habits which ultimately translate into Nielsen ratings. The NAVE IIc® makes advances over prior units in that it inserts the watermarks for audio in the digital domain and can simultaneously insert watermarking on an entire transport stream with up to four programs. Alternatively, stations have to down-convert to analog audio to insert Nielsen data.

The SpoTTrac® Encoder is a turnkey workstation that encodes both the audio and video of television commercials, Public Service Announcements and other spots with Nielsen Media Research content identification information as they are being produced and distributed, so the content has the Nielsen codes all the way from the program origination point. The tracked data is collected and integrated into Nielsen Tracking Service’s reporting and performance management tools.

5

DTV Digital Stream Processors

The DTV Digital Stream Processor product line is designed for cable and telecom headends. It allows them to integrate local off-air HD broadcast television channels and digital programs and easily insert them into their networks. Our products provide for multiple signals to be inserted with one unit. Models include DTV 720, DTV 742 and DTV 744.

Uplink Equipment

We offer our customers complete system solutions for video and audio distribution. The complete system solution requires us to resell components, such as encoders, modulators and IP encapsulators from other manufacturers.

Customized Products

We offer our customers the option to create custom products for their needs when they cannot find off-the-shelf products to satisfy their requirements. They pay non-recurring engineering expenses through product pricing and/or up-front milestone payments. Typically the products are based on our standard products and require modifications to fit particular customer needs. This is an area of competitive advantage for us.

MARKET OPPORTUNITY

Growth opportunities are most significant in the technologies in which we have been making significant R&D investments, including file-based broadcasting technology, digital signage, IP terrestrial distribution and MPEG-4/h.264 technology and DVB-S2. See “Research and Development” below.

We have completed shipments of file-based broadcasting networks, including iPump®, Compel® and MediaPlan®, in multiple applications, including digital signage, virtual channel generation and broadcast radio. Some examples of iPump® applications are described below.

A private network customer for digital signage and distance training is using the iPump® for both signage and training applications simultaneously. The customer is using the iPump’s optional feature to generate two networks from a single unit. A third output is streamed from the iPump over Ethernet to SMD Set-Tops. Within a retail environment, the main output and the SMD are being used for advertising at the point of sale and in the electronics department by outputting high quality video advertisements to large video monitors. Within eight months of deployment, the customer generated a positive return on equipment expenses through advertising revenue. With this asset, the customer is also generating a back-room training center for its employees at each site, basically for free, since the advertisements are funding the network. The customer can create customized training schedules at each location depending on the employees’ availability, or the employees can watch the materials on demand.

The virtual channel application of the iPump® allows a current private network customer to reduce its budget for satellite bandwidth by greater than 90% of what it had been spending prior to upgrading to iPump®. Satellite bandwidth utilization was one of the customer’s largest operating expenses, so this reduction represents a sizable savings, allowing the customer to launch an additional channel. This network used to run continuously, utilizing satellite bandwidth the entire time; now the customer uses bandwidth only twice a month to update the iPumps® with new content, advertisements and playout schedules. This example demonstrates the significant savings that potential customers may achieve with the iPump®.

iPump® broadcast radio customers are using file-based broadcasting technology to update its operations and enable localization of broadcasts. It allows them to send repetitive material to their affiliates a single time and provides an easy interface for affiliates to access the audio files. With the iPump®, radio broadcasters can create a localized listening experience for each affiliate location to drive increased advertising dollars and listener loyalty. One customer regularly generates over 150,000 playlists per week through their iPump® network to localize all of its radio channels throughout the country.

The digital signage market is still very fragmented and as the industry consolidates, there is increased opportunity for our products. We have fielded multiple networks with over two thousand sites of digital signage into the banking sector. Other sectors with fielded iPump® networks include retail and medical.

Integrating IP terrestrial delivery into our products increases the market for them, since it enables customers to use them in tandem with satellite delivery networks, or completely autonomously with solely terrestrial delivery. Terrestrial delivery is particularly cost effective when networks have smaller numbers of receive locations. Integrating this function into our solutions allows us to target smaller networks for our solutions that had not been relevant with satellite only solutions.

6

Another area of growth for us relates to the development of MPEG-4/h.264 video decoding and DVB-S2 satellite demodulation products (see “Research and Development” below for additional information). The Unity® 552, iPump® 562 and iPump® 525 products offers MPEG-4/h.264 and/or DVB-S2 technology. The MPEG-4/h.264 standard is the latest evolutionary step in video compression and DVB-S2 is the newest technology in satellite modulation. The two technologies combined reduce the bandwidth requirements of satellite media distribution approximately in half. This reduction in bandwidth requirements is significant, as bandwidth utilization is one of the largest operating costs for our customers. This new technology can drive growth in two ways. First, existing satellite operators can replace their existing equipment with new MPEG-4/h.264 and DVB-S2 capable equipment since they can justify the capital expense with the operational benefits of the transition. Additionally, the lower operating expenses enable new business models to develop that could not be supported by the older technology’s cost structure.

SALES AND MARKETING

Domestically, we sell our products principally through our own direct sales force, which is organized geographically and by market segment. We have sales representatives in Georgia, New York and Eastern Canada. We use a major domestic value added reseller for additional sales coverage in the cable market. We have relationships with a few key integrators as an additional sales channel. Internationally, we sell primarily through independent distributors and integrators, mostly in North America, South America and Europe. The majority of our sales have payment terms of net 30 days. Due to the technical nature of our business, system integration engineering supports sales.

Our marketing organization develops strategies for product lines and provides direction to product development on product feature requirements. Marketing is also responsible for setting price levels and general support of the sales force, particularly with major proposal responses, presentations and demonstrations. We focus on establishing WCI’s brand further within the industry, including participation on technical committees, publication of articles in industry journals, speaking opportunities at industry events and exhibitions at trade shows.

Manufacturing and Suppliers; Sources and Availability of Raw Materials

During fiscal years 2011 and 2010, we used offshore manufacturers for a significant amount of our finished goods or component inventories. An offshore manufacturer, with facilities located in Taiwan and the Peoples Republic of China, accounted for approximately 58% and 79% of inventory purchases in fiscal 2011 and fiscal 2010, respectively. Raw materials consist of passive electronic components, electronic circuit boards and fabricated sheet metal. Approximately 20% of our raw materials are purchased directly from manufacturers and the other 80% are purchased from distributors. Passive and active components include parts such as resistors, integrated circuits and diodes. We use approximately ten distributors and two contract manufacturers to supply our electronic components. We often use a single contract manufacturer or subcontractor to supply a total subassembly or turnkey solution for higher volume products. Direct suppliers provide sheet metal, electronic circuit boards and other materials built to specifications. We maintain relationships with approximately 20 direct suppliers. Most of our materials are available from a number of different suppliers; however, certain components used in existing and future products are currently available from a single or a limited number of sources. Although we believe that all single-source components currently are available in adequate quantities, there can be no assurance that shortages or unanticipated delivery interruptions will not develop in the future. Any disruption or termination of supply of certain single-source components or agreements with contract manufacturers could have an adverse effect on our business and results of operations. Our manufacturing operations consist primarily of final assembly and testing of our products, utilizing technically trained personnel, electronic test equipment and proprietary test programs.

Intellectual Property

Currently, we hold six U.S. patents and have one patent application pending. We retain a worldwide, non-exclusive, royalty-free license under the patents for use in both existing and future products. A patent covering advanced receiver grouping techniques in Compel® expired on November 14, 2008. In addition to the advanced grouping techniques, we believe Compel®, along with our MediaPlanÒ CM and MediaPlanÒ i/o modules, offers other significant features and functionalities for complex network control applications that provide us with an advantage over competitive control systems. Compel®, which has been operational since 1989, will continue to be upgraded and enhanced. The expiration of the Compel® patent has, to date, not had a material adverse effect on our business and results of operations. However, no assurances may be given that a material adverse effect will not occur in the future (see Item 1A. “Risk Factors” section below).

7

We hold nine active trademarks, such as Compel®, iPump®, Wegener® and Unity® and have two pending trademark applications.

Although we attempt to protect our intellectual property rights through patents, trademarks, copyrights, licensing arrangements and other measures, we cannot assure you that any patent, trademark, copyright or other intellectual property rights owned by us will not be invalidated, circumvented or challenged, that such intellectual property rights will provide competitive advantages to us, or that any of our pending or future patent and trademark applications will be issued. We also cannot assure you that others will not develop technologies that are similar or superior to our technology, duplicate our technology or design around the patents that we own. In order to develop and market successfully certain of our planned products for digital applications, we may be required to enter into technology development or licensing agreements with third parties. Although many companies are often willing to enter into such technology development or licensing agreements, we cannot assure you that such agreements will be negotiated on terms acceptable to us, or at all. The failure to enter into technology development or licensing agreements, when necessary, could limit our ability to develop and market new products and could cause our business to suffer. Third parties have in the past claimed, and may in the future claim, that we have infringed their current or future intellectual property rights. There can be no assurance that we will prevail in any intellectual property infringement litigation given the complex technical issues and inherent uncertainties in litigation. Even if we prevail in litigation, such litigation could result in substantial costs and diversion of resources and could negatively affect our business, operating results, financial position and cash flows.

Although we believe that the patents and trademarks we own are of value, we believe that success in our industry will be dependent upon new product introductions, frequent product enhancements, and customer support and service. However, we intend to protect our rights when, in our view, these rights are infringed upon.

As of September 2, 2011, we have entered into approximately six license agreements for utilization of various technologies. These agreements currently require royalty payments, or may require future royalties for products under development, none of which are expected to have a material adverse effect on our financial condition or results of operations.

Seasonal Variations in Business

There do not appear to be any seasonal variations in our business.

Working Capital Practices

Information contained under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (MD&A) section of this report is incorporated herein by reference in response to this item.

Dependence upon a Limited Number of Customers

We sell to a variety of domestic and international customers on an open-unsecured account basis. These customers principally operate in the cable television, broadcast, business music, private network and data communications industries. Sales to Muzak LLC and SSL Digital S.A. de C.V. accounted for approximately 24.6% and 17.7% of revenues in fiscal 2011. Sales to Muzak LLC and Corporation of the Presiding Bishop of The Church of Jesus Christ of Latter-Day Saints accounted for approximately 22.8% and 10.7% of revenues in fiscal 2010, respectively. At September 2, 2011, four customers accounted for approximately 28.1%, 15.5%, 14.0% and 10.1%, respectively, of our accounts receivable. At September 3, 2010, four customers accounted for approximately 24.1%, 18.1%, 14.1% and 10.7%, respectively, of our accounts receivable. Sales to a relatively small number of major customers have typically comprised a majority of our revenues. This trend is expected to continue in fiscal 2012 and beyond. The loss of one or more of these customers would likely have, at least in the near term, a material adverse effect on our results of operations.

8

Backlog of Orders

Our backlog is comprised of undelivered, firm customer orders, which are scheduled to ship within 18 months. Our eighteen month backlog was approximately $3,534,000 at September 2, 2011, $5,972,000 at September 3, 2010, and $4,316,000 at August 28, 2009. Approximately $2,642,000 of the September 2, 2011, backlog is expected to ship during fiscal 2012. At September 2, 2011, three customers accounted for 88% of the eighteen month backlog and 84% of the backlog expected to ship during fiscal 2012. Reference is hereby made to the information contained in MD&A, which is incorporated herein by reference in response to this item.

Competitive Conditions

We compete both with companies that have substantially greater resources and with small specialized companies. Competitive forces generally change on a year-by-year basis for the markets we serve due to the length of time required to develop new products. Through relationships with component and integrated solution providers, we believe we are positioned to provide complete end-to-end digital video and audio systems to our customers.

Broadcast Television and Program Originators

Competition for our products in the broadcast television and program originators market is from large and well-established companies such as Tandberg, Motorola and Cisco. We believe our Unity® products have a competitive advantage with our advanced Compel® control, so we focus on opportunities where that advantage is of value to the customer.

Headends

Competition for our DTV products is mostly from smaller companies that do not have as favorable a reputation in the cable television market. Significant orders for this product line will depend on the overall growth of broadcast and telecom HDTV offerings.

Competition for the SMD Set Top box is from companies producing cable set-top boxes as well as from companies specifically addressing the IPTV market.

Broadcast Radio

Competition is currently limited to a few companies for our iPump® Media Server in the broadcast radio market. Our solution includes Compel® Network Control and our full-featured iPump® 6420 Media Server.

Business and Private Networks

Competition in the business and private networks market generally comes from smaller companies with unique products tailored to the needs of the customer. Competition in this field is increasing, although still limited, and we expect to be among the industry key players. We believe our products are well positioned for this market and have competitive advantages, such as our powerful network control and targeting capabilities. Digital signage is a new and growing market which is currently very fragmented.

Research and Development

Our research and development activities are designed to strengthen and enhance our existing products and systems and to develop new products and systems. Our development strategy is to identify features, products and systems which are, or are expected to be, needed by a number of customers. A major portion of the fiscal 2011 and 2010 research and development expenses were spent on product development of our iPump® 6420, iPump® 562, iPump® 525, Compel®, and Unity® 552 products. WCI’s research and development expenses totaled $1,232,000 in fiscal 2011 and $1,148,000 in fiscal 2010. Additional information contained in the “Products” and “Intellectual Property” sections above and in MD&A is incorporated herein by reference in response to this item.

Technological advances occur frequently in our industry and our product offerings must be upgraded with the advances to remain current with industry trends and attract potential customers. During fiscal 2010, we invested in new technologies while they are still very innovative and of high value to customers. During fiscal 2010, we invested in file-based broadcasting, digital signage, and network management. We anticipate that we will continue to invest in these technologies in the coming years.

9

With our file-based broadcasting solutions, network operators can intersperse live broadcasts with files that are prepositioned on the receiver’s hard drive before they are played to air. This allows operators to manage their bandwidth more closely and to regionalize their broadcasts to make them more relevant for each market. Our iPump® products, in combination with Compel® and MediaPlan® control, provide advanced file-based broadcasting solutions for applications such as digital signage and broadcast radio.

The digital signage market requires products to integrate text and graphics onto the screen with video to aid in advertising, information distribution and branding. Our iPump® and Compel® products had major additions to the digital signage offerings during fiscal 2010 to better serve the market.

Network control and management have long been a differentiator for our Unity® receivers and iPump® media servers. Through fiscal 2011, we continued to invest in network control for our products, which allows customers to create dynamic environments with their receivers and to gain additional advertising revenue by regionalizing broadcasts and advertisements. When network control is included in a file-based broadcasting network, it becomes a very complex operation to manage the media content and data files on media servers throughout the network. It is imperative to customers that it is managed properly, as the content often has limited viewing rights, so it must be deleted when rights have expired or replaced by newer versions over time. Network control and management products, such as Compel® and MediaPlan®, manage such operations.

During fiscal 2011, we launched CompelConnect.com service based on our new Compel 2 product, which was under development during fiscal 2011 and 2010. CompelConnect.com service revenues were less than 1% of total revenues in fiscal 2011.

Employees

As of September 2, 2011, we had 48 full-time employees employed by WCI and no employees employed by Wegener Corporation. No employees are parties to a collective bargaining agreement and we believe that employee relations are good.

Available Information

Our Web site is http://www.wegener.com. Information contained on our Web site should not be considered incorporated by reference in this Form 10-K.

EXECUTIVE OFFICERS OF THE REGISTRANT

The executive officers of the Company, for purposes of section 401(b) of Regulation S-K, are as follows:

|

Name and Business Experience

|

Age

|

Office Held

|

||

|

C. Troy Woodbury, Jr.

President and Chief Executive Officer of the Company and WCI since October 2009. Treasurer and Chief Financial Officer of the Company from June 1988 to October 2009 and Director since 1989. Treasurer and Chief Financial Officer of WCI from 1992 to October 2009. Senior Vice President of Finance of WCI from March 2002 to October 2009. Executive Vice President of WCI from July 1995 to March 2002. Chief Operating Officer of WCI from September 1992 to June 1998. Group Controller for Scientific-Atlanta, Inc. from March 1975 to June 1988.

|

64

|

President and Chief Executive Officer of the Company and WCI

|

||

|

James Traicoff

Treasurer and Chief Financial Officer of the Company and WCI since October 2009. Controller of the Company and WCI from July 1988 to October 2009.

|

61

|

Treasurer and Chief Financial Officer of the Company and WCI

|

10

|

ITEM 1A.

|

RISK FACTORS

|

Our business, financial condition and operating results can be affected by a number of factors, including those listed below, any one of which could cause our actual results to vary materially from recent results or from our anticipated future results. Any of these risks could also materially and adversely affect our business, financial condition or the price of our common stock.

We may not have sufficient capital to continue as a going concern.

Our bookings and revenues during fiscal 2011 and to date in fiscal 2012 have been insufficient to attain profitable operations and to provide adequate levels of cash flow from operations. We have experienced recurring net losses from operations, which have caused an accumulated deficit of approximately $21,731,000 at September 2, 2011. We had a working capital deficit of approximately $4,441,000 at September 2, 2011 compared to a working capital deficit of approximately $3,248,000 at September 3, 2010. Our ability to continue as a going concern will depend upon our ability to increase our bookings and revenues in the near term to attain profitable operations and to generate sufficient cash flow from operations. Should increased revenues not materialize, we are committed to further reducing operating costs to bring them in line with reduced revenue levels. Should we be unable to achieve near term profitability and generate sufficient cash flow from operations and if we are unable to sufficiently reduce operating costs, we would need to raise additional capital or increase our borrowings. No assurances can be given that operating costs can be sufficiently reduced, or if required, that additional capital or borrowings would be available to allow us to continue as a going concern. The audit reports relating to the Consolidated Financial Statements for the years ended September 2, 2011 and September 3, 2010 contain explanatory paragraphs regarding the Company’s ability to continue as a going concern.

The volatility and disruption of the capital and credit markets, and adverse changes in the global economy, will likely have a negative impact on our ability to access the capital and credit markets.

The capital and credit markets remain tight as a result of adverse economic conditions that have caused the failure and near failure of a number of large financial services companies. If the capital and credit markets continue to experience crisis and the availability of funds remains low, it is likely that our ability to access the capital and credit markets will be limited, available on less favorable terms or not available at all during this period in the event we need to raise additional capital or obtain additional credit facilities in order to continue as a going concern. In addition, if current global economic conditions persist for an extended period of time or worsen substantially, our business may suffer in a manner which could cause us to fail to satisfy the representations, warranties and covenants to which we are subject under our existing credit facility.

Conditions and changes in the national and global economic environments may adversely affect our business and financial results.

Economic conditions have been weak and global financial markets have experienced a severe downturn. The current global economic slowdown and tight credit markets has led many of our customers to delay or plan lower capital expenditures, and we believe that these economic and credit conditions caused certain of our customers to reduce or delay orders for our products. If adverse economic and credit conditions resulting from slower economic activity and tight credit markets remain weak or deteriorate further, we may continue to experience a material adverse impact on our business, financial condition and results of operations.

Our future bookings, revenues, cash flow from operations and operating results are difficult to predict and may fluctuate materially.

Our future operating results are difficult to predict and may be materially affected by a number of factors, including: the timing of purchasing decisions by our customers, the timing of new product announcements or introductions by us or our competitors, competitive pricing pressures, adequate availability of components and offshore manufacturing capacity. Additional factors affecting our operating results include our ability to hire, retain and motivate adequate numbers of engineers and other qualified employees, changes in product mix, and the effect of adverse changes in economic conditions in the United States and international markets. In addition, our markets have historically been cyclical and subject to significant economic downturns. Our business is subject to rapid technological changes and there can be no assurance, depending on the mix of future business, that products stocked in inventory will not be rendered obsolete before we ship them. Our cash collections from our accounts receivable are impacted by the timing and levels of our bookings and revenues. As a result of these and other factors, there can be no assurance that we will not experience material fluctuations in future operating results and cash flows from operations on a quarterly or annual basis.

11

Our lender has the right to terminate our loan facility at any time by providing a ninety (90) day written notice of termination.

The initial term of our loan facility matured on April 7, 2011. The loan facility automatically renews for successive twelve (12) month periods provided, however, the lender may terminate the facility by providing a ninety (90) day written notice of termination at any time after April 7, 2011. In the event of a ninety day notice of termination of our loan facility, we would need to obtain additional credit facilities or raise additional capital to continue as a going concern and to execute our business plan. There is no assurance that such financing would be available or, if available, that we would be able to complete financing on satisfactory terms.

We may not have sufficient financing to support future inventory purchases.

At September 2, 2011, our net inventory balances decreased $1,615,000 to $1,530,000 from $3,145,000 at September 3, 2010, compared to $4,464,000 at August 28, 2009. The decrease in inventory levels during fiscal 2011 and prior fiscal years has minimized the amount of required inventory purchases during those periods to meet revenue levels. We will need to increase inventory purchases in future quarters in order to have sufficient inventory balances to support revenue levels in fiscal 2012 and beyond. A substantial portion of future inventory purchases will be with our offshore suppliers whom we have been paying under extended payment terms and credit limits which are beyond normal payment terms and credit limits. In order to have sufficient liquidity available for future inventory purchases it is likely we will need additional credit limits and continued extended payment terms from offshore and domestic suppliers; increased customer deposits from future bookings; additional borrowing capacity and/or additional capital. No assurances may be given that we will be able to generate sufficient liquidity from these or other sources that may be required to support future inventory purchases.

Our line of credit balance at June 3, 2011 has reached the maximum available credit limit of $4,250,000, as a result, our near term liquidity is dependent on our working capital. Additional capital or borrowings, if needed, may not be available to continue as a going concern.

With our line of credit currently at the maximum limit, our very near term liquidity is dependent on our working capital and primarily on the timely collection of accounts receivable balances and conversion of inventory into receivable balances. During the second quarter of fiscal 2011 and continuing to date, the days outstanding of our accounts receivable has increased beyond our expectations, primarily due to a delay in payment from one customer, which has adversely impacted our cash balances. Our low level of bookings has lengthened the cycle of conversion of inventory into receivable balances and then into cash balances.

Our near term liquidity and ability to continue as a going concern is dependent on our ability to timely collect our existing accounts receivable balances and to generate sufficient new orders and revenues in the very near term to provide sufficient cash flow from operations to pay our current level of operating expenses, to provide for inventory purchases and to reduce past due amounts owed to vendors and service providers. No assurances may be given that the Company will be able to achieve sufficient levels of new orders in the near term to provide adequate levels of cash flow from operations. Should we be unable to achieve near term profitability and generate sufficient cash flow from operations, we would need to raise additional capital or obtain additional borrowings beyond our existing loan facility. We currently have limited sources of capital, including the public and private placement of equity securities and additional debt financing. No assurances can be given that additional capital or borrowings would be available to allow us to continue as a going concern. If near term shippable bookings are insufficient to provide adequate levels of near term liquidity and any required additional capital or borrowings are unavailable we will likely be forced to enter into federal bankruptcy proceedings. See also Note 1 to the Consolidated Financial Statements and “MD&A- Liquidity and Capital Resources.”

Our inability to pay vendors within normal trade payment terms could adversely impact our operations.

Our bookings and revenues during fiscal 2011, as well as to date in fiscal 2012, have been insufficient to attain profitable operations and to provide adequate levels of cash flow from operations. During fiscal 2011 and fiscal 2010, as well as to date in fiscal 2012, due to insufficient cash flow from operations and maximum borrowing limitations under our loan facility, we negotiated extended payment terms with our offshore vendor and have been extending other vendors beyond normal payment terms. Until such vendors are paid within normal payment terms, no assurances can be given that required services and materials needed to support operations will continue to be provided. In addition, no assurances can be given that vendors will not pursue legal means to collect past due balances owed. Any interruption of services or materials would likely have an adverse impact on our operations.

12

The Nasdaq Stock Market delisted our securities, which could limit investors’ ability to trade in our securities.

During fiscal 2010, we were unable to maintain compliance with the listing requirements of The Nasdaq Stock Market (Nasdaq). As a result on April 20, 2010, we received notification from Nasdaq that the our common stock would be delisted. Nasdaq suspended trading of our common stock shares effective at the open of trading on April 22, 2010 and our common stock has not traded on NASDAQ since that time. As a result, on April 22, 2010, our common stock began trading over-the-counter under the symbol WGNR.PK. On June 9, 2010, NASDAQ filed a Form 25 with the Securities and Exchange Commission to complete the delisting. The delisting became effective ten days after the filing of Form 25.

The delisting of our common stock by Nasdaq could adversely affect the trading market for our common stock, as price quotations may not be as readily obtainable, which would likely have a material adverse effect on the market price of our common stock and the Company’s ability to raise additional capital.

We have in the past experienced delays in product development and introduction, and there can be no assurance that we will not experience further delays in connection with our current product development or future development activities.

Delays in development, testing, manufacture and/or release of new products or features, including digital receivers, Compel® network control software, MediaPlan® content management software, streaming media, and other products could adversely affect our sales and results of operations. In addition, there can be no assurance that we will successfully identify new product opportunities, develop and bring new products to market in a timely manner and achieve market acceptance of our products, or that products and technologies developed by others will not render our products or technologies obsolete or noncompetitive.

Our lengthy and variable qualification and sales cycles make it difficult to predict the timing of a sale or whether a sale will be made.

As is typical in our industry, our customers may expend significant efforts in evaluating and qualifying our products. This evaluation and qualification process frequently results in a lengthy sales cycle, typically ranging from three to six months and sometimes longer. While our customers are evaluating our products and before they place an order with us, we may incur substantial sales, marketing, and research and development expenses, expend significant management efforts, increase manufacturing capacity and order long-lead-time supplies prior to receiving an order. Even after this evaluation process, it is possible that a potential customer will not purchase our products.

Our customer base is concentrated and the loss of one or more of our key customers would harm our business.

Sales to a relatively small number of major customers have typically comprised a majority of our revenues, and that trend is expected to continue throughout fiscal 2012 and beyond. In fiscal 2011, two customers accounted for approximately 24.6% and 17.7% of revenues, respectively. At September 2, 2011, three customers accounted for 88% of the eighteen month backlog and 84% of the backlog expected to ship during fiscal 2012. In addition, recent disruptions in global economic and market conditions could result in decreases in demand for our products as the current tightening in credit in financial markets may adversely affect the ability of our major customers to obtain financing for significant purchases. The loss of any significant customer or any reduction in orders by any significant customer would adversely affect our business and operating results and potentially our liquidity.

We rely on third-party subcontractors, certain suppliers and offshore manufacturers.

We use offshore manufacturers for a significant amount of finished goods or component inventories. One offshore manufacturer accounted for approximately 58% and 79% of inventory purchases in fiscal 2011 and 2010, respectively. Certain raw materials, video sub-components and licensed video processing technologies used in existing and future products are currently available from a single source or limited sources. Any disruption or termination of supply of certain single-source components or technologies, or interruption of supply from offshore manufacturers, would likely have a material adverse effect on our business and results of operations, at least in the near term.

13

Our intellectual property rights may be insufficient to protect our competitive position. In addition, our pending or future intellectual property applications may not be issued.

We hold six U.S patents and nine active trademarks, such as Compel®, iPump®, Wegener® and Unity®. (see also “Intellectual Property” section above). Currently we have one patent and two trademark applications pending. Although we attempt to protect our intellectual property rights through patents, trademarks, copyrights, licensing arrangements and other measures, we cannot assure you that any patent, trademark, copyright or other intellectual property rights owned by us will not be invalidated, circumvented or challenged, that such intellectual property rights will provide competitive advantages to us, or that any of our pending or future patent and trademark applications will be issued. We also cannot assure you that others will not develop technologies that are similar or superior to our technology, duplicate our technology or design around the patents that we own.

We may not be able to license necessary third-party technology or it may be expensive to do so. In addition, claims that we infringe third-party intellectual property rights could result in significant expenses and restrictions on our ability to sell our products in particular markets.

In order to develop and market successfully certain of our planned products for digital applications, we may be required to enter into technology development or licensing agreements with third parties. Although many companies are often willing to enter into such technology development or licensing agreements, we cannot assure you that such agreements will be negotiated on terms acceptable to us, or at all. The failure to enter into technology development or licensing agreements, when necessary, could limit our ability to develop and market new products and could cause our business to suffer. Third parties have in the past claimed, and may in the future claim, that we have infringed their current or future intellectual property rights. There can be no assurance that we will prevail in any intellectual property infringement litigation given the complex technical issues and inherent uncertainties in litigation. Even if we prevail in litigation, such litigation could result in substantial costs and diversion of resources and could negatively affect our business, operating results, financial position and cash flows.

Competition in our industry is intense and can result in reduced sales and market share.

We compete with companies that have substantially larger operations and greater financial, engineering, marketing, production and other resources than we have. These competitors may develop and market their products faster, devote greater marketing and sales resources, or offer more aggressive pricing, than we can. As a result, this could cause us to lose orders or customers or force reductions in pricing, all of which would have a material adverse effect on our financial position and results of operations.

Our business is subject to rapid changes in technology and new product introductions.

The market for our products is characterized by rapidly changing technology, evolving industry standards and frequent product introductions. Product introductions are generally characterized by increased functionality and better quality, sometimes at reduced prices. The introduction of products embodying new technology may render existing products obsolete and unmarketable. Our ability to successfully develop and introduce on a timely basis new and enhanced products that embody new technology, and achieve levels of functionality and price acceptable to the market, will be a significant factor in our ability to grow and to remain competitive. If we are unable, for technological or other reasons, to develop competitive products in a timely manner in response to changes in the industry, our business and operating results will be materially and adversely affected.

Our stock price is subject to volatility.

Our common stock has experienced substantial price volatility and such volatility may occur in the future, particularly as a result of quarter to quarter variations in the actual or anticipated financial results of the Company or other companies in the satellite communications industry or in the markets we serve. These and other factors may adversely affect the market price of our common stock.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

Not applicable

14

|

ITEM 2.

|

PROPERTIES

|

Our executive, sales, engineering and administrative offices are located at 11350 Technology Circle, Johns Creek, Georgia 30097-1502. This 40,000 square foot facility, which is located on a 4.7 acre site, was purchased by WCI in February 1987. During August 1989, WCI purchased an additional 4.4 acres of adjacent property which remains undeveloped. WCI also leases a 9,500 square foot manufacturing facility in Alpharetta, Georgia under a three year lease expiring in January 2013 with future annual rents of approximately $64,000 in fiscal 2012 and $27,000 in fiscal 2013. WCI’s 40,000 square foot facility, including the 4.7 acre site on which the building is located, and 4.4 acres of adjacent land are pledged as collateral under our line of credit facility.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

On June 1, 2006, a complaint was filed by Rembrandt Technologies, LP (Rembrandt) against Charter Communications, Inc. (Charter), Cox Communications Inc. (Cox), CSC Holdings, Inc. (CSC) and Cablevisions Systems Corp. (Cablevision) in the United States District Court for the Eastern District of Texas alleging patent infringement. The complaint alleges that products and services sold by Charter infringe certain Rembrandt patents related to cable modem, voice-over internet, and video technology and applications. Wegener has not been named a party in the suit. However, subsequent to December 1, 2006, Charter has requested us to defend and indemnify Charter to the extent that the Rembrandt allegations are premised upon Charter’s use of products that we have sold to Charter. To date, we have not agreed to Charter’s request.

On June 1, 2006, a complaint substantially similar to the above described suit was filed by Rembrandt against Time Warner Cable (TWC) in the United States District Court for the Eastern District of Texas. Wegener has not been named a party in the suit, but TWC has requested us (as well as other equipment vendors) to contribute a portion of the defense costs related to this matter as a result of the products that we and others have sold to TWC. To date, we have not agreed to contribute to the payment of legal costs related to this case.

In addition, Cisco Systems, Inc. (Scientific Atlanta) has made indemnity demands against us, related to the fact that a number of Cisco’s customers that are defendants in the Rembrandt lawsuit have made indemnity demands against Cisco. Cisco’s demands are based upon allegations that Wegener sold devices to these companies that are implicated by the patent infringement claims in the Rembrandt lawsuit. To date, we have not agreed to Cisco’s demands.

These actions have been consolidated into a multi-district action pending in the United States District Court for the District of Delaware. On October 23, 2009, the Delaware District Court issued an Order dismissing eight of the substantive patent claims embodied in the consolidated action, as well as all counterclaims. The parties also have agreed to summary judgment of non-infringement on a remaining patent claim. On September 7, 2011, the Delaware District Court issued a Final Judgment and Order dismissing the claims. On November 13, 2009, the Court allowed the parties to the consolidated lawsuits to file motions for fees and costs with respect to one another. On July 13, 2011, the Court ruled that the motion for attorney’s fees and costs was premature. On September 28, 2011, Rembrandt Technologies LP filed a Notice of Appeal from the Court’s September 7, 2011 judgment, the Court’s construction ruling concerning one of the patents in question, and all prior rulings, orders and judgments of the Court. At this point, we are presently unable to assess the impact, if any, of this litigation on Wegener.

On October 4, 2010, a Second Amended Complaint was filed by Multimedia Patent Trust (MPT) against Fox News Networks, LLC (Fox News) and other parties in the United States District Court for the Southern District of California for patent infringement. (The initial Complaint was filed on January 19, 2010). The Second Amended Complaint asserts that Fox News has infringed upon certain MPT patents relating to video compression, encoding and decoding. This litigation may be very expensive to defend and there could be significant financial exposure if MPT is successful in its claims. On November 3, 2010, however, Fox News wrote to Wegener, asking Wegener to fully indemnify, hold harmless and defend Fox News in connection with the litigation. In its letter, Fox News states that it has identified Wegener as a vendor that provided Fox News with products and/or services relating to video compression. Fox News states further that it believes that MPT’s claims give rise to indemnity obligations and other obligations for Wegener products obtained from Wegener by Fox News. The November 3, 2010 letter asked Wegener to acknowledge such tender on or before November 24, 2010. Wegener has not agreed to do so, nor has Wegener acknowledged or agreed that the specific claims against Fox News by MPT give rise to such obligations on the part of Wegener. On August 11, 2011, counsel for MPT served a subpoena on Wegener seeking certain documents relating to the subject matter of the patent infringement action. On September 8, 2011, Wegener produced certain documents in response to that subpoena. Additional responsive documents may be produced in the future on a schedule to be agreed upon by Wegener and MPT. At this point, we are unable to assess the impact of this litigation, if any, on Wegener.

15

|

ITEM 4.

|

REMOVED AND RESERVED

|

PART II

|

ITEM 5.

|

MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATEDSTOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

On April 22, 2010, our Common Stock began trading over-the-counter under the symbol WGNR.PK. Prior to April 22, 2010 our Common Stock traded on The NASDAQ Stock Market. As of November 1, 2011, there were approximately 335 holders of record of our Common Stock. This number does not reflect beneficial ownership of shares held in nominee or “street” name.

The quarterly ranges of high and low sale prices for fiscal 2011 and 2010 were as follows:

|

Fiscal 2011

|

Fiscal 2010

|

|||||||

|

High

|

Low

|

High

|

Low

|

|||||

|

First Quarter

|

$.14

|

$ .07

|

$.38

|

$ .20

|

||||

|

Second Quarter

|

.18

|

.09

|

.29

|

.08

|

||||

|

Third Quarter

|

.18

|

.06

|

.30

|

.10

|

||||

|

Fourth Quarter

|

.08

|

.03

|

.15

|

.07

|

||||

Dividends

We have not paid any cash dividends on our Common Stock. For the foreseeable future, our Board of Directors does not intend to pay cash dividends, but rather plans to retain any earnings to support our operations. Furthermore, we are prohibited from paying dividends under our loan agreement, as more fully described in MD&A and in Note 9 to the consolidated financial statements contained in this report.

Recent Sales of Unregistered Securities

On December 6, 2010, pursuant to our 2010 Incentive Plan, the Compensation Committee authorized the issuance to all eligible employees of the Company common stock options to purchase an aggregate of 563,700 shares of common stock and issued equally to the four non-employee members of the Board common stock options to purchase an aggregate of 100,000 shares of common stock. Stock options for 638,700 shares of common stock are exercisable at $0.125 and one stock option for 25,000 shares of common stock, issued to a 10% or greater stockholder and executive officer, is exercisable at $0.1375. The options vested upon issuance and expire five years from the date of issuance. In addition, 500,000 shares of restricted common stock were granted to two executive officers. The issuances of the restricted stock were made in reliance upon an exemption from securities registration afforded by the provisions of Section 4(2) of the Securities Act of 1933, as amended, and the provisions of Regulation D promulgated thereunder.

As of November 15, 2011, a registration statement for the 2010 Incentive Plan has not been filed, although the Company currently intends to file a Form S-8 Registration Statement. Therefore, all of the foregoing securities are deemed restricted securities for purposes of the Securities Act.

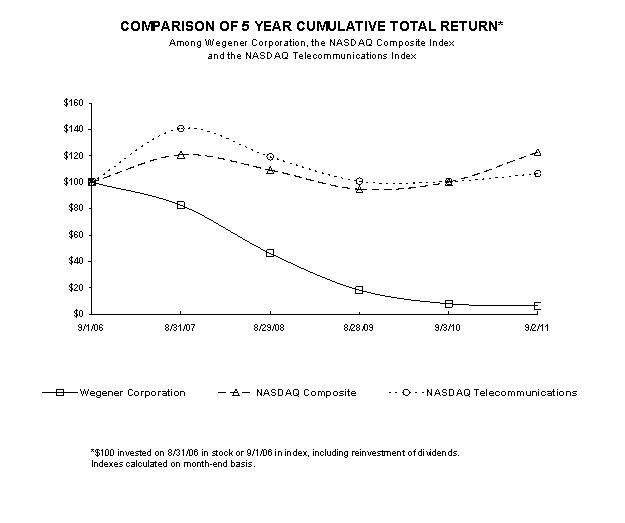

The following graph compares the cumulative total stockholder return of our Common Stock with the cumulative total return of the NASDAQ Composite Index and the NASDAQ Telecommunications Index for the five fiscal years ended September 2, 2011. The graph assumes that $100 was invested on September 1, 2006 in our Common Stock and each index and that all dividends were reinvested. We have not declared any cash dividends on our Common Stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

16

|

9/1/06

|

8/31/07

|

8/29/08

|

8/28/09

|

9/3/10

|

9/2/11

|

|

|

Wegener Corporation

|

100.00

|

82.54

|

46.03

|

18.25

|

7.94

|

6.35

|

|

NASDAQ Composite

|

100.00

|

120.88

|

109.33

|

94.74

|

100.35

|

122.93

|

|

NASDAQ Telecommunications

|

100.00

|

140.77

|

119.37

|

100.87

|

100.61

|

106.58

|

(1) The stock performance graph shall not be deemed soliciting material or to be filed with the Securities and Exchange Commission or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 (the “Exchange Act”) or to the liabilities of Section 18 of the Exchange Act, nor shall it be incorporated by reference into any past or future filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except to the extent we specifically request that it be treated as soliciting material or specifically incorporate it by reference into a filing under the Securities Act or the Exchange Act.

17

Equity Compensation Plan Information

The following table summarizes information as of September 2, 2011, regarding our Common Stock reserved for issuance under our equity compensation plans.

|

Plan Category

|

Number of Securities to be Issued Upon Exercise of Outstanding Options

(a)

|

Weighted-Average Exercise Price of Outstanding Options

(b)

|

Number of Securities Remaining Available for Future Issuance Under the Plans (Excluding Securities Reflected in Column (a))

(c)

|

|||||||||

|

Equity Compensation Plans

Approved by Security Holders |

1,308,875 | $ | 0.74 | 1,352,500 | ||||||||

|

Equity Compensation Plans

Not Approved by Security Holders |

- | - | - | |||||||||

|

Total

|

1,308,8375 | $ | 0.74 | 1,352,500 | ||||||||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

SELECTED FINANCIAL DATA

(in thousands, except per share amounts)

|

September 2,

2011 |

September 3, 2010 |

August 28,

2009

|

August 29,

2008

|

August 31,

2007

|

||||||||||||||||

| Revenues, net | $ | 9,111 | $ | 8,921 | $ | 12,655 | $ | 21,494 | $ | 21,546 | ||||||||||

|

Operating (loss) income (a)

|

(1,100 | ) | (1,841 | ) | (2,477 | ) | 540 | (613 | ) | |||||||||||

|

Net (loss) earnings (a)

|

(1,466 | ) | (2,313 | ) | (2,606 | ) | 383 | (753 | ) | |||||||||||

|

Net (loss) earnings per share

|

||||||||||||||||||||

|

Basic

|

$ | (.11 | ) | $ | (.18 | ) | $ | (.21 | ) | $ | .03 | $ | (.06 | ) | ||||||

|

Diluted

|

$ | (.11 | ) | $ | (.18 | ) | $ | (.21 | ) | $ | .03 | $ | (.06 | ) | ||||||

|

Cash dividends paid per share (b)

|

- | - | - | - | - | |||||||||||||||

|

Total assets

|

$ | 7,285 | $ | 8,362 | $ | 9,542 | $ | 13,213 | $ | 12,812 | ||||||||||

|

Long-term obligations inclusive of current maturities

|

- | - | - | - | - | |||||||||||||||

|

(a)

|

The year ended August 29, 2008 includes a fourth quarter gain on sale of patents of $894,000.

|

|

(b)

|

We have never paid cash dividends on our Common Stock and do not intend to pay cash dividends in the foreseeable future. Additionally, our line of credit precludes the payment of dividends.

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|