Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED SURGICAL PARTNERS INTERNATIONAL INC | d263659d8k.htm |

USPI

November 2011

Exhibit 99.1 |

2

SAFE HARBOR STATEMENT

This presentation contains forward-looking statements,

including those regarding United Surgical Partners

International, Inc. and the services it provides. Investors

are cautioned not to place an undue reliance on these

forward-looking statements, which will speak only as of

the date of this presentation. United Surgical Partners

International, Inc. undertakes no obligation to publicly

revise these forward-looking statements. |

3

NON-GAAP MEASUREMENT

We

have

used

the

non-GAAP

financial

measurement

term

“EBITDA.”

EBITDA

is calculated as operating income plus net gain (loss) on deconsolidations,

disposals, impairments and depreciation and amortization. USPI uses EBITDA and

EBITDA less noncontrolling interests as analytical indicators for purposes of

allocating resources and assessing performance. EBITDA is commonly used as an

analytical indicator within the health care industry and also serves as a measure of

leverage

capacity

and

debt

service

ability.

EBITDA

should

not

be

considered

as

a

measure of financial performance under generally accepted accounting principles,

and the items excluded from EBITDA could be significant components in

understanding and assessing financial performance.

Because EBITDA is not a measurement determined in accordance with

generally

accepted

accounting

principles

and

is

thus

susceptible

to

varying

calculation methods, EBITDA as presented by USPI may not be comparable to

similarly titled measures of other companies. |

4

COMPANY OVERVIEW

Leading operator of short-stay multi-specialty surgical facilities in the

United States and U.K.

Strategic partnerships with local physicians and prominent not-for-profit

health systems

Strong focus on patient safety, physician efficiency and cost

management

$2.1 billion of revenues under management for 204 facilities

Attractive business model with strong cash flow and modest exposure

to government reimbursement

Industry positioned as low cost, high quality solution for reform

initiatives |

5

U.S. INDUSTRY OVERVIEW

ASCs have been widely successful and are a significant

presence in the U.S. healthcare delivery system

Advantages in patient safety and physician efficiency are

meaningful

Significant savings to patients, government and commercial

payors

Typically a savings to commercial insurers

Medicare savings >40%

Medicare beneficiary savings >50%

Industry largely unconsolidated

Top ten companies own less than 20%

Growth of new facilities has slowed in recent years |

6

BENEFITS OF ASCs

All

Constituents

Benefit

PATIENTS

Allows higher patient

satisfaction as a result of more

comfortable setting,

scheduling flexibility and

consistent staffing

HOSPITAL PARTNERS

Allows hospital systems to

expand their capacity and

geographic reach with lower

capital use than traditional

acute care facilities

HIGH QUALITY CARE

92% patient satisfaction

Superior patient outcomes

Comprehensive regulatory

standards

PAYORS

In general, ASC represent a

discount

of

20

–

30%

compared with HOPD

reimbursement

PHYSICIANS

Freestanding environment

more conducive to meeting

high volume physicians’

requirements

Significant administrative,

clinical and economic benefits

to physicians

6 |

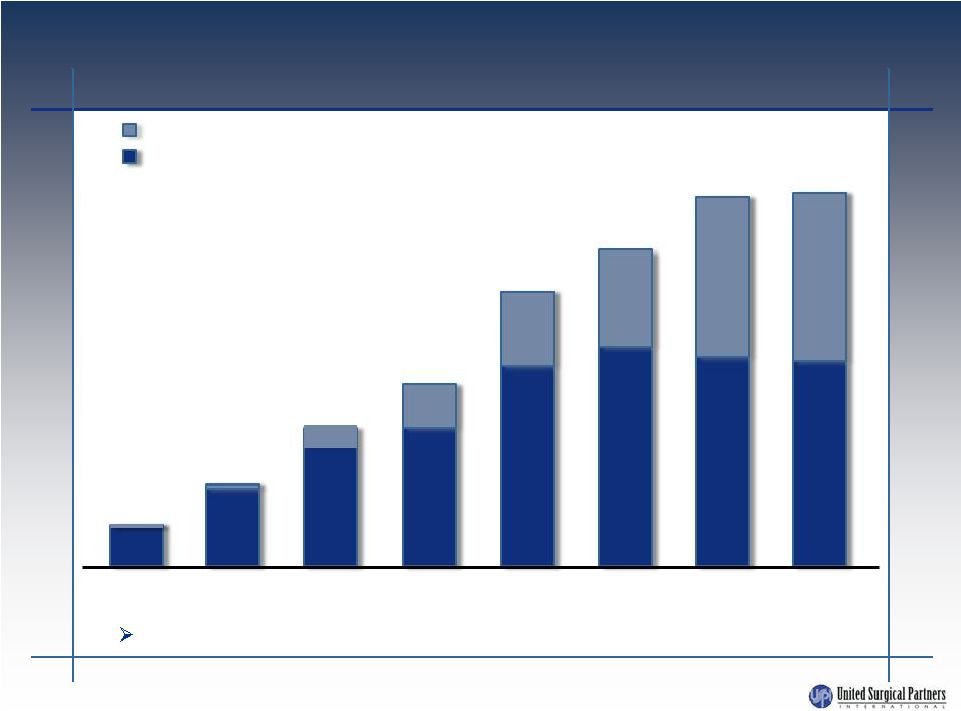

7

GROWING MARKET

Source: Verispan report and Wall Street research

Freestanding Facility Outpatient Surgeries

Hospital Outpatient

1981

1985

1990

1995

2002

2005

2007

Continued

shift

of

outpatient

surgery

to

freestanding

outpatient

facilities

2009

94%

10%

17%

25%

29%

32%

83%

75%

71%

68%

6%

90%

43%

57%

48%

52% |

8

KEY MARKETS

USPI operates 199 facilities in the United States and five in

the United Kingdom

Denver

6 facilities

Centura Health

Partnership

Oklahoma City

2 facilities

INTEGRIS Health

Partnership

St. Louis

18 facilities

New Jersey

10 facilities

Meridian Health

Partnership

Nashville

21 facilities

St. Thomas Partnership

Atlanta

6 facilities

Houston

19 facilities

Memorial

Hermann

Partnership

Austin

4 facilities

Seton Partnership

San Antonio/Corpus Christi

3 facilities

CHRISTUS Health Partnership

Dallas/Ft. Worth

32 facilities

Baylor Health Care

System Partnership

Phoenix/Las Vegas

11 facilities

Catholic Healthcare

West Partnership

Los Angeles

6 facilities

Catholic Healthcare

West Providence

Partnership

Kansas City

6 facilities

North Kansas City

Hospital Ascension

Partnership

Chicago

5 facilities

NorthShore University

HealthSystem, Adventist

Partnership

Major Market

Facilities |

9

UNITED KINGDOM

USPI entered the U.K. market in 2000 and currently operates three private

hospitals, a cancer center in greater London and an outpatient clinic in

Edinburgh, Scotland

Approximately 30% of

the population in the

Greater London market

accesses the private

healthcare market

Strategically located

facilities

Physician-driven

healthcare

Inherent limitations of

National Health System

Strong management

team

London Area Map

Parkside Hospital &

Parkside Oncology

(Wimbledon)

Highgate

Hospital

Holly House Hospital

(Buckhurst Hill)

Facilities |

10

HEALTHCARE SYSTEM PARTNERS

Benefits to Healthcare Systems

Leverage USPI’s operational

expertise and singular focus

Provides a strategy to promote

physician alignment

Provides defensive mechanism to

maintain short-stay surgical

business

Provides capital and spreads risk

through USPI and physicians’

investment

Provides an opportunity to expand

in new markets at lower capital

outlay than a hospital

Benefits to USPI

Provides long-term strategic

stability in the marketplace

Provides brand, image,

reputation and credibility

Accelerates growth

Enhances relationships with

managed care payors

137 facilities are in a partnership with a healthcare system |

11

HEALTHCARE SYSTEM PARTNERS

USPI’s

strategy

of

partnering

with

not-for-profit

healthcare

systems

aligns

the

Company’s

facilities

with

strong

networks

of

physicians

and

hospitals

that

are

prominent

in

their

communities

and

known

for

providing

high

quality

care

BON SECOURS HEALTH SYSTEM, INC. |

12

FAVORABLE REVENUE AND PAYOR MIX

High margin, elective procedures

55% of revenue mix from orthopedic

and pain management

Diversification of specialties insulates

USPI from negative utilization and

specialty pricing changes

Over 80% private insurance

Insurance companies favor low cost

providers

Modest exposure to government

reimbursement fluctuations

Government payor mix worldwide

Reliable payors and operating discipline

yields bad debt expense of less than 2%

of revenues and receivable days

outstanding is under 40 days

Low risk cash flows from high margin

specialties and reliable payors:

Orthopedic

Gynecology

ENT

Gastrointestinal

Plastic

Ophthalmology

Medical/Other

Pain Mgmt.

11%

11%

44%

44%

3%

3%

6%

6%

8%

8%

8%

8%

8%

8%

3%

3%

9%

9%

2010 U.S. Revenue Mix

Private

Insurance

Self-pay

16%

16%

82%

82%

2%

2%

2010 U.S. Payor Mix

Government

General |

13

DEVELOPMENT STRATEGY

Poised to react to current economic conditions and legislative

changes

Acquisition of troubled facilities

Selective acquisition of strong facilities

Selective de novo development

Selective acquisition of multi-facility companies

Work with existing partners (physicians and hospitals) to grow

market share

Selectively enter new markets with existing or new partners

Attractive demographics and/or payor characteristics

Prominent health system that embraces physician alignment

strategy

Prominent physicians who are influential in the market |

14

FINANCIAL PROFILE

(in millions)

GAAP Revenue

$ 620.9

$ 615.1

$ 593.5

$576.7

$601.8

Operating Income

$ 162.4

$ 198.1

$ 198.3

$ 210.5

$231.1

Add:

Losses on deconsolidations,

disposals and impairments

(0.4)

1.8

29.2

6.4

2.1

Add:

Depreciation & amortization

35.1

32.3

31.2

29.8

29.7

Less:

Noncontrolling interests

(63.7)

(55.1)

(63.7)

(60.6)

(67.1)

Add:

LBO costs

25.4

-

-

-

-

Add:

Non-recurring expenses

(detailed in Form 10-K and 10-Q)

-

-

(1.0)

14.0

16.6

Adjusted EBITDA less noncontrolling

interests

$ 158.8

$ 177.1

$ 194.0

$ 200.1

$212.4

Growth

11.5%

9.5%

3.1%

4.0%

2

Other Data:

GAAP revenue

(0.9%)

(3.5%)

(2.8%)

5.7%

2

Systemwide revenue growth

14.1%

9.4%

7.3%

12.0%

2

U.S. same-facility revenue growth

10.7%

7.5%

5.4%

5.8%

2

1

TTM 9/30/11

2

Q3 2011 versus Q3 2010

2007

2008

2009

2010

2011

1 |

15

SYSTEMWIDE FINANCIALS

2007 2008

2009 2010

2011 1

Equity method facilities

21.8%

21.2%

21.5%

21.7%

22.5%

Consolidated facilities

46.5%

48.8%

48.1%

46.7%

44.9%

Weighted average

32.6%

30.2%

29.4%

28.2%

28.4%

1

As of 9/30/11

USPI Ownership

Ownership is stable in each category of facilities; we continue to add a

greater number of equity centers versus consolidated facilities |

16

CAPITALIZATION

(in millions)

2007

2008

2009

2010

2011

3

Balance sheet data:

Cash

$ 76.8

$ 49.4

$ 34.9

1

$60.3

$55.9

Debt

1,098.1

1,097.9

1,069.8

1,065.7

1,042.0

Net debt

$1,021.3

$1,048.5

$1,036.6

$1,009.5

$986.1

Adjusted EBITDA less

noncontrolling interests

2

$ 158.8

$ 177.1

$ 194.0

$ 200.1

$212.4

4

Debt/EBITDA less

noncontrolling interests

6.43x

5.92x

5.34x

5.04x

4.64x

1

On December 1, 2009, the Company paid an $89 million dividend

2

Adjusted to reflect discontinued operations recorded in 2010

3

As of 9/30/11

4

TTM 9/30/11 |

17

DEBT MATURITIES

Total debt $1.0 billion as of September 30, 2011

2%

53%

1%

44%

$559.1M

$460.1M

Next 12 Months

Months 13-36

Months 37-60

Beyond 5 years |

18

SUMMARY

USPI is well positioned: low cost, high quality, high customer

satisfaction provider

Partner with key local not-for-profit hospital systems

Strong partnering capabilities will continue to provide opportunities

for growth, even in difficult times

Focused on key strategic markets with significant market share

Stable revenue growth

Strong equity sponsor in WCAS

Capitalized for growth and flexibility |