Attached files

| file | filename |

|---|---|

| EX-99.1 - TWO RIVER BANCORP | ex99_1.pdf |

| 8-K - TWO RIVER BANCORP | s11231108k.htm |

Exhibit 99.1

Investor Presentation

Third Quarter 2011

William D. Moss, President and CEO

A. Richard Abrahamian, EVP and CFO

Alan B. Turner, EVP and SLO - Two River Community Bank

Robert C. Werner, EVP and COO - Two River Community Bank

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such

statements are not historical facts and include expressions about management's confidence and strategies and management's current views

and expectations about new and existing programs and products, relationships, opportunities, taxation, technology and market conditions.

These statements may be identified by such forward-looking terminology as "expect," "look," "believe," "anticipate," "may," "will," “should”,

“projects” or similar statements or variations of such terms. Actual results may differ materially from such forward-looking statements, and

no undue reliance should be placed on any forward-looking statement.

statements are not historical facts and include expressions about management's confidence and strategies and management's current views

and expectations about new and existing programs and products, relationships, opportunities, taxation, technology and market conditions.

These statements may be identified by such forward-looking terminology as "expect," "look," "believe," "anticipate," "may," "will," “should”,

“projects” or similar statements or variations of such terms. Actual results may differ materially from such forward-looking statements, and

no undue reliance should be placed on any forward-looking statement.

Factors that may cause results to differ materially from such forward-looking statements include, but are not limited to, unanticipated

changes in the financial markets and the direction of interest rates; volatility in earnings due to certain financial assets and liabilities held at

fair value; passage by Congress of a law which unilaterally amends the terms of the Treasury’s preferred stock investment in the Company in

a way that adversely affects the Company; stronger competition from banks, other financial institutions and other companies; changes in

loan, investment and mortgage prepayment assumptions; insufficient allowance for credit losses; a higher level of net loan charge-offs and

delinquencies than anticipated; material adverse changes in the Company’s operations or earnings; a decline in the economy in Community

Partners’ primary market areas; changes in relationships with major customers; changes in effective income tax rates; higher or lower cash

flow levels than anticipated; inability to hire or retain qualified employees; a decline in the levels of deposits or loss of alternate funding

sources; a decrease in loan origination volume; changes in laws and regulations, including issues related to compliance with anti-money

laundering and the bank secrecy act laws; adoption, interpretation and implementation of new or pre-existing accounting pronouncements;

operational risks, including the risk of fraud by employees or outsiders; and the inability to successfully implement new lines of business or

new products and services.

changes in the financial markets and the direction of interest rates; volatility in earnings due to certain financial assets and liabilities held at

fair value; passage by Congress of a law which unilaterally amends the terms of the Treasury’s preferred stock investment in the Company in

a way that adversely affects the Company; stronger competition from banks, other financial institutions and other companies; changes in

loan, investment and mortgage prepayment assumptions; insufficient allowance for credit losses; a higher level of net loan charge-offs and

delinquencies than anticipated; material adverse changes in the Company’s operations or earnings; a decline in the economy in Community

Partners’ primary market areas; changes in relationships with major customers; changes in effective income tax rates; higher or lower cash

flow levels than anticipated; inability to hire or retain qualified employees; a decline in the levels of deposits or loss of alternate funding

sources; a decrease in loan origination volume; changes in laws and regulations, including issues related to compliance with anti-money

laundering and the bank secrecy act laws; adoption, interpretation and implementation of new or pre-existing accounting pronouncements;

operational risks, including the risk of fraud by employees or outsiders; and the inability to successfully implement new lines of business or

new products and services.

The above-listed risk factors are not necessarily exhaustive, particularly as to possible future events, and new risk factors may emerge from

time to time. Certain events may occur that could cause the Company’s actual results to be materially different than those described in the

Company’s periodic filings with the Securities and Exchange Commission (“SEC”). For a list of other factors which could affect the

Company’s results, including earnings estimates, see the Company’s filings with the SEC, including “Item 2. Management’s Discussion and

Analysis of Financial Condition and Results of Operations,” including “Forward-Looking Statements,” set forth in the Company’s Quarterly

Report on Form 10-Q for the quarter ended September 30, 2011. Any statements made by the Company that are not historical facts should be

considered to be forward-looking statements. The statements in this investor presentation are made as of the date of this investor

presentation, even if subsequently made available by the Company on its website or otherwise. No undue reliance should be placed on any

forward-looking statements. The Company is not obligated to update and does not undertake to update any of its forward-looking

statements made herein.

time to time. Certain events may occur that could cause the Company’s actual results to be materially different than those described in the

Company’s periodic filings with the Securities and Exchange Commission (“SEC”). For a list of other factors which could affect the

Company’s results, including earnings estimates, see the Company’s filings with the SEC, including “Item 2. Management’s Discussion and

Analysis of Financial Condition and Results of Operations,” including “Forward-Looking Statements,” set forth in the Company’s Quarterly

Report on Form 10-Q for the quarter ended September 30, 2011. Any statements made by the Company that are not historical facts should be

considered to be forward-looking statements. The statements in this investor presentation are made as of the date of this investor

presentation, even if subsequently made available by the Company on its website or otherwise. No undue reliance should be placed on any

forward-looking statements. The Company is not obligated to update and does not undertake to update any of its forward-looking

statements made herein.

2

Forward-Looking Statements

Company Profile

• Community Partners Bancorp was formed in 2006 as the holding

company for Two River Community Bank, which was established in

2000

company for Two River Community Bank, which was established in

2000

• Relationship-based lender

• Focus on Business banking, including a fast-growing Private Banking

Division (medical practitioners and business owners) and SBA lending

Division (medical practitioners and business owners) and SBA lending

• Seasoned senior management and lending team along with an engaged

Board of Directors from local communities

Board of Directors from local communities

• $665 million commercial bank headquartered in Monmouth County,

NJ

NJ

• 15 branches (11 in Monmouth County, 4 in Union County)

• 2 loan production offices (New Brunswick and Summit)

• 90% of deposits core, with 16% non-interest bearing demand

3

|

|

Title

|

Years in

Banking |

Years with CPBC

|

|

William D. Moss

|

President and CEO

|

31

|

11

(since inception)

|

|

A. Richard Abrahamian

|

EVP and Chief Financial

Officer |

27

|

1

|

|

Alan B. Turner

|

EVP and Senior Loan

Officer - Two River Community Bank |

26

|

11

|

|

Robert C. Werner

|

EVP and Chief

Operating Officer - Two River Community Bank |

27

|

1

|

Experienced Executive

Management Team

Management Team

Management transition took place in 2010

4

• NASDAQ symbol: CPBC

• Market Cap - $35.5 million

• 3% stock dividend (4Q’11)

• Price / TBV - 63.7%

Price / LTM EPS - 10.7x

Price / “Est” EPS - 10.5x

• Daily average share volume (52 weeks) - 3,880

• Shares outstanding - 7.7 million

• Public Float - 6.5 million (84.1%)

• Ownership:

• 80.7% Retail

• 15.9% Insider

• 3.4% Institutional

5

Source: SNL Financial

— Strong Net Interest Margin 1

— Company ranks #5 in net interest margin out of 24 NJ Banks as of 6/30/11

— Yield on earning assets ranks 10th while cost of interest bearing deposits ranks

5th as of 6/30/11

5th as of 6/30/11

— Attractive Deposit Mix

— Core deposits comprise over 90% of deposit base

— 16% of deposits consist of non-interest bearing demand

— Company ranks 6th out of 24 in non-interest checking (1)

— Stable low deposit cost of funds - 0.83% for 3Q’11

— Appealing Market Demographics

— Above average household incomes

— Densely populated market areas

— Exceptionally strong medical service industry

— Private Banking Market Focus

1 NJ banks with assets from $300 million to $1.5 billion

Investment Appeals

6

— High unemployment

— Real estate value pressures

— Consumer and business deleveraging

— Regulatory demands and costs

— Prolonged low interest rate environment

Market Challenges

7

8

— We have been able to capitalize on opportunities resulting from

recent consolidation activity in our market area

recent consolidation activity in our market area

— Attract deposit and loan customers seeking higher service levels

— Service fee structure of larger banks becoming cost prohibitive for

the smaller business and retail customer

the smaller business and retail customer

— Recent acquisitions in our market area:

— Kearny / Central Jersey

— Wells Fargo / Wachovia

— TD Bank / Commerce Bank

— Northfield / First State

Opportunities Resulting

from Recent Mergers

from Recent Mergers

9

— NJ is # 1 in median household income - $72,519

— Monmouth County is ranked 6th in NJ

— Middlesex County is ranked 7th in NJ

— NJ is #2 in per capita income - $34,739

— Monmouth County is #5 in NJ

— Middlesex County is #8 in NJ

— NJ is #2 in population density

— Union County is ranked 3rd in NJ

Note: Rankings in NJ based on 21 counties

New Jersey Demographics

Source: SNL Financial

10

2010 Median Household Income:

— Current Markets:

— Monmouth, NJ $ 82,974 (#6 in NJ)

— Union, NJ $ 73,602 (#11 in NJ)

— Middlesex, NJ $ 78,561 (#7 in NJ)

— New Jersey $ 72,519

NJ - #1 in Median

Household Income

Household Income

Source: SNL Financial

11

Current counties of operation:

County State Total Market State # of Small

Deposits ($M) (1) Rank (2) Businesses (3)

Monmouth NJ $17,745 #6 32,022

Middlesex NJ $22,274 #3 27,519

Union NJ $17,226 #7 22,257

(1) Data as of June 30, 2011

(2) Rankings in NJ based on 21 counties

(3) Data as of 2010; Small businesses defined as those with less than 100 employees and $15

million in sales

million in sales

Appealing Business

Opportunities

Opportunities

Source: SNL Financial

12

|

At or for

Nine Months Sept. 30, 2011 |

Outstanding

|

NPA’s

|

NPA’s as % of

Outstanding 1 |

Net

Charge

-Offs |

C/O’s as % of

Outstanding (annualized)

|

|

C & I

|

$133.5

|

$2.3

|

1.76%

|

$0.5

|

0.46%

|

|

R/E -

Construction |

$39.2

|

$0.3

|

0.74%

|

$0.1

|

0.28%

|

|

R/E -

Commercial |

$273.5

|

-

|

-

|

-

|

-

|

|

R/E -

Residential |

$19.3

|

$0.3

|

1.36%

|

-

|

-

|

|

Consumer

|

$51.3

|

$3.4

|

6.61%

|

$0.5

|

1.46%

|

|

OREO

|

-

|

$6.6

|

-

|

-

|

-

|

|

TOTAL

|

$516.8

|

$12.9

|

2.47%

|

$1.1

|

0.29%

|

Loan Credit Metrics

(dollars in millions)

13

1 NPA’s defined as non-accrual loans, 90+ past due and still accruing and OREO

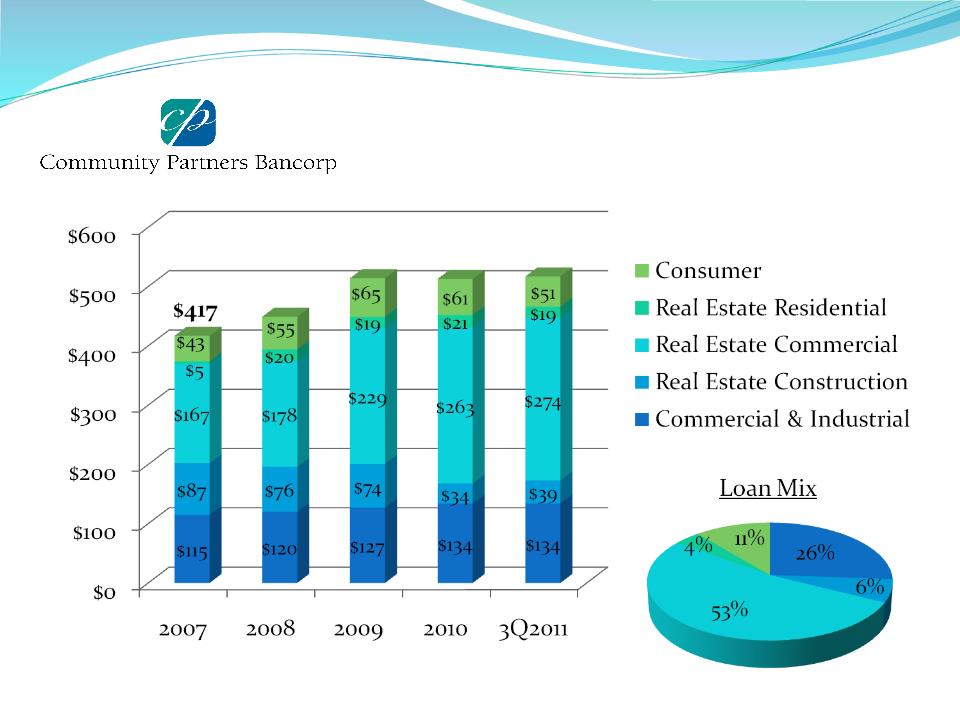

Loan Portfolio

(dollars in millions)

$449

$514

$513

$517

14

Commercial Real Estate

— Portfolio totals $274 million

— Legal lending limit - $11.2 million

— 100% of portfolio is secured by NJ properties

— Average commercial loan size approximately $680,000

— Average LTV at origination was less than 75%

— Approximately 54% of portfolio is owner-occupied

— More than 96% carries personal guarantees

— Conservative underwriting parameters on debt-service coverage

ratios and real estate valuations

ratios and real estate valuations

Commercial Lending

As of September 30, 2011

15

Commercial Real Estate

Concentration

Concentration

As of September 30, 2011

16

Commercial and Industrial

— Portfolio totals $134 million

— Relationship banking with deposit focus

— Average loan size approximates $200,000

— Most commercial loans supported by personal guarantees and by

collateral, including

collateral, including

— First and second liens on residential and/or commercial properties

— Liquid assets, such as marketable securities

— Business assets (i.e. inventory, accounts receivable, equipment)

— Private Banking Division formed in 2008

— Targets business owners, high net worth individuals and medical

practitioners

practitioners

— Established Small Business Administration unit during 2010

— Generated $101,000 in gains from SBA sales during first nine

months of 2011

months of 2011

— Earned Preferred Lender Status in 4Q’11

Commercial Lending

(continued)

17

— Portfolio totals $39 million, representing 8% of total loans

— Repositioned portfolio towards more residential owner

occupied projects with pre-determined takeouts in place

occupied projects with pre-determined takeouts in place

— Reduced speculative development and land exposure beginning

in 2008

in 2008

Construction Lending

As of September 30, 2011

18

— Portfolio totals $51 million (62% home equity)

— 100% in State of NJ

— Stronger underwriting criteria's focused on lower debt to

income ratios and loan to value requirements

income ratios and loan to value requirements

Consumer Lending

As of September 30, 2011

19

— Portfolio totals $19 million

— Primary function is to originate and sell, with servicing released

(fee-based)

(fee-based)

— No interest rate or credit exposure risk

— Mortgages retained typically have strong underwriting

characteristics with low loan to value ratios and debt to income

ratios

characteristics with low loan to value ratios and debt to income

ratios

Residential Lending

As of September 30, 2011

20

Asset Quality Metrics

As of September 30, 2011

Source: SNL Financial

1 NPA’s defined as non-accrual loans, troubled debt restructured loans and OREO

21

— Primarily used for liquidity purposes

— Portfolio totals $57 million (8.5% of total assets)

— 68% of portfolio guaranteed by U.S. Gov’t Agencies, GSEs

— One impaired security

— Pooled trust preferred - $272k balance

— Tax-equivalent yield: 3.00%

— Weighted average life: 4.4 years

Investment Portfolio

As of September 30, 2011

22

Deposits

(dollars in millions)

$475

$535

$524

$544

Core deposits represent 90% of total deposits

23

Demand Deposits

(dollars in millions)

24

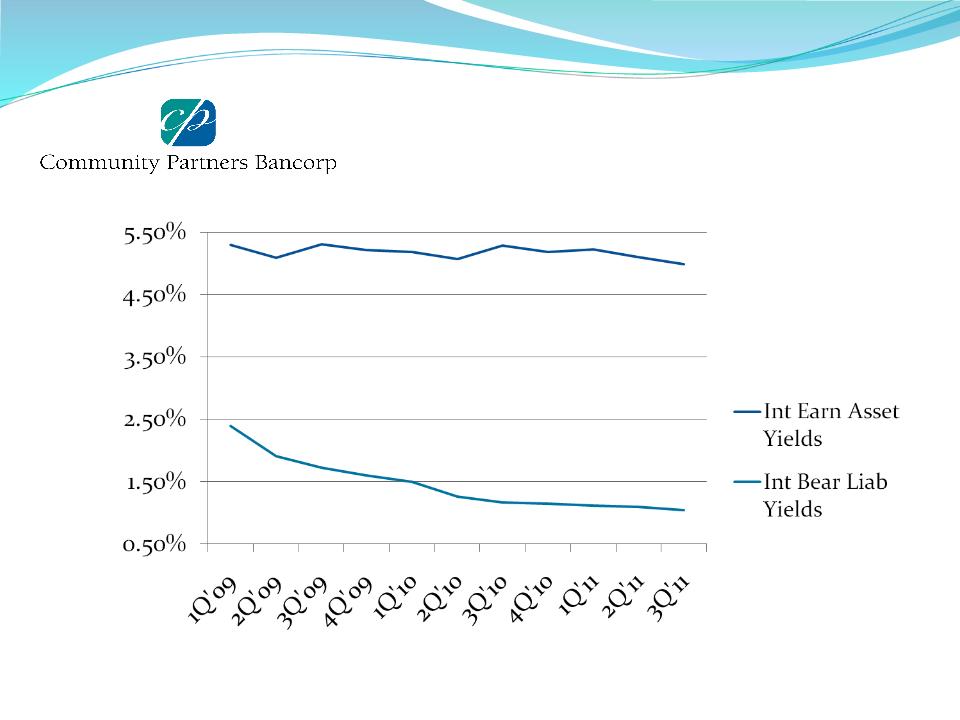

— Positioned well for rising interest rates

— 12 month positive gap position (11.0% of assets)

— Economic Value of Portfolio Equity “increases” in rising rate

scenario

scenario

— Currently hold $41 million, or 6% of balance sheet, in

overnight funds at FRB

overnight funds at FRB

— 39% of loan portfolio reprices within 12 months, while only

6% reprices over 5 year

6% reprices over 5 year

— 26% of deposits represent core checking while 90%

represent core deposits 1

represent core deposits 1

Interest Rate Risk Profile

1 Core checking consists of non-interest and interest checking deposits while core deposits

consist of all deposits, except CD’s over $100K

consist of all deposits, except CD’s over $100K

25

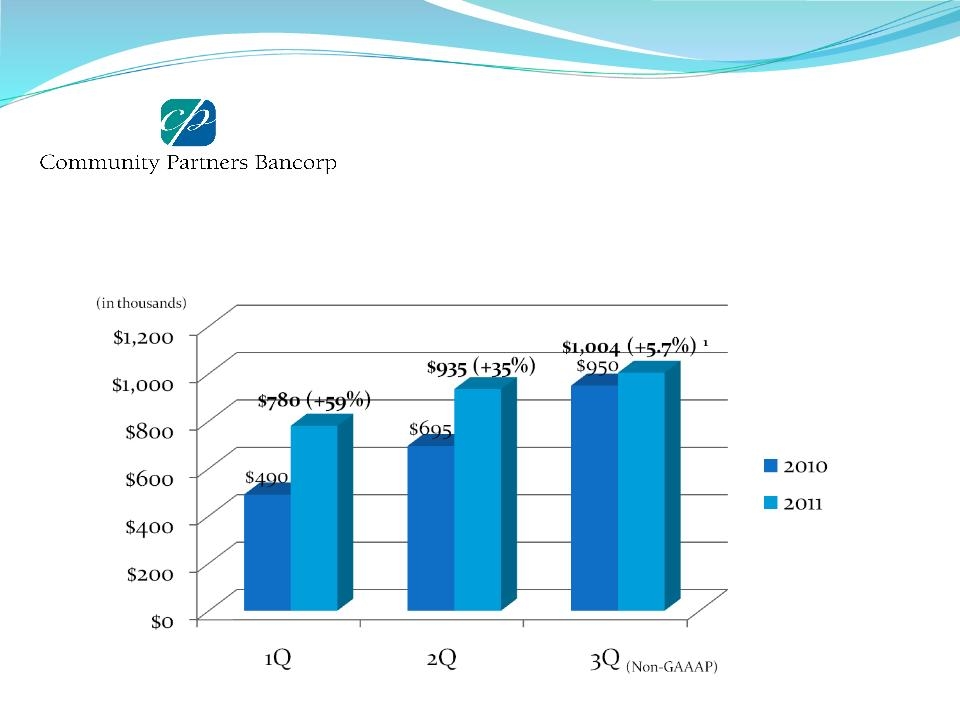

Net Income

to Common Shareholders

$3,039

1 3Q 2011 results exclude $301K of accelerated discount accretion relating to redemption of TARP

preferred stock.

preferred stock.

26

— 3Q 2011 adjusted EPS of $0.13 versus unadjusted $0.12 from 3Q 2010 1

— Nine months 2011 adjusted EPS of $0.34 versus unadjusted $0.27 from 2010 1

Net Income

to Common Shareholders

Quarterly

1 3Q 2011 results exclude $301K, or $0.04 per share, of accelerated discount accretion relating

to redemption of TARP preferred stock

to redemption of TARP preferred stock

27

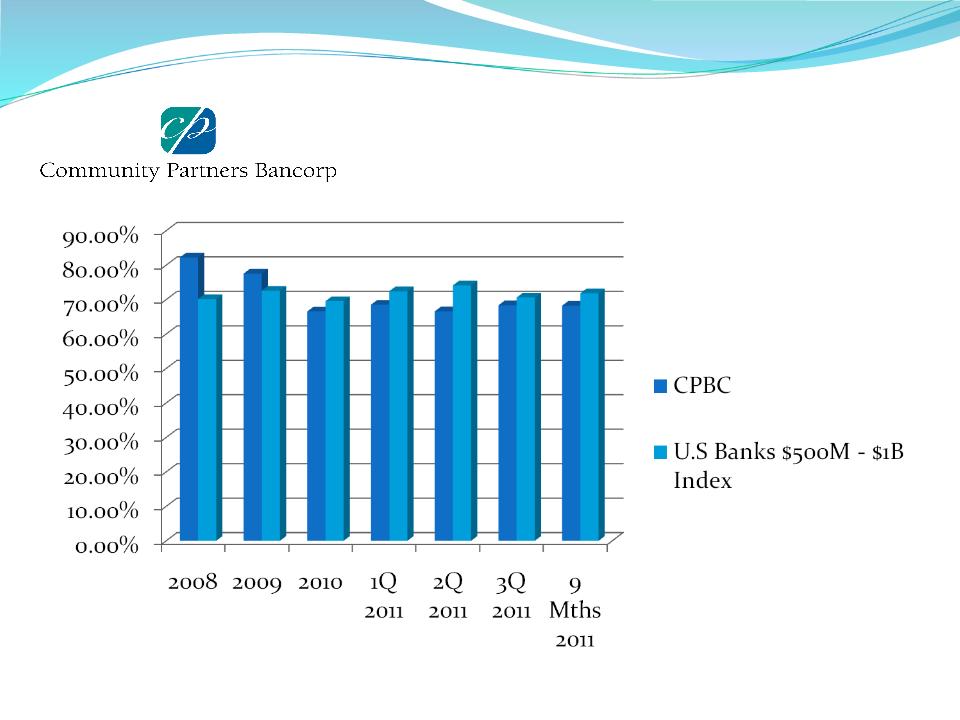

Return on Average Assets

0.56%

28

Return on Average Assets

(Quarterly)

29

30

Return on Average

Tangible Equity

Source: SNL Financial

Net Interest Margin

31

Net Interest Margin

- Trends -

32

Pricing Trends

33

Efficiency Ratio

Source: SNL Financial

34

Capital Events and Ratios

— Received $9.0 million of TARP capital in January 2009 as an

abundance of caution during financial crisis

abundance of caution during financial crisis

— Received $12 million of SBLF capital in August 2011 and fully

redeemed TARP funds

redeemed TARP funds

— Redeemed TARP warrant in October 2011 for $460,000

35

Stock Price and Valuation

As of 11/10/11

Source: SNL Financial

36

— Attractive franchise in some of the more desirable markets in New

Jersey

Jersey

— Experienced and energetic management team and bankers

— Conservative underwriting culture

— Compelling valuation

— Continued strong profitability during challenging economic times

Summary

37

This investor presentation contains certain financial information determined by methods other than in accordance with generally

accepted accounting policies in the United States (GAAP). These non-GAAP financial measures are “net income available to

common shareholders excluding accelerated discount accretion” and “return on average tangible equity.” This non-GAAAP

disclosure has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of the

Company's results as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be

presented by other companies. Our management uses these non-GAAP measures in its analysis of our performance because it

believes these measures are material and will be used as a measure of performance by investors.

accepted accounting policies in the United States (GAAP). These non-GAAP financial measures are “net income available to

common shareholders excluding accelerated discount accretion” and “return on average tangible equity.” This non-GAAAP

disclosure has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of the

Company's results as reported under GAAP, nor is it necessarily comparable to non-GAAP performance measures that may be

presented by other companies. Our management uses these non-GAAP measures in its analysis of our performance because it

believes these measures are material and will be used as a measure of performance by investors.

Reconciliation of Non-GAAP

Measures

Measures

|

($ in thousands)

|

3Q 2011

|

9 Mths 2011

|

|

Net income available to common shareholders

|

$ 703

|

$2,418

|

|

Effect of accelerated portion of discount accretion

|

301

|

301

|

|

Net income available to common shareholders excluding

accelerated discount accretion |

$1,004

|

$2,719

|

|

|

|

|

|

Diluted earnings per common share

|

$ 0.09

|

$ 0.30

|

|

Effect of accelerated portion of discount accretion

|

0.04

|

0.04

|

|

Diluted earnings per common share excluding accelerated

discount accretion |

$ 0.13

|

$ 0.34

|

|

|

9 Mths 2011

|

9 Mths 2010

|

|

Return on average equity

|

5.03%

|

4.38%

|

|

Effect of average intangible assets

|

1.68%

|

1.66%

|

|

Return on average tangible equity

|

6.71%

|

6.04%

38

|