Attached files

Exhibit 10.6

OFFICE LEASE AGREEMENT

between

PROPERTY RESERVE, INC.

as “Landlord”

and

CEMPRA PHARMACEUTICALS, INC.,

as “Tenant”

[Quadrangle IV]

TABLE OF CONTENTS

| 1. |

DEFINITIONS |

2 | ||||

| 2. |

BASIC LEASE TERMS |

2 | ||||

| 3. |

PREMISES |

3 | ||||

| 4. |

TERM |

4 | ||||

| 5. |

RENT |

4 | ||||

| 6. |

SECURITY DEPOSIT |

5 | ||||

| 7. |

ALTERATIONS |

5 | ||||

| 8. |

USE AND COMPLIANCE WITH LAWS |

7 | ||||

| 9. |

MAINTENANCE AND REPAIRS |

8 | ||||

| 10. |

TENANT’S TAXES |

9 | ||||

| 11. |

UTILITIES AND SERVICES |

9 | ||||

| 12. |

RELEASE AND INDEMNIFICATION |

11 | ||||

| 13. |

INSURANCE |

11 | ||||

| 14. |

DAMAGE OR DESTRUCTION |

14 | ||||

| 15. |

CONDEMNATION |

15 | ||||

| 16. |

ASSIGNMENT AND SUBLETTING |

15 | ||||

| 17. |

DEFAULT AND REMEDIES |

17 | ||||

| 18. |

LATE CHARGE AND INTEREST |

20 | ||||

| 19. |

WAIVER |

20 | ||||

| 20. |

ENTRY, INSPECTION AND CLOSURE |

20 | ||||

| 21. |

SURRENDER AND HOLDING OVER |

21 | ||||

| 22. |

ENCUMBRANCES |

21 | ||||

| 23. |

ESTOPPEL CERTIFICATES AND FINANCIAL STATEMENTS |

22 | ||||

| 24. |

NOTICES |

22 | ||||

| 25. |

ATTORNEYS’ FEES |

23 | ||||

| 26. |

QUIET POSSESSION |

23 | ||||

| 27. |

FORCE MAJEURE |

23 | ||||

| 28. |

RULES AND REGULATIONS |

23 | ||||

| 29. |

LANDLORD’S LIABILITY |

23 | ||||

| 30. |

CONSENTS AND APPROVALS |

24 | ||||

| 31. |

PARKING |

24 | ||||

| 32. |

BROKERS |

24 | ||||

| 33. |

RELOCATION OF PREMISES |

24 | ||||

| 34. |

ENTIRE AGREEMENT |

24 | ||||

| 35. |

MISCELLANEOUS |

24 | ||||

| 36. |

INDEPENDENT COVENANTS/CONTROLLING NATURE OF LEASE |

25 | ||||

| 37. |

REPRESENTATION OF AUTHORITY |

25 | ||||

| 38. |

SECURITY INTEREST |

25 | ||||

| 39. |

OFAC REPRESENTATION |

25 | ||||

| 40. |

SECURITY OF PREMISES |

25 | ||||

| 41. |

OTHER OCCUPANTS |

26 | ||||

| 42. |

BUILDING NAME AND SIGNAGE |

26 | ||||

| 43. |

SIGNS |

26 | ||||

| 44. |

BUILDING RENOVATIONS |

26 | ||||

| 45. |

LIMITATION OF ACTIONS AGAINST LANDLORD |

27 | ||||

| 46. |

NONDISCLOSURE OF LEASE TERMS |

27 | ||||

| 47. |

CHANGES REQUESTED BY LENDER |

27 | ||||

| 48. |

TRANSPORTATION MANAGEMENT |

27 | ||||

| 49. |

PRIOR DRAFTS |

27 | ||||

| 50. |

PRIOR LEASE |

27 | ||||

| 51. |

SEC FILINGS |

27 |

EXHIBITS:

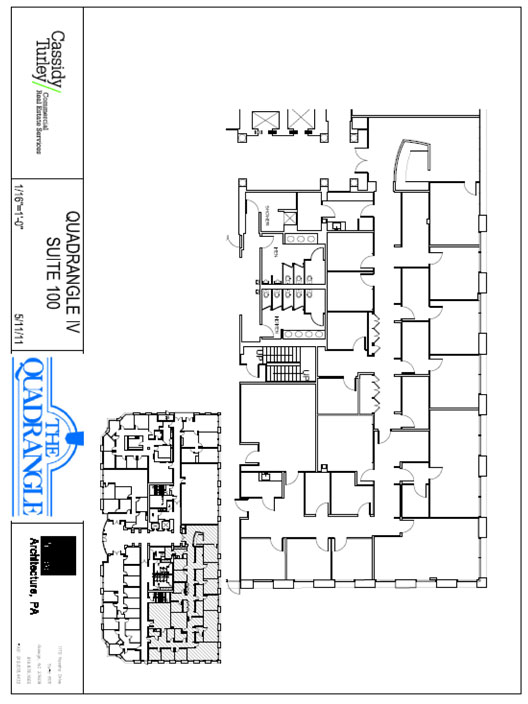

| Exhibit A: |

Defined Terms | Exhibit D: | Memorandum of Term | |||

| Exhibit B: |

Floor Plan of Premises | Exhibit E: | Building Rules | |||

| Exhibit C: |

Work Letter |

OFFICE LEASE AGREEMENT

This Office Lease Agreement is made and entered into as of the 9th day of November, 2011 by and between Property Reserve, Inc., a Utah nonprofit corporation, as Landlord, and Cempra Pharmaceuticals, Inc., a Delaware corporation, as Tenant.

1. DEFINITIONS. Capitalized terms used in this Lease have the meanings ascribed to them on the attached Exhibit “A”.

2. BASIC LEASE TERMS. The following Basic Lease Terms are hereby incorporated into the Lease:

| 2.1 Building: | The building commonly known as Quadrangle IV, with an address of 6340 Quadrangle Drive, Chapel Hill, North Carolina. |

| 2.2 Premises: | Suite 100 consisting of approximately 6,074 RSF located on the first floor of the Building. The Premises are depicted on the floor plan(s) attached hereto as Exhibit B. |

2.3 Permitted Use: General office.

2.4 Omitted

2.5 Commencement Date of Term: June 1, 2011.

2.6 Length of Term: Forty-Two (42) months.

2.7 Base Rent:

| Period | Rate Per RSF | Annual Base Rent | Monthly Base Rent | |||||||||

| 6/1/11 – 11/30/11 |

$ | 9.75 | $ | 29,610.75 | (6 mos) | $ | 4,935.13 | |||||

| 12/1/11 – 5/31/12 |

$ | 19.50 | $ | 59,221.50 | (6 mos) | $ | 9,870.25 | |||||

| 6/1/12 – 5/31/13 |

$ | 20.09 | $ | 122,026.66 | $ | 10,168.89 | ||||||

| 6/1/13 – 5/31/14 |

$ | 20.69 | $ | 125,671.06 | $ | 10,472.59 | ||||||

| 6/1/14 – 11/30/14 |

$ | 21.31 | $ | 64,718.47 | (6 mos) | $ | 10,786.41 | |||||

2.8 Base Year: Calendar year: 2011

2.9 Tenant’s Share: 9.39% (est.); proportional, based upon 95% of the total RSF in the Building.

2.10 Work Letter: Work Letter attached as Exhibit C.

2.11 Security Deposit: $9,870.25 (which the parties acknowledge has been paid by Tenant to Landlord)

| 2.12 Landlord’s Address for Payment of Rent: | Property Reserve, Inc. | |||

| c/o Cassidy Turley | ||||

| P.O. Box 198975 | ||||

| Atlanta, GA 30384-8975 | ||||

| 2.13 Landlord’s Address for Notices: |

Property Reserve, Inc. | |||

| Attn: VP of Property Management | ||||

| 5 Triad Center, Suite 450 | ||||

| Salt Lake City, Utah 84180 | ||||

-2-

| With a copy to: | ||||

| Kilpatrick, Townsend & Stockton, LLP | ||||

| Attn: James C. McCaskill | ||||

| 4208 Six Forks Road, Suite 1400 | ||||

| Raleigh, North Carolina 27609 | ||||

| 2.14 Tenant’s Address for Notices: |

Cempra Pharmaceuticals, Inc. | |||

| 6340 Quadrangle Drive | ||||

| Chapel Hill, North Carolina 27517 | ||||

| Attn: Cali Downs | ||||

| 2.15 Tenant’s Telephone Number: |

(919) 313-6616 | |||

| 2.16 Tenant’s Facsimile Number: |

(919) 313-6620 | |||

| 2.17 Tenant’s Social Security Number or Tax Identification Number: |

203905814 | |||

| 2.18 Tenant’s Information: Entity Type: |

Corporation | |||

| State of Origin: |

Delaware | |||

| 2.19 Tenant’s Broker(s): |

Deborah Boucher, Cassidy Turley | |||

| 2.20 Omitted |

||||

| 2.21 Exhibits. The following Exhibits are attached hereto and incorporated herein by this reference: | ||||

| Exhibit A: |

Defined Terms | |

| Exhibit B: |

The Premises | |

| Exhibit C: |

Work Letter | |

| Exhibit D: |

Memorandum of Term | |

| Exhibit E: |

Building Rules | |

| Exhibit F: |

Description of Project Real Property |

2.22 Memorandum of Lease Terms/First Lease Amendment. Within thirty (30) days after the Commencement Date of the Term, Landlord and Tenant shall confirm the basic terms and conditions of the Lease using a Memorandum of Lease Terms/First Lease Amendment substantially in the form and content attached hereto as Exhibit D. The terms set forth in the Memorandum of Lease Terms/First Lease Amendment shall be controlling and supersede any conflicting terms set forth in this Section 2, Basic Lease Terms.

The failure of Tenant to execute such Confirmation of Lease Terms/First Lease Amendment shall not affect any obligation of Tenant hereunder or Landlord’s determination of the Commencement Date. If Tenant fails to execute and deliver such Confirmation of Lease Terms/First Lease Amendment in the form proposed by Landlord, Landlord and any prospective purchaser or encumbrancer may conclusively presume and rely upon the following facts: (a) that the Premises were in acceptable condition and were delivered in compliance with all of the requirements of this Lease and any Work Letter attached hereto and (b) the Commencement Date is the date specified in the Memorandum of Lease Terms/First Lease Amendment executed by Landlord.

3. PREMISES. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, upon the terms and subject to the conditions of this Lease, the Premises (defined in Subsection 2.2), together with use of all appurtenant exterior common areas, sidewalks, walkways, drive aisles, parking areas and landscaping.

-3-

4. TERM. The Term shall commence on the Commencement Date of the Term and, unless sooner terminated, shall expire upon the last day of the calendar month following the length of the Term (defined in Subsection 2.6). Landlord shall deliver possession of the Premises to Tenant on the Commencement Date.

5. RENT.

5.1 Base Rent. Tenant agrees to pay to Landlord the Base Rent (defined in Subsection 2.7) on the first day of each and every calendar month during the Term without notice, deduction or set off. The schedule of Base Rent in Subsection 2.7 is based upon full calendar months during the Term.

5.2 Direct Costs. Tenant shall pay to Landlord the amount of any Direct Costs within thirty (30) days after receipt of a statement from Landlord for any such Direct Costs.

5.3 Expenses. Prior to the commencement of each calendar year, Landlord shall notify Tenant of Landlord’s estimate of the Expenses for the following calendar year. Commencing on the first day of January of each calendar year and continuing on the first day of every month thereafter in such year, Tenant shall pay to Landlord one-twelfth (1/12th) of Tenant’s Share of the estimated Expenses. If Landlord thereafter estimates that Expenses for such year will vary from Landlord’s prior estimate, Landlord may, by notice to Tenant, revise the estimate for such year (and Tenant shall pay the accrued difference between the original and the revised estimate of Expenses within fifteen (15) days after receipt of the revised estimate, and thereafter pay the revised estimate). Notwithstanding the above, if during any calendar year of the Term the occupancy of the Building is less than ninety-five percent (95%), then Landlord may, in Landlord’s sole discretion, make an appropriate adjustment of the variable components of Expenses, as reasonably determined by Landlord, to determine the amount of Expenses that would have been incurred had the Building been ninety-five percent (95%) occupied during that calendar year. This adjusted amount shall be deemed the amount of Expenses for that calendar year. For purposes hereof, “variable components” shall include only those Expenses that are affected by variations in occupancy levels.

Notwithstanding the above, if the Premises are separately assessed for any utility service (such as electricity), upon mutual agreement by Landlord and Tenant, Tenant shall pay the charges for such utility services directly to the utility provider. In addition, upon mutual agreement of Landlord and Tenant, Tenant may provide Tenant’s own janitorial service to the Premises. In such an event, Tenant’s obligation to contribute toward the cost of such utility service or janitorial service shall be appropriately adjusted by Landlord. Tenant, however, shall continue to be responsible to pay Tenant’s Share of the cost of utility service and janitorial service for the common areas and facilities of the Building.

5.4 Annual Statement. Within one hundred eighty (180) days after the end of each calendar year during the Term, and as soon as reasonably practicable after the expiration of the Term, Landlord shall furnish Tenant a statement with respect to the previous calendar year showing the total Expenses and Tenant’s Share of Expenses for such calendar year, and the total payments made by Tenant with respect thereto. Unless Tenant objects to Landlord’s statement within ninety (90) days after receipt of the same, such statement shall conclusively be deemed correct and accepted by Tenant. If Tenant does timely object to such statement, Landlord shall provide Tenant with reasonable verification of the disputed figures shown on the statement and the parties shall negotiate in good faith to resolve any disputes. Any objection of Tenant to Landlord’s statement and resolution of any dispute shall not postpone the payment of any undisputed amounts due Tenant or Landlord based on Landlord’s statement. Failure of Landlord to deliver Landlord’s statement in a timely manner does not relieve Tenant of Tenant’s obligation to pay any amounts due Landlord pursuant to a subsequently delivered statement.

5.5 Reconciliation of Expenses. If Tenant’s Share of Expenses as finally determined for the year exceeds the total payments made by Tenant on account thereof, Tenant shall pay Landlord the deficiency within thirty (30) days of Tenant’s receipt of Landlord’s statement. If the total payments made by Tenant on account thereof exceed Tenant’s Share of Expenses as finally determined for the year, Tenant’s excess payment shall be credited toward Tenant’s payment toward Expenses next due under this Lease; provided that Landlord shall reimburse any overpayment of Expenses after the expiration of the Term. For any partial calendar year at the beginning or end of the Term, Tenant’s Share of Expenses shall be prorated on the basis of a 365-day year by

-4-

computing Tenant’s Share for the entire year and then prorating such amount for the number of days during such year included in the Term.

Landlord shall maintain complete and accurate records of all Expenses. Landlord’s records of its Expenses shall be kept using accounting practices consistently maintained on a year-to-year basis, in accordance with good accounting practices, consistently applied. Tenant shall have the right, at Tenant’s expense and no more frequently than once per calendar year, to inspect Landlord’s books and records showing Expenses for the calendar year in question; provided, however, Tenant shall not have the right to withhold any payments of Tenant’s Share of Expenses due and payable hereunder the amount of which may be in dispute, and Tenant must pay the entire amount due and payable hereunder prior to reviewing Landlord’s books and records. In the event Tenant’s inspection of Landlord’s books and records reveals a verifiable error in Landlord’s computation of Tenant’s Share of Expenses resulting in an overpayment by Tenant in excess of five percent (5%) of Tenant’s actual Share of Expenses, Landlord shall promptly reimburse the amount of such overpayment to Tenant, together with interest thereon from the date of overpayment until the date of reimbursement at the Interest Rate. The foregoing notwithstanding, Landlord shall be permitted to dispute Tenant’s determination of actual Expenses prior to its obligation to reimburse Tenant for any overpayment of Expenses.

5.6 Miscellaneous. If Taxes are temporarily reduced as a result of space in the Building (defined in Subsection 2.1) being leased to a tenant that is entitled to an exemption from property taxes or other taxes, then for purposes of determining Taxes for each year in which Taxes are reduced by any such exemption, Taxes for such year shall be calculated on the basis of the amount the Taxes were reduced.

5.7 Payment of Rent. All amounts of Rent shall be paid by Tenant within the time periods as set forth in this Lease without prior notice or demand (unless otherwise set forth herein), or, if no time period is specified, within thirty (30) days after notice from Landlord of the amounts due. All Rent shall be paid without offset, recoupment or deduction (unless otherwise specifically permitted in this Lease and agreed to by Landlord), in lawful money of the United States of America to Landlord at Landlord’s Address for Payment of Rent (defined in Subsection 2.12), or to such other person or at such other place as Landlord may from time to time designate. Tenant’s obligation to pay any amount of Rent accruing during the Term shall survive the expiration or earlier termination of the Lease.

5.8 No “Key Money”. Tenant agrees that Tenant’s obligation to pay all sums owing under this Lease (including, without limitation, any sum payable prior to the Commencement Date, such as any Security Deposit under Section 6, or any sum payable thereafter, such as Base Rent under Subsection 5.1, Direct Costs under Subsection 5.2, Expenses under Subsection 5.3, or Landlord’s fees and costs incurred in connection with any proposed Transfer pursuant to Subsection 16.6), are clearly stated and to Tenant’s knowledge do not violate any applicable Laws.

6. SECURITY DEPOSIT. The parties acknowledge Landlord currently holds the amount of the Security Deposit (defined in Subsection 2.11), in cash, as security for the performance of Tenant’s obligations under this Lease. Landlord may (but shall have no obligation to) use the Security Deposit or any portion thereof to cure any Event of Default under this Lease or to compensate Landlord for any damage, cost, or expense Landlord incurs as a result of Tenant’s failure to perform any of Tenant’s obligations hereunder (including the costs to repair and clean the Premises upon vacation by Tenant to the extent necessary to satisfy Tenant’s obligations set forth in Subsection 21.1). In such event Tenant shall immediately pay to Landlord an amount sufficient to replenish the Security Deposit to the sum initially deposited with Landlord. If Tenant is not in default at the expiration or termination of this Lease, within thirty (30) days from the expiration or termination of this Lease, Landlord shall return to Tenant the Security Deposit or the balance thereof then held by Landlord and not applied as provided above. Landlord may commingle the Security Deposit with Landlord’s general and other funds, and Landlord shall not be required to pay interest on the Security Deposit. Tenant shall not assign or encumber the Security Deposit without the consent of Landlord; any attempt to do so shall be void and not binding on Landlord. If Landlord disposes of its interest in the Premises, Landlord will deliver or credit the Security Deposit to Landlord’s successor in interest and upon such transfer be relieved of all further responsibility with respect to the Security Deposit.

7. ALTERATIONS.

-5-

7.1 Acceptance of Premises. By taking possession of the Premises, Tenant acknowledges and agrees that the Premises are then in good and tenantable condition, and hereby accepts the Premises and all aspects thereof in “AS-IS,” “WHERE-IS” condition and “WITH ALL FAULTS,” subject to the terms and conditions of the Work Letter and any punch list items, if applicable, and Landlord’s maintenance and repair obligations set forth herein. Tenant acknowledges and agrees that, except as specifically provided in this Lease and the Work Letter, Seller and any person acting on behalf of Seller has not made, and Seller hereby specifically disclaims, any warranty, promise, guarantee, and/or representation, oral or written, express or implied, past, present, or future, of, as to, or concerning the Premises, the Building, and the Project in any manner whatsoever.

7.2 Consent. Tenant shall not make any Alterations to the Premises without Landlord’s prior written consent. Landlord may withhold its consent to such Alterations in its sole discretion if (a) the proposed Alterations would adversely affect the structure or safety of the Building, the HVAC, or the Building Systems, (b) lower the value of the Building or the Premises, or (c) the proposed Alterations would create an obligation on Landlord’s part to make modifications to the Building (in order, for example, to comply with laws such as the ADA mandating Building accessibility for persons with disabilities), incur any expense, or be subject to any liability; in all other circumstances, Landlord agrees not to unreasonably withhold or delay its consent to proposed Alterations. Upon request of Landlord, Landlord and Tenant shall enter into a Work Letter pertaining to any Alterations. Any such Alterations shall be completed by Tenant at Tenant’s sole cost and expense. All Alterations performed by Tenant shall be performed in a good workmanlike manner using good materials and in a diligent manner and under the supervision of a licensed architect or structural engineer and made in accordance with plans and specifications approved by Landlord. If any work outside the Premises or any work on or adjustment to any of the Building Systems, is required in connection with or as a result of the Alterations, such work shall be performed at Tenant’s expense by contractors designated by Landlord.

7.3 Liens. Tenant shall keep the Premises and the Property free and clear of all liens arising out of any work performed, materials furnished or obligations incurred by Tenant. If any such lien attaches to the Premises or the Property, and Tenant does not cause the same to be released by payment, bonding or otherwise within thirty (30) days after the attachment thereof, Landlord shall have the right but not the obligation to cause the same to be released, and any sums expended by Landlord in connection therewith shall be payable by Tenant within thirty (30) days of demand with interest thereon from the date of expenditure by Landlord at the Interest Rate. Tenant shall give Landlord at least five (5) days’ notice before Tenant commences any Alterations or Tenant’s Work.

7.4 Trade Fixtures. Subject to the provisions of Section 8 - Use and Compliance with Laws and the foregoing provisions of this Section 7, Tenant may install and maintain Trade Fixtures in the Premises, provided that the Trade Fixtures do not become an integral part of the Premises or the Building. Tenant shall promptly repair any damage to the Premises or the Building caused by any installation or removal of such Trade Fixtures.

7.5 Telecommunications.

(a) Tenant may not install any Telecommunications Facilities on the roof of the Building or in any risers, shafts, equipment rooms or any other part of the Building, except as expressly provided below. If Tenant desires to install, operate or maintain any such telecommunication facilities within the Building and Landlord is willing to permit such installation and operation, Tenant shall enter into a separate Telecommunications License Agreement with Landlord. Notwithstanding the above, Tenant may install, maintain, replace, remove, and use Telecommunications Lines within the Premises, subject to the following: (1) the Telecommunication Lines shall use the existing facilities and telecommunications pathways located within the Premises for such Telecommunications Lines, including any existing equipment and telecommunications rooms or closets and conduits designated by Landlord to service the Premises; (2) Tenant at the origination point, every twenty-five (25) feet thereafter and at the termination point shall label the Telecommunication Lines placed within the Premises and in the telecommunications pathways and in each telecommunications room or closet through which the Telecommunication Lines pass, with identification information including, but not limited to, the floor where cable originates and floor and room where cable terminates, the name of the Tenant, and any other information as may be required by the Building Rules; (3) Tenant shall obtain, at its sole cost and expense, prior to construction and work, any necessary federal, state, and municipal permits, licenses and approvals, copies of which will be delivered to

-6-

Landlord prior to commencement of construction and work; and (4) all Telecommunication Lines shall satisfy all applicable Laws, including building codes, and have sufficient insulation to minimize any Interference. Upon request by Landlord, Tenant shall provide Landlord with detailed plans, schematics, and specifications identifying the Telecommunication Lines located or placed within the Premises. Landlord disclaims all responsibility for the condition or utility of the intra-building cabling network, and makes no representation regarding the suitability of such network for Tenant’s intended use.

(b) The Telecommunications Lines and any other equipment placed within the Premises, including any equipment that uses wireless transmission of data, shall not cause any Interference with other communications, computing, electronic, building or life safety services in the Building or with any other tenant’s or occupant’s use or operation of communications, computer or electronic equipment or devices within or on the Building or neighboring properties. In the event of any Interference, Tenant shall use diligent efforts to immediately remedy the Interference. If Tenant fails to remedy the Interference within forty-eight (48) hours after notice from Landlord, Landlord shall have the right, but not the obligation, to take any reasonable actions to correct the same at Tenant’s expense; provided that Landlord may take immediate action in the event any Interference causes a threat to the safety to persons or the Building or in the event of a viable claim by any third party. Tenant indemnifies, holds harmless and agrees to defend Landlord from any Claims arising from any Interference caused by the use or presence of any Telecommunications Facilities or other equipment or devices that may be placed within the Premises or the Building by Tenant or Tenant’s Representatives.

(c) Tenant, at its sole cost and expense, shall maintain and repair the Telecommunication Lines exclusively servicing the Premises from the demarcation point into the Building, including within the Premises. Tenant shall remove all such Telecommunication Lines on or before the expiration or earlier termination of this Lease. If Tenant fails to remove any such Telecommunication Lines, Landlord, at is sole option, may remove such s Telecommunication Lines at Tenant’s expense. If Landlord elects not to remove such Telecommunication Lines, such Telecommunication Lines shall be deemed abandoned and become the property of Landlord. Tenant shall not, without the prior written consent of Landlord in each instance, grant to any third party a security interest or lien in or on such Telecommunication Lines, and any such security interest or lien granted without Landlord’s written consent shall be null and void.

8. USE AND COMPLIANCE WITH LAWS.

8.1 Use. The Premises shall be used solely for the Permitted Use (defined in Subsection 2.3) and for no other use or purpose. Tenant shall comply with all present and future Laws relating to Tenant’s use or occupancy of the Premises, and shall make any repairs, alterations or improvements to the Building as required to comply with all such Laws to the extent that such Laws relate to or are triggered by: (a) Tenant’s particular use of the Premises, (b) the Improvements, or (c) any Alterations. Tenant shall observe all Building Rules. Tenant shall not do, bring, keep or sell anything in or about the Premises that is prohibited by, or that will cause a cancellation of or an increase in the existing premium for, any insurance policy covering the Building or any part thereof. Tenant shall not permit the Premises to be occupied or used in any manner that will constitute waste or a nuisance, or disturb the quiet enjoyment of or otherwise unreasonably disturb other tenants in the Building. Tenant shall not, without the prior consent of Landlord, (i) bring into the Building or the Premises anything that may cause substantial noise, odor or vibration, overload the floors in the Premises or the Building or any of the HVAC, the Building Systems, or jeopardize the structural integrity of the Building or any part thereof; (ii) connect to the utility systems of the Building any apparatus, machinery or other equipment other than typical office equipment; or (iii) connect (directly, or indirectly through use of intermediate devices, electrified strip molding, or otherwise) to any electrical circuit in the Premises any equipment or other load with aggregate connected load requirements in excess of 20 amps; or (iv) place any signs or placard on the exterior of the Premises, the Building or within any window without the prior written consent of Landlord.

8.2 Hazardous Materials. To Landlord’s Knowledge, the Premises are in compliance with all Environmental Requirements as of the Commencement Date of Term. Tenant shall not cause or permit any Hazardous Materials to be generated, brought onto, used, stored, or disposed of in or about the Premises or the Building by Tenant or Tenant’s Representatives or Visitors except for deminimus quantities of substances that are normally associated with general office duties (such as copier fluids and cleaning supplies) or which are otherwise

-7-

approved by Landlord. Tenant shall use, store, transport and/or dispose of all such Hazardous Materials in strict compliance with all Environmental Requirements, and shall comply at all times during the Term with all Environmental Requirements.

8.3 Prohibited Activities. Tenant shall not do or allow any of the following acts to be done or conditions to exist upon the Premises: (a) any violation of any Law concerning the use and safety of the Premises as such Laws now exist or may hereafter be established or amended; (b) any public or private nuisance; (c) the practice of medicine or any of the healing arts, unless otherwise granted in Subsection 2.3; (d) the sale or promotion of alcoholic beverages, marijuana, tobacco products, or illicit drugs; (e) the sale, rental, display, or distribution of any sexually explicit or morally inappropriate (as determined by Landlord in its sole discretion) or pornographic, lewd, obscene, or adult-oriented material; (f) gambling; (g) any smoking within the Building or on the Property; (h) overnight sleeping; and (i) any use or occupancy by a governmental entity or governmental contractor. Notwithstanding anything in this Lease to the contrary, in Landlord’s discretion, the common areas in the Building and any ground floor retail spaces shall not be open or available for use by the public, customers or clients on Sundays. If Tenant or Tenant’s business operations results in any protests, riots, or disturbance of the peace, which shall not include the lawful exercise of First Amendment rights, Landlord, in its sole and absolute discretion, shall have the right to: (1) require Tenant to cease business operations for a reasonable period of time to cease such disturbance, in which event Rent payable hereunder shall not abate; or (2) if such disturbance continues for a period of at least five (5) Business Days from the date of Landlord’s notice to cease operations, such disturbance shall constitute an Event of Default (with no additional notice required to be given, notwithstanding the terms of Subsection 17.1 below), and Landlord may immediately terminate this Lease.

8.4 Governmental Use. As a material condition of this Lease, Tenant represents and warrants that: (1) it is not a federal governmental entity or instrumentality, nor that the Premises will be used to support a federal government contract or subcontract whereby the Tenant would be considered a federal government contractor or subcontractor in the context of this Lease, (2) this Lease is not, and shall not be, or considered to be, a governmental contract, subcontract or third party contract, and (3) by entering into this Lease Landlord does not become a subrecipient, a subgrantee, a project participant, or a third party contractor or subcontractor. In the event, (a) this Lease is considered or alleged to be a federal government contract, subcontract or third party contract, or (b) Landlord is considered or alleged to be a subrecipient, a subgrantee, a project participant, a third party contractor, or a government contractor or subcontractor under federal contracting law, or (c) if due to this Lease Landlord, the Premises or the Building become or is alleged to become subject to any federal laws, statutes, rules or regulations, including, without limitation, any civil rights statutes, such as Title VI and VII of the Civil Rights Act, Executive Order 11246, as amended, 29 U.S.C. Section 793, et seq., 38. U.S.C. Section 4212, et. seq., 41 U.S.C. Section 601, et. seq., or the regulations promulgated in 41 C.F.R. 60-1 or 41 C.F.R. 60-2, and/or any other laws, rules, or regulations that would impose any obligation on Landlord to comply with any affirmative action, equal opportunity, or similar program required of federal or state government contractors and subcontractors arising from this Lease, the relationship with Tenant or Tenant’s use of the Premises, Tenant shall be in default of this Lease and this Lease shall, at the option of Landlord, terminate. Notwithstanding the above, Landlord, in its sole and absolute discretion, shall have the right to waive such default and/or the termination of the Lease. Nothing herein shall prevent Landlord from pursuing any other rights or remedies that it may pursue in the event of a default of this Lease.

9. MAINTENANCE AND REPAIRS.

9.1 Landlord’s Maintenance Obligations. During the Term, Landlord shall maintain or cause to be maintained in reasonably good order, condition and repair, the roof, foundations, exterior walls of the Building, the Building Systems (except for the portion of such systems installed by Tenant and/or located within the Premises and exclusively servicing the Premises), and the public and common areas of the Property. Tenant shall pay the cost of repairs for damage occasioned by Tenant’s use of the Premises or the Property or any act or omission of Tenant or Tenant’s Representatives or Visitors, and such costs may be billed to Tenant as Direct Costs. Tenant shall promptly report in writing to Landlord any defective condition known to Tenant which Landlord is required to repair. The costs incurred by Landlord to maintain and repair the Building as set forth herein may be included as part of the Operating Costs.

-8-

9.2 Tenant’s Maintenance Obligations. During the Term, Tenant at Tenant’s expense but under the direction of Landlord, shall maintain and repair the Premises, including, but not limited to any and all Improvements, Alterations, Trade Fixtures, Telecommunications Facilities, and any appliances, such as dishwashers, hot water heaters, refrigerators, garbage disposers, and any Dedicated HVAC Unit (as defined in Subsection 11.2(d) below), in or servicing the Premises, and Tenant’s personal property and inventory, in good order and condition, and keep the Premises in a clean, safe and orderly condition.

9.3 Landlord’s Rights. Landlord hereby reserves the right, at any time and from time to time, without liability to Tenant and provided such changes do not materially interfere with or adversely impact Tenant’s access to the Building or Tenant’s use of the Premises: (a) to make alterations, additions, repairs, improvements to or in all or any part of the Building, the fixtures and equipment therein, and the Building Systems; (b) to change the Building’s name or street address; (c) to install and maintain any and all signs on the exterior and interior of the Building; (d) to reduce, increase, enclose or otherwise change the size, number, location, lay-out and nature of the common areas and other tenancies and premises in the Building and to create additional rentable areas through use or enclosure of common areas; and (e) to comply with any Governmental Controls, whether mandatory or voluntary, and make any alterations to the Building related thereto.

If Landlord performs any activity on a floor of the Building where the Tenant is located, Landlord will provide Tenant with reasonable prior notice of such activity. Landlord’s performance of the above activities shall not constitute an eviction, constructive or otherwise, and Tenant shall not be entitled to any abatement of Rent, to terminate this Lease, nor to any waiver or release of Tenant’s obligations under this Lease as a result thereof.

10. TENANT’S TAXES. Tenant shall pay all Tenant’s Taxes before delinquency (and, at Landlord’s request, shall furnish Landlord satisfactory evidence thereof). If Tenant fails to pay such Taxes before delinquency, Landlord may thereafter pay Tenant’s Taxes or any portion thereof, whereupon Tenant shall reimburse Landlord upon demand for the amount of such payment, together with interest at the Interest Rate from the date of Landlord’s payment to the date of Tenant’s reimbursement. In addition, if any Rental Taxes are due and payable, Tenant shall pay any Rental Tax to Landlord in addition to and at the same time as Base Rent is payable under this Lease.

11. UTILITIES AND SERVICES.

11.1 Description of Services. Landlord shall make available to the Premises reasonable amounts of electricity, water, heat and air-conditioning, and janitorial service, and sewer and water service to any restrooms and/or break rooms in the Premises. Landlord shall also furnish Building Standard fluorescent tube replacement, window washing, elevator service, and toilet room supplies. Landlord shall furnish heat, ventilation and air-conditioning during Business Hours. The cost incurred by Landlord to provide such services shall be included as part of the Operating Costs. Any additional utilities or services that Landlord may agree to provide (including lamp or tube replacement for Improvements) shall be at Tenant’s sole expense.

11.2 Payment for Additional Utilities and Services.

(a) Upon request by Tenant in accordance with the procedures established by Landlord from time to time, Landlord shall furnish such HVAC service to Tenant at times other than during Business Hours and Tenant shall pay for such services on an hourly basis at the then prevailing rate established for the Building by Landlord.

(b) If the temperature otherwise maintained in any portion of the Premises by the HVAC systems of the Building exceeds the capacity provided by the Building Standard as a result of (1) any Improvements (i.e., lights, machines or equipment) used by Tenant in the Premises, or (2) the occupancy of the Premises by more than one person per 150 RSF, then Landlord shall have the right to install any machinery or equipment reasonably necessary to restore the temperature, including modifications to the Building Standard air-conditioning equipment to the extent following notice from Landlord and Tenant fails to take action necessary to correct the same. The cost of any such equipment and modifications, including the cost of installation and any additional cost of operation and maintenance of the same, shall be paid by Tenant to Landlord within thirty (30) days of invoice.

-9-

(c) If Tenant’s usage of electricity exceeds the Building’s standard electrical usage, Landlord may determine the amount of such excess use by any reasonable means (including the installation at Landlord’s request but at Tenant’s expense of a separate meter or other measuring device) and charge Tenant for the cost of such excess usage. In addition, Landlord may impose a reasonable charge for the use of any additional or unusual janitorial services required by Tenant because of any unusual Improvements or Alterations, the carelessness of Tenant or the nature of Tenant’s business (including hours of operation).

(d) If there is any Dedicated HVAC Unit, HVAC or other cooling system located in the Premises that is dedicated to Tenant’s computers or other equipment, Landlord may determine the amount of gas, electricity or other utility costs attributable to such Dedicated HVAC Unit by any reasonable means (including the installation by Landlord but at Tenant’s expense of a separate meter or other measuring device) and charge Tenant for such cost.

(e) Tenant acknowledges that Landlord’s obligations pursuant to Subsection 11.1 to provide janitorial services to the Premises excludes any portions of the Premises not used as office areas (e.g., closets, storage rooms, mailrooms, computer areas, laboratories, and areas used for the storage, preparation, service, or consumption of food or beverages). Tenant, at its sole cost and expense, shall cause all portions of the Premises not used as office areas to be cleaned on a regular basis in a manner and by a person or entity satisfactory to Landlord. Tenant shall contract directly with Landlord or, at Landlord’s option, directly with Landlord’s contractor for cleaning services in excess of those furnished by Landlord in accordance with this Lease.

11.3 Interruption of Services. In the event of a Service Failure, the Service Failure shall not, regardless of its duration or cause (except as otherwise provided herein): (a) impose upon Landlord any liability whatsoever, (b) constitute an eviction of Tenant, constructive or otherwise, (c) entitle Tenant to an abatement of Rent or to terminate this Lease, or (d) otherwise release Tenant from any of Tenant’s obligations under this Lease; provided, however, if a Service Failure occurs during Business Hours and is caused by the gross negligence or willful misconduct of Landlord and Tenant cannot and does not conduct business operations in the Premises, Tenant shall be entitled to an abatement of Base Rent commencing as of the fifth (5th) consecutive Business Day of such Service Failure and ceasing upon the date the Service Failure ceases or Tenant recommences operations within the Premises. If the Service Failure continues more than thirty (30) consecutive days and (i) the failure or delay is not the result of a casualty or condemnation, (ii) the repair of such service is within Landlord’s reasonable control and (iii) Landlord is not diligently pursuing such repair, then Tenant may terminate this Lease on that date ten (10) days after Landlord’s receipt of written notice to Landlord from Tenant given immediately after such thirty (30) day period, provided if Landlord cures such Service Failure within such ten (10) day period, Tenant’s termination notice shall be of no force and effect. Except as provided above, Tenant waives and releases any and all Claims against Landlord associated with a Service Failure, including, without limitation, any consequential or special damages. Landlord shall use good faith and diligent efforts to cure any Service Failure and restore service and utilities to the Premises.

11.4 Utility Providers. Landlord may, in Landlord’s sole and absolute discretion, at any time and from time to time, contract, or require Tenant to contract, for utility services (including generation, transmission, or delivery of the utility service) with a utility service provider of Landlord’s choosing; provided, however, before contracting with an alternative utility service provider, Landlord shall use good faith efforts to ensure that such service provider’s rates shall be customary and in line with rates for the market area. Tenant shall fully cooperate with Landlord and any utility service provider selected by Landlord. Tenant shall permit Landlord and the utility service provider to have reasonable access to the Premises and the utility equipment serving the Premises, including lines, feeders, risers, wiring, pipes, and meters. Tenant shall either pay or reimburse Landlord for all costs associated with any change of utility service, including the cost of any new utility equipment, within ten (10) days after Landlord’s written demand for payment or reimbursement. Except as otherwise provided for herein, unless due to Landlord, its agents or employee’s negligence or willful misconduct, Landlord shall not be responsible or liable for any loss, damage, or expense that Tenant may incur as a result of any change of utility service, including any change that makes the utility supplied less suitable for Tenant’s needs, or for any failure, interference, or defect in any utility service. No such change, failure, interference, or defect shall constitute an actual or constructive eviction of Tenant, or entitle Tenant to any abatement of rent, or relieve Tenant from any of Tenant’s obligations under this Lease.

-10-

12. RELEASE AND INDEMNIFICATION.

12.1 Release. Landlord and Landlord Parties shall not be liable to Tenant for any loss, harm, or damage to any property (including Tenant’s property) in or about the Premises or the Building from any cause whatsoever, (including, but not limited to: defects in the Building or in any equipment in the Building; fire, explosion or other casualty; bursting, rupture, leakage or overflow of any plumbing or other pipes or lines, sprinklers, tanks, drains, drinking fountains or wash stands in, above, or about the Premises or the Building; or acts of other tenants in the Building), except for loss, harm or damage arising from the gross negligent or intentional misconduct of Landlord or Landlord’s employees acting within the scope of their employment. In addition, Landlord and Landlord Parties shall not be liable to Tenant for any bodily injury in or about the Premises or the Building from any cause (including the acts of other tenants or their agents, servants, contractors, employees, guests or invitees), except for bodily injury arising from the sole negligence or intentional misconduct of Landlord or Landlord’s employees acting within the scope of their employment. Tenant hereby releases and waives all Claims against Landlord and Landlord Parties for any such loss, harm, damage, and/or injury and the cost and expense of defending against such Claims, provided that Tenant does not release Landlord from any Claims for loss, harm or damage to any property (including Tenant’s Property) arising from the gross negligent or intentional misconduct of Landlord or Landlord’s employees acting within the scope of their employment or for bodily injury arising from the sole negligence or intentional misconduct of Landlord or Landlord’s employees acting within the scope of their employment. In no event, however, shall Landlord or Landlord Parties be liable to Tenant for any punitive or consequential damages or damages for loss of business by Tenant. The terms of this Subsection 12.1 shall not relieve Landlord of its obligations under Subsection 14.1 of this Lease.

12.2 Indemnification. Tenant shall indemnify, defend and hold Landlord and Landlord Parties harmless for, from and against Claims arising from: (a) the acts or omissions of Tenant or Tenant’s Representatives or Visitors in or about the Property, (b) Tenant’s use or occupancy of the Premises, or (c) any construction or other work undertaken by Tenant on the Premises (including any design defects), or (d) any breach or default under this Lease by Tenant, or (e) any accident, injury or damage to any person or property, occurring in or about the Premises during the Term regardless of the cause; except that Tenant does not indemnify Landlord from any Claims for bodily injury solely arising from the negligent acts or omissions of Landlord or its authorized representatives. Subject to Tenant’s indemnification obligations above, Landlord shall indemnify, defend and hold Tenant harmless from and against Claims solely arising from the negligent acts or omissions of Landlord or Landlord’s Representatives resulting in any harm or injury to persons in or about the Property; except that Landlord does not indemnify Tenant from any Claims for personal injury arising in any degree from the negligent acts or omissions of Tenant, Tenant’s Representatives or Visitors. Tenant’s indemnification obligation is independent of Tenant’s obligation to maintain insurance, and the minimum limits on Tenant’s insurance coverage set forth in this Lease shall not limit the Tenant’s indemnification obligations under this Lease.

12.3 Miscellaneous. The obligations of the parties under this Section 12 (a) are independent of, and will not be limited by, each other or any insurance obligations set forth in this Lease or comparative negligence statutes or principles or damages or benefits payable under workers compensation or other employee benefit acts, and (b) shall survive the expiration or earlier termination or this Lease until such time as all related Claims against the benefited parties are fully and finally barred by applicable laws. All applicable Laws affecting the validity or enforceability of any portion of the waivers, releases and indemnities contained in this Section 12 are made a part of this Section 12, Release and Indemnification, and will operate to amend such obligations to the minimum extent necessary to bring the provisions into conformity with applicable Laws and cause the provisions, as modified, to continue in full force and effect.

13. INSURANCE.

13.1 Tenant’s Insurance.

(a) Tenant shall maintain in full force throughout the Term, commercial general liability insurance providing coverage on an occurrence basis with limits of not less than Two Million Dollars ($2,000,000.00) each occurrence; Two Million Dollars ($2,000,000.00) annual general aggregate, Two Million Dollars ($2,000,000.00) products and completed operations annual aggregate. Tenant’s liability insurance policy or

-11-

policies shall: (1) be on ISO form CG 00 01 12 04 or equivalent, (2) include premises and operations liability coverage, products and completed operations liability coverage, broad form property damage coverage including completed operations, blanket contractual liability coverage, and personal and advertising injury coverage; (3) provide that the insurance company has the duty to defend all insureds under the policy or policies (separation of insured language will not be modified); (4) provide that defense costs are paid in addition to and do not deplete any of the policy(ies) limits; and (5) cover liabilities arising out of or incurred in connection with Tenant’s use or occupancy of the Premises or the Property.

(b) Intentionally deleted

(c) Tenant shall at all times maintain in effect with respect to any Alterations, Improvements, Trade Fixtures and Tenant’s goods, inventory and personal property, commercial property insurance (cause of loss – special form) (formerly “all-risk”) providing coverage for one-hundred percent (100%) of the full replacement cost of the covered property. Tenant’s commercial property insurance policy or policies shall: (1) be on ISO form CP 10 30 or equivalent, (2) name Landlord and any Mortgagee (if notified by Landlord) as “insured as its interest may appear,” (3) contain only standard printed exclusions, (4) contain an ordinance of law coverage endorsement; and (5) contain an equipment floater to cover Tenant’s Trade Fixtures and equipment. Tenant may carry such insurance under a blanket policy, provided that such policy provides equivalent coverage to a separate policy. During the Term, the proceeds from any such policies of insurance shall be used for the repair or replacement of the Alterations, Improvements, Trade Fixtures and Tenant’s goods, inventory and personal property so insured. Landlord shall be provided coverage under such insurance to the extent of its insurable interest and, if requested by Landlord, both Landlord and Tenant shall sign all documents reasonably necessary or proper in connection with the settlement of any claim or loss under such insurance. Landlord will have no obligation to carry insurance on any Alterations, Improvements, Trade Fixtures, or Tenant’s goods, inventory and personal property.

(d) Beginning on the date Tenant is given access to the Premises for any purpose and continuing until expiration of the Term, Tenant shall procure, pay for and maintain in effect Workers’ Compensation Insurance for all of its employees who work at or visit the Premises and Employers Liability Insurance with coverage and minimum limits of the greater of: (i) bodily injury by accident ($500,000.00 each accident); (ii) bodily injury by disease ($500,000 policy limit); and (iii) bodily injury by disease ($500,000 each employee).

(e) Beginning on the Commencement Date of the Term and continuing throughout the Term, Tenant shall maintain a policy of Business Interruption Insurance and Extra Expense Insurance covering at least a one-year period. Such policy shall contain an endorsement covering losses arising from interruption of utilities outside the Premises and a waiver of subrogation in favor of Landlord and Property Manager and any Mortgagee (if requested by Landlord).

(f) Each policy of insurance required under this Section 13 shall: (1) be in a form, and written by an insurer, reasonably acceptable to Landlord, (2) be maintained at Tenant’s sole cost and expense, and (3) be endorsed as primary with the policies of Landlord, Property Manager and any Mortgagee (if requested by Landlord) being excess, secondary and noncontributing; (4) unless the Tenant’s right to waiver subrogation is permitted in the insurance policy, be endorsed to provide a waiver of subrogation in favor of Landlord and Landlord Parties; (5) require at least thirty (30) days’ written notice to Landlord prior to any cancellation, non-renewal or modification of insurance coverage; and (6) be issued by insurance companies that have rating classifications of “A” or better and financial size category ratings of “VIII” or better according to the latest edition of the A.M. Best Key Rating Guide. All insurance companies issuing such policies shall be licensed to do business in the state where the Property is located. Any deductible amount under such insurance shall not exceed Twenty Thousand Dollars ($20,000.00). Tenant shall provide to Landlord, upon request, evidence that the insurance required to be carried by Tenant pursuant to this Section 13, including any endorsement affecting the additional insured status, is in full force and effect and that premiums therefor have been paid.

(g) Each policy of commercial general liability insurance required by Subsection 13.1(a) shall: (1) contain a cross liability endorsement or separation of insureds clause; (2) provide that any waiver of subrogation rights or release prior to a loss does not void coverage; (3) provide that any failure to comply with the reporting provisions shall not affect coverage provided to Landlord, the Property Manager, and any Mortgagee; (4)

-12-

provide that the coverage is available in the aggregate to the Premises pursuant to a CG 25 04 endorsement or an equivalent endorsement acceptable to Landlord; and (5) name Landlord, the Property Manager, and any Mortgagee (if requested by Landlord) and such other parties in interest as Landlord may from time to time reasonably designate to Tenant in writing, as additional insureds. All endorsements creating such additional insured status shall be acceptable to Landlord and shall be at least as broad as additional insured endorsement form number CG 20 11 01 96 promulgated by the Insurance Services Office.

(h) A review of the Tenant’s insurance requirement shall be made periodically, but, not more frequently than once every three (3) years. If any Mortgagee or Landlord’s insurance broker or other risk management consultant determines in the opinion of any of them that the amount of insurance then required under this Lease is not adequate, Tenant agrees to increase the amounts and limits of insurance as recommended by such professionals or any Mortgagee.

(i) Prior to occupancy of the Premises by Tenant, and not less than thirty (30) days prior to expiration of any policy thereafter, Tenant shall furnish to Landlord a certificate of insurance in the form of: (a) ACORD™ Form 25-S (1/95) (or its replacement) Certificates of Liability Insurance for liability coverages accompanied by the endorsement form CG 20 11 01 96 and the endorsement form 25 04 as referred to in (g) above, showing the required additional insureds satisfactory to Landlord in substance and form, and (b) ACORD™ Form 28 (or its replacement) Evidence of Property Insurance for property coverages. Each certificate of insurance must: (i) show the Landlord, the Property Manager and any Mortgagee (if requested by Landlord) as certificate holders (with Landlord’s mailing address); (ii) show Tenant as the “Named Insured,” (iii) show the insurance companies producing each coverage and the policy number and policy date of each coverage; (iv) name the producer of the certificate (with correct address and telephone number) and have the signature of the authorized representative of the producer; (v) specify the additional insured status (on ACORD™ Form 45) and/or waivers of subrogation; (vi) show the amounts of all deductibles and self-insured retentions; (vii) show the primary status and aggregate limit per project where required; and (viii) the phrases “endeavor” and “but failure to mail such notice will impose no obligation or liability of any kind upon Company, its agents or representatives” are deleted from the cancellation provision of the ACORD™ Form 25 certificate and the following express provision added: “This is to certify that the policies of insurance described herein have been issued to the Insured for whom this certificate is executed and are in force at this time. In the event of cancellation, non-renewal, or material reduction in coverage affecting the certificate holder, 30 days’ prior written notice will be given to the certificate holder by certified mail or registered mail, return receipt requested.” If the insurance carrier is unwilling to provide such certification, Tenant shall provide Landlord with thirty (30) days’ prior written notice of the modification or cancellation of Tenant’s insurance policies. Notwithstanding the requirements of this paragraph, Tenant shall at Landlord’s request provide to Landlord a complete copy of each insurance policy required to be in force at any time pursuant to the requirements of this Lease or its Exhibits.

13.2 Insurance Coverage During Construction. Intentionally Deleted

13.3 Landlord’s Insurance. Landlord may manage a program of alternative risk transfer related to risk of harm, loss or damage to the Building and the Property to the extent and degree that Landlord deems necessary in Landlord’s reasonable judgment. Landlord’s risk management program may include elements of traditional insurance, self-insurance, large deductibles, or risk assumption. The cost of Landlord’s risk management program shall be deemed to be the cost of obtaining and managing an insurance policy covering the risk managed or assumed by Landlord, which cost shall be determined by an estimate or quote from a reputable insurance company regarding such insurance coverage. The cost of Landlord’s risk management program, as determined above, shall be deemed the cost of insurance for expense reimbursement purposes and Landlord may, in its discretion, include such costs as part of Expenses. Landlord shall not be required to carry insurance of any kind on Tenant’s personal property, and shall not be obligated to repair any damage thereto or replace the same for any reason.

13.4 Property Insurance - Waiver of Subrogation. Landlord and Tenant each hereby waive any right of recovery against the other(s) (Tenant’s waiver of subrogation shall be in favor of Landlord and Property Manager and any Mortgagee (if notified by Landlord) and the partners, members, shareholders, officers, directors and authorized representatives of the other for any loss or damage that is covered by any policy of property insurance

-13-

maintained by either party (or required by this Lease to be maintained) with respect to the Premises or the Building or any operation therein. If any such policy of insurance relating to this Lease or to the Premises or the Building does not permit the foregoing waiver or if the coverage under any such policy would be invalidated as a result of such waiver, the party maintaining such policy shall obtain from the insurer under such policy a waiver of all right of recovery by way of subrogation against either party in connection with any claim, loss or damage covered by such policy.

14. DAMAGE OR DESTRUCTION.

14.1 Landlord’s Duty to Repair

(a) If all or a substantial part of the Premises are rendered untenantable or inaccessible by damage to any part of the Property from fire or other casualty then, unless either party is entitled to and elects to terminate this Lease pursuant to Subsection 14.3 - Landlord’s Right to Terminate and 14.4—Tenant’s Right to Terminate, Landlord shall, at its expense, use reasonable efforts to repair and restore the Premises and/or the Building, as the case may be, to substantially their former condition to the extent permitted by then applicable Laws; provided, however, that in no event shall Landlord have any obligation for repair or restoration beyond the extent of insurance proceeds received by Landlord for such repair or restoration, or for any Alterations, Improvements, Trade Fixtures or Tenant’s goods, inventory and personal property.

(b) If Landlord is required or elects to repair damage to the Premises and/or the Building, this Lease shall continue in effect. Tenant hereby acknowledges and agrees that Tenant may obtain business interruption insurance to mitigate against the risk of damage or destruction of the Premises or the Building. If Tenant is prevented from using any portion of the Premises by reason of such damage or its repair or due to damage to any fixtures or equipment within the Premises, Rent shall not abate. In no event shall Landlord be liable to Tenant by reason of any injury to or interference with Tenant’s business or property arising from fire or other casualty or by reason of any repairs to any part of the Property necessitated by such casualty.

14.2 Tenant’s Duty to Repair. If any Alterations, Improvements, Trade Fixtures or Tenant’s goods, inventory or personal property is damaged or destroyed, Tenant shall repair and/or replace such damaged items as soon as possible after the restoration of the Premises.

14.3 Landlord’s Right to Terminate. Landlord may elect to terminate this Lease following damage by fire or other casualty under the following circumstances:

(a) If, in the reasonable judgment of Landlord, the Premises and the Building cannot be substantially repaired and restored under applicable Laws within one hundred eighty (180) days from the date of the casualty;

(b) If, in the reasonable judgment of Landlord, adequate proceeds are not, for any reason, made available to Landlord from Landlord’s insurance policies (and/or from Landlord’s funds made available for such purpose, at Landlord’s sole option) to make the required repairs; provided that Landlord has maintained the insurance coverage required by this Lease;

(c) If the Building is damaged or destroyed to the extent that, in the reasonable judgment of Landlord, the cost to repair and restore the Building would exceed twenty-five percent (25%) of the full replacement cost of the Building, whether or not the Premises are at all damaged or destroyed; or

(d) If the fire or other casualty occurs during the last two (2) years of the Term.

If any of the circumstances described in subparagraphs (a), (b), (c) or (d) of this Subsection 14.3 occur or arise, Landlord shall notify Tenant in writing of that fact within one hundred twenty (120) days after the date of the casualty and in such notice Landlord shall also advise Tenant whether Landlord has elected to terminate this Lease as provided above; provided, however, Landlord shall provide such notice to Tenant within sixty (60) days if the damage to the Building is not structural in nature and concerns less then twenty-five percent (25%) of the Building.

-14-

If Landlord elects not to terminate this Lease, Landlord will specify in such notice the estimated completion date of the restoration of the Premises and/or the Building. Tenant acknowledges and agrees that any estimate of the completion date to repair and restore the Premises and Building is an estimate subject to force majeure. Tenant releases Landlord from any damages or Claims and waives any right to terminate this Lease if the completion date of such restoration exceeds the estimated completion date.

14.4 Tenant’s Right to Terminate. If all or a substantial part of the Premises are rendered untenantable or inaccessible by damage to all or any part of the Property from fire or other casualty, then Tenant may elect to terminate this Lease under the following circumstances:

(a) Where Landlord fails to commence the required repairs within one hundred and twenty (120) days after the date of the casualty, in which event Tenant may elect to terminate this Lease upon notice to Landlord given within ten (10) days after such one hundred and twenty (120) day period; or

(b) If the estimated completion date of the restoration of the Premises and/or the Building is in excess of one (1) year from the date of the casualty, in which event Tenant may elect to terminate this Lease by giving Landlord notice of such election to terminate within ten (10) days after Landlord’s notice to Tenant pursuant to Subsection 14.3 - Landlord’s Right to Terminate.

14.5 Waiver. Intentionally deleted.

15. CONDEMNATION.

15.1 Effect on Lease. If the Premises, or any portion thereof, are taken by Condemnation, this Lease shall terminate as of the Date of Condemnation as to that portion of the Premises that is taken. If the portion of the Premises remaining after the Condemnation is unsuitable for Tenant’s continued use as reasonably determined by the parties, then Tenant may terminate this Lease upon thirty (30) days’ written notice to Landlord after the Date of Condemnation. If the entire Premises is not taken and the Lease is not terminated by Tenant as provided herein, this Lease shall remain in effect and Landlord shall diligently proceed to repair and restore the Premises to an architecturally complete office space; provided, however, that Landlord’s obligations to so repair and restore shall be limited to the amount of any Award received by Landlord and not required to be paid to any Mortgagee. Landlord shall not be obligated to repair or replace any Alterations, Improvements, Trade Fixtures, or Tenant’s goods, inventory or personal property. From and after the Date of Condemnation, Tenant shall not be obligated to pay any Rent applicable to such portion of the Premises taken based upon the percentage of RSF in the Premises so taken from and after the Date of Condemnation.

15.2 Awards. Any Award made shall be paid to Landlord, and Tenant hereby assigns to Landlord, and waives all interest in or claim to, any such Award, including any claim for the value of the unexpired Term; provided, however, that Tenant shall be entitled to receive, or to prosecute a separate claim for, an Award for a temporary taking of the Premises or a portion thereof by a Condemnor where this Lease is not terminated (to the extent such Award relates to the unexpired Term), or an Award or portion thereof separately designated for relocation expenses of, or for the interruption of or damage to Tenant’s business or as compensation for Trade Fixtures and Tenant’s personal property.

15.3 Waiver. Intentionally deleted.

16. ASSIGNMENT AND SUBLETTING.

16.1 Landlord’s Consent Required. Tenant shall not Transfer this Lease nor any part of the Premises, without the prior written consent of Landlord, which (subject to the other provisions of this Section 16) shall not be unreasonably withheld. If Tenant is a business entity, any direct or indirect transfer of fifty percent (50%) or more of the ownership interest of the entity (whether in a single transaction or in the aggregate through more than one transaction) shall be deemed a Transfer. Notwithstanding any provision in this Lease to the contrary, Tenant shall not mortgage, pledge, hypothecate or otherwise encumber all or any portion of Tenant’s interest under this Lease. In

-15-

addition, Tenant shall not make any Transfer to a Prohibited Person and any Transferee shall make the representation and warranty contained in Section 39 hereof to Landlord and Tenant in any Transfer document.

16.2 Reasonable Consent.

(a) If Tenant complies with the following conditions, Landlord shall not unreasonably withhold its consent to the subletting of the Premises or any portion thereof or the assignment of this Lease. Prior to any proposed Transfer, Tenant shall submit in writing to Landlord (1) the name and legal composition of the proposed Transferee; (2) the nature of the business proposed to be carried on in the Premises; (3) a current balance sheet, income statements for the last two years and such other reasonable financial and other information concerning the proposed Transferee as Landlord may request; and (4) a copy of the proposed assignment, sublease or other agreement governing the proposed Transfer, which must contain the following: (i) Transferee’s waiver, release and indemnification of Landlord as set forth in Section 12; (ii) representation and indemnification of Landlord consistent with Section 39; and (iii) Transferee’s agreement to maintain the insurance required by Section 13, including endorsing Landlord as an additional insured on Transferee’s liability insurance policy. Within fifteen (15) days after Landlord receives all such information it shall notify Tenant whether it approves or disapproves such Transfer or if it elects to proceed under Subsection 16.8 - Landlord’s Right to Space.

(b) The parties hereto agree and acknowledge that, among other circumstances for which Landlord could reasonably withhold consent to a proposed Transfer, it shall be reasonable for Landlord to withhold consent where (1) the proposed Transferee does not intend itself to occupy the entire portion of the Premises assigned or sublet, (2) Landlord reasonably disapproves of the Transferee’s business operating ability or history, reputation or creditworthiness or the character of the business to be conducted by the Transferee at the Premises, (3) the Transferee is a governmental agency or unit or an existing tenant in the Building, (4) the proposed Transfer would violate any exclusive rights of any tenants in the Building, (5) the rental and other consideration payable by the Transferee is less than that currently being paid by tenants under new leases of comparable space in the Building, (6) the Transferee’s financial strength is less than the financial strength of Tenant, (7) the proposed use does not conform to the Permitted Use, or (8) Landlord otherwise determines that the proposed Transfer would have the effect of decreasing the value of the Building or increasing the expenses associated with operating, maintaining and repairing the Building.

16.3 Advertisement. Tenant shall not publicly offer or advertise all or any portion of the Premises for assignment or sublease at a Rent less than that then being sought by Landlord for a direct lease (non-sublease) of comparable space in the Building.

16.4 Excess Consideration. If Landlord consents to the assignment or sublease, Landlord shall be entitled to receive as increased Rent hereunder an amount equal to fifty percent (50%) of the amount (if any) by which the total value of (a) any consideration paid by the Transferee for the assignment or sublease and, in the case of a sublease, the excess of the rent and other consideration payable by the subtenant over the amount of Base Rent and Additional Rent payable hereunder applicable to the subleased space, exceeds (b) the reasonable direct, out-of-pocket costs (such as, but not necessarily limited to, reasonable brokerage commissions, tenant improvement costs, attorneys’ fees, and other cash concessions as may be typical, reasonable and appropriate under then prevailing conditions) actually and necessarily paid by Tenant to third parties not affiliated with Tenant to procure the assignment or sublease.

16.5 No Release of Tenant. Unless granted to Tenant by Landlord in writing, no consent by Landlord to any Transfer shall relieve Tenant of any obligation to be performed by Tenant under this Lease, whether occurring before or after such consent, assignment, subletting or other Transfer. Each Transferee shall be jointly and severally liable with Tenant (and Tenant shall be jointly and severally liable with each Transferee) for the payment of Rent (or, in the case of a sublease, rent in the amount set forth in the sublease) and for the performance of all other terms and provisions of this Lease. The consent by Landlord to any Transfer shall not relieve Tenant or any such Transferee from the obligation to obtain Landlord’s prior written consent to any subsequent Transfer by Tenant or any Transferee. The acceptance of Rent by Landlord from any other person shall not be deemed to be a waiver by Landlord of any provision of this Lease or to be a consent to any Transfer.

-16-

16.6 Administrative Review Fee and Attorneys’ Fees. Concurrently with submitting each request for Landlord’s consent to any Transfer, Tenant shall pay Landlord an administrative review fee of Three Hundred Dollars ($300.00). In addition to the administrative review fee, Tenant shall pay to Landlord on demand all costs and expenses (including reasonable attorneys’ and consultant’s fees) incurred by Landlord in connection with reviewing or consenting to any proposed Transfer, such costs not to exceed $1,500.00.

16.7 Effectiveness of Transfer. Prior to the date on which any permitted Transfer (whether or not requiring Landlord’s consent) becomes effective, Tenant shall deliver to Landlord a counterpart of the fully executed transfer document and Landlord’s then standard form of “Consent to Assignment” or “Consent to Sublease” executed by Tenant and the Transferee in which each of Tenant and the Transferee confirms its obligations pursuant to this Lease. Failure or refusal of a Transferee to execute any such instrument shall not release or discharge the Transferee from liability as provided herein. The voluntary, involuntary or other surrender of this Lease by Tenant, or a mutual cancellation by Landlord and Tenant, shall not work a merger, and any such surrender or cancellation shall, at the option of Landlord, either terminate all or any existing subleases or operate as an assignment to Landlord of any or all of such subleases.

16.8 Landlord’s Right to Space. Notwithstanding any of the above provisions of this Section 16 to the contrary, if Tenant notifies Landlord that it desires to enter into a Transfer, Landlord, in lieu of consenting to such Transfer, may elect (a) in the case of an assignment or a sublease of the entire Premises, to terminate this Lease, or (b) in the case of a sublease of less than the entire Premises, to terminate this Lease as it relates to space proposed to be subleased by Tenant. In such event, this Lease will terminate (or the space proposed to be subleased will be removed from the Premises subject to this Lease and the Base Rent and Tenant’s Share under this Lease shall be proportionately reduced) on the date the Transfer was proposed to be effective, and Landlord may lease such space to any party, including the prospective Transferee identified by Tenant.

16.9 Assignment of Sublease Rents. Tenant hereby absolutely and irrevocably assigns to Landlord any and all rights to receive rent and other consideration from any sublease and agrees that Landlord, as assignee or as an attorney-in-fact for Tenant for purposes hereof, or a receiver for Tenant appointed on Landlord’s application may (but shall not be obligated to) collect such rents and other consideration and apply the same toward Tenant’s obligations to Landlord under this Lease; provided, however, that Landlord grants to Tenant at all times prior to occurrence of any breach or default by Tenant a revocable license to collect such rents (which license shall automatically and without notice be and be deemed to have been revoked and terminated immediately upon any Event of Default).

16.10 Transfer to Affiliate. Tenant may assign this Lease or sublet the Premises or any portion thereof, without Landlord’s written consent, but upon prior written notice to Landlord and subject to all other provisions of this Lease, to any Affiliate, subject to all the terms of this Lease (except only that Landlord shall not be entitled to any excess consideration pursuant to Subsection 16.4 - Excess Consideration or to terminate this Lease pursuant to Subsection 16.8 - Landlord’s Right to Space upon such an assignment or sublease to an Affiliate), provided that (i) the Affiliate assumes in writing all of Tenant’s obligations under this Lease, (ii) the original entity executing this Lease as “Tenant” remains fully liable under this Lease, (iii) Landlord receives written notification of such Transfer, and all relevant documents requested by Landlord, at least twenty (20) days prior to the effective date of such Transfer, (iv) no Event of Default is ongoing, (v) the intended Transferee has a tangible net worth, as evidenced by financial statements delivered to Landlord and certified by an independent certified public accountant in accordance with generally accepted accounting principles that are consistently applied at least equal to Tenant’s net worth either immediately before the Transfer or as of the date of this Lease, whichever is greater; (vi) the nature of the business of the occupant of the Premises is reasonably acceptable and approved by Landlord; and (vii) such Transfer is not a subterfuge by Tenant to avoid its obligations under this Lease or the restrictions on Transfers under this Section 16. Tenant shall have the burden of establishing that all the terms of this Subsection 16.10 have been satisfied.

17. DEFAULT AND REMEDIES.

17.1 Event of Default. The occurrence of any of the following shall constitute an Event of Default by Tenant:

-17-

(a) Tenant fails to make any payment of Rent, or any amount required to replenish the Security Deposit as provided in Section 6 - Security Deposit, within ten (10) days after the date of a notice from Landlord;

(b) Tenant abandons or vacates the Premises;

(c) Tenant makes any material misrepresentation to Landlord or violates any term or condition of Section 8 - Use and Compliance with Laws;

(d) Tenant fails to deliver any estoppel certificate requested by Landlord within the period described in Subsection 23.1 - Estoppel Certificates;

(e) Tenant violates the restrictions on Transfer set forth in Section 16 - Assignment and Subletting.

(f) Tenant fails to maintain the insurance required to be maintained by Tenant pursuant to Subsections 13.1 and 13.2 and/or otherwise fails to perform its obligations under such subsections;