Attached files

| file | filename |

|---|---|

| 8-K - 8K LAZARD CAPITAL HEALTHCARE CONFERENCE - WEST PHARMACEUTICAL SERVICES INC | form8k.htm |

WEST PHARMACEUTICAL SERVICES, INC.

Solutions for Injectable Drug Delivery NYSE:WST www.westpharma.com

© 2011 by West Pharmaceutical Services, Inc., Lionville, PA.

All rights reserved. This material is protected by copyright. No part of it may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.. All

trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

form or by any means, electronic, mechanical, photocopying or otherwise, without written permission of West Pharmaceutical Services, Inc.. All

trademarks and registered trademarks are property of West Pharmaceutical Services, Inc., unless noted otherwise.

Lazard Capital Markets 8th Annual Healthcare Conference

New York, NY

November 16, 2011

Safe Harbor Statement

2

Cautionary Statement Under the Private Securities Litigation Reform Act of 1995

This presentation and any accompanying management commentary contain “forward-looking statements”

as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to statements about expected financial results for 2011 and future years.

as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to statements about expected financial results for 2011 and future years.

Each of these estimates is based on preliminary information, and actual results could differ from these

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in

our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual

Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or

supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially

from those estimated or predicted in the forward-looking statements. You should evaluate any statement

in light of these important factors. Except as required by law or regulation, we undertake no obligation to

publicly update any forward-looking statements, whether as a result of new information, future events, or

otherwise.

preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in

our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual

Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or

supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially

from those estimated or predicted in the forward-looking statements. You should evaluate any statement

in light of these important factors. Except as required by law or regulation, we undertake no obligation to

publicly update any forward-looking statements, whether as a result of new information, future events, or

otherwise.

Non-GAAP Financial Measures

For the purpose of aiding the comparison of our year-over-year results, we often refer to net sales and

other financial results excluding the effects of changes in foreign exchange rates. These re-measured

results excluding effects from currency translation are not in conformity with U.S. Generally Accepted

Accounting Principles (“U.S. GAAP”) and should not be considered in isolation or as an alternative to

such measures determined in accordance with U.S. GAAP. Additionally, performance measurements

such as compound annual growth rate and gross margin are indicators commonly used in the financial

community, but they are not measures of performance under U.S. GAAP.

other financial results excluding the effects of changes in foreign exchange rates. These re-measured

results excluding effects from currency translation are not in conformity with U.S. Generally Accepted

Accounting Principles (“U.S. GAAP”) and should not be considered in isolation or as an alternative to

such measures determined in accordance with U.S. GAAP. Additionally, performance measurements

such as compound annual growth rate and gross margin are indicators commonly used in the financial

community, but they are not measures of performance under U.S. GAAP.

Pharmaceutical Packaging Systems

Pharmaceutical Delivery Systems

• A globally diverse manufacturer of

products used primarily in containing and

administering small-volume parenteral

drugs.

products used primarily in containing and

administering small-volume parenteral

drugs.

• Strong competitive position

– Substantial market shares

– Proprietary technology

– Diversified customer base

– Global footprint

– Preferred products for biologics

– Long-term customer relationships

• Stability with growth potential

• Proprietary products

• Geographic expansion

• Financial strength to invest

– Reliable operating cash flow

– Well capitalized

3

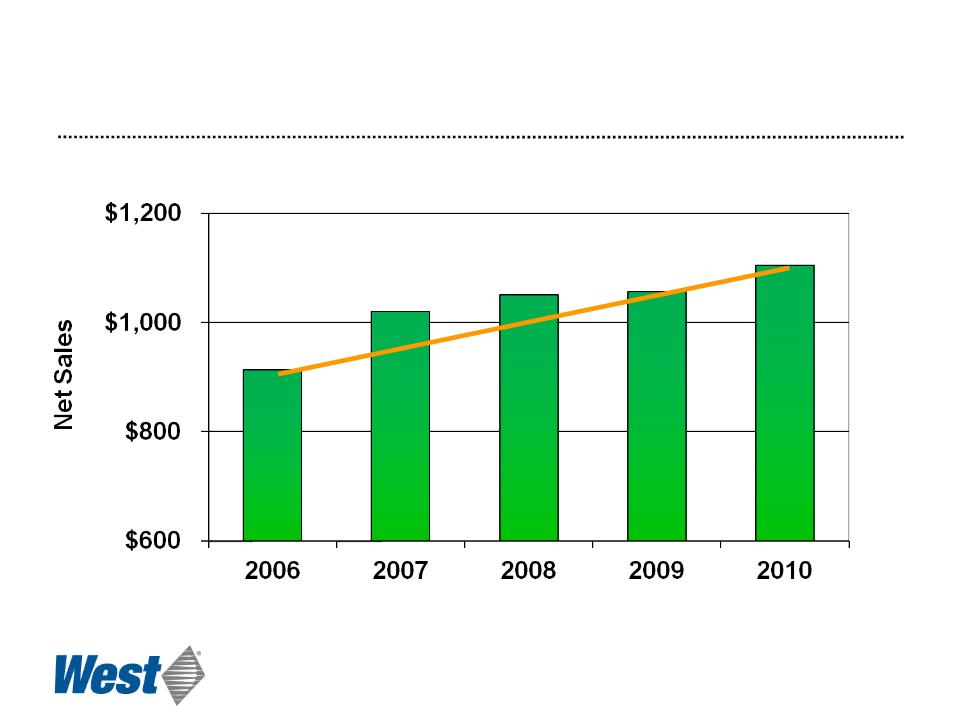

Sales

($ in millions)

($ in millions)

4

Compound annual growth rate: 4.9% (4.3% ex-currency)

Business Segments

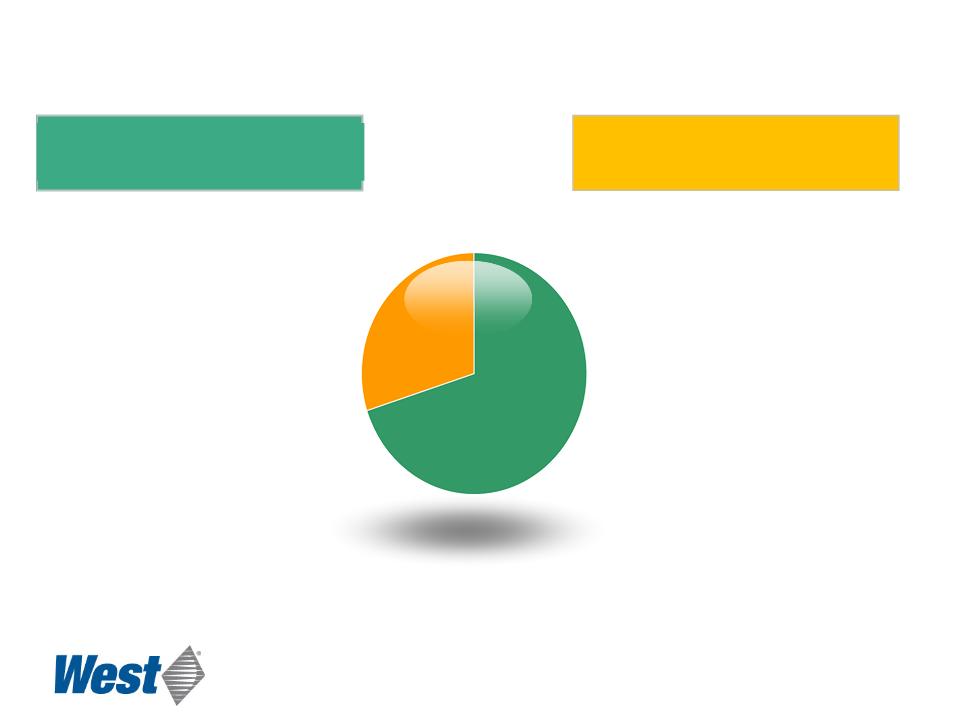

$785

$324

2010 Revenues

($ millions)

Delivery Systems

• Contract manufacturing base

• Multi-material

• Project management

• Automated assembly

• Regulated products

• Capabilities + IP = proprietary

delivery devices

delivery devices

• Proprietary devices are

expected to drive growth

expected to drive growth

Packaging Systems

• Established leadership

• Designed-in revenue base

• Diverse global capabilities

• High market shares

• Steady growth in base

• Increasing unit value of products

and geographic expansion are

expected to enhance growth

and geographic expansion are

expected to enhance growth

5

A Diverse, Stable Customer Base

(representative healthcare customers)

(representative healthcare customers)

PHARMACEUTICAL / BIOTECHNOLOGY

GENERIC

MEDICAL DEVICE

6

• Company

– Demographics and increasing prevalence of chronic disease

– Increasing use of biologics to treat those

– Broader access to healthcare

• Packaging Systems Segment

– Growth in emerging markets

– Products and processes to satisfy escalating regulatory and quality

expectations

expectations

• Delivery Systems Segment

– Demand for combination products that promote safety, dosing accuracy,

ease of use, and deliver cost savings

ease of use, and deliver cost savings

– Drug product life cycle management

– Growing customer & regulatory awareness of glass quality issues

What Will Drive Growth?

7

|

Category

|

Key Customers

|

Projected

Growth |

|

Diabetes

|

|

> 10 %

|

|

Oncology

|

|

> 10 %

|

|

Vaccines

|

|

> 10 %

|

|

Autoimmune

|

|

> 8%

|

|

Generics

|

|

>10%

|

IMS April 2010 Report; Business Insights 2009; GBI Research 2009

Therapeutic Category Growth Drivers

8

Pharmaceutical Packaging Systems

Packaging Components for Small Volume Parenterals

Packaging Components for Small Volume Parenterals

Plungers, Tip Caps,

Needle Shields for Glass

Syringes

Needle Shields for Glass

Syringes

Plungers, Lined

Seals for Glass

Cartridges for Pens

Seals for Glass

Cartridges for Pens

Primary packaging components (those that touch the drug) are typically

proprietary to West and are “designed into” customers’ drug products

proprietary to West and are “designed into” customers’ drug products

9

Packaging Systems Segment

• Increase per-unit value

• Continued growth of prefilled syringes

• Improve operating efficiency: lean operations

• Geographic expansion - capacity investments in Asia

• Strategic acquisitions and partnerships

Growth Strategy

10

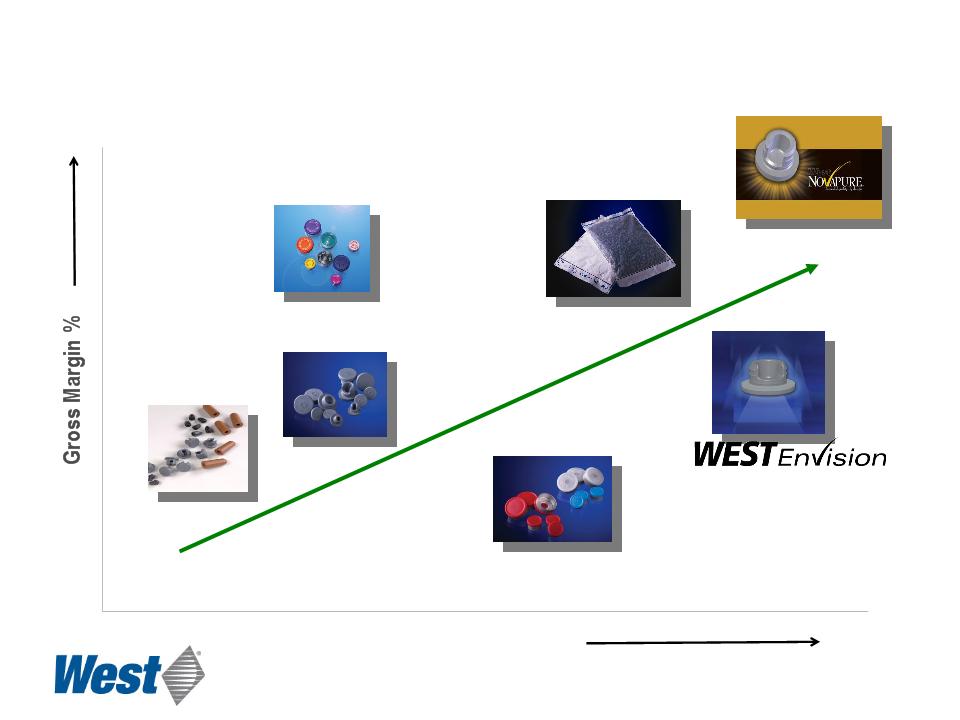

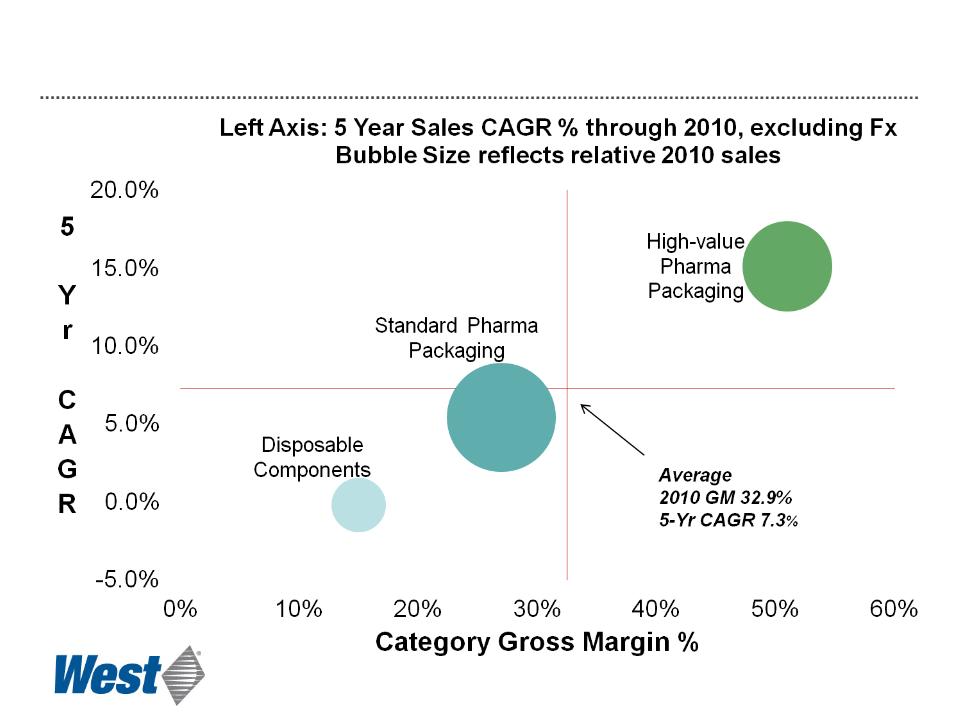

Standard High-Value

Products Products

Revenue Opportunity ($ per unit)

Plungers and

sleeve stoppers

sleeve stoppers

Stoppers

Seals

RU seals

Westar® RU

11

Faster Growth of High-Value Products

Pharmaceutical Packaging Systems

Pharmaceutical Packaging Systems

12

Pharmaceutical Packaging Systems

Key High-Value Products

Key High-Value Products

• Westar® RS (ready-to-sterilize) and Westar® RU (ready-to-use)

components

components

• Barrier film coatings (FluroTec®, Teflon® coated) enhance

drug-product stability

drug-product stability

– Key feature for biotech products

• B-2 and LyoTec® coatings for enhanced handling and machinability

• Envision™ 100% vision-inspected products

– Eliminate deformation, surface and embedded defects

Teflon® is a registered trademark of DuPont.

FluroTec® technology is licensed from Daikyo Seiko, Ltd.

FluroTec® technology is licensed from Daikyo Seiko, Ltd.

13

Delivery Systems

ConfiDose®

auto-injector system

auto-injector system

Daikyo Crystal Zenith®

life-cycle containment solutions

life-cycle containment solutions

SmartDose® electronic

patch injector system

patch injector system

MixJect® and

Vial2Bag®

Vial2Bag®

Custom Manufacturing of

Components and Devices

Components and Devices

Proprietary Components, Devices and Systems

14

Delivery Systems Segment

• Realize commercial potential of Crystal Zenith products

• Leverage life-cycle management opportunities

• Develop new platform opportunities - combination products

• Custom solution provider

Growth Strategy

15

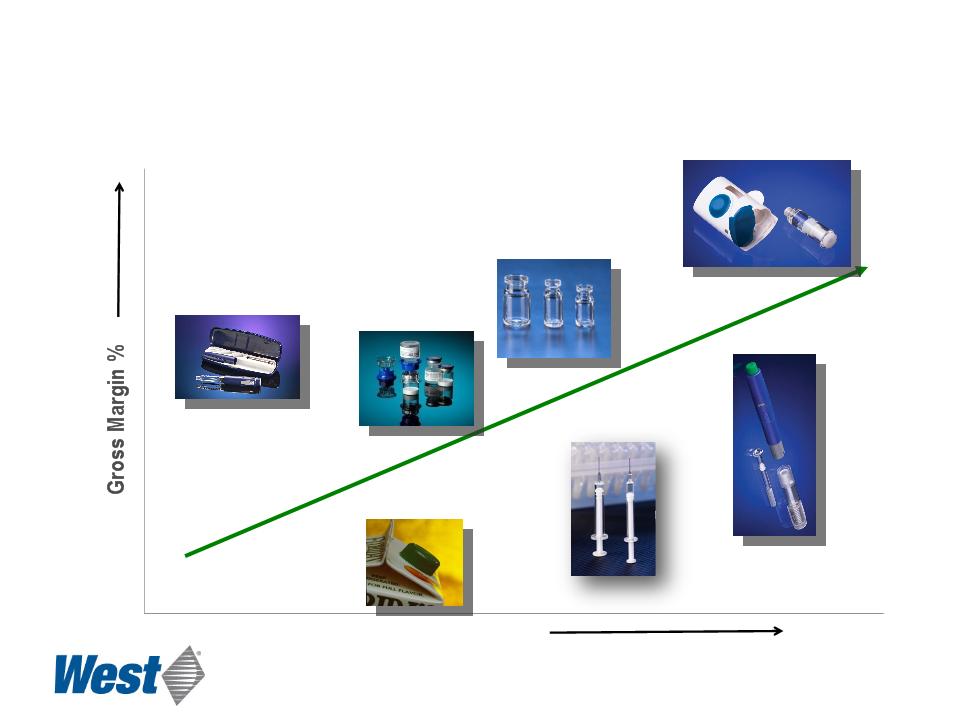

Revenue per-unit

Consumer product

manufacturing

manufacturing

Medical device

manufacturing

manufacturing

Mix2Vial®

Crystal

Zenith vials

Zenith vials

Crystal

Zenith syringes

Zenith syringes

ConfiDose®

Effect of Increasing Proprietary Device Sales

Contract Manufacturing Proprietary Devices

Products

SmartDose ®

16

Daikyo Crystal Zenith® Solution

with Daikyo FluroTec® Barrier Film

with Daikyo FluroTec® Barrier Film

• Reduces:

– drug exposure to extractables

– risk of protein aggregation caused by silicone oil in the drug product

– returns and in-process clean-ups caused by broken glass

– risk of delamination and glass-particulate contamination

• Consistent piston release and travel forces without using silicone oil

17

SmartDose®

Electronic Patch Injector

Programmed by PDA or PC

Dose may be customized

Applied and activated by patient

• Controlled, subcutaneous, micro-infusion delivery

of high volumes and high viscosity drugs

of high volumes and high viscosity drugs

• Prefilled cartridge, no need for user filling

• Based on Daikyo Crystal Zenith® cartridge

• Compact

• Hidden needle for safety

• Single push-button operation

Prototype Operation

18

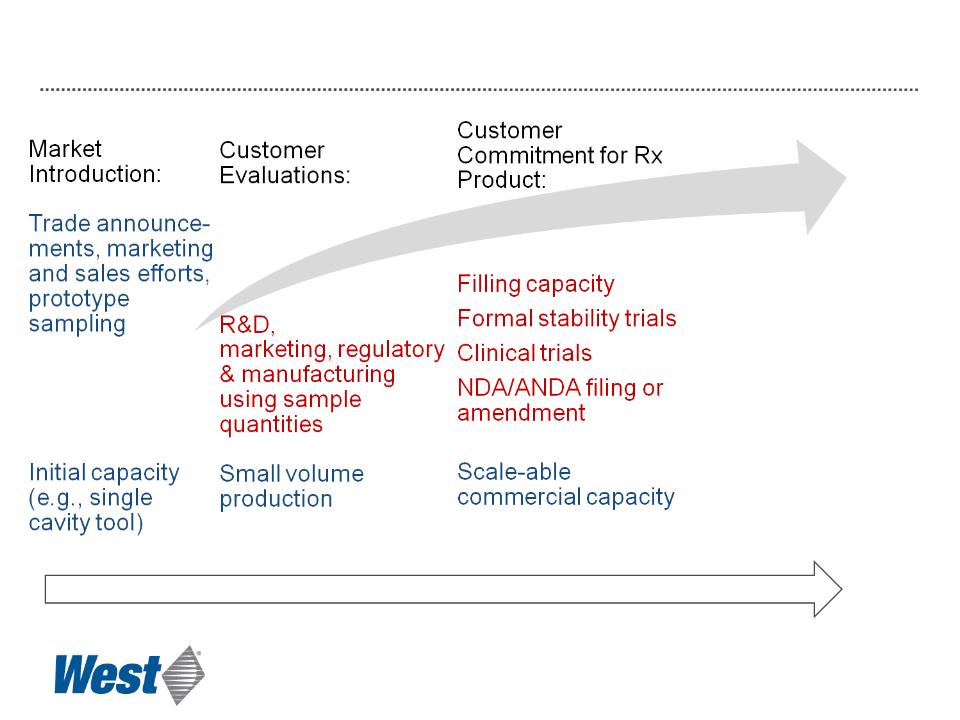

New Product Commercialization

Schematic representation of order and timing of West & Customer activities

Schematic representation of order and timing of West & Customer activities

Commercial Sales:

Rx product approval

and launch (new

product)

and launch (new

product)

Production using

new West product

new West product

Commercial

production

production

1 2 4 5 6

Approximate timing (years)

19

Our Long-Term Focus

• Pharmaceutical Packaging Systems

– Organic growth of 3-5% per year

– Margin expansion from efficiency, product mix

– Capital investments target enhanced quality and value

• Pharmaceutical Delivery Systems

– Deliver the potential of Daikyo Crystal Zenith® products

– Stronger mix of healthcare-consumable contract manufacturing

– Grow proprietary safety and delivery systems

• Financial discipline

– Operating cash flow supports R&D and capital spending

– Deliver returns (ROIC) that regularly exceed cost of capital (WACC)

– Maintain quarterly dividend

– Align incentives with financial performance and value creation

20

Pharmaceutical Packaging Systems

Pharmaceutical Delivery Systems

• Strong competitive position

– Substantial market shares

– Proprietary technology

– Diversified customer base

– Global footprint

– Preferred products for biologics

– Long-term customer

relationships

relationships

• Stability with growth potential

• Proprietary products

• Geographic expansion

• The financial strength to invest

– Reliable operating cash flow

– Well capitalized

Summary

21

On average, approximately 100 million components manufactured by West and

our Global Partners are used to enhance the quality of healthcare worldwide

everyday.

our Global Partners are used to enhance the quality of healthcare worldwide

everyday.

Global Partners with Daikyo Seiko, Ltd. and West Pharmaceutical services Mexico, S.A. de

C.V.

C.V.

22