Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TFS Financial CORP | d259338d8k.htm |

Investor Conference Call

November 17, 2011

Exhibit 99.1 |

2

Forward-Looking Statements

This presentation contains forward-looking statements, which can be identified

by the use of such words as estimate, project, believe, intend, anticipate, plan,

seek, expect and similar expressions. These forward-looking statements

include: Statements of our goals, intentions and expectations;

Statements regarding our business plans and prospects and growth and operating

strategies; Statements concerning trends in our provision for loan losses

and charge-offs; Statements regarding the asset quality of our loan and

investment portfolios; and Estimates of our risks and future costs and

benefits. These forward-looking statements are subject to significant

risks, assumptions and uncertainties, including, among other things, the

following important factors

that could affect the actual outcome of future events:

Significantly increased competition among depository and other financial

institutions; Inflation and changes in the interest rate environment that

reduce our interest margins or reduce the fair value of financial instruments;

General

economic

conditions,

either

nationally

or

in

our

market

areas,

including

employment

prospects

and

conditions

that

are

worse

than expected;

Decreased demand for our products and services and lower revenue and earnings in

the event of a recession; Adverse changes and volatility in the securities

and credit markets; Legislative or regulatory changes that adversely affect

our business; Changes in consumer spending, borrowing and savings habits;

Changes

in

accounting

policies

and

practices,

as

may

be

adopted

by

the

bank

regulatory

agencies,

the

Financial

Accounting

Standards

Board

and the Public Company Accounting Oversight Board;

Future adverse developments concerning Fannie Mae or Freddie Mac;

Changes in monetary and fiscal policy of the U.S. Government, including policies of

the U.S. Treasury and the Federal Reserve Board; Changes

in

policy

and/or

assessment

rates

of

taxing

authorities

that

adversely

affect

us;

The timing and the amount of revenue that we may recognize;

Changes in expense trends (including, but not limited to, trends affecting

non-performing assets, charge offs and provisions for loan losses); The

impact of the current governmental effort to restructure the U.S. financial and regulatory system

The extensive reforms enacted in the Dodd-Frank Act which will impact us

The adoption of implementing regulations by a number of different regulatory bodies

under the Dodd-Frank Act, and uncertainty in the exact nature, extent

and timing of such regulations and the impact they will have

on us, including the impact of coming under the jurisdiction of

new federal regulators

Changes in our organization, or compensation and benefit plans;

Inability of third-party providers to perform their obligations to us;

Adverse changes and volatility in real estate markets;

A slowing or failure of the moderate economic recovery that began last year;

The strength or weakness of the real estate markets and of the consumer and

commercial credit sectors and its impact on the credit quality of our loans

and other assets; and. The efficacy of the U.S. Federal Government to manage

federal debt limits. Because of these and other uncertainties, our actual

future results may be materially different from the results indicated by these forward-

looking statements. |

3

Organized in 1997 as the mid-tier stock holding company for Third Federal

Savings & Loan Association of Cleveland (“Thrift”), which was

founded in 1938 by Ben and Gerome Stefanski

Completed first step IPO conversion in April 2007

TFSL (NASDAQ)

Financials at 9/30/2011:

Total Assets:

$10.9B

Total Deposits:

$ 8.7B

Shareholders’

Equity:

$ 1.8B

Market Capitalization:

$ 2.5B

As of September 30, 2011, there were 308.9 million shares outstanding, of

which 73.5% were held by the Mutual Holding Company

Overview of TFS Financial Corporation |

4

Strategic Overview

Our business model is to originate and service first mortgage loans and continue to

service

existing

home

equity

loans

and

lines,

which

we

fund

with

core

retail

deposits

Historically a fixed rate lender, but 55% of fiscal 2011 loan production was Smart

Rate adjustable rate mortgage product (product introduced to market in July

2010). First mortgage loans and retail deposits have been generated

mainly in our Ohio and Florida footprint.

Expanded to several new states in May 2011, offering our Smart Rate adjustable

rate mortgage

to

refinance

customers

through

our

Customer

Service

and

Internet

Channels

and

using

our

underwriting

standards

and

processing

requirements

of

our

traditional

markets.

Only non-commissioned Third Federal associates have been and continue to be

used to gather applications, underwrite and process the requests to generate

mortgage loans and home equity loans and lines

First

mortgage

originations

continue

to

be

made

using

stringent,

conservative

lending

standards. For first mortgages originated during the current fiscal year, the

average FICO score was 775, and the average LTV was 64%.

Being a low cost provider is a critical strategic advantage

Historically, prudent capital management has supplemented shareholder

returns. Repurchased

24.1

million

shares

of

TFSL

stock

(approximately

23%

of

the

public

float)

since

the IPO in April 2007

Dividends of $49 million paid to public common shareholders since IPO

|

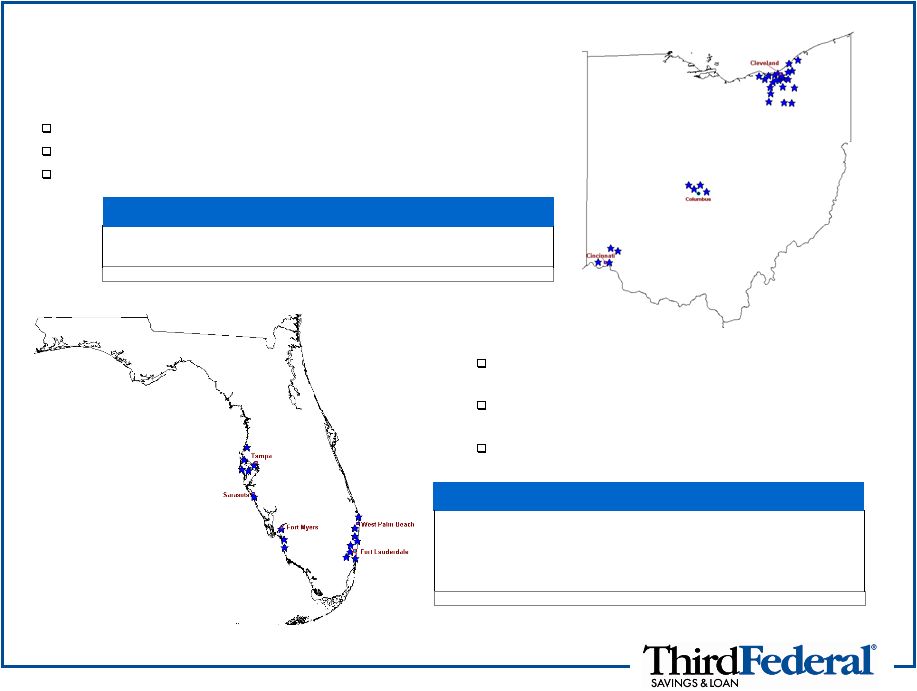

5

Ohio

22 full service branches in Northeast Ohio

4 loan production offices in the Columbus area (Central Ohio)

4 loan production offices in the Cincinnati area (Southwestern Ohio)

Markets of Operation

Florida

Organic, de novo expansion into Florida started in

2000

9 full service branches along the West Coast from

New Port Richey to Naples

8 full-service branches along the East Coast from

Palm Gardens to Hallandale

Source: SNL Financial for market data as of June 30, 2011

Deposits from Company data as of September 30, 2011

Deposits

Market

Market

MSA

Branches

($M)

Share (%)

Rank

Tampa-St.Petersburg-Clearwater, FL

5

1,112

1.86

8

Miami-Fort Lauderdale, FL

8

1,076

0.66

26

Cape Coral-Fort Myers, FL

2

257

2.14

14

Sarasota-Bradenton-Venice, FL

1

255

1.53

12

Naples-Marco Island, FL

1

117

1.18

17

Florida Totals

17

2,817

0.66

22

Deposits

Market

Market

MSA

Branches

($M)

Share (%)

Rank

Cleveland-Elyria-Mentor, OH

19

5,405

11.23

3

Akron, OH

3

494

4.21

8

Ohio Totals

22

5,899

2.64

9 |

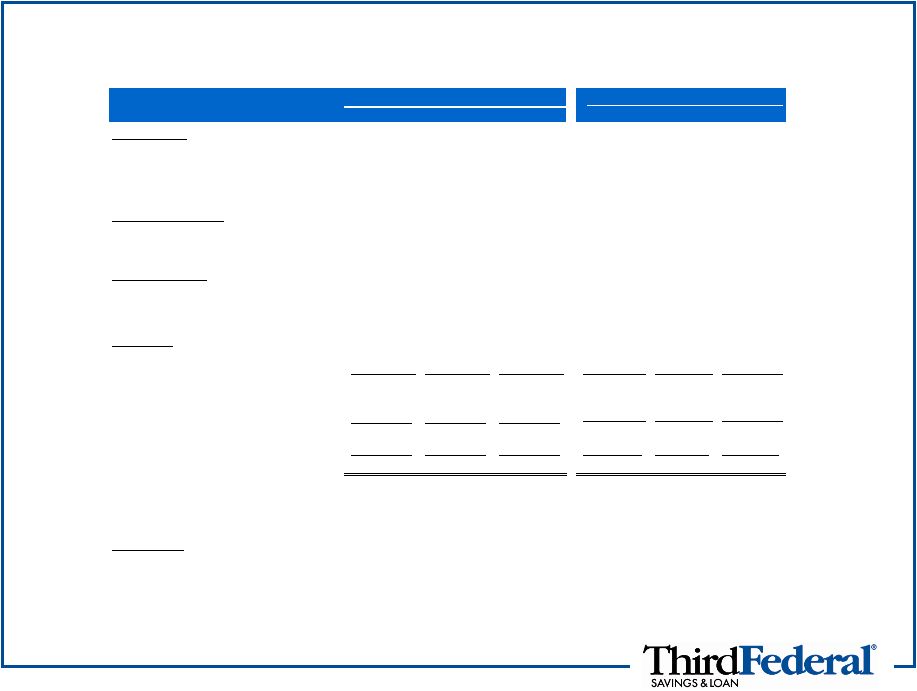

6

Financial Highlights

(Dollars in Thousands)

At, or for the year ended,

9/30/11

9/30/10

9/30/09

9/30/11

6/30/11

9/30/10

Balance Sheet

Assets ($)

10,892,948

11,076,027

10,598,840

10,892,948

10,877,541

11,076,027

Net Loans ($)

9,750,943

9,181,749

9,219,585

9,750,943

9,698,228

9,181,749

Deposits ($)

8,715,910

8,851,941

8,570,506

8,715,910

8,701,896

8,851,941

Common Equity ($)

1,773,924

1,752,897

1,745,865

1,773,924

1,766,387

1,752,897

Balance Sheet Ratios

Loans/ Deposits (%)

111.9

103.7

107.6

111.9

111.4

103.7

TCE / TA (%)

16.2

15.8

16.4

16.2

16.2

15.8

Thrift Only Ratios:

Core Capital Ratio (%)

13.9

12.1

12.5

13.9

13.8

12.1

Tier 1 Risk Based Ratio (%)

21.0

18.0

17.3

21.0

20.8

18.0

Total Risk Based Capital Ratio (%)

22.3

19.2

18.2

22.3

22.0

19.2

Profitability

Net Interest income ($)

247,648

227,506

230,075

64,016

63,045

55,143

Provision for loan losses ($)

(98,500)

(106,000)

(115,000)

(19,000)

(22,500)

(35,000)

Net Interest income after prov for loan losses ($)

149,148

121,506

115,075

45,016

40,545

20,143

Non-interest income ($)

30,982

58,638

67,384

7,137

8,759

6,828

Non-interest expense ($)

(168,055)

(161,933)

(162,388)

(41,584)

(39,552)

(41,820)

Income (loss) before income taxes ($)

12,075

18,211

20,071

10,569

9,752

(14,849)

Income tax benefit (expense) ($)

(2,735)

(6,873)

(5,676)

(2,090)

(3,767)

4,102

Net income (loss) ($)

9,340

11,338

14,395

8,479

5,985

(10,747)

Net interest margin (%)

2.32

2.16

2.20

2.42

2.37

2.05

Non-interest expense to average assets (%)

1.54

1.50

1.51

1.54

1.45

1.52

Asset Quality

NPAs/ Assets (%)

2.3

2.7

2.6

2.3

2.4

2.7

NCOs/ Avg Loans (%)

0.8

0.7

0.7

0.6

0.8

0.9

Reserves/ Loans (%)

1.6

1.4

1.0

1.6

1.6

1.4

Texas Ratio (NPAs & TDRs / TCE & LLR) (%)

19.6

20.9

17.4

19.6

19.9

20.9

At, or for the three months ended, |

7

Capital Position as of September 30, 2011

16.21%

13.90%

21.04%

22.29%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

Tangible Common

Equity Ratio (TFSL)

Core Capital Ratio

(Thrift)

Tier 1 Risk-based Ratio

(Thrift)

Total Risk-Based

Capital Ratio (Thrift)

Well Capitalized

6.00%

10.00%

5.00%

TFSL/Thrift |

8

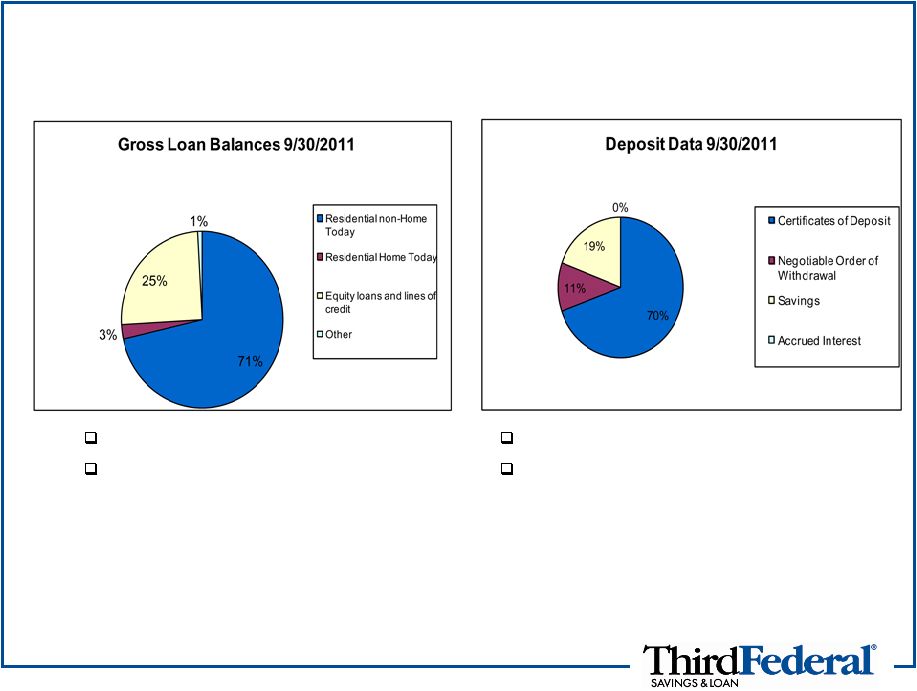

Loan and Deposit Balances

*About Home Today:

An affordable housing program targeted toward low and moderate income home buyers

that is designed to teach the essential skills needed for successful

homeownership. Most loans supported by private mortgage insurance. Cumulative

loan originations under this program have been less than $20 million over the last

three years. 80% of first mortgages in Ohio

Also service $5.4 billion in loans for

others

No brokered deposits

Average branch has $223 million in deposits |

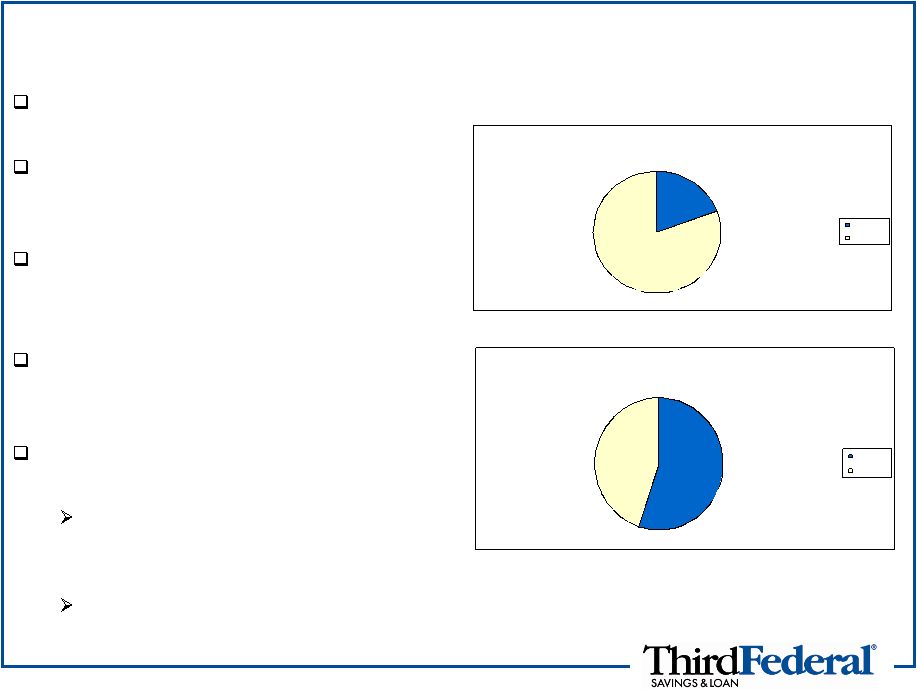

9

Adjustable Rate Growth

Smart Rate adjustable product

began July 2010

Fiscal year 2011 total loan

production of $2.14 billion was

55% adjustable and 45% fixed

Average credit score of fiscal

2011 ARM production is

775 with

average LTV of 63%

Total ARMs of $1.8 billion

represent approximately 25% of

all first mortgages at 9/30/11

Expansion of ARM refinance

offerings into new states:

PA, NJ, IL, NC in May, 2011

–

Represents $20MM in closed loans

as of 9/30/11

VA, CT, TN, CO, OR, and WA in

Sept. 2011

81%

Loan Production, 9/30/10

Adjustable

Fixed

81%

19%

Loan Production, 9/30/11

Adjustable

Fixed

45%

55% |

10

Loan Delinquencies and Charge-offs

Dollars in millions

Loan

Balances

9/30/11

9/30/11

6/30/11

9/30/10

9/30/11

6/30/11

9/30/11

9/30/10

Residential non-Home Today

Ohio

$5,692

1.4%

1.5%

1.9%

$2

$3

$9

$5

Florida

$1,269

5.1%

5.1%

5.2%

3

2

9

7

Other

160

0.7%

0.9%

1.5%

-

-

-

-

Total

$7,121

2.1%

2.1%

2.5%

$5

$5

$18

$12

Residential Home Today

Ohio

$253

30.0%

29.8%

34.8%

$1

$2

$7

$5

Florida

11

32.1%

35.3%

32.1%

-

-

-

-

Total

$264

30.1%

30.0%

34.6%

$1

$2

$7

$5

Home Equity Loans and Lines of Credit

Ohio

$983

1.6%

1.7%

2.0%

$3

$2

$10

$7

Florida

712

3.3%

3.1%

4.1%

4

9

29

33

California

293

1.4%

1.7%

1.5%

1

1

5

4

Other

503

2.1%

2.1%

2.4%

1

1

5

5

Total

$2,491

2.2%

2.2%

2.6%

$9

$13

$49

$49

Other

$89

4.3%

4.7%

4.2%

-

-

$1

$2

Overall Total

$9,965

2.9%

2.9%

3.5%

$15

$20

$75

$68

Quarter-end

Net Charge Offs

Delinquencies at:

FYE |

11

Regulatory Status

Company believes it has met all key provisions of February 7, 2011

MOU received from OTS, subject to regulatory exam validation

Supervisory responsibility transferred from OTS to OCC (for thrift) and

Federal Reserve (for holding company) on July 21, 2011

Dividends and stock buyback program still subject to regulatory 45 day

non-objection

OCC charge-off rules to be implemented, resulting in one time $55.5

million additional charge-off in quarter ending December 31, 2011. No

income statement impact, but the allowance and non-performing loans

will decrease by same amount.

Comment letter submitted October 27, 2011, on proposed Fed rules

for

MHCs |

12

Cash Dividends and Stock Repurchases

Under the terms of the MOU, TFS Financial must provide 45 days written

notice and obtain the non-objection of its regulator prior to the

Company’s intent to declare and pay dividends to its stockholders or

repurchase any of its outstanding stock.

The Company understands and shares the view of the importance to

shareholders of dividends and stock repurchases. However, given the new

regulators and oversight, The Federal Reserve and the OCC will need to

review and determine the ability of the Company to repurchase stock and

declare dividends moving forward. It is unclear the

exact timing of any decisions with regard to these steps. The Company

continues to work diligently to resolve this matter on behalf of the Company

and its shareholders. |

13

Summary

Focus on our core competency of originating high credit quality 1-4

family residential mortgages primarily in our banking footprint,

expanding into new markets with our adjustable rate mortgage loans

TFSL has a strong capital position and flexibility at the holding

company

Working with new regulatory agencies to refocus efforts on returning

to shareholder-enhancing activities

Dividends

Share Buybacks |

14

Investor Conference Call

November 17, 2011

Investor Questions |