Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSEMBLY BIOSCIENCES, INC. | v240371_8k.htm |

| EX-99.1 - EX-99.1 - ASSEMBLY BIOSCIENCES, INC. | v240371_ex99-1.htm |

1 This material contains estimates and forward - looking statements. The words “believe,” “may,” “might,” “will,” “aim,” “estimate,” “continue,” “would,” “anticipate, ”“intend,” “expect,” “plan” and similar words are intended to identify estimates and forward - looking statements. Our estimates and forward - looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or might affect our businesses and operations. Although we believe that these estimates and forward - looking statements are based upon reasonable assumptions, they are subject to many risks and uncertainties and are made in light of information currently available to us. Our estimates and forward - looking statements may be influenced by the following factors, among others: risks related to the costs, timing, regulatory review and results of our studies and clinical trials; our ability to obtain FDA approval of our product candidates; differences between historical studies on which we have based our planned clinical trials and actual results from our trials; our anticipated capital expenditures, our estimates regarding our capital requirements, and our need for future capital; our liquidity and working capital requirements; the risks of not closing the acquisition of VEN 309 from Sam Amer & Co.; our expectations regarding our revenues, expenses and other results of operations; the unpredictability of the size of the markets for, and market acceptance of, any of our products, including VEN 309; our ability to sell any approved products and the price we are able realize; our need to obtain additional funding and our ability to obtain future funding on acceptable terms; our ability to retain and hire necessary employees and to staff our operations appropriately; our ability to compete in our industry and innovation by our competitors; our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business; estimates and estimate methodologies used in preparing our financial statements; the future trading prices of our common stock and the impact of securities analysts’ reports on these prices; and the risks set out in our filings with the SEC, including our Annual Report on Form 10 - K. Estimates and forward - looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of known and unknown risks and uncertainties, including those described above, the estimates and forward - looking statements discussed in this material might not occur and our future results and our performance might differ materially from those expressed in these forward - looking statements due to, including, but not limited to, the factors mentioned above. Estimates and forward - looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or to review any estimate and/or forward - looking statement because of new information, future events or other factors. Forward Looking Statements

2 Summary of Update » $ 53 mil cash end Q3 2011; no debt » Programs: Ventrus is on track to deliver Ph 3 data on two significant GI drug development candidates by mid 2012 VEN 309: topical Iferanserin for the treatment of hemorrhoids Top line data from pivotal trial and PK data now expected at end of Q2 2012 NDA filing timelines are unchanged Data quality favorable; no serious severe adverse events related to drug, to date VEN 307 topical Diltiazem for the treatment of anal fissure Topline data still expected in Q2 2012 (most likely May); » Market Research – Third party Omnibus survey on hemorrhoids Confirms hemorrhoid prevalence is high and exceeds previous estimates: patients are taking action Patient response to hemorrhoid product concept is strong » Completion of acquisition of VEN 309 expected Nov 14, 2011

3 Q3 - 2011 Financial Update » Cash balance Cash and cash equivalents at Sept 30, 2011 $ 53.3 Mil Expected cash burn next 12 months* $ 12 - $ 16 Mil Cash and cash equivalents YE 2011 end guidance $ 34 - $ 36 Mil » Stock data Fully diluted shares outstanding 15.3 Mil Shares outstanding 12.4 Mil » Sources of funding 2007 to present Funding pre - IPO $ 10 Mil IPO December 2010 $ 18 Mil Secondary public offering July 2011 $ 47.5 Mil * Excludes payment to acquire rights to Amer: estimates - our operation expenditures could change

VEN309 ( Iferanserin ) for the Treatment of Hemorrhoids » Ongoing Phase III trial: Iferanserin 0.5% ointment b.i.d . Design 3 arms, 200 patients per arm (placebo, 14 day treatment, 7 day treatment), total 600 patients, 70 sites 2 week treatment followed by 2 week observation, double - blind 1 year open - label extension (treatment for recurrence of symptoms) Primary endpoint, cessation of bleeding day 7 – 14; secondary endpoints, cessation of pain, itching day 7 - 14. Endpoints collected daily using Interactive Voice Response System (IVRS) Patients need 2 consecutive days of bleeding and either pain or itching at randomization: meaningful symptoms to get meaningful improvement Due to 1 year open - label extension Colonoscopy required pre - randomization if > 3 yrs ago No DDI data re CYP2D6: exclude history of and current depression, SSRI’s Exclude history of heart disease, BMI > 36, other chronic diseases Progress Initiated early August with 65 sites; currently all 70 sites screening Enrolling correct patients, minimal loss of key outcome data on IVRS, continuous data review Large number of patients entering screening as expected 4

VEN309 ( Iferanserin ) for the Treatment of Hemorrhoids Estimated timelines Previous guidance Enrollment complete: Early 2012 Double blind data and open label recurrence data to date : Q1 2012 Updated guidance based on 3 months of enrollment Enrollment complete: April 2012 Double - blind data and available open - label recurrence data : around June 2012 ─ Screen failure rate higher than expected: need for symptoms x 2 days and exclusion criteria Impact On Future studies (2 nd pivotal and double - blind recurrence trial) Screen failure rate expected to decrease due to less restrictive exclusion criteria ─ Neither trial has open - label extension; DDI studies will be available No effect on NDA filing timelines; no material effect on the balance sheet 5

6 VEN309 ( Iferanserin ) for the Treatment of Hemorrhoids » Pharmacology program: CYP2D6 metabolism Iferanserin is dependant on CYP2D6 for metabolism and inhibits CYP2D6 in the liver (Prozac) Advantage: GI topical drug with low systemic exposure Program designed to generate the following data Poor metabolizers (missing genes): safety and exposure, needed for QT study One poor metabolizer (2 genes missing) in Ph I had no adverse events Drug interaction with CYP2D6 dependant/inhibiting drugs ( Cymbalta [ duloxetine ], dextromethorphan ) Data expected Q2 2012 (with pivotal trial data expected) Allow less restrictions in exclusion criteria for the next studies Provide high dose arm for QT study De - risk safety profile

7 VEN307 ( Diltiazem Cream) for Anal Fissures » Ongoing Phase III study in Europe Design 3 arms (2%, 4%, placebo) 155 patients each (465 total); 31 sites in Europe 3 months double - blind (2 months treatment, 1 month follow - up) Primary endpoint: reduction in pain on defecation at 1 month; Secondary endpoint: reduction in pain on defecation at 2 months Patients need to have pain 2 days per week for 4 weeks prior to entry; moderate to severe pain at randomization Progress Ventrus did detailed review of blinded data and study operations 10/2011: Correct patients enrolled, IVRS compliance good to date, data being reviewed continuously Expected timelines Enrollment expected to be complete: January 2012 Unblinded data expected to be available: around May 2012

8 Hemorrhoid Rx Commercial Potential Study » Ventrus commissioned an omnibus survey and predictive modeling market research in September 2011 of 800 physicians and 1,125 hemorrhoid patients Physician project is beginning the analysis stage Consumer project is in analysis stage and initial results are available » Study Approach Each respondent sees only one profile PBE factors (discounts) the self - stated survey responses regarding VEN 309 adoption to accurately reflect real world behavior, based on extensively validated in - market models » Princeton Brand Econometrics Founded in 1991 and has worked for 9 of the top 10 pharmaceutical companies Chosen based on their track record of accurately predicting physician and consumer behavior given a range of product profiles and promotional levels Mean absolute percentage error over 31 validated forecasts is 2.68%

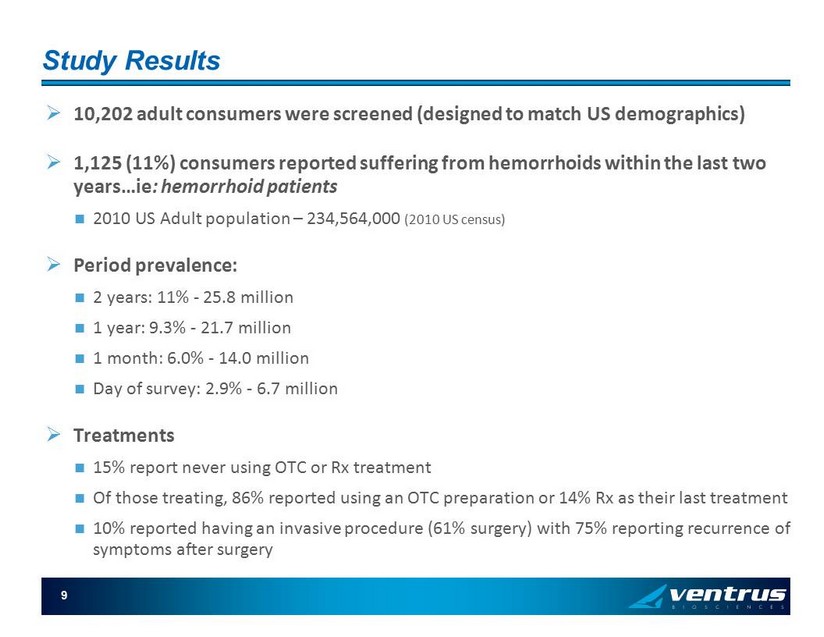

Study Results » 10,202 adult consumers were screened (designed to match US demographics) » 1,125 (11%) consumers reported suffering from hemorrhoids within the last two years… ie : hemorrhoid patients 2010 US Adult population – 234,564,000 (2010 US census) » Period prevalence: 2 years: 11% - 25.8 million 1 year: 9.3% - 21.7 million 1 month: 6.0% - 14.0 million Day of survey: 2.9% - 6.7 million » Treatments 15% report never using OTC or Rx treatment Of those treating, 86% reported using an OTC preparation or 14% Rx as their last treatment 10% reported having an invasive procedure (61% surgery) with 75% reporting recurrence of symptoms after surgery 9

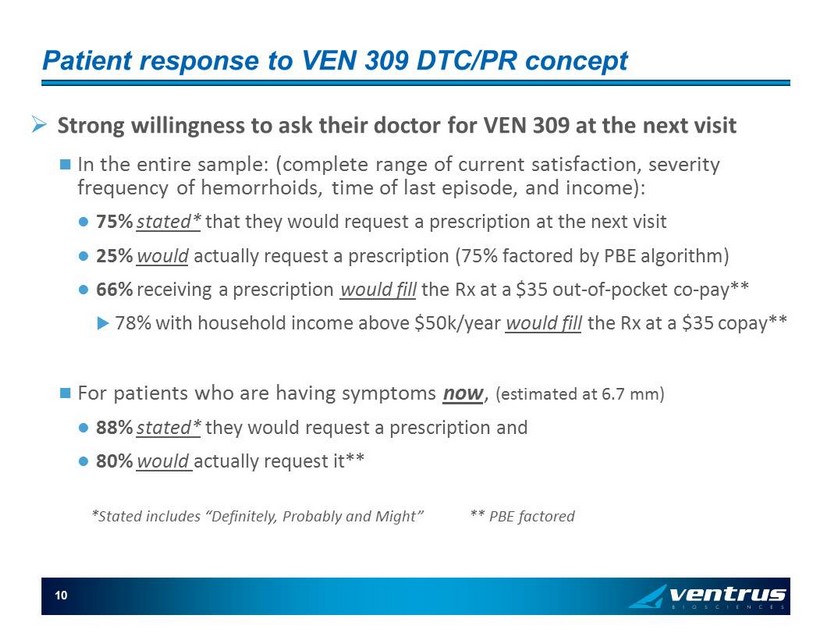

10 Patient response to VEN 309 DTC/PR concept » Strong willingness to ask their doctor for VEN 309 at the next visit In the entire sample: (complete range of current satisfaction, severity frequency of hemorrhoids, time of last episode, and income): 75% stated* that they would request a prescription at the next visit 25% would actually request a prescription (75% factored by PBE algorithm) 66% receiving a prescription would fill the Rx at a $35 out - of - pocket co - pay** 78% with household income above $50k/year would fill the Rx at a $35 copay** For patients who are having symptoms now , (estimated at 6.7 mm) 88% stated* they would request a prescription and 80% would actually request it** *Stated includes “Definitely, Probably and Might” ** PBE factored

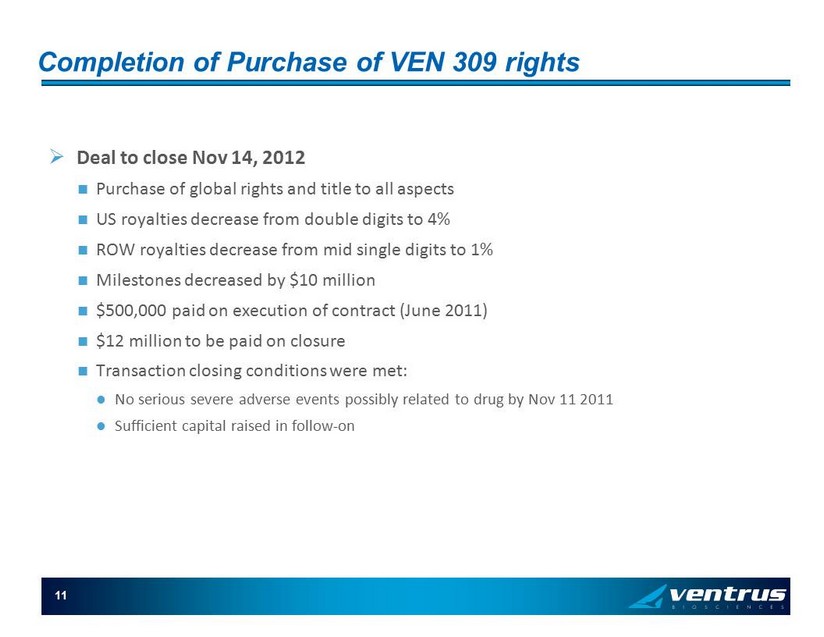

11 Completion of Purchase of VEN 309 rights » Deal to close Nov 14, 2012 Purchase of global rights and title to all aspects US royalties decrease from double digits to 4% ROW royalties decrease from mid single digits to 1% Milestones decreased by $10 million $500,000 paid on execution of contract (June 2011) $12 million to be paid on closure Transaction closing conditions were met: No serious severe adverse events possibly related to drug by Nov 11 2011 Sufficient capital raised in follow - on