Attached files

| file | filename |

|---|---|

| EX-24 - POWER OF ATTORNEY - PENFORD CORP | d252712dex24.htm |

| EX-21 - SUBSIDIARIES OF THE REGISTRANT - PENFORD CORP | d252712dex21.htm |

| EX-32 - CERTIFICATIONS OF CEO AND CFO - PENFORD CORP | d252712dex32.htm |

| EX-31.2 - CERTIFICATIONS OF CHIEF FINANCIAL OFFICER - PENFORD CORP | d252712dex312.htm |

| EX-23.1 - CONSENT OF ERNST & YOUNG LLP - PENFORD CORP | d252712dex231.htm |

| EX-31.1 - CERTIFICATIONS OF CHIEF EXECUTIVE OFFICER - PENFORD CORP | d252712dex311.htm |

| EX-23.2 - CONSENT OF KPMG LLP - PENFORD CORP | d252712dex232.htm |

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the Fiscal Year Ended August 31, 2011 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 0-11488

Penford Corporation

(Exact name of registrant as specified in its charter)

| Washington | 91-1221360 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 7094 S. Revere Parkway Centennial, Colorado |

80112-3932 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (303) 649-1900

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $1.00 par value | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer” and “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one).

| Large accelerated filer | ¨ | Accelerated filer | x | Non-accelerated filer ¨ | Smaller reporting company | ¨ | ||||||||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the Registrant’s Common Stock held by non-affiliates of the Registrant as of February 28, 2011, the last business day of the Registrant’s second quarter of fiscal 2011, was approximately $64.6 million based upon the last sale price reported for such date on The NASDAQ Global Market. For purposes of making this calculation, Registrant has assumed that all the outstanding shares were held by non-affiliates, except for shares held by Registrant’s directors and officers and by each person who owns 10% or more of the outstanding Common Stock. However, this does not necessarily mean that there are not other persons who may be deemed to be affiliates of the Registrant.

The number of shares of the Registrant’s Common Stock outstanding as of November 3, 2011 was 11,346,601.

Documents Incorporated by Reference

Portions of the Registrant’s definitive Proxy Statement relating to the 2012 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

FISCAL YEAR 2011 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| Page | ||||||

| PART I | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

9 | |||||

| Item 1B. |

13 | |||||

| Item 2. |

14 | |||||

| Item 3. |

14 | |||||

| Item 4. |

15 | |||||

| PART II | ||||||

| Item 5. |

15 | |||||

| Item 6. |

17 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||||

| Item 7A. |

31 | |||||

| Item 8. |

33 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

70 | ||||

| Item 9A. |

70 | |||||

| Item 9B. |

70 | |||||

| PART III | ||||||

| Item 10. |

71 | |||||

| Item 11. |

71 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

71 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

72 | ||||

| Item 14. |

72 | |||||

| PART IV | ||||||

| Item 15. |

72 | |||||

| 73 | ||||||

| 74 | ||||||

2

Table of Contents

PART I

Description of Business

Penford Corporation (which, together with its subsidiary companies, is referred to herein as “Penford” or the “Company”) is a developer, manufacturer and marketer of specialty natural-based ingredient systems for food and industrial ingredient applications, including fuel grade ethanol. The Company’s strategically-located manufacturing facilities in the United States provide it with broad geographic coverage of its target markets. The Company has significant research and development capabilities, which are used in understanding the complex chemistry of carbohydrate-based materials and in development applications to address customer needs.

Penford is a Washington corporation originally incorporated in September 1983. The Company commenced operations as a publicly-traded company on March 1, 1984.

Penford operates in two business segments, Industrial Ingredients and Food Ingredients. Each of the Company’s businesses utilizes the Company’s carbohydrate chemistry expertise to develop starch-based ingredients for value-added applications that improve the quality and performance of customers’ products. Financial information about Penford’s segments and geographic areas is included in Note 19 to the Consolidated Financial Statements. Additional information on Penford’s two business segments follows:

| - | Industrial Ingredients, which in fiscal years 2011, 2010 and 2009 generated approximately 74%, 72% and 73%, respectively, of Penford’s revenue, is a supplier of chemically modified specialty starches to the paper and packaging industries. Through a commitment to research and development, Industrial Ingredients develops customized product applications that help its customers realize improved manufacturing efficiencies and advancements in product performance. Industrial Ingredients has specialty processing capabilities for a variety of modified starches. Specialty products for industrial applications are designed to improve the strength and performance of customers’ products and efficiencies in the manufacture of coated and uncoated paper and paper packaging products. These starches are principally ethylated (chemically modified with ethylene oxide), oxidized (treated with sodium hypochlorite) and cationic (carrying a positive electrical charge). Ethylated and oxidized starches are used in coatings and as binders, providing strength and printability to fine white, magazine and catalog paper. Cationic and other liquid starches are generally used in the paper-forming process in paper production, providing strong bonding of paper fibers and other ingredients. |

The Company’s Industrial Ingredients segment also produces and sells fuel grade ethanol from its facility in Cedar Rapids, Iowa. Ethanol production gives the Company the ability to select an additional output choice to capitalize on changing industry conditions and selling opportunities. Sales of ethanol in fiscal years 2011, 2010 and 2009 were 45%, 37% and 29%, respectively, of this segment’s reported revenue.

| - | Food Ingredients, which in fiscal years 2011, 2010 and 2009 generated approximately 26%, 28% and 27%, respectively, of Penford’s revenue, is a developer and manufacturer of specialty starches and dextrins to the food manufacturing and food service industries. Its expertise is in leveraging the inherent characteristics from potato, corn, tapioca and rice to help improve its customers’ product performance. Food Ingredients’ specialty starches produced for food applications are used in coatings to provide crispness, improved taste and texture, and increased product life for products such as french fries sold in restaurants. Food-grade starch products are used to reduce fat levels, modify texture, and improve color and consistency in a variety of foods such as canned products, sauces, whole and processed meats, dry powdered mixes and bakery products. Food-grade starch products are also used as moisture binders and in companion pet products, such as dog treats and chews. |

3

Table of Contents

Discontinued Operations

In August 2009, the Company’s Board of Directors made a determination that the Company would exit from the business conducted by the Company’s Australia/New Zealand Operations. As a result of this determination, on September 2, 2009, the Company completed the sale of its subsidiary company, Penford New Zealand Limited (“Penford New Zealand”), and on November 27, 2009, the Company completed the sale of the operating assets of another subsidiary company, Penford Australia Limited (“Penford Australia”), including its two remaining Australian plants.

The Australia/New Zealand Operations developed, manufactured and marketed ingredient systems, including specialty starches and sweeteners for food and industrial applications. Until September 2, 2009, the Company operated a corn wet milling facility in Auckland, New Zealand through Penford New Zealand. Until November 27, 2009, the Company operated a corn wet milling facility in Lane Cove, Australia and a wheat starch manufacturing facility in Tamworth, Australia through Penford Australia.

The financial data for the Australia/New Zealand Operations have been presented as discontinued operations. The financial statements have been prepared in compliance with the provisions of Financial Accounting Standards Board Accounting Standards Codification 205-10, “Presentation of Financial Statements – Discontinued Operations” (“ASC 205-10”). Accordingly, for all periods presented herein, the Consolidated Balance Sheets, Statements of Operations and Statements of Cash Flows have been conformed to this presentation. The Australia/New Zealand Operations was previously reported as the Company’s third operating segment. See Note 17 to the Consolidated Financial Statements for further details.

Unless otherwise indicated, all amounts, analyses and discussions in this Annual Report on Form 10-K pertain to the Company’s continuing operations.

Raw Materials

Corn: Penford’s North American corn wet milling plant is located in Cedar Rapids, Iowa, the middle of the U.S. corn belt. Accordingly, the plant has truck-delivered corn available throughout the year from a number of suppliers at prices consistent with those available in the major U.S. grain markets.

Potato Starch: The Company’s facilities in Idaho Falls, Idaho; Richland, Washington; and Plover, Wisconsin use starch recovered as by-products from potato processors as the primary raw material to manufacture modified potato starches. The Company enters into contracts typically having durations of one to three years with potato processors in the United States and Canada to acquire potato-based raw materials.

Chemicals: The primary chemicals used in the manufacturing processes are readily available commodity chemicals. The prices for these chemicals are subject to price fluctuations due to market conditions.

Natural Gas: The primary energy source for most of Penford’s plants is natural gas. Penford contracts its natural gas supply with regional suppliers, generally under short-term supply agreements, and regularly uses futures contracts to hedge the price of natural gas.

Corn, potato starch, chemicals and natural gas are not currently subject to availability constraints; however, demand for these items can significantly affect the prices. Penford’s current potato starch requirements constitute a material portion of the available North American supply. Penford estimates that it purchases approximately 50% of the recovered potato starch in North America. It is possible that, in the long term, continued growth in demand for potato starch-based ingredients and new product development could result in capacity constraints.

Over half of the Company’s manufacturing costs consist of the costs of corn, potato starch, chemicals and natural gas. The remaining portion consists of the costs of labor, distribution, depreciation and maintenance of manufacturing plant and equipment, and other utilities. The prices of raw materials may fluctuate, and increases

4

Table of Contents

in costs may affect Penford’s business adversely. To mitigate this risk, Penford hedges a portion of corn and gas purchases with futures and options contracts in the U.S. and enters into short-term supply agreements for other production requirements.

Research and Development

Penford’s research and development efforts cover a range of projects including technical service work focused on specific customer support projects which require coordination with customers’ research efforts to develop innovative solutions to specific customer requirements. These projects are supplemented with longer-term, new product development and commercialization initiatives. Research and development expenses were $4.8 million, $4.4 million and $4.3 million for fiscal years 2011, 2010 and 2009, respectively.

At the end of fiscal 2011, Penford had 20 scientists, including six with a Ph.D. degree with expert knowledge of carbohydrate characteristics and chemistry.

Patents, Trademarks and Trade Names

Penford owns a number of patents, trademarks and trade names. The Company has approximately 57 current patents and pending patent applications, most of which are related to technologies in french fry coatings, coatings for the paper industry, and animal and human nutrition. Penford’s issued patents expire at various times between 2012 and 2027. The annual cost to maintain all of the Company’s patents is not significant. Most of Penford’s products are currently made with technology that is broadly available to companies that have the same level of scientific expertise and production capabilities as Penford.

Specialty starch ingredient brand names for industrial applications include, among others, Penford® gums, Pensize® binders, Penflex® sizing agent, Topcat® cationic additive and the Apollo® starch series. Product brand names for food ingredient applications include PenBind®, PenCling® and PenPlus®.

Quarterly Fluctuations

Penford’s revenues and operating results vary from quarter to quarter. Sales volumes of the Food Ingredients products used in french fry coatings are generally lower during Penford’s second fiscal quarter due to decreased consumption of french fries during the post-holiday season. The cost of natural gas in North America is generally higher in the winter months than the summer months.

Working Capital

The Company’s growth is funded through a combination of cash flows from operations and short- and long-term borrowings. For more information, see the “Liquidity and Capital Resources” section under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and the audited consolidated financial statements and the related notes included elsewhere in this Annual Report on Form 10-K.

Penford generally carries a one- to 45-day supply of materials required for production, depending on the lead time for specific items. Penford manufactures finished goods to customer orders or anticipated demand. The Company is therefore able to carry less than a 30-day supply of most products. Terms for trade receivables and trade payables are standard for the industry and region and generally do not exceed 30-45 day terms except for trade receivables for export sales.

Environmental Matters

Penford’s operations are governed by various federal, state, and local environmental laws and regulations. These laws and regulations include the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the EPA Oil Pollution Control Act, the Occupational Safety and Health Administration’s hazardous materials regulations, the Toxic Substances Control Act, the Comprehensive Environmental Response Compensation and Liability Act, and the Superfund Amendments and Reauthorization Act.

5

Table of Contents

Permits are required by the various environmental agencies that regulate the Company’s operations. Penford believes that it has obtained all necessary material environmental permits required for its operations. Penford believes that its operations are in compliance with applicable environmental laws and regulations in all material aspects of its business. Penford estimates that annual compliance costs, excluding operational costs for emission control devices, wastewater treatment or disposal fees, are approximately $1.1 million.

Penford has adopted and implemented a comprehensive corporate-wide environmental management program. The program is managed and designed to structure the conduct of Penford’s business in a safe and fiscally responsible manner that protects and preserves the health and safety of employees, the communities surrounding the Company’s plants, and the environment. The Company continuously monitors environmental legislation and regulations that may affect Penford’s operations.

During fiscal 2011, compliance with environmental regulations did not have a material impact on the Company’s operations. No unusual expenditures for environmental facilities and programs are anticipated in fiscal 2012.

Principal Customers

Penford sells to a variety of customers and has several relatively large customers in each business segment. The Company’s sales of ethanol to its sole ethanol customer, Eco-Energy, Inc., represented approximately 34%, 27% and 21% of the Company’s net sales for fiscal years 2011, 2010 and 2009, respectively. Eco-Energy, Inc. is a marketer and distributor of bio-fuels in the United States and Canada. The Company’s second largest customer, Domtar, Inc., represented approximately 8%, 8% and 11% of the Company’s net sales for fiscal years 2011, 2010 and 2009, respectively. Domtar, Inc. and Eco-Energy are customers of the Company’s Industrial Ingredients business.

Competition

In its primary markets, Penford competes directly with approximately five other companies that manufacture specialty starches for the papermaking industry, approximately six other companies that manufacture specialty food ingredients, and numerous producers of fuel grade ethanol. Penford competes indirectly with a larger number of companies that provide synthetic and natural-based ingredients to industrial and food customers. Some of these competitors are larger companies, and have greater financial and technical resources than Penford. Application expertise, quality and service are the major competitive advantages for Penford.

Employees

At August 31, 2011, Penford had 333 employees, of which approximately 40% were members of a trade union. The collective bargaining agreement covering the Cedar Rapids-based manufacturing workforce expires in August 2012.

Sales and Distribution

Sales are generated using a combination of direct sales and distributor agreements. In many cases, Penford supports its sales efforts with technical and advisory assistance to customers. Penford generally ships its products upon receipt of purchase orders from its customers and, consequently, backlog is not significant.

Since Penford’s customers are generally other manufacturers and processors, most of the Company’s products are distributed via rail or truck to customer facilities in bulk.

6

Table of Contents

Export Sales

Export sales from Penford’s businesses in the U.S. accounted for approximately 9%, 9% and 8% of total sales in fiscal 2011, 2010 and 2009, respectively. See Note 19 to the Consolidated Financial Statements for sales by country to which the product was shipped.

Available Information

Penford’s Internet address is www.penx.com. The Company makes available, free of charge through its Internet site, the Company’s annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; Directors and Officers Forms 3, 4 and 5; and amendments to those reports, as soon as reasonably practicable after electronically filing such materials with, or furnishing them to, the Securities and Exchange Commission (“SEC”). The information found on Penford’s web site will not be considered to be part of this or any other report or other filing filed with or furnished to the SEC. The SEC also maintains an Internet site which contains reports, proxy and information statements, and other information regarding issuers that file information electronically with the SEC. The SEC’s Internet address is www.sec.gov.

In addition, the Company makes available, through the Investor Relations section of its Internet site, the Company’s Code of Business Conduct and Ethics and the written charters of the Audit, Governance and Executive Compensation and Development Committees.

Executive Officers of the Registrant

| Name |

Age | Title | ||||

| Thomas D. Malkoski |

55 | President and Chief Executive Officer | ||||

| Steven O. Cordier |

55 | Senior Vice President, Chief Financial Officer and Assistant Secretary | ||||

| Timothy M. Kortemeyer |

45 | Vice President; President, Industrial Ingredients | ||||

| Wallace H. Kunerth |

63 | Vice President and Chief Science Officer | ||||

| Christopher L. Lawlor |

61 | Vice President - Human Resources, General Counsel and Secretary | ||||

| John R. Randall |

67 | Vice President; President, Food Ingredients | ||||

Mr. Malkoski joined Penford Corporation as Chief Executive Officer and was appointed to the Board of Directors in January 2002. He was named President of Penford Corporation in January 2003. From 1997 to 2001, he served as President and Chief Executive Officer of Griffith Laboratories, North America, a formulator, manufacturer and marketer of ingredient systems to the food industry. Previously, he served in various senior management positions, including as Vice President/Managing Director of the Asia Pacific and South Pacific regions for Chiquita Brands International, an international marketer and distributor of bananas and other fresh produce. Mr. Malkoski began his career at the Procter and Gamble Company, a marketer of consumer brands, progressing through major product category management responsibilities. Mr. Malkoski holds a Masters of Business Administration degree from the University of Michigan.

Mr. Cordier is Penford’s Senior Vice President, Chief Financial Officer and Assistant Secretary. He joined Penford in July 2002 as Vice President and Chief Financial Officer, and was promoted to Senior Vice President in November 2004. From September 2005 to April 2006, Mr. Cordier served as the interim Managing Director of Penford’s Australian and New Zealand operations. He came to Penford from Sensient Technologies Corporation, a manufacturer of specialty products for the food, beverage, pharmaceutical and technology industries, where he held a variety of senior financial management positions.

Mr. Kortemeyer has served as Vice President of Penford Corporation since October 2005 and President, Industrial Ingredients since June 2006. He served as General Manager of Penford Products from August 2005 to June 2006. Mr. Kortemeyer joined Penford in 1999 and served as a Team Leader in the manufacturing operations

7

Table of Contents

of Penford Products until 2001. From 2001 until 2003, he was an Operations Manager and Quality Assurance Manager. From July 2003 to November 2004, Mr. Kortemeyer served as the business unit manager of the Company’s co-products business, and from November 2004 until August 2005, as the director of the Company’s specialty starches product lines, responsible for sales, marketing and business development.

Dr. Kunerth has served as Penford’s Vice President and Chief Science Officer since 2000. From 1997 to 2000, he served in food applications research management positions in the Consumer and Nutrition Sector at Monsanto Company, a provider of hydrocolloids, high intensity sweeteners, agricultural products and integrated solutions for industrial, food and agricultural customers. Before Monsanto, he was the Vice President of Technology at Penford’s food ingredients business from 1993 to 1997.

Mr. Lawlor joined Penford in April 2005 as Vice President-Human Resources, General Counsel and Secretary. From 2002 to April 2005, Mr. Lawlor served as Vice President-Human Resources for Sensient Technologies Corporation, a manufacturer of specialty chemicals and food products. From 2000 to 2002, he was Assistant General Counsel for Sensient. Mr. Lawlor was Vice President-Administration, General Counsel and Secretary for Kelley Company, Inc., a manufacturer of material handling and safety equipment from 1997 to 2000. Prior to joining Kelley Company, Mr. Lawlor was employed as an attorney at a manufacturer of paper and packaging products and in private practice with two national law firms.

Mr. Randall is Vice President of Penford Corporation and President, Food Ingredients. He joined Penford in February 2003 as Vice President and General Manager of Penford Food Ingredients and was promoted to President of the Food Ingredients division in June 2006. Prior to joining Penford, Mr. Randall was Vice President, Research & Development/Quality Assurance of Griffith Laboratories, USA, a specialty foods ingredients business, from 1998 to 2003. From 1993 to 1998, Mr. Randall served in various research and development positions with KFC Corporation, a quick-service restaurant business, most recently as Vice President, New Product Development. Prior to 1993, Mr. Randall served in research and development leadership positions at Romanoff International, Inc., a manufacturer and marketer of gourmet specialty food products, and at Kraft/General Foods.

8

Table of Contents

Risks Related to Penford’s Business

The availability and cost of agricultural products Penford purchases are vulnerable to weather and other factors beyond its control. The Company’s ability to pass through cost increases for these products is limited by worldwide competition and other factors.

In fiscal 2011, approximately 49% of Penford’s manufacturing costs were the costs of corn, potato starch and other agricultural raw materials. Weather conditions, plantings, government programs and policies, and energy costs and global supply, among other things, have historically caused volatility in the supply and prices of these agricultural products. Due to local and/or international competition, the Company may not be able to pass through the increases in the cost of agricultural raw materials to its customers. To manage price volatility in the commodity markets, the Company may purchase inventory in advance or enter into exchange traded futures contracts. Despite these hedging activities, the Company may not be successful in limiting its exposure to market fluctuations in the cost of agricultural raw materials. Increases in the cost of corn, potato starch and other agricultural raw materials due to weather conditions or other factors beyond Penford’s control and that cannot be passed through to customers will reduce Penford’s future profitability.

Increases in energy and chemical costs may reduce Penford’s profitability.

Energy and chemicals comprised approximately 9% and 10%, respectively, of the cost of manufacturing the Company’s products in fiscal 2011. Penford uses natural gas extensively in its Industrial Ingredients business to dry starch products, and, to a lesser extent, in the Food Ingredients business. The Company uses chemicals in all of the businesses to modify starch for specific product applications and customer requirements. The prices of these inputs to the manufacturing process fluctuate based on anticipated changes in supply and demand, weather and the prices of alternative fuels, including petroleum. The Company may use short-term purchase contracts or exchange traded futures contracts to reduce the price volatility of natural gas; however, these strategies are not available for the chemicals the Company purchases. If the Company is unable to pass on increases in energy and chemical costs to its customers, margins and profitability would be adversely affected.

The loss of a major customer could have an adverse effect on Penford’s results of operations.

The Company’s sales of ethanol to its sole ethanol customer, Eco-Energy, Inc., represented approximately 34%, 27% and 21% of the Company’s net sales for fiscal years 2011, 2010 and 2009, respectively. Eco-Energy, Inc. is a marketer and distributor of bio-fuels in the United States and Canada. The Company’s second largest customer, Domtar, Inc., represented approximately 8%, 8% and 11% of the Company’s net sales for fiscal years 2011, 2010 and 2009, respectively. Sales to the top ten customers represented 65%, 65% and 69% of net sales for fiscal years 2011, 2010 and 2009, respectively. Generally, the Company does not have multi-year sales agreements with its customers. Many customers place orders on an as-needed basis and generally can change their suppliers without penalty. If Penford lost one or more major customers, or if one or more major customers significantly reduced its orders, sales and results of operations would be adversely affected.

The Company is substantially dependent on its manufacturing facilities; any operational disruption could result in a reduction of the Company’s sales volumes and could cause it to incur substantial losses.

Penford’s revenues are, and will continue to be, derived from the sale of starch-based ingredients and ethanol that the Company manufactures at its facilities. The Company’s operations may be subject to significant interruption if any of its facilities experiences a major accident or is damaged by severe weather or other natural disasters, as occurred as a result of the flood of the Cedar River at the Company’s Cedar Rapids, Iowa facility in fiscal 2008. In addition, the Company’s operations may be subject to labor disruptions and unscheduled downtime, or other operational hazards inherent in the industry, such as equipment failures, fires, explosions,

9

Table of Contents

abnormal pressures, blowouts, pipeline ruptures, transportation accidents and natural disasters. Some of these operational hazards may cause personal injury or loss of life, severe damage to or destruction of property and equipment or environmental damage, and may result in suspension of operations and the imposition of civil or criminal penalties. The Company’s insurance may not be adequate to fully cover the potential operational hazards described above or that it will be able to renew this insurance on commercially reasonable terms or at all.

The agreements governing the Company’s debt and preferred stock contain various covenants that limit its ability to take certain actions and also require the Company to meet financial maintenance tests, and Penford’s failure to comply with any of the debt covenants could have a material adverse effect on the Company’s business, financial condition and results of operations.

The agreements governing Penford’s outstanding debt contain a number of significant covenants that, among other things, limit its ability to:

| • | incur additional debt or liens; |

| • | consolidate or merge with any person or transfer or sell all or substantially all of its assets; |

| • | make investments or acquisitions; |

| • | pay dividends or make certain other restricted payments; |

| • | enter into transactions with affiliates; and |

| • | create dividend or other payment restrictions with respect to subsidiaries. |

In addition, the Company’s revolving credit facility requires it to comply with specific financial ratios and tests, under which it is required to achieve specific financial and operating results. Events beyond the Company’s control may affect its ability to comply with these provisions. A breach of any of these covenants would result in a default under the Company’s revolving credit facility. In the event of any default that is not cured or waived, the Company’s lenders could elect to declare all amounts borrowed under the revolving credit facility, together with accrued interest thereon, due and payable, which could permit acceleration of other debt. If any of the Company’s debt is accelerated, there is no assurance that the Company would have sufficient assets to repay that debt or that it would be able to refinance that debt on commercially reasonable terms or at all.

Changes in interest rates may affect Penford’s profitability.

As of August 31, 2011, approximately $22.1 million of its outstanding debt was subject to variable interest rates which move in direct relation to the London InterBank Offered Rate (“LIBOR”), or the prime rate in the United States, depending on the selection of borrowing options. Any significant changes in these interest rates would materially affect the Company’s profitability by increasing or decreasing its borrowing costs.

Unanticipated changes in tax rates or exposure to additional income tax liabilities could affect Penford’s profitability.

The Company is subject to income taxes in the federal and various state jurisdictions in the United States. The Company’s effective tax rates could be adversely affected by changes in the mix of earnings in tax jurisdictions with differing statutory tax rates, changes in the valuation of deferred tax assets and liabilities or changes in tax laws. The carrying value of deferred tax assets is dependent on the Company’s ability to generate future taxable income in the United States. The amount of income taxes paid is subject to interpretation of applicable tax laws in the jurisdictions in which the Company operates. Although the Company believes it has complied with all applicable income tax laws, there is no assurance that a tax authority will not have a different interpretation of the law or that any additional taxes imposed as a result of tax audits will not have an adverse effect on the Company’s results of operations.

10

Table of Contents

Pension expense and the funding of pension obligations are affected by factors outside the Company’s control, including the performance of plan assets, interest rates, actuarial data and experience, and changes in laws and regulations.

The future funding obligations for the Company’s two U.S. defined benefit pension plans qualified with the Internal Revenue Service depend upon the level of benefits provided for by the plans, the future performance of assets set aside in trusts for these plans, the level of interest rates used to determine funding levels, actuarial data and experience and any changes in government laws and regulations. The pension plans hold a significant amount of equity and fixed income securities. When the values of these securities decline, pension expense can increase and materially affect the Company’s results. Decreases in interest rates that are not offset by contributions and asset returns could also increase the Company’s obligations under such plans. The Company is legally required to make contributions to the pension plans in the future, and those contributions could be material. The Company expects to contribute $2.8 million to its pension plans during fiscal 2012.

The current capital and credit market conditions may adversely affect the Company’s access to capital, cost of capital and business operations.

The general economic and capital market conditions in the United States and other parts of the world have deteriorated significantly and have adversely affected access to capital and increased the cost of capital. If these conditions continue or become worse, the Company’s future cost of debt and equity capital and its access to capital markets could be adversely affected. An inability to obtain adequate financing from debt and equity sources could force the Company to self-fund strategic initiatives or even forgo some opportunities, potentially harming its financial position, results of operations and liquidity.

Economic conditions may impair the businesses of the Company’s customers and end user markets, which could adversely affect the Company’s business operations.

As a result of the current economic downturn and macro-economic challenges currently affecting the economy of the United States and other parts of the world, the businesses of some of the Company’s customers may not be successful in generating sufficient revenues. Customers may choose to delay or postpone purchases from the Company until the economy and their businesses strengthen. The Company’s Industrial Ingredients business is dependent upon end markets for paper and ethanol in North America. Paper markets have been under competitive pressure from imports and over-capacity and may be further stressed by the continuing economic downturn. In fiscal 2011, one of the Company’s paper industry customers shut down its mill operations and one paper industry customer filed for reorganization in bankruptcy. The Company’s Industrial Ingredients business increased its reserve for uncollectible accounts by $1.2 million for these customers. Ethanol markets have been under pressure from declining oil prices and increasing ethanol production capacity in the United States. Decisions by current or future customers to forego or defer purchases and/or customers’ inability to pay the Company for its products may adversely affect the Company’s earnings and cash flow.

Penford depends on its senior management team; the loss of any member could adversely affect its operations.

Penford’s success depends on the management and leadership skills of its senior management team. The loss of any of these individuals, particularly Thomas D. Malkoski, the Company’s President and Chief Executive Officer, or Steven O. Cordier, the Company’s Chief Financial Officer, or the Company’s inability to attract, retain and maintain additional personnel, could prevent it from fully implementing its business strategy. There is no assurance that it will be able to retain its existing senior management personnel or to attract additional qualified personnel when needed.

11

Table of Contents

Penford is subject to stringent environmental and health and safety laws, which may require it to incur substantial compliance and remediation costs, thereby reducing profits.

Penford is subject to many federal, state and local environmental and health and safety laws and regulations, particularly with respect to the use, handling, treatment, storage, discharge and disposal of substances and hazardous wastes used or generated in its manufacturing processes. Compliance with these laws and regulations is a significant factor in the Company’s business. Penford has incurred and expects to continue to incur expenditures to comply with applicable environmental laws and regulations. The Company’s failure to comply with applicable environmental laws and regulations and permit requirements could result in civil or criminal fines or penalties or enforcement actions, including regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures, installation of pollution control equipment or remedial actions.

The Company may be required to incur costs relating to the investigation or remediation of property, including property where it has disposed of its waste, and for addressing environmental conditions. Some environmental laws and regulations impose liability and responsibility on present and former owners, operators or users of facilities and sites for contamination at such facilities and sites without regard to causation or knowledge of contamination. Consequently, there is no assurance that existing or future circumstances, the development of new facts or the failure of third parties to address contamination at current or former facilities or properties will not require significant expenditures by the Company.

The Company expects to continue to be subject to increasingly stringent environmental and health and safety laws and regulations. It is difficult to predict the future interpretation and development of environmental and health and safety laws and regulations or their impact on the Company’s future earnings and operations. The Company anticipates that compliance will continue to require increased capital expenditures and operating costs. Any increase in these costs, or unanticipated liabilities arising, for example, out of discovery of previously unknown conditions or more aggressive enforcement actions, could adversely affect the Company’s results of operations, and there is no assurance that they will not have a material adverse effect on its business, financial condition and results of operations.

Penford’s unionized workforce could cause interruptions in the Company’s provision of services.

As of August 31, 2011, approximately 40% of the Company’s 333 employees were members of a trade union. Although the Company’s relations with the relevant union are stable and the Company’s labor contract does not expire until August 2012, there is no assurance that the Company will not experience work disruptions or stoppages in the future, which could have a material adverse effect on its business and results of operations and adversely affect its relationships with its customers.

Risk Factors Relating to Penford’s Common Stock

Penford’s stock price has fluctuated significantly; the trading price of its common stock may fluctuate significantly in the future.

The trading price of the Company’s common stock has fluctuated significantly. In fiscal 2011, the stock price ranged from a low of $4.50 on September 1, 2010 and September 23, 2010 to a high of $7.95 on November 9, 2010. The trading price of Penford’s common stock may fluctuate significantly in the future as a result of a number of factors, including:

| • | actual and anticipated variations in the Company’s operating results; |

| • | general economic and market conditions, including changes in demand for the Company’s products; |

| • | interest rates; |

12

Table of Contents

| • | geopolitical conditions throughout the world; |

| • | perceptions of the strengths and weaknesses of the Company’s industries; |

| • | the Company’s ability to pay principal and interest on its debt when due; |

| • | developments in the Company’s relationships with its lenders, customers and/or suppliers; |

| • | announcements of alliances, mergers or other relationships by or between the Company’s competitors and/or its suppliers and customers; and |

| • | quarterly variations in the Company’s results of operations due to, among other things, seasonality in demand for products and fluctuations in the cost of raw materials |

The stock markets in general have experienced broad fluctuations that have often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of the Company’s common stock. Accordingly, Penford’s common stock may trade at prices significantly below an investor’s cost and investors could lose all or part of their investment in the event that they choose to sell their shares.

Provisions of Washington law could discourage or prevent a potential takeover.

Washington law imposes restrictions on certain transactions between a corporation and certain significant shareholders. The Washington Business Corporation Act generally prohibits a “target corporation” from engaging in certain significant business transactions with an “acquiring person,” which is defined as a person or group of persons that beneficially owns 10% or more of the voting securities of the target corporation, for a period of five years after such acquisition, unless the transaction or acquisition of shares is approved by a majority of the members of the target corporation’s board of directors prior to the time of the acquisition. Such prohibited transactions include, among other things, (1) a merger or consolidation with, disposition of assets to, or issuance or redemption of stock to or from, the acquiring person; (2) a termination of 5% or more of the employees of the target corporation as a result of the acquiring person’s acquisition of 10% or more of the shares; and (3) allowing the acquiring person to receive any disproportionate benefit as a shareholder. After the five year period, a “significant business transaction” may occur if it complies with “fair price” provisions specified in the statute. A corporation may not “opt out” of this statute.

Item 1B: Unresolved Staff Comments

None.

13

Table of Contents

Penford’s facilities as of August 31, 2011 are as follows:

| Bldg.

Area (Approx. Sq. Ft.) |

Land Area (Acres) |

Owned/ Leased |

Function of Facility | |||||||||

| Centennial, Colorado |

25,200 | — | Leased | Corporate headquarters and research laboratories | ||||||||

|

| ||||||||||||

| Cedar Rapids, Iowa |

759,000 | * | 29 | Owned | Manufacture of corn starch products and research laboratories | |||||||

|

| ||||||||||||

| Idaho Falls, Idaho |

30,000 | 4 | Owned | Manufacture of potato starch products | ||||||||

|

| ||||||||||||

| Richland, Washington |

— | 4.4 | — | Manufacture of potato and tapioca starch products | ||||||||

| (owned and leased) |

||||||||||||

| Building 1 |

45,000 | — | Owned | |||||||||

| Building 2 |

9,600 | — | Leased | |||||||||

|

| ||||||||||||

| Plover, Wisconsin (two facilities, one of which is located on leased land) |

— | — | — | Manufacture of potato starch products | ||||||||

| Facility 1 |

45,000 | 9.5 | Owned | |||||||||

| Facility 2 |

15,000 | 3.3 | Owned | |||||||||

| (leased land) |

||||||||||||

|

| ||||||||||||

* Approximately 119,150 square feet are subject to a long-term lease to the purchaser of the Company’s former dextrose business

Penford’s production facilities are strategically located near sources of raw materials. The Company believes that its facilities are maintained in good condition and that the capacities of its plants are sufficient to meet current production requirements. The Company invests in expansion, improvement and maintenance of property, plant and equipment as required.

The Company filed suit on January 23, 2009 in the United States District Court for the Northern District of Iowa against two insurance companies, National Union Fire Insurance Company of Pittsburgh, Pennsylvania, owned by American International Group, Inc. (“AIG”), and ACE American Insurance Company (“ACE”), due to the insurers’ denial of certain insurance coverage for damages that the Company suffered from the flood that struck the Company’s Cedar Rapids, Iowa plant in June 2008. On January 19, 2010, the presiding judge ruled that flood coverage language contained in the applicable insurance policy was “ambiguous” and that the interpretation of the policy was “a question of fact reserved for a jury.” At the conclusion of the jury trial subsequently conducted in August 2010, the presiding judge dismissed the Company’s claims without issuing a written opinion. In the fall of 2010, the Company appealed the dismissal to the United States Court of Appeals for the Eighth Circuit. The Company’s appeal has not yet been decided. The Company cannot at this time determine the likelihood of any outcome of the appeal or estimate the amount of any judgment that might be awarded.

In June 2011, the Company was notified that a complaint had been filed in the United States District Court for the District of New Jersey alleging that certain pet chew products supplied to a customer by the Company’s subsidiary, Penford Products Co. (“Penford Products”), infringe upon a patent owned by T.F.H. Publications, Inc. (“TFH”). The customer requested that Penford Products defend this lawsuit pursuant to the terms of its supply

14

Table of Contents

agreement with Penford Products. The Company believes that its products do not infringe upon the patent and has commenced a defense of the lawsuit. The Company cannot at this time determine the likelihood of any outcome or estimate any damages that might be awarded.

In July 2011, the purchaser of the Company’s Lane Cove, New South Wales, Australia operating assets filed a claim for $787,000 pursuant to the sale agreement. See Note 17 to the Consolidated Financial Statements.

The Company regularly evaluates the status of claims and legal proceedings in which it is involved in order to assess whether a loss is probable or there is a reasonable possibility that a loss may have been incurred and to determine if accruals are appropriate. For the matters identified in the preceding two paragraphs, management is unable to provide additional information regarding any possible loss because, among other reasons, (i) the matters are in early stages; (ii) the Company currently believes that the claims are not adequately supported; and (iii) there are significant factual issues to be resolved. With regard to these matters, management does not believe, based on currently available information, that the eventual outcomes will have a material adverse effect on the Company’s financial condition, although the outcomes could be material to the Company’s operating results for any particular period, depending, in part, upon the operating results for such period.

The Company is involved from time to time in various other claims and litigation arising in the normal course of business. In the judgment of management, which relies in part on information obtained from the Company’s outside legal counsel, the ultimate resolution of these other matters will not materially affect the consolidated financial position, results of operations or liquidity of the Company.

PART II

Item 5: Market for the Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of

| Equity | Securities |

Market Information and Holders of Common Stock

Penford’s common stock, $1.00 par value, trades on The NASDAQ Global Market under the symbol “PENX.” On November 3, 2011, there were 393 shareholders of record. The high and low closing prices of Penford’s common stock during the last two fiscal years are set forth below.

| Fiscal 2011 | Fiscal 2010 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| Quarter Ended November 30 |

$ | 7.95 | $ | 4.50 | $ | 9.63 | $ | 5.68 | ||||||||

| Quarter Ended February 28 |

$ | 7.27 | $ | 5.50 | $ | 12.15 | $ | 7.94 | ||||||||

| Quarter Ended May 31 |

$ | 6.35 | $ | 5.22 | $ | 11.68 | $ | 7.44 | ||||||||

| Quarter Ended August 31 |

$ | 6.49 | $ | 5.04 | $ | 8.25 | $ | 4.83 | ||||||||

Dividends

In April 2009, the Board of Directors suspended payment of dividends. The Company may not declare or pay any dividends on its common stock without first obtaining approval from the holders of a majority of the Series A Preferred Stock. See Note 5 to the Consolidated Financial Statements for further details.

Issuer Purchases of Equity Securities

None

15

Table of Contents

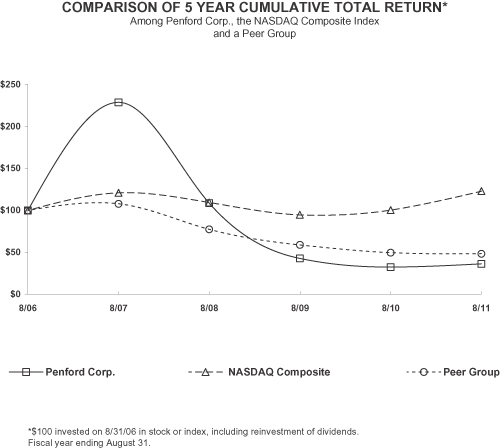

Performance Graph

The following graph compares the Company’s cumulative total shareholder return on its common stock for a five-year period (September 1, 2006 to August 31, 2011) with the cumulative total return of the Nasdaq Market Index and all companies traded on the Nasdaq Stock Market (“Nasdaq”) with a market capitalization of $100—$200 million, excluding financial institutions. The graph assumes that $100 was invested on September 1, 2006 in the Company’s common stock and in the stated indices. The comparison assumes that all dividends are reinvested. The Company’s performance as reflected in the graph is not indicative of the Company’s future performance.

ASSUMES $100 INVESTED ON SEPTEMBER 1, 2006

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING AUGUST 31, 2011

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||||||

| PENFORD CORPORATION |

100.00 | 228.44 | 108.69 | 42.70 | 32.49 | 36.47 | ||||||||||||||||||

| NASDAQ MARKET INDEX (U.S.) |

100.00 | 120.88 | 109.33 | 94.74 | 100.35 | 122.93 | ||||||||||||||||||

| NASDAQ MARKET CAP ($100-200M) |

100.00 | 107.78 | 77.43 | 58.92 | 49.62 | 48.36 | ||||||||||||||||||

Management does not believe there is either a published index or a group of companies whose overall business is sufficiently similar to the business of Penford to allow a meaningful benchmark against which the Company can be compared. The Company sells products based on specialty carbohydrate chemistry to several distinct markets, making overall comparisons to one of these markets misleading with respect to the Company as a whole. For these reasons, the Company has elected to use non-financial companies traded on Nasdaq with a similar market capitalization as a peer group.

16

Table of Contents

Item 6: Selected Financial Data

The following table sets forth certain selected financial information for the five fiscal years as of and for the period ended August 31, 2011. The amounts have been restated to reflect the reclassification of discontinued operations and should be read in conjunction with the consolidated financial statements and the notes to these statements included in Item 8.

| Year Ended August 31, |

||||||||||||||||||||

| 2011 |

2010 |

2009 |

2008 |

2007 |

||||||||||||||||

| (Dollars in thousands, except share and per share data) | ||||||||||||||||||||

| Operating Data: |

||||||||||||||||||||

| Sales |

$ | 315,441 | $ | 254,274 | $ | 255,556 | $ | 239,581 | $ | 257,944 | ||||||||||

| Cost of sales |

$ | 281,606 | $ | 230,820 | $ | 243,265 | $ | 194,993 | $ | 203,886 | ||||||||||

| Gross margin percentage |

10.7% | 9.2% | 4.8% | 18.6% | 21.0% | |||||||||||||||

| Income (loss) from continuing operations (2) |

$ | (5,117 | ) | $ | (9,629 | ) | $ | (6,645 | ) | $ | (10,808 | )(1) | $ | 11,283 | (1) | |||||

| Income (loss) from discontinued operations (3) |

$ | - | $ | 16,312 | $ | (58,142 | ) | $ | (1,892 | ) | $ | 2,234 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (5,117 | ) | $ | 6,683 | $ | (64,787 | ) | $ | (12,700 | ) | $ | 13,517 | |||||||

| Diluted earnings (loss) per share from continuing operations |

$ | (0.42 | ) | $ | (0.84 | ) | $ | (0.59 | ) | $ | (1.02 | ) | $ | 1.22 | ||||||

| Diluted earnings (loss) per share from discontinued operations |

$ | - | $ | 1.41 | $ | (5.21 | ) | $ | (0.18 | ) | $ | 0.24 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted earnings (loss) per share |

$ | (0.42 | ) | $ | 0.57 | $ | (5.80 | ) | $ | (1.20 | ) | $ | 1.46 | |||||||

| Dividends declared per common share |

$ | - | $ | - | $ | 0.12 | $ | 0.24 | $ | 0.24 | ||||||||||

| Average common shares and equivalents–assuming dilution |

12,250,914 | 11,600,885 | 11,170,493 | 10,565,432 | 9,283,125 | |||||||||||||||

| Balance Sheet Data (as of August 31): |

||||||||||||||||||||

| Total assets |

$ | 212,414 | $ | 208,408 | $ | 258,245 | $ | 320,433 | $ | 288,388 | ||||||||||

| Capital expenditures |

8,295 | 5,980 | 5,379 | 38,505 | 32,782 | |||||||||||||||

| Long-term debt |

23,802 | 21,038 | 71,141 | 59,860 | 63,403 | |||||||||||||||

| Total debt |

24,223 | 21,467 | 92,382 | 67,889 | 67,459 | |||||||||||||||

| Redeemable preferred stock, Series A (4) |

38,982 | 34,104 | - | - | - | |||||||||||||||

| Shareholders’ equity |

85,465 | 83,572 | 79,359 | 160,362 | 125,676 | |||||||||||||||

| (1) | Includes pre-tax charges of $1.4 million and $2.4 million in fiscal years 2008 and 2007, respectively, related to the settlement of litigation. |

| (2) | In the third quarter of fiscal 2010, the Company refinanced its bank debt. See Note 6 to the Consolidated Financial Statements. In connection with the refinancing, the Company recorded a pre-tax non-cash charge to earnings of approximately $1.0 million related to unamortized transaction fees associated with the prior credit facility. In addition, the Company terminated its interest rate swap agreements with several banks in the third quarter of fiscal 2010 and recorded a loss of approximately $1.6 million. In the second quarter of fiscal 2009, the Company’s Food Ingredients business segment sold assets related to its dextrose product line to a third-party purchaser and recorded a $1.6 million gain on the sale. In the fourth quarter of fiscal 2008, the Company’s Cedar Rapids, Iowa manufacturing facility suffered severe flooding which suspended production for most of the fourth quarter. The Company recorded pre-tax costs of $27.6 million, net of insurance recoveries in fiscal year 2008 and net insurance recoveries of $9.1 million in fiscal 2009. See Note 18 to the Consolidated Financial Statements. |

| (3) | In August 2009, the Company recorded a $33.0 million non-cash asset impairment charge related to the property, plant and equipment of the Australia/New Zealand Operations. In the second quarter of fiscal 2009, the Australia/New Zealand Operations recorded a $13.8 million non-cash goodwill impairment charge. See Note 17 to the Consolidated Financial Statements. In the second quarter of fiscal 2010, the liquidation of the remaining net assets of Penford Australia was substantially complete and, as a result, $13.8 of currency translation adjustments were |

17

Table of Contents

| reclassified from accumulated other comprehensive income into earnings. Includes a pre-tax gain of $0.7 million related to the sale of land in New Zealand in fiscal year 2008. |

| (4) | In the third quarter of fiscal 2010, the Company issued $40 million of Series A 15% cumulative non-voting, non-convertible preferred stock (“Series A Preferred Stock”) and 100,000 shares of Series B voting convertible preferred stock (“Series B Preferred Stock”) in a private placement to Zell Credit Opportunities Master Fund, L.P., an investment fund managed by Equity Group Investments, a private investment firm (the “Investor”). Proceeds from the preferred stock issuance of $40.0 million were used to repay bank debt. See Note 5 to the Consolidated Financial Statements. |

18

Table of Contents

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) should be read in conjunction with the Company’s consolidated financial statements and the accompanying notes. The notes to the Consolidated Financial Statements referred to in this MD&A are included in Part II Item 8, “Financial Statements and Supplementary Data.” Unless otherwise noted, all amounts and analyses are based on continuing operations.

Overview

Penford generates revenues, income and cash flows by developing, manufacturing and marketing specialty natural-based ingredient systems for industrial and food applications and by producing and selling fuel grade ethanol. The Company develops and manufactures ingredients with starch as a base, providing value-added applications to its customers. Penford’s starch products are manufactured primarily from corn and potatoes and are used principally as binders and coatings in paper and food production and as an ingredient in fuel.

In analyzing business trends, management considers a variety of performance and financial measures, including sales revenue growth, sales volume growth, and gross margins and operating income of the Company’s business segments. Penford manages its business in two segments. Industrial Ingredients and Food Ingredients are broad categories of end-market users, served by operations in the United States. See Item 1 and Note 19 to the Consolidated Financial Statements for additional information regarding the Company’s business segment operations.

In June 2008, the Company’s Industrial Ingredients plant in Cedar Rapids, Iowa was temporarily shut down due to record flooding of the Cedar River and government-ordered mandatory evacuation of the plant and surrounding areas. The Company sustained substantial damage to this facility and the plant was shut down from mid-June 2008 until the end of August 2008. In fiscal 2009, the Company recorded flood-related costs of $7.6 million and insurance recoveries of $16.7 million. The Company is seeking additional payments from its insurers for damages arising from the flooding in June 2008 and has filed a lawsuit against the insurers. See Notes 18 and 21 to the Consolidated Financial Statements for additional information.

In August 2009, the Company’s Board of Directors made a determination that the Company would exit from the business conducted by the Company’s Australia/New Zealand Operations. On September 2, 2009, the Company completed the sale of Penford New Zealand Limited. On November 27, 2009, the Company’s Australian operating subsidiary, Penford Australia Limited, completed the sale of substantially all of its operating assets to two unrelated parties. The financial data for the Australia/New Zealand Operations have been presented as discontinued operations. See Note 17 to the Consolidated Financial Statements.

Consolidated Results of Operations

Consolidated fiscal 2011 sales expanded $61.2 million, or 24.1%, over the prior year, driven by pricing improvements in the Industrial Ingredients business and favorable sales volume and pricing for non-coating applications in the Food Ingredients segment. Average unit pricing for ethanol improved 44% in fiscal 2011 and higher corn costs drove higher pricing for industrial starch as corn costs are passed through to customers. The market for industrial starch continues to be highly price competitive.

Fiscal 2011 consolidated gross margin increased to $33.8 million from $23.5 million in fiscal 2010. Consolidated gross margin expanded primarily due to improvements in gross margin at the Industrial Ingredients business through higher ethanol pricing and favorable volume and product mix at the Food Ingredients segment. Consolidated income from operations was $4.4 million in fiscal 2011 compared to an operating loss of $4.9 million in fiscal 2010. The expansion in operating income in fiscal 2011 was due to the improvement in gross margin, offset by $1.1 million of increased administrative and employee costs.

19

Table of Contents

Interest expense in fiscal 2011 was $9.4 million compared with $7.5 million in fiscal 2010. Interest expense increased in fiscal 2011 due to the increase in the dividend rate on the Series A Preferred Stock issued in April 2010 over the interest rate for the Company’s bank debt plus the accretion of the discount on the Series A Preferred Stock.

In fiscal 2011, the Company recorded $0.3 million of tax expense on a pretax loss of $4.8 million, resulting in an effective tax rate of (7)%. The effective tax rate for fiscal 2011 varied from the U.S. federal statutory rate of 35% primarily due to tax incentives for the production of ethanol of $1.0 million, offset by $7.7 million of dividends and discount accretion on the preferred stock which are recorded as interest expense for financial reporting purposes but are not deductible in the computation of taxable income. See Note 15 to the Consolidated Financial Statements.

Results of Operations

Fiscal 2011 Compared to Fiscal 2010

Industrial Ingredients

| Year Ended August 31, | ||||||||

| 2011 | 2010 | |||||||

| (Dollars in thousands) | ||||||||

| Sales – industrial starch |

$ | 127,471 | $ | 115,681 | ||||

| Sales – ethanol |

105,730 | 68,335 | ||||||

|

|

|

|

|

|||||

| Total sales |

$ | 233,201 | $ | 184,016 | ||||

| Gross margin |

$ | 7,523 | $ | 461 | ||||

| Loss from operations |

$ | (4,718 | ) | $ | (11,512 | ) | ||

Industrial Ingredients fiscal 2011 sales of $233.2 million grew $49.2 million, or 26.7%, from fiscal 2010. Industrial starch sales of $127.5 million increased 10.2% primarily on a higher pass through of corn costs to customers, offset by a 7% decrease in volume. Sales of the Company’s Liquid Natural Additives products, included in the industrial starch sales amount, improved 19% driven by a volume increase of 14% and higher average unit pricing of 4%. During fiscal 2011, the Industrial Ingredients business continued to shift more of its manufacturing mix to the production of ethanol. Sales of ethanol constituted 45% of industrial sales in fiscal 2011 compared to 37% in fiscal 2010. Revenue expanded 55% to $105.7 million as pricing per gallon improved 44% and volume increased 8%.

Gross margin improved $7.0 million to $7.5 million in fiscal 2011 from $0.5 million a year ago. Margins improved due to higher ethanol pricing of $32.2 million, favorable energy costs of $2.0 million, improvements in manufacturing yields of $2.2 million, and reduced distribution costs of $1.2 million, offset by higher corn costs of $27.5 million, higher chemical costs of $1.6 million, and unfavorable industrial starch pricing and mix of $1.5 million.

The loss from operations for fiscal 2011 improved $6.8 million to $4.7 million from a loss of $11.5 million last year, primarily due to the increase in gross margin. Operating expenses of $9.6 million were comparable to fiscal 2010. An increase in the reserve for uncollectible accounts of $1.5 million in fiscal 2011 due to two paper industry customers, and higher employee costs, license fees and other expenses of $0.8 million were offset by a $2.3 million reduction in legal costs.

20

Table of Contents

Food Ingredients

| Year Ended August 31, | ||||||||

| 2011 | 2010 | |||||||

| (Dollars in thousands) | ||||||||

| Sales |

$ | 82,240 | $ | 70,258 | ||||

| Gross margin |

$ | 26,311 | $ | 22,993 | ||||

| Income from operations |

$ | 18,037 | $ | 15,145 | ||||

Sales of $82.2 million for the year ended August 31, 2011, increased 17.1%, or $12.0 million, on volume growth of 7% and favorable product mix and pricing of 10%. Sales of non-coating applications expanded 44%, with revenues from gluten-free applications and pet chews and treats more than doubling. Sales of coating applications declined 11% due to lower volume.

Gross margin improved $3.3 million due to the favorable pricing and mix of product sales and growth in non-coating sales. Income from operations grew 19% on the increase in gross margin. Operating expenses increased $0.3 million to $6.2 million on higher employee costs. Research and development expenses increased $0.1 million to $2.1 million.

Corporate Operating Expenses

Corporate operating expenses increased to $8.8 million in fiscal 2011 from $8.4 million a year ago, primarily due to an increase in employee-related costs.

Fiscal 2010 Compared to Fiscal 2009

Industrial Ingredients

| Year Ended August 31, | ||||||||

| 2010 | 2009 | |||||||

| (Dollars in thousands) | ||||||||

| Sales – industrial starch |

$ | 115,681 | $ | 131,709 | ||||

| Sales – ethanol |

68,335 | 54,817 | ||||||

|

|

|

|

|

|||||

| Total sales |

$ | 184,016 | $ | 186,526 | ||||

| Gross margin |

$ | 461 | $ | (9,327 | ) | |||

| Loss from operations |

$ | (11,512 | ) | $ | (11,154 | ) | ||

Industrial Ingredients fiscal 2010 sales of $184.0 million declined $2.5 million, or 1.3%, from fiscal 2009. Industrial starch sales of $115.7 million declined 12% from fiscal 2009 sales of $131.7 million on competitive pricing and lower pass through of corn costs to customers, offset by volume increases of 5%. The industrial starch business continued to be impacted by weak demand for printing and writing paper products. Sales of the Company’s Liquid Natural Additives products, included in the industrial starch sales amount, improved 28% driven by volume increases. During fiscal 2010, the Industrial Ingredients business shifted more of its manufacturing mix to the production of ethanol. Sales of ethanol expanded 25% to $68.3 million from $54.8 million in fiscal 2009 as both volume and pricing improved.

Gross margin improved to $0.5 million in fiscal 2010 from a negative margin of $9.3 million in fiscal 2009. Margins improved due to the impact of increased volumes of both industrial starch and ethanol of $4.6 million, favorable ethanol pricing of $2.0 million, improved manufacturing yields and efficiencies of $9.0 million, favorable energy costs and yields of $6.7 million and reduced distribution costs of $2.4 million, offset by unfavorable industrial starch pricing and mix of $14.7 million.

21

Table of Contents

The loss from operations for fiscal 2010 increased $0.4 million to $11.5 million; however, the operating loss for fiscal 2009 of $11.2 million included $9.1 million of net insurance recoveries related to the Cedar Rapids flooding in fiscal 2008. Excluding the impact of the net insurance recoveries, operating income increased by $8.8 million driven by the increase in gross margin. Operating expenses increased by $1.2 million primarily due to increased legal costs related to the litigation against the Company’s insurance carriers (see Note 21 to the Consolidated Financial Statements). Research and development expenses of $2.4 million were comparable to last year.

Food Ingredients

| Year Ended August 31, | ||||||||

| 2010 | 2009 | |||||||

| (Dollars in thousands) | ||||||||

| Sales |

$ | 70,258 | $ | 69,030 | ||||

| Gross margin |

$ | 22,993 | $ | 21,618 | ||||

| Income from operations |

$ | 15,145 | $ | 13,512 | ||||

Sales of $70.3 million for the year ended August 31, 2010, increased 1.8%, or $1.2 million, on volume growth of 8% partially offset by unfavorable product mix and pricing. In the second quarter of fiscal 2009, the Company sold its dextrose product line which generated $1.9 million in sales for fiscal 2009. Excluding dextrose product sales in fiscal 2009, the Food Ingredients sales for fiscal 2010 increased $3.2 million, or 4.7%. Sales of applications to growth end markets, protein, bakery and pet chews, grew 16%.

Gross margin improved $1.4 million on lower raw material, distribution and energy costs. Income from operations grew 12% on an increase in gross margin. Operating expenses declined $0.4 million to $5.9 million compared to fiscal 2009 and research and development expenses increased $0.1 million to $1.9 million.

Corporate Operating Expenses

Corporate operating expenses decreased to $8.4 million in fiscal 2010 from $9.3 million in fiscal 2009, primarily due to a decrease in professional fees and employee related costs.

Non-Operating Income (Expense)

Other non-operating income (expense) consists of the following:

| Year Ended August 31, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (Dollars in thousands) | ||||||||||||

| Loss on extinguishment of debt |

$ | — | $ | (1,049 | ) | $ | — | |||||

| Loss on interest rate swap termination |

— | (1,562 | ) | — | ||||||||

| Gain on sale of dextrose product line |

— | — | 1,562 | |||||||||

| Gain on foreign currency transactions |

— | 419 | 127 | |||||||||

| Other |

115 | 271 | 226 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 115 | $ | (1,921 | ) | $ | 1,915 | ||||||

|

|

|

|

|

|

|

|||||||

On April 7, 2010, the Company refinanced its bank debt. See Note 6 to the Consolidated Financial Statements. In connection with the refinancing, the Company recorded a pre-tax non-cash charge to earnings of approximately $1.0 million in fiscal 2010 related to unamortized transaction fees associated with the prior credit facility. In addition, the Company terminated its interest rate swap agreements with several banks and recorded a loss of approximately $1.6 million.

In fiscal 2009, the Company’s Food Ingredients business segment sold assets related to its dextrose product line to a third-party purchaser for $2.9 million, net of transaction costs. The Company recorded a $1.6 million gain on the sale.

22

Table of Contents

The Company recognized a gain on foreign currency transactions on Australian dollar denominated assets and liabilities as disclosed in the table above.

Interest expense

Interest expense was $9.4 million, $7.5 million and $5.6 million in fiscal years 2011, 2010 and 2009, respectively. Interest expense for fiscal years 2011 and 2010 increased over the previous years primarily due to the increase in the dividend rate on the Series A Preferred Stock issued in April 2010 over the interest rate for the Company’s bank debt. The accretion of the discount on the Series A Preferred Stock and the amortization of issuance costs, which are included in interest expense, were $1.2 million and $0.5 million for the years ended August 31, 2011 and 2010, respectively. On April 7, 2010, the Company issued $40 million of preferred stock at a dividend rate of 15%, the proceeds of which were used to repay outstanding bank debt. Prior to the $40 million repayment, the Company paid interest at LIBOR (London Interbank Offered Rate) plus 5%. See Notes 5 and 6 to the Consolidated Financial Statements.

Income taxes

The effective tax rates for fiscal years 2011, 2010 and 2009 were (7)%, 33% and 34%, respectively. In fiscal 2011, the Company recorded $0.3 million of tax expense on a pretax loss of $4.8 million. The effective tax rate for fiscal 2011 varied from the U.S. federal statutory rate of 35% primarily due to tax incentives for the production of ethanol of $1.0 million, offset by $7.7 million of dividends and discount accretion on the preferred stock which are recorded as interest expense for financial reporting purposes but are not deductible in the computation of taxable income.

The effective tax rate for fiscal 2010 is lower than the U.S. federal statutory rate of 35% primarily due to tax incentives for the production of ethanol of $1.0 million, offset by the effect of state taxes and $2.9 million of dividends and discount accretion on the preferred stock as described above. In fiscal 2009, the effective tax rate is lower than the U.S. federal statutory rate of 35% primarily due to adjustments to the unrecognized tax benefits and adjustments resulting from filing current and amended tax returns, offset by state income taxes. See Note 15 to the Consolidated Financial Statements.

At August 31, 2011, the Company had $13.6 million of net deferred tax assets. A valuation allowance has not been provided on the net U.S. deferred tax assets as of August 31, 2011. The determination of the need for a valuation allowance requires significant judgment and estimates. The Company evaluates the requirement for a valuation allowance each quarter. The tax benefits of operating losses incurred in fiscal 2009 have been carried back to offset taxable income in prior years. The Company believes that it is more likely than not that future operations will generate sufficient taxable income to realize its deferred tax assets. Dividends on the Series A Preferred Stock, as well as accretion of the related discount, are not deductible for tax return purposes. There can be no assurance that management’s current plans will be achieved or that a valuation allowance will not be required in the future.

Results of Discontinued Operations

In fiscal 2010, the Company sold the operating assets of its Australia/New Zealand Operations, which were previously reported in the Consolidated Financial Statements as an operating segment.

The financial results of the Australia/New Zealand Operations for fiscal years 2010 and 2009 have been classified as discontinued operations in the Consolidated Financial Statements. Australian administrative expenses for the year ended August 31, 2011 of $102,000 were included in income from continuing operations. The net assets of the Australia/New Zealand Operations as of August 31, 2011 have been reported as assets and liabilities of the continuing operations in the Consolidated Balance Sheets.

23