Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KEYCORP /NEW/ | d250032d8k.htm |

| Key

Corporate Bank Strong, Focused and Building Momentum

Christopher M. Gorman

President

Key Corporate Bank

BancAnalysts Association of Boston

Exhibit 99.1 |

2

PRIVATE SECURITIES LITIGATION REFORM ACT OF

1995 FORWARD-LOOKING STATEMENT DISCLOSURE

This presentation contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including statements about

Key’s financial condition, results of operations, earnings outlook,

asset quality trends and profitability. Forward-looking statements are not

historical facts but instead represent only management’s current expectations

and forecasts regarding future events, many of which, by their nature, are

inherently uncertain and outside of Key’s control. Key’s

actual results and financial condition may differ, possibly materially, from the anticipated results

and financial condition indicated in these forward-looking statements.

Factors that could cause Key’s actual results to differ materially from

those described in the forward-looking statements may be found in

KeyCorp’s Annual Report on Form 10-K for the year ended December 31, 2010 and any Form 10-Q

filings for the subsequent quarterly periods ended during 2011, which have been

filed with the Securities and Exchange Commission and are available on

Key’s website (www.key.com/ir) and on the Securities and Exchange

Commission’s website (www.sec.gov). Forward-looking statements are

not guarantees of future performance and should not be relied upon as representing

management’s views as of any subsequent date. Key does not

undertake any obligation to update the forward- looking statements to

reflect the impact of circumstances or events that may arise after the date of the

forward-looking statements. |

3

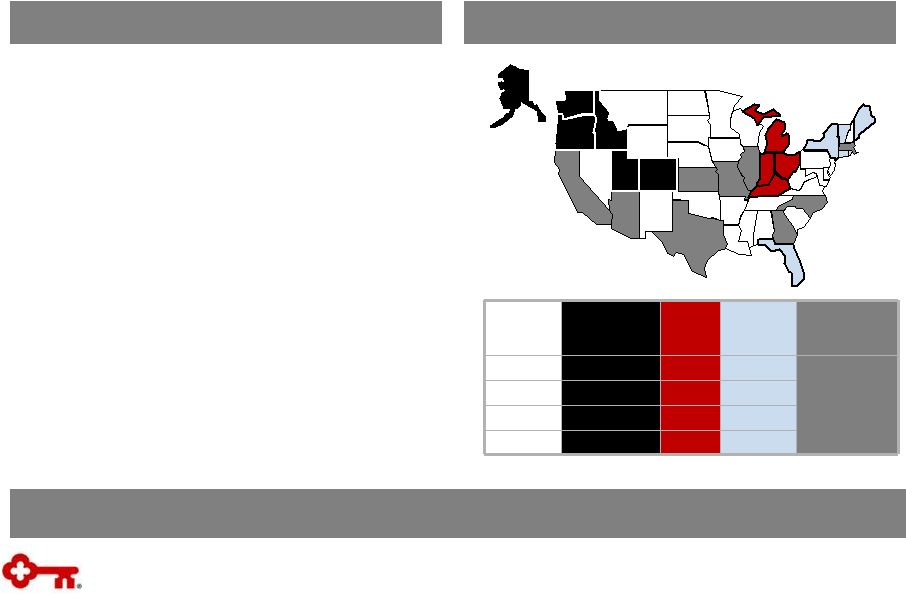

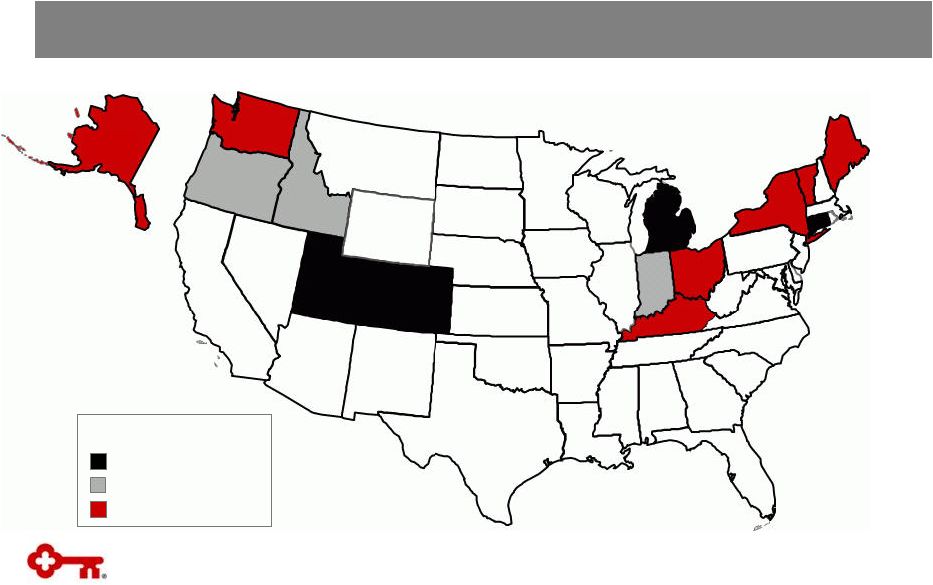

•

The

14

largest

U.S.

bank-based

financial

services company

•

Assets of approximately $89 billion

•

Market capitalization of $6 billion

•

15,490 employees

•

Unique and diverse geography

–

Building presence in higher-growth

markets in Rocky Mountain and Northwest

regions

–

Strong market share in Great Lakes and

Northeast regions

–

Targeting specific industries in selected

states outside branch footprint

Diverse, Advantaged Geography

Key Facts

Note: All figures as of September 30, 2011

Provides combination of profitability and opportunities for growth

Key –

An Overview

Rocky

Mountain

& Northwest

Great

Lakes

Northeast

Corporate

Bank

Branches

403

354

306

Includes

offices in

these states

and all

Community

Bank regions

ATMs

582

559

443

Loans

$10.1B

$6.7B

$5.3B

Deposits

$15.8B

$15.3B

$14.1B

th |

4

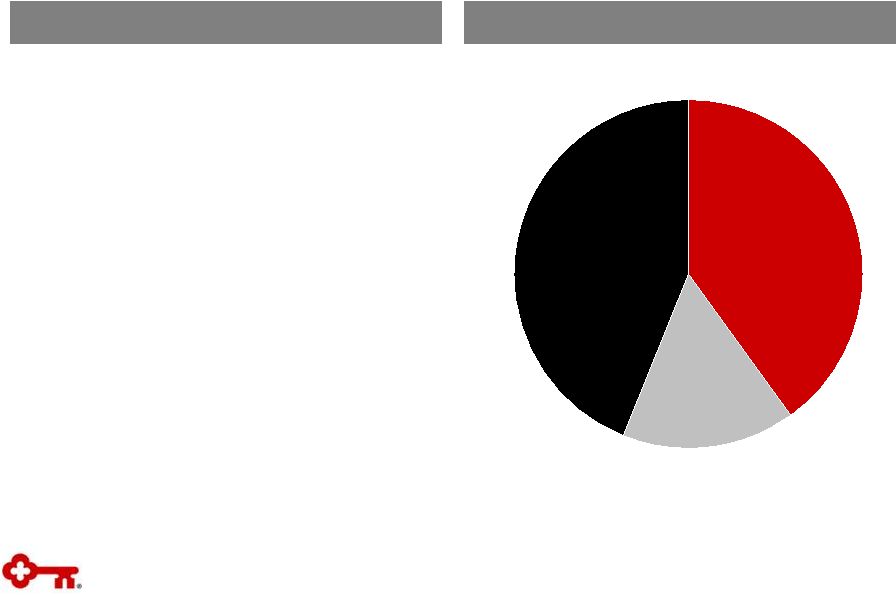

Community

Bank

Corporate

Bank

Diverse and Balanced Business Mix

2011 YTD Revenue

Note:

2011

YTD

Revenue

from

continuing

operations;

“Other”

consists

of

corporate

treasury,

principal

investing

and

exit

portfolios

Corporate

Bank

36%

Community

Bank

54%

Other

10% |

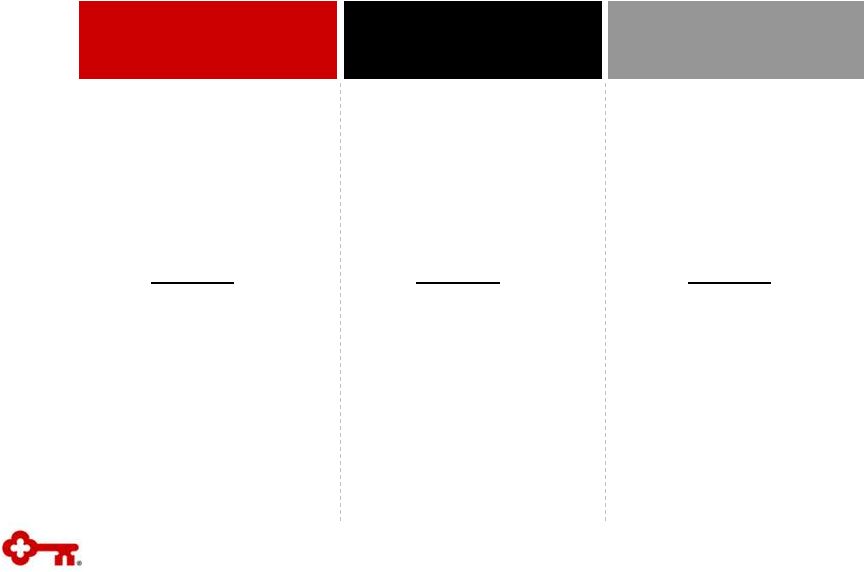

5

•

Presentation provides detail about Key Corporate

Bank, which is comprised of the following

business units:

–

Real Estate Capital & Corporate Banking

Services (“REC”)

–

Institutional & Capital Markets (“ICM”)

–

Equipment Finance (“KEF”)

•

Information shown in KeyCorp’s SEC filings is

presented on a segment basis for:

–

Key Community Bank

–

Key Corporate Bank

•

Presentation illustrates the levers that drive

growth for Key Corporate Bank with details

provided on its business units

Key Corporate Bank Segment

As of 9/30/11

Corporate Bank LTM Revenue

Presentation Focus

Real Estate Capital

& Corporate

Banking Services

40%

Institutional &

Capital Markets

44%

Equipment

Finance

16% |

6

•

National franchise focused on

REITs, long-term real estate

owners and healthcare clients

•

Highly rated, scalable third-party

commercial loan servicer

•

Provides derivatives, foreign

exchange and cash management

solutions to clients across Key

•

Leading middle-market corporate

and investment bank, focused on

serving consumer, energy,

healthcare, industrial, public

sector and real estate clients

•

Manages investment portfolios for

a national client base through

Victory Capital Management

•

6th largest bank-owned

equipment finance company (out

of 46)

•

Bank Channel supports franchise

relationships

•

Vendor Channel supports

healthcare, software and

technology manufacturers

Loans & Leases

(2)

PPNR

Fee Income

(1)

(%)

Revenue

Real Estate Capital &

Corporate Banking

Services

Institutional &

Capital Markets

Key Equipment Finance

LTM 3Q11

$640mm

35%

$374mm

$7.1B

LTM 3Q11

$693mm

71%

$263mm

$5.6B

LTM 3Q11

$260mm

NM

$66mm

$4.6B

(1)

Real Estate Capital fee income % adjusted downward 300bps to exclude $18mm in

Private Equity mark-to-market recoveries; Key Equipment Finance fee

income % excluded as it is primarily an asset generation business

(2)

Loans & Leases are as of September 30, 2011

Key Corporate Bank Overview

Employees

904

779

518

Net Income

$418mm

$189mm

$92mm |

7

Product Breadth with an Industry Focus

Capital Solutions

Capital Solutions

Financial Advisory

Syndicated Finance

Equipment Finance

Foreign Exchange

Treasury Management

Equity Capital Markets

Banking Services

Banking Services

Asset Management

Commercial Loan Servicing

Public Finance

Equity Research

Debt Capital Markets

Derivatives

Commercial Mortgage

Banking

Private Capital

Vendor Leasing

Equity Sales & Trading

Fixed Income Sales & Trading

Client Sectors

Client Sectors

Industrials

Consumer

Energy

Healthcare

Public Sector

Real Estate

Asset-based Lending |

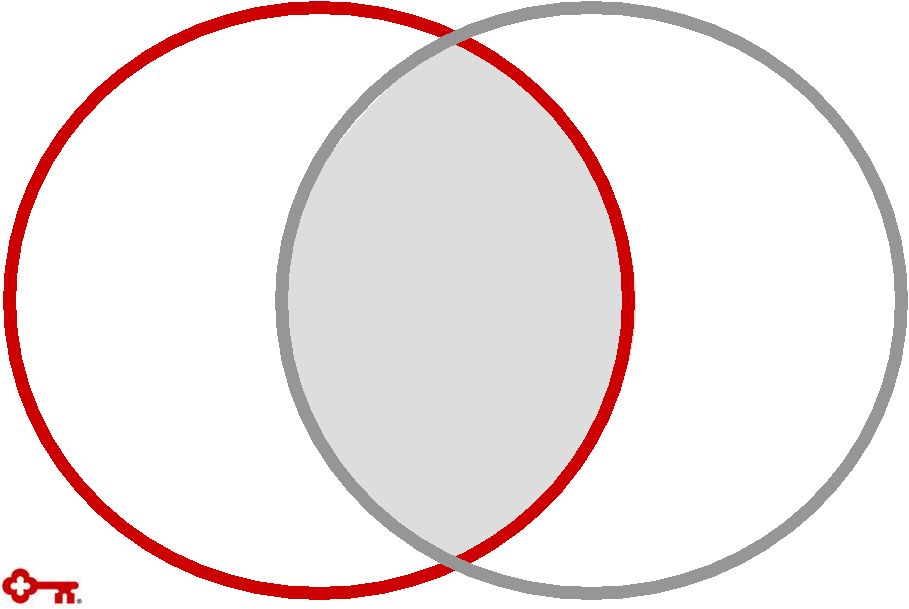

8

Competitive Advantage

•

Delivering more value to business clients by

combining the local knowledge and service of

a Community Bank with the specialized

expertise and industry knowledge of a

Corporate Bank

•

Distinctive knowledge and capabilities in the

middle market and targeted industries

•

Unique go-to-market alignment of Community

and Corporate Bank

•

Broadest range of products and expertise

delivered with local authority

Primary Focus Client Size (revenue)

<$10 million

$1 billion

Low

High

Breadth of

Industry &

Product

Capabilities

>$10 billion

$200 million

Bulge Bracket/

Universal Banks

Regional and

Community

Banks

Boutiques

KeyCorp

Corporate and Community Bank Business Continuum |

9

Activity

•

Tight coordination between Real Estate

relationship managers and Capital Markets

execution bankers

Results

•

$106mm in LTM 3Q11 real estate Investment

Banking

Income

and

Debt

Placement

Fees

(1)

•

#1 among domestic regional banks in equity

capital markets fee revenue since 1Q10

Aligned to Serve Our Clients

Key’s integrated model is aligned to serve client needs

•

KEF product specialists are embedded in all

districts to deepen relationships with

colleagues and clients for tailored solutions

•

$497mm in Community Bank lease volume

LTM 3Q11, up 40% YoY

•

Commercial Banking-Investment Banking

initiative leverages local relationships with

industry/product

expertise

–

a

differentiator

•

Industry and capital markets specialists

complete 850 client calls with commercial

bankers

•

Regular, two-way referral activity between Key

Corporate Bank and Key Community Bank

•

Treasury Management, foreign exchange

and derivatives teams provide solutions to

clients across Key’s franchise

•

Treasury Management services provided to

Community Bank clients with more than $8B

in deposits

•

Provide foreign exchange and derivatives

solutions to nearly 3,000 Community Bank

clients

(1)

Includes debt and equity capital markets underwriting, loan syndication, M&A

advisory, and commercial mortgage banking private placement fees |

10

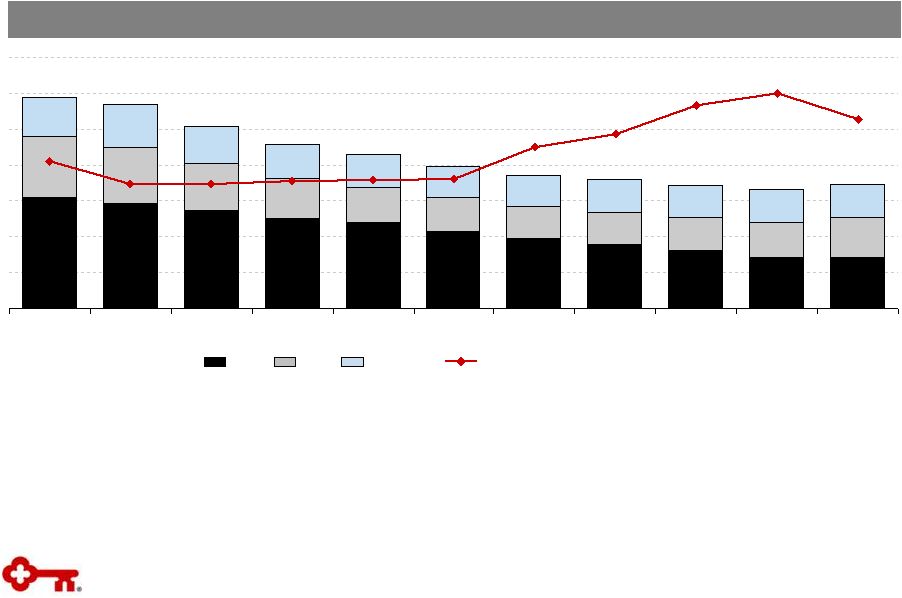

15.4

14.6

13.7

12.5

11.9

10.7

9.7

8.9

8.0

7.1

7.1

8.7

6.6

5.7

5.1

4.7

4.4

4.4

4.6

4.9

5.6

5.4

5.8

5.3

4.7

4.6

4.7

4.6

4.7

4.6

7.9

4.5

4.5

$227

$258

$243

$208

$193

$149

$149

$177

$153

$154

$155

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

Loan Balances ($B)

REC

KEF

ICM

LTM Investment Banking Income and Debt Placement Fees ($mm)

Past the Inflection Point

•

Period-end loan balances increase for the first time since October 2008

–

Loan balances in Institutional & Capital Markets up $1.1B, or 25%, since trough

in 4Q10 with eight consecutive months of increase –

Period-end REC loans at 3Q11 show first QoQ increase since December 2008

•

Originated or renewed $15.2B of loan and lease commitments LTM 3Q11, up 49%

YoY –

More than 99% are to clients where we have or are actively developing franchise

relationships Ending

Loan

Balances

($B)

&

LTM

Investment

Banking

Income

and

Debt

Placement

Fees

($mm)

$29.4

$28.4

$25.5

$22.9

$21.5

$19.9

$18.7

$18.0

$17.2

$16.6

$17.3

Note: REC denotes Real Estate Capital & Corporate Banking Services; ICM

denotes Institutional & Capital Markets; KEF denotes Equipment Finance

The

inflection

point

analysis

provided

above

utilizes

period-end

loan

balances

as

opposed

to

average

quarterly

loan

balances,

which

we

report

in

our

Form 10-Q and Form 10-K filings with the

Securities and Exchange Commission Investment Banking Income and Debt

Placement Fees is shown on a rolling trailing twelve month basis and includes debt and equity capital markets

underwriting, loan syndication, M&A advisory, and commercial mortgage banking

private placement fees |

11

Institutional

and Capital

Markets

•

Significant investment in commercial

mortgage banking professionals

•

Real estate private equity specialists

Investing in Relationships and Capabilities

Real Estate

Capital and

Corporate

Banking

Services

Equipment

Finance

•

New heads of U.S. Vendor, Federal

Finance and Healthcare Finance

•

Deepened capabilities in healthcare

and technology

•

Industry coverage bankers in

consumer, energy, industrial and real

estate

•

Product specialists in debt capital

markets, equity research, loan

syndications, M&A and public finance

•

$700mm increase in annual

commercial mortgage volume

–

Placement fees up 40%

–

Strong pipeline

•

Three new strategic vendor

programs YTD

•

YoY healthcare volume up 22% LTM

3Q11

•

$12mm of closed investment banking

fees with engaged backlog of $20mm

•

$430mm of credit commitments with

line utilization of 54%

•

45 new companies under research

Areas of Strategic Hire

Results from Strategic Hires

Key Corporate Bank has hired more than 100 senior professionals since 1Q10

|

12

Fee Revenue

Assets

Converting New Client Relationships

New Clients Since January 2011

Financial Impact of New Clients

•

Tracking new client generation across the

franchise

•

Semi-annual prospect review sessions with

sales team leaders

•

Capital Markets pitch activity up 60% YoY

Note:

REC denotes Real Estate Capital & Corporate Banking Services; ICM denotes

Institutional & Capital Markets New ICM and REC client counts exclude

institutional investors, Victory Capital Management, public sector, Treasury Management and foreign exchange clients

KEF is excluded from the above analysis

•

New clients have significant financial impact

–

Average fee revenue from new clients is nearly

$0.3mm per client

–

New clients have superior line utilization vs.

existing clients, on average

•

Active effort to expand new client

relationships through product cross-sell

$45mm

$1.5B

65

89

REC

ICM |

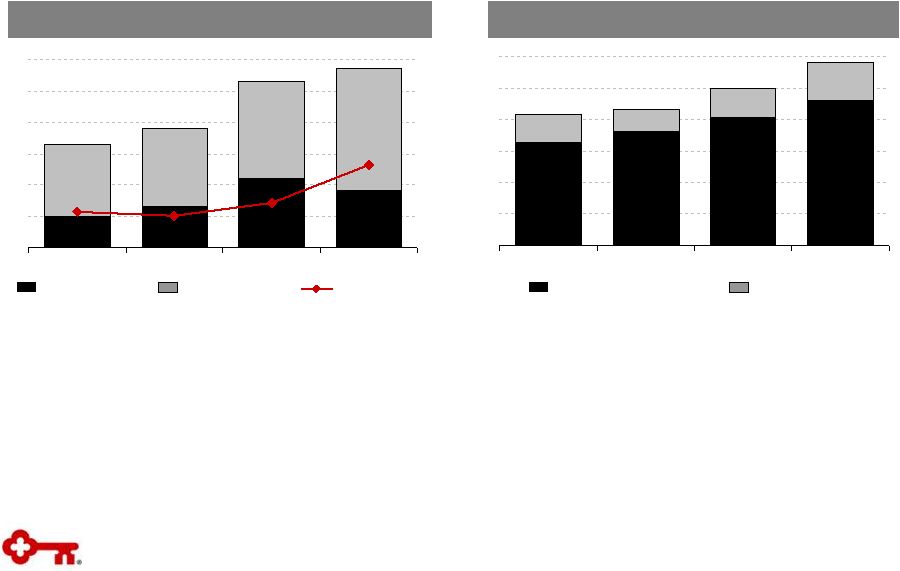

13

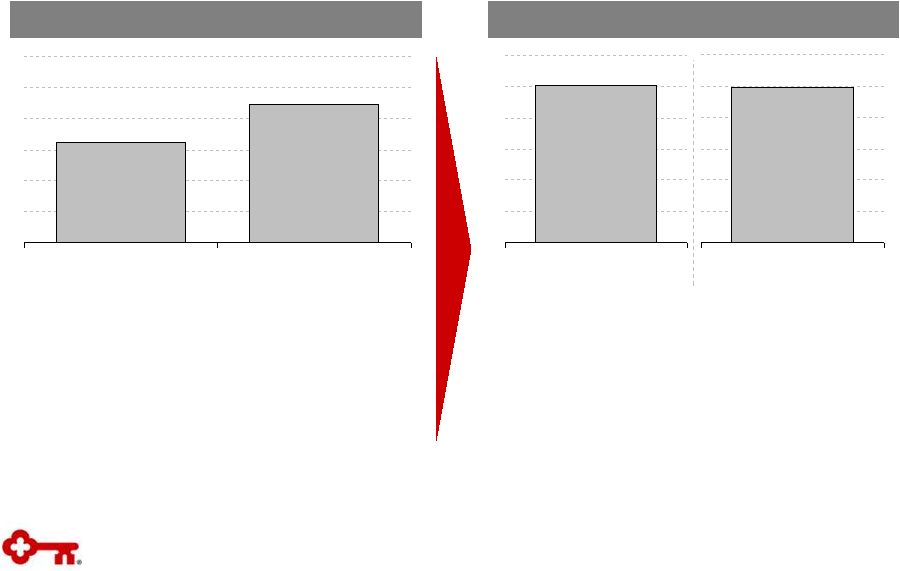

Growing Capital Markets Presence

Client Transactions & Capital Raised ($B)

Investment Banking Income and Debt

Placement Fees ($mm)

•

Our capital markets businesses raised $135B

for clients through LTM 3Q11, up $33B YoY

–

Growth driven by loan syndications

•

Transaction volume up 29%

•

LTM 3Q11, Key led 305 transactions (75%),

vs. 191 transactions (60%) in LTM 3Q10

Note:

Analysis excludes transactions where KeyCorp was the issuer as well as

TARP-related issuances by other Bank Holding Companies Investment

Banking Income and Debt Placement Fees includes debt and equity capital markets underwriting, loan syndication, M&A advisory, and

commercial mortgage banking private placement fees

Lead transaction includes Bookrun and Lead-Managed equity and debt capital

markets transactions, Agented syndicated finance transactions and originated

commercial mortgage banking transactions

•

Investment Banking Income and Debt

Placement Fees increased $34mm, or 17%,

YoY for LTM 3Q11

–

Strong fee income growth in commercial

mortgage banking private placements and loan

syndications

–

Solid commercial mortgage banking pipeline

$193

$227

LTM 3Q10

LTM 3Q11

# of Transactions

Capital Raised ($B)

316

409

$135

$102

LTM 3Q10

LTM 3Q11 |

14

Targeted Collaboration for Growth

Community and Corporate Bank

Less than 10%

Between 10% -

20%

Greater than 20%

KEY client penetration

Our footprint contains more than 7,000 targets in our focus industry segments

with

revenue

between

$25

million

and

$1.5

billion

--

18%

are

clients

Source: Dun & Bradstreet, Capital IQ, Thomson Reuters

1,725

550

900

1,350

225

100

550

325

175

500

775

125

n = # of target

companies in

state

25

76 |

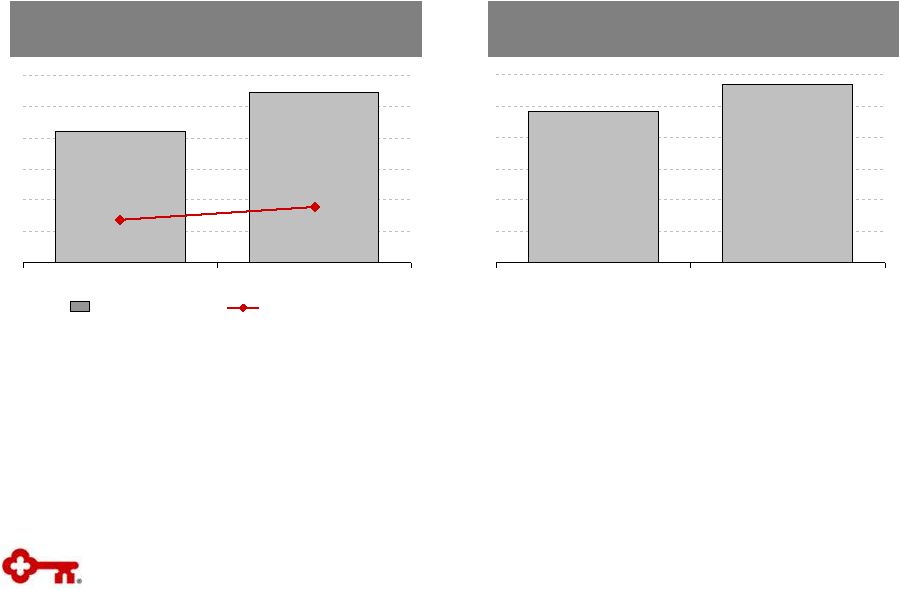

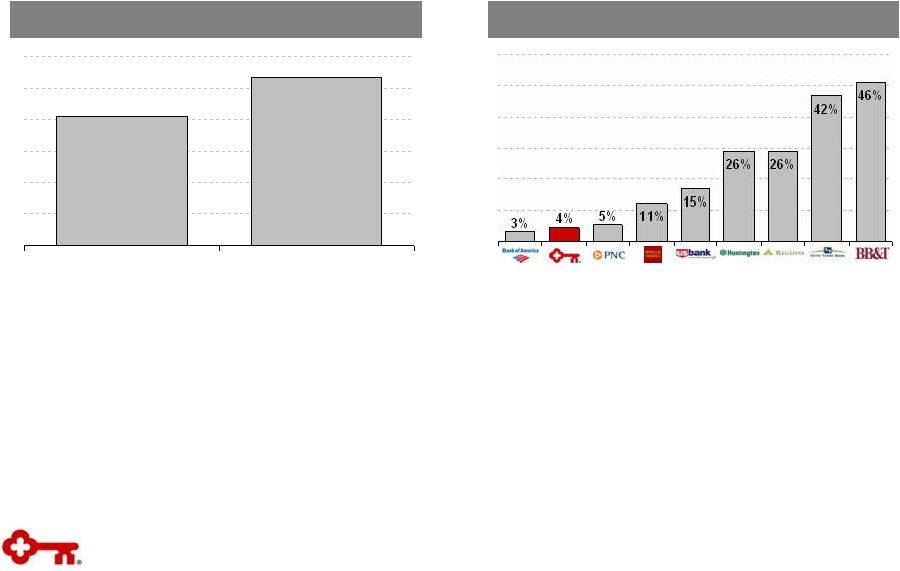

15

•

Created a series of programs structured around acquiring and broadening client

relationships •

All Relationship Managers and business leaders participate in regular prospect

review sessions Fee Income %

Revenue per FTE ($000s)

Efficiency Ratio

(1)

We

are

aggressively

pursuing

client

acquisition

—

and

measuring

the

efficiency

and

effectiveness of our actions

Measuring Our Progress

Performance

Metrics

--

Key

Corporate

Bank

(1)

Efficiency ratio is adjusted to exclude OREO, intangible asset amortization and

provision for unfunded commitments. On an unadjusted basis, Key Corporate

Bank’s efficiency ratio is 68% and 56% for the twelve months ended 3Q10 and

3Q11, respectively 48%

54%

LTM 3Q10

LTM 3Q11

$724

$696

LTM 3Q10

LTM 3Q11

58%

64%

LTM 3Q10

LTM 3Q11 |

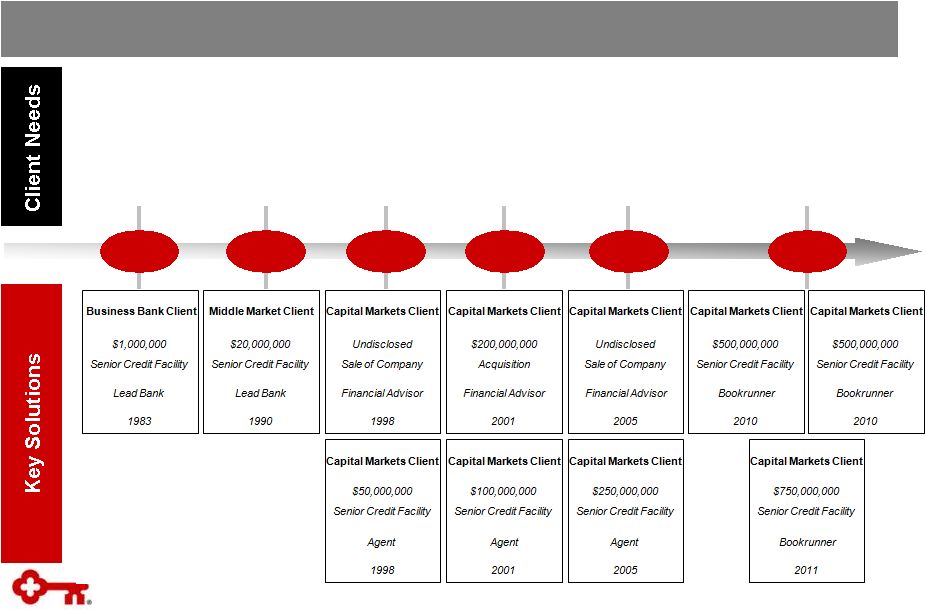

16

Key helped a business client grow from a small enterprise with less than

$1mm in annual revenue to a $1B national leader in its industry

•

Capital to Fund PP&E

1983

1990

1998

2001

2005

2011

•

Capital to Fund Strategic Acquisitions

•

Financial Advisory Solutions

Relationship Strategy in Action |

17

Appendix |

18

Pre-Crisis

Today

Fragmented, inefficient & high-risk

•

1,000 real estate clients in all sectors and

states (raw land to industry REITs)

•

>50% construction loans

•

Investing in junior debt and equity capital

•

1,100 employees

Focused, efficient & de-risked

•

500 real estate clients in three segments

•

Emphasis on owners/operators

•

15% construction loans

•

Exited higher risk business activities/credits

•

624 employees

Building the Foundation for Growth

Real Estate Capital

Credit-led sales strategy

•

$149mm of fee income with $23.9B of

commitments

•

Fee income 22% of revenue

•

Limited collaboration with KeyBanc Capital

Markets

Emphasis on fee revenue

•

$151mm of fee income with $10.2B of

commitments

•

Fee income 30% of revenue

(1)

•

$106mm in LTM 3Q11 real estate Investment

Banking Income and Debt Placement Fees

•

Treasury Management penetration of Real

Estate clients is 2x pre-crisis levels

Note:

Information above is for Real Estate Capital only and excludes Corporate Banking

Services Investment Banking Income and Debt Placement Fees includes debt and

equity capital markets underwriting, loan syndication, M&A advisory and

commercial mortgage banking private placement fees (1)

Real Estate Capital fee income % adjusted downward 300bps to exclude $18mm in

Private Equity mark-to-market recoveries |

19

Senior Debt Bookrunner

Rank

Firm

# of Deals

Volume ($MM)

1

Bank of America Merrill Lynch

59

$13,954

2

JP Morgan

40

12,749

3

Wells Fargo & Company

43

8,090

4

Key

26

4,868

5

PNC

14

2,545

Equity Issuance (IPOs and Follow-ons)

Rank

Firm

# of Deals

Volume ($MM)

1

Bank of America Merrill Lynch

27

$2,589

2

Wells Fargo Securities

24

2,168

3

RBC Capital Markets

23

1,443

4

Key

18

1,287

4

UBS

18

1,589

Equity Issuance (IPOs only)

Rank

Firm

# of Deals

Volume ($MM)

1

RBC Capital Markets

4

$379

2

Key

3

370

2

Bank of America Merrill Lynch

3

474

4

Wells Fargo Securities LLC

2

406

4

Deutsche Bank Securities Inc

2

198

Industry-Leading Real Estate Franchise

Capabilities & Relationships

•

Deep relationships with REITs and real

estate operating companies

–

Key agents 78 REIT and real estate credits

–

Equity research coverage of 60 REITs

–

Helped REITs raise more than $40B in debt

and equity capital since 1Q10

•

Full complement of financing alternatives,

including balance sheet, mortgage banking,

private placements and equity capital

markets

•

Highly-rated third-party servicing business

with more than $100B in assets under

management

Source: Thomson Reuters

YTD U.S. REIT League Tables (by # of deals) |

20

•

Bolstered Industrial, Consumer, Energy,

Public Sector and Financial Sponsor

coverage groups

•

Significant Debt Capital Markets investment

•

Enhanced equity research platform and

tightened

alignment

with

small-

and

mid-

cap strategy --

369 companies under

research coverage with market

capitalization <$5B

Pre-Crisis

Today

Early stage of integrating 14 distinct

business units

Refined relationship strategy

•

Narrowing focus to small and mid-size;

target clients where we can matter

•

$488mm fee income with $4.9B in average

loan and lease balances

•

Broadened advisory approach

Building the Foundation for Growth

Institutional & Capital Markets

Gaps in industry coverage and product

capability

Deepened industry coverage and enhanced

product support through senior hires

•

No explicit size focus

•

$455mm fee income and $6.7B average

loan and lease balances

•

Credit-led, narrow sales approach

•

No national financial sponsor effort

•

No high-yield debt origination capability

•

262 companies under research coverage

with market capitalization <$5B

Note:

Loan and lease balances are twelve month average figures

|

21

22

18

31

13

10

25

23

39

$11

$10

$14

$26

3Q08

3Q09

3Q10

3Q11

Growing Equity Capital Markets Platform

Equity

Capital

Markets

Activity

(LTM

figures)

Equity

Research

Coverage

(#

of

companies)

•

Executed 57 equity transactions raising

more than $26B in capital for our clients in

LTM 3Q11

–

Completed 18 lead-managed transactions

including 11 bookrun offerings

•

Strong LTM performance in real estate

–

27 equity transactions for REITs

–

Key ranks #2 in REIT IPOs (by number of

transactions)

•

Niche focus within industry segments:

Basic Materials, Consumer, Energy,

Industrial and Real Estate

•

Focused

on

small-

and

mid-cap

companies

–

Nearly 80% of research coverage has market

capitalization < $5B

–

Increased coverage of small-

and mid-cap

companies by 41% since 3Q08

Note:

Analysis excludes transactions where KeyCorp was the issuer as well as

TARP-related issuances by other Bank Holding Companies Equity research

coverage counts are at period-end Source:

Thomson Reuters

333

346

400

464

33

38

53

57

262

291

326

369

71

55

74

95

3Q08

3Q09

3Q10

3Q11

Lead Transactions

Capital Raised ($B)

Other Transactions

<$5B Market Capitalization

>$4B Capitalization |

22

Pre-Crisis

Today

Lack of focus

•

Significant volume outside Key footprint

•

Large, fragmented Vendor franchise

–

3,000 Vendor clients in five major industry

groups globally

–

Target size from small-ticket office equipment

to large project finance

•

Significant International operations

–

126 employees

–

18 country locations across Europe and Asia

•

Many unprofitable clients

Narrowed operating focus

•

Tightened alignment between KEF and Key

–

$497mm in Community Bank lease volume

YTD 3Q11, up 40% YoY

•

Highly focused Vendor franchise

–

900 Vendor clients

–

Domestic focus in three industry segments:

healthcare, technology equipment and

software

–

Concentrate on programs with annual volume

> $50mm

•

Limited International operations to support

domestic Vendor relationships

–

65 employees

–

Six country locations in Western Europe

•

Exiting and re-pricing unprofitable clients

and transaction types

Building the Foundation for Growth

Key Equipment Finance |

23

Strong Equipment Finance Business

New Asset Origination ($B)

Buy-desk

Activity

as

%

of

Originations

(1)

•

Originated $3.2B in gross new business

volume YTD 3Q11, up $756mm or 31% YoY

•

Growth driven by our focus on targeted

segments

–

Bank Channel up 73% YoY

–

Technology up 39% YoY

–

Healthcare up 22% YoY

•

Key is achieving volume targets while

remaining focused on our core client

relationship strategy

–

Much less reliant than many bank-owned

peers on third-party originated assets

(1)

Source: 2011 Monitor 100; Data are for FY10

$2.5

$3.2

LTM 3Q10

LTM 3Q11 |