Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Enventis Corp | form8k.htm |

Exhibit 99.1

Third Quarter 2011

Earnings Conference Call

November 2, 2011

NASDAQ: HTCO

“Safe Harbor” Statement

Information set forth in this presentation contains financial estimates

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may effect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures are

available in our presentation.

2

Third Quarter 2011 Highlights

• Revenue totaled $45.2 million, +4%

– Equipment revenue up 43%

– Fiber and data organic revenue growth

of 14%

of 14%

– Broadband revenue grew 5%

• New favorable financing agreement

secured

secured

• Increased fiscal 2011 outlook

3

Consolidated Revenue

Q3 ’11 compared to Q3 ’10

• Equipment product revenue

+43%

+43%

• Fiber and data revenue down

14%

(+14% when excluding the 2010

fiber construction project)

14%

(+14% when excluding the 2010

fiber construction project)

• Broadband revenue +5%

($ in Millions)

Quarterly Revenue

4

70% of YTD 2011 revenue is from Business Sector & Broadband Services

Revenue Diversification

5

Q3 ’11 compared to Q3 ’10

• Q3 ’10 earnings positively impacted by

$1.9 M income tax reserve release.

Excluding release, EPS would be $0.24

per share

$1.9 M income tax reserve release.

Excluding release, EPS would be $0.24

per share

Q3 ’11 compared to Q3 ’10

• Higher profit operating revenue

• Q3 ’10 included $1.9 M income from

fiber construction project

fiber construction project

6

Excludes tax reserve release

Business Sector

Q3 ’11 compared to Q3 ’10

• Revenue down 14%; excluding the fiber

construction project in 2010 revenue up 14%

construction project in 2010 revenue up 14%

• Fiber construction project (Dakotas expansion)

added $3.3 M revenue in Q3 ’10

added $3.3 M revenue in Q3 ’10

Q3 ’11 compared to Q3 ’10

• Equipment sales up 43%

• Equipment support services stable

Equipment Revenue

($ in Millions)

before intersegment

eliminations

eliminations

Formerly referred to as “Enventis Sector”

7

Excludes fiber construction project

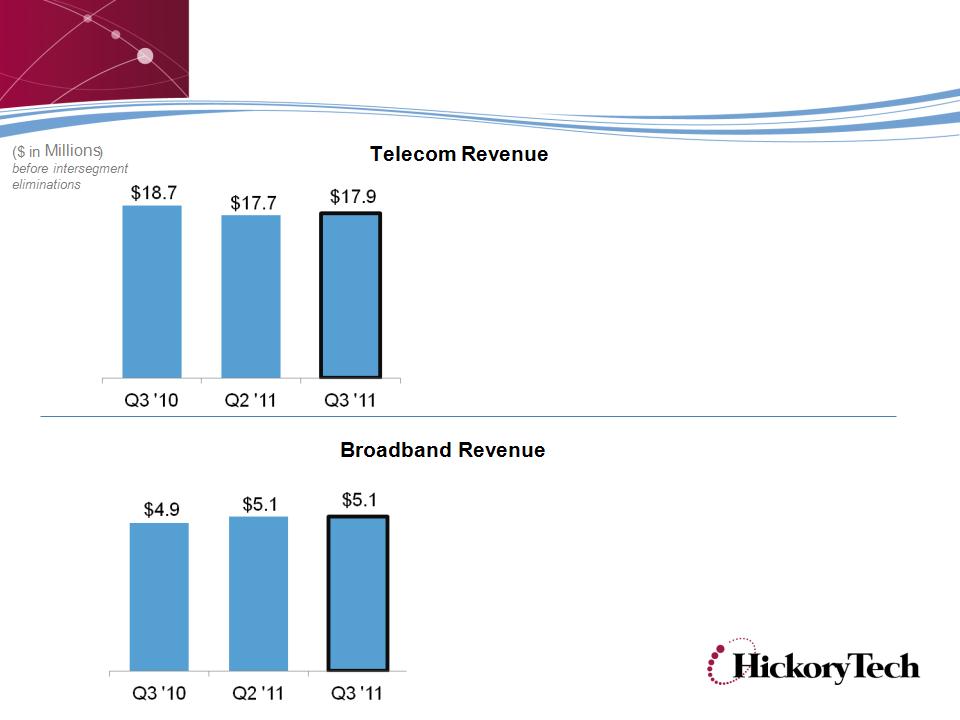

Telecom Sector

Q3 ’11 compared to Q3 ’10

• Stable Telecom revenue

• Broadband revenue up 5%

• Network Access revenue down 5% and

Local Service revenue down 8%

Local Service revenue down 8%

Q3 ’11 compared to Q3 ’10

• Business Ethernet and data sales

• Digital TV subscribers +2%

• DSL subscribers +1%

8

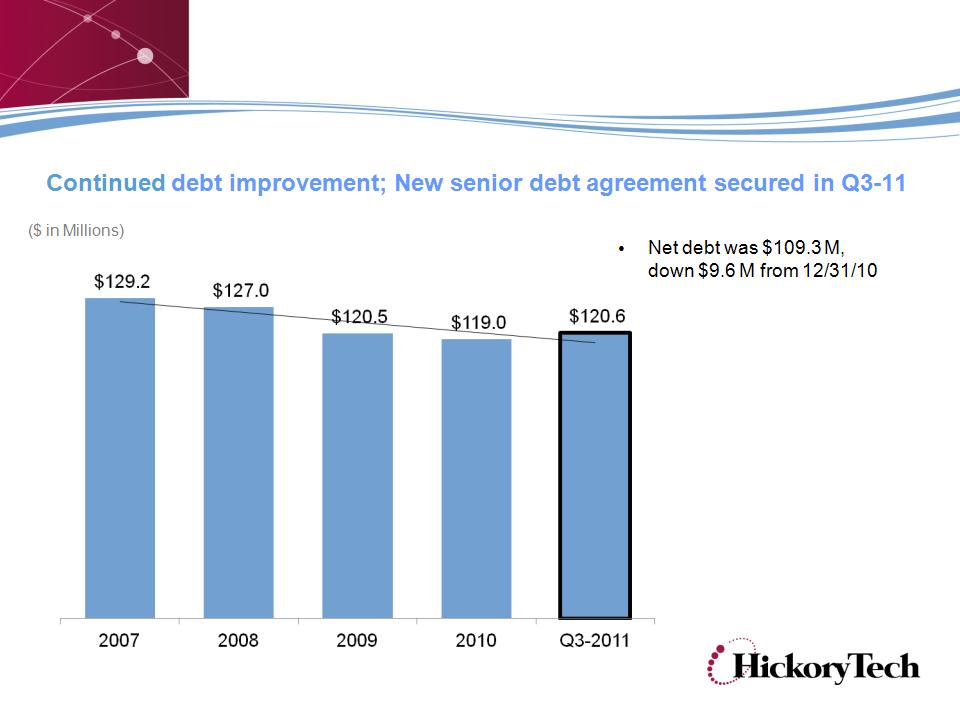

Debt Balance

9

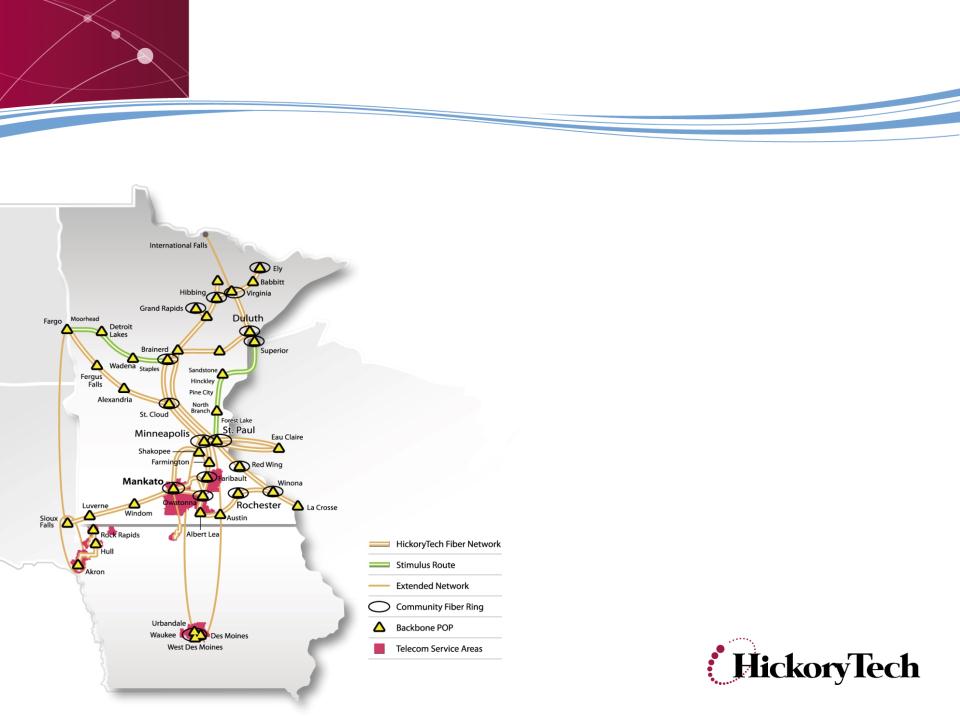

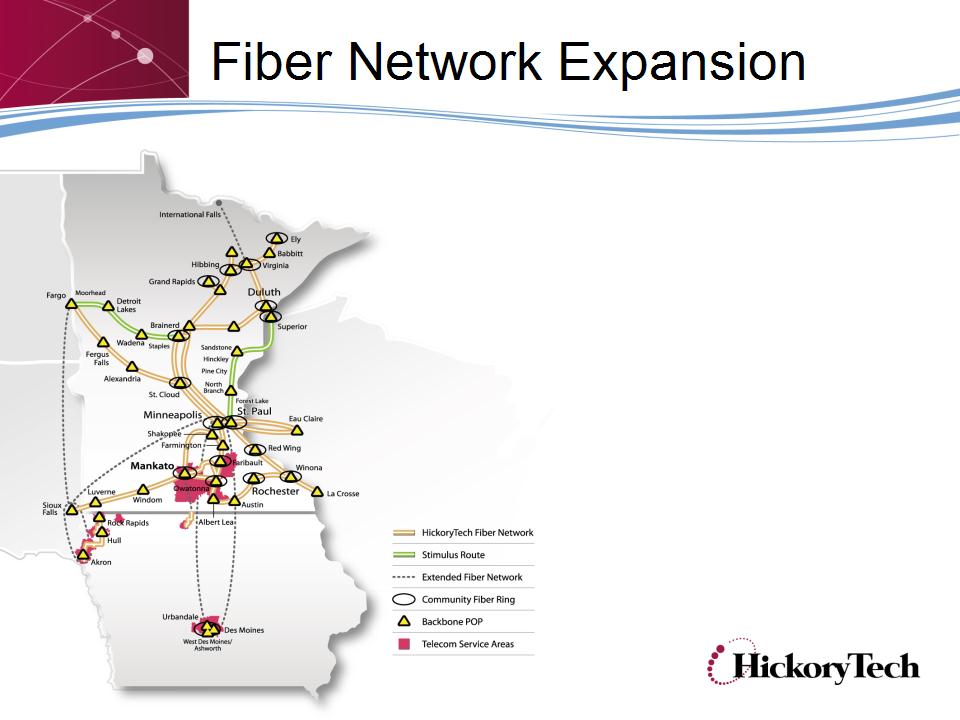

Greater Minnesota Broadband

Collaborative Project

•Phase 1 extends fiber network from

St. Paul to Duluth, Minn. / Superior, Wisc.

Majority of project will be completed in 2011

St. Paul to Duluth, Minn. / Superior, Wisc.

Majority of project will be completed in 2011

•Phase 2 will extend fiber from Brainerd, Minn.

to Fargo, N.D.

Construction to begin in 2012

to Fargo, N.D.

Construction to begin in 2012

•Project will be completed by Aug. 2013

10

News Summary

11

10/24/11 HickoryTech Named One of Forbes 100 Best Small Companies

10/13/11 Enventis Launches TelePresence Video Solutions

9/26/11 HickoryTech Declares Increased Quarterly Cash Dividend

8/25/11 Enventis Holds Ground Breaking for Greater Minnesota

Broadband Collaborative Project

Broadband Collaborative Project

8/22/11 Enventis Celebrates 10-Year Anniversary of SingleLink® Unified

Communications

Communications

8/18/11 HickoryTech Announces Share Repurchase Plan of up to $3 M

8/11/11 HickoryTech Signs Favorable New Financing Agreement for

Senior Notes and Revolving Credit Agreement

Senior Notes and Revolving Credit Agreement

8/9/11 Enventis Recognized by Cisco for Excellence in Customer

Satisfaction in United States

Satisfaction in United States

8/2/11 Enventis Total Care Support Provides Customers Peace of Mind

7/29/11 Enventis Recognized as Cisco TelePresence Video ATP Partner

2011 Fiscal Outlook

2011 Guidance increased in third quarter earnings released Nov. 1, 2011

12

Strategic Initiatives

• Focus on growing business services:

Ø Fiber network expansion

Ø Accelerated SMB market plan

Ø Target last-mile fiber builds

Ø Construction of broadband stimulus project

• Grow broadband services (Digital TV, DSL, data services)

• Increase capital spending on key strategic initiatives

• Manage free cash flow, manage costs and reduce debt in long

term

term

13

Strategic Initiatives

14

Strategic Initiatives Focused on Growth

HTCO Investment Highlights

• Stable growth and cash flows; 60+ years of dividend payments,

Q4-11 dividend increased to $0.14 per share, yield 5-6%

Q4-11 dividend increased to $0.14 per share, yield 5-6%

• Business transformation from a pure telephone company to an

integrated communications company serving businesses and

consumers

integrated communications company serving businesses and

consumers

• Emerging growth through B2B strategy and fiber network expansion

• High level of recurring revenue, expanded broadband service area

• Experienced Company with 112-year track record generating

stable operating results and financial position with strong strategic

plan

stable operating results and financial position with strong strategic

plan

15

Reconciliation of Non-GAAP Measures

16

|

|

|

|

|

|

|

|

|

|

Reconciliation of net debt:

|

Sept. 30, 2011

|

|

June 30, 2011

|

|

Dec. 31, 2010

|

||

|

|

Debt obligations, net of current maturities

|

$ 119,169

|

|

$ 8,462

|

|

$ 114,067

|

|

|

|

Current maturities of long-term obligations

|

1,436

|

|

110,230

|

|

4,892

|

|

|

|

Total Debt

|

|

$ 120,605

|

|

$ 118,692

|

|

$ 118,959

|

|

|

Less:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

11,316

|

|

14,930

|

|

73

|

|

|

|

Net Debt

|

|

$ 109,289

|

|

$ 103,762

|

|

$ 118,886

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Measures