Attached files

| file | filename |

|---|---|

| 8-K - CYTORI THERAPEUTICS FORM 8-K FILED 11-3-2011 - PLUS THERAPEUTICS, INC. | cytori8k_110311.htm |

| EX-99.1 - EXHBIT 99.1 CYTORI PRESS RELEASE 11-3-2011 - PLUS THERAPEUTICS, INC. | exhibit991_pressrelease.htm |

Cytori Cell Therapy Third Quarter Business Update

Dear Shareholders,

We manage our business across three areas: 1) clinical development pipeline 2) the commercial business, and 3) partnering and licensing. In this letter, we discuss how we made progress during the third quarter building market access for our cardiovascular and breast reconstruction therapies, our revenue performance, and our management of expenses.

Breast Reconstruction

Our priority for establishing market access for breast reconstruction is pursuit of reimbursement in Europe, approval and reimbursement in Japan, and approval and reimbursement in other select countries around the world.

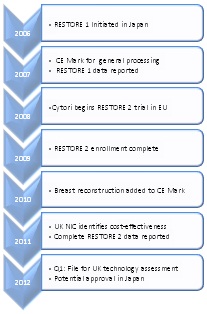

In Europe, we are initially targeting the G5 countries, starting in the UK. We are well into a multiyear process, which in Europe, starts with regulatory approval, followed by data, such as that from RESTORE 2, utilization, and ultimately reimbursement (Table 1).

Year-to-date, 1) Celution® received a favorable cost-effectiveness assessment from the British National Innovation Center (NIC) who recommends new technologies to the National Institute for Health and Clinical Excellence (NICE), which is responsible for medical guidelines and reimbursement, 2) reported 12-month outcomes in September for the RESTORE 2 trial before the audience at the British Oncoplastic surgery meeting, 3) submitted the manuscript for the RESTORE 2 trial data, and 4) had our technology included in the joint guidelines issued by the leading plastic, reconstructive and breast surgery societies in the UK.

Our next step in the UK is to apply in the first quarter of 2012 to the advisory committee to NICE. The advisory committee provides formal product specific certification of clinical and economic benefit. This process typically takes nine to 12 months. A positive outcome will facilitate use of the Celution® System and related consumables for breast reconstruction across the UK in both private and National Healthcare System hospitals.

Related efforts are underway in the other G5 countries and we will provide further details as tangible and reportable developments occur.

Approval of the Celution® device for breast reconstruction is also being sought in Japan. We have submitted for approval to MHLW and the application is under review.

Cardiovascular Disease

US Chronic Myocardial Ischemia (CMI) Trial

In the third quarter, we had a Pre-IDE meeting with the FDA in which we presented our pre-clinical and clinical package and proposed a general outline for a prospective, randomized, double-blind, placebo-controlled pilot (phase I/II) trial. The Pre-IDE application will be submitted in the fourth quarter of 2011.

1

Chronic Myocardial Ischemia CE Mark

In the second quarter of 2011 we submitted an application to expand our CE MARK to include treatment of no-option chronic myocardial ischemia (CMI). Cytori is engaged in an active dialogue with our European regulatory body. Based on feedback from regulatory officials, there appear to be no meaningful barriers to approval. CE Mark cardiac claims would allow Cytori to expand clinical use and market access initiatives for Celution® in CMI no-option patients in Europe and the other countries that recognize the CE Mark.

European Heart Attack Trial (ADVANCE)

The ADVANCE European pivotal (Phase II/III) acute heart attack trial has four centers initiated and 14 centers in process. We anticipate including up to 35 centers. Our current focus is securing country approvals followed by site initiation. Aggressive patient enrollment will commence once a critical mass of trial centers are up and running.

US Regulatory

In the U.S., our priority is the IDE/PMA ATHENA no option chronic myocardial infarction trial. This trial is intended to be a prospective, placebo-controlled, pilot (Phase I/II) trial. We continue to pursue additional indications through the 510(k) and humanitarian use device pathways.

Commercial Business

We market a portfolio of products in three major categories today: Systems and tissue banks, consumables, and ancillary products. These products are marketed in multiple geographies with limited regulatory approval and no formal reimbursement.

Systems and banks are capital expense items and therefore subject to sales cycles of 12 to 24 months. Consumables benefit from much shorter sales cycles and, without reimbursement, are limited by institutional discretionary and private pay economics.

Based on our core goal of addressing major medical markets, we have shifted our resources to cardiovascular disease and soft tissue indications. Operationally, we restructured for profitable revenue growth and to build market access for our lead indications.

Near-term growth to come from multiple sources

|

•

|

Cell & tissue banks

|

|

•

|

New academic research centers conducting investigator-initiated trials

|

|

•

|

Advancement of previously completed investigator-initiated trials to next phase of development

|

|

•

|

Breast reconstruction

|

|

•

|

Elective aesthetic indications where we have existing approvals

|

Investigator-Initiated Trials in Japan

|

•

|

Four approved clinical trials using Celution® under MHLW stem cell guidelines

|

|

•

|

Identifying potential new indications

|

|

•

|

Positioned to attract more academic centers

|

|

•

|

Source of revenue

|

A total of 176 systems, including seven banks, have been shipped as of the end of the third quarter of 2011. In this quarter, 224 consumables were shipped including 129 system consumable reorders. In addition, 883 PureGraft™ units were shipped. As previously discussed, we shifted our commercial focus starting in mid-2010 from opportunistic and cosmetic clinic sales, which tend to have a higher associated cost of sales and lower price point, to more profitable hospital-based sales. Today, we estimate 20% of the systems shipped currently drive approximately 80% of consumable utilization.

We are in the process of organizing and managing the commercial business toward profitability. Our goal will be to have this business unit provide positive contribution margin to the corporation as soon as possible. We will provide more detail on our plans and timing in our 2011 Year End Results conference call.

2

Cytori-Olympus Joint Venture

Cytori has a long-standing relationship with Olympus Corporation. We have a joint venture company titled the Olympus-Cytori Joint Venture, which owns the manufacturing rights to the Celution® platform, including both the device as well as the consumables. Despite the recent events at Olympus, our operating relationship remains unchanged and unaffected. We will continue to monitor the developing situation at Olympus in the event there may be any material changes that might affect our working relationship. We have numerous contingencies planned and in place to protect our business interests, should the situation materially change.

Celution® One

We submitted a CE Mark application for the next-generation Celution® One System in August of 2010. While the process has taken longer than anticipated, we do not know of any outstanding issue or barrier and expect CE Mark approval will be achieved. This filing is a reminder about the complexity of such an application, the careful consideration given to these applications and the potential barriers to entry that it can support.

Financials

In the third quarter, we improved our cash position, reduced operating expenses and favorably amended our loan facility led by GE Capital. The equity agreement with Seaside 88 was an important factor in achieving the amended loan terms, which significantly extended maturity and deferred principal payments. Expenses improved in Q3 2011 compared to Q2 2011, with reductions in sales and marketing and G&A costs.

We ended the quarter with $ 40.8 million in cash and equivalents and $2.0 million in accounts receivable. Net cash used in operating activities for the third quarter of 2011 was $7.9 million, compared to $9.0 million in the second quarter of 2011 and $10.5 million in the first quarter of 2011. We will continue to contain or reduce operating expenses in a manner that does not disrupt our clinical, regulatory, market access and strategic goals. Multiple initiatives are underway to continue to improve gross margin. Recent margin gains are due in part to improved product mix, pricing decisions, reduced manufacturing costs, and supply chain management.

Outlook

We have actively moved the business forward this year, achieved several milestones that support our market access and advance our product pipeline.

Recent progress to establish European market access for breast reconstruction includes:

|

·

|

Final 12-month RESTORE 2 trial results presented in September at the UK Oncoplastic Reconstructive Breast Society meeting

|

|

·

|

Final manuscript completed for the RESTORE 2 trial and under peer-review for publication

|

|

·

|

Favorable economic assessment of Celution® from NHS National Innovation Centre (NIC) in the UK

|

|

·

|

Inclusion of breast reconstruction therapy in joint British surgical, reconstructive and aesthetic society guidelines

|

Progress in our cardiovascular pipeline includes:

|

·

|

Completed US chronic myocardial ischemia pre-IDE meeting with FDA

|

|

·

|

US IDE/PMA pilot (Phase I/II) application submission expected Q4 2011

|

|

·

|

EU notified body application for ‘no option chronic heart disease’ indications-for-use submitted, under evaluation

|

|

·

|

EU pivotal (Phase II/III) prospective acute myocardial infarction trial (ADVANCE) initiated

|

|

·

|

Final manuscript completed for APOLLO trial and under peer-review for publication

|

3

|

|

Future milestones include:

|

|

·

|

Decision on Celution® One CE Mark in Q4 2011

|

|

·

|

Submit Pre-IDE application to FDA in Q4 2011

|

|

·

|

Apply for breast reconstruction technology evaluation in UK Q1 2012

|

|

·

|

Receive decision on CE Mark for chronic myocardial ischemia by end of Q1 2012

|

Developing innovative new products and creating new markets takes time and capital. We are constantly working to balance the investments in product and clinical development with the investment in market creation. We are building to a point of market access, focused on achieving the three required elements, which are clinical data, indications-for-use and reimbursement. Cell therapy will have a profound effect on the practice of medicine and on restoring patient’s lives. Cytori has established itself as the leading brand in bringing cell therapy to doctors and patients around the world today. We are executing on our business plan and on our mission to help patients. Thank you again for your support.

Regards,

Christopher J. Calhoun

Chief Executive Officer

Cautionary Statement Regarding Forward-Looking Statements

This shareholder letter includes forward-looking statements regarding events, trends and business prospects, which may affect our future operating results and financial position. Such statements, including, but not limited to, those regarding our ability to increase revenue growth and reduce our cash burn rate, obtain European cardiac claims and reimbursement, obtain reimbursement in select European countries for soft tissue repair, obtain CE Mark approval for Celution® One, complete enrollment in the ADVANCE

trial, complete trial design and initiate enrollment in the ATHENA trial, expand growth in PureGraft™ product sales, and complete a strategic corporate partnership, are all subject to risks and uncertainties that could cause our actual results and financial position to differ materially. Some of these risks and uncertainties include, but are not limited to, risks related to our history of operating losses, the need for further financing and our ability to access the necessary additional capital for our business, inherent risk and uncertainty in the protection intellectual property rights, regulatory uncertainties regarding the collection and results of clinical data, uncertainties relating to the success of our sales and marketing programs, changing and unpredictable regulatory environment, dependence on third party performance and, the risk of natural disasters and other

occurrences that may disrupt the normal business cycles in areas of our global operations, as well as other risks and uncertainties described under the "Risk Factors" in Cytori's Securities and Exchange Commission Filings on Forms 10-K and 10-Q. We assume no responsibility to update or revise any forward-looking statements to reflect events, trends or circumstances after the date they are made.

4