Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Symetra Financial CORP | d247827d8k.htm |

Third Quarter 2011

Review

October 27, 2011

Draft, 10/26/11

Exhibit 99.1 |

2

Forward-Looking Statements |

3

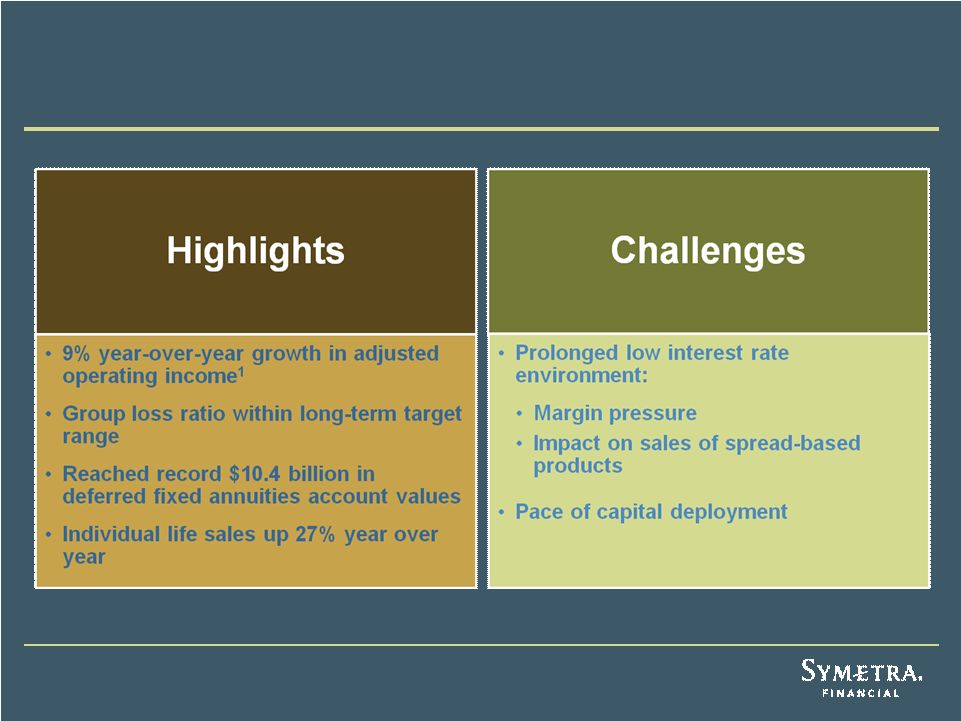

Third Quarter 2011 Summary

1

Denotes a non-GAAP financial measure. See Appendix for a definition of

these measures and reconciliations to the most directly comparable GAAP

measures. |

Financial Results

4

Twelve Months Ended Sept. 30

2011

2010

Return on Equity (ROE)

7.1%

8.6%

Operating

Return

on

Average

Equity

(ROAE)

2

9.6%

9.4%

Three Months Ended Sept. 30

2011

2010

Net Income

$ 11.1

$ 56.6

Less:

Net

realized

investment

gains

(losses)

1

(36.9)

13.0

Add:

Net

investment

gains

(losses)

on

FIA

options

1

(0.4)

0.2

Adjusted

Operating

Income

2

$ 47.6

$ 43.8

$ in millions

1

Net of taxes

2

Denotes a non-GAAP financial measure. See Appendix for a definition of

these measures and reconciliations to the most directly comparable GAAP

measures. |

Group Segment

33%

of

Pretax

Adjusted

Operating

Income

1

5

Priorities:

•

Successful campaign for 1/1/12 medical stop-loss renewals and new

business

•

Transition

AUL

3

medical

stop-loss

business

to

Symetra

(we

expect

to

renew approx. 2/3 of the AUL premium)

•

Drive growth in group life premium

3Q11

3Q10

Operating Revenues

2

$ 149.2

$ 117.3

Pretax Adjusted Operating Income

$ 22.0

$ 16.7

Group Loss Ratio

63.6%

66.5%

Total Sales

$ 20.1

$ 18.4

$ in millions

1

Denotes a non-GAAP financial measure. See Appendix for a definition of

these measures and reconciliations to the most directly comparable GAAP

measures. 2

Defined

as

total

revenue

excluding

net

realized

investment

gains

(losses).

3

American United Life Insurance Co. |

Deferred Annuities Segment

41%

of

Pretax

Adjusted

Operating

Income

1

6

Priorities:

•

Maintain strong interest spread on fixed annuities

•

Accelerate the uptake rate of fixed indexed annuity (FIA) product on bank

and broker-dealer platforms

•

Develop new variable annuity (VA) product for the lower cost non-living

benefits market

3Q11

3Q10

Operating

Revenues

2

$ 137.2

$ 124.0

Pretax Adjusted Operating Income

$ 28.0

$ 22.5

Interest Spread

1.92%

1.85%

Total Sales

$ 393.6

$ 286.4

Ending Total Account Values

$11,093.3

$9,548.2

$ in millions

1

Denotes a non-GAAP financial measure. See Appendix for a definition of

these measures and reconciliations to the most directly comparable GAAP

measures. 2

Defined

as

total

revenue

excluding

net

realized

investment

gains

(losses)

and

including

net

investment

gains

(losses) on FIA options. |

Income Annuities Segment

11%

of

Pretax

Adjusted

Operating

Income

1

7

Priorities:

•

Continue to drive profitability of existing block in low interest rate

environment with commercial mortgage loan origination strategy

•

Focus on shorter duration opportunities

3Q11

3Q10

Operating

Revenues

2

$ 102.5

$ 105.7

Pretax Adjusted Operating Income

$ 7.1

$ 9.5

Base Interest Spread

3

0.54%

0.59%

Total Sales

$ 64.6

$ 58.0

$ in millions

1

Denotes a non-GAAP financial measure. See Appendix for a definition of

these measures and reconciliations to the most directly comparable GAAP

measures. 2

Defined

as

total

revenue

excluding

net

realized

investment

gains

(losses).

3

Interest spread excluding mortgage-backed securities prepayment speed

adjustment. |

Life Segment

18%

of

Pretax

Adjusted

Operating

Income

8

Priorities:

•

Enhance new Symetra Classic Universal Life insurance product with the

rollout of additional benefits riders in 4Q11

•

Secure

distribution

agreements

with

select

BGA

partners

3Q11

3Q10

Operating

Revenues

$ 110.9

$ 107.4

Pretax Adjusted Operating Income

$ 12.4

$ 15.3

BOLI Return on Assets

0.82%

0.92%

Individual Sales

$ 3.3

$ 2.6

BOLI Sales

$ --

$ 7.5

$ in millions

1

Denotes a non-GAAP financial measure. See Appendix for a definition of

these measures and reconciliations to the most directly comparable GAAP

measures. 2

Defined

as

total

revenue

excluding

net

realized

investment

gains

(losses).

3

Brokerage general agents.

1

3

2 |

9

Clean Balance Sheet

•

Tangible book value

1

1

= 90% of total stockholders’

equity

•

Statutory book value = $1,996.7 million = 65% of total stockholders’

equity (97% of adjusted book value

1

1

)

•

Estimated risk-based capital (RBC) ratio of 455%

•

Down from estimated 466% at 6/30/11 due to AUL renewal rights

acquisition and unrealized losses on mark-to-market equities and

REITs •

DAC = only 7% of total stockholders’

equity

•

3Q11 includes $1.3M pretax favorable unlocking

As of 9/30/11

1

Denotes a non-GAAP financial measure. See Appendix for definition and

reconciliation to most directly comparable GAAP measure.

|

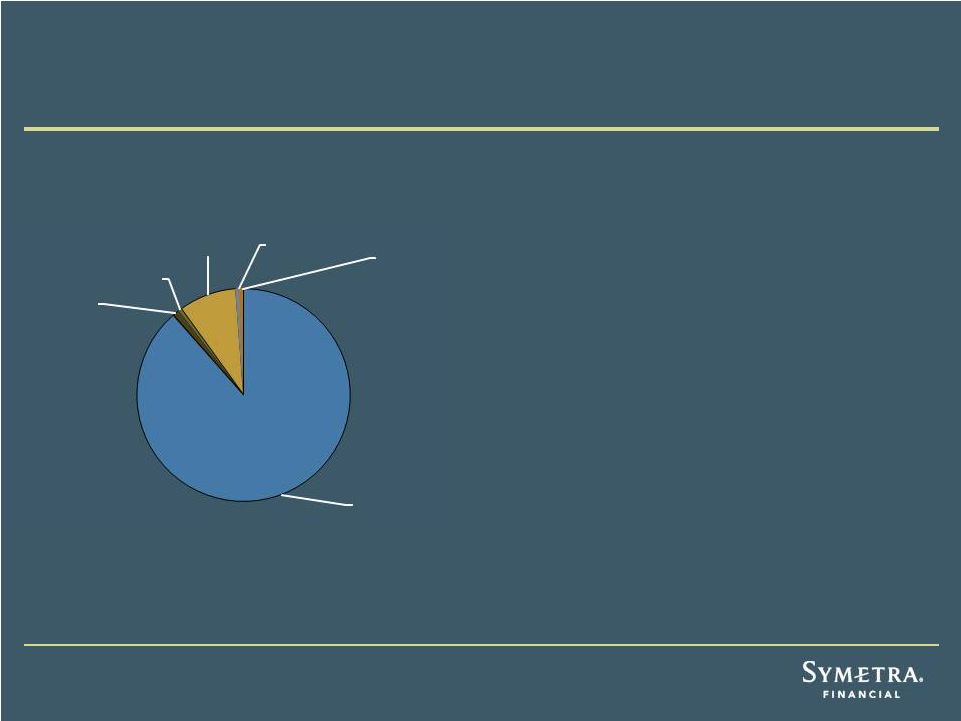

$25.9 billion

Portfolio Composition

As of 9/30/11

10

High-Quality Investment Portfolio

1

Included in trading marketable equity securities.

2

From inception of Symetra portfolio in January 2005 through 9/30/11.

3

FTSE NAREIT All Equity REITS Index.

•

Pretax impairments of $4.9M in 3Q11 vs $3.5M in

3Q10

•

AOCI of $1,006.5M at 9/30/11 vs $819.4M at

9/30/10

•

RMBS $3.7B

•

Gross premium of ($68.2M)

•

Gross discount of $74.1M

•

Average mortgage loan rate = 5.5%

•

Outstanding long-term equity portfolio

performance: Life-to-date annualized total return

of 8.6% (vs 1.1% for S&P 500 Total Return Index)

•

YTD annualized total return for REITs of (10.9)% vs

benchmark total return of (8.5)%

•

European exposure of $1.3B

•

$0.7M of sovereign

•

$162.4M of financials

•

Largest holding = $112.6M of Shell

•

Commercial mortgage loans (CML) offer attractive

yields: 3Q11 originations funded at approx. 300 bp

spread to Treasurys

Fixed

maturities,

88.5%

Equities,

1.0%

REITs

1

, 0.5%

Commercial

mortgage

loans, 8.8%

Limited

partnerships,

0.8%

Policy loans

and other,

0.4%

2

3 |

11

•

“Successful efforts”

DAC accounting becomes effective 1/1/2012

•

Symetra will retrospectively adopt

•

Expenses that will no longer be deferrable include:

•

Indirect sales costs (e.g., key account management)

•

Marketing and advertising costs

•

Future net income impact will depend upon expected future sales levels, sales

expense levels and changes in projected amortization

1

Accounting Standards Update 2010-26, Financial Services –

Insurance (ASU 2010-26), Accounting for

Costs Associated with Acquiring or Renewing Insurance Contracts.

2

Denotes a non-GAAP financial measure. See Appendix for definition and

reconciliation to most directly comparable GAAP measure.

New Accounting for Deferred Acquisition Costs

1

As of

12/31/10

Range of Estimated Impact

on 12/31/10 Balances

DAC Balance

$ 250.0

-12%

to

-18%

Book Value

$ 2,380.6

-0.8%

to

-1.2%

Adjusted

Book

Value²

$ 1,948.1

-1.3%

to

-1.7% |

Analysis of Low Interest Rates

12

•

Previously, we said that a shock drop of 100 bp in interest rates from 6/30/11

$(0.03) -

$(0.05) estimated impact on Adjusted Operating EPS

1

over a six-month period

•

For 3Q11 analysis, we used interim models to develop reinvestment cash flows and

statutory reserve estimates

•

We focused on results using 9/30/11 interest rates (10-year Treasury =

2.01%) •

Our estimates could be affected by changes in monetary policy, government programs

to stimulate mortgage refinancing, significant increases in corporate

refinance activity Estimated

Amount of

Reinvestment

Risk

Management

Tools

Surplus

~ $250

CML

Deferred Annuity

< $50

Rate resets

Income Annuity

< $50

CML

BOLI

< $350

CML, rate resets,

other product levers

$ in millions

1

Denotes a non-GAAP financial measure. See Appendix for a definition of

these measures and reconciliations to the most directly comparable GAAP

measures. Estimated Statutory Cash

Flow Testing Reserves

$30 -

$60

8 -16 points RBC |

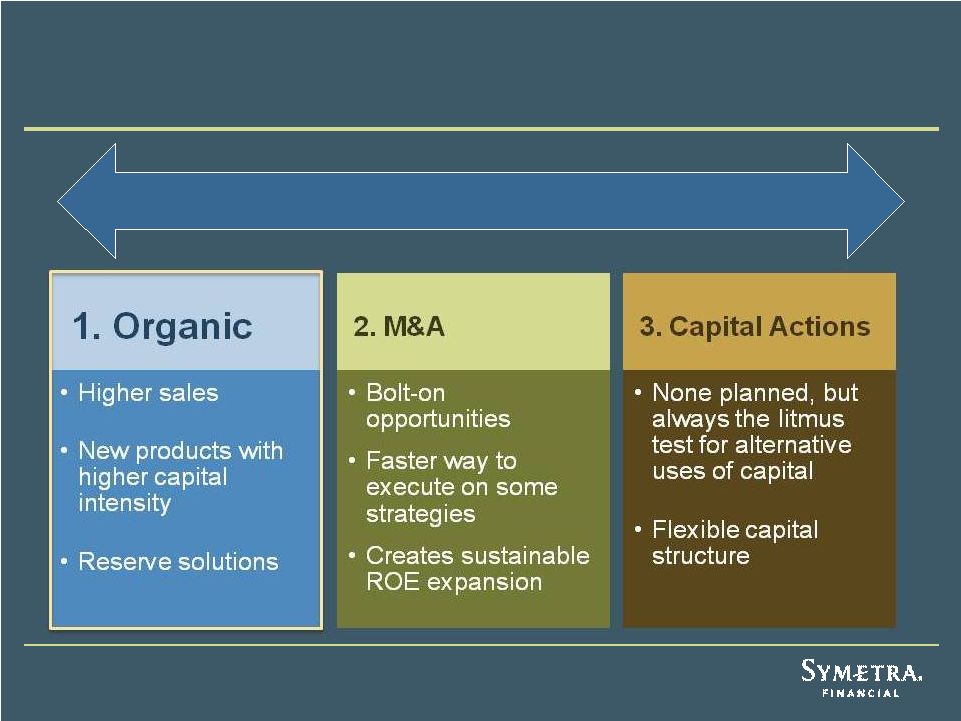

Capital Management Priorities

Key Consideration: Ratings

13 |

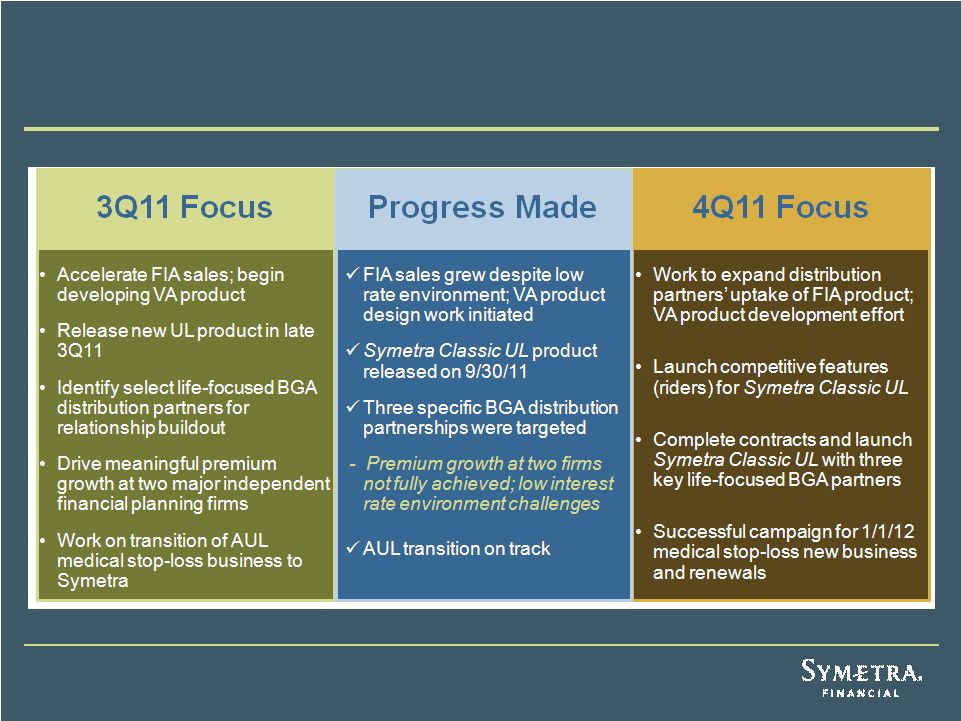

Grow & Diversify: Tracking Our Progress

14 |

Appendix

15 |

Reconciliation of Non-GAAP Measures

Three Months Ended

September 30

2011

2010

Net income

$ 11.1

$ 56.6

Less: Net realized investment gains (losses) (net of taxes)

(36.9)

13.0

Add: Net investment gains (losses) on FIA options (net of taxes)

(0.4)

0.2

Adjusted operating income

1

$ 47.6

$ 43.8

Adjusted operating income per diluted share of common stock

2

$ 0.35

$ 0.32

Twelve Months Ended

September 30

2011

2010

Return on equity (ROE)

7.1%

8.6%

Average book value

$ 2,646.0

$ 1,987.9

Operating return on average equity (ROAE)

3

9.6%

9.4%

Average adjusted book value

$ 1,988.0

$ 1,695.9

1

Adjusted operating income is a non-GAAP financial measure calculated as net

income, less after-tax net realized investment gains (losses), plus

after-tax net investment gains (losses) on our fixed indexed annuity (FIA)

options. ² Diluted weighted average shares outstanding for the three

months ended Sept. 30, 2011 and 2010 were 137.571 million and 137.145 million,

respectively. ³ Operating ROAE is a non-GAAP financial

measure computed as adjusted operating income for the most recent four quarters,

divided by average adjusted book value for the most recent five

quarters. Adjusted book value is stockholders’ equity

excluding

AOCI.

$ in millions

16 |

Reconciliation of Non-GAAP Measures (cont.)

Three Months Ended

September 30

2011

2010

Segment pretax adjusted operating income:

Group

$ 22.0

$ 16.7

Deferred Annuities

28.0

22.5

Income Annuities

7.1

9.5

Life

12.4

15.3

Other

(1.7)

(0.5)

Subtotal

67.8

63.5

Less: Income Taxes

1

20.2

19.7

Adjusted operating income

2

$ 47.6

$ 43.8

1

Represents the total provision for income taxes adjusted for the tax effect on net

realized investment gains (losses) and on net realized and unrealized

investment gains (losses) on fixed indexed annuity (FIA) options at the U.S. federal income tax rate of 35%.

2

Adjusted operating income is a non-GAAP financial measure calculated as net

income, less after-tax net realized investment gains (losses), plus

after-tax net investment gains (losses) on our fixed indexed annuity (FIA) options.

$ in millions

17 |

Reconciliation of Non-GAAP Measures (cont.)

1

Adjusted

book

value

is

a

non-GAAP

financial

measure

calculated

as

stockholders’

equity

excluding

AOCI.

2

Tangible

book

value

is

a

non-GAAP

financial

measure

calculated

as

stockholders’

equity

excluding

deferred

policy

acquisition

costs, goodwill and other non-tangible assets.

$ in millions

18

As of Sept. 30, As of Dec. 31,

2011

2010

Total stockholders' equity

$ 3,060.0

$ 2,380.6

Less: Accumulated other comprehensive income (AOCI)

1,006.5

432.5

Adjusted book value

2,053.5

1,948.1

Total Stockholders' Equity

3,060.0

Less:

Deferred policy acquisition costs

202.1

Goodwill

29.9

Intangible assets

29.6

Other non-tangible assets

57.4

Tangible

book

value

$ 2,741.0

2

1 |

|