Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE OF VISA INC. - VISA INC. | d247231dex991.htm |

| 8-K - FORM 8-K - VISA INC. | d247231d8k.htm |

Visa

Inc. Fiscal Fourth Quarter and

Full-Year 2011

Financial Results

October 26, 2011

Exhibit 99.2 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

2

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. These statements can be identified by the terms

“expect,” “will,” “continue” and similar references to the future. Examples of such forward-looking statements include, but are not

limited to, statements we make about our earnings per share, cash flow, revenue, incentive payments,

expenses, operating margin, tax rate and capital expenditures and the growth of those

items. By their nature, forward-looking statements: (i) speak only as of the date they are made, (ii) are

neither statements of historical fact nor guarantees of future performance and (iii) are

subject to risks, uncertainties, assumptions and changes in circumstances that are difficult to predict or quantify. Therefore, actual results

could differ materially and adversely from those forward-looking statements because of a variety

of factors, including the following:

–

the impact of new laws, regulations and marketplace barriers, particularly the rules recently

promulgated under the U.S. Wall Street Reform and Consumer Protection Act, including: •

rules capping debit interchange rates; •

rules expanding issuers’ and retailers’ choice among debit payment networks; •

the spread of regulation of debit payments to credit and other product categories; •

the spread of U.S. regulations to other countries; and •

rules about consumer privacy and data use and security –

developments in current or future disputes and our ability to absorb their impact, including

interchange, tax and antitrust; –

macroeconomic factors, such as:

•

global economic, political, health and other conditions; •

cross-border activity and currency exchange rates; and •

material changes in our clients’ performance compared to our estimates; –

industry developments, such as: •

competitive pressure, particularly on client pricing; •

rapid technological developments; •

bank and merchant consolidation and their increased focus on payment card costs; •

disintermediation from the payments value stream through new entrants, government actions or

bilateral agreements; and

•

adverse changes in our relationships and reputation; –

system developments, such as: •

disruption of our transaction processing systems or the inability to process transactions

efficiently;

•

our clients’ failure to fund settlement obligations we have guaranteed; •

disruption of our transaction processing systems or the inability to process transactions

efficiently;

•

account data breaches or increased fraudulent or other illegal activities involving our cards; and •

issues arising at Visa Europe, including failure to maintain interoperability between our systems; –

costs arising if Visa Europe were to exercise its right to require us to acquire all of its

outstanding stock;

–

loss of organizational effectiveness or key employees; –

failure to integrate successfully recent acquisitions or new technologies; –

changes in accounting principles or treatments; and the other

factors discussed under the heading “Risk Factors” in our annual report on Form 10-K filed with the U.S. Securities and Exchange Commission. You

should not place undue reliance on such statements. Unless required to do so by law, we do not intend

to update or revise any forward-looking statement because of new information or future

developments or otherwise. |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

3

Solid Fiscal Fourth Quarter and

Full-Year Results

•

Strong

operating

revenues

of

$2.4

billion

for

the

fourth

quarter

and

$9.2

billion for the full-year, up 13% and 14% over prior year

•

Quarterly and adjusted annual net income of $880 million and $3.5 billion,

and diluted earnings per share of $1.27 and $4.99, up 34% and 28% over

prior period adjusted amounts

•

Continued positive secular trends and spending momentum contributed to

double-digit growth year over year in key underlying business drivers for the

past two years

•

Repurchased 5.2 million class A common shares during the fiscal fourth

quarter at an average price of $80.87. For full-year 2011, effectively

repurchased 43 million shares at an average price of $74.94 per share for a

total cost of $3.2 billion |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

4

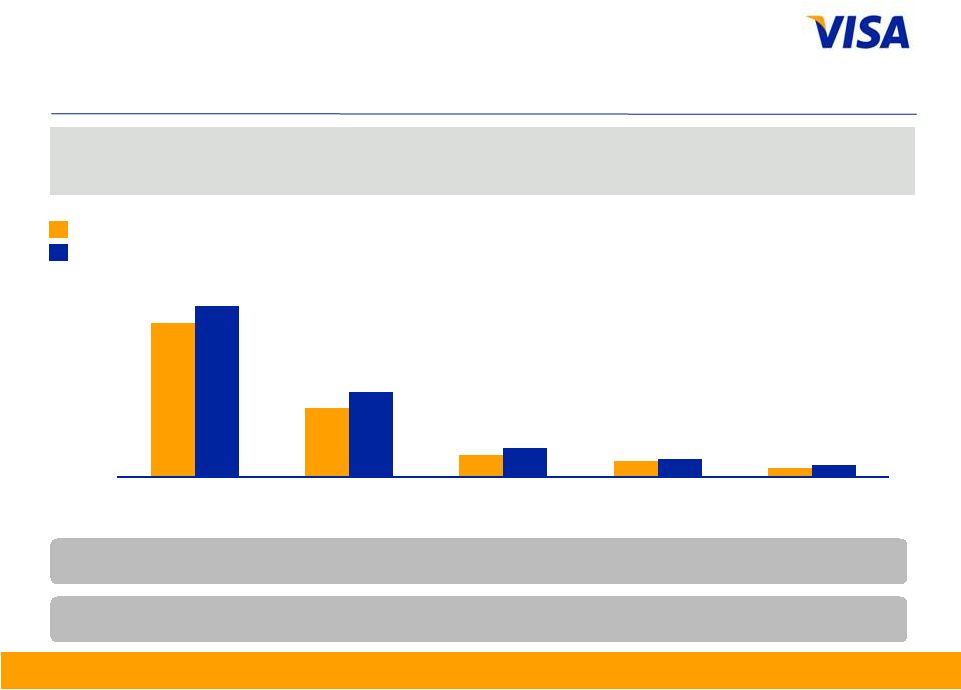

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

19%

15%

17%

YOY Change

(constant)

14%

13%

14%

Note: Figures may not sum due to rounding. Growth rates calculated based on whole

numbers, not rounded numbers. From time to time, previously submitted volume

information may be updated. Prior year volume information presented has not been updated, as changes made are not material.

Constant dollar growth rates exclude the impact of foreign currency fluctuations

against the U.S. dollar in measuring performance. ROW

=

Rest

of

World

Quarter ended June

802

481

321

941

572

369

Total Visa Inc.

Credit

Debit

2010

2011

U.S.

469

ROW

333

U.S.

204

ROW

277

U.S.

518

ROW

423

U.S.

224

ROW

348

U.S.

294

ROW 75

U.S.

266

ROW 55 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

5

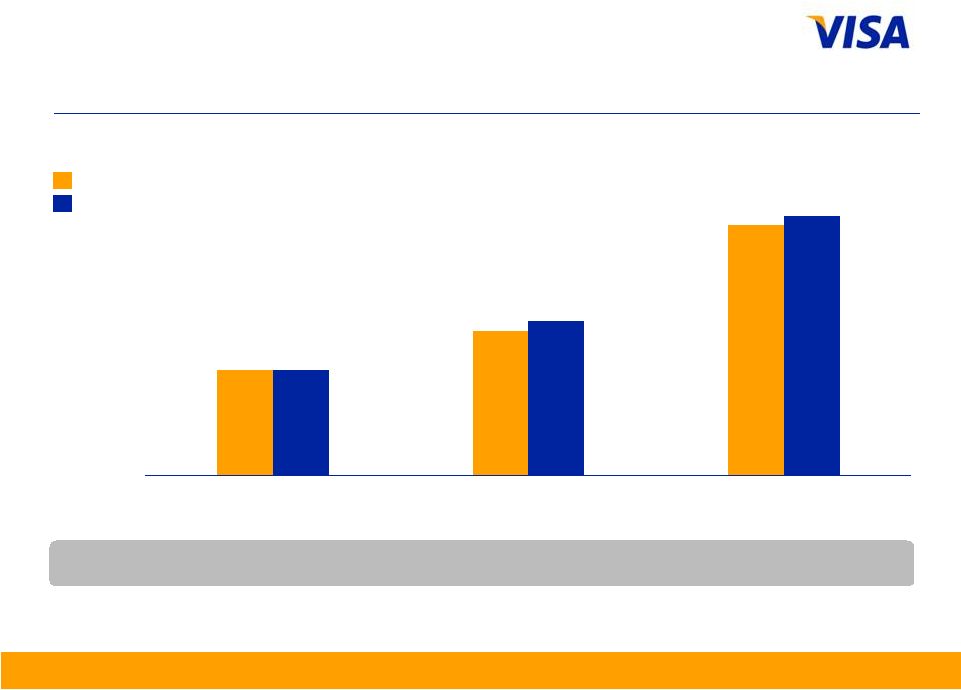

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

19%

14%

17%

YOY Change

(constant)

13%

14%

13%

Note: Current quarter payments volume and other select metrics are provided in the

operational performance data supplement to provide more recent operating

data. Service revenues continue to be recognized based on payments volume in the prior quarter. From time to time, reported

payments volume information may be updated to reflect revised client submissions or

other adjustments. Prior year volume information presented has not

been updated, as changes made are not material Figures may not sum due to rounding.

Quarter ended September

2010

2011

829

970

502

327

597

373

473

ROW

356

U.S.

207

ROW

295

U.S.

266

ROW 61

U.S.

516

ROW

453

U.S.

228

ROW

369

ROW 85

U.S.

288

ROW

=

Rest

of

World

Total Visa Inc.

Credit

Debit

U.S.

473 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

6

Payments Volume

US$ in billions, nominal, except percentages

Twelve Months ended June

YOY Change

(nominal)

15%

18%

16%

YOY Change

(constant)

14%

12%

17%

Note: Figures

may

not

sum

due

to

rounding.

Growth

rates

calculated

based

on

whole

numbers,

not

rounded

numbers.

From

time

to

time,

previously

submitted

volume

information

may

be

updated.

Prior

year

volume

information

presented

has

not

been

updated,

as

changes

made

are

not

material.

Constant

dollar

growth

rates

exclude

the

impact

of

foreign

currency

fluctuations

against

the

U.S.

dollar

in

measuring

performance.

ROW

=

Rest

of

World

3,037

1,861

1,176

3,530

2,141

1,390

Total Visa Inc.

Credit

Debit

Fiscal 2010

Fiscal 2011

U.S.

1,752

ROW

1,285

U.S.

781

ROW

1,080

U.S.

1,961

ROW

1,569

U.S.

846

ROW

1,295

U.S.

1,115

ROW 275

U.S.

971

ROW 206 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

7

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

17%

16%

17%

YOY Change

(constant)

14%

13%

15%

Note: Current quarter payments volume and other select metrics are provided in the

operational performance data supplement to provide more recent operating

data. Service revenues continue to be recognized based on payments volume in the prior quarter. From time to time, reported

payments volume information may be updated to reflect revised client submissions or

other adjustments. Prior year volume information presented has

not

been

updated,

as

changes

made

are

not

material

Figures

may

not

sum

due

to

rounding.

Twelve Months ended September

Total Visa Inc.

Credit

Debit

ROW 220

U.S.

1,808

ROW

1,337

U.S.

794

ROW

1,116

U.S.

2,004

U.S.

867

U.S.

1,137

U.S.

1,014

ROW

1,666

ROW

1,368

ROW 299

3,145

1,910

1,235

3,670

2,235

1,435

ROW

=

Rest

of

World

Fiscal 2010

Fiscal 2011 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

8

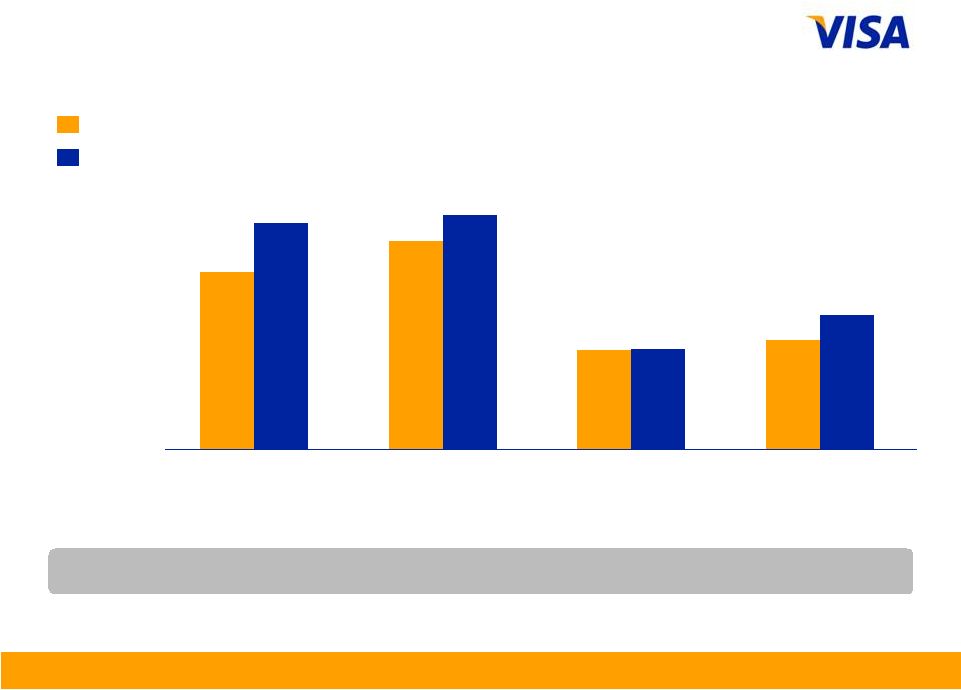

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

26%

14%

10%

37%

42%

YOY Change

(constant)

10%

15%

8%

28%

35%

Note: Growth rates calculated based on whole numbers, not rounded numbers. From

time to time, previously submitted volume information may be updated. Prior

year volume information presented has not been updated, as changes made are not material. Constant dollar growth rates exclude

the impact of foreign currency fluctuations against the U.S. dollar in measuring

performance. 2010

2011

469

198

62

48

24

518

248

85

55

35

United States

Asia Pacific

Latin America and

Caribbean

Canada

Central and

Eastern Europe,

Middle East and

Africa

Quarter ended June |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

9

Payments Volume

US$ in billions, nominal, except percentages

Note: Current quarter payments volume and other select metrics are provided in the

operational performance data supplement to provide more recent operating

data. Service revenues continue to be recognized based on payments volume in the prior quarter. From time to time, reported

payments volume information may be updated to reflect revised client submissions or

other adjustments. Prior year volume information presented has not been

updated, as changes made are not material. Figures may not sum due to rounding.

YOY Change

(nominal)

28%

14%

9%

31%

40%

YOY Change

(constant)

17%

7%

9%

25%

37%

Quarter ended September

2010

2011

473

212

68

49

27

516

271

90

55

37

United States

Asia Pacific

Latin America and

Caribbean

Canada

Central and

Eastern Europe,

Middle East and

Africa |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

10

1,752

771

240

183

91

1,961

931

312

204

122

United States

Asia Pacific

Latin America and

Caribbean

Canada

Central and

Eastern Europe,

Middle East and

Africa

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

21%

12%

12%

30%

34%

YOY Change

(constant)

12%

13%

7%

26%

32%

Note: Growth rates calculated based on whole numbers, not rounded numbers. From

time to time, previously submitted volume information may be updated. Prior

year volume information presented has not been updated, as changes made are not material. Constant dollar growth rates exclude

the impact of foreign currency fluctuations against the U.S. dollar in measuring

performance. Twelve Months ended June

2010

2011 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

11

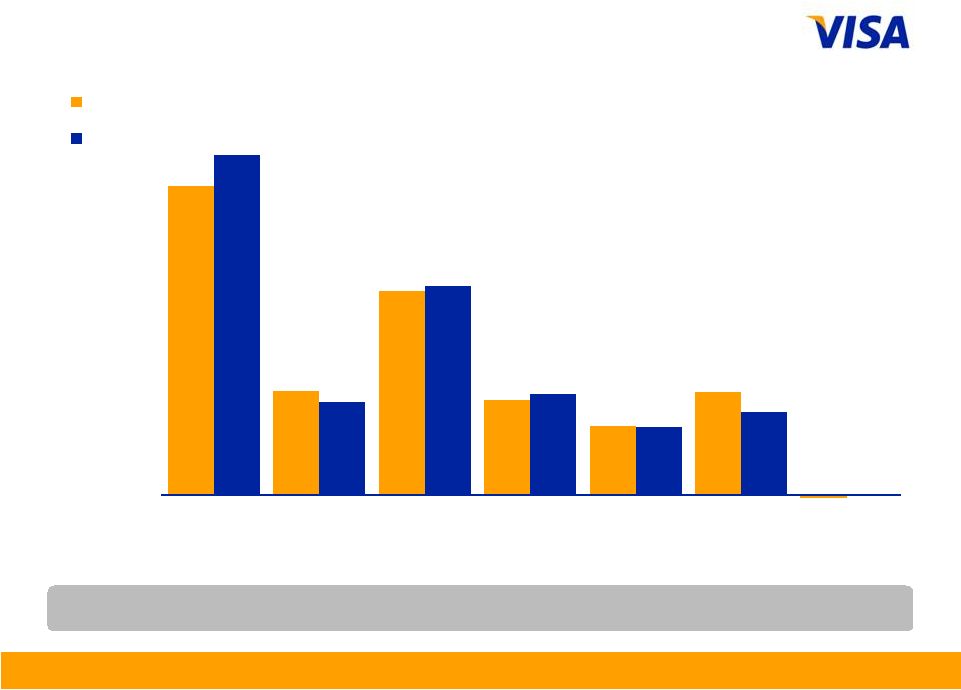

Payments Volume

US$ in billions, nominal, except percentages

YOY Change

(nominal)

23%

13%

11%

32%

37%

YOY Change

(constant)

15%

7%

11%

26%

34%

Twelve Months ended September

2010

2011

Note: Current quarter payments volume and other select metrics are provided in the

operational performance data supplement to provide more recent operating

data. Service revenues continue to be recognized based on payments volume in the prior quarter. From time to time, reported

payments volume information may be updated to reflect revised client submissions or

other adjustments. Prior year volume information presented has not been

updated, as changes made are not material. Figures may not sum due to rounding.

1,808

800

253

187

97

2,004

990

333

211

133

United States

Asia Pacific

Latin America and

Caribbean

Canada

Central and Eastern

Europe, Middle East

and Africa |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

12

Transactions

in millions, except percentages

Quarter ended June

Quarter ended September

Note: Processed transactions represent transactions involving Visa, Visa Electron,

Interlink and Plus cards processed on Visa’s networks. Total transactions

represent payments and cash transactions as reported by Visa clients on their

operating certificates. From time to time, previously submitted transaction

information may be updated. Prior year transaction information presented has not

been updated, as changes made are not material. YOY

Change

10%

11%

9%

9%

2010

2011

17,582

11,721

19,404

13,038

Total Transactions

Processed

Transactions

Credit

35%

Debit

65%

Credit

35%

Debit

65%

18,149

12,119

19,779

13,263

Total Transactions

Processed

Transactions

Credit

35%

Debit

65%

Credit

36%

Debit

64% |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

13

Transactions

in millions, except percentages

Twelve Months ended June

Twelve Months ended September

Note: Processed transactions represent transactions involving Visa, Visa Electron,

Interlink and Plus cards processed on Visa’s networks. Total

transactions represent payments and cash transactions as reported by Visa clients

on their operating certificates. From time to time, previously submitted

transaction information may be updated. Prior year transaction information presented has not been updated, as changes made are not

material.

YOY

Change

13%

14%

11%

12%

2010

2011

Credit

36%

Debit

64%

Credit

35%

Debit

65%

Credit

36%

Debit

64%

Credit

35%

Debit

65%

Total Transactions

Processed

Transactions

Total

Transactions

Processed

Transactions

Total

66,158

43,755

74,456

49,778

68,423

45,411

76,084

50,922 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

14

Total Cards

in millions, except percentages

YOY

Change

7%

4%

(1%)

Note: From time to time, previously submitted card information may be

updated. Prior year card information presented has not been updated, as

changes made are not material

2010

2011

772

1,065

1,837

766

1,137

1,903

Credit

Debit

Visa Inc.

Quarter ended June |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

15

Revenue –

Q4 2011

US$ in millions, except percentages

YOY

Change

37%

13%

17%

Note: Growth rates calculated based on whole numbers, not rounded numbers.

Percentage of

Gross Revenues

19%

81%

2,538

(421)

2,117

2,959

(576)

2,383

Gross Revenues

Incentives

Net Operating Revenues

Fiscal 2010

Fiscal 2011 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

16

Revenue –

Fiscal Year 2011

US$ in millions, except percentages

Percentage of

Gross Revenues

17%

83%

Note: Growth rates calculated based on whole numbers, not rounded numbers.

YOY

Change

21%

14%

15%

9,625

(1,560)

8,065

11,068

(1,880)

9,188

Gross Revenues

Incentives

Net Operating

Revenues

Fiscal 2010

Fiscal 2011 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

17

Revenue Detail –

Q4 2011

US$ in millions, except percentages

Note: Growth rates calculated based on whole numbers, not rounded numbers.

YOY

Change

10%

23%

21%

3%

Fiscal 2010

Fiscal 2011

912

840

619

167

1,105

925

758

171

Service

Revenues

Data Processing

Revenues

International

Transaction

Revenues

Other Revenues |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

18

Revenue Detail –

Fiscal Year 2011

US$ in millions, except percentages

Note: Growth rates calculated based on whole numbers, not rounded numbers.

YOY

Change

11%

17%

22%

(8%)

Fiscal 2010

Fiscal 2011

3,497

3,125

2,290

713

4,261

3,478

2,674

655

Service

Revenues

Data Processing

Revenues

International

Transaction

Revenues

Other Revenues |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

19

Operating Margin –

Q4 2011

US$ in millions, except percentages

Note: Growth rates calculated based on whole numbers, not rounded numbers.

YOY

Change

13%

2%

4 ppts

22%

Fiscal 2010

Fiscal 2011

53%

2,117

1,004

1,113

57%

2,383

1,021

1,362

Operating

Margin

Net Operating

Revenues

Total Operating

Expenses

Operating

Income |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

20

Operating Margin –

Fiscal Year 2011

US$ in millions, except percentages

Note: Growth rates calculated based on whole numbers, not rounded numbers.

YOY

Change

14%

7%

2 ppts

19%

Fiscal 2010

Fiscal 2011

57%

8,065

3,476

4,589

59%

9,188

3,732

5,456

Operating

Margin

Net Operating

Revenues

Total Operating

Expenses

Operating

Income |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

21

Operating Expenses –

Q4 2011

US$ in millions, except percentages

Note: Growth rates calculated based on whole numbers, not rounded numbers.

YOY

Change

2%

7%

10%

(19%)

(1)%

(11%)

NM

353

119

233

108

78

117

(4)

388

106

239

115

77

95

1

Personnel

Network

and Processing

Marketing

Professional Fees

Depreciation

and Amortization

General

and

Administrative

Litigation

Provision

Fiscal 2010

Fiscal 2011 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

22

Operating Expenses –

Fiscal Year 2011

US$ in millions, except percentages

Note: Growth rates calculated based on whole numbers, not rounded numbers.

YOY

Change

18%

19%

15%

9%

(10%)

(16%)

NM

1,222

425

964

286

265

359

(45)

1,459

357

870

337

288

414

7

Personnel

Network

and

Processing

Marketing

Professional Fees

Depreciation and

Amortization

General and

Administrative

Litigation

Provision

Fiscal 2010

Fiscal 2011 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

23

Other Income (Expense)

Fiscal Year 2011

US$ in millions

The following table presents components of our other income (expense).

Gain on sale of investment in CBSS

85

$

Revaluation of Visa Europe put option

122

Other

(1)

(7)

Total other income

200

$

(1)

Amount primarily represents interest expense, other investment income and the accretion associated

with litigation settlements to be paid over periods longer than one year.

|

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

24

Other Financial Results

•

Cash, cash equivalents, restricted cash, and available-for-sale

investment securities of $6.9 billion at the end of the fiscal year, which

includes $2.9 billion of restricted cash in the litigation escrow account

•

Free cash flow of $3.9 billion was fully deployed to effectively

repurchase 43 million shares at $3.2 billion, pay $423 million in

dividends, and finance PlaySpan and Fundamo acquisitions of $268

million

•

Capital

expenditures

of

$117

million

and

$353

million

during

the

fiscal

fourth quarter and the full-year 2011, respectively

Note: See appendix for reconciliation of adjusted non-GAAP measures to the

closest comparable GAAP measures. |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

25

Financial Metrics for Fiscal Year 2012

Under $1

billion

Marketing expenses

Annual operating margin

About 60%

17% to 18%

range

Client incentives as % of gross revenues

Annual net revenue growth

High single to

low double

digit range |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

26

Financial Metrics for Fiscal Year 2012

*Excludes impact of possible non-cash revaluation of deferred tax liabilities,

which could decrease the GAAP tax rate to 30% to 31%. These deferred tax

liabilities are primarily associated with indefinite-lived intangible assets recorded as

part of Visa’s October 2007 reorganization.

Capital expenditures

Adjusted annual diluted class A common stock

earnings per share growth

Mid to high

teens

range

Adjusted tax rate*

33% to 34%

range

Annual free cash flow

Above $4

billion

$350 million

to $400

million range |

Appendix

Reconciliation of

Non-GAAP Measures |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

Adjusted Net Income and Earnings

US$ in millions, except per share data

Management believes the presentation of adjusted net income and diluted earnings

per share provides a clearer understanding of

our

operating

performance

for

the

periods.

The

revaluation

of

the

Visa

Europe

put

option

during

the

third

fiscal

quarter

resulted in non-cash, non-operating income during fiscal 2011. The

reduction in the fair value of the put option was primarily the result

of

declines

in

our

estimated

long-term

price-to-earnings

ratio

and

does

not

reflect

any

change

in

the

likelihood

that

Visa

Europe will exercise its option. Management therefore believes that the

resulting non-operating income is not indicative of Visa’s

performance in the current or future periods. (1)

Non-cash, non-operating income resulting from the revaluation of this financial instrument is

not subject to tax. September 30, 2011

September 30, 2011

Net income attributable to Visa Inc. (as reported)

880

774

3,650

2,966

Revaluation of Visa Europe Put option

(1)

-

(79)

(122)

(79)

Adjusted net income attributable to Visa Inc.

880

695

3,528

2,887

692

731

707

739

Adjusted diluted earnings per share

1.27

0.95

4.99

3.91

Diluted earnings per share (as reported)

1.27

1.06

5.16

4.01

Impact of the revaluation of Visa Europe put option

-

0.17

0.10

Three months ended

Twelve months ended

Weighted average number of diluted shares

outstanding (as reported)

September 30, 2010

September 30, 2010

0.11

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

A1 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

Calculation of Free Cash Flow

US$ in millions

(1) Includes changes in client incentives, trade receivables/payable, settlement

receivable/payable, and personnel incentives. Additions (+) /

Reductions (-) to

Net income

attributable to

Visa Inc.

Net income attributable to Visa Inc. (as reported)

880

3,650

Capital Assets

+

Depreciation and amortization

77

288

-

Capital expenditures

(117)

(40)

(353)

(65)

Litigation

+

Litigation provision

1

7

+

Accretion expense

2

11

-

Settlement payments

(90)

(302)

+

Settlement payments funded by litigation escrow

70

(17)

280

(4)

Share-based Compensation

+

Share-based compensation

32

154

Pension

+

Pension expense

10

34

-

Pension contribution

(74)

(64)

(74)

(40)

Taxes

+

Income tax expense

476

2,010

-

Income taxes paid

(480)

(4)

(1,731)

279

Visa Europe Put Option

-

Fair Value Adjustment

-

(122)

Changes in Working Capital

(1)

+/-

Changes in other working capital accounts

(45)

6

Total Free Cash Flow

742

3,858

Less: PlaySpan and Fundamo

Acquisitions

-

Purchase consideration, net of cash received

-

(268)

Adjusted Free Cash Flow

742

3,590

Three Months Ended

September 30, 2011

Twelve Months Ended

September 30, 2011

A2 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

Impact of PlaySpan Acquisition

US$ in millions, except per share data

The following table presents the impact of the PlaySpan acquisition on Visa’s

fiscal fourth quarter and full-year adjusted diluted earnings per

share. (1)

(2)

(3)

Represents tax rate applicable to PlaySpan.

(4)

(5)

Operating revenues recognized by Visa related to PlaySpan transactions. Amount primarily

represents data processing revenues.

Operating expenses incurred by Visa related to PlaySpan. Amounts incurred subsequent to the

acquisition primarily represent personnel, amortization of intangibles and normal operating

expenses. Amount primarily represents professional fees related to closing the transaction and

some minor compensation expense, which are non-deductible for tax purposes.

See slide A1 for a reconciliation of adjusted diluted earnings per share to GAAP diluted earnings per

share. Net income attributable to Visa Inc. (as reported)

880

$

3,650

$

Revaluation of Visa Europe Put option

-

(122)

Adjusted net income attributable to Visa Inc.

880

$

3,528

$

Taxable PlaySpan adjustments:

Less: Operating revenue

(1)

(10)

(18)

Addback: Deductible operating expenses

(2)

22

43

Subtotal of taxable adjustments

12

25

Tax rate

(3)

39%

39%

Tax impact of adjustments

(4)

(10)

Impact of taxable PlaySpan adjustments

8

15

Addback: Non-deductible adjustments

(4)

-

8

Impact of PlaySpan

8

23

Adjusted net income attributable to Visa Inc.

888

$

3,551

$

Weighted average number of diluted shares outstanding (as reported)

692

707

Adjusted diluted earnings per share, excluding impact of PlaySpan acquisition

1.28

$

5.02

$

Adjusted diluted earnings per share

(5)

1.27

$

4.99

$

Impact of PlaySpan acquisition

(0.01)

$

(0.03)

$

A3

Three Months Ended

Twelve Months Ended

September 30, 2011

September 30, 2011 |

Fiscal Fourth Quarter and Full-Year 2011 Financial Results

Impact of Fundamo Acquisition

US$ in millions, except per share data

The following table presents the impact of the Fundamo acquisition on Visa’s

fiscal fourth quarter and full-year adjusted diluted earnings per

share. A4

(1)

(2)

See slide A1 for a reconciliation of adjusted diluted earnings per share to GAAP diluted earnings per

share. Represents the net operating results of Fundamo recognized by Visa since the acquisition

in June 2011. Three Months Ended

September 30, 2011

Twelve Months Ended

September 30, 2011

Net income attributable to Visa Inc. (as reported)

880

$

3,650

$

Revaluation of Visa Europe Put option

-

(122)

Adjusted net income attributable to Visa Inc.

880

$

3,528

$

After

tax

impact

of

Fundamo

(1)

10

$

14

$

Adjusted net income attributable to Visa Inc.

890

$

3,542

$

Weighted average number of diluted shares outstanding (as reported)

692

707

Adjusted

diluted

earnings

per

share,

excluding

impact

of

Fundamo

acquisition

1.28

$

5.01

$

Adjusted diluted earnings per share

(2)

1.27

$

4.99

$

Impact of Fundamo acquisition

(0.01)

$

(0.02)

$

|