Attached files

| file | filename |

|---|---|

| EX-32.1 - SECTION 906 CERTIFICATION - W&E Source Corp. | exhibit32-1.htm |

| EX-31.1 - SECTION 302 CERTIFICATION - W&E Source Corp. | exhibit31-1.htm |

| EX-32.2 - SECTION 906 CERTIFICATION - W&E Source Corp. | exhibit32-2.htm |

| EX-31.2 - SECTION 302 CERTIFICATION - W&E Source Corp. | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ___________

Commission file number 000-52276

NEWS OF CHINA INC.

(Exact

name of registrant as specified in its charter)

| Delaware | 98-0471083 |

| State or other jurisdiction | (I.R.S. Employer |

| of incorporation or organization | Identification No.) |

Delaware Intercorp, Inc., 113 Barksdale Professional

Center, Newark, DE 19711

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code (450) 443-1153

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of Each Class | Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act:

Shares of common stock with a par value of

$0.0001

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No

[X]

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No

[X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act).

Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

4,100,000 shares of common stock at a price of $0.10 per share for an aggregate market value of $410,000 1

1 The aggregate market value of the voting stock held by non-affiliates is computed by reference to the price of our common stock on December 31, 2010.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: 25,900,000 shares of common stock as of October 13, 2011.

ii

TABLE OF CONTENTS

iii

PART I

ITEM 1. BUSINESS

Forward Looking Statements

This report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States generally accepted accounting principles.

In this report, unless otherwise specified, all references to “common shares” refer to the common shares of our capital stock.

As used in this report, the terms “we”, “us”, “our”, “News of China” means News of China Inc., unless otherwise indicated.

Corporate Overview

We are a development stage company incorporated in Delaware on October 11, 2005. Our principal business when we were first established was to provide an online financial media outlet for researching China-related stocks. This media outlet would provide financial news and commentary, online video broadcasting, and other information for researching China-related stocks. China-related stocks refer to the stocks issued by companies whose main operations are located in China.

In our online financial media outlet, we provided financial news and commentary, online video broadcasting, and other information for researching China-related stocks listed on the United States and Canadian stock markets. “China-related stocks” refer to stock issued by companies whose main operations are located in China. Due to the inefficiency of China’s capital markets, more and more China-related companies are seeking avenues to access the public markets in the United States and Canada to raise capital needed to cope with China’s fast growing economy. Stock exchanges in the United States and Canada have also expressed interest in attracting more Chinese companies.

We finished our online financial media outlet software development in August 2006, and our media outlet became operational online at www.newsofchina.com in August 2006. Since the initial launch of our online financial media outlet, we updated the contents of our online financial media outlet with relevant news updates, editorials and market analyses relating to public companies with business operations in China. In addition to Mr. Chenxi Shi and Mr. Zibing Zhang, we also engaged additional part time staff members to help us gather relevant financial information for the contents of our online financial media outlet.

1

Furthermore, in December of 2006, Messrs. Zhang and Shi also traveled to China to promote our business with the investment community there. During this trip, Messrs. Zhang and Shi attended meetings with candidates who can assist us to gather and collect relevant financial information in China on Chinese reporting companies. Messrs. Zhang and Shi also met with individuals from Beijing University to discuss the possibility of organizing an investor relations forum at Beijing University. It was hoped that our company would then be able to promote the benefits of its online media outlet to the attendees. However, our management was not able to organize an investor relations forum as planned.

In early 2007, our online financial media outlet experienced software difficulties and is currently not operational.

In August 2007, we started incorporating a wholly owned subsidiary in China called News of China (Beijing) Management Consultants Co., Ltd. and paid the initial capital registration fee of $30,000 as required under Chinese company law. However, the further capital contribution in the amount of $120,000 was too onerous for our company at that time, so subsequent to the advance of $30,000, we decided not to invest the remaining $120,000 in order to complete the incorporation process. As a consequence thereof, our agent in China repaid the $30,000 advance we made in full to our company and the incorporation of our subsidiary was cancelled.

In our management’s opinion, we have not been able to achieve the milestones we set to fully implement our business operations. Because we have not been able to generate revenues from our online financial media outlet and we have little working capital remaining, our management has decided to suspend the implementation of our current business plan until such time when we are able to obtain further financing. We anticipate that we will need to raise $2-2.5 million additional financing through sales of our securities in traditional private placement offerings or other types of private placement transactions such as Private Investment in Public Equity (“PIPE”) before we can continue implementing our current business plan. Alternatively, we may decide to pursue a new business in a different direction other than our current business plan.

Competition

We are a company seeking prospective business opportunities. We compete with other companies for both the acquisition of prospective businesses and the financing necessary to develop such businesses.

Employees

We currently have no employees, other than our sole officer and director, and we do not expect to hire any employees in the foreseeable future. We presently conduct our business through agreements with consultants and arms-length third parties.

Subsidiaries

We do not have any subsidiaries.

Research and Development Expenditures

We did not incur expenditures in research and development over the last fiscal year.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

ITEM 1A. RISK FACTORS

Our common shares are considered speculative. Prospective investors should consider carefully the risk factors set out below.

2

Risks Related To Our Company

The global financial crisis has had, and may continue to have, an impact on our business and financial condition.

The ongoing global financial crisis may also limit our ability to access the capital markets at a time when we would like, or need, to raise capital, which could have an impact on our ability to react to changing economic and business conditions. Accordingly, if the global financial crisis and current economic downturn continue or worsen, our business, results of operations and financial condition could be materially and adversely affected.

We commenced our business operations in October, 2005 and we have a limited operating history. If we cannot successfully manage the risks normally faced by start-up companies, we may not achieve profitable operations and ultimately our business may fail.

We have a limited operating history. We are currently a development stage company and have developed preliminarily the necessary software for the planned online financial media outlet. Accordingly, we have a very limited operating history and we face all of the risks and uncertainties encountered by early-stage companies.

As at June 30, 2011, we had an accumulated deficit of $199,860 since inception. We anticipate continuing to incur significant losses until, at the earliest, we generate sufficient revenues to offset the substantial up-front expenditures and operating costs associated with developing and marketing our services. There can be no assurance that we will ever operate profitably.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

In their report dated October 13, 2011, our independent auditors stated that our financial statements for the period October 11, 2005 (Date of Inception) to June 30, 2011 were prepared assuming that we would continue as a going concern. Our ability to continue as a going concern is an issue raised as we have never generated any revenue from operations. We anticipate that we will continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities. Our lack of revenue and continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

We have no customers and generate no revenues and have only limited marketing experience to develop customers.

We have not yet entered into any agreements to sell our online financial medial outlet services to any customers. We do not believe that we will generate significant revenues in the immediate future. We will not generate any meaningful revenues unless we successfully launch our online financial media outlet and we obtain contracts with a significant number of customers. There can be no assurance that we will ever be able to obtain contracts with a significant number of customers to generate meaningful revenues or achieve profitable operations.

We have only limited experience in developing and marketing online financial media services, and there is limited information available concerning the potential performance or market acceptance of our proposed services. There can be no assurance that unanticipated expenses, problems or technical difficulties will not occur which would result in material delays in commercialization of our services or that our efforts will result in successful commercialization.

3

We need substantial additional financing and a failure to obtain such required financing will inhibit our ability to grow or we may have to curtail or cease operations.

Our capital requirements relating to the developing and marketing of our services have been, and will continue to be, significant. We are dependent on the proceeds of future financing in order to continue in business and to develop and commercialize additional proposed services. We anticipate requiring approximately $2,000,000 to $2,500,000 in additional financing for our longer term growth. Our management has decided to suspend implementation of our current business until such time when additional financing of approximately $2,000,000 to $2,500,000 is achieved. There can be no assurance that we will be able to raise the substantial additional capital resources necessary to permit us to pursue our business plan. We have no current arrangements with respect to, or sources of, additional financing and there can be no assurance that any such financing will be available to us on commercially reasonable terms, or at all. Any inability to obtain additional financing will have a material adverse effect on us, such as requiring us to significantly curtail or cease operations. In that case, you may lose your entire investment.

The continued growth of our business will require additional funding from time to time which would be used for general corporate purposes. General corporate purposes may include acquisitions, investments, repayment of debt, capital expenditures, repurchase of our capital stock and any other purposes that we may specify in any prospectus supplement. Obtaining additional funding would be subject to a number of factors including market conditions, operational performance and investor sentiment. These factors may make the timing, amount, terms and conditions of additional funding unattractive, or unavailable, to us.

The terms of any future financing may adversely affect your interest as stockholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in our company. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of our business more difficult because the lender’s consent will be required before we take certain actions. Similarly the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in our company, which may reduce the value of your investment.

We could lose our competitive advantages if we are not able to continuously develop superior services in our market niche and gain substantial market penetration quickly.

Our success and ability to compete depends, to a significant degree, on our ability to continuously develop superior services in our selected market niche of targeting and providing information on publicly reporting companies with business based in China and obtain substantial market penetration quickly. Our business model is vulnerable to duplication by competitors, especially competitors who are established in providing business and financial information of publicly reporting companies, who have superior financial and technological resources, industry experiences and marketing capacities. It is difficult to take, and we have not taken, any action to protect our business model in our selected market niche. If any of our competitors copies our business model or develops similar services independently, we would not be able to compete as effectively.

We may face regulatory difficulties for our services.

Development of such a media solution might be subject to regulations of various national, state, and provincial authorities in various jurisdictions. To comply with the regulations we may face a variety of bureaucratic difficulties that may likely add extra financial burden to our company.

4

The online media industry in China is subject to regulations of several Ministries and the State Agencies, including China Internet Network Information Center (CNNIC), The Ministry of Public Security of the People’s Republic of China, the Ministry of Information Industry of the People’s Republic of China, and Internet Society of China (ISC) etc. Although we are not required to obtain authorization from these Ministries and State Agencies, the accessibility of our planned online media might be blocked in China for political or other unpredictable reasons, which might affect our business activities in China substantially.

The uncertain legal environments in the People’s Republic of China and our industry may be vulnerable to local government agencies who have persistent bureaucratic power over customers, reporters and other parties who wish to renegotiate the terms and conditions of, or terminate their agreements or other understandings with us, when we enter substantial agreement of manufacturing and marketing of our proposed services in China.

Our Certificate of Incorporation and Bylaws contain limitations on the liability of our directors and officers, which may discourage suits against directors and executive officers for breaches of fiduciary duties.

Our Certificate of Incorporation, as amended, and our Bylaws contain provisions limiting the liability of our directors for monetary damages to the fullest extent permissible under Delaware law. This is intended to eliminate the personal liability of a director for monetary damages on an action brought by origin our right for breach of a director’s duties to us or to our stockholders except in certain limited circumstances. In addition, our Certificate of Incorporation, as amended, and our Bylaws contain provisions requiring us to indemnify our directors, officers, employees and agents serving at our request, against expenses, judgments (including derivative actions), fines and amounts paid in settlement. This indemnification is limited to actions taken in good faith in the reasonable belief that the conduct was lawful and in, or not opposed to our best interests. The Certificate of Incorporation and the Bylaws provide for the indemnification of directors and officers in connection with civil, criminal, administrative or investigative proceedings when acting in their capacities as agents for us. These provisions may reduce the likelihood of derivative litigation against directors and executive officers and may discourage or deter stockholders or management from suing directors or executive officers for breaches of their fiduciary duties, even though such an action, if successful, might otherwise benefit our stockholders and directors and officers.

Our success depends on our management team and other key personnel, the loss of any of whom could disrupt our business operations.

Our future success will depend in substantial part on the continual services of our senior management, including our President and Chief Executive Officer, Chenxi Shi. As a startup company, currently none of the senior management team draws salaries from our company. We do not carry key person life insurance on any of our officers or employees. The loss of the services of one or more of our key personnel could impede implementation of our business plan and result in reduced profitability.

Our future success will also depend on the continued ability to attract, retain and motivate highly qualified technical, sales and marketing, customer support personnel. Competition for qualified personnel is intense in our industry. We cannot assure you that we will be able to retain our key personnel or that we will be able to attract, assimilate or retain qualified personnel in the future. Our inability to hire and retain qualified personnel or the loss of the services of our key personnel could have a material adverse effect upon our business, financial condition and results of operations.

Because our officers, directors and principal shareholders control a majority of our common stock, investors will have little or no control over our management or other matters requiring shareholder approval.

Our officers and directors and their affiliates in the aggregate, beneficially own approximately 66.9% of issued and outstanding shares of our common stock. As a result, they have the ability to control matters affecting minority shareholders, including the election of our directors, the acquisition or disposition of our assets, and the future issuance of our shares. Because our officers, directors and principal shareholders control the company, investors will not be able to replace our management if they disagree with the way our business is being run. Because control by these insiders could result in management making decisions that are in the best interest of those insiders and not in the best interest of the investors, you may lose some or all of the value of your investment in our common stock.

5

Because we do not have sufficient insurance to cover our business losses, we might have uninsured losses, increasing the possibility that you would lose your investment.

We may incur uninsured liabilities and losses as a result of the conduct of our business. We do not currently maintain any comprehensive liability or property insurance. Even if we obtain such insurance in the future, we may not carry sufficient insurance coverage to satisfy potential claims. We do not carry any business interruption insurance. Should uninsured losses occur, any purchasers of our common stock could lose their entire investment.

Risks Relating to our Business

Our success depends upon the development of China’s and the world’s capital markets.

China is one of the fastest growing economies in the world. China is now taking great efforts to develop its current capital market into a more effective one. The growth of China’s capital market might significantly reduce the necessity of Chinese companies to go public in the United States and Canada. Furthermore, Chinese companies also have the options to go public in other global capital markets such as those in Hong Kong and Singapore. The development of other global capital markets can also attract more companies to go public in those alternative stock markets. Moreover, Chinese regulators might limit the number and the ability of Chinese companies to go public in the United States and Canada. Because our online financial media outlet will focus on North American publicly reporting companies with business based in China, all these circumstances can have an adverse effect on our business.

We face competition from larger and stronger companies that have the resources to provide superior and less costly services.

The markets that we are entering are intensely competitive. We expect additional competition to come from the increasing number of new market entrants who can develop potentially competitive services. We will face competition from numerous sources, including, large established traditional and online media who have superior resources and industry experiences. Our potential competitors may succeed in developing services that are more effective or less costly (or both) than our services. Some of our potential competitors may be large, well-financed and established companies that have greater resources and, therefore, may be better able than us to compete for a share of the market.

Our business is to provide online financial information through our online financial media outlet for researching China-related stocks to North America financial institutions. To our best knowledge, there is no established online media focused on our selected market niche yet. However, we have to compete with a large number of traditional media providing similar or even superior services such as The Wall Street Journal, CNBC, Bloomberg and Financial Times. Competition also comes from various financial online media such as finance.yahoo.com, Reuters.com, wallst.net etc. These traditional and online financial media have superior financial resources, industry experiences, market penetration and marketing capacity. Potential new entrants can copy our business model and compete with us in our selected market niche as well. Our competitive edge relies upon providing a one place financial media solution for researching China-related stocks listed in North American stock exchanges. Our Chinese cultural and language literacy and local connections in China enable us to provide information that is not available to these established traditional and online media. Our media will also cover information about China-related companies, especially small to medium sized ones, which are usually not covered by these established media. However, there is no assurance we can compete with these established or new competitors effectively, and if we fail to provide superior services effectively than these competitors, our business will fail and you will lose your entire investment.

Our operations depend upon the timeliness and quality of the services of web hosting service providers.

Our online financial media outlet is dependent on the quality and the timeliness of web hosting services. We currently use the web hosting services of DailyRazor Hosting (www.dailyrazor.com), a division of Vecordia Corporation. The failure to provide high quality and timely services of the provider will have material adverse effects on our business activities and our profitability.

6

We may face technological difficulties

Our online media outlet services are dependent upon the smooth operation of the software we develop. Shortcomings and bugs in the software may have material adverse effect on our business. Our online media outlet may also be vulnerable to attacks from hackers and computer viruses, which may cause interruption of our business.

We may be sued by reporting companies covered by our online financial media outlet, and investors who rely on information disseminated through our online financial media outlet.

We may have dispute with China related reporting companies about the materials and information we cover and disseminate through our online financial media outlet and thus be sued by these companies. Investors who make investment decisions relying upon information disseminated through our financial media outlet may also sue us for their losses. These legal proceedings might have material negative effect on profitability of our business.

Risks Relating to the People’s Republic of China

The economic policies of the People’s Republic of China could affect our business.

Our business is to provide financial information through our online financial media outlet for researching China’s listed companies in the United States and Canada. Accordingly, our results of operations and prospects are subject, to a significant extent, to the economic, political and legal developments in the People’s Republic of China.

While the People’s Republic of China’s economy has experienced significant growth in the past 20 years, such growth has been uneven, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall economy of the People’s Republic of China, but they may also have a negative effect on us.

The economy of the People’s Republic of China has been changing from a planned economy to a more market-oriented economy. In recent years, the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform and the reduction of state ownership of productive assets, and the establishment of corporate governance in business enterprises; however, a substantial portion of productive assets in the People’s Republic of China are still owned by the Chinese government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over the People’s Republic of China’s economic growth through the allocation of resources, the control of payment of foreign currency-denominated obligations, the setting of monetary policy and the provision of preferential treatment to particular industries or companies.

Capital outflow policies in the People’s Republic of China may hamper our ability to expand our business and/or operations. The People’s Republic of China has adopted currency and capital transfer regulations. These regulations may require us to comply with complex regulations for the movement of capital. Although our management believes that it is currently in compliance with these regulations, should these regulations or the interpretation of them by courts or regulatory agencies change, we may not be able to remit income earned and proceeds received in connection with any off-shore operations or from other financial or strategic transactions we may consummate in the future.

Fluctuation of the Renminbi could materially affect our financial condition and results of operations.

Fluctuation of the Renminbi, the currency of the People’s Republic of China, could materially affect our financial condition and results of operations. The value of the Renminbi fluctuates and is subject to changes in the People’s Republic of China’s political and economic conditions. Since July 2005, the conversion of Renminbi into foreign currencies, including United States dollars, is pegged against the inter-bank foreign exchange market rates or current exchange rates of a basket of currencies on the world financial markets. As of June 30, 2011, the exchange rate between the Renminbi and the United States dollar was 6.20 Renminbi to every one United States dollar.

7

We may have difficulty establishing adequate management, legal and financial controls in the People’s Republic of China.

The People’s Republic of China historically has not adopted a Western style of management and financial reporting concepts and practices, as well as in modern banking, computer and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the People’s Republic of China. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

It will be extremely difficult to acquire jurisdiction and enforce liability against our officers, directors and assets based in The People’s Republic of China.

Because some of our executive officers and current directors are Chinese citizens, it may be difficult, if not impossible, to acquire jurisdiction over these persons in the event a lawsuit is initiated against us and/or our officers and directors by a stockholder or group of stockholders in the United States.

Our business may face regulatory difficulties in the People’s Republic of China.

The online media industry in China is subject to regulations of several Ministries and the State Agencies, including China Internet Network Information Center (CNNIC), The Ministry of Public Security of the People’s Republic of China, the Ministry of Information Industry of the People’s Republic of China, and Internet Society of China (ISC). Although we are not required to obtain authorization or approval from these Ministries and State Agencies as a foreign online media, the accessibility of our online media might be blocked in China for political or other unpredictable reasons, which might adversely affect our business activities in China substantially. To comply with the regulations the Company may face a variety of bureaucratic difficulties that may likely add extra financial burden to our company. Bureaucracy and corruption that are often seen in China may also have adverse effects on our operation and financial conditions.

Risks Associated With Our Common Stock

Trading on the OTC Bulletin Board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Bulletin Board service of the Financial Industry Regulatory Authority (“FINRA”). Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a stock exchange like the American Stock Exchange. Accordingly, our shareholders may have difficulty reselling any of their shares.

8

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations and the FINRA’s sales practice requirements, which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common stock.

In addition to the “penny stock rules” promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Other Risks

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of the risk factors before making an investment decision with respect to our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable

ITEM 2. PROPERTIES

Our executive and head offices are located at 1855 Talleyrand, Suite 203A, Brossard, Quebec, Canada. The offices are provided to us at no charge by Mr. Chenxi Shi. We believe our current premises are adequate for our current operations and we do not anticipate that we will require any additional premises in the foreseeable future.

9

ITEM 3. LEGAL PROCEEDINGS

We know of no material, active or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is currently not traded on any exchange. Our common stock was quoted on the OTC Bulletin Board, but effective February 23, 2011, our common stock has not been eligible for quotation on the OTC Bulleting Board. We cannot assure you that there will be a market for our common stock in the future.

The following is a report of high and low bid prices for each quarterly period for the years ended June 30, 2011 and 2010 obtained from Yahoo! Finance.

| Quarter Ended | High | Low |

| June 30, 2011 | $0.11 | $0.07 |

| March 31, 2011 | $0.10 | $0.10 |

| December 31, 2010 | $0.10 | $0.02 |

| September 30, 2010 | $0.10 | $0.08 |

| June 30, 2010 | $0.00 | $0.00 |

| March 31, 2010 | $0.00 | $0.00 |

| December 31, 2009 | $0.00 | $0.00 |

| September 30, 2009 | $0.58 | $0.05 |

Holders of our Common Stock

As of October 13, 2011, there were approximately 63 holders of record of our common stock. As of such date, 25,900,000 shares of common stock were issued and outstanding.

Our shares of common stock are issued in registered form. Colonial Stock Transfer Co, Inc. is the registrar and transfer agent for our shares of common stock. Our CUSIP number is 65248X102.

Dividends

Since our inception, we have not declared nor paid any cash dividends on our capital stock and we do not anticipate paying any cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance the expansion of our operations. Our board of directors will determine future declarations and payments of dividends, if any, in light of the then-current conditions they deem relevant and in accordance with applicable corporate law.

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

10

| 1. |

we would not be able to pay our debts as they become due in the usual course of business; or | |

| 2. |

our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

Securities authorized for issuance under equity compensation plans.

Equity Compensation Plan Information

As at June 30, 2011, we had not adopted any equity compensation plan.

Recent Sales of Unregistered Securities

None.

ITEM 6. SELECTED FINANCIAL DATA

Not Applicable

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this prospectus. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include those discussed below and elsewhere in this prospectus and registration statement.

Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Anticipated Cash Requirements

We estimate our minimum operating expenses and working capital requirements for the next 12 month period to be as follows:

| Expense | Estimated Amount | ||

| General and administrative | $ | 24,000 | |

| Professional fees | 30,000 | ||

| Foreign exchange | 6,000 | ||

| Interest | 5,000 | ||

| Total | $ | 65,000 |

Results of Operations

The following summary of our results of operations should be read in conjunction with our audited financial statements for the year ended June 30, 2011 which are included herein.

| Percentage | |||||||||

| Year Ended | Year Ended | Increase/ | |||||||

| June 30, 2010 | June 30, 2011 | Decrease | |||||||

| Revenue | $ | -- | $ | -- | -- | ||||

| Expenses | 31,837 | 12,964 | -59.3% | ||||||

| Net Loss | $ | (31,837 | ) | $ | (12,964 | ) | -59.3% |

11

Revenues

We recorded a net operating loss of $12,964 for the year ended June 30, 2011 and have an accumulated deficit of $199,860 since inception. We have had no operating revenues since our inception on October 11, 2005 through the year ended June 30, 2011. We anticipate that we will not generate any revenues for so long as we are a development stage company.

Expenses

The major components of our expenses for the years ended June 30, 2010 and 2011are outlined in the table below:

| June 30, | June 30, | |||||

| 2010 | 2011 | |||||

| General and administrative | $ | 4,506 | $ | 4,773 | ||

| Professional fees | 25,928 | 7,517 | ||||

| Foreign exchange | 1,403 | 674 | ||||

| Total Expenses | $ | 31,837 | $ | 12,964 |

In the year ended June 30, 2011, our expenses decreased 59.3% relative to the year ended June 30, 2010 because of a decrease in the professional fees we paid.

Liquidity and Capital Resources

Our financial condition for the year ended June 30, 2011 and 2010 and the changes between those periods for the respective items are summarized as follows:

Working Capital

| Year ended June 30, | Percentage | ||||||||

| 2010 | 2011 | Decrease | |||||||

| Current Assets | $ | 28,851 | $ | 14,013 | (51.43% | ) | |||

| Current Liabilities | 38,832 | 35,911 | (7.52% | ) | |||||

| Working Capital | $ | (9,981 | ) | $ | (21,898 | ) | (119.40% | ) | |

The 119.40% decrease in our working capital was primarily due to uses of cash for operating expenses and our lack of revenues.

Cash Flows

| Year | Year | |||||

| ended | ended | |||||

| June 30, | June 30, | |||||

| 2010 | 2011 | |||||

| Cash used in operating activities | $ | (30,610 | ) | $ | (16,334 | ) |

| Cash used in investing activities | -- | -- | ||||

| Cash provided by financing activities | 628 | 699 | ||||

| Cumulative translation adjustment | 546 | 1,047 | ||||

| Net decrease in cash | (29,436 | ) | (14,588 | ) |

Cash Used in Operating Activities

For year ended June 30, 2011, our cash used in operating activities has decreased 46.64% compared to the previous year mainly due to the decrease in the professional fees we paid.

12

Cash Provided by Financing Activities

For year ended June 30, 2011, our cash provided by financing activities has increased to $699 because we obtained additional advances from our officer compare to the previous year.

Future Financings

We recorded a net operating loss of $12,964 for the year ended June 30, 2011 and have an accumulated deficit of $199,860 since inception. As at June 30, 2011 we had cash totaling $14,013 and for the next 12 months, management anticipates that the minimum cash requirements to fund our proposed exploration program and our continued operations will be $65,000. Accordingly, we do not have sufficient funds to meet our planned expenditures over the next 12 months and we will need further financing in order to meet our anticipated expenses.

We currently do not have any arrangements for financing and may not be able to find such financing if required. The most likely sources of future funds that will be available to us are through debt financing and through the issuance of equity capital.

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our development activities during the next 12-month period.

Going Concern

Because we are in the development stage, have not yet achieved profitable operations and are dependent on our ability to raise capital from stockholders or other sources to meet our obligations and repay our liabilities arising from normal business operations when they become due, in their report on our audited financial statements for the years ended June 30, 2010 and 2011, our independent auditors included an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our financial statements contain additional note disclosure describing management’s plan related to this uncertainty.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not Applicable

13

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

News of China Inc.

(A Development Stage

Company)

Financial Statements

As of Jun 30, 2010, 2011 and

from inception to June 30, 2011

Contents

F-1

Report of Independent Registered Public Accounting Firm

To the Board of Directors of

News of China Inc.

(a

Development Stage Company)

Montréal, Québec, Canada

We have audited the accompanying balance sheet of News of China Inc. (the “Company”) as of June 30, 2011, and the related statements of operations and other comprehensive loss, changes in shareholders’ equity (deficit) and cash flows for the year then ended and the period from October 11, 2005 (inception) to June 30, 2011. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit. The financial statements for the period from October 11, 2005 (inception) through June 30, 2010 were audited by other auditors whose reports expressed unqualified opinions on those statements. Our opinion on the statements of operations, stockholders' deficit and cash flows for the period from October 11, 2005 (inception) through June 30, 2011, insofar as it relates to amounts for prior periods through December 31, 2010, is based solely on the reports of other auditors.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of News of China Inc. as of June 30, 2011 and the results of its operations and its cash flows for the year then ended and the period from October 11, 2005 (inception) to June 30, 2011, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the financial statements, the Company has a working capital deficiency, has no source of revenues and needs additional cash resources to maintain its operations. Those conditions raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to those matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ GBH CPAs, PC

GBH CPAs, PC

www.gbhcpas.com

Houston, Texas

October 13, 2011

F-2

F-3

| News of China Inc. |

| (A Development Stage Company) |

| Balance Sheets |

| At June 30, 2010 and 2011 |

| 2010 | 2011 | |||||

| Assets | ||||||

| Cash | $ | 28,601 | $ | 14,013 | ||

| Prepaid expenses | 250 | - | ||||

| Total Assets | $ | 28,851 | $ | 14,013 | ||

| Liabilities | ||||||

| Accrued liabilities | $ | 9,498 | $ | 5,878 | ||

| Loan payable, shareholder | 29,334 | 30,033 | ||||

| Total Liabilities | 38,832 | 35,911 | ||||

| Shareholders' Deficit | ||||||

| Common stock, $0.0001 par value, authorized

25,900,000 shares, issued and outstanding 25,900,000 shares |

2,590 |

2,590 |

||||

| Additional paid-in capital | 173,695 | 173,695 | ||||

| Accumulated other comprehensive income | 630 | 1,677 | ||||

| Deficit accumulated during the development stage | (186,896 | ) | (199,860 | ) | ||

| Total Shareholders’ Deficit | (9,981 | ) | (21,898 | ) | ||

| Total Liabilities and Shareholders’ Deficit | $ | 28,851 | $ | 14,013 |

See accompanying notes to financial statements.

F-4

| News of China Inc. |

| (A Development Stage Company) |

| Statements of Operations |

| For the Years Ended June 30, 2010 and 2011 and the Period from Inception to June 30, |

| 2011 |

| From Inception | |||||||||

| (October 11, | |||||||||

| 2005) | |||||||||

| June 30, | June 30, | June 30, 2011 | |||||||

| 2010 | 2011 | ||||||||

| Revenue | $ | - | $ | - | $ | - | |||

| Expenses | |||||||||

| General and administrative | 30,434 | 12,290 | 204,201 | ||||||

| Foreign exchange losses | 1,403 | 674 | (3,194 | ) | |||||

| Interest | - | - | (1,147 | ) | |||||

| Total expenses | 31,837 | 12,964 | 199,860 | ||||||

| Net loss | (31,837 | ) | (12,964 | ) | (199,860 | ) | |||

| Other comprehensive income | |||||||||

| Cumulative foreign currency translation adjustment | 546 | 1,047 | 1,677 | ||||||

| Comprehensive loss | (32,383 | ) | (11,917 | ) | (198,183 | ) | |||

| Basic and diluted weighted average number of shares outstanding | 25,900,000 | 25,900,000 | |||||||

| Basic and diluted loss per share | $ | (0.00 | ) | $ | (0.00 | ) |

See accompanying notes to financial statements

F-5

| News of China Inc. |

| (A Development Stage Company) |

| Statement of Changes in Shareholders' Equity (Deficit) |

| From Inception (October 11, 2005) to June 30, 2011 |

| Deficit | ||||||||||||||||||

| Accumulated | accumulated | |||||||||||||||||

| Additional | other | during | Total | |||||||||||||||

| Common stock | paid-In | comprehensive | development | shareholders' | ||||||||||||||

| Shares | Amount | capital | income | stage | deficit | |||||||||||||

| Balance - October 11, 2005 (date of inception) | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||

| Issuance of common shares | 13,900,000 | 1,390 | 104,895 | - | - | 106,285 | ||||||||||||

| Net loss from inception (October 11, 2005) to June 30, 2006 | - | - | - | - | (10,414 | ) | (10,414 | ) | ||||||||||

| Balance - June 30, 2006 | 13,900,000 | 1,390 | 104,895 | - | (10,414 | ) | 95,871 | |||||||||||

| Issuance of common shares | 2,000,000 | 200 | 19,800 | - | - | 20,000 | ||||||||||||

| Net loss for the year ended June 30, 2007 | - | - | - | - | (57,345 | ) | (57,345 | ) | ||||||||||

| Balance - June 30, 2007 | 15,900,000 | 1,590 | 124,695 | - | (67,759 | ) | 58,526 | |||||||||||

| Foreign currency translation adjustment | - | - | - | (732 | ) | - | (732 | ) | ||||||||||

| Net loss for the year ended June 30, 2008 | - | - | - | - | (54,565 | ) | (54,565 | ) | ||||||||||

| Balance - June 30, 2008 | 15,900,000 | 1,590 | 124,695 | (732 | ) | (122,324 | ) | 3,229 | ||||||||||

| Issue of common shares | 10,000,000 | 1,000 | 49,000 | - | - | 50,000 | ||||||||||||

| Foreign currency translation adjustment | - | - | - | 816 | - | 816 | ||||||||||||

| Net loss for the year ended June 30, 2009 | - | - | - | - | (32,735 | ) | (32,735 | ) | ||||||||||

| Balance – June 30, 2009 | 25,900,000 | 2,590 | 173,695 | 84 | (155,059 | ) | 21,310 | |||||||||||

| Foreign currency translation adjustment | - | - | - | 546 | - | 546 | ||||||||||||

| Net loss for the year ended June 30, 2010 | - | - | - | - | (31,837 | ) | (31,837 | ) | ||||||||||

| Balance – June 30, 2010 | 25,900,000 | 2,590 | 173,695 | 630 | (186,896 | ) | (9,981 | ) | ||||||||||

| Foreign currency translation adjustment | - | - | - | 1,047 | - | 1,047 | ||||||||||||

| Net loss for the year ended June 30, 2011 | - | - | - | - | (12,964 | ) | (12,964 | ) | ||||||||||

| Balance – June 30, 2011 | 25,900,000 | $ | 2,590 | $ | 173,695 | $ | 1,677 | $ | (199,860 | ) | $ | (21,898 | ) | |||||

See accompanying notes to financial statements.

F-6

| News of China Inc. |

| (A Development Stage Company) |

| Statements of Cash Flows |

| For the years ended June 30, 2010 and 2011 and the period from inception to June 30, 2011 |

| From Inception | |||||||||

| (October 11, 2005) | |||||||||

| Year Ended | Year Ended | to | |||||||

| June 30, 2010 | June 30, 2011 | June 30, 2011 | |||||||

| Operating Activities | |||||||||

| Net loss | $ | (31,837 | ) | $ | (12,964 | ) | $ | (199,860 | ) |

| Changes in non-cash operating elements of working capital | |||||||||

| Prepaid expenses | (250 | ) | 250 | - | |||||

| Accrued liabilities | 1,477 | (3,620 | ) | 5,878 | |||||

| Cash used in Operating Activities | (30,610 | ) | (16,334 | ) | (193,982 | ) | |||

| Financing Activities | |||||||||

| Proceeds from shareholder loan | 628 | 699 | 30,033 | ||||||

| Common stock issuance | - | - | 176,285 | ||||||

| Cash provided by Financing Activities | 628 | 699 | 206,318 | ||||||

| Foreign currency translation adjustment | 546 | 1,047 | 1,677 | ||||||

| Increase (decrease) in cash | (29,436 | ) | (14,588 | ) | 14,013 | ||||

| Cash - beginning of period | 58,037 | 28,601 | - | ||||||

| Cash - end of period | $ | 28,601 | $ | 14,013 | $ | 14,013 | |||

| Supplemental cash flow information: | |||||||||

| Interest paid | $ | - | $ | - | - | ||||

| Income taxes paid | - | - | - |

See accompanying notes to financial statements.

F-7

| News of China Inc. |

| (A Development Stage Company) |

| Notes to Financial Statements |

| 1. |

History and Organization of the Company |

|

The Company was incorporated in the State of Delaware on October 11, 2005 and is based in Montréal, Québec, Canada. Its principal business is the development of a financial website focused on researching companies whose main operations are in China and are listed on American and Canadian stock exchanges. | |

|

The Company is a development stage enterprise and its main activities to date have been developing a market for its services. | |

| 2. |

Summary of significant accounting policies |

|

Basis of presentation | |

|

The Company prepares its financial statements in accordance with accounting principles generally accepted in the United States. This basis of accounting involves the application of accrual accounting and consequently, revenues and gains are recognized when earned, and expenses and losses are recognized when incurred. The financial statements are expressed in U.S. dollars. | |

|

Use of estimates | |

|

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. | |

|

Foreign currency translation | |

|

The Company's functional currency for its operations is the Canadian dollar. However, the Company's reporting currency is the U.S. dollar. Therefore, the financial statements for all periods presented have been translated into the U.S. dollar using the current rate method. Under this method, the income statement and the cash flows for each period have been translated into U.S. dollars using the rates in effect at the date of the transactions, and assets and liabilities have been translated using the exchange rate at the end of the period. All resulting exchange differences are reported in the cumulative translation adjustment account as a separate component of shareholders’ deficit. | |

|

Cash and cash equivalents | |

|

The Company includes in cash and cash equivalents all short-term, highly liquid investments that mature within three months of their acquisition date. Cash equivalents consist principally of investments in interest-bearing demand deposit accounts and liquidity funds with financial institutions and are stated at cost, which approximates fair value. | |

|

Loss per share | |

|

Basic earnings per share (“EPS”) is computed by dividing net income available to common stockholders by the weighted average number of common shares outstanding during the period, excluding the effects of any potentially dilutive securities. Diluted EPS gives effect to all dilutive potential of shares of common stock outstanding during the period including stock options or warrants, using the treasury stock method (by using the average stock price for the period to determine the number of shares assumed to be purchased from the exercise of stock options or warrants), and convertible debt or convertible preferred stock, using the if-converted method. EPS excludes all potential dilutive shares of common stock if their effect is anti-dilutive. There were no dilutive securities at June 30, 2011 or 2010. |

F-8

| News of China Inc. |

| (A Development Stage Company) |

| Notes to Financial Statements |

|

Income taxes | |

|

Deferred tax assets and liabilities are recognized for future tax consequences attributable to differences between financial statement carrying amounts of existing assets and liabilities and their respective tax bases. In addition, the Company recognizes future tax benefits, such as carryforwards, to the extent that realization of such benefits is more likely than not and that a valuation allowance is provided when it is more likely than not that some portion of the deferred tax asset will not be realized. There was a change of ownership incurred on June 12, 2011 and the Company’s net operating losses carryforwards are subject to Section 382 limitation. | |

|

Recently issued accounting pronouncements | |

|

The Company does not expect that any recently issued accounting pronouncement will have a significant impact on the results of operations, financial position, or cash flows of the Company. | |

|

Subsequent events | |

|

Management has performed an evaluation of the Company’s activities through the date and time these financial statements were issued and concluded that there are no additional significant events requiring recognition or disclosure. | |

| 3. |

Going concern |

|

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. The Company has not generated any revenue and has never paid any dividends. The Company is unlikely to pay dividends or generate significant earnings in the immediate or foreseeable future. The continuation of the Company as a going concern and the ability of the Company to emerge from the development stage is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and ability to generate sustainable significant revenue. There is no guarantee that the Company will be able to raise any equity financing or generate profitable operations. As at June 30, 2011, the Company has accumulated losses of $199,860 since inception. These factors raise substantial doubt regarding the Company's ability to continue as a going concern. Should the Company be unable to continue as going concern, it may be unable to realize the carrying value of its assets and to meet its liabilities as they become due. We are currently looking for additional funding through equity financing. | |

| 4. |

Related party transactions |

|

The related party transactions have been measured at the exchange amount which is the amount of the consideration established and agreed to by the related parties. | |

|

The Company borrows money from one of the Company’s shareholders from time to time. These advances are due on demand and are non-interest bearing. As of June 30, 2011 and 2010, the Company has payable to this shareholder in the amount of $30,033, and $29,334, respectively. | |

|

Included in general and administrative are approximately $500 and $200 paid to a shareholder for accounting services rendered for the Company for the years ended June 30, 2011 and 2010, respectively. |

F-9

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

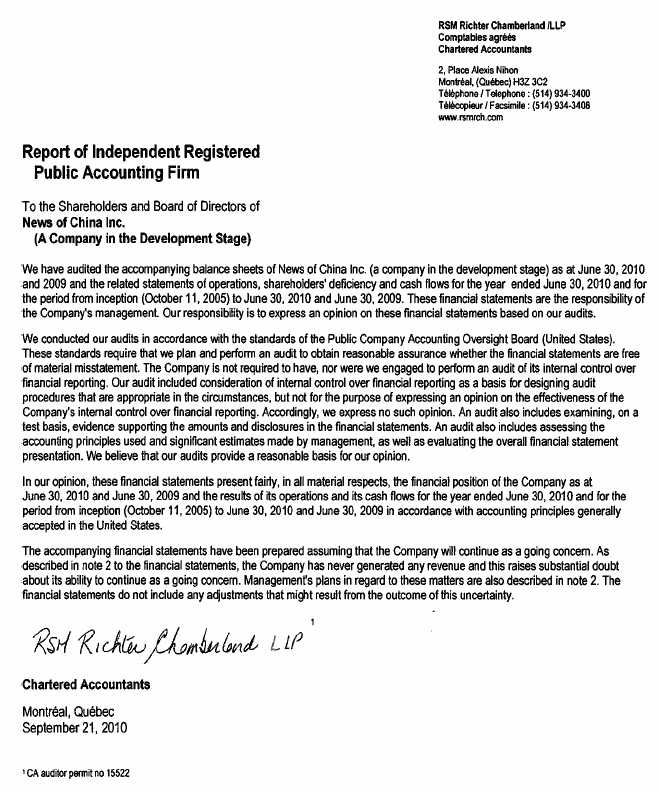

(a) On July 15, 2011, the board of directors of News of China Inc. dismissed RSM Richter Chamberland LLP (“RSM Richter”), as our principal independent accountant. On July 26, 2011, we engaged GBH CPAs, PC as our principal independent accountant.

RSM Richter’s report on our financial statements for each of the two fiscal years ended June 30, 2009 and June 30, 2010 did not contain an adverse opinion or disclaimer of opinion, or qualification or modification as to uncertainty, audit scope, or accounting principles, except that such report on our financial statements contained an explanatory paragraph in respect to the substantial doubt about its ability to continue as a going concern.

During our fiscal years ended June 30, 2009 and June 30, 2010 and in the subsequent interim period through the date of dismissal, there were no disagreements, resolved or not, with RSM Richter on any matter of accounting principles or practices, financial statement disclosure, or audit scope and procedures, which disagreement(s), if not resolved to the satisfaction of RSM Richter, would have caused RSM Richter to make reference to the subject matter of the disagreement(s) in connection with its report.

During our fiscal years ended June 30, 2009 and June 30, 2010 and in the subsequent interim period through the date of dismissal, there were no reportable events as described in Item 304(a)(1)(v) of Regulation S-K.

We provided RSM Richter with a copy of our Current Report on Form 8-K prior to its filing with the Securities and Exchange Commission, and requested that they furnish us with a letter addressed to the Securities and Exchange Commission stating whether they agree with the statements made in this Current Report on Form 8-K, and if not, stating the respects with which he does not agree. A copy of the letter provided by RSM Richter is attached as an exhibit to our Current Report on Form 8-K filed on October 12, 2011.

(b) During our fiscal years ended June 30, 2009 and June 30, 2010 and in the subsequent interim period through the date of appointment of GBH on July 26, 2011, we have not consulted with GBH regarding either the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on its financial statements, nor has GBH provided to our company a written report or oral advice that GBH concluded was an important factor considered by us in reaching a decision as to the accounting, auditing or financial reporting issue. In addition, during such periods, we have not consulted with GBH regarding any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) and the related instructions) or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

ITEM 9A(T). CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

We maintain “disclosure controls and procedures”, as that term is defined in Rule 13a-15(e), promulgated by the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and principal accounting officer to allow timely decisions regarding required disclosure.

As required by paragraph (b) of Rules 13a-15 under the Securities Exchange Act of 1934, our management, with the participation of our principal executive officer and principal financial officer, evaluated our company’s disclosure controls and procedures as of the end of the period covered by this annual report on Form 10-K. Based on this evaluation, our management concluded that as of the end of the period covered by this annual report on Form 10-K, our disclosure controls and procedures were not effective due to the material weaknesses described in Management's Report on Internal Control over Financial Reporting below.

14

Management's annual report on internal control over financial reporting

Our management, including our principal executive officer, principal financial officer and our Board of Directors, is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934).

Our management, with the participation of our principal executive officer and principal financial officer, evaluated the effectiveness of our internal control over financial reporting as of June 30, 2011. Our management’s evaluation of our internal control over financial reporting was based on the framework in Internal Control—Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, our management concluded that our internal control over financial reporting was not effective as of June 30, 2011 due to the material weaknesses described below.

(a) The Company has inadequate segregation of duties consistent with control objectives.

(b) The Company has insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of GAAP and SEC disclosure requirements.

A material weakness is a deficiency or a combination of control deficiencies in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

Limitations on Effectiveness of Controls

Our principal executive officer and principal financial officer do not expect that our disclosure controls or our internal control over financial reporting will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additional controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the controls. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, controls may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Changes in internal control over financial reporting

There were no changes in our internal control over financial reporting during the year ended June 30, 2011 that have materially affected, or are reasonably likely to materially affect our internal control over financial reporting.

Certifications

Certifications with respect to disclosure controls and procedures and internal control over financial reporting under Rules 13a-14(a) or 15d-14(a) of the Exchange Act are attached to this annual report on Form 10-K.

ITEM 9B. OTHER INFORMATION

None.

15

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors and Executive Officers, Promoters and Control Persons

As at October 13, 2011, our directors and executive officers, their age, positions held, and duration of such, are as follows:

Name |

Position Held with our Company |

Age |

Date First Elected or

Appointed |

| Hong Ba |

Chief Executive Officer

Director |

44 |

August 1, 2011 September 1, 2011 |

| Chenxi Shi | Chief Financial Officer and Director | 44 | October 2005 |

| Junjun Wu | Director | 40 | September 1, 2011 |

Certain Significant Employees

We do not have other significant employees.

Business Experience

The following is a brief account of the education and business experience of directors and executive officers during the past five years, indicating their principal occupation during the period, and the name and principal business of the organization by which they were employed.

Hong Ba

Mrs. Ba joined our company in August 2011 as Chief Executive Officer and was appointed as a Director on September 1, 2011. Mrs. Ba was born in 1966. She graduated from Taiyuan University Software in 1988. She had worked in China Eastern Airline from 1988. She has over 20 years of work experience in aviation marketing. Mrs. Ba has been working for Shanxi Jinyan Aviation Business Inc. as the president and a director from 2008. Mrs. Ba provides her services on a full time basis to our company.

We believe Mrs. Ba is qualified to serve on our board of directors because of her extensive business experience and network of business associates in China which will assist our company to seek and identify future opportunities.

Chenxi Shi

Mr. Shi is our founding director and has served on the Board of the Directors since the founding of our company in October 11, 2005 (Date of Inception). He has over 10 years of work experience in computer technology and business management. Mr. Shi has held various technical and managerial positions from entry level to the corporate senior. Mr. Shi has worked in Northern Jiaotong University, Beijing Jiada Technologies Company, Legend Computer Group Co. (Lenovo) and Investors Group of Canada. Mr. Shi received his Bachelor of Science degree in computer sciences from Northern Jiaotong University and his Master of Business Administration degree from Peking University. Mr. Shi provides his services on a full time basis to our company.

We believe Mr. Shi is qualified to serve on our board of directors because of his knowledge of our company’s history and current operations, which he gained from working for our company as described above, in addition to his business experiences as described above.

16

Junjun Wu

Mr. Wu was born in 1970. He graduated from Wanbailin High School in 1990. He started to do business from 1990 such as garage, scrap steel recycling, decoration materials, storage and logistics, trade, etc. Mr. Wu is the founder of Shanxi Baisheng Investment Ltd and has been serving as President and Director since founding the company in June, 2004 (Date of Inception). Shanxi Baisheng Investment Ltd is focused on investments in coal mining and real estate.