Attached files

| file | filename |

|---|---|

| EX-32.2 - SECTION 906 CERTIFICATION - GOLDEN GLOBAL CORP. | exhibit32-2.htm |

| EX-31.2 - SECTION 302 CERTIFICATION - GOLDEN GLOBAL CORP. | exhibit31-2.htm |

| EX-31.1 - SECTION 302 CERTIFICATION - GOLDEN GLOBAL CORP. | exhibit31-1.htm |

| EX-32.1 - SECTION 906 CERTIFICATION - GOLDEN GLOBAL CORP. | exhibit32-1.htm |

| EX-14.1 - CODE OF ETHICS - GOLDEN GLOBAL CORP. | exhibit14-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

For the fiscal year ended June 30, 2011

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 333- 169757

GOLDEN GLOBAL CORP.

(Exact

name of registrant as specified in its charter)

| Nevada | N/A |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 17412 105 Ave NW, Suite 201, Edmonton, Alberta | T5S 1G4 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant's telephone number, including area code: 780.443.4652 |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Name of Each Exchange On Which Registered |

| N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

N/A

(Title of class)

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 the Securities Act.

Yes [ ] No[x]

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or Section 15(d) of the Act

Yes

[ ] No[x]

Indicate by check mark whether the registrant: (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports) and (2) has been subject to such

filing requirements for the last 90 days.

Yes[x] No[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-K (§229.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant's

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form

10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company[x] |

Yes [ ] No[x]

State the aggregate market value of voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of Common Stock held by non-affiliates of the Registrant on December 31, 2010 was $nil based on a $nil closing price for the Common Stock on December 31, 2010. For purposes of this computation, all executive officers and directors have been deemed to be affiliates. Such determination should not be deemed to be an admission that such executive officers and directors are, in fact, affiliates of the Registrant.

Indicate the number of shares outstanding of each of the

registrant’s classes of common stock as of the latest practicable

date.

33,947,417 shares of common stock issued & outstanding as of

October 13, 2011

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

TABLE OF CONTENTS

3

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States Dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our company”, mean Golden Global Corp. a Nevada corporation, and our wholly-owned subsidiary, Golden Global Mining Corporation, an Alberta company, unless otherwise indicated.

Corporate History

We were incorporated on December 9, 2009 under the laws of the State of Nevada. We have a wholly-owned subsidiary, Golden Global Mining Corporation, incorporated under the laws of the Province of Alberta. Our principal executive offices are located at Suite 201, 17412 105 Ave NW, Edmonton, Alberta, T5S 1G4. Our telephone number is 780.443.4652. Our website address is www.goldenglobal.ca.

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Our Current Business

We are a start up, exploration stage company. We have only recently begun operations and we rely upon the sale of our securities to fund those operations as we have not generated any revenue. We have a going concern uncertainty as of the date of our most recent financial statements. Our initial goal is to begin mining our placer gold claims on our “McDame” property located in north central British Columbia, Canada. The McDame property consists of placer claims #362586 and #363240, located near Cassiar, in the Liard Mining Division of British Columbia, Canada. Our long term aim is to explore and, if warranted, develop further mining operations on the two other properties which we own, the “Thibert Creek” placer gold property and “Dynasty” property located in north western British Columbia. Our McDame property is fully described in the section of this document entitled “Description of the Property”.

On December 12, 2009 we entered into an asset purchase and share exchange agreement with Velocity Resources Canada Ltd., an Alberta company whereby we acquired mining equipment as well as the Thibert Creek and Dynasty properties in exchange for 18,000,000 shares of our common stock which were issued to 46 shareholders of Velocity Resources Canada Ltd. John Hope, our President, Chief Executive Officer and Director is also the President, controlling shareholder and a Director of Velocity Resources Canada Ltd. John Hope received 5,423,333 shares of our common stock in the transaction. Hon Ming Tony Wong, our Chief Financial Officer, Principal Accounting Officer, Secretary, Treasurer and Director who is also a shareholder of Velocity Resources Canada Ltd., received 3,905,000 shares of our common stock. The Thibert Creek and Dynasty properties are not currently material to our operations. Although we hope to be able to explore and possibly to develop the Thibert Creek and Dynasty properties, we have not taken any steps to do so due to a lack of funding. Additionally, there can be no assurance that we will ever be able to undertake any exploration or development on these properties. In light of our limited funding, we have focused on our McDame property and will be undertaking exploration activities there. Unless we are able to raise substantially more funds, we will not be able to undertake work on the Thibert Creek and Dynasty properties. Accordingly, we have not carried out any initial, or detailed examination of the properties as would be required to estimate the costs of an exploration or development program. As a result, we do not consider the properties to be material to our business at this time. If the properties do become material to our operations at a future date, we will provide all required disclosure.

4

We have not undertaken any further exploration on the McDame property since we acquired it, but we do anticipate spending $45,000 on exploration activity in the following 12 months and require additional financing of $225,000 for the next 12 months of operations. We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any such financings on terms that will be acceptable to us. If we are unable to raise sufficient capital to carry out our business plan, we may be forced to cease operations and you may lose your entire investment.

Competition

The mineral exploration industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the mineral exploration companies with which we compete for financing and for the acquisition of mineral exploration properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests or explore and develop our current or future mineral exploration properties.

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their mineral exploration properties or the price of the investment opportunity. In addition, we compete with both junior and senior mineral exploration companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

General competitive conditions may be substantially affected by various forms of energy legislation and/or regulation introduced from time to time by the governments of the United States and other countries, as well as factors beyond our control, including international political conditions, overall levels of supply and demand for mineral exploration.

5

In the face of competition, we may not be successful in acquiring, exploring or developing profitable mineral properties or interests, and we cannot give any assurance that suitable oil and gas properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the mineral exploration industry by:

- keeping our costs low;

- relying on the strength of our management’s contacts; and

- using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

Market, Customers and Distribution Methods

Although there can be no assurance, large and well capitalized markets are readily available for all metals and precious metals throughout the world. A very sophisticated futures market for the pricing and delivery of future production also exists. The price for metals is affected by a number of global factors, including economic strength and resultant demand for metals for production, fluctuating supplies, mining activities and production by others in the industry, and new and or reduced uses for subject metals.

The mining industry is highly speculative and of a very high risk nature. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price of metal, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, the mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

Intellectual Property

We hold copyright in the contents of our website, www.goldenglobal.ca. However, certain materials licensed from third parties (such as photographs, for example) may appear on our website from time to time. We have not filed for any protection of our trademark, and we do not have any other intellectual property.

Government Regulation

The British Columbia Ministry of Energy and Mines governs the operations of all mines with in the province of British Columbia. The Federal Government has jurisdiction over the Province regarding Fisheries as well as environmental concerns.

There are significant differences in obtaining a permit for a Placer Mine, like the McDame property, verses a permit to Hard Rock Mine. The necessary permitting to Hard Rock Mine can take as long as three years for the operator to become fully permitted where as Placer Mining operations takes 30 to 90 days. The reason for this is the impact Hard Rock Mining can have on the environment and local communities verses Placer Mining. There is no dangerous chemicals or emission required or allowed to be used in Placer Mining and they are a much smaller operation that are usually seasonal compared to Hard Rock Mines that are permanent requiring a large infrastructure.

The first step to be taken in Placer Mining is to have legal possession of the land you are to mine. Then you must apply for a permit and that application is called “Notice of Work and Reclamation Program on a Placer Property”. This application is (presently) forwarded to the Regional Mines Inspector who advises the applicant of any deficiencies if any and advises of the amount of bonding required for reclamation. The bonding amount is usually based on the amount of surface area disturbed and varies from location to location. It is estimated from past experience that the bonding for the McDame project will be somewhere between $5,000.00 and $10,000.00. The bond is used to ensure that proper reclamation takes place and the bond will not be released until such time that is completed and approved by the Mines Inspector.

6

First Nations are also now involved in the approval of all mining permits and have never to date declined the approval of a Placer Mining permit. Once the Mines Inspector has approved the “Notice of Work and Reclamation Program on a Placer Property” he will authorize the issuance of a permit allowing the applicant to commence operation under the guidelines set forth. These guidelines include but may not be limited to a closed circuit water system for washing the material being processed and the plant and tailings ponds 100 meter distances from any streams or lakes. Tailings ponds to be constructed as set forth in the regulations and the mines site kept in a neat and orderly fashion allowing all equipment to work without endangering operations of one another. There must also be certified environment fuel storage tanks on site and limited fire-fighting equipment such as pick axes, shovels, water spray cans and a first aid attendant with a Level One First Aid Kit, stretcher and backboard available along with Satellite phone communication to local air ambulance and hospitals. The reclamation may be carried out as the mining progresses or at the end of the mining season being no later than November 1st of each year and in the event of abandonment before equipment is removed from property. The Mines Inspector inspects the mining operation once or twice during an operating year.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of October 13, 2011, we have one full-time employee, our President and CEO, John Hope. He currently contributes approximately 40 hours per week to us. We also have one part time employee, Mr. Wong, our director, Secretary, Treasurer Chief Financial Officer and Principal Accounting Officer, who contributes approximately 8 hours per week to company business.

We currently engage independent contractors in the areas of accounting and legal services. We plan to engage independent contractors in the areas of marketing, bookkeeping, investment banking and other services including at least 3 part time consultants who will each focus on sales and marketing, business development and investor relations.

Research and Development

We have not spent any amounts on which have been classified as research and development activities in our financial statements during the last two fiscal years.

Going Concern

We anticipate that additional funding will be required in the form of equity financing from the sale of our common stock. At this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or through a loan from our directors to meet our obligations over the next twelve months. We do not have any arrangements in place for any future equity financing.

7

Subsidiaries

We have one wholly-owned subsidiary, Golden Global Mining Corporation, an Alberta company.

REPORTS TO SECURITY HOLDERS

We are not required to deliver an annual report to our stockholders but will voluntarily send an annual report, together with our annual audited financial statements upon request. We are required to file annual, quarterly and current reports, proxy statements, and other information with the Securities and Exchange Commission. Our Securities and Exchange Commission filings are available to the public over the Internet at the SEC's website at http://www.sec.gov.

The public may read and copy any materials filed by us with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. We are an electronic filer. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The Internet address of the site is http://www.sec.gov.

Item 1A. Risk Factors

Much of the information included in this annual report includes or is based upon estimates, projections or other “forward looking statements”. Such forward looking statements include any projections and estimates made by us and our management in connection with our business operations. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein.

Such estimates, projections or other “forward looking statements” involve various risks and uncertainties as outlined below. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other “forward looking statements”.

Risks Related to Our Business

We do not expect positive cash flow from operations in the near term. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business.

We do not expect positive cash flow from operations in the near term. There is no assurance that actual cash requirements will not exceed our estimates. In particular, additional capital may be required in the event that:

-

drilling, exploration and completion costs for our McDame project increase beyond our expectations; or

-

we encounter greater costs associated with general and administrative expenses or offering costs.

The occurrence of any of the aforementioned events could adversely affect our ability to meet our business plans.

We will depend almost exclusively on outside capital to pay for the continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. We can provide no assurances that any financing will be successfully completed.

Capital may not continue to be available if necessary to meet these continuing development costs or, if the capital is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us would result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

8

If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be unable to continue our business and as a result may be required to scale back or cease operations for our business, the result of which would be that our stockholders would lose some or all of their investment.

We have a limited operating history and if we are not successful in continuing to grow our business, then we may have to scale back or even cease our ongoing business operations.

We have no history of revenues from operations and limited tangible assets. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and must be considered in the development stage. The success of our company is significantly dependent on a successful acquisition, drilling, completion and production program. Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted, developing commercial reserves of gold and silver. Our properties are in the exploration stage only and are without known reserves of gold and silver. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of gold, silver or other minerals, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

As our properties are in the exploration and development stage there can be no assurance that we will establish commercial discoveries on our properties.

Exploration for mineral reserves is subject to a number of risk factors. Few properties that are explored are ultimately developed into producing mines. Our properties are in the exploration and development stage only and are without proven reserves. We may not establish commercial discoveries on any of our properties.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration programs do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

9

Because of the speculative nature of exploration of mineral properties, there is no assurance that our exploration activities will result in the discovery of new commercially exploitable quantities of minerals.

We plan to continue exploration on our mineral properties. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on our properties will establish that additional commercially exploitable reserves of precious metals on our properties. Problems such as unusual or unexpected geological formations or other variable conditions are involved in exploration and often result in exploration efforts being unsuccessful. The additional potential problems include, but are not limited to, unanticipated problems relating to exploration and attendant additional costs and expenses that may exceed current estimates. These risks may result in us being unable to establish the presence of additional commercial quantities of ore on our mineral claims with the result that our ability to fund future exploration activities may be impeded.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

If our exploration costs are higher than anticipated, then our profitability will be adversely affected.

We are currently proceeding with exploration of our mineral properties on the basis of estimated exploration costs. If our exploration costs are greater than anticipated, then we will not be able to carry out all the exploration of the properties that we intend to carry out. Factors that could cause exploration costs to increase are: adverse weather conditions, difficult terrain and shortages of qualified personnel.

As we face intense competition in the mining industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

The mining industry is intensely competitive in all of its phases. Competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional attractive mining claims or financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration and development programs may be slowed down or suspended.

As we undertake exploration of our mineral claim, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several Federal and Provincial governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the Province of British Columbia as we carry out our exploration programs. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

10

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in Canada or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

Our By-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our By-laws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares for significant amount of services or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of 75,000,000 shares of common stock with a par value of $0.0001. In the event that we are required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we issue any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other shareholders. Further, any such issuance may result in a change in our control.

Our directors and officers are residents of countries other than the United States and investors may have difficulty enforcing any judgments against such persons within the United States.

Our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof

Mr. Wong, our CFO, Secretary, Treasurer and director, has other time commitments that will prevent him from devoting full-time to our operations, which may affect our operations.

Because Mr. Wong, who is responsible for some of our business activities, does not devote his full working time to operation and management of us, the implementation of our business plans may be impeded. Mr. Wong has other obligations and time commitments, which may slow our operations and impact our financial results. Additionally, when Mr. Wong becomes unable to handle the daily operations on his own, we may not be able to hire additional qualified personnel to replace him in a timely manner. If this event should occur, we may not be able to implement our business plan in a timely manner or at all.

11

Risks Related to the Ownership of Our Stock

Because there is no public trading market for our common stock, you may not be able to resell your shares.

There is currently no public trading market for our common stock. Therefore, there is no central place, such as stock exchange or electronic trading system, to resell your shares. If you do wish to resell your shares, you will have to locate a buyer and negotiate your own sale. As a result, you may be unable to sell your shares, or you may be forced to sell them at a loss.

We cannot assure you that there will be a market in the future for our common stock. The trading of securities on the OTC Bulletin Board is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price of our common stock. You may not be able to sell your shares at their purchase price or at any price at all. Accordingly, you may have difficulty reselling any shares you purchase from the selling security holders.

The continued sale of our equity securities will dilute the ownership percentage of our existing stockholders and may decrease the market price for our common stock.

Given our lack of revenues and the doubtful prospect that we will earn significant revenues in the next several years, we will require additional financing of $225,000 for the next 12 months, which will require us to issue additional equity securities. We expect to continue our efforts to acquire financing to fund our planned development and expansion activities, which will result in dilution to our existing stockholders. In short, our continued need to sell equity will result in reduced percentage ownership interests for all of our investors, which may decrease the market price for our common stock.

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934 (the “Exchange Act”) which imposes additional sales practice requirements on brokers-dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement prior from you to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

Financial Industry Regulatory Authority (FINRA) sales practice requirements may limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

12

Our security holders may face significant restrictions on the resale of our securities due to state “blue sky” laws.

Each state has its own securities laws, often called “blue sky” laws, which (i) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (ii) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or the transaction must be exempt from registration. The applicable broker must be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as the market-makers for our common stock. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

Our compliance with the Sarbanes-Oxley Act and SEC rules concerning internal controls will be time-consuming, difficult, and costly.

It will be time-consuming, difficult and costly for us to develop and implement the internal controls, processes and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional personnel to do so, and if we are unable to comply with the requirements of the legislation we may not be able to obtain the independent accountant certifications that the Sarbanes-Oxley Act requires publicly traded companies to obtain.

Under Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we will be required to furnish a report by our management on our internal control over financial reporting beginning with our Annual Report on Form 10-K for our fiscal year ending June 30, 2011. We will soon begin the process of documenting and testing our internal control procedures in order to satisfy these requirements, which is likely to result in increased general and administrative expenses and may shift management’s time and attention from revenue-generating activities to compliance activities. While we expect to expend significant resources to complete this important project, we may not be able to achieve our objective on a timely basis.

Other Risks

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. Properties

Our principal executive offices are located at Suite 201, 17412-105 Ave. NW, Edmonton, Alberta, Canada, T5S 1G4 and we pay rent of approximately $1,000 per month for the use of this space. Our telephone number is 780-443-4652 and our internet site is located at www.golden-resources.ca.

13

McDame Property

Location and Access

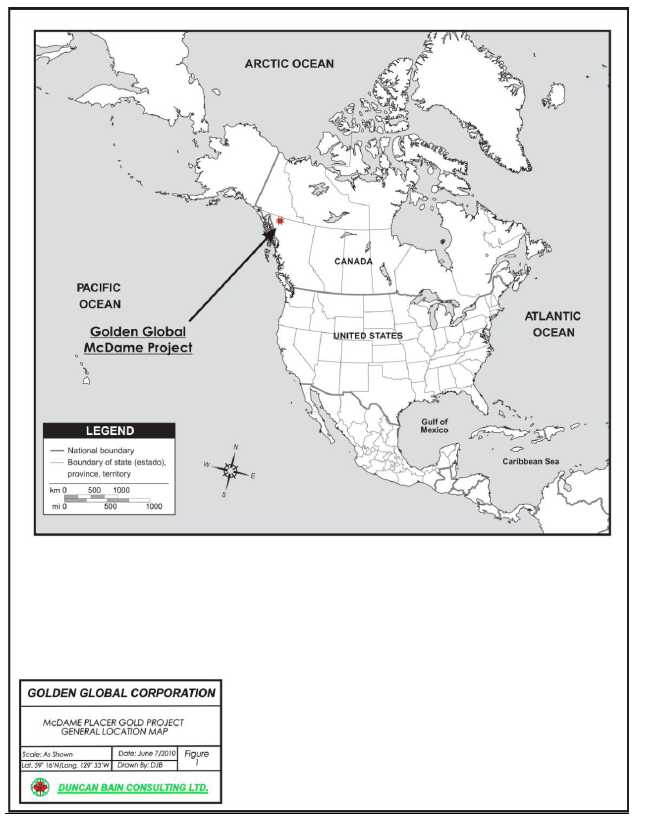

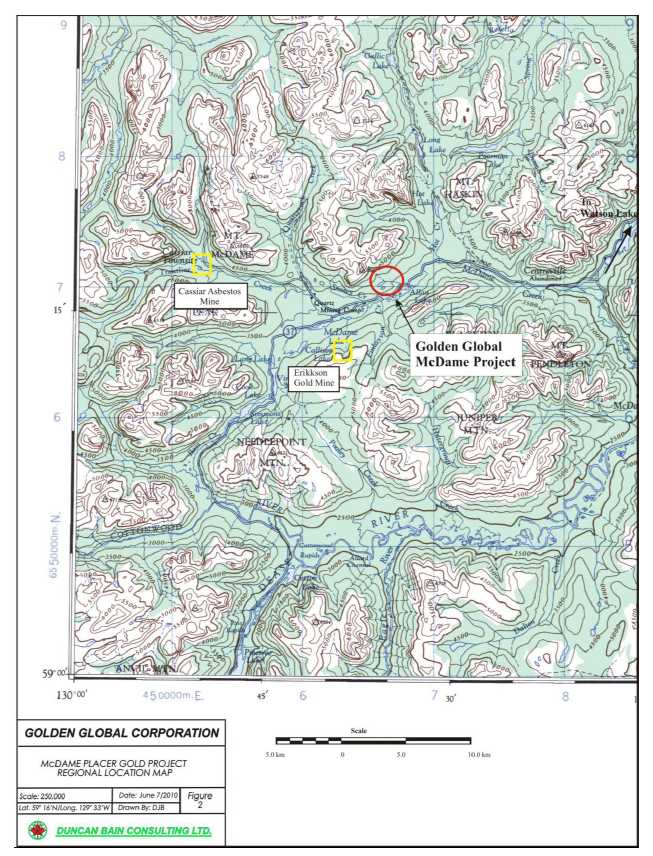

The McDame property is located 120 kilometers north-northeast of the town of Dease Lake, in the north-central part of British Columbia, Canada and 140 kilometers SSW of the town of Watson Lake, Yukon. It is situated on NTS map sheets 104P/05 (B.C. claim map 104 P, 023), at Latitude 59 degrees 16’ 34”N, Longitude 129 degrees 33’ 40”W, and is centered at UTM coordinates 657000 m N and 465000 m E, using the NAD27, Zone 9 datum point. The property consists of two Placer leases and two Placer claims which cover a total area of approximately 182.7 hectares.

Access to the McDame Property is by a paved all-weather road, British Columbia Highway 37 (Stewart-Cassiar Highway) from Watson Lake, Yukon, a distance of 140 kilometers and approximately a 2 hour drive in good weather. Chartered flights can be made into the Cassiar airstrip located at coordinates 453738 E, 6571429 N. Commercial air service is available to Dease Lake and Watson Lake.

The McDame property occupies part of an upland plateau ranging between 800-1300 meters above sea level. Rising above this from 1600 to 2600 meters are the peaks and ridges of the Cassiar mountain range. Within the plateau is the drainage basin of the Dease River. McDame Creek is a major component of this system and flows in a general west to east direction.

The climate is characterized by short, warm summers and long, cold winters. The mining season is anticipated to last between May 1 and September 30, depending on weather conditions.

The property has ample water throughout the summer. Electrical power if required can be accessed from Highway 37 or may be negotiated from the local operating mines. There are only small villages along Highway 37 where some food and accommodation can be found.

14

15

16

Ownership Interest

On May 16, 2010 we purchased placer claims #362586 and #363240, located near Cassiar, in the Liard Mining Division of British Columbia, Canada for a total purchase price of $20,010 (Canadian). The purchase price consisted of an initial $10,000 (Canadian) payment in cash and 167,000 shares of our common stock at a value of $0.03 (Canadian) and a subsequent payment of $5,000 (Canadian) to be paid by November 20, 2010, which we paid via a stock issuance on September 27, 2010. The claims we purchased give us the right to explore, mine and produce all minerals lying on the surface of the property. We are also required to pay annual fees to the province of British Columbia of approximately $600 per year per claim.

After the acquisition of placer claims #362586 and #363240, our President and CEO, John Hope registered two additional placer leases: #776902 and #776862 in the name of our company. All four claims are physically connected. All claims are now owned directly by us.

The total amount of land covered by the claims and leases we own is approximately 182.7 hectares. The table below presents the details of the McDame concessions.

| Certificate Number | Area (Hectares) | Staking Date | Expiration Date |

| 363240 | 50 | June 7, 1998 | June 30, 2011 |

| 362586 | 50 | May 14, 1998 | June 30, 2011 |

| 776902 | 66.16 | May 20, 2010 | May 20, 2011 |

| 776862 | 16.54 | May 20, 2010 | May 20, 2011 |

History of Previous Operations*

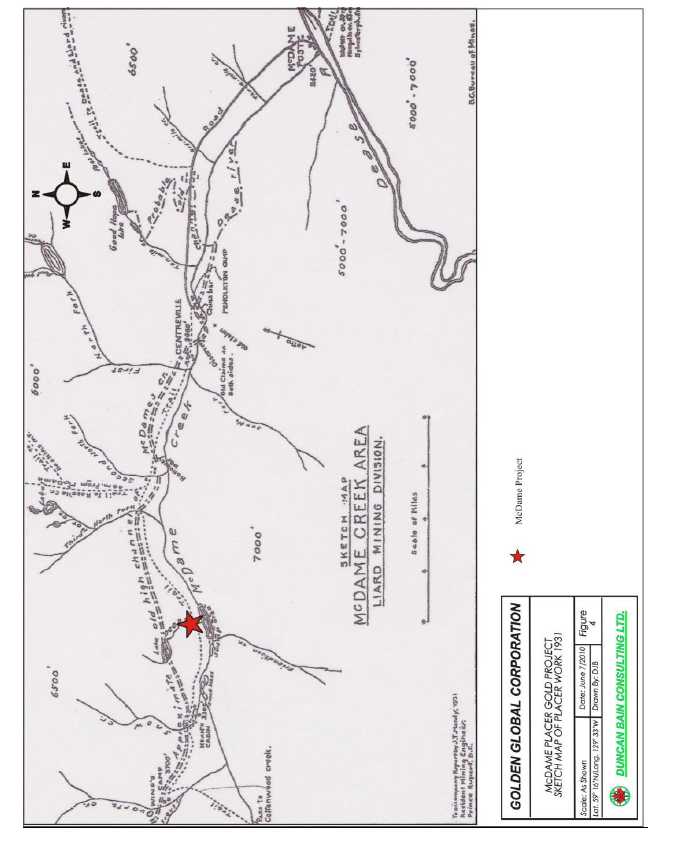

Placer gold was first discovered in McDame Creek in 1874, as part of the Cariboo gold rush farther south. The mining was undertaken by individual operators using primitive shoveling and washing techniques, with some limited drifting into the upper bench of stratified sand and gravel.

Most of the historical gold was recovered from the lower bench on the north side of McDame Creek. The richest ground was the low ground of a series of tributary creeks which covered a stretch of ground from Quartz Creek downstream for 20 kilometers to the old town of Centreville. However, on the Second North Fork (approximately 9 kilometers downstream from our McDame property claims), a tunnel was driven for 160 meters into the old upper channel. Small dredging operations were carried out on McDame Creek around Centreville in the 1920’s, with some success. A small amount of hydraulic mining (cutting and washing of stratified sand and gravel using high pressure water lines) was carried out up-stream at Quartz Creek.

In the early 1930s there was still a large area of untested ground in the creek bed where it cuts across the old channel above old workings. The ground was wet and was considered to need drainage prior to being tested. Since the 1930s only intermittent placer mining operations have been carried out in these creeks.

*The historical information contained in this section of the Prospectus may be found in Bulletin 28 Placer Gold Production of British Columbia by Stuart S. Hall. Galloway J.D., 1932 Annual Report of Mines of the Province of British Columbia, for the year ending 31st December 1931.

17

18

Present Condition of the Property and Current State of Exploration

In the summer of 2009 a test program was undertaken by the property’s previous owner on the McDame area. An area of approximately 90 m long X 6.5 m wide X 3 m deep was mined. This area lies 400 m north of Hwy. 37, in a gorge with a small stream (Deepe Creek) and some old placer workings in it.

We have not undertaken any further exploration on the property since we acquired it, but we do anticipate spending $45,000 on exploration activity in the following 12 months.

We have recently moved a processing plant, water pump, excavator, wheel loader and a fuel truck onto the McDame property in anticipation of further development and exploration on the property. The property also has a tailings pond area that was used by previous owners and we plan to expand to accommodate our operations.

Geology

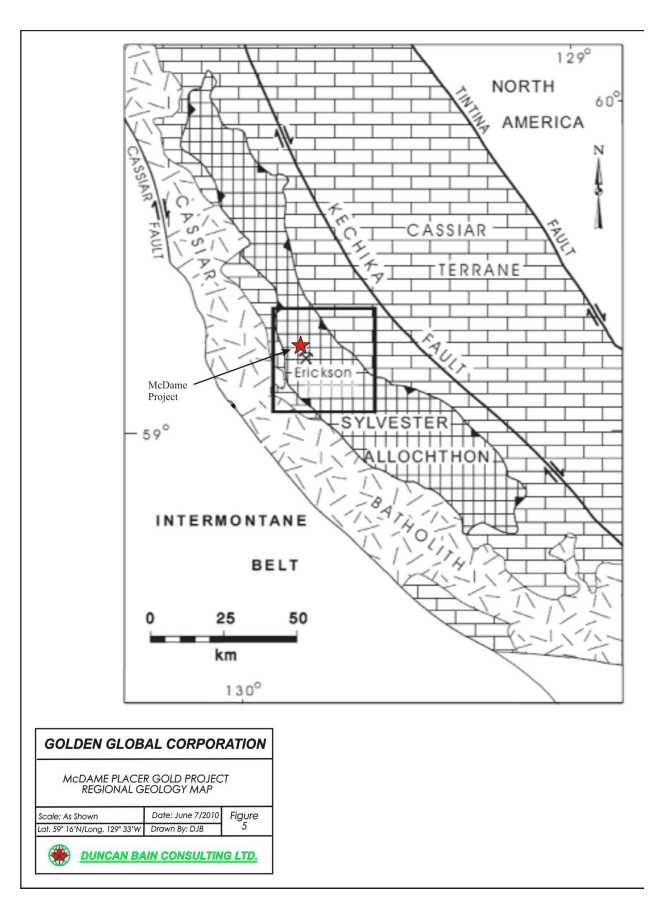

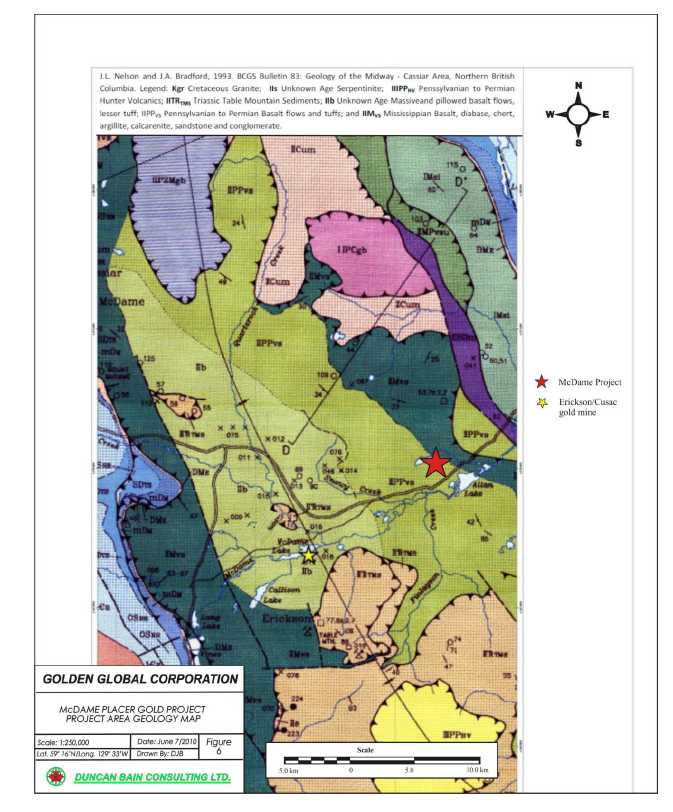

The McDame Project is underlain by rocks of the Sylvester allochthon, an accreted late Paleozoic to early Mesozoic oceanic terrane. It is comprised of volcanic, sedimentary, and ultramafic rocks of the Mississippian to Triassic Sylvester Group (see diagram below). The allochthon was emplaced onto autochthonous rocks of the North American miogeocline after the Triassic and prior to the mid-Cretaceous; later it was intruded by mid- to Late Cretaceous quartz monzonite of the Cassiar Complex. Gold quartz vein mineralization occurred in the Early Cretaceous.

19

20

No detailed mapping has been carried out on the McDame Project. However, a compilation report by Nelson and Bradford (see diagram below) indicates that this site is in close proximity to the contact between Pennsylvanian to Permian basalt flows and tuffs and Mississippian unit containing basalt, diabase, chert, argillite, calcarenite, sandstone and conglomerate.

The McDame Creek valley is a broad drift-covered trough with a gentle northeast slope. Outcrops are scarce in the valley. Riverbanks are composed of stratified river sands and gravels of Pleistocene and post-glacial origin. Remnants of high terraces occur on both banks. At least three distinct bench flats are observed. These benches occur at 2880 ft, 3130 ft and 3400 ft. Most of the gold was recovered from the lowest bench. The stratified gravels consist of greenstone, serpentinite and granitic rock types. They range from 30 to 60 cm in diameter, particularly immediately above the bedrock, and are interstratified with layers of sand.

In the Quartz Creek area (upstream from the property) unstratified glacial debris 5 to 6 m thick overlies a layer of stratified gravel from 2.5 to 4 m thick which itself lies on bedrock. Above these two layers can be seen a 2 m thick unit of stratified interglacial gravel, on top of which lies Recent alluvium. The third (highest) bench can be traced along the north side of McDame Creek. Old channels of McDame Creek, represented by these three benches, occupied a higher elevation than the current stream.

21

22

Plan of Exploration

We have conducted initial exploration investigation during the summer and fall of 2011. We intend to conduct initial exploration on the McDame property by the spring/summer of 2012 as weather conditions allow. Exploration will continue on the McDame property in 2012. We have allocated $45,000 as a budget for this program, which will involve test holes to advance and better define the reserves and grade of the property. This program is a one phase program consisting of an excavator, bulldozer testing plant, geologist, two equipment operators and one labourer for one month. The anticipated program costs are broken down as follows:

| Operations | Cost ($) |

| 2 equipment operators | 10,000 |

| 1 general laborer | 3,500 |

| 1 Geologist | 15,000 |

| Rental fee for a bulldozer | 10,000 |

| Fuel and miscellaneous | 6,500 |

| Total | 45,000 |

We own a testing plant and excavator which are already on the property, so we will not incur additional costs for these items. This is the projected plan recommended by the Directors and Officers of the Company based on cost estimates prepared by John Hope, our President, CEO and Director. The estimates were prepared based on prevailing labor and equipment costs and exploration standards in the Canadian mining industry. The estimates are based on Mr. Hope’s personal analysis and not on third party statistics or evidence. Mr. Hope will be supervising the testing program. We anticipate that we will engage Mr. Duncan J. Bain, Ph. D. P. Geo. a graduate of the University of Western Ontario in London, Canada to guide our exploration and development activities as Mr. Bain has been involved in drafting a report on this property for us. Mr. Bain received a Bachelor of Science degree in Geology in 1977 and received a Ph. D. in Geology from the University of Western Ontario in 2010. Mr. Bain is also a Fellow of the Geological Association of Canada, a member of the Prospectors and Developers Association of Canada for more than 20 years, and has practiced continuously as an exploration, development and mine Geologist since graduating in 1977.

Glossary of Technical Terms

| Term | Definition |

| Allochton |

A rock mass formed somewhere other than its present location, which was transported by fault movements, large-scale gravity sliding, or similar processes |

| Alluvium |

sediment deposited by flowing water, especially soil formed in river valleys and deltas from material washed down by the river |

| Argillite |

rock that is made up of clay or silt particles, especially a hardened mudstone |

23

| Term | Definition |

| Autochthonous |

describes a rock, mineral deposit, or geologic feature that was formed in the area where it is found |

| Basalt |

a dark-green or black rock formed when hot liquid rock from a volcano becomes solid |

| Calcarenite |

a rock formed by the percolation of water through a mixture of calcareous shell fragments and quartz sand causing the dissolved lime to cement the mass together |

| Chert |

a very hard and resistant microcrystalline variety of quartz, SiO2. It is extremely resistant to weathering and remains in the soil that forms from the weathering of dolomite. As the soils are eroded and washed away, the chert remains or gets washed into the streams as gravel bars. |

| Conglomerate |

a rock consisting of individual rock formations within a finer-grained matrix that have become cemented together. Conglomerates are sedimentary rocks consisting of rounded fragments and are thus differentiated from breccias, which consist of angular clasts |

| Cretaceous |

The Cretaceous Period is one of the major divisions of the geologic timescale, reaching from the end of the Jurassic Period (i.e. from 145.5 ± 4.0 million years ago (Ma)) to the beginning of the Paleocene epoch of the Tertiary Period (about 65.5 ± 0.3 Ma). |

| Diabase |

a mafic, subvolcanic rock equivalent to volcanic basalt |

| Greenstone |

a green igneous rock containing the minerals feldspar and hornblende |

| Jurassic |

The Jurassic Period is a major unit of the geologic timescale that extends from about 199.6 ± 0.6 Ma (million years ago) to 145.4 ± 4.0 Ma, the end of the Triassic to the beginning of the Cretaceous. |

| Mesozoic |

the era of geologic time, 248 million to 65 million years ago, during which dinosaurs, birds, and flowering plants first appeared |

| Miogeocline |

An association chiefly of carbonates, shales, and clean sand-stones, with an absence of volcanics. These sediments are thought to have formed in shallow water on a continental margin. |

| Monzonite |

rock that contains abundant and approximately equal amounts of plagioclase and potash feldspar; it also contains subordinate amounts of biotite and hornblende, and sometimes minor quantities of orthopyroxene. |

| Paleozoic |

the era of geologic time, about 570 million to 248 million years ago, during which fish, insects, amphibians, reptiles, and land plants first appeared |

| Pleistocene |

the epoch of geologic time, about 1.6 million to 10,000 years ago, characterized by the disappearance of continental ice sheets and the appearance of humans |

| Quartz |

a common, hard, usually colorless, transparent crystalline mineral with colored varieties |

| Sandstone |

a sedimentary rock made up of particles of sand bound together with a mineral cement |

24

| Term | Definition |

| Serpentinite |

composed of minerals of the serpentine group. It forms by regional metamorphism of deep-sea rocks from the oceanic mantle |

| Strata |

layers of sediment or layers of sedimentary rock. |

| Terrane |

short-hand term for a tectonostratigraphic terrane, which is a fragment of crustal material formed on, or broken off from, one tectonic plate and accreted or "sutured" to crust lying on another plate. |

| Triassic |

the period of geologic time, 248 million to 206 million years ago, during which reptiles flourished and dinosaurs and evergreen forests first appeared |

| Ultramafic | also referred to as ultrabasic, rocks are rocks with very low silica content (less than 45%), generally >18% MgO, high FeO, low potassium, and are composed of usually greater than 90% mafic minerals (dark colored, high magnesium and iron content). The Earth's mantle is composed of ultramafic rocks. |

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company.

Item 4. [Removed and Reserved]

PART II

Item 5. Market for Registrant's Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is not traded on any exchange. We intend to engage a market maker to apply to have our common stock quoted on the OTC Bulletin Board once this Registration Statement has been declared effective by the SEC; however, there is no guarantee that we will obtain a listing.

There is currently no trading market for our common stock and there is no assurance that a regular trading market will ever develop. OTC Bulletin Board securities are not listed and traded on the floor of an organized national or regional stock exchange. Instead, OTC Bulletin Board securities transactions are conducted through a telephone and computer network connecting dealers. OTC Bulletin Board issuers are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

To have our common stock listed on any of the public trading markets, including the OTC Bulletin Board, we will require a market maker to sponsor our securities. We have not yet engaged any market maker to sponsor our securities and there is no guarantee that our securities will meet the requirements for quotation or that our securities will be accepted for listing on the OTC Bulletin Board. This could prevent us from developing a trading market for our common stock.

On October 13, 2011, the list of stockholders for our shares of common stock showed 112 registered stockholders and 33,947,417 shares of common stock outstanding.

25

Dividends

We have not declared any dividends on our common stock since the inception of our company on December 9, 2009. There is no restriction in our Articles of Incorporation and Bylaws that will limit our ability to pay dividends on our common stock. However, we do not anticipate declaring and paying dividends to our shareholders in the near future.

Equity Compensation Plan Information

As of June 30, 2011, we have not adopted an equity compensation plan under which our common stock is authorized for issuance.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during the year ended June 30, 2011.

Recent Sales of Unregistered Securities

None.

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our audited financial statements and the related notes for the years ended June 30, 2011 and June 30, 2010 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this registration statement, particularly in the section entitled "Risk Factors" beginning on page 8 of this annual report.

Our consolidated audited financial statements are stated in Canadian Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Plan of Operation

Not accounting for our working capital of $738, we require additional funds of approximately $225,000 at a minimum to proceed with our plan of operation over the next twelve months. As we do not have the funds necessary to cover our projected operating expenses for the next twelve month period, we will be required to raise additional funds through the issuance of equity securities, through loans or through debt financing. There can be no assurance that we will be successful in raising the required capital or that actual cash requirements will not exceed our estimates. We intend to fulfill any additional cash requirement through the sale of our equity securities.

If we are not able to obtain the additional financing on a timely basis, if and when it is needed, we will be forced to scale down or perhaps even cease the operation of our business.

Capital Expenditures

We do not intend to invest significant funds in capital expenditures during the twelve-month period ending June 30, 2012.

26

General and Administrative Expenses

We expect to spend $225,000 during the twelve-month period ending June 30, 2012 on general and administrative expenses including legal and auditing fees, rent, office equipment and other administrative related expenses.

Product Research and Development

We do not anticipate expending any funds on research and development, manufacturing and engineering over the twelve months ending June 30, 2011.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the twelve months ending June 30, 2012.

Results of Operations for the Years Ended June 30, 2011 and 2010

The following summary of our results of operations should be read in conjunction with our audited financial statements for the years ended June 30, 2011 and 2010.

Our operating results for the years ended June 30, 2011 and 2010 are summarized as follows:

| Year Ended | ||||||

| June 30 | ||||||

| 2011 | 2010 | |||||

| Revenue | $ | Nil | $ | Nil | ||

| Operating Expenses | $ | 295,921 | $ | 45,139 | ||

| Net Loss | $ | (295,898 | ) | $ | (45,139 | ) |

Revenues

We have not earned revenues since our inception.

Operating Expenses

Our operating expenses for the year ended June 30, 2011 and June 30, 2010 are outlined in the table below:

| Year Ended | ||||||

| June 30 | ||||||

| 2011 | 2010 | |||||

| Administration fees | $ | 33,975 | $ | 8,400 | ||

| Consulting fees | $ | 21,775 | $ | 18,232 | ||

| Dividend on preferred shares | $ | 3,131 | $ | - | ||

| Depreciation | $ | 42,950 | $ | 17,384 | ||

| Professional fees | $ | 42,706 | $ | 308 | ||

| Office and general | $ | 135,696 | $ | 815 | ||

| Travel expenses | $ | 15,688 | $ | - | ||

The increase in operating expenses for the year ended June 30, 2011, compared to fiscal 2010, was mainly due to the fact that our 2010 fiscal year spanned only the period from our inception on December 9, 2009 to June 30, 2010 and that the first few months of our operations were mainly administrative in nature.

27

Liquidity and Financial Condition

As of June 30, 2011, our total assets were $219,101, our total liabilities were $34,418 and we had working capital of $738. Our financial statements report a net loss of $295,898 for the year ended June 30, 2011, and a net loss of $337,906 for the period from December 9, 2009 (date of inception) to June 30, 2011.

We have suffered recurring losses from operations. The continuation of our company is dependent upon our company attaining and maintaining profitable operations and raising additional capital as needed. In this regard we have raised additional capital through equity offerings and loan transactions.

| Cash Flows | ||||||

| At | At | |||||

| June 30, 2011 | June 30, 2010 | |||||

| Net Cash (Used in) Operating Activities | $ | (226,506 | ) | $ | (38,547 | ) |

| Net Cash Provided by (Used In) Investing Activities | $ | (50,935 | ) | $ | (10,000 | ) |

| Net Cash Provided by Financing Activities | $ | 159,033 | $ | 196,788 | ||

| Cash (decrease) increase during the year | $ | (118,408 | ) | $ | 148,241 |

We had cash in the amount of $29,833 as of June 30, 2011 as compared to $148,241 as of June 30, 2010. We had a working capital surplus of $738 as of June 30, 2011 compared to working capital surplus of $158,695 as of June 30, 2010.

Our principal sources of funds have been from sales of our common stock and our subsidiary’s preferred shares.

Anticipated Cash Requirements

We estimate that our expenses over the next 12 months will be approximately $225,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

| Description |

Estimated Completion Date |

Estimated Expenses ($) |

| Legal and accounting fees | 12 months | 70,000 |

| Exploration expenses | 12 months | 40,000 |

| Investor relations and capital raising | 12 months | 5,000 |

| Management and operating costs | 12 months | 45,000 |

| Salaries and consulting fees | 12 months | 35,000 |

| Fixed asset purchases | 12 months | 10,000 |

| General and administrative expenses | 12 months | 20,000 |

| Total | 225,000 |

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any such financings on terms that will be acceptable to us.

If we are not able to raise the full $225,000 to implement our business plan as anticipated, we will scale our business development in line with available capital. Our primary priority will be to retain our reporting status with the SEC which means that we will first ensure that we have sufficient capital to cover our legal and accounting expenses. Once these costs are accounted for, in accordance with how much financing we are able to secure, we will focus on product acquisition, testing and servicing costs as well as marketing and advertising of our products. We will likely not expend funds on the remainder of our planned activities unless we have the required capital.

28

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

The consolidated audited financial statements included with this annual report have been prepared on the going concern basis which assumes that adequate sources of financing will be obtained as required and that our assets will be realized and liabilities settled in the ordinary course of business. Accordingly, the audited financial statements do not include any adjustments related to the recoverability of assets and classification of assets and liabilities that might be necessary should we be unable to continue as a going concern.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

Our consolidated audited financial statements and accompanying notes are prepared in accordance with generally accepted accounting principles used in the United States. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management's application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our consolidated financial statements is critical to an understanding of our financials.

Fair Value Measurements

The Company follows FASB ASC 820, Fair Value Measurements and Disclosures, for all financial instruments and non-financial instruments accounted for at fair value on a recurring basis. This accounting standard established a single definition of fair value and a framework for measuring fair value, sets out a fair value hierarchy to be used to classify the source of information used in fair value measurement and expands disclosures about fair value measurements required under other accounting pronouncements. It does not change existing guidance as to whether or not an instrument is carried at fair value. The Company defines fair value as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities, which are required to be recorded at fair value, the Company considers the principal or most advantageous market in which the Company would transact and the market-based risk measurements or assumptions that market participants would use in pricing the asset or liability, such as inherent risk, transfer restrictions and credit risk. The Company has adopted FASB ASC 825, Financial Instruments, which allows companies to choose to measure eligible financial instruments and certain other items at fair value that are not required to be measured at fair value. The Company has not elected the fair value option for any eligible financial instruments.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Management makes its best estimate of the ultimate outcome for these items based on historical trends and other information available when the financial statements are prepared. Changes in estimates are recognized in accordance with the accounting rules for the estimate, which is typically in the period when new information becomes available to management. Actual results could differ from those estimates.

29

Basic and Diluted Net Income (Loss) Per Share

The Company computes net loss per share in accordance with FASB ASC Topic 260, Earnings Per Share. This topic requires presentation of both basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic loss per share is computed by dividing net loss available to common shareholders by the weighted average number of common shares outstanding during the year. Diluted EPS gives effect to all dilutive potential common shares outstanding during the year including stock options, using the treasury stock method, and convertible preferred stock, using the if-converted method. In computing diluted EPS, the average stock price for the year is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential common shares if their effect is anti dilutive.

Equipment

Property, plant and equipment are stated at cost less accumulated depreciation and amortization. Depreciation is computed using the straight-line method based upon the useful lives of the assets, estimated to be 5 years. Improvements and betterments are capitalized if they extend the useful life of the asset. Repair and maintenance costs are charged to expense as incurred. Gain (loss) related to retirement or disposition of fixed assets is recognized in the period which the gain (loss) occurs.

Impairment of long-lived assets

The Company evaluates the recoverability of the net carrying value of its equipment and identifiable intangible assets with definite lives, whenever certain events or changes in circumstances indicate that the carrying amount of these assets may not be recoverable, by comparing the carrying values to the estimated future undiscounted cash flows. A deficiency in cash flows relative to the carrying amounts is an indication of the need for a write-down due to impairment. The impairment write-down would be the difference between the carrying amounts and the fair value of these assets. A loss on impairment would be recognized as a charge to earnings.

Preferred shares of subsidiary.

Golden Global Mining Corporation, the Company’s wholly owned subsidiary, issued preferred shares which have been classified as equity in their financial statements. In these statements, the financial instruments have been classified as noncontrolling interests and dividends paid on behalf of the preferred shares have been recorded as a charge against income.

RECENT ACCOUNTING PRONOUNCEMENTS

The Company adopts new pronouncements relating to generally accepted accounting principles applicable to the Company as they are issued, which may be in advance of their effective date. Management does not believe that any recently issued, but not yet effective accounting standards, if currently adopted, would have a material effect on the accompanying financial statements.

With the exception of the pronouncements noted above, no other accounting standards or interpretations issued or recently adopted are expected to have a material impact on our company’s financial position, operations or cash flows.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

Our consolidated audited financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

30

| GOLDEN GLOBAL CORP. |

| (An Exploration Stage Company) |

| Consolidated Financial Statements |

| Stated in Canadian Dollars |

| June 30, 2011 |

Index

31

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders, Golden Global Corp.: